What is Bybit?

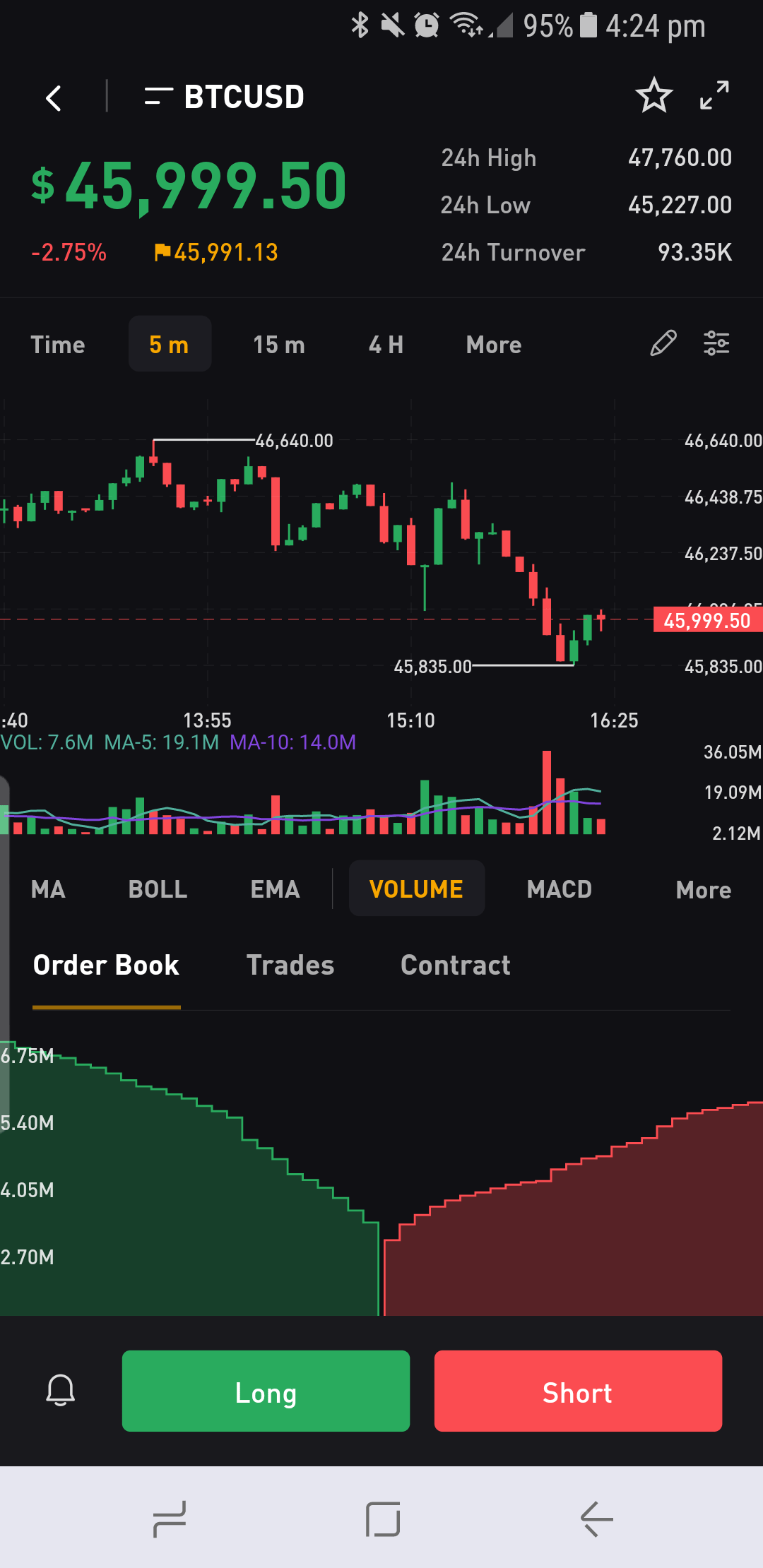

Bybit is a cryptocurrency exchange offering spot trading and derivatives trading with a focus on margin trading, offering up to 100x leverage on BTC/USD and ETH/USD trading pairs.

Bybit was founded in Singapore in March 2018, and comprises professionals from investment banks, tech firms, forex industry and early blockchain adopters. It is a registered trading exchange in the British Virgin Islands, and has over 10 million users.

My Overall Thoughts on Bybit

Bybit is an excellent platform for experienced crypto traders that are looking for an exchange with more advanced features, but also has a user-friendly interface to cater to newcomers to crypto. If you have not yet signed up to Bybit, use my link here, to receive FREE $10 BTC when you register and deposit $100. These are the three things I love the most about Bybit:

1) Low trading fees: Bybit has 0.1% spot trading fees, and derivatives trading fees of 0.01% for makers and 0.06% for takers. This can be lowered depending on your trading volume per month, so if you are a frequent trader, you will enjoy that discount.

2) More than 280+ coins on offer: There is a wide range of coins accessible on Bybit, which means you will always find a trading pair that you like.

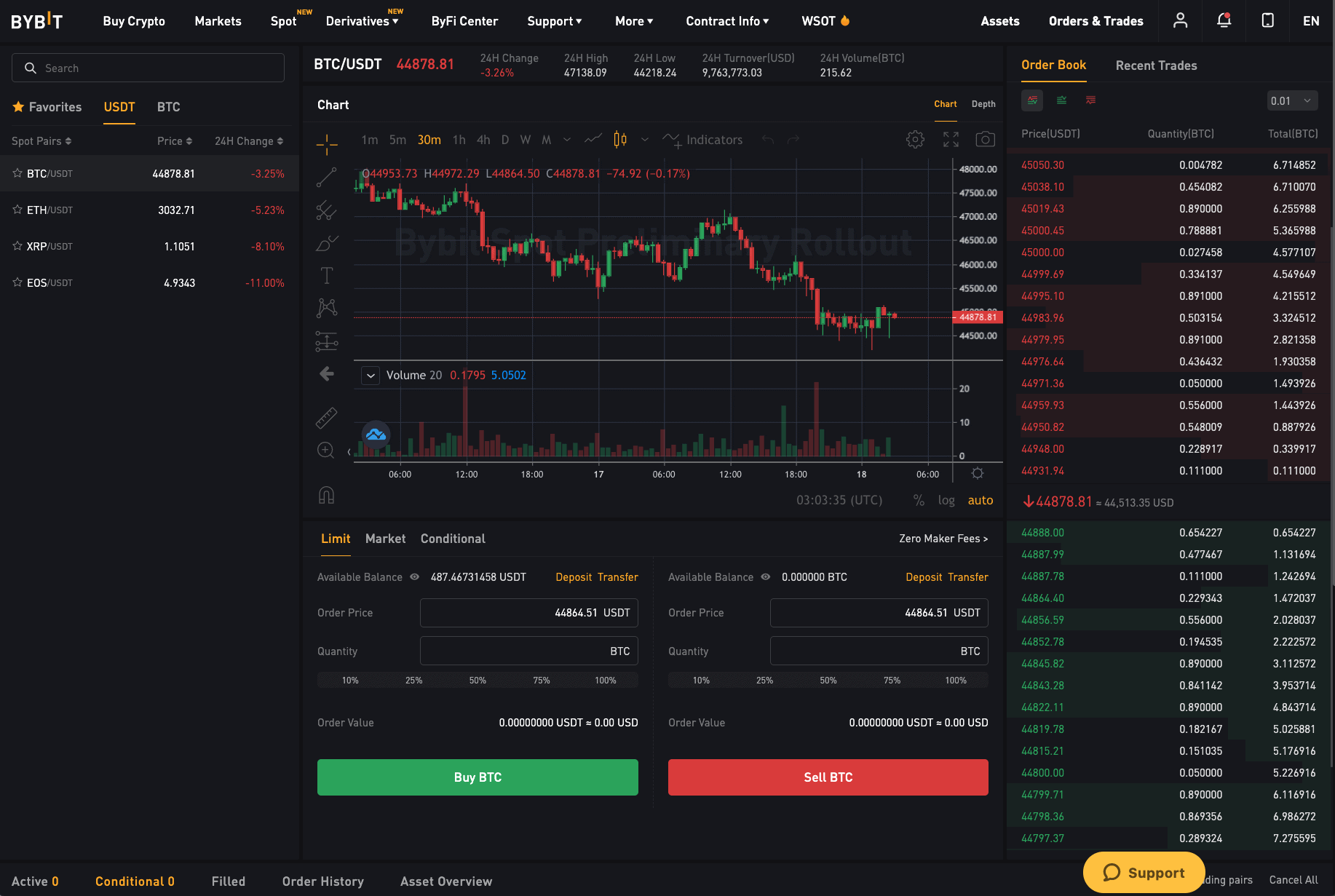

3) Bybit offers a fully-featured trading platform: Bybit meets the demands of the discerning crypto trader, with plenty of trading options, such as spot trading, derivatives trading, margin trading (up to 100x leverage), and even copy trading. The advanced charting interface is highly detailed and filled with features, yet easy to navigate.

Sign up with Bybit to enjoy all the trading features and tools, and you will see for yourself why it is one of the best crypto exchanges in the world.

Key Features & Advantages of Bybit

Some of the top features on Bybit that make it one of the best margin trading platforms available:

Negatives & Disadvantages of Bybit

While Bybit is one of my recommended crypto exchanges, there are a couple of downsides to keep in mind before signing up.

What Services does Bybit offer?

Bybit's focus on advanced crypto trading means it has a ton of features that make it a desirable platform to use. Here I will go into detail about the services offered on Bybit.

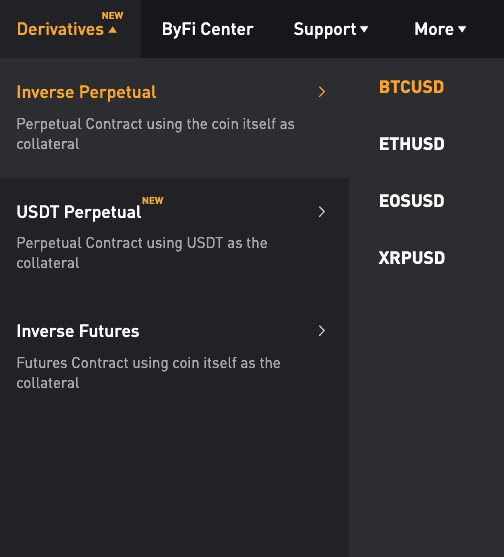

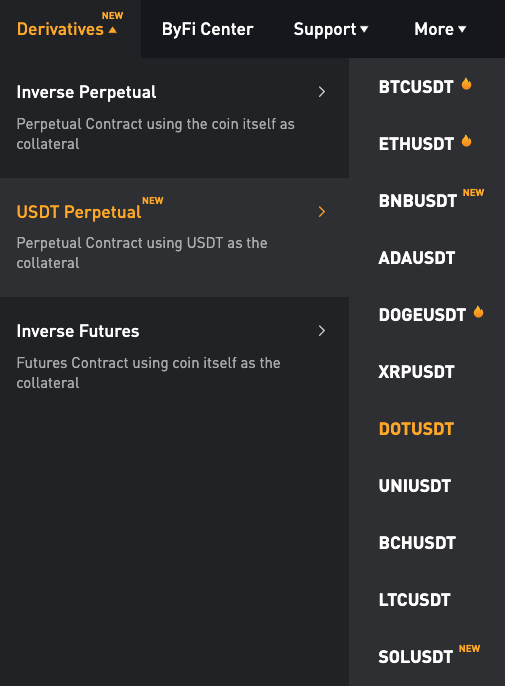

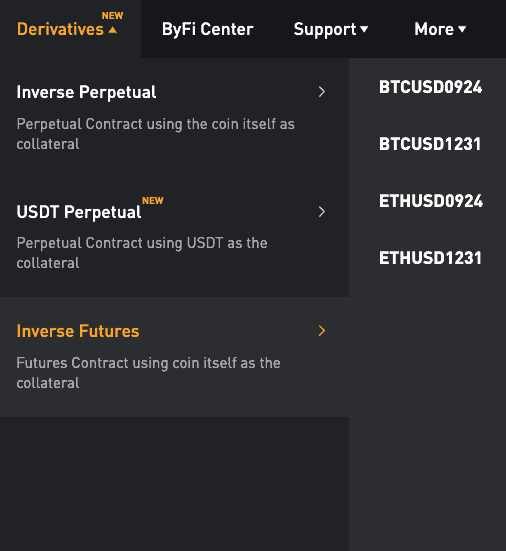

Spot trading and Derivatives trading: Bybit is one of the largest crypto derivatives exchanges around, with over 10 million users. This leads to high liquidity, with the 24-hour volume often exceeding $10 billion. The following derivatives are available at Bybit:

Inverse Perpetual contracts: BTC/USD, ETH/USD, EOS/USD and XRP/USD, where the coin is used as the collateral.

USDT Perpetual contracts: BTC/USDT, ETH/USDT, BNB/USDT, ADA/USDT, XRP/USDT and 15 more, where USDT is used as the collateral.

Inverse Futures contracts: BTC/USD and ETH/USD, with maximum 6 month contracts, where the coin is used as the collateral.

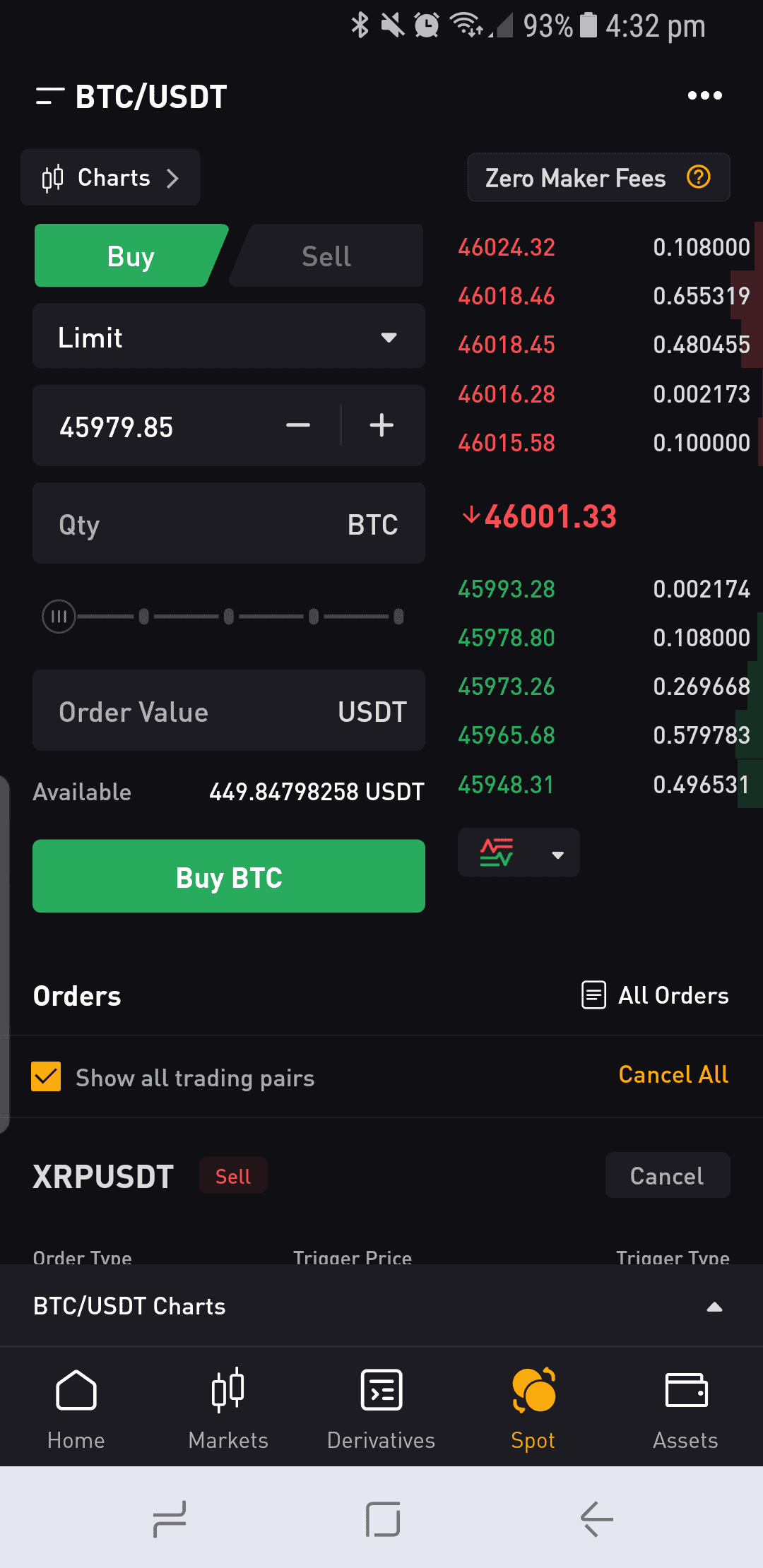

Bybit also added Spot trading in July 2021 to complement its core derivatives offering. It started off with only four trading pairs: BTC/USDT, ETH/USDT, XRP/USDT and EOS/USDT but has quickly grown, and now has over 70+ trading pairs available.

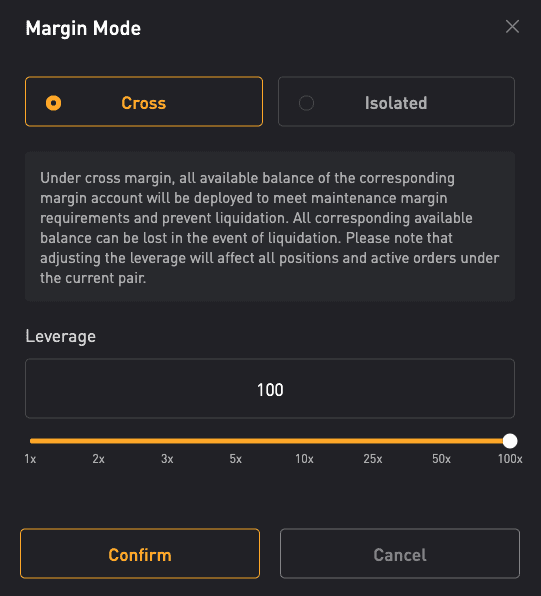

Margin trading with up to 100x leverage: Margin trading is highly sought after for experienced traders that want to make larger profits on successful trades. It means the trader can use borrowed funds to leverage their trading, leading to a higher return on a small investment. Some crypto exchanges only allow up to 5x leverage, but Bybit supports a maximum of 100x leverage, which will be enough for almost all traders.

Of course, users need to be aware of the risks involved, and the biggest disadvantage is that the trader can lose more than their initial investment, even with a small drop in the market price. Margin trading should only be conducted by those that have a strong understanding of technical analysis and is definitely not recommended for beginners.

Bybit insurance fund: Bybit offers up to 100x leverage on their trading exchange, which means some traders may have a highly leveraged position that may be liquidated and closed at a worse than bankruptcy price in a volatile market. Bybit has an insurance fund to manage and absorb the excess loss, so traders already dealing with loss are not on the hook for more than their initial margin, and profiting traders are not made to cover the difference.

Bybit’s insurance fund is, quite simply, a reserve pool that the system can dip into in order to protect traders from negative equity and being held accountable for excessive loss. Assuming that a trader’s position has been liquidated; if the close price is better than the bankruptcy price, the trader’s remaining margin will be added to the insurance fund. However, if the close price is worse than the bankruptcy price, the loss of the position will have exceeded the trader’s initial margin, whereupon the deficit will be covered by the insurance fund.

This information was sourced from the Bybit blog, and if you are after additional details about their insurance fund, including an example of how the insurance works, click here.

Testnet platform to practise trading: Bybit offers a Testnet which is a demo version of the main site. It allows users to practise trading without depositing any real money or crypto. Instead, you use demo Bitcoin to conduct your trades, to get a feel for the exchange before you use your real money.

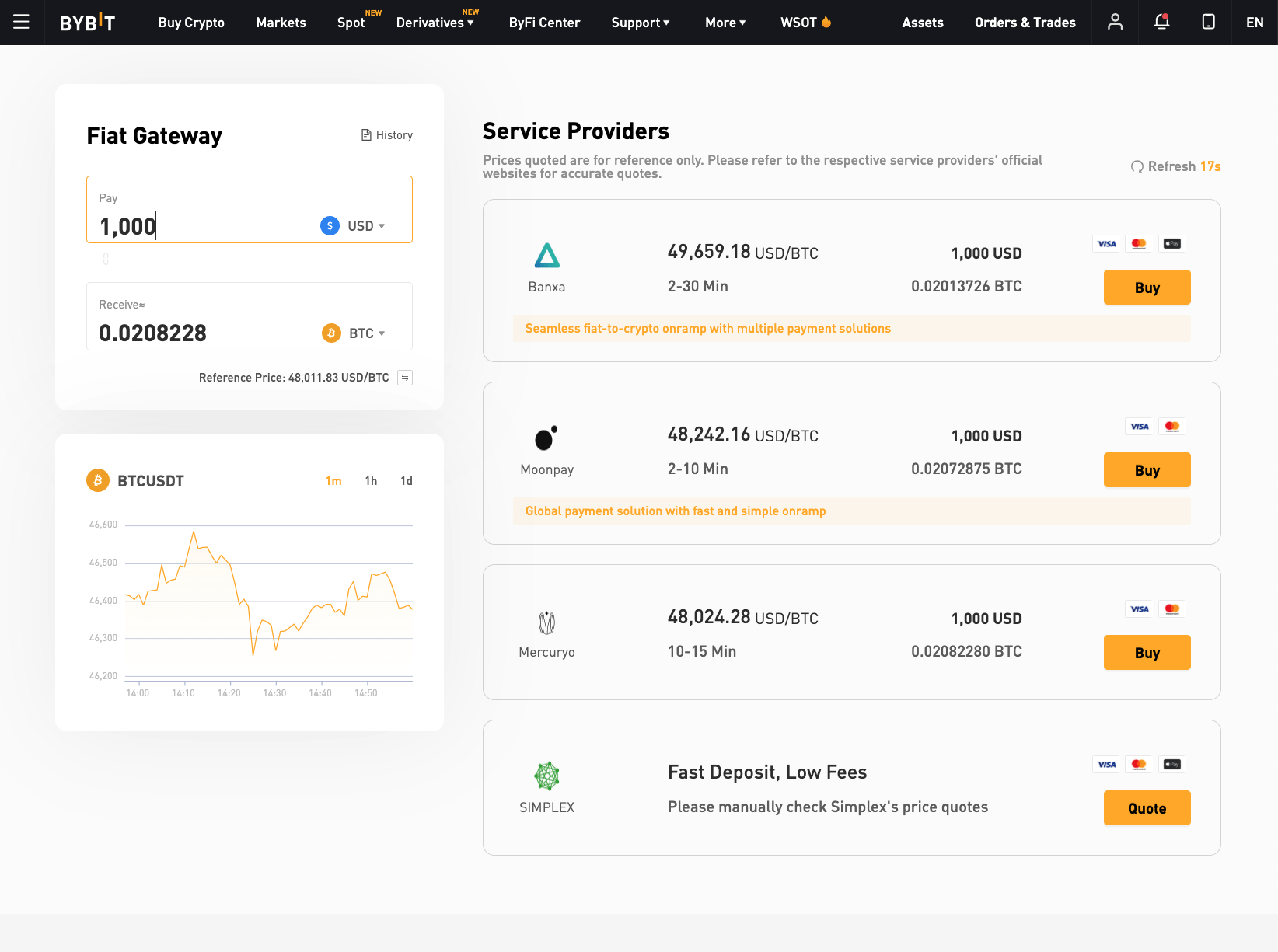

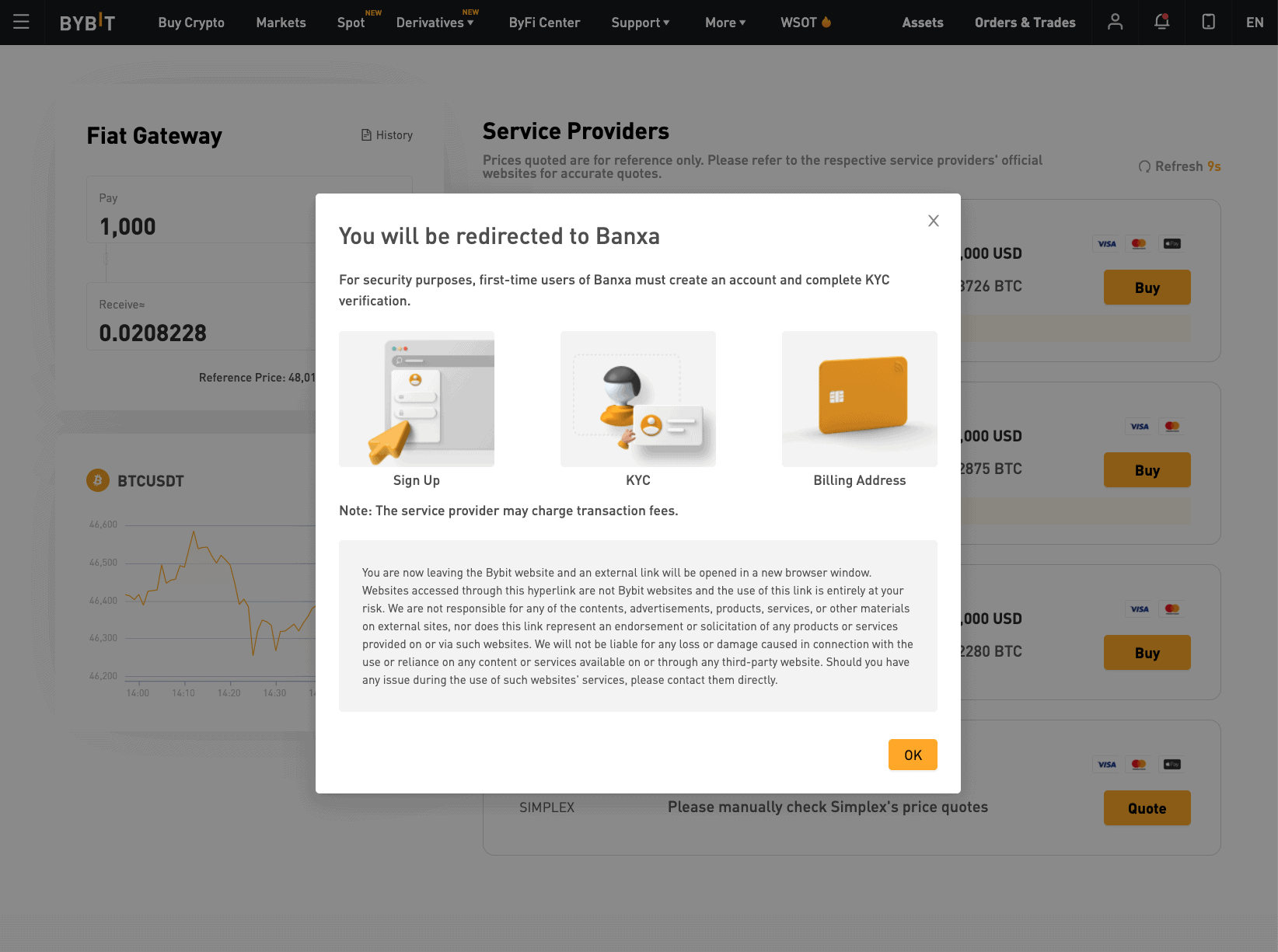

Fiat gateway for easy deposits: Bybit supports cryptocurrency deposits as its easiest deposit method, but it also has the option for fiat deposits using its fiat gateway. Although you cannot directly deposit fiat currency into the Bybit exchange, you can access the fiat gateway easily by clicking Buy Crypto at the top left of the screen.

You select the currency and the amount you want to deposit (over 50 currencies including USD, GBP, AUD, CAD) and which crypto to convert to (BTC, ETH or USDT). Then on the right of the screen you can see your fiat gateway options. When you click 'Buy', you will be taken to their website to finish the deposit process. Whilst it is not the simplest way to convert fiat currency to crypto, at least the option is available, as opposed to limiting deposits to only cryptocurrencies.

Various payment methods are available, depending on the currency you want to deposit, including Visa/Mastercard, Google Pay, Apple Pay, and Bank Transfer.

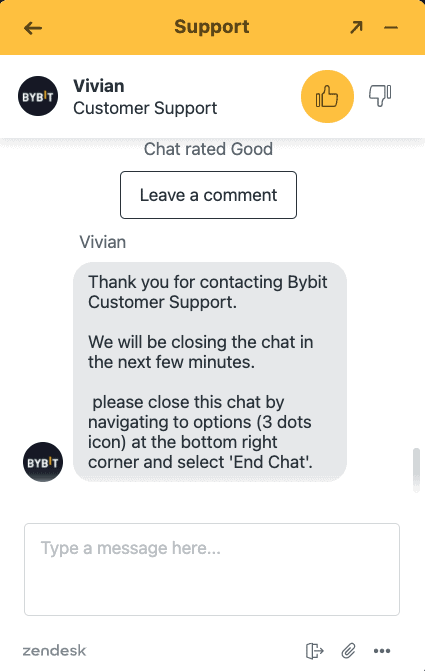

24/7 Live Chat support team: If you have any issues with the exchange, there is a yellow Support button at the bottom right of the interface. You can type in a question, and it will bring up Top Results to answer your query. If this doesn't help, you can hit the Live Chat button. I tested it out twice, on separate days to see how responsive they are. The first time I used Live Chat, I was at position #2 in the queue and it took 18 minutes until a live agent responded. The second time, I was at position #2 again, but this time it only took 8 minutes wait time. This is quite good compared to other exchanges that only reply via email, with no Live Chat option.

Mobile app for iOS and Android: Bybit's mobile app is available for iOS on the Apple App store, and for Android on the Google Play store. On the Google Play store, the app has an average rating of 4.7 stars from 118,000 reviews, and over 10 million downloads.

I downloaded the mobile app to compare it to the desktop site and I was impressed. The app is easy to use, very responsive, and it appears to have all of the trading tools, charts and conditional orders found on the desktop site. The app is a must-have for any trader that is always on the go.

Rapid trade speed and reliable platform: Traders don't need to worry about overloads on the Bybit exchange, as they have an ultra-fast matching engine, which allows 100,000 trades per second. Bybit also allows users to conduct high-frequency trading (HFT) as their platform has lightning-fast market updates, with market data pushed every 20 milliseconds. Traders can always rely on Bybit with its 99.99% system functionality.

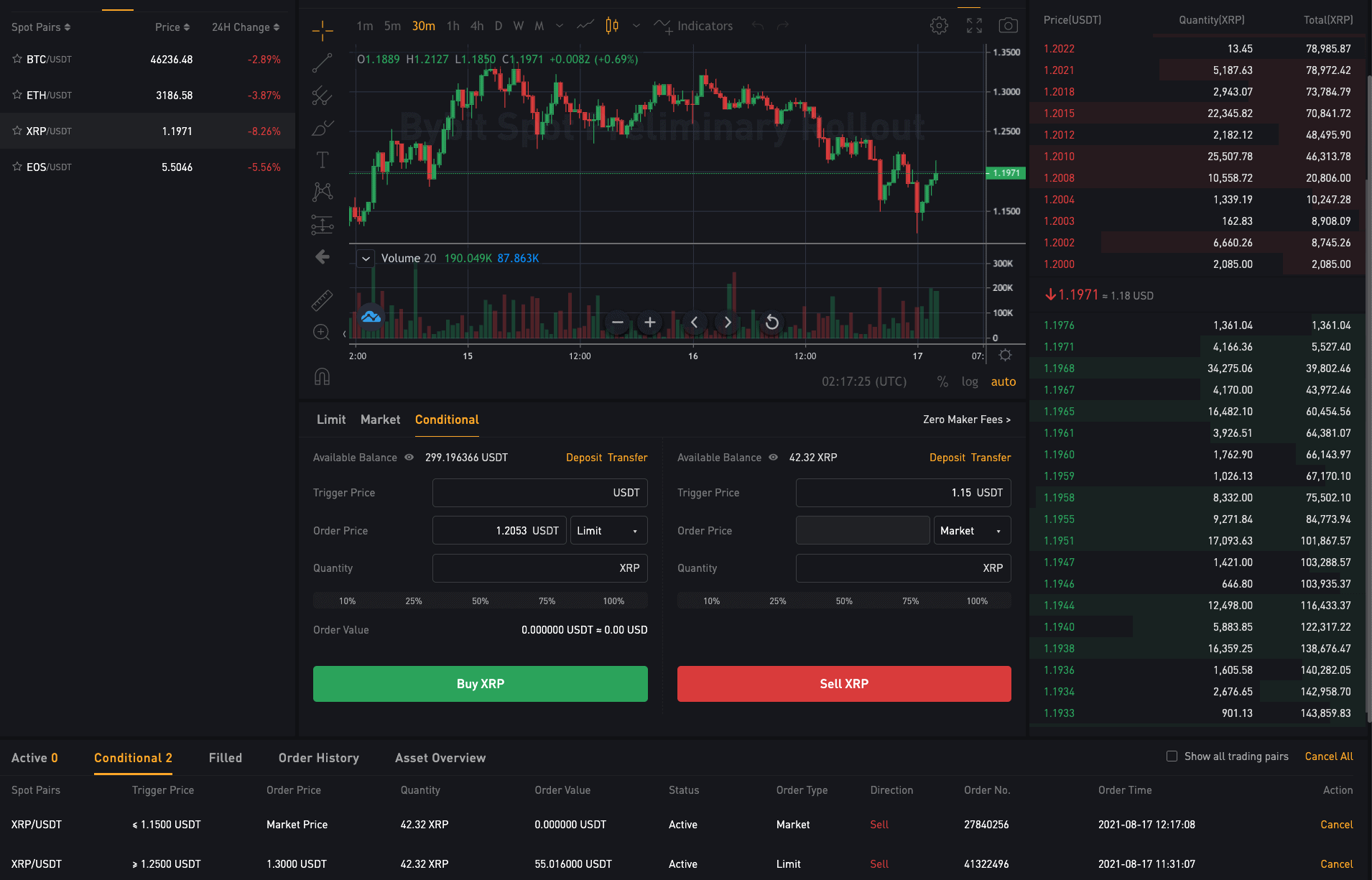

Take Profit / Stop-Loss orders supported: Trading cryptocurrency involves risk, since it is such a volatile market. Savvy investors know that risk needs to be managed, and one way of minimising that risk is through stop-losses. Stop-losses are automated instructions that tell the exchange to sell a coin when the price drops to a predetermined level (set by the trader). This means that you don't need to constantly monitor the price of your digital assets while you are busy, and you still maintain some control when you are asleep.

Take profit orders are conditional orders that will tell the exchange to sell your crypto when the price rises to a certain level (set by the trader). This means you are able to automatically take your profits when the price suddenly shoots up, without worrying that the price will drop back before you get a chance to sell. This is a very useful short-term trading strategy for day traders who want to capitalize on a quick jump in crypto prices.

What I Don't Like About Bybit

These are the disadvantages of using Bybit, however they are only minor, and I will explain how I get around these issues.

No fiat withdrawals available on Bybit: As a dedicated cryptocurrency trading platform, Bybit only offers crypto withdrawals, and you won't be able to withdraw USD or other fiat currencies. However, this is not a major issue for most traders. It is easy to transfer your crypto to another exchange that supports fiat withdrawals, and withdraw your money to your bank from there. Here is a simple guide on withdrawing from Bybit to help you with this process.

Not available in the USA: Bybit is a global crypto exchange, but it is not available in the US due to strict regulations. However, since Bybit does not require any KYC, you can use a VPN to use Bybit. See this article to see how you can use Bybit in the USA.

Bybit Fees

Bybit Deposit Fees

There are no deposit fees to deposit cryptocurrency into your Bybit account.

If you want to deposit fiat currency, Bybit does not charge any fees, but the service provider of the fiat gateway will charge a fee. You will need to check with each provider on their website to determine the fees incurred.

Bybit Withdrawal Fees

Bybit charges the following fees when withdrawing cryptocurrency:

Header | BTC | ETH | XRP | EOS | USDT (ERC-20) | USDT (TRC-20) |

|---|---|---|---|---|---|---|

Withdrawal Fees | 0.0005 | 0.005 | 0.25 | 0.1 | 10 | 1 |

Bybit does not support direct fiat currency withdrawals. However, if you wish to withdraw fiat from Bybit to your bank account, you can easily do so using another crypto exchange. See my step-by-step guide here for full instructions.

Bybit Trading Fees

There are different fees involved for market makers and market takers, and dependent on if you are Derivatives trading or Spot trading.

Derivatives Trading: Market makers pay a fee of 0.01%, and market takers pay a fee of 0.06%.

Spot Trading: The fees are 0.1% for makers and takers. High volume traders will receive discounts based on the trading amount over the last 30 days.

Bybit Assets Exchange Fees

To convert from one digital asset to another, Bybit charges a flat rate fee of 0.1%.

Pros and Cons of Bybit

- Over 280+ cryptocurrecies supported

- Derivatives trading and spot trading available

- Margin trading with up to 100x leverage

- Mobile app for iOS and Android

- Fiat gateway for easy deposits

- Only crypto withdrawals supported, no fiat withdrawals

- Not available to US citizens

Is Bybit Legitimate or a Scam?

Bybit is a legitimate cryptocurrency trading exchange based in Singapore, and registered in the British Virgin Islands. They have over 10 million users, and reaches over $10 billion in trade volume in a 24 hour period.

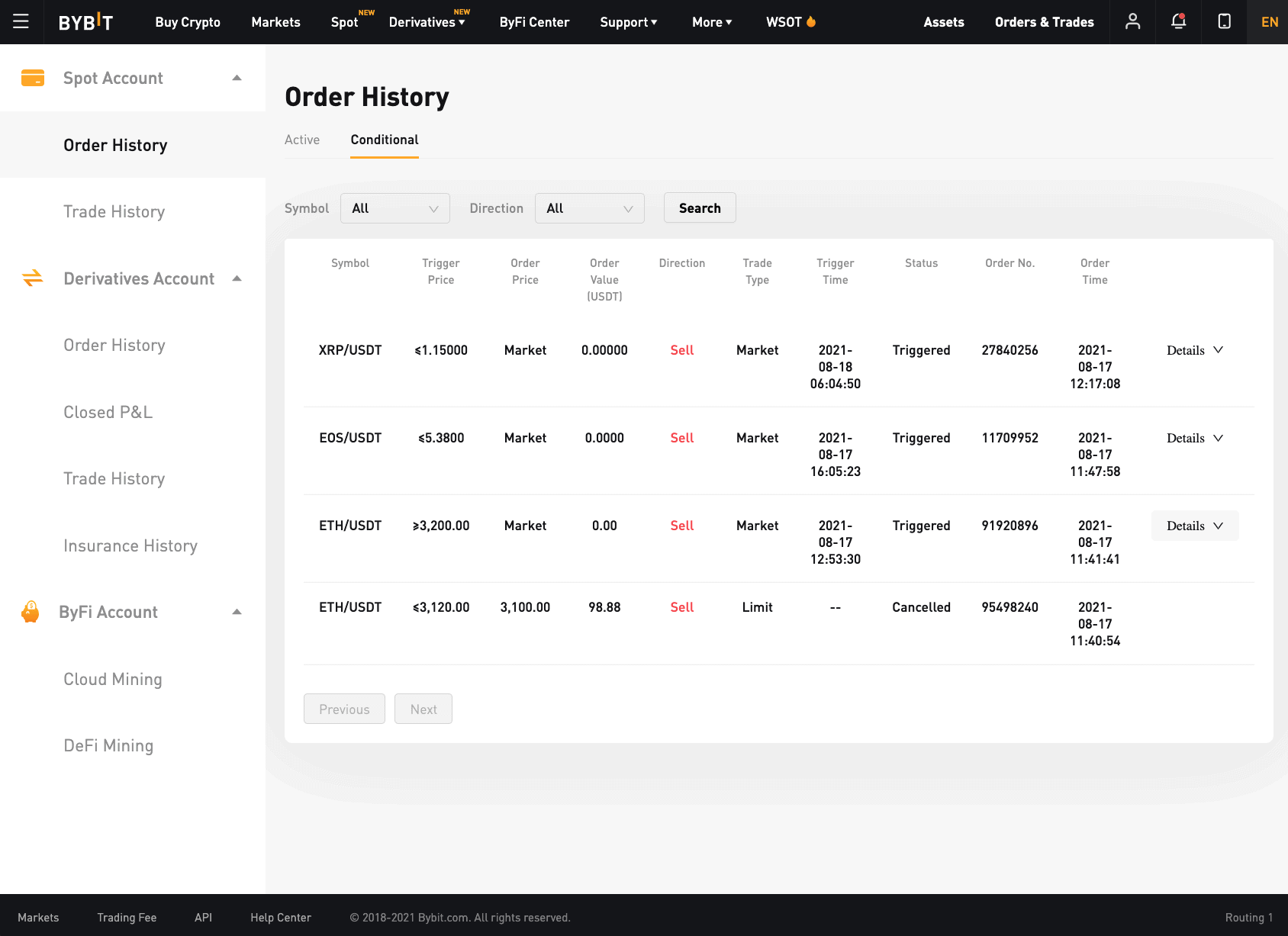

I have read some negative reviews online about Bybit being a scam, not allowing withdrawals, and not fulfilling stop-loss orders, so I decided to test it out myself. I deposited USDT into Bybit, made a few trades on the Spot market, and put in some conditional orders (both take profit orders and stop-loss orders).

I had no problems executing any of my trades (both Market and Limit), and my Conditional trades were successfully fulfilled, as shown in the screenshot below.

I withdrew some USDT from my account, with no issues at all. It only took a few minutes for the USDT to reach my crypto wallet. Bybit's instant withdrawals take up to 15 minutes to process, but keep in mind that if there is high network congestion, it can take longer.

I suspect that people leaving negative reviews about Bybit being a scam are inexperienced traders that have made errors and try to blame the exchange. For example, when withdrawing USDT you need to select either ERC-20 or TRC-20 depending on the chain type, and selecting the incorrect one will result in a loss of funds. Others may have fallen victim to a fake Bybit website scam, where an unrelated organization has set up a replica site, to scam users. Be sure to always visit the official Bybit website.

The Verdict

Bybit is my #1 recommendation for margin traders with its 100x leverage, and offerings of perpetual contracts, futures contracts and spot trading all in the one exchange, with low fees. The interface on both the desktop site and mobile app are packed full of features, yet still easy to navigate for the experienced trader.

The only downside is that Bybit is not available for residents of the USA. If you are a US citizen, I suggest you check out the best crypto margin trading exchanges here.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this breakdown.