Key Takeaways

- Gold can be purchased in Australia through various methods, including physically buying and storing gold, investing in gold on the stock market, or trading gold via contracts for difference (CFDs).

- When investing in gold on the stock market, options include buying shares in gold mining companies or investing in gold-themed exchange traded funds (ETFs).

- A popular Australian broker for trading gold is TMGM, which offers a user-friendly platform and CFD trading options.

- Factors to consider when buying gold include the location and reputation of the dealer, production source, fees and commissions, price comparison, and storage options such as home safes, bullion dealer storage, secure vaults, or safety deposit boxes at banks.

Since ancient times, gold has been seen as a reliable value store. Today, it is considered to be one of the most stable investments, since it does not experience the same level of volatility compared to stocks and other tradable assets. If you are looking for an investment option that will help you protect your wealth, gold is definitely worth considering. But, how do you go about purchasing gold bullion or investing in gold via the stock market? Let’s take a closer look at the process of buying gold and where to purchase it in Australia.

Choosing a Gold Asset Type:

Most people imagine bank vaults piled high with chunky gold bars when they imagine gold bullion. However, the reality is that this term refers to gold that has a purity level of at least 99.5% and has either been minted into coins or made into bars or ingots. Bullion is the form of gold that is traded on commodities markets worldwide. There are a few different options to consider if you want to gain exposure to gold. You can physically buy and store it or invest in gold prices or companies on the stock market. You can also trade gold on financial markets as contracts for difference.

Investing in Gold on the Stock Market:

You can invest in gold on the stock market and make money by profiting from gold prices rather than physically purchasing and storing gold. Stock market investors are able to purchase shares in companies such as gold miners, or there is the option to invest in units in a gold-based exchange traded fund (ETF). Using this approach, there is no need to actually purchase any gold – instead, you will be investing in the gold industry’s performance or the performance of a certain gold company. You will usually need a full-service broker or an online trading platform in order to invest in gold via the stock market.

Investing in gold via the stock market is a popular choice since it allows you to invest in gold without the added hassle of purchasing, storing, and insuring the gold. However, since you do not actually own any physical gold using this method, you will be exposed to all the typical risks that come with investing in the stock market including company bankruptcy, market volatility and the risk of losing your investment.

There is the option to purchase units in a gold-themed EFT, which is basically tracking the price movements of the gold or stocks in several companies that are exposed to gold. There are several gold-themed ETFs that are listed on the Australian Stock Exchange including:

If you are looking to purchase stocks in companies with gold exposure, there are several to choose from on the Australian Stock Exchange.

Speculating on price movements through CFD investing in the futures market is an alternative to buying gold stocks or units in an ETF. CFD investors aim to profit from the movement of bond prices whether they go up or down. This means that even if the prices of gold are falling, CPD investors are still able to make a profit. However, bear in mind that CFDs are complex, derivative products that can be highly risky. As a result, they are a better option for advanced traders

Investing in physical gold is a traditional approach which involves purchasing gold as a physical asset to own and store it yourself. It provides you with an option of owning a tangible asset and avoiding the risks that are involved with exchange-traded funds.

If you decide to go down the route of buying physical gold, you’ll need to decide on the form of gold that you would like to purchase. You can purchase gold bullion in either coins or bars. Bars tend to be larger and more expensive, but they are an ideal option for those who want to make a sizable investment. Gold coins, on the other hand, are less valuable since they are smaller in size, but can often be a more convenient choice if you need to liquidate some of your investment.

Gold bars will generally range in size from 1/10 ounces to 1kg, but there are some bars of up to 500 ounces available. Bear in mind that precious metals are measured in troy ounces and that one troy ounce is the equivalent to 31.1g grams.

There are two types of gold bars to choose from; these are minted bars and cast bars. Minted gold bars are manufactured via a stamping or minting process, while cast bars are made by pouring molten gold into an ingot mould. Minted bars tend to be easier to sell since they look better, while cast bars are easier to produce.

Gold bullion coins are produced by mints around the world. They are generally smaller than bars and ingots and considered to be a more convenient alternative for investors. They are cheaper to purchase compared to bars and make it easier for investors to liquidate a small portion of their investment if they need cash. Coins will typically contain between 1/10 ounces to one ounce of pure gold.

Gold coins also have a nominal monetary value and can be accepted as legal tender in the country where they are produced.

How to trade gold in Australia

There are several Australian based brokers that allow users to trade gold.

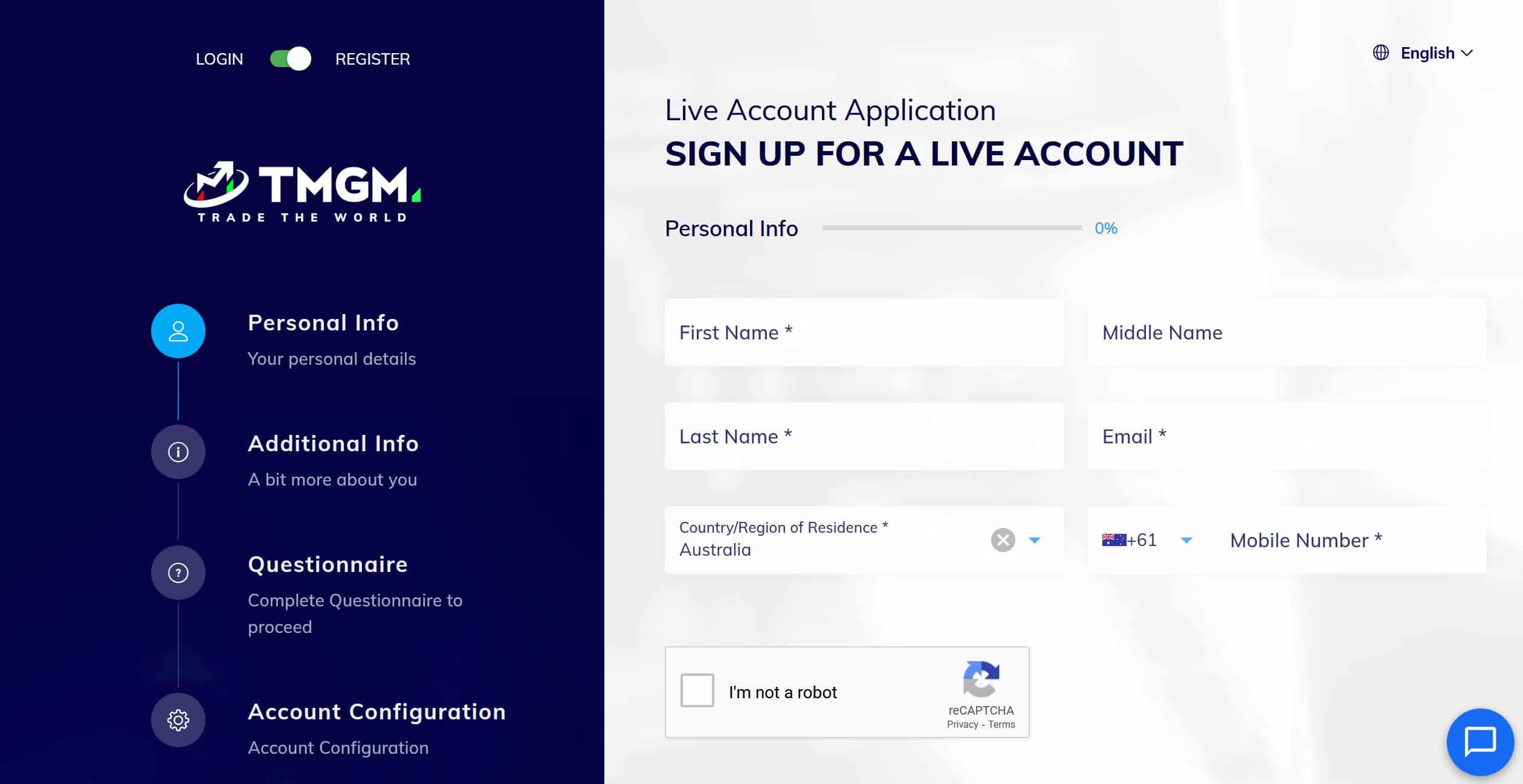

1. TMGM - Best Australian Broker for trading gold

TMGM is a leading global online broker that has its roots embedded within the Australian market. Originally founded in Sydney, TMGM has a deep understanding of Australian traders and their pain points.

With TMGM, traders are able to hedge against market volatility risk through trading CFDs on gold, essentially allowing you to enjoy all of the diversification and speculation benefits without ever having to physically own the gold.

TMGM offers two types of trading accounts to cater for your specific needs, with zero commissions. From this, you can access to the leading MetaTrader 4 trading platform that allows Australian users to trade gold CFDs online seamlessly.

Where to Buy Gold:

When choosing where to buy gold, there are several options to consider. Some of the main factors to keep in mind when choosing where to buy gold include:

Storing Your Gold:

Once you have purchased gold, you will need to find a safe place to store it. There are various different options to consider, which include:

What to Consider Before Buying Gold:

If you want to diversify your investment portfolio or are looking for ways to protect your wealth, gold can be a very effective and practical solution. However, it’s important to be aware that buying gold does come with some risks, just like making any other investment. It’s important to conduct research to ensure that you fully understand the risks that are involved in purchasing gold, including any additional costs for storage and security. Bear in mind that the returns might not match those that are provided by some other investments.

Frequently Asked Questions:

Some banks do sell gold to customers, but the majority do not. If you are interested in buying gold from a bank, it’s worth researching which banks do offer this service.

Buying gold online is safe as long as you are purchasing the gold from a reputable and trustworthy gold dealer. Be sure to thoroughly research the dealer before you buy to check that they are accredited by any trade associations and to find out more about their reputation.

Aside from purchasing physical gold, you can potentially make money from gold in a range of other ways. You can invest in ETFs that track the price of gold, or invest in shares in gold mining companies. Bear in mind that both of these options tend to come with more risk and there is no guarantee that you will make a profit.

GST is not payable if you buy or sell gold in an investment form. However, if your gold increases in value in between the date of purchase and the date of sale, capital gains tax may apply. For more information, you should speak to an accountant or an investment advisor who will be able to provide you with further advice on which taxes might apply to your gold and how the process of working out capital gains tax works.

Read our terms and conditions plus our privacy policy here.