The majority of leading cryptocurrency exchanges adhere to stringent Know Your Customer (KYC) protocols. This compliance is crucial for aligning with global Anti-Money Laundering (AML) laws. KYC procedures involve verifying the identities of users before they are permitted to trade on the platform, a measure that helps prevent the use of crypto exchanges by criminals to move illicit funds under false identities.

While KYC plays a vital role in deterring criminal activities, it can be seen as an inconvenience for those who prefer to trade anonymously or are hesitant to upload personal identification documents online. However, there are still some cryptocurrency exchanges that allow trading or buying of crypto without undergoing KYC procedures. Drawing from my extensive experience in trading crypto without KYC, I have put together a list of the best crypto exchanges that operate without KYC requirements, offering a balance between regulatory compliance and user privacy.

The Best Crypto Exchanges with No KYC 2024

- Bybit: Best no KYC crypto exchange overall

- KCEX: Lowest Fees no KYC crypto exchange

- Kine: Best DEX (decentralized exchange) - no KYC or VPN

- KuCoin: Best for trading wide range of 700+ coins without KYC

- Margex: Best for no KYC margin trading

- Weex: Best no KYC exchange for margin market depth in the USA

- Bitfinex: Best for derivatives trading

- PrimeXBT: Best for CFD trading

- AAX: Best for advanced features

- Bisq: Decentralized Bitcoin exchange with no KYC

The best no KYC crypto exchanges: Reviews

Having used and reviewed many no KYC cryptocurrency exchanges, I've found a few excellent choices. I have written a brief overview of each platform, highlighting what sets them apart as top choices for those who want to trade crypto without KYC. These summaries will give you a snapshot of each exchange's unique features and benefits, helping you to make an informed decision about which to choose. For more detailed info, you can read my full reviews by following the corresponding links below.

#1. Bybit: Best no KYC crypto exchange overall

Bybit stands out as a leading global cryptocurrency exchange, notably offering the option to buy crypto without needing KYC. Established in 2018, Bybit has quickly become a popular choice, boasting over 10 million users worldwide and handling more than $10 billion in daily trading volume. The platform is renowned for its deep liquidity, 99.99% system functionality, and an impressive capability of processing 100,000 trades per second.

For frequent traders, Bybit is an attractive option, offering a wide selection of over 280+ cryptocurrencies along with very competitive trading fees. Spot trading fees are set at a low 0.1%, while derivatives trading fees are even lower at 0.01% for makers and 0.06% for takers. The platform also provides advanced charts, technical tools, and options like margin trading with up to 100x leverage and copy trading, catering to the needs of seasoned traders.

Bybit is also well-suited for crypto newcomers who prefer a straightforward way to buy cryptocurrencies without KYC. The platform features a fiat gateway, allowing purchases through various payment methods such as Visa/Mastercard, Apple Pay, Google Pay, or bank transfer. If the desired crypto is not directly available, users can buy USDT and trade it for their chosen coin.

For those new to trading, Bybit offers a testnet (demo) mode where virtual money can be used for practice. This feature is invaluable for learning the ropes and testing trading strategies in a risk-free environment that mirrors real market conditions. Additionally, Bybit's customer support team is available 24/7 via live chat, providing assistance whenever needed.

One limitation of Bybit is its unavailability to US residents due to IP address restrictions. However, for users who are keen on accessing Bybit, using a VPN set to a location like Australia, where Bybit operates freely, can be a workaround. This approach, though, requires careful consideration of the legal and ethical implications of bypassing regional restrictions.

- Large global exchange that has been around since 2018, and has over 10 million users

- More than 280+ cryptocurrencies available to trade

- Extremely low trading fees

- 24/7 live chat support

- Testnet demo mode so you can learn how to trade and test out new strategies risk-free

- Not available in the USA

#2. KCEX: Lowest Fee no KYC crypto exchange

KCEX has the lowest fees for a no KYC crypto exchange, and this makes it one of my top suggestions. For starters, spot trading fees are only 0.1% which is the same as Bybit, but futures trading fees are FREE for makers and only 0.04% for takers if you sign up using this unique link. With zero fee trading, it means more money in your pocket which adds up quickly if you are a high volume day trader. KCEX also offers a great welcome bonus of over $6,000 when you fulfill certain tasks after registering on the platform. For example, making a deposit of over 100 USDT in the first five days of registration will reward you with 10 USDT. To see how to claim the entire bonus, read my detailed review here.

KCEX is also extremely beginner-friendly and easy to use. The layout is clean so you new users can easily find what they are looking for, yet there are plenty of advanced trading tools and features available for experienced traders to explore. While the range of 80+ cryptocurrencies isn't as wide as some other trading platforms, KCEX only supports the most popular and widely traded coins. This ensures they always maintain high liquidity so even your large trades will be executed almost instantly with little slippage.

- Zero fees for makers when trading futures

- Spot trading fees are only 0.1%

- More than 80+ popular cryptocurrencies supported

- 100x leverage for futures trading

- High liquidity so that you can execute trades quickly

- Not able to buy or sell crypto using fiat

#3. Kine: Best DEX - no VPN required

Kine stands out as a versatile and truly anonymous crypto exchange, offering the unique feature of both centralized (CEX) and decentralized (DEX) exchange options within the same platform. For those looking to buy and trade crypto without undergoing KYC procedures, the DEX option is the ideal choice. All you need to begin trading on the DEX is to connect your cryptocurrency wallet, making the process straightforward and privacy-centric.

Kine is also an excellent platform for those interested in earning interest on their crypto holdings without KYC requirements. The platform provides various options such as staking, farming, and other earning opportunities through Kine Finance. This feature allows users to potentially grow their crypto portfolios while holding (HODLing) their assets for the long term, maintaining anonymity throughout.

For Advanced traders, Kine offers an appealing array of features. The trading fees are low at only 0.05%, and the platform supports high leverage trading up to 200x. Additionally, traders can benefit from minimal slippage and virtually unlimited liquidity, enhancing the trading experience.

As a special offer exclusive to my readers, Kine is providing an opportunity to claim up to $8,060 USDT as a bonus. The bonus structure is tiered based on the deposit amount, with a 10 USDT bonus for a $200 deposit, a 50 USDT bonus for a $1,000 deposit, and a substantial $8,000 USDT bonus for deposits over $5,000. This offer adds significant value for new users signing up through the link here, making Kine an even more attractive option for those seeking a versatile and anonymous crypto trading experience.

The only real limitation of Kine currently lies in its trading options; the platform offers only derivatives trading and does not provide spot trading. However, there are plans to expand its offerings to include spot trading in the near future. For those interested in this feature, it's advisable to keep an eye on Kine's official website for updates regarding the availability of spot trading. This expansion would certainly enhance the platform's appeal, catering to a broader range of trading preferences and strategies.

- Low trading fees of only 0.05%

- High liquidity and minimal slippage

- No KYC and no VPN required on DEX site

- Copy trading is available

- Zero gas fee trading

- No spot trading available

- Limited range of only 21 cryptocurrencies to trade

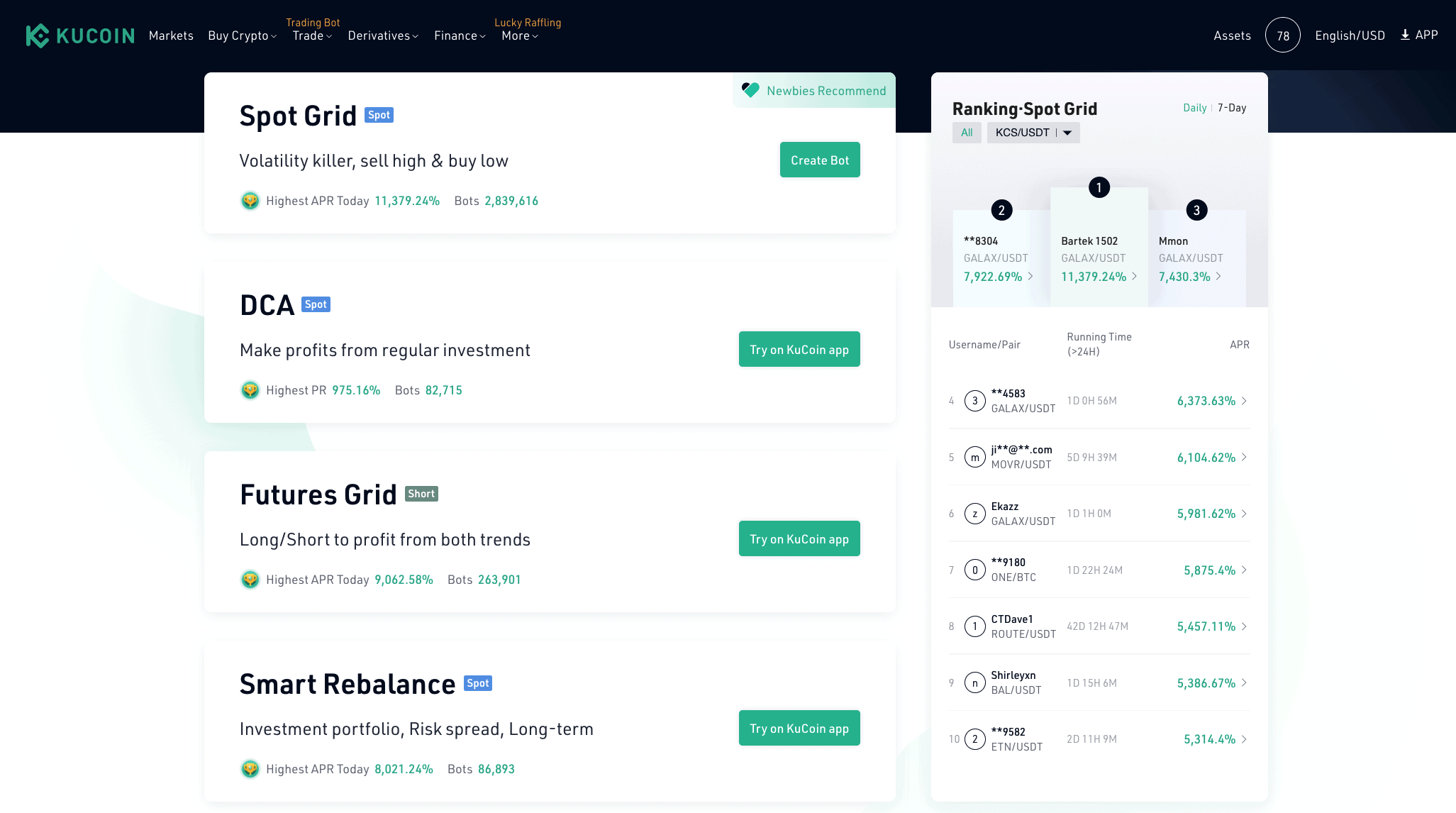

#4. KuCoin: Best for wide range of 700+ coins

KuCoin stands out as an optimal no KYC crypto exchange for those seeking access to a vast selection of coins. As one of the best exchanges globally, KuCoin boasts over 30 million users and provides a plethora of trading options. With more than 700+ coins available for trading and low fees of just 0.1%, KuCoin caters to a wide range of trading preferences. The platform features an array of additional functionalities, including spot trading, margin trading, futures, a P2P marketplace, and crypto lending services.

A notable feature of KuCoin is the availability of FREE trading bots on its platform. These bots, which include options like Spot Grid, Futures Grid, Smart Rebalance, DCA, and Infinity Grid, are immensely beneficial for users interested in automating their trading strategies. I personally found KuCoin's bots particularly useful as they allow for capitalizing on market movements even when I'm not actively online. The trades are carried out based on predetermined parameters, requiring no ongoing manual intervention. Considering that trading bots are often paid services, KuCoin's provision of these tools for free is a significant advantage.

For a thorough understanding of all that KuCoin has to offer, you can refer to my comprehensive review. Additionally, if you're interested in comparing KuCoin with Bybit, another leading exchange, my article on KuCoin vs Bybit offers detailed insights and analysis to help you evaluate which platform best suits your trading needs.

- More than 700+ coins available to trade

- Low trading fees of 0.1% which can be discounted by 20% if you pay with KCS coin

- Spot, margin, and futures trading available

- Free trading bots included in the platform

- Crypto lending, crypto borrowing, and staking supported

- Poor customer service - no live chat available

#5. Margex: Best for margin trading with no KYC

Margex stands out as a specialized no KYC crypto exchange focusing on margin trading, known for its high level of security. The exchange ensures the safety of user assets by storing 100% of cryptocurrencies offline in cold storage, offering a security standard comparable to banks. Additionally, Margex has implemented an innovative system known as MP Shield, designed to safeguard against price manipulation. This system utilizes AI algorithms, continuous monitoring of trading activities, and aggregates liquidity from over 12 providers to protect users from unfair liquidations due to market manipulation.

The platform's trading fees are notably low, tailored specifically for margin trading, as spot trading is not available on Margex. The fees stand at 0.019% for makers and 0.060% for takers, with the option to leverage up to 100x.

However, Margex does have a limitation in terms of the range of cryptocurrencies offered. The selection is limited to 39 cryptocurrencies, focusing primarily on major coins like BTC, ETH, LTC, and SOL. This limitation can be seen as a safeguard, as it minimizes the risks associated with less liquid and potentially volatile altcoins that are often subject to pump and dump schemes.

For those interested in exploring Margex, I have a special welcome offer available. By signing up through my link, new users can receive a $100 free bonus, plus an additional 15% bonus on their first deposit. For more details on how to claim this offer and to understand the specifics of the platform, you can click here. This offer provides an excellent opportunity to get started with margin trading on Margex with some added benefits.

- Extremely low fees of 0.019/0.060% (maker/taker)

- Excellent customer support available

- Great for beginners to margin trading

- Very secure exchange, and protected against price manipulation

- Welcome offer of $100 bonus FREE, plus receive 15% of your first deposit as bonus

- Only supports 39 cryptocurrencies

- Only margin trading, no spot trading available

#6. Weex: Best no KYC exchange for margin market depth in the USA

Weex is an ideal crypto exchange for those seeking anonymity combined with zero trading fees. It offers fee-free spot trading for both makers and takers, setting it apart in the industry. Additionally, Weex boasts superior liquidity compared to other top trading platforms, including MEXC and Bitget. This high liquidity is beneficial for all types of investors, from beginners to large-scale traders, ensuring minimal concerns regarding liquidity and slippage.

For those interested in derivatives trading, Weex is a compelling choice. The platform offers USDT perpetual contracts, inverse contracts, and simulated contracts, with relatively low trading fees of 0.02% for makers and 0.06% for takers. Traders can choose from over 30 of the most popular cryptocurrencies and have the option to leverage up to 200x, which is considerably higher than many competing exchanges.

Copy trading is another standout feature on Weex, allowing users to automatically replicate the trades of experienced traders. This feature enables traders to leverage the expertise of professionals, potentially profiting alongside them. Importantly, Weex has a cap on the commission for copy trading, ensuring you never pay more than 10% of your profits to the trader you're copying.

Security is a top priority at Weex, with robust industry-leading protocols in place. The platform also has a significant user protection fund, containing 1,000 BTC to cover potential losses in the event of a security breach. This fund offers substantial peace of mind for Weex users. Moreover, Weex is well-regulated, holding licenses in the US (MSB), Canada (MSB), and with the SVGFSA. Additionally, it undergoes audits by four security vendors: Shencha Technology, Qingsong Cloud Security, HEAP, and Armors, further reinforcing its commitment to security and regulatory compliance.

- Zero-fee spot trading

- Low futures trading fees of 0.02/0.06% (maker/taker)

- Copy trading with maximum 10% commission fees

- Excellent security, with user protection fund worth 1,000 BTC

- Several regulatory licenses so it is legal to operate in US, Canada and China

- Direct crypto purchases using fiat are not supported

#7. Bitfinex: Best for derivatives trading

Bitfinex ranks next on my list of the best no KYC crypto exchanges, known for its long-standing reputation in the crypto world since its establishment in 2012. The platform is renowned for offering deep liquidity and outstanding customer support, making it a strong contender for both new and experienced traders.

Bitfinex's trading options are comprehensive, including spot and margin trading, with a particular emphasis on derivatives trading. The fee structure on Bitfinex is competitive, with spot trading fees set at 0.1% for makers and 0.2% for takers. For derivatives trading, the fees are even lower, at 0.02% for makers and 0.075% for takers.

One of the appealing aspects of Bitfinex is its customizable interface. Users can tailor the platform to their preferences, choosing their preferred theme and setting up personalized alerts. With over 150 different coins and more than 300 trading pairs available, Bitfinex offers a wide range of options, ensuring that traders can find the pairs and markets that best fit their trading strategies and interests. This variety, combined with user-friendly customization and low fees, makes Bitfinex a strong choice for those seeking a no KYC crypto exchange.

- Best for derivatives trading, and ideal for experienced crypto traders

- Well-established exchange that has been around for over a decade

- High liquidity

- More than 150+ coins and 300+ trading pairs

- Spot and margin trading available

- Trading fees are higher than some other exchanges on this list

#8. PrimeXBT: Best for CFD trading

PrimeXBT is the best no KYC crypto exchange for CFD (contract for difference) trading. It offers more than 40+ different cryptocurrencies, as well as a range of other traditional financial markets: forex, commodities and indices.

One of the best features of this exchange is 'Covesting', which is another name for copy trading. You can easily automatically copy the most successful traders and make profits while they do too. This is an excellent feature for those that don't want to spend time continually monitoring the market, or simply are new to trading and do not have much experience.

PrimeXBT has a customisable interface that allows experienced traders to use which ever indicators and charts they prefer. The fees on PrimeXBT are just 0.05%, but keep in mind that this is for margin trading (with up to 100x leverage) using CFDs. CFD trading means that you can go long or short, so you can make money from the prices of crypto dropping, which is not possible when spot trading.

The downside of PrimeXBT is that spot trading is not supported; if you intend to spot trade, you need to consider one of the other options.

- 40+ different cryptocurrencies, 50+ forex pairs, 11 stock indices, 5 commodities

- Covesting available to copy the trades of successful investors

- CFD trading means you can bet on prices to rise or fall

- Live chat support

- Only supports margin trading with CFDs - no spot trading

- Not available in the USA, Canada, France, Japan, and Israel

#9. AAX: Best for advanced features

AAX is another option of no KYC crypto exchange, and is the best choice for those who are looking for lots of advanced features. AAX has spot trading, futures trading, and OTC service desk, as well as crypto interest earning options. The exchange is powered by LSEG Technology so the transactions are lightning-fast.

While AAX is packed with features, it is still suitable for beginners, as it is easy to navigate, and there is a learning center and live chat support if they are needed. There are more than 100+ cryptocurrencies available, with more than 20 fiat currencies supported. The fees for spot trading are just 0.1/0.15% (maker/taker) and 0.04/0.06% (maker/taker) for futures trading.

One of the downsides of AAX is that it is not suitable for US residents, so you will have to choose another option if you live in the States.

- Excellent customer support and learning content

- Spot trading, futures trading, and OTC desk

- More than 100+ cryptocurrencies available

- Low trading fees

- Not available in the USA

- No margin trading supported

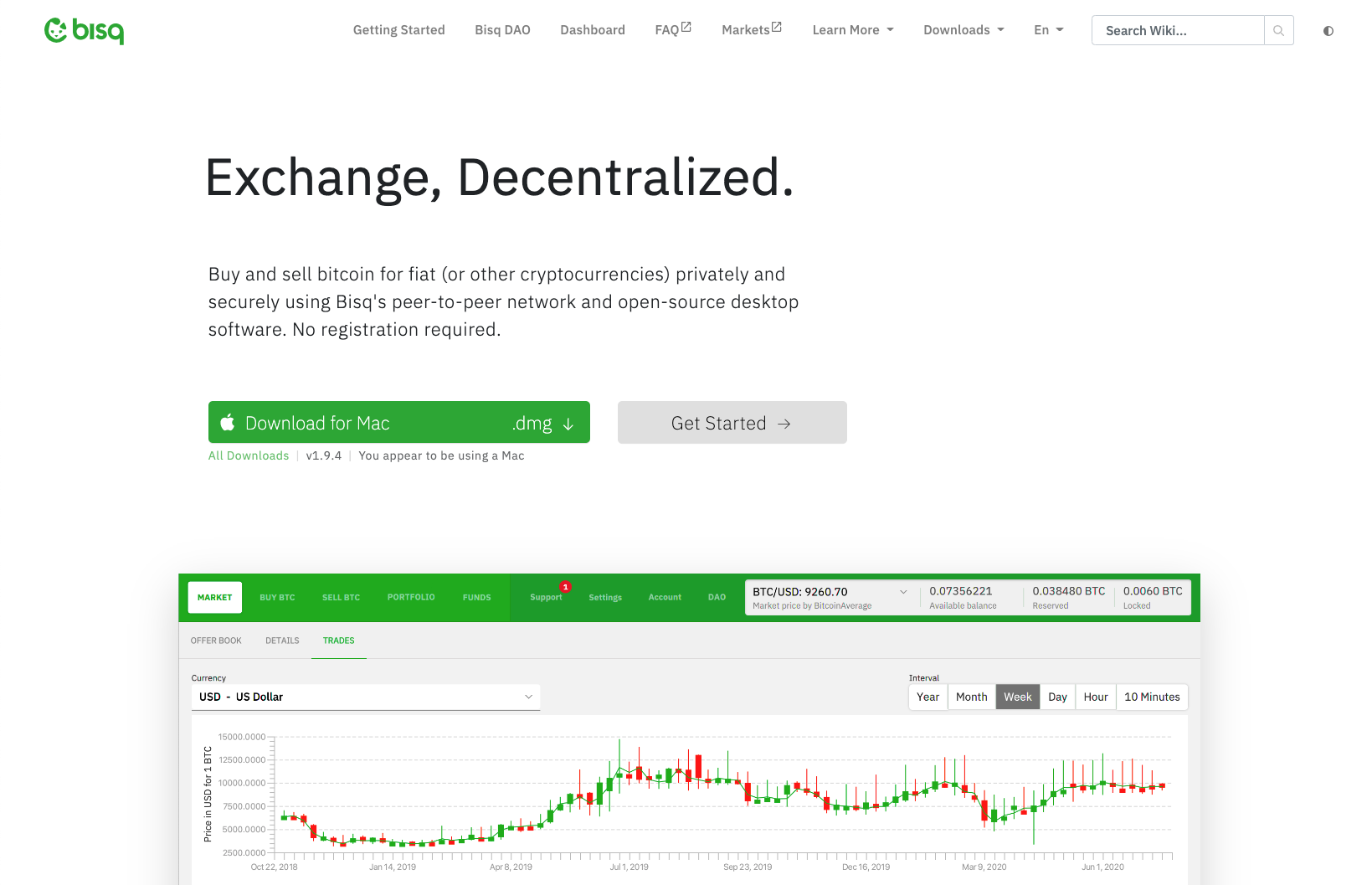

#10. Bisq: Decentralized Bitcoin exchange

Rounding out our list of the best no KYC crypto exchanges is Bisq. This is a unique exchange because it is actually completely decentralized, and you do not need to input any personal details, not even your name. Bisq is extremely secure, using Tor, and does not store any cryptocurrency or fiat funds on the server.

There are more than 15 different payment methods, and a decent range of 125+ different cryptocurrencies available to trade. The trading fees are very low for makers at just 0.05%, but slightly higher for takers (0.35%).

One disadvantage of Bisq is that you can only trade against BTC. You cannot trade against fiat currencies, or stablecoins, such as USDT. This is something to keep in mind before signing up to this exchange.

- Fully decentralized platform

- Trade completely anonymously

- Extremely secure, with no crypto or fiat funds stored on the server

- More than 125+ cryptocurrencies to trade

- Over 15+ payment methods accepted

- Not suitable for beginners

- BTC is the only crypto you can trade against

Frequently Asked Questions:

Yes, you can buy crypto without KYC if you use one of the exchanges on our list. This means that even if you are under 18, you will be able to buy or trade crypto.

While Kraken is an excellent cryptocurrency exchange, there are strict KYC regulations it has to adhere to. If you want to sign up to a crypto exchange without KYC, check out our list here.

Coinbase is a very popular crypto exchange, but it has to comply with very strict KYC rules to remain compliant. That means you cannot sign up to Coinbase anonymously. If you want to sign up to a crypto exchange that does not require KYC, read our list above for several options.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our terms of service please click the link.