Key Takeaways

- An Order Book is a record of the current buy and sell orders for a particular cryptocurrency.

- The order book shows the supply and demand, and the spread.

- The spread is the difference between the best bid (highest buying price) and the best offer (lowest ask price).

- As a trader, you want a tighter spread, so you don't lose as much money on your trade.

How to read an order book

Before you can start trading crypto, you need to understand what an order book is and how to read it. An order book is simply a record of the current buy and sell orders for a particular cryptocurrency. It will display the prices and the amounts of each order in a list. It is important to check the order book before trading; it gives an idea of the supply and demand for the cryptocurrency trading pair you are looking at, and can help you make more informed decisions.

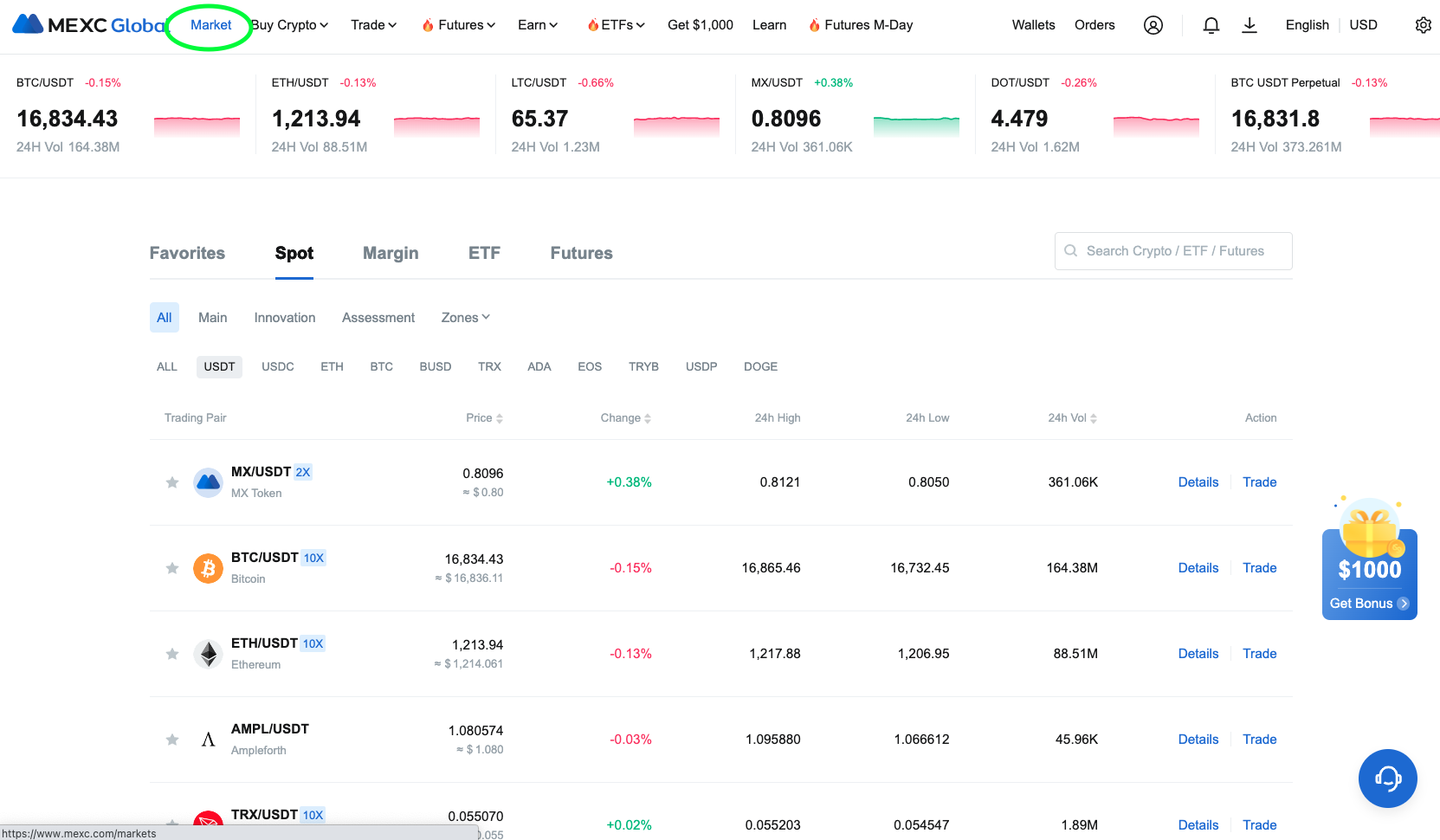

Let's show you how to find the order book in your MEXC trading account. Sign into the exchange, and then click 'Market' in the menu along the top (as circled in green in the screenshot below).

You can see various markets here, let's pick the BTC/USDT market to look at. Click on 'BTC/USDT' and you will be taken to a screen like the one below. It might look very complicated if you are not used to trading, but after you finish our course, you will have a much better understanding.

On the left side of the screen, you will see the order book. As you can see, it is constantly changing: new buy and sell orders are being added to the book, and existing orders are fulfilled, and removed from the list. Let's take a look at a still image of the order book, so I can explain it in more detail.

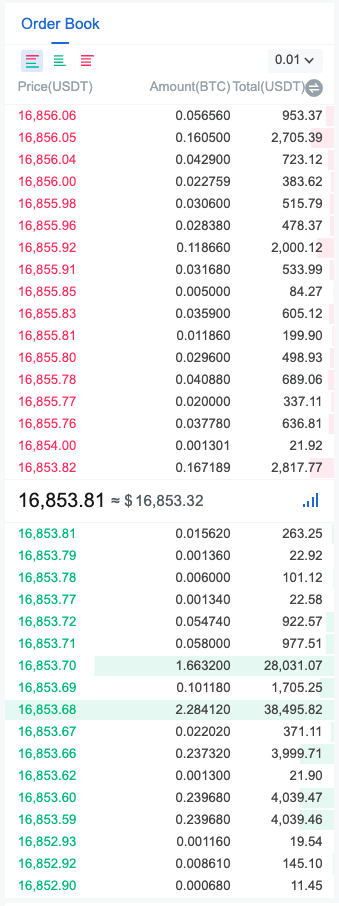

In our example here, the order book is for the trading pair BTC/USDT. If you remember from Lesson 2, BTC is the base currency, or the one that is being bought, and USDT is the quote currency, the one that is being sold.

In an order book, we can see the buy and sell orders that are made public. Note that not every single order may be displayed, because traders that want to place huge orders generally don't want others to see that. At the top of the list in red are the sellers, and at the bottom in green are the buyers.

If you look at the prices, from the top of the list down to the bottom, you can see it is in descending order. At the very top of the list, we can see 16,856.06 which is the price that a seller is willing to sell their BTC for, also known as the 'ask' price. As you go down the list to the last red seller, you will see the lowest ask price (best offer) is 16,853.82. At the time the screenshot was taken, that is the very lowest price that any seller on MEXC is willing to accept for 1 Bitcoin.

Between the red and the green list, you can see in bold 16,853.81, which is the last sold price of Bitcoin. Then below that, we get to the first number on the buy or 'bid' list at 16,853.81; this is the highest price that any buyer is willing to pay for Bitcoin at the time the screenshot was taken. This is also known as the 'best bid'. As we go down the list, we see that at the bottom, there is a buyer who only wants to buy Bitcoin at the price 16,852.90.

It is important to note that there are more buyers below this price, and there are more sellers above the highest price listed, but the order book only shows the ones that are closest to fulfilling an order. If you placed a buy order at 16,800.00, it will be live, but you will not see it in the order book unless the price of BTC starts to drop closer to 16,800.00.

Another point to remember is that the buyers and sellers are usually not selling 1 whole Bitcoin. The price in red and green is the price for 1 BTC, but the actual amount they are trading is in the second column, titled Amount (BTC). Looking at the lowest sell order, priced at 16,853.82, you can see they want to sell 0.167189 BTC at that price. The third column tells you the total amount in the quote currency (USDT), which is 2,817.77.

What is spread?

Since you are new to trading, you may have heard the term spread before but not understood what it is. The spread is the difference between the best bid (or highest buying price) and the best offer (lowest ask price). When you are trading frequently, you want the tightest (lowest) spreads possible. In the example above, the spreads are as close as possible, at 0.01 USDT (which is equal to 1 cent).

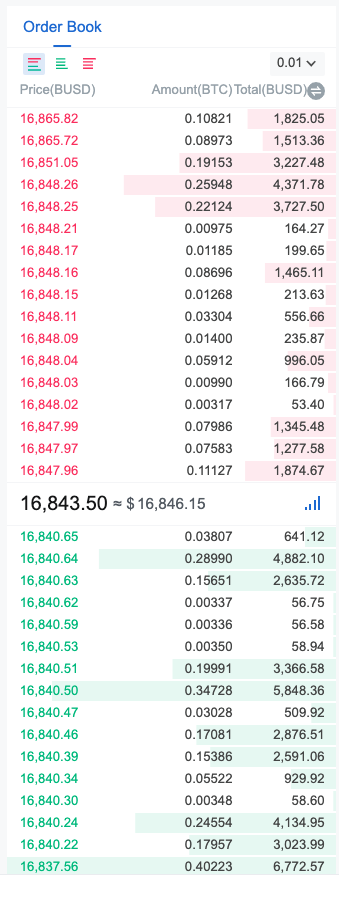

However, let's take a look at another trading pair, BTC/BUSD, which I have taken a screenshot of. You can see the lowest ask price is 16,847.96 and the highest bid price is 16,840.65. This gives a spread of 7.31 BUSD (equal to $7.31).

As you can tell, this is a much wider spread than the BTC/USDT trading pair and essentially this means that if you bought BTC and sold it straight away, you would lose more money on this trading pair than if you traded the BTC/USDT trading pair above.