Key Takeaways

- A trading pair is expressed in the following way: BTC/USD where the base currency (on the left) is the currency you are buying, and the quote currency (on the right) is the asset you are selling.

- BTC/USD 20,000 means it will cost 20,000 US Dollars to buy one Bitcoin.

- Stablecoins are a type of cryptocurrency that remain at a stable price. For example, the most popular stablecoin USDT (Tether) is always pegged to the US Dollar, so 1 USDT = 1 USD.

- Most trading pairs will include one of the following: BTC, ETH, USDT (or other stablecoins), fiat currencies.

Understanding trading pairs

A trading pair is two assets that can be traded for each other on a cryptocurrency exchange. This can be a cryptocurrency and a fiat currency, or two cryptocurrencies against each other. Trading pairs are expressed in the following manner: BTC/USD, where the first asset (in this case BTC) is the base currency, and the second asset (in this case USD) is the quote currency.

Base currency is the asset that you are buying, and the quote currency is the one you are selling, or trading, for the base currency. So in the example above of BTC/USD, you are trading USD to receive BTC in return. If the trading pair is BTC/ETH, you will be trading ETH to receive BTC.

When you see the currency pair written with a number next to it, like below, the number refers to how much of the quote currency is required to receive one of the base currency.

BTC/USD 20,000 means that it will cost 20,000 US Dollars to buy 1 Bitcoin.

When you see a percentage change next to a trading pair, as shown below, this is how much the price of the base currency has increased or decreased over the given time period.

BTC/USD +10% means that the price of Bitcoin (the base currency) has increased by 10%, so it now costs more USD (quote currency) to buy 1 BTC.

When you search for trading pairs on a cryptocurrency exchange, you may notice that not every cryptocurrency trading pair is available. The main quote cryptocurrencies found in most pairs are BTC, ETH, stablecoins, and in some cases fiat currencies. Smaller altcoins usually will not have a trading pair with another altcoin. For example if you had DOT and you wanted to trade it for XRP, you may not find a XRP/DOT trading pair. Instead, you will have to trade DOT to USD, and then trade USD for XRP.

What are stablecoins?

You may have heard of the term stablecoins before, but not understood exactly what they are. Stablecoins were created to combat the issues with volatility in the industry. They are a type of cryptocurrency that remains at a stable price, linked to a fiat currency (eg: USD or EUR) or a commodity, such as gold. The way they remain stable is because they are backed by a physical asset, so 1 USDT (a stablecoin called Tether) can always be exchanged for 1 US Dollar.

Stablecoins are useful because they do not fluctuate in value, and are therefore good ways to store value, and trade in and out of cryptocurrencies such as BTC and altcoins. You will find that many large crypto exchanges and trading platforms will use USDT as one of the main currencies in trading pairs, as opposed to a fiat currency like USD.

Trading cryptocurrencies

When you first trade cryptocurrencies, it is easier to begin with stablecoin trading pairs. For example, trading USDT against BTC. If you think the price of BTC will go up, you are investing in BTC by trading your USDT for BTC, and if you think that BTC is about to fall, you trade BTC back to USDT. This is the most basic form of cryptocurrency trading; all you are looking at is the price of the cryptocurrency you want to trade (eg: Bitcoin) against the US Dollar.

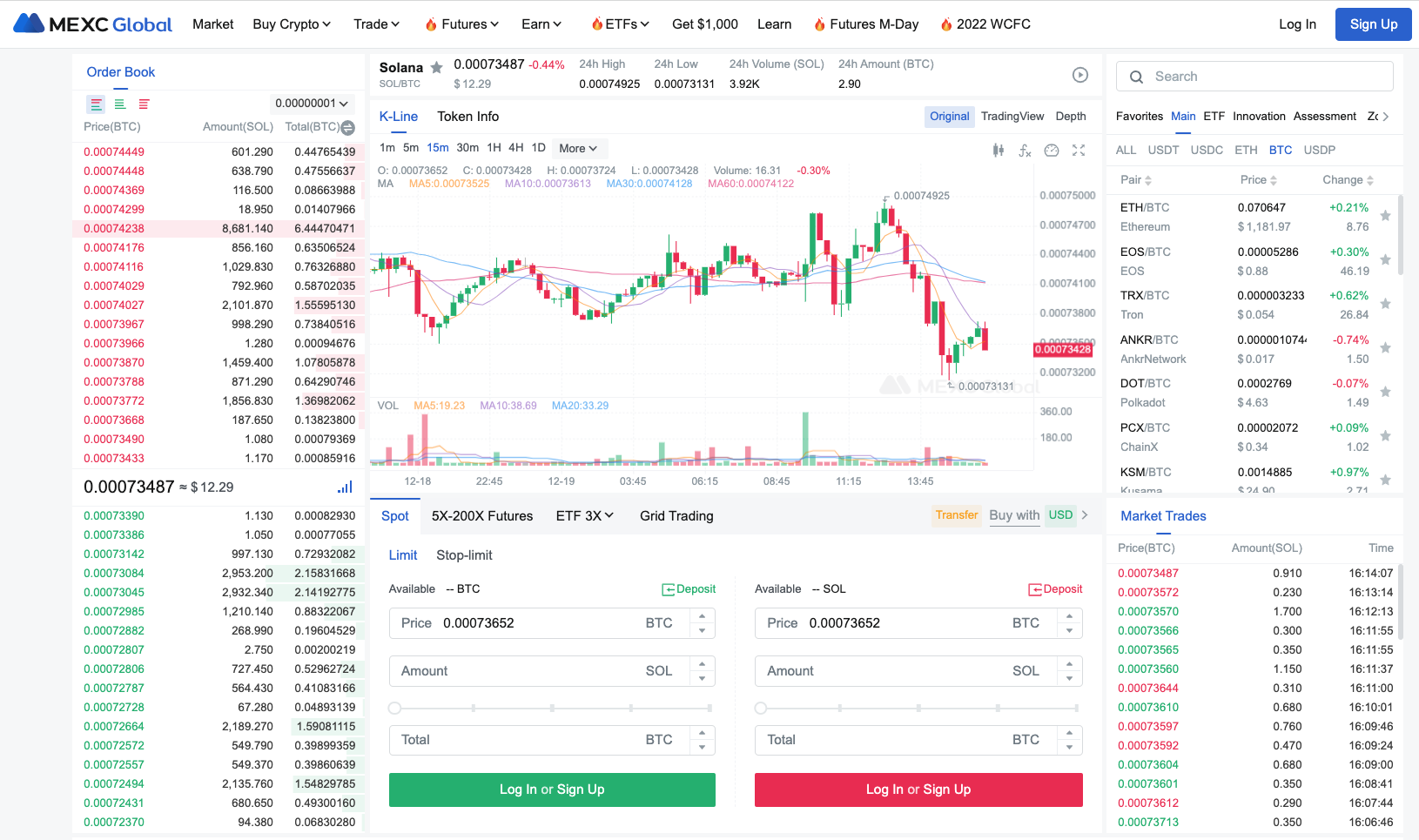

Once you have built up some experience trading against stablecoins, you may wish to venture into cryptocurrency pair trading, which is trading one coin for another (instead of for a stablecoin or fiat currency). We will use an example of trading Bitcoin against Solana (SOL/BTC). When you trade in this manner, you are doing more than simply investing in one cryptocurrency. Instead, you are betting on which of the two cryptocurrencies is going to outperform the other. For example, if you have done some research and believe that Solana has some new developments that will increase its value in the next 3 months, you can trade your BTC for SOL. Let's say that after the 3 months, Solana gained value as you predicted. You may wish to trade back to BTC if you think that the price of SOL is not going to continue rising so much, and BTC will outperform SOL in the future.