Key Takeaways

- Crypto lending platforms provide a mechanism for borrowing and lending cryptocurrencies, creating a bridge between borrowers and lenders to make it easier to get crypto loans quickly or invest their digital assets.

- Hodlnaut is the best crypto lending platform overall, Nexo is the best wallet for lending cryptocurrencies.

- YouHodler has a wide range of coins to lend, Crypto.com offers crypto cashback on Visa purchases, and CoinRabbit does not require KYC.

- These platforms offer attractive interest rates, flexibility in investing and lending, and options for swapping and diversifying portfolios.

The Top 6 Crypto Lending Platforms in 2024

- Hodlnaut: Best crypto lending platform overall

- Nexo: Best wallet for lending cryptocurrencies

- YouHodler: Wide range of coins to lend

- Crypto.com: Crypto cashback on Visa purchases

- CoinRabbit: No KYC required

We are living in the era of technology, innovation, and digitalization. In the finance industry, more and more people are opting for digital assets rather than going with the old-school banking system. Be it trading, investing, lending, or borrowing, thanks to digital assets such as cryptocurrencies, everything has been made easier and accessible online.

You can earn passive income with your crypto assets, or if you are in need of crypto, you can also borrow cryptocurrencies. This is where the best crypto lending platforms come in, providing opportunities to investors to lend their money and borrowers to secure a loan by simply providing collateral.

In this review, we’ll discuss the 6 most trusted crypto lending platforms in 2024. But before we move on, it’s important that we first understand what crypto lending platforms are and how they work.

What is a crypto lending platform, and how does it work?

A crypto lending platform provides a borrowing and lending mechanism where users can opt for digital loans or invest or lend their cryptocurrencies to create an income stream. It creates a bridge between the borrowers and lenders, making it easier for them to get crypto loans quickly, or invest their digital assets by lending them to others.

Most of the crypto lending platforms have their own equity to facilitate borrowers. They also utilize investors’ funds to complete a circle. For lending, investors are paid or rewarded interest rates depending on the amount lent and the overall investment period. The same scenario applies to borrowers, but they have to pay an interest rate depending on how much they are going to borrow and for how long.

The best crypto lending platforms: Reviews

Learn more about the top 6 crypto lending platforms in 2024. Make sure to go through each of them, evaluating their features, and how much interest you can earn on the various platforms.

#1. Hodlnaut: Best Crypto Lending Platform Overall

Hodlnaut offers users a wide variety of investment opportunities. While a relatively new crypto platform established in 2019, it has always aimed to offer what is beneficial for their users. Hodlnaut is currently headquartered in Singapore and serves thousands of users from all over the world. The platform is solely designed for investment purposes.

Investors can earn up to 7.25% APY on their stablecoins like USDC and USDT. For other cryptocurrencies, the returns are up to 4.08% APY on BTC, 4.60% on ETH, and 3.56% on DAI. These rates vary depending on market conditions and other circumstances. The interest rate is calculated daily and paid as per the agreement to the users. Users can withdraw their profits or assets anytime they want, without any restrictions.

The platform also offers a fixed-term investment plan that pays relatively more than their flexible plans. However, with this plan, you have to totally lock your cryptocurrencies ranging from 28 days to 360 days, depending on the chosen plan. To get started, register on the platform, take a look at their resources, understand the concepts, and start investing or lending your digital currencies. You can swap your assets absolutely free if you think a different asset could benefit you more.

If you want to sign up to Hodlnaut, click our link here to receive $30 USDC FREE when you deposit $1,000 or more and leave it for 31 days.

- Up to 7.25% APY returns on stablecoins

- Swap your assets instantly

- Free 30 USDC sign-up bonus

- No lock-in periods, and interest is paid weekly

- Optional custody cover by Nexus Mutual

- Only 6 different cryptocurrencies supported

#2. Nexo: Best Wallet for Lending Crypto

Nexo is a cryptocurrency exchange whose mission is to maximize the utility of crypto assets and provide their users with efficient and beneficial ways to invest, earn, swap, and hold. It is a privately held cryptocurrency exchange founded in 2017 and currently based in London. Nexo offers a variety of services, including the crypto interest feature, which is probably their most attractive option.

Nexo urges their users to put their crypto assets to work rather than letting them sit idly. You can start getting considerable returns from your assets, whose prices might shoot up during your investment period. You can earn up to 16% APR, which is paid every single day. Nexo charges no fee and provides the option of flexible earnings paid with compound interest. There are more than 30 cryptocurrencies supported for investments which can easily help you diversify your portfolio and maximize your profits.

One of the unique things about Nexo is that the platform also offers investment options for fiat assets converted into crypto form, such as USDx, EURx, GBPx. You can earn 12% APR on almost all stable assets like USDT, DAI, USDC, USDP, and TUSD. For volatile but popular assets, you can get the interest rate of 7% on BTC and 8% on ETH, BNB, SOL, ADA, and many other cryptocurrencies. Some crypto assets like MATIC and DOT even offer up to 16% APR which can help you grow your equity much quicker.

It is very easy to get started with Nexo as you simply have to register on the platform by providing your details. You can purchase crypto assets with your bank card or bank transfers. Swapping, borrowing, and Nexo Cards are some of the other features that you might love.

If you want to sign up to Nexo, you will receive $25 FREE BTC if you register with our link, and deposit $100 or more.

- More than 30+ assets available to lend and earn interest

- Up to 16% APR on cryptocurrencies

- Buy and exchange cryptocurrencies easily

- Borrow assets starting with 0% APR

- Daily payouts and flexible earnings

- Interest earning is not available for US residents

#3. YouHodler: Wide Range of Coins to Lend

As its name suggests, YouHodler is specifically designed for crypto holders who want to invest or lend their digital assets and earn an interest rate on them. YouHodler was founded in 2018 and is currently based in Limassol, Cyprus. One of the best things about YouHodler is their variety of investment options that you can explore to kickstart your investing journey.

YouHodler claims that lenders can easily earn up to 11.28% APY, depending on what crypto asset they are planning to lend. The platform supports more than 50 cryptocurrencies that lenders can lend and profit from. YouHodler also supports some of the most popular cryptocurrencies like BTC and ETH, along with many stable assets to lower risk in your entire investment period.

You can earn 10.7% on USDT, 10.3% on USDC, 4.7% on BTC, and 5.5% on ETH. Of course, the interest rates may vary based on market conditions, but they will usually hover around this mark.

YouHodler also allows their users to purchase cryptocurrencies via fiat assets and easily swap or exchange them as per your liking. There is also an option for crypto loans in case you need some cash and do not want to utilize your own cryptocurrencies, but you will have to provide collateral to take a loan.

- 50+ crypto assets supported

- Earn up to 10.7% APY on USDT

- Beginner-friendly platform

- Instant loans available

- Weekly payouts are available

- Not available in the USA

#4. Crypto.com: Crypto Cashback on Visa Purchases

Crypto.com is probably one of the most popular and most versatile crypto exchanges. Established in 2016, the platform has served millions of crypto users globally. It offers many opportunities to crypto lenders who want to put their crypto assets to good use and start earning money through them.

Crypto.com supports over 250 coins, and you can earn interest on more than 40+ of them, including many of the popular cryptos, and stablecoins. The interest rate offered on stable assets is relatively better than the rate offered on popular assets like Bitcoin or Ethereum. This might be good news for investors or lenders who want to keep their equity safe and sound.

The highest interest rate currently offered on the platform is 12.5% APY, which you can earn on Polygon and Polkadot. For BTC and ETH, the interest rate is 4%, and for stable assets like USDC and USDT, you can easily earn up to 6.5% APY. The rates you receive will also vary depending on how much CRO (Crypto.com's native token) you have staked, as well as whether you choose to keep it flexible, or locked for 1- or 3- month periods.

Besides investing, Crypto.com has much more to offer, including professional trading, purchasing and selling of assets, crypto loans, wallets, and even a Visa debit card. You can receive this card for free when you stake CRO, and use it to spend your fiat currency. With each purchase, you receive a cashback in CRO coins, up to 5% depending on your loyalty level. To find out more, read our review on Crypto.com.

Crypto.com also offers loans of 50% of your collateral that you can pay off without worrying about deadlines. A great customer support team with live chat, along with the accessibility of the mobile app, make your investing or lending experience even better.

- Lend more than 40+ cryptocurrencies to earn interest

- Earn up to 12.5% APY

- Borrow up to 50% of your collateral

- Buy and sell 250+ coins with ease

- Beginner-friendly app

- To access competitive rates, you need to lock in your crypto for 3 months

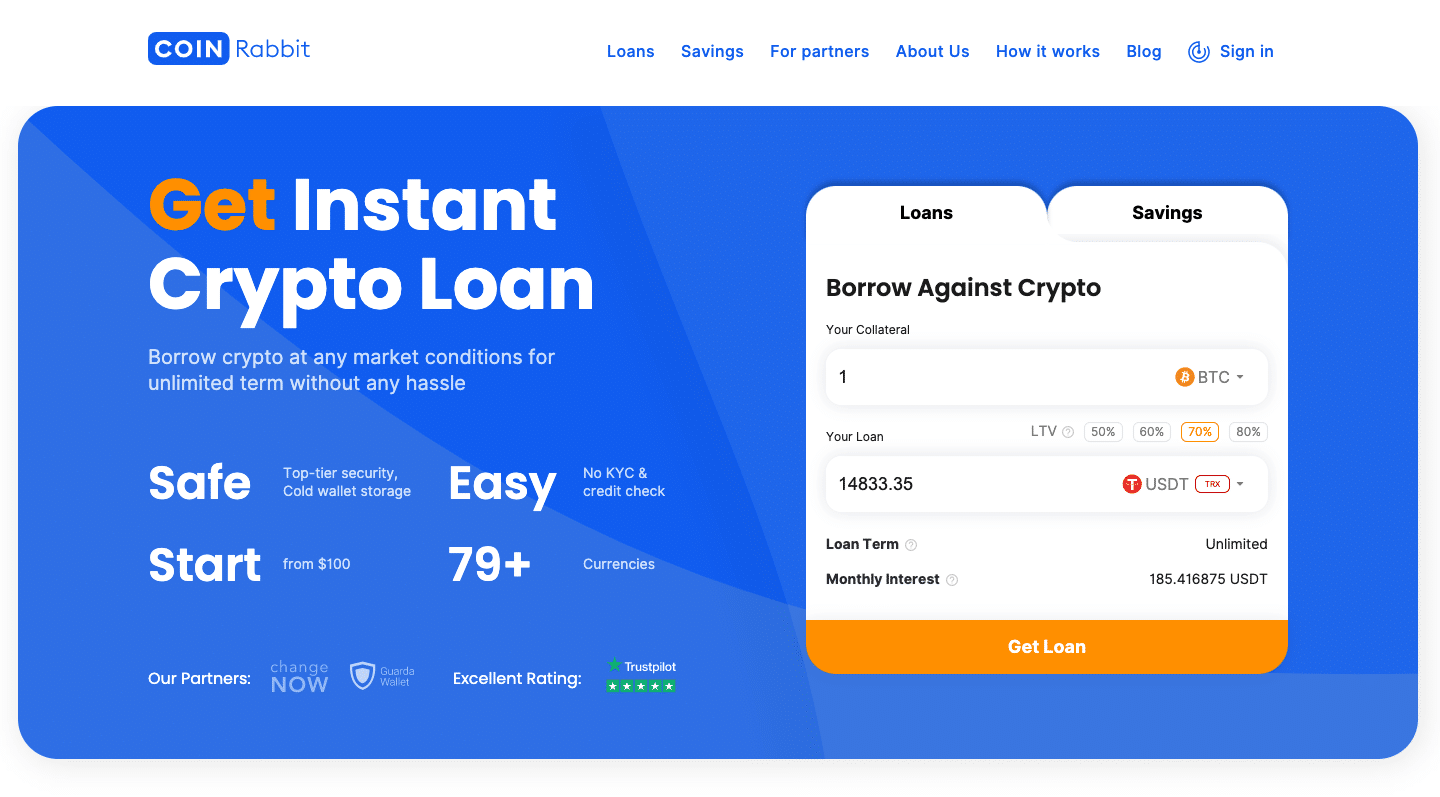

#5. CoinRabbit: No KYC Required

If you are looking for crypto investment plans with almost zero risk, your best choice is CoinRabbit, a crypto platform that specifically caters to users who plan to borrow or invest. You can opt for instant loans through CoinRabbit without going through long processes like KYC verifications or submitting different documents. Starting from $100, you can opt for a loan through your collateral.

For lending, CoinRabbit allows users to earn interest on five stablecoins: USDT(TRX), USDT(ETH), USDT(BSC), USDC, and BUSD. You can earn a fixed and flat interest rate of 8% APY on all these stable coins and watch your portfolio grow with time.

The best thing about CoinRabbit is that the platform pays profit on a daily basis, and users can withdraw their funds or profits anytime they want, without any waiting periods or limitations. You can sign up on the platform, deposit your cryptocurrencies, and start earning profit right away.

If you encounter a problem, you can get in touch with the CoinRabbit support team. They also have a blog along with detailed guidelines and FAQs that can help answer your queries.

- Earn 8% APY on stablecoins

- Get instant loans

- Live Chat with blog and guides

- No KYC verification required

- Daily payouts

- Limited range of 5 assets to invest

- No crypto buying, selling, or swapping supported

Summary

We all know cryptocurrency has a great future ahead, and more and more people are getting to understand the concept of the blockchain industry and how revolutionary it can be for the financial world. If you are holding on to a few crypto assets and waiting for their price to shoot up, it is a good idea not to let them sit idly and instead put them to good use. The best way to do so is to lend your crypto assets with the help of the crypto lending platforms mentioned in this review.

You will get better returns than with traditional bank saving accounts, and you will also be able to grow your equity. Some platforms allow users to withdraw their assets and profits whenever they want, making it even easier for them to invest without locking their assets for a specific period.

Most of the crypto lending platforms offer their investors the opportunity to earn anywhere between 5% and 20% APY depending on what asset you have chosen to invest.

Yes, it is generally safe to lend your cryptocurrencies, however you have to be aware of the investment period, hidden charges, withdrawal locks, and other similar aspects. Of course, opting for a well-established, trusted, and secure crypto lending platform is also a must.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our terms of service please click the link.