Cryptocurrency and blockchain technology has come on leaps and bounds since Bitcoin was created in 2009. Originally, it started as a simple alternative currency to fiat money, but now an entire financial system has been created, also known as Decentralized Finance, or DeFi for short.

DeFi has experienced monumental growth in recent years. However, despite this growth, mass adoption has still not occurred. One of the main reasons for this is the volatility of crypto assets. DeFi protocols are also rather complex, and the low-interest rates make it hard for consumers and investors to see the value in getting involved.

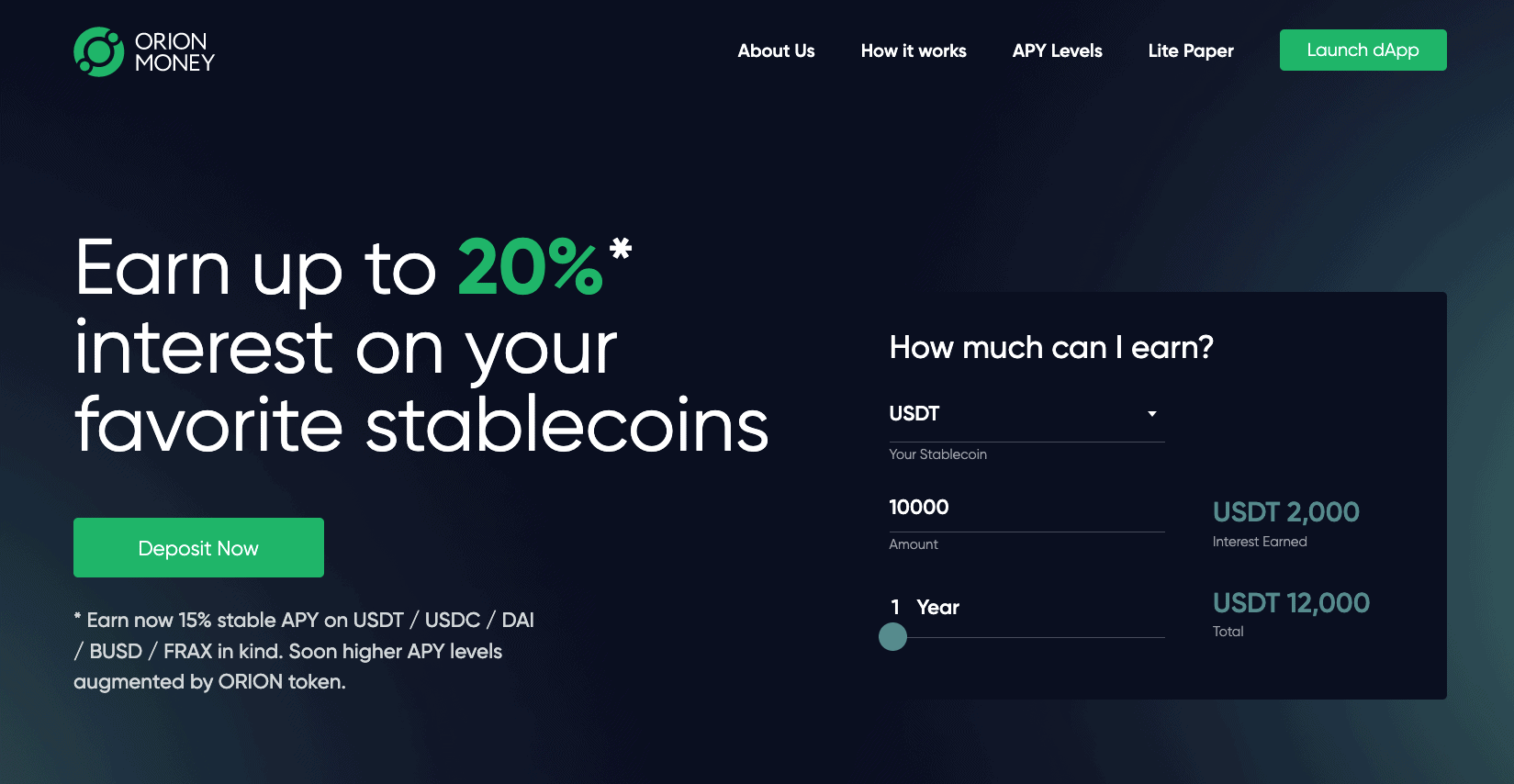

But what if there was a DeFi platform available that allowed you to earn as much as 20% APY on your crypto? Introducing Anchor protocol. This article will look at this phenomenon in greater detail, how it works, and how you can earn while using it.

What is Anchor Protocol?

Anchor Protocol positions itself as a savings protocol that sits on the Terra blockchain. It provides users with low volatility yields up to 20%. The platform was founded by Terraform Labs, a company based in South Korea, and got launched over a year ago, on March 17, 2021.

At first, the Anchor Protocol helped improve the demand for UST, a USD-pegged stable coin created by Terra. However, its ultimate goal is to become the interchain protocol that customers use to borrow layer-1 native tokens.

When it first launched, yields via Anchor Protocol were only possible with UST-based deposits. However, that all changed after the launch of EthAnchor. This significant update led to a lucrative partnership with Orion Money, which meant users could deposit Ethereum-based stablecoins such as USDT, DAI, BUSD, and USDC.

How does Anchor Protocol Work?

Anchor Protocol acts as a money market of stablecoins that sits between lenders and borrows. Lenders have the power to deposit their stable coins onto the Anchor platform. When borrowing occurs, they earn interest on them. On the other side, the borrowers have the power to borrow these stablecoins by offering stackable assets as collateral.

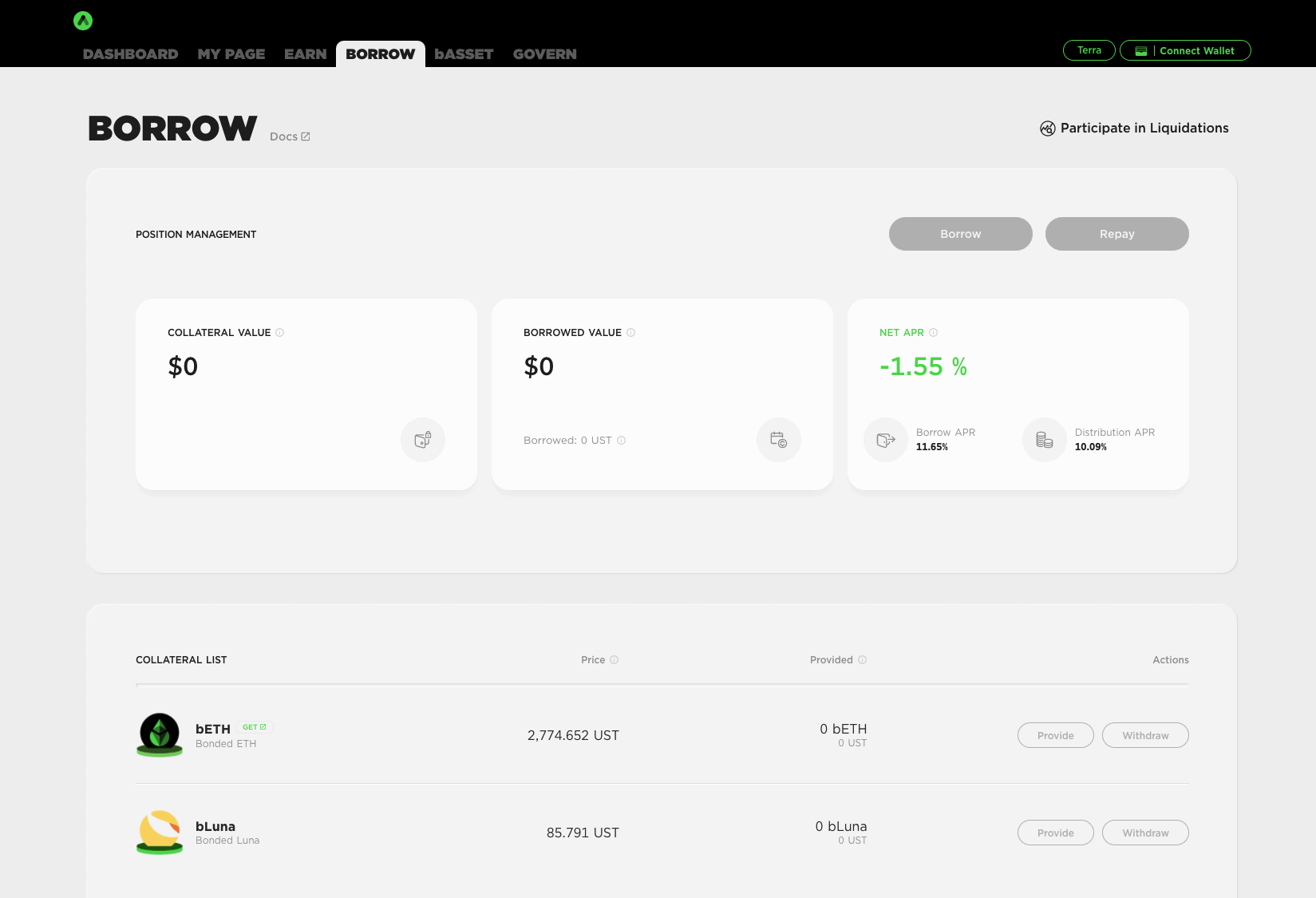

These assets get viewed as bonded assets, and the two current bonded assets that can get used as collateral are bETH and bLUNA. Once the bonded assets get offered, UST gets borrowed against them. The Anchor Protocol defines the borrowing limit.

Anchor Protocol functions using liquid-staking technology. Any staking rewards gained on bETH or bLUNA by borrowers become liquidated by Anchor Protocol into UST, which lets them earn a target yield of up to 20%.

20% APY might seem too good to be true, but it is 100% real. Anchor Protocol can build at least 24% staking revenue on deposits because of the 12% per annum LUNA staking yield. Combine that with the maximum borrow limit, and you can start to see why this is possible. Each loan gets overcollateralized, which means the staking rewards are magnified, another contributing factor to the high-interest rate.

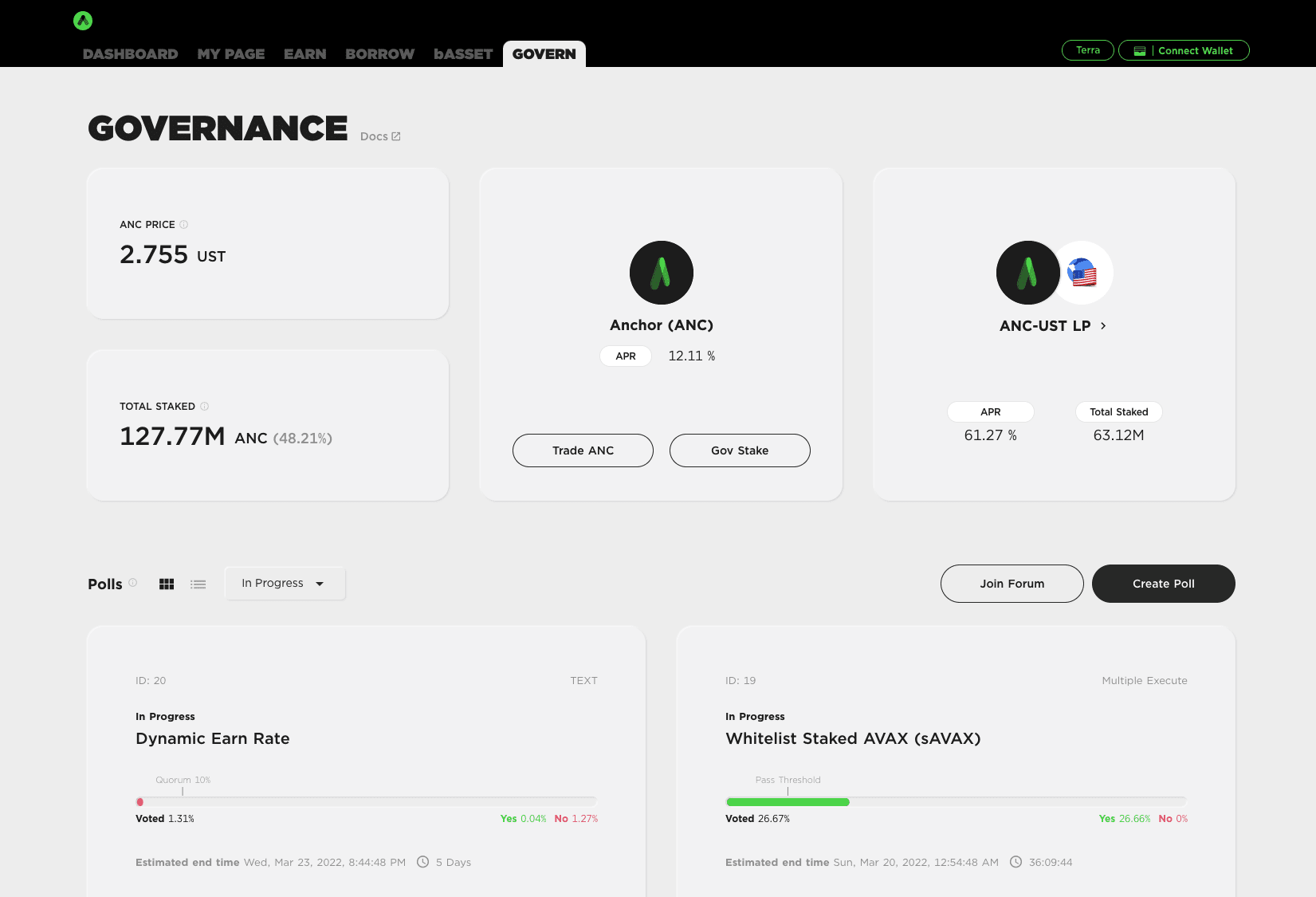

Another important aspect of the Anchor Protocol is Anchor Tokens, also known as ANC. ANC is the native token of Anchor Protocol, and users must deposit ANC to develop governance polls. Any users that deposit ANC can vote on these polls, which impact the future of the Anchor Protocol. Since it was launched, Anchor Protocol has experienced incredible growth and adoption.

How to Earn with Anchor Protocol?

There are various ways you can earn with Anchor Protocol:

Deposit

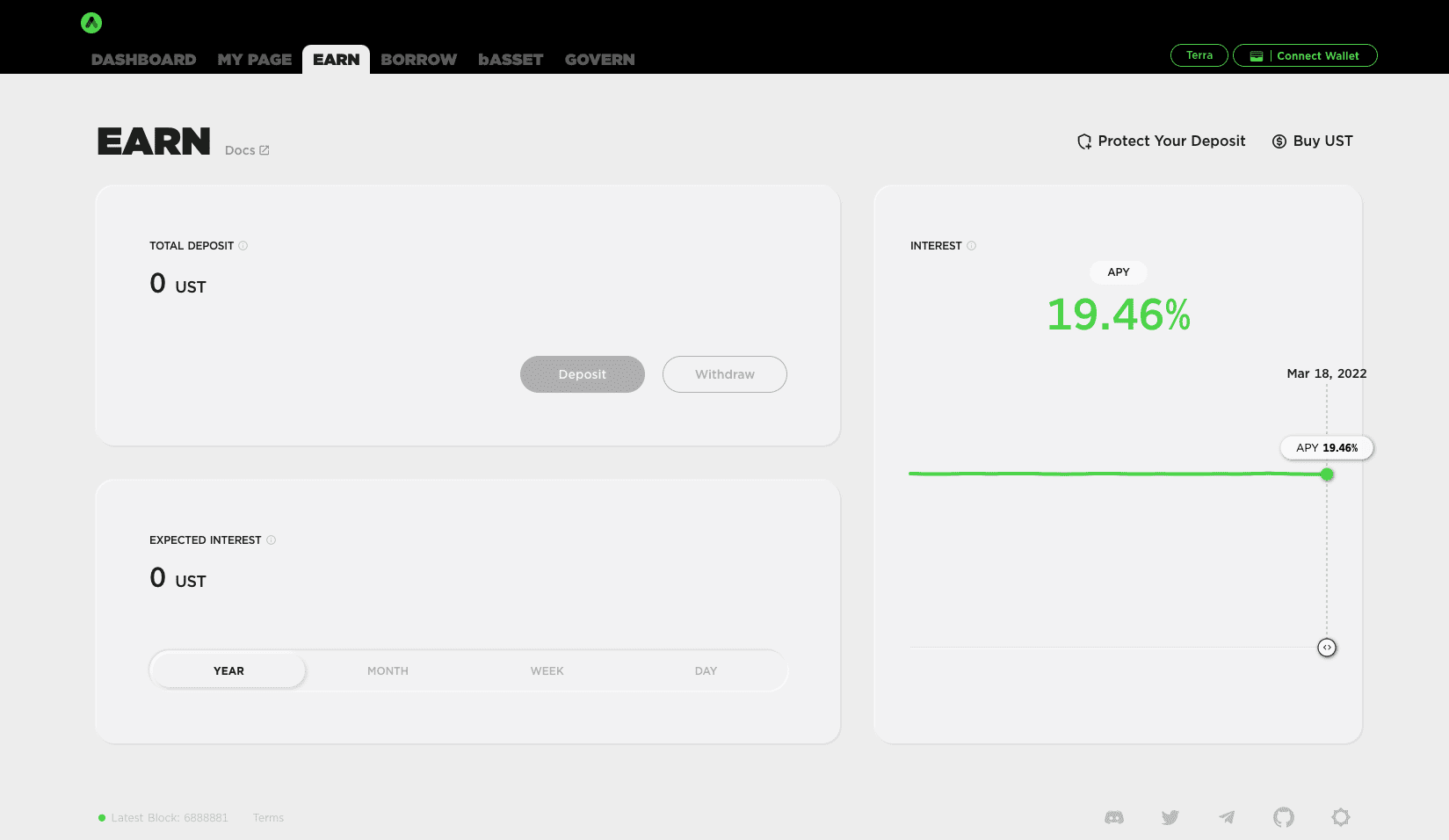

The simplest way to earn with Anchor Protocol is by depositing UST into the protocol. Anchor protocol is designed as a savings opportunity, with a 20% APY, which is much more lucrative than any other DeFi platform.

Borrow

Another option is to borrow UST by submitting a bonded ETH or LUNA as collateral. This option is viable as the reward provided in ANC tokens is a higher value than how much interest gets paid on the loan.

You can see the Net APR on the borrow page.

Stake ANC

Another option available to you is to buy and stake ANC to earn from the staking rewards on Anchor. The current APR for staking ANC can be found on this page.

Offer Liquidity

The final option available for you to earn rewards is by offering liquidity for ANC via staking ANC-UST LP tokens.

What are the Risks of Anchor Protocol?

Similar to other DeFi platforms, Anchor Protocol poses one significant risk that you should be aware of, loan liquidation. Loan liquidation can occur when the collateral value drops lower than the value of the loan. This situation is quite common across DeFi platforms, so I would recommend your borrow usage is never higher than 75%.

Frequently Asked Questions About Anchor Protocol

Is Anchor Protocol safe?

As with any investment, Anchor Protocol comes with risk attached. No investment is risk-free. Regarding security, Anchor Protocol has not experienced any major issues and uses the latest technology to protect its customers.

How do I use Anchor Protocol?

Using Anchor Protocol is pretty simple. You don't need to worry about minimum deposits or account freezes, and you can withdraw funds instantly.

Firstly, you need to download the Terra Station Google Chrome extension. This extension will allow you to store UST and LUNA tokens. You can also download Terra Station on iOS and Android.

Once you have installed the extension, create a Terra wallet. You can import it from a seed phrase if you already have one. Remember, it is good practice to create a backup to restore your wallet if you lose the password.

Once your wallet gets set up, go to Anchor Protocol’s Earn page and click Deposit.

Choose the amount of stablecoins you would like to deposit and click Proceed.

Sign the transaction agreement with Station Extension, and you’re all set up!

To withdraw your funds, reverse the steps with the Withdraw function.

How do I borrow UST with collateral?

If you go to the Borrow page, you can borrow UST from Anchor. To do this, you will need to deposit bAsset tokens as collateral.

Borrows are allowed until the loan’s loan-to-value (LTV) ration hits the maximum. As mentioned, if the LTV goes beyond the LTV limit, your collateral could be liquidated.

To start, choose your bAsset collateral, such as bLuna, and select Provide. Choose the amount of collateral you want to provide.

Sign the transaction, and then head over to the top of the page where it says Borrow.

Submit how much UST you would like to borrow, and sign the transaction.

To pay back the loan and get your collateral back, reverse the steps above.

Can Anchor Protocol be hacked?

As with any new technology, hacking is plausible and something to be aware of. To date, Anchor Protocol has not got hacked, but that does not mean it is not susceptible to top-quality cyber attacks.

The most significant risk that occurs with DeFi is human error. If Anchor Terra got successfully hacked, the users and protocol would be at risk.

Anchor Protocol: Summary and Key Takeaways

In summary, Anchor Protocol is an extremely exciting and interesting step for DeFi as a whole. It will be interesting to see where this company goes from here and whether it inspires other DeFi companies to attempt something.

One thing is for sure, this type of innovation and advancement can only be good for cryptocurrencies' long-term future. If you are interested in other ways to earn interest on your crypto, read our article on the best places to do so.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read it here.