With hundreds of cryptocurrency exchanges available in 2024, it is difficult to know which one to choose. In this article, I provide you with the latest information, based on actual testing and research, so you have the most trusted advice on crypto exchanges. The top 3 crypto exchanges in Australia are listed below, updated for 2024, and if you are looking for more options, you will find them further down the page.

✔️ Best for frequent traders, with rapid trade speed and 280 cryptocurrencies

✔️ Low fees - spot trading: 0.1%, derivatives trading: 0.01% (maker), 0.06% (taker)

✔️ Margin trading with up to 100x leverage

✔️ FREE $10 BTC when you sign up here and deposit at least $100

✔️ Most secure and trusted crypto exchange, est. 2013

✔️ Largest crypto exchange in Australia, with 2.5 million customers

✔️ 430+ cryptocurrencies to buy, sell and trade

✔️ $20 FREE BTC when you sign up here

✔️ Highly trusted - 4.7/5 on TrustPilot, ISO 27001 certification and partnership with TRM Labs

✔️ Best educational exchange - Learn & Earn and unique demo mode

✔️ Aussie SMSF crypto leaders, with set up in under 24 hours

✔️ Generous welcome offer, FREE $20 BTC when you sign up here

In the first few months of 2024, we have seen the crypto market enter a bull cycle. As the prices are on the way up, you might consider it an excellent time to invest, as you could see significant profits in the coming months.

However, the biggest challenge is identifying which crypto exchanges are trustworthy, which are scams, and which one is best suited to your needs. To help you in this process, I have spent countless hours meticulously researching and testing various exchanges in Australia, so that you can find a crypto platform that aligns with your requirements. For example, I've conducted comprehensive tests to find the exchange with the best customer support and the lowest combined fees and spreads.

My goal is to help you with your crypto investing and trading journey by providing accurate, useful, and current information based on thorough research and practical testing.

Selecting the right crypto exchange involves understanding which category best meets your specific needs. It's advisable to sign up to and test several exchanges for yourself. What suits one person may not be the best fit for another. Taking advantage of sign-up offers can also be beneficial, and diversifying where you store your cryptocurrency can help minimise the risk of losing your assets.

Best Crypto Exchanges in Australia: Updated April 2024

- Bybit Exchange - Best overall for Australians, low fees

- CoinSpot Exchange - Most trusted and secure in Australia

- Swyftx Exchange - Best educational exchange

- Digital Surge - Best for low spreads

- MEXC Trading Platform - Lowest trading fees (Zero fees)

- Crypto.com App - Best mobile app for beginners

- Binance Exchange - Best for serious traders

- KuCoin Trading Platform - Best for huge range of 700+ coins

- eToro Australia Broker - Best for copy trading

- CoinJar Exchange - Use CoinJar card to spend your crypto like cash

- Independent Reserve Exchange - Best for crypto insurance

What is the best crypto exchange?

Bybit takes the top spot as the best crypto exchange in Australia, primarily due to its competitive fees, extensive selection of 280+ cryptocurrencies, and a wide range of trading options. It strikes a balance between being user-friendly for beginners and offering advanced features for experienced traders, including spot, margin, and futures trading. Bybit's 24/7 Live Chat support, intuitive interface, and top-tier security measures make it an excellent choice. If you're interested in joining Bybit, use my unique link to get $10 in FREE BTC upon depositing a minimum of $100.

Best Australian Cryptocurrency Exchanges of 2024

#1. Bybit - Best overall in Australia, low fees, best for frequent traders

SUMMARY

Bybit is the best choice for frequent traders, with extremely low fees, wide range of coins, and plenty of trading markets.

PROS:

CONS:

Bybit stands out as my preferred crypto exchange in Australia, particularly for active traders, thanks to its proven reliability and trustworthiness since its inception in 2018. Boasting over 10 million customers and daily trading volumes exceeding $10 billion, Bybit is a major player in the crypto trading scene. It offers deep liquidity, near-perfect system functionality at 99.99%, and an impressive trade execution speed of 100,000 transactions per second.

I find that Bybit is ideally suited for frequent crypto traders, eg: day traders, but it's also accommodating for newcomers interested in buying and holding crypto. My personal experience with Bybit involved straightforward crypto purchases using PayID, and other options like Visa/Mastercard, Apple Pay, and Google Pay are also available. I also tested how to trade the purchased crypto, which was extremely easy.

Bybit features spot trading for over 280+ coins and provides derivative markets (USDT Perpetual contracts, Inverse Perpetual contracts, and Inverse Futures contracts) for more seasoned traders. Trading fees are among the lowest in Australia, with derivatives trading fees at 0.01% / 0.06% (maker/taker) and 0.1% for spot trading.

Advanced traders will appreciate Bybit for its comprehensive charts, technical tools, and trading options like copy trading and margin trading with up to 100x leverage. While high leverage can increase your profits, it's crucial to be mindful of the risks involved, as market fluctuations can lead to substantial losses. Margin trading is recommended only for those who understand and can manage these risks.

Bybit also offers a testnet (demo) platform, which mirrors the main website. It is great for both new and seasoned traders to test their strategies using play money. This is a valuable tool for practicing risk-free before depositing real money. Additionally, Bybit's 24/7 Live Chat support and insurance fund provide added layers of support and protection against excessive losses. For serious Australian crypto traders, Bybit is certainly worth considering. Plus, by using this link, you can get $10 FREE Bitcoin when you deposit a minimum of $100.

Related articles: Best margin trading exchanges, Best copy trading platforms, Bybit referral code, Bybit vs Margex, Bybit vs KuCoin, Bybit vs Binance, Bybit vs Bitget, Bybit vs FTX, Best no KYC crypto exchanges, Best crypto trading bots, Bybit vs Phemex, Bybit vs Binance, Best anonymous crypto exchanges

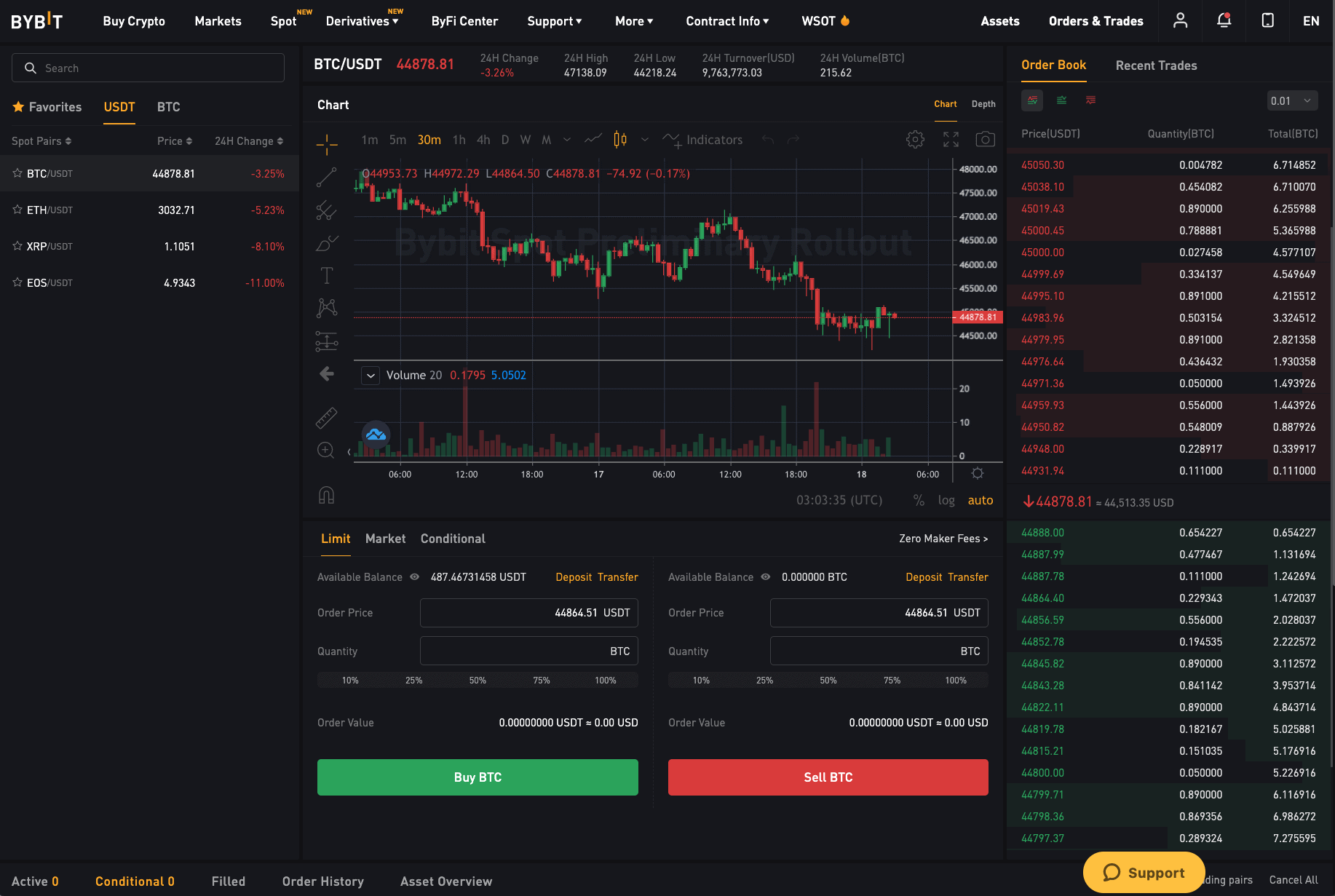

#2. CoinSpot Exchange - Most trusted and secure platform

SUMMARY

CoinSpot is the most secure exchange in Australia, established in 2013, and trusted by over 2.5 million users. With more than 430+ coins available, you won't need to look elsewhere.

PROS:

CONS:

CoinSpot ranks as one of Australia's top cryptocurrency exchanges, thanks to its comprehensive features, extensive array of over 430+ coins, and a solid reputation established since 2013. It's a certified member of Blockchain Australia, registered with the Australian Securities and Investments Commission (ASIC), and regulated by AUSTRAC, adhering to all Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. Signing up with CoinSpot means you're partnering with a trustworthy and established exchange. As a bonus, using this link to sign up will give you $20 FREE Bitcoin to start your crypto investing journey!

The platform is particularly user-friendly, ideal for those new to the world of crypto. The dashboard is streamlined and intuitive on both desktop and mobile app versions, ensuring a hassle-free user experience. CoinSpot emphasises customer service, offering 24/7 Live Chat support and specialised email support teams, complemented by a comprehensive Help Centre filled with articles and tutorials. In fact, CoinSpot was awarded the #1 crypto exchange for customer support, in our detailed real-world test.

With over 430+ coins available, CoinSpot boasts one of the largest ranges of any Australian crypto exchange. This variety is especially appealing if you're looking to invest in less mainstream altcoins, which could be available on CoinSpot before other Australian platforms.

A standout feature is the CoinSpot Mastercard, a complimentary crypto debit card that lets you spend your crypto like cash, both in-person and online. When I tested it out, I found it integrated seamlessly with Apple Pay, for effortless crypto purchases in-store and online. Android users can also add the card to Google Pay for tap-to-pay convenience. The introduction of CoinSpot's Mastercard is a significant step towards integrating crypto into mainstream payment systems in Australia.

While some users might find CoinSpot's 1% fee for Instant Buys too high (compared to their competitors), it's a small concession for the security and peace of mind provided by Australia's most secure exchange. More competitive fees of 0.1% are available for market trades and over-the-counter (OTC) transactions. For a comprehensive review of CoinSpot, including its features and services, you can click here.

Related articles: CoinSpot vs Swyftx, CoinSpot vs Independent Reserve, CoinSpot vs Binance, CoinSpot vs Coinbase, CoinSpot vs Digital Surge, How to stake crypto on CoinSpot, CoinSpot referral code

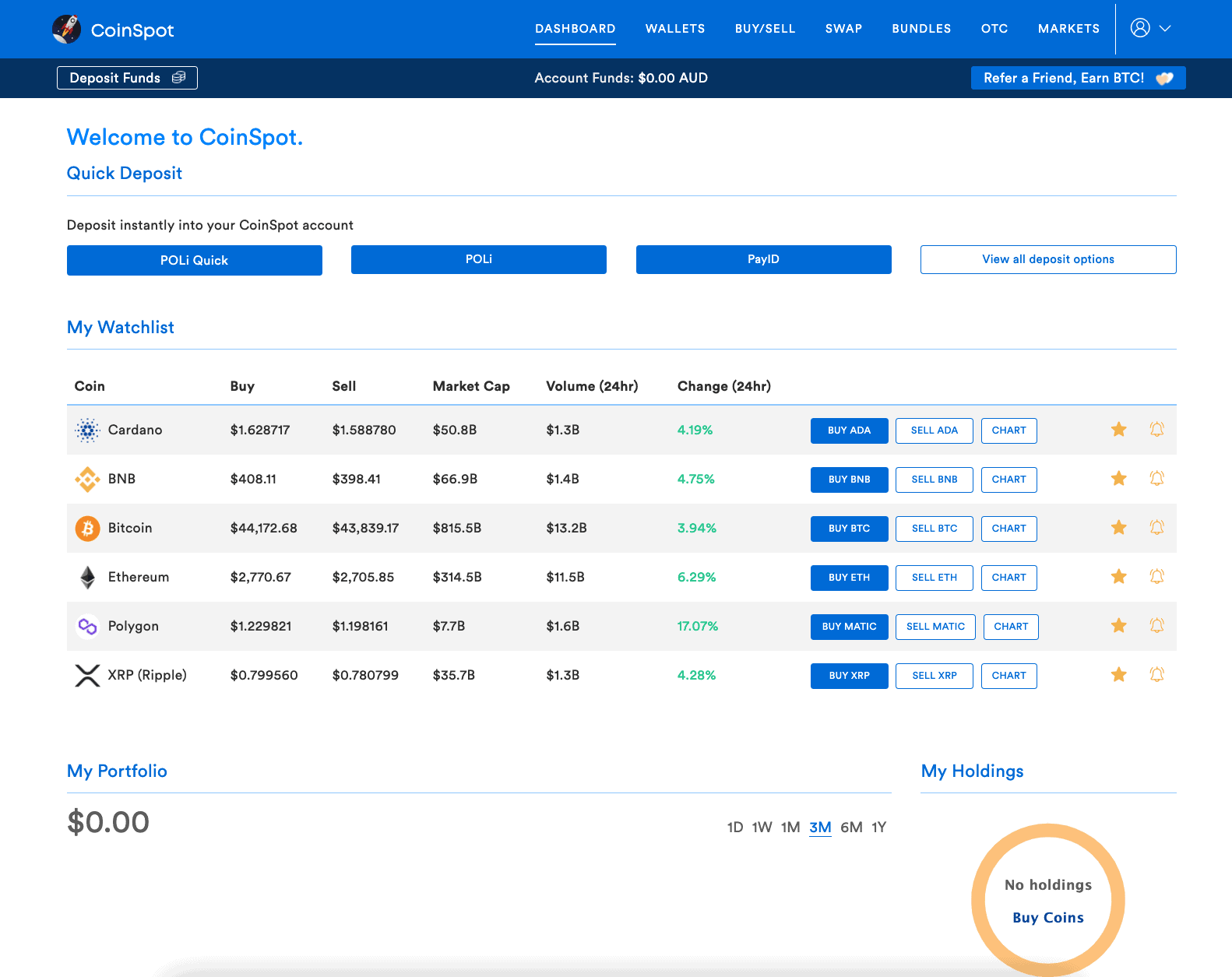

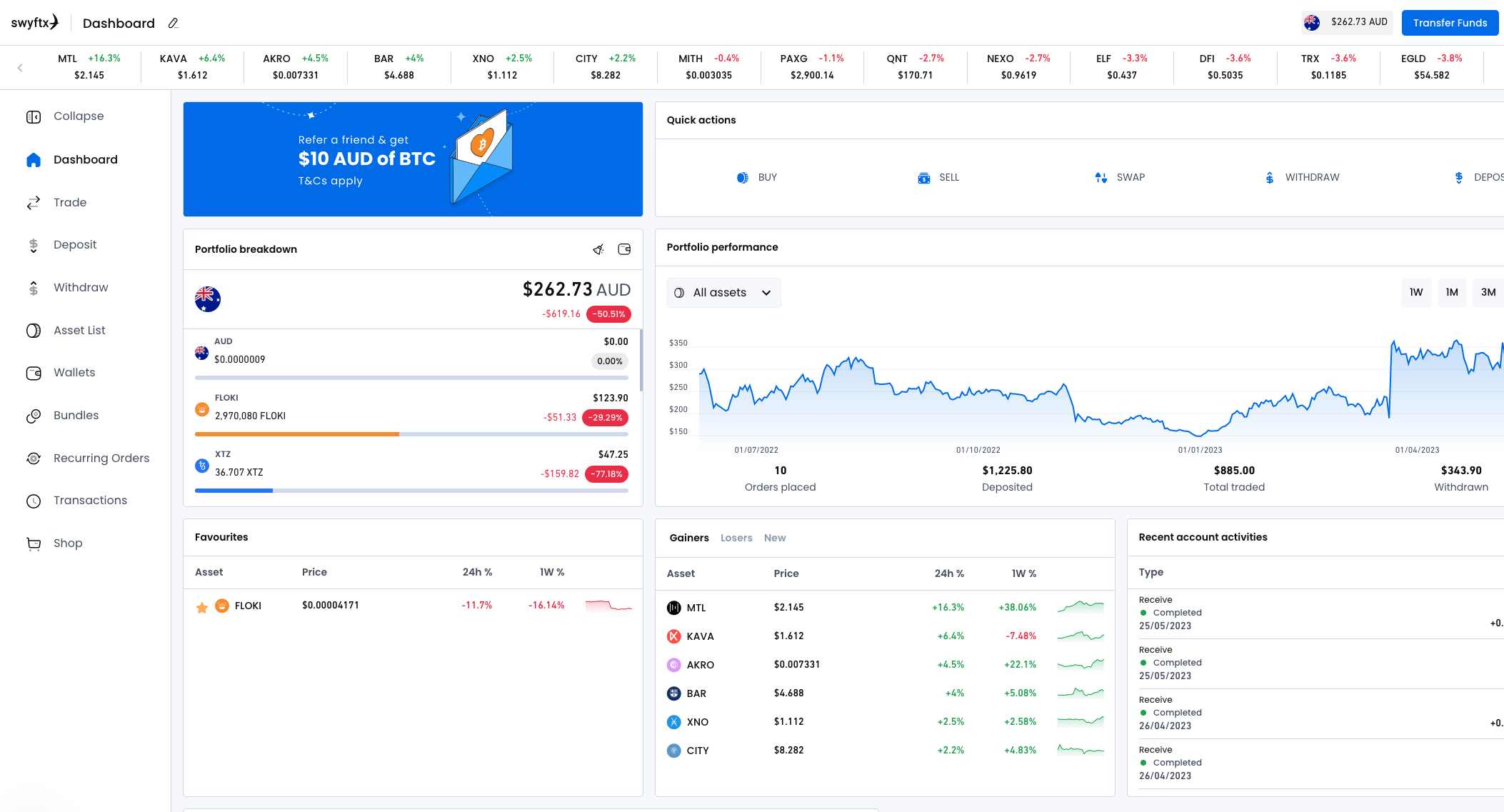

#3. Swyftx Exchange - Best educational exchange

SUMMARY

Swyftx is one of the best crypto exchanges, with a demo mode, low spreads, and more than 320 coins to buy, sell and trade.

PROS:

CONS:

Swyftx is an outstanding option for those new to the world of cryptocurrency. It boasts a user-friendly interface, a unique demo mode, Live Chat support, low fees, and a welcome offer of $20 FREE Bitcoin, even without a deposit. The platform offers a continuously expanding selection of over 320+ cryptocurrencies, regularly adding new coins to its portfolio.

For beginners to crypto, Swyftx is the perfect option, as there is a heavy focus on educating users. There are a wide range of Learn & Earn courses, where you receive free crypto for completing a short online course! Swyftx has also partnered with educational providers such as CollectiveShift, Investified and crypto YouTuber Jason Pizzino. There is even a Demo mode which is a game-changer for new traders. You can easily activate this from the top right corner of the website, and it provides $10,000 in virtual money to practise buying, selling and trading crypto. The demo mode uses current live market prices, offering a realistic experience and a safe space to test various trading strategies without financial risk.

Another attractive feature of Swyftx is their fee structure. Deposits and withdrawals in AUD are free, regardless of the method used, and trading fees are a competitive 0.6%. In my comparative analysis of spreads across various Australian crypto exchanges, Swyftx consistently ranked among the lowest.

It's worth noting that advanced traders might find Swyftx lacking in certain areas. The exchange doesn’t offer staking, futures or margin trading, making it more suited for beginner and intermediate investors. For those who are more serious about crypto trading, a trading platform like Bybit or MEXC would be a better fit.

Related articles: Swyftx vs Coinspot, Swyftx vs Binance, Swyftx vs Digital Surge, Swyftx vs Coinbase, Swyftx vs Independent Reserve, How to stake crypto on Swyftx, Swyftx referral code

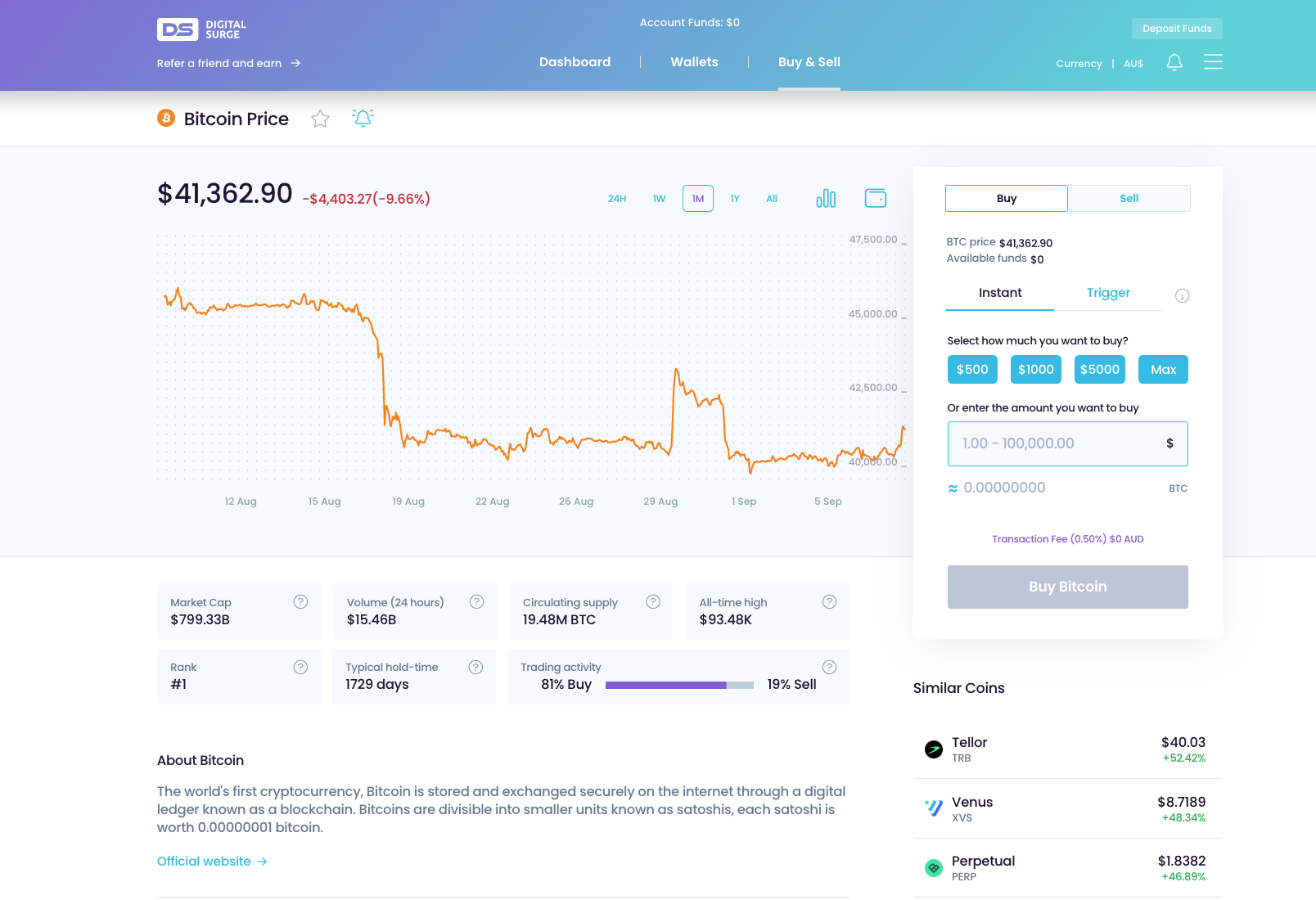

#4. Digital Surge - Best for Low Spreads

SUMMARY

Digital Surge is an Australian crypto exchange with 300+ coins, low fees of 0.5%, and extremely tight spreads, according to this independent test.

PROS:

CONS:

Digital Surge is a top choice for Australian crypto enthusiasts, especially for those at the beginner to intermediate level. The platform's design is notably intuitive and user-friendly, complemented by 24/7 live chat support for any assistance needed. With a selection of over 300+ coins, users have access to a wide range of popular cryptocurrencies, as well as numerous emerging altcoins.

One of the key reasons I rank Digital Surge so highly is the competitive fee structure and narrow spreads. The trading fees start at 0.5% and decrease with increased trading volume. In my comprehensive comparison of Digital Surge against other platforms like CoinSpot, Swyftx, and Crypto.com, Digital Surge consistently offered the best rates in terms of fees and spreads. The full test results and details are available here.

While some users, particularly those looking for advanced features like staking, margin trading, or trading bots, might find Digital Surge somewhat basic, it remains an ideal choice for the majority of Australian crypto investors. For those seeking a more sophisticated day trading platform, platforms like Bybit or MEXC might be more appropriate. For most Australian crypto traders, however, Digital Surge is a fantastic option. Plus, by signing up through this special link, you'll receive $10 in FREE BTC to kickstart your trading journey.

Related articles: Digital Surge vs Coinspot, Digital Surge vs Swyftx, How to stake crypto on Digital Surge, Digital Surge referral code

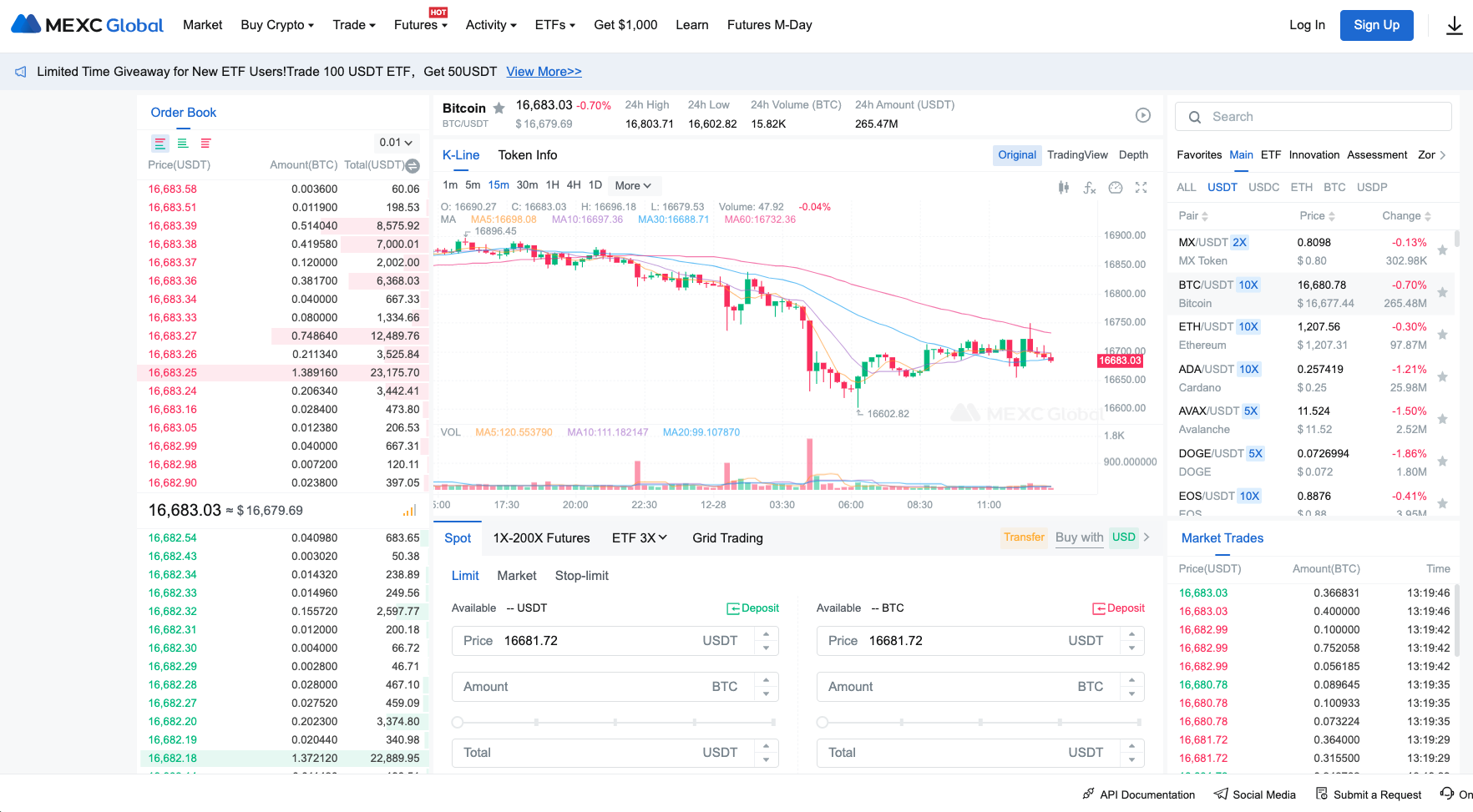

#5. MEXC Trading Platform - Lowest Trading Fees (Zero Fees)

SUMMARY

MEXC is the best option for advanced cryptocurrency traders who value low fees, deep liquidity and a massive range of trading pairs. With more than 1,520 coins and 2,110+ pairs, you are bound to find a market suited for you.

PROS:

CONS:

MEXC is my top recommendation for those who are focused on a comprehensive trading experience. With more than 1,520+ coins, and 2,110+ trading pairs, you will be able to find countless markets that you can profit from. MEXC has the lowest fees in Australia, with FREE spot trading for makers and takers, and free futures trading for makers. For futures takers, the fees are only 0.01%. Not only that, but you receive $30 USDT free if you sign up with this link! If you are new to cryptocurrencies and you want to learn how to trade for FREE, see my crypto trading course for beginners. I run through everything from the basics to technical analysis, and use screenshots from my MEXC account to explain how it works. I have received lots of positive feedback from my readers.

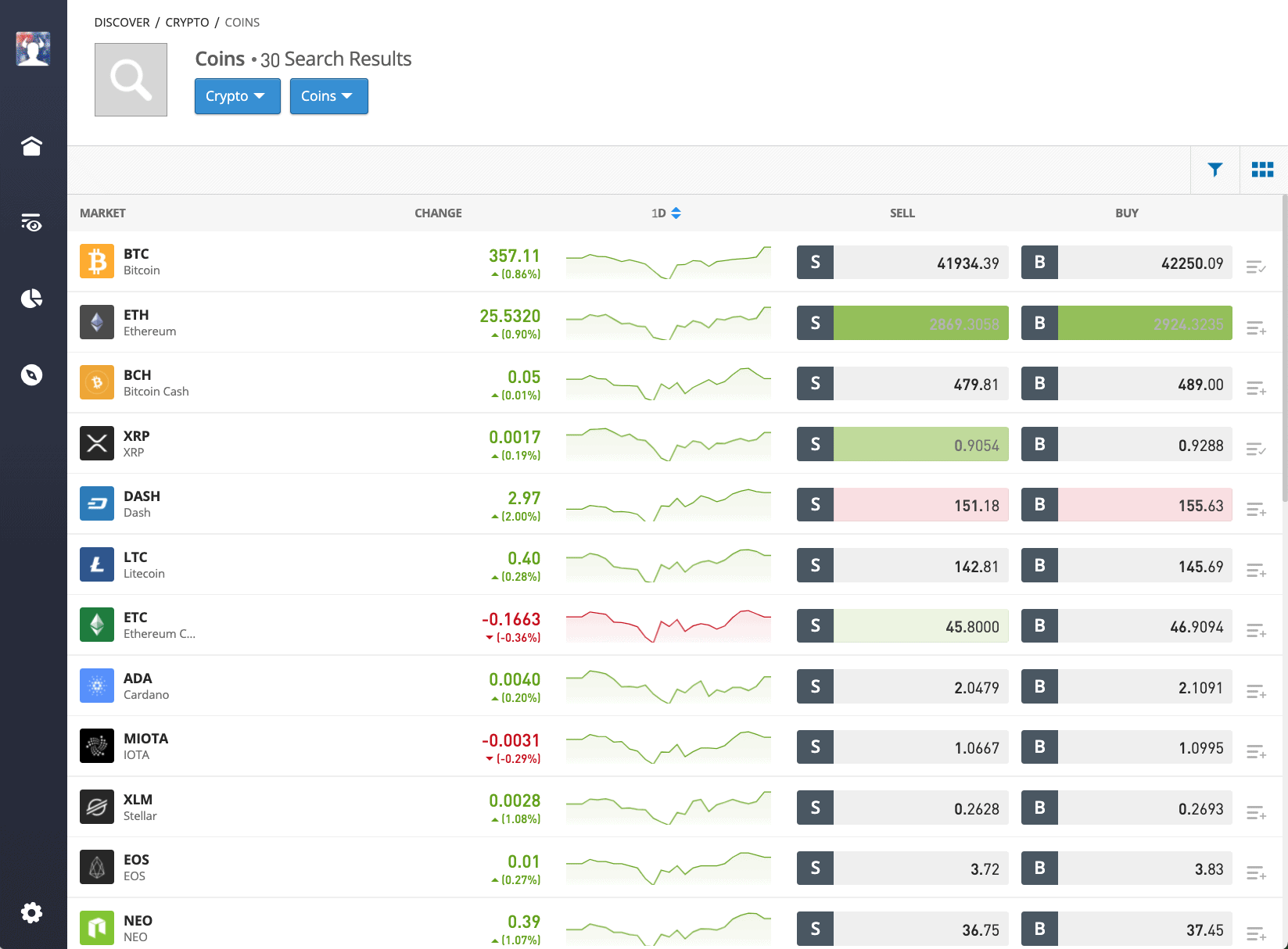

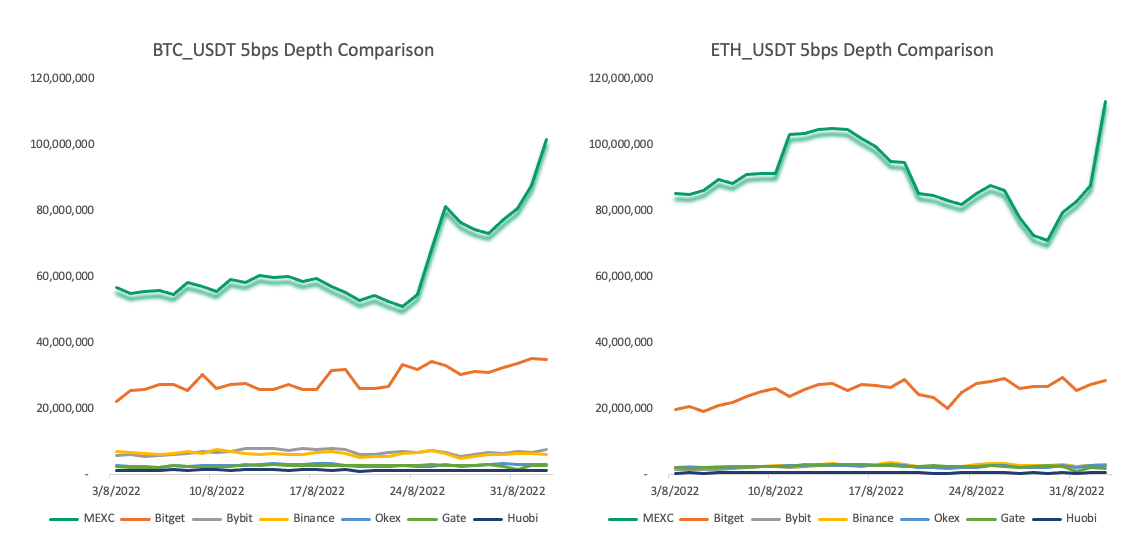

If you have some experience trading, you will understand the importance of liquidity, and will be pleased to know that on MEXC, it is much higher compared to other top trading platforms, such as Bybit, Binance, KuCoin, and Huobi. Take a look at the graphs below, which show the liquidity of ETH/USDT and BTC/USDT, and you can see that MEXC has more than twice the liquidity of its nearest competitor Bitget, and 10x more than the other exchanges.

There are plenty of trading markets available to suit every type of trader. Spot trading, derivatives trading, P2P market, and margin trading (up to 200x leverage) are all supported on MEXC. If you are interested in automating your trading processes, you can use MEXC's free trading bots to take advantage of market fluctuations even while you sleep. Also, if you are new to trading, or simply don't have time to research the markets and continually watch them, you can use copy trading; this is where you find successful investors and copy their exact trades automatically.

To sign up to MEXC, don't forget to use my link, as you will receive $30 FREE USDT to get you started on your trading journey.

Related articles: MEXC referral code, Best margin trading platforms in Australia, Best crypto trading bots, Best copy trading platforms

#6. Crypto.com App - Best mobile app for beginners

SUMMARY

Crypto.com is an incredibly easy-to-use mobile app that allows users to instantly buy and sell 250+ coins from their phone, earn interest, and spend funds using the free Visa card.

PROS:

CONS:

- Only available on mobile app

- Higher spreads compared to others

Crypto.com is the best crypto mobile app for beginners. It is convenient and easy to use, and features a wide range of 250+ coins which can be easily bought or sold at the click of a button, without having to deal with confusing graphs or markets. The fees are all included in the spread, so whatever price you see for the coins is what you will pay, with no additional commission.

Besides buying and selling cryptocurrencies, Crypto.com offers a range of other features that new and experienced crypto investors will enjoy. For example, there is an NFT marketplace, interest earning options, 'Supercharger' (where you are rewarded with new coins), and 'Missions', which add a gaming aspect to your crypto investing, allowing users to earn diamonds which can be exchanged for crypto and NFTs.

Crypto.com also offers a unique crypto Visa debit card, which is free for any customers who stake at least $500 of CRO (Crypto.com's own token). You receive various benefits depending on the amount of CRO you stake, and these include Netflix rebates, Spotify rebates, Airbnb rebates, and even complimentary airport lounge access. Not only that, but when you use your Visa debit card to spend AUD or crypto (which you pre-load beforehand), you receive up to 5% cashback paid in CRO on every purchase.

Crypto.com is definitely an app you want to investigate if you want the world of crypto easily accessible from your pocket. Click here to read my full review, or sign up here to get started.

Related articles: Crypto.com vs CoinSpot vs Swyftx, Best crypto apps in Australia

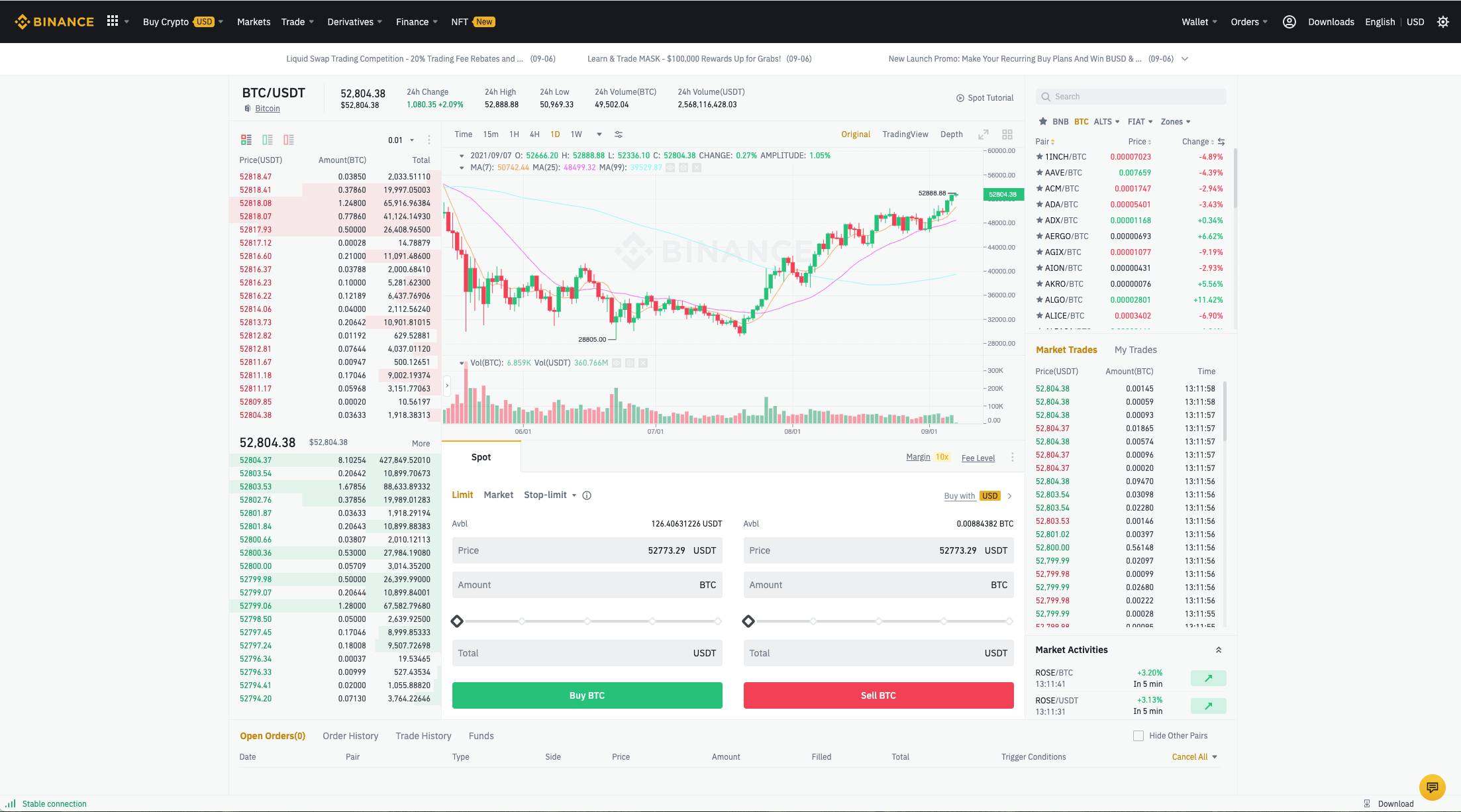

#7. Binance Exchange - Best for serious traders

SUMMARY

Binance is a massive crypto exchange with the largest trading volume in the world. With low fees, more than 600+ coins, and additional features, it is very popular with serious crypto traders.

PROS:

CONS:

Binance is the largest cryptocurrency exchange in the world based on trading volume. The reason this platform is so incredibly popular is due to the massive range of 600+ coins, low trading fees of 0% - 0.1%, integration with trading bots, and advanced features, such as P2P and an NFT marketplace.

Binance is not recommended for beginners, since it is not very intuitive for those who have never dabbled with trading before. There are complicated graphs, and order books that can turn away a newcomer to crypto investing. However, if you do run into trouble, there is a 24/7 customer service team focused on the Australian market only.

If you're serious about trading, then Binance is an excellent platform for you. Their fees are extremely competitive, at 0% for BTC and BUSD trades, and 0.1% for all other trading pairs. You can even instantly reduce your fees by 25% if you pay using Binance Coin (BNB). As an additional bonus, new users who sign up with our link can receive $100 in cashback vouchers, depending on trading volume in the first week of registration.

If you are interested in automated trading to maximise profits even when you're offline, Binance is an excellent choice, since it integrates seamlessly with most of the best trading bots, and its massive liquidity makes it attractive to use.

Related articles: Swyftx vs Binance, CoinSpot vs Binance, Binance vs KuCoin, Binance vs Bybit

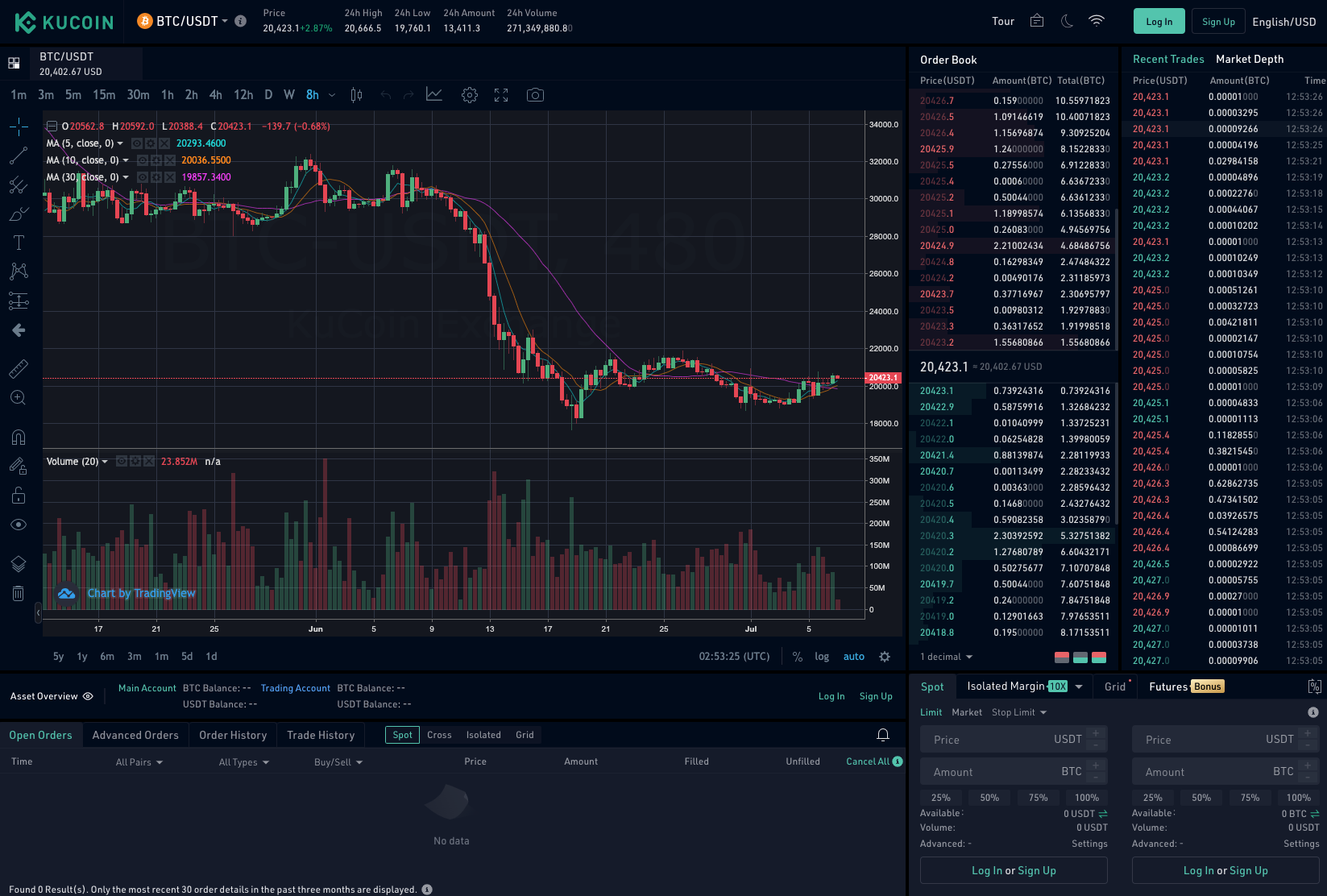

#8. KuCoin Trading Platform - Best for huge range of 700+ coins

SUMMARY

KuCoin is an advanced crypto trading platform. With more than 700+ coins, low trading fees of 0.1%, and plenty of markets, experienced traders will love KuCoin.

PROS:

CONS:

KuCoin is an extremely popular exchange around the world, with over 30 million users, and this is because it offers so much to advanced crypto traders. A massive range of 700+ coins, low trading fees of 0.1%, and plenty of markets and trading options, such as spot trading, margin trading, futures, and P2P marketplace.

KuCoin has included FREE trading bots on their platform, which you can use to automate your trading strategy. The bots currently available are Spot Grid, Futures Grid, Smart Rebalance, DCA, and Infinity Grid. These are excellent ways to make trades without letting emotion get in the way, and allows you to profit from market volatility when you are away from your devices, and even while asleep. Crypto trading bots can cost hundreds of dollars, so being able to access them for free on KuCoin is a great feature.

KuCoin offers plenty of options for crypto enthusiasts, such as spot trading, margin trading, derivatives trading, crypto lending, crypto borrowing, crypto interest, and even NFTs. Read our full review of KuCoin to learn all that this feature-packed exchange has to offer.

Related articles: KuCoin vs Binance, KuCoin vs Kraken, KuCoin vs CoinSpot, KuCoin vs Bybit, How to withdraw from KuCoin, How to sell on KuCoin, How to transfer from Coinbase to KuCoin

#9. eToro Australia Broker - Best for copy trading

"eToro AUS Capital Ltd ACN 612 791 803 AFSL 491139. eToro offers both real crypto assets as well as crypto assets as OTC Derivatives.

Real crypto assets are unregulated & highly speculative. Being unregulated, there is no consumer protection. Your capital is at risk.

Leveraged positions are OTC Derivatives, which are regulated financial products. OTC Derivatives are considered risky financial products, speculative and include leverage. Not suitable for all investors. Capital at risk. See PDS"

SUMMARY

eToro Australia allows users to invest in cryptocurrencies, stocks, forex and even commodities. There is a strong focus on social trading, where you can interact with other investors and even copy successful traders.

PROS:

CONS:

"eToro AUS Capital Ltd ACN 612 791 803 AFSL 491139. eToro offers both real crypto assets as well as crypto assets as OTC Derivatives.

Real crypto assets are unregulated & highly speculative. Being unregulated, there is no consumer protection. Your capital is at risk.

Leveraged positions are OTC Derivatives, which are regulated financial products. OTC Derivatives are considered risky financial products, speculative and include leverage. Not suitable for all investors. Capital at risk. See PDS"

eToro is a broker offering many trading instruments, including cryptocurrency. It is built from the ground up as a social trading platform, meaning you can interact with other users, by posting and commenting on the News Feed, and even automatically copy the exact trades of the most successful investors.

Even though eToro is not a dedicated crypto exchange, it has a lot of excellent features to keep up with the competition. eToro offers a demo account with $100,000 virtual money to practise trading, it has crypto staking, and margin trading with 2x leverage.

eToro only offers 75 popular cryptocurrencies on their platform, but they also offer global stocks, forex, and commodities to invest in. It is an excellent broker if you plan on expanding your investments beyond crypto, and they currently have a promotion of $10 bonus when you buy $100 worth of ASX shares.

A downside is that eToro operates in USD, so you will need to pay a currency conversion fee when you deposit and withdraw. To learn about all the features and trading options available on eToro, click here.

Related articles: eToro vs CoinSpot, eToro vs Swyftx

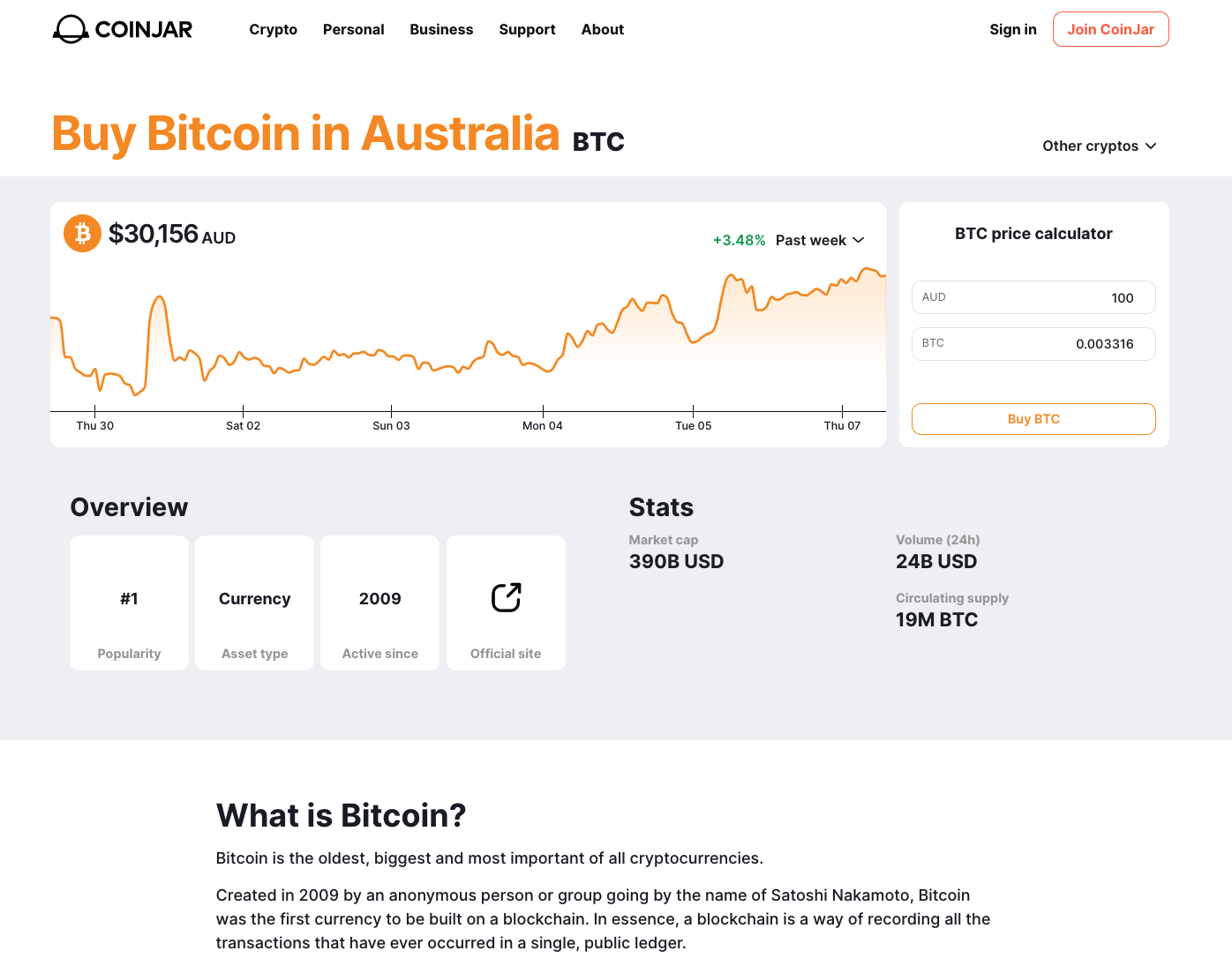

#10. CoinJar Exchange - Use CoinJar card to spend your crypto like cash

SUMMARY

CoinJar is one of the longest-running crypto exchanges in Australia, established in 2013. Its unique CoinJar card lets you spend your crypto like cash.

PROS:

CONS:

CoinJar is a simple cryptocurrency exchange, that has been around for a long time. It has built up its reputation and trust in the Australian crypto industry, and the best feature is the CoinJar card, that operates like a debit card for your cryptocurrency. It is powered by MasterCard, and you load it with any cryptocurrency you like in your CoinJar account. After you have pre-loaded it, you can spend it on any purchases where MasterCard is accepted, whether online or in a store. It is free to set up the card, and there are no monthly fees. In fact, you actually earn CoinJar Rewards each time you spend! For additional convenience, you can add the card to your Google Pay or Apple Pay, so you can pay using your crypto on your phone, without needing to carry the physical card.

Speaking of Google Pay and Apple Pay, CoinJar also accepts these methods of payment for buying cryptocurrency. Besides this, they also support Visa/MasterCard, NPP, and Blueshyft, which are payment methods not often found on most other crypto exchanges.

The downside of CoinJar is that there is a limited range of 50+ coins. To learn more about this exchange, read our full review of CoinJar.

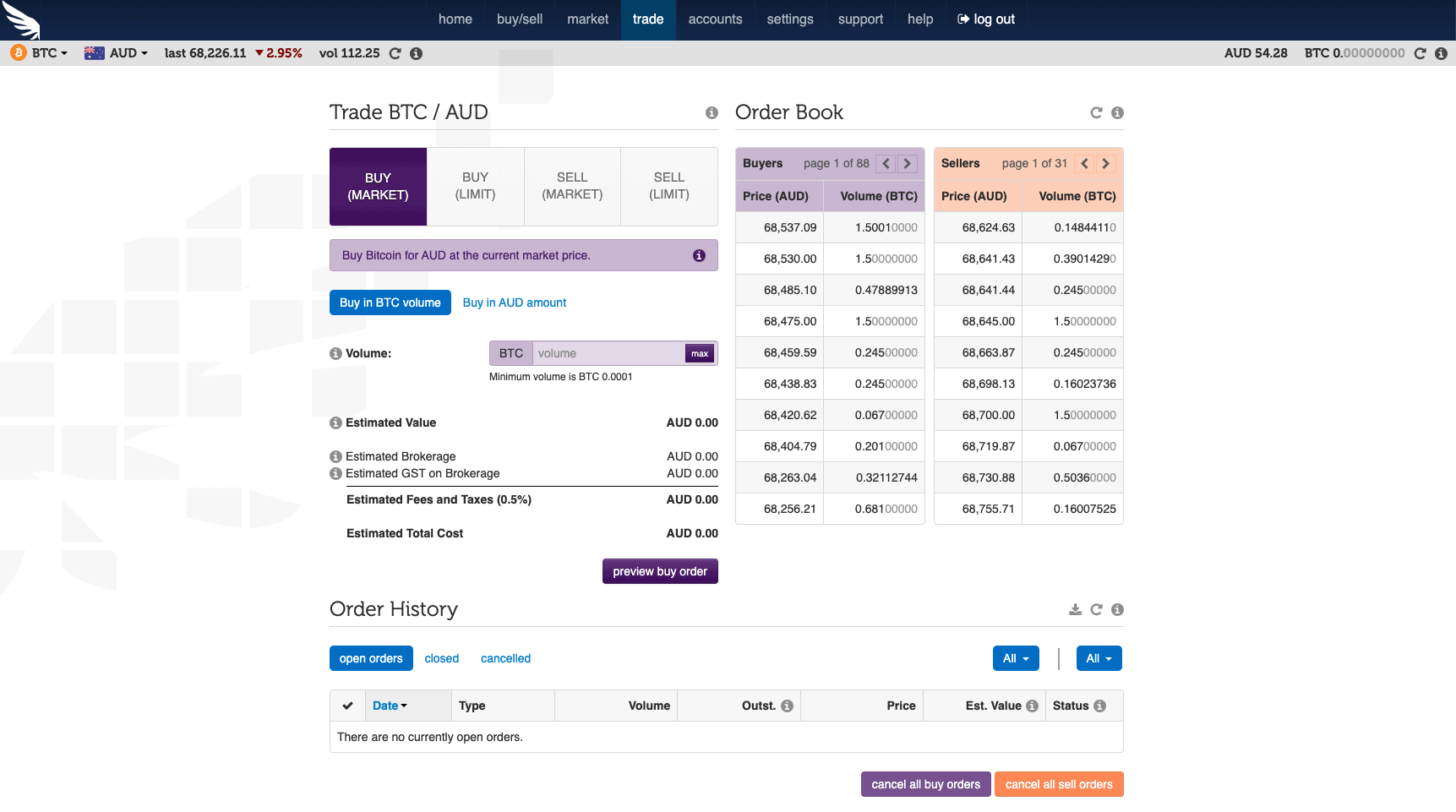

#11. Independent Reserve Exchange - Best for crypto insurance

SUMMARY

Independent Reserve is a crypto exchange that focuses on security, with optional insurance cover on your cryptocurrencies. It is ideal for large-volume traders like SMSFs.

PROS:

CONS:

Independent Reserve is an extremely secure crypto exchange, and the only one in Australia in 2024 to offer insurance on crypto assets, up to $5 million. This combined with their excellent OTC desk makes it an attractive option for SMSFs, family offices, sophisticated investors, and businesses who want to execute large trades of over $100,000.

The trading fees start at 0.5% and reduce if you exceed $100,000 trading volume over the last 30 days, so high-volume traders can take advantage of this. Independent Reserve also offers a tax report powered by KPMG to make reporting easy at the end of each financial year.

The biggest downfall of Independent Reserve is that only 27 cryptocurrencies are supported. However, most of these are top 30 globally traded and trusted coins. Click here to read our full detailed review of Independent Reserve.

Related articles: Swyftx vs Independent Reserve, CoinSpot vs Independent Reserve

Main Factors to Consider when choosing a Crypto Exchange

When choosing a crypto exchange in Australia, it's crucial to assess various factors including regulation, security, fees, user experience, and liquidity. Let's delve into these aspects in more detail:

Regulation and Compliance

The increasing adoption of cryptocurrency necessitates regulatory oversight to protect consumers and uphold the crypto industry's integrity. In Australia, AUSTRAC oversees crypto exchanges, ensuring they comply with AML and CTF laws. Opting for a registered exchange like CoinSpot or Swyftx guarantees adherence to these regulations, safeguarding your funds and private information.

Security Measures

Given the history of security breaches in the crypto world, it's vital to consider an exchange's security protocols. Effective measures should include two-factor authentication (2FA) for logins and withdrawals, cold storage for funds, encrypted user data and communications, along with regular security audits and certifications like ISO 27001.

Fees and Spreads

Fees can significantly impact your crypto investment or trading returns. These fees vary, typically ranging from 0.1% to 1% per transaction. Some exchanges, like MEXC, offer zero fees for spot trading, and 0% fees for makers when futures trading. This is an excellent way to keep more money in your pocket, particularly if you are trading large amounts.. Additionally, consider the spread – the difference between buy and sell prices – as wider spreads can effectively increase transaction costs.

Besides trading fees, some crypto exchanges also charge for depositing and/or withdrawing crypto, while others have no cost for these services. It is important to do your research and compare all the various charges that may be incurred before selecting an exchange.

User Experience and Customer Support

A platform that's easy to navigate is key for both beginners and experienced traders. Evaluate the platform’s usability, range of trading tools, and mobile app functionality. Customer support, particularly live chat and email, is also crucial. Exchanges like CoinSpot and Swyftx, known for their 24/7 live chat support, are excellent examples.

Liquidity

Liquidity, or the ease of trading a coin with minimal price slippage, is essential for efficient trading. High liquidity on an exchange means faster order execution, especially important for less common trading pairs. Remember, high liquidity in popular pairs like BTC/USDT doesn't necessarily translate to overall platform liquidity.

How to Choose a Crypto Exchange

Before settling on a crypto exchange, it's crucial to conduct thorough research and compare the offerings of different platforms. Identifying your specific needs and the features you require will streamline the process of finding an exchange that aligns with your requirements. Below are some key aspects to consider, each linked to more detailed information:

Getting started can be confusing if you are new to crypto, while on the other hand, more experienced traders may want a platform that offers more advanced features.

Consider how you want to deposit money to the exchange and make sure that your preferred payment method is available. Most exchanges accept popular options like credit and debit cards or PayPal.

Consider whether you want to trade fiat-to-crypto, crypto-to-crypto, or a combination of both.

How much is it going to cost you to buy and sell crypto from the beginning to the end of the process on the platform? Remember to consider any fees associated with the payment method you plan to use, exchange rates, and any discounts you might be entitled to.

Be aware of any deposit and withdrawal limits that you may be subjected to when using the exchange. Minimum and maximum limits may apply.

Do you want to trade on a web browser, or do you prefer the option to trade from a mobile app? How easy will it be for you to access your exchange account wherever you are?

Does the exchange offer any discounts or rewards for those who meet certain guidelines, such as keeping up a certain trade volume each month?

Compare cryptocurrency exchange rates across a variety of different exchanges - you may be surprised to see just how much they can fluctuate.

The higher the liquidity of the exchange, the easier and faster it will be for you to complete trades. Larger crypto exchanges tend to have high liquidity levels.

Most platforms will require you to verify your identity before allowing you to begin trading. Are you happy to give out this information or would you prefer to use an anonymous platform?

When you deposit money into or withdraw money from the exchange, how long can you expect to wait for your transaction to complete?

Security should be a top priority when choosing a crypto exchange. Platforms without a range of high-security features such as two-factor authentication, strong account verification processes, 24/7 security monitoring, and offline secure storage for customer funds leave you vulnerable to hackers and fraudsters.

The crypto industry is still quite lightly regulated, and how an exchange is regulated will depend on where it is based. In Australia, all crypto exchange operators must be registered with AUSTRAC and meet compliance and reporting obligations for anti-money laundering and counter-terrorism financing.

What is the customer support like on the exchange? Is there Live Chat support? Is a customer service team available at all times? How responsive and helpful are customer service agents?

Overall, you should look for an exchange that has a strong reputation for being reliable and secure. Read independent reviews and find out about as many user experiences as possible - both positive and negative - to find out what the exchange is doing well and where it could do better.

Final Thoughts

Cryptocurrency exchanges vary widely, catering to different trading styles, needs, and preferences. It's important to recognise that an exchange that is ideal for one person may not necessarily be the best fit for another. Therefore, conducting your own research is crucial before deciding on the most suitable crypto exchange for your individual needs.

To aid in your decision-making process, I have compiled detailed reviews of prominent crypto exchange platforms, both within Australia and internationally. In these reviews, I discuss and compare various aspects such as features, advantages and disadvantages, as well as fee structures. These insights are designed to help you determine which exchange aligns best with your specific trading requirements, ensuring that you make an informed choice that supports your crypto trading or investing journey.

Frequently Asked Questions (FAQs)

Cryptocurrency is stored in digital wallets. When you sign up to a crypto exchange, most of them provide you with a wallet that is held in your exchange online. You can either leave your cryptocurrency in the exchange account, or transfer it to an external wallet (either a hot wallet app, or a cold hardware wallet). Some other platforms require you to have your own external wallet at the time of purchase, and any crypto you buy is sent straight there.

It is not recommended to leave your crypto on an exchange in the long-term, since the exchange controls the private key to your wallet, leaving you without full control of your funds. If the exchange is the victim of a cybersecurity attack, your digital assets may be lost or stolen. Click here to read about the best crypto wallets in Australia.

It only takes a few steps to buy crypto using a crypto exchange. You need to create an account, verify your identity, deposit AUD, then purchase the coin you like. For a detailed step-by-step guide with screenshots, read our article on how to buy crypto in Australia.

Each crypto exchange will accept different methods of payment. Some of the most common are bank transfer, PayID, POLi, credit card, debit card, PayPal, and BPAY.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read it here.