Cryptocurrency has been on a steady decline since its peak in November 2021, but that doesn't mean it's dead. Far from it! In fact, this has happened many times before; once a bull run is over, and the hype has died down, you hear doomsayers pronounce Bitcoin or crypto as dead, only for it to come back stronger in the next cycle.

A crypto bear market is part of the lifecycle of cryptocurrency, and many refer to this period as a crypto winter. It seems cold and bleak, but if you can survive through it, you will be in a much better position when the next bull run hits.

We interviewed some of Australia's cryptocurrency experts, including co-founders and CEOs of the best crypto exchanges in Australia, to give you some tips on how to survive this crypto winter. Whether you are a frequent trader, a long-term investor, a crypto newbie, or a seasoned crypto enthusiast, you will find something helpful from these experts. Please remember that these tips are not financial advice, and you should consider your own circumstances before making any investment decisions.

Tips on surviving crypto winter as a trader

If you are a frequent crypto trader, crypto winter can be a struggle. This is especially true if it is your first crypto winter, as you have no prior experience. Listen to what our crypto experts have to say:

Regardless of the market there are plenty of opportunities to be found as a trader. Whether we are in bull or bear conditions, the purpose of a trader is to buy low and sell high. This involves monitoring a coin and looking for support and resistance levels which happen in all market conditions. Generally these trades are made over a short to medium time period, where the trader is looking to buy and sell at set price points, and to take incremental profit. As crypto can be more volatile than other markets and have swings over a shorter time interval it provides an opportunity to trade in and out more often and allow the trader to compound their gains over time.

DAN RUTTER // Co-founder & CEO of Digital Surge

Trade less, take profit more. In winter 10% is a great return – and one that can and will vanish in a single candle. If you do have to take a position, don’t trade the chop and wait for a clear trend to emerge.

LUKE RYAN // Head of Content at CoinJar

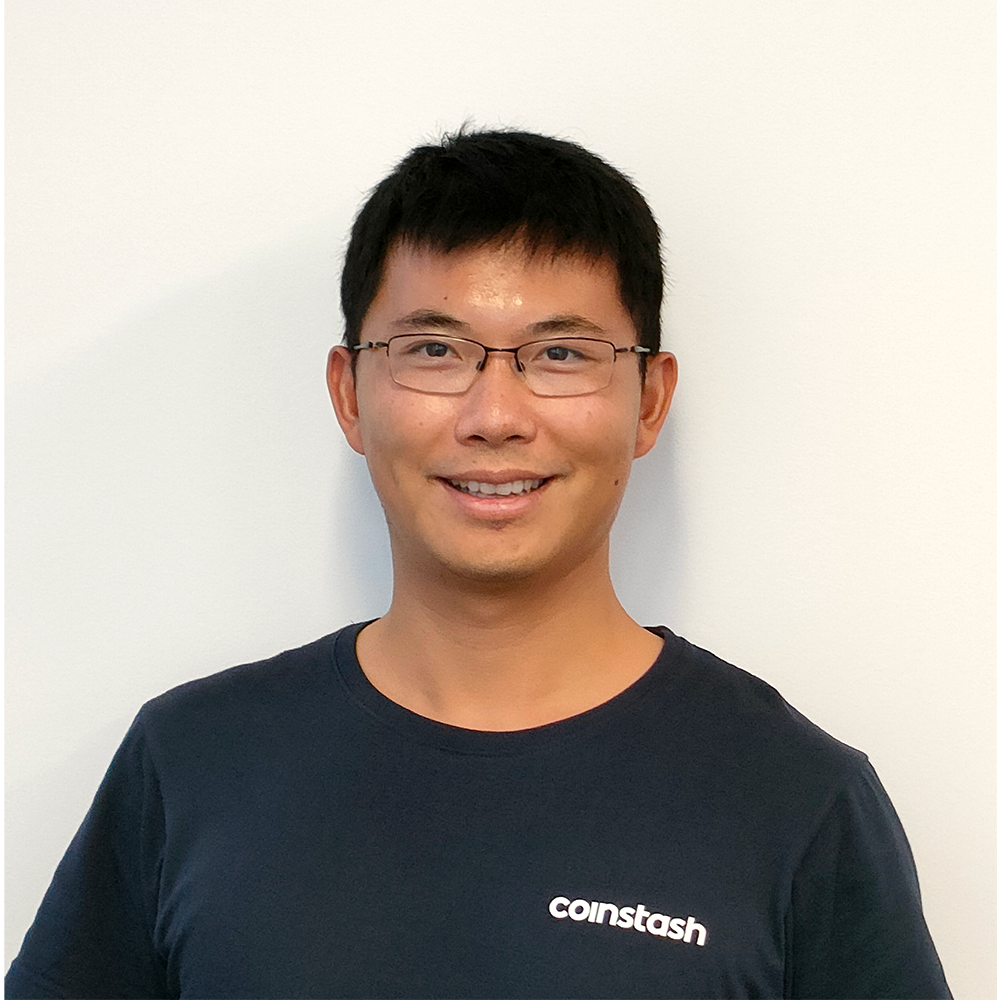

We also have two tips from Ting Wang, the co-founder and CEO of Coinstash.

- Be cautious with “buying the dip”. Beginner traders are normally subject to the temptation of buying the dip in hopes that the asset will bounce back up to its all time high. This can render disastrous for many investors as the market can plummet further at any point especially during crypto winter, For example, many people jumped in during the LUNA dip and it didn’t end well.

- Keep track of key macro-level financial events. With crypto becoming more mainstream, the crypto market has shown to be highly correlated to the broader financial markets, and they classify as an ‘at-risk’ asset class. Since late 2021, the cryptocurrency prices have had similar movements to equity prices. More specifically, Bitcoin (BTC) had similar price movements to S&P 500 (SPX) and the Nasdaq100. (NDX) Therefore, keeping track of events like the recent Fed interest rate decision (21 Sep) and the US CPI inflation (13 Sep) can help inform your short-term investment decisions.

How to survive crypto winter as a HODLer

For long-term crypto investors, it may seem easier to survive a crypto winter. All you need to do is HODL right? While it seems simple in theory, the problem is when we start to doubt ourselves, and are tempted to sell off our crypto in order to buy more as the prices go lower. The problem is that you never know when you are at the bottom. Australian crypto expert Luke Ryan (Head of Content at CoinJar) has this helpful piece of advice:

Don’t check the charts, and stop reading the news. If your focus is on a 2, 5 or 10 year horizon, the worst thing you can do is focus on what’s happening to the price right now.

This is really wise advice - it seems obvious, but it is important to remember that any declines in the short-term are irrelevant if you are genuinely investing in the long term.

Ting Wang, co-founder and CEO of Coinstash gave us three tips for those who plan to HODL through a crypto winter.

- Back your beliefs with actions & knowledge. It is not easy to truly HODL crypto, you have to remain unwavered during bearish times, like right now. Many HODLers with unquestioning beliefs ended up withdrawing from the marathon, which can last up to 5-10 years, or simply forgot that they ever invested. Successful HODLers are those that stay updated with market trends and put in the time and effort to broaden research, including the future of blockchain technology and Web3, this helps them direct their DCA strategies to offset short-term losses.

- HODL with a goal. Having a clear goal is key to HODLing, even if it’s as simple as “Over the next 4 years, DCA during the bear market and do not sell during the bull market”. Emotions like FOMO & FUD always get in the way of investing, have a clear goal and stick to it.

- HODL with peace of mind. In light of the recent Celsius saga, more of us realised the importance of safeguarding your keys and making sure that you have full access to your assets. My suggestion is to use a trusted and regulated Australian exchange, or use a cold wallet to store your crypto.

Ting's final point about security is an important one. Make sure that your crypto is stored on one of the best crypto exchanges in Australia (see article), or use a hardware wallet like a Trezor or Ledger. Read our review on the best crypto wallets for Australians if you need to find somewhere safe to HODL your coins.

Dan Rutter, co-founder and CEO of Digital Surge offers this pointer:

A crypto winter can be difficult for new investors if the price is lower than when they purchased. In these cases, it's important to remind yourself of the reasons you purchased the specific asset in the first place. Understanding the reasons you chose that crypto and your long-term expectation of its price point will help you get through to sunnier times. It may also help to look back at historical charts of previous winters and see how the price is affected at the next bull run. If you believe in the long-term value, then it can be easier to simply stop looking at the daily prices and trust in your original decision.

Tips for staking during a crypto winter

Staking is a popular option for crypto investors that want a steady way to increase their crypto holdings. Is staking a straightforward process during a crypto winter, or are there risks we need to consider?

Remember you’re only earning as much as your coin is worth, so even a 10% return can look feeble in the face of an 80% price decline. Stablecoins, even if they’re only earning 1.5%, can be a much better bear market alternative.

LUKE RYAN // Head of Content at CoinJar

This is an easy trap for crypto beginners to fall into. They notice a certain coin has high annualised returns, of 30-40%, and decide to invest their money there. However, that cryptocurrency may be declining much faster than any interest paid on the staking rewards, and it is potentially a useless coin that can become worthless. Before you invest or stake any crypto, it is important to do your own research and understand what it is you are buying. As Luke mentioned, earning interest on stablecoins can be a smarter choice during a crypto winter.

Ting Wang covers similar points with his advice:

Understand the risks involved with earning/staking your crypto, there is no such thing as free money, however some methods are more proven than others, do your research and similar to trading, test with a small amount.

Be wary of unrealistically high rates, these currencies are typically highly volatile and are subject to price crashes. If you don’t understand where the yield comes from, YOU are the yield.

Don’t be greedy. Once you make some profits, the best option is always take them and convert them into stablecoins.

TING WANG // CEO & co-founder of Coinstash

We also have these suggestions from Dan Rutter about staking during a crypto winter:

Staking is a great opportunity to make additional revenue from an asset you are already holding long term. If you believe in an asset's long-term value, then getting more of that asset for simply holding it is an easy choice.

However, if you are looking to purchase an asset specifically for its yield you should make sure you understand its underlying value. For example, if you were to earn 18% yield on a crypto but its overall value went down by 25% then you aren't in a better position.

Additionally finding a yield provider that will allow you to unlock your assets immediately will give you peace of mind that you can sell the asset when you want or if market conditions change.

It's always best to understand how the yield is generated so you know how your assets are used. On-chain staking utilises a blockchains native proof-of-stake protocol to generate yield by providing validation services to help secure the blockchain, whereas off-chain staking is where companies utilise your crypto in other ways to generate yield which could have a higher return but may come with additional risk. Unfortunately, it can often be difficult to know exactly how off-chain staking works with different providers as there can be little transparency. Your choice of yield provider will come down to your own risk appetite. As always in crypto be sure to do your own research (DYOR).

DAN RUTTER // CEO & co-founder of Digital Surge

Final tips to surviving a crypto winter

It can be daunting when we face uncertainty about how long this bear market will last, but keep an eye on the long-term future of cryptocurrency. Ting, the CEO of Coinstash, gave us these final words of advice in our interview:

"

No matter the strategy, always start by taking action, with a small amount of money that you can afford to lose, learning is always more important.

Invest with a purpose, understand where your money is going and how you are getting it back.

Don’t get too caught up in making instant returns, zoom out, look at historic trends, and make informed decisions by improving your understanding of the market.

Keep track of the coins you invest in, stay up to date, we don’t like surprises like Luna.

TING WANG // CEO & co-founder of Coinstash

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this.