Key Takeaways

- Stablecoins are a form of digital currency with the stability of a fiat currency, designed to maintain parity with the value of their underlying collateral on a 1:1 ratio.

- They provide a more stable, secure, and predictable way to store and transfer value, making them a better investment option in crypto.

- Stablecoins offer various ways of earning interest, including liquidity provider, lending, staking, and savings accounts.

- Some of the most reliable stablecoins with high-yield returns over longer periods include USDT (Tether), USDC, BUSD, and DAI.

In light of the high volatility of digital assets, investing in stablecoins has emerged as a compelling alternative to traditional investments, offering a form of digital money with the stability of a fiat currency. Investors can benefit from the advantages of investing in digital currencies without worrying about sudden market shifts commonly found in the crypto markets.

For individuals looking to capitalize on digital assets, stablecoins present an unparalleled investing opportunity. Moreover, these coins offer a dependable currency for transaction settlements because of their relative price stability that provides a reliable and secure settlement currency.

Why are Stablecoins a Better Crypto Investment Option?

Before discussing why stablecoins are the better investment option in crypto, let's first define stablecoins.

What are Stablecoins?

Stablecoins are cryptocurrencies designed to maintain stable prices, and are usually backed by an underlying asset (gold) or fiat currency like the U.S. dollar. The investments are generally tied to the value of a fiat asset, making them much less volatile than their cryptocurrency counterparts.

These coins are designed to maintain parity with the value of their underlying collateral on a 1:1 ratio. This means that, for instance, one stablecoin is equivalent to its USD counterpart and changes depending on the current market value of dollars.

Why You Should Invest in Stablecoins

Stablecoins provide a more stable, secure, and predictable way to store and transfer value. With their price stability, investors can be confident that their investments won't suffer from the same volatility that other cryptocurrencies often experience, allowing them to maintain their capital and invest without the fear of rapid changes in market value.

In addition, users get a transparent form of digital payments and asset transfers that is not subject to manipulation or control by centralized and governmental forces. Stablecoins can also be used as collateral in decentralized finance (DeFi), further revolutionizing investment opportunities in cryptocurrency and allowing traders to increase their investment portfolio.

Different Ways of Earning Interest with Stablecoins

Are you looking to generate passive income without sacrificing your crypto coins? Earning interest on stablecoins is one way to do this. Not only does it provide the possibility of acquiring higher returns, but it also maintains low-risk levels for investors. Here are four ways you can earn interest on your stablecoins:

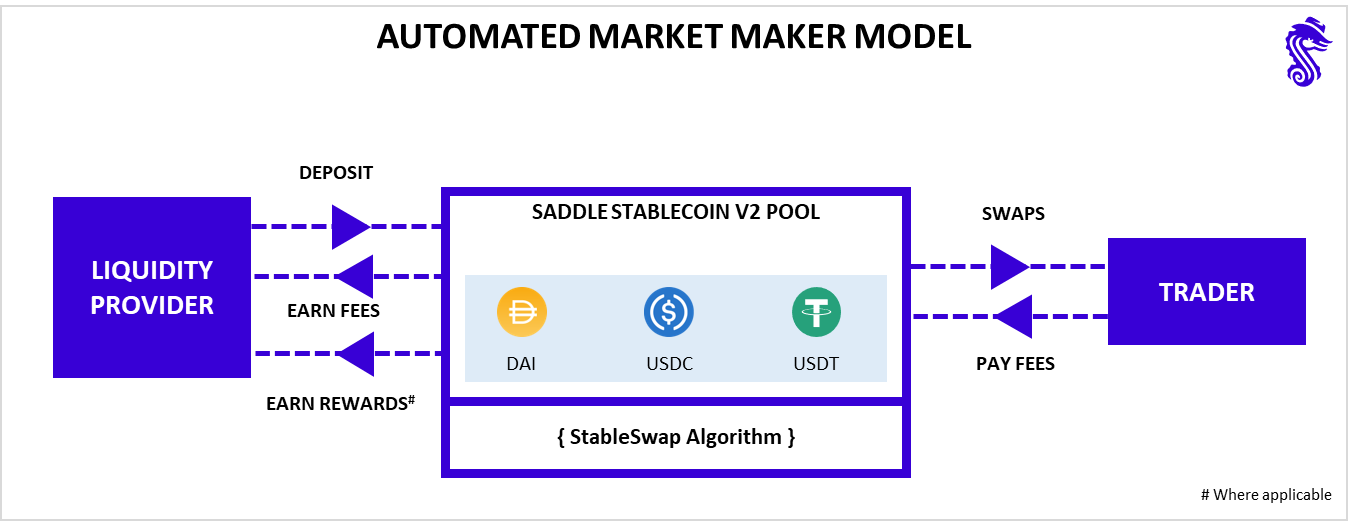

Liquidity Provider

Becoming a liquidity provider is an excellent way to generate interest with stablecoins. As a lender, you will be rewarded for supplying market liquidity on cryptocurrency exchanges. The fees will provide generous returns and ensure that your investment remains secure.

Some platforms offer yield farming services and often use an Automated Market Maker (AMM) to provide liquidity and manage the associated risk. When using an AMM, yield farming platforms quickly provide liquidity to users and manage the risk associated with services.

The AMM also provides users access to more complex products, such as options and derivatives, allowing traders to access a wide range of financial instruments to hedge their risks efficiently, thus increasing earnings.

Lending Stablecoins

Stablecoins provide investors with yet another avenue to earn interest: leveraging peer-to-peer lending platforms. These platforms connect borrowers and lenders, allowing users to generate returns based on the number of assets lent out. It's a simple yet effective way to diversify your portfolio while earning additional passive income!

Borrowers and lenders agree upon a fixed interest rate to ensure that all parties are comfortable with the terms. Once the agreement is finalized, lenders receive interest payments in either stablecoins or traditional currencies.

Staking Crypto Assets

If you're looking to make your stablecoins work harder for you, look no further than the exciting world of crypto staking. Stablecoin staking is the perfect way to earn passive income with minimal effort and maximum rewards!

Participating in DeFi protocols offers a fun yet profitable way of earning from asset creation, liquidity pools, governance, custodial services, and yield farming projects. With many platforms offering APYs of up to 25%, joining the growing legion of users taking advantage of staking could be an incredibly lucrative decision – not to mention potential bonuses based on the amount invested. So, the more you commit, the bigger the potential payouts.

With an ever-evolving list of options and incentives, staking crypto assets to earn interest on stablecoins is a surefire way to unlock untapped potential in your crypto endeavors.

Savings account

Users can earn interest through savings accounts which work similarly to a traditional bank savings account, where the user deposits their stablecoins into the account and receives interest payments over time. Depending on the platform, users may earn interest on their stablecoins at an annual rate of up to 10%.

The advantages of using crypto savings accounts to earn interest on stablecoins include the potential for higher interest rates and the ability to access funds quickly. Some providers offer additional features such as automated investing and earning rewards for referring friends to the platform.

Most Reliable Stablecoins That Earn Users the Best Interest

Interest rates around the world remain at historic lows, so investors are increasingly turning to digital currencies for more lucrative returns. Stablecoins, with their low volatility and diversification of assets, have become one of the most popular options for high-yield returns over longer periods. Finding the most reliable stablecoin can be challenging, as there has been a sharp increase in the number of tokens released in the market. But don’t worry, we'll explain why some coins stand above the rest when it comes to yielding substantial profits for users holding these digital assets.

This comprehensive list of stablecoins features coins that have the backing of popular and well-established exchanges and are fully fiat-collateralized, highly liquid, and easy to access.

USDT (Tether)

The USDT (Tether) offers a secure way to hold, manage and earn interest on cryptocurrency assets. A cryptographic proof backs the network, and the coin is tied to the U.S. dollar, which means that each Tether coin is pegged in a 1:1 ratio with an equivalent amount of U.S. dollars held in reserve by Tether.

This means the stablecoin is not subject to price fluctuations thereby reducing the risk of asset loss and making it ideal for crypto traders.

Investors can earn from staking USDT (Tether) depending on the selected exchange platform and current market conditions. Generally, staking rewards range from 4% to 14% annual return.

USDC (USD Coin)

USDC stablecoins are bound to their market demand, meaning that the interest rate for these coins increases with heightened demand. This serves as a lucrative incentive for traders to hold on to USD coins and reap higher returns from their investments.

The USDC coin interest rate also reflects the utility of the stablecoin and its ability to facilitate payments and transfers. Therefore, as the USD coin gains more utility, the interest rate will likely increase as more people look to use it for their transactions. Traders can, therefore, expect a promising return on their stablecoin investment. Compare the differences between USDT and USDC here.

BUSD (Binance USD)

Binance USD (BUSD) is another U.S. dollar-backed stablecoin that allows traders to earn interest on their BUSD holdings by providing liquidity to the Binance USD markets. The Binance platform offers a Liquidity Provider Program that allows traders to earn rewards for providing liquidity to its markets. Traders can earn a share of the fees from all market trades. The rewards are calculated daily, and users can receive them in BUSD or BNB tokens.

BUSD traders can also earn interest through staking, where users stake their BUSD tokens to earn a percentage of the trading fees generated by their holdings in the form of Binance Coins (BNB).

Paxos Standard (PAX)

Paxos is the first approved stablecoin by the (NYDF) backed with gold. To stake PAX liquidity, traders can use a platform like Compound or Yearn Finance that allows them to deposit their PAX into a pool and receive a portion of the pool's trading fees generated by the pool.

Traders can also lend out PAX coins and reap bountiful returns as interest, paid out in top-tier assets such as Ethereum based on their applicable lending rate.

Best Stablecoins Exchange Platforms that Offer the Highest Interest Rates

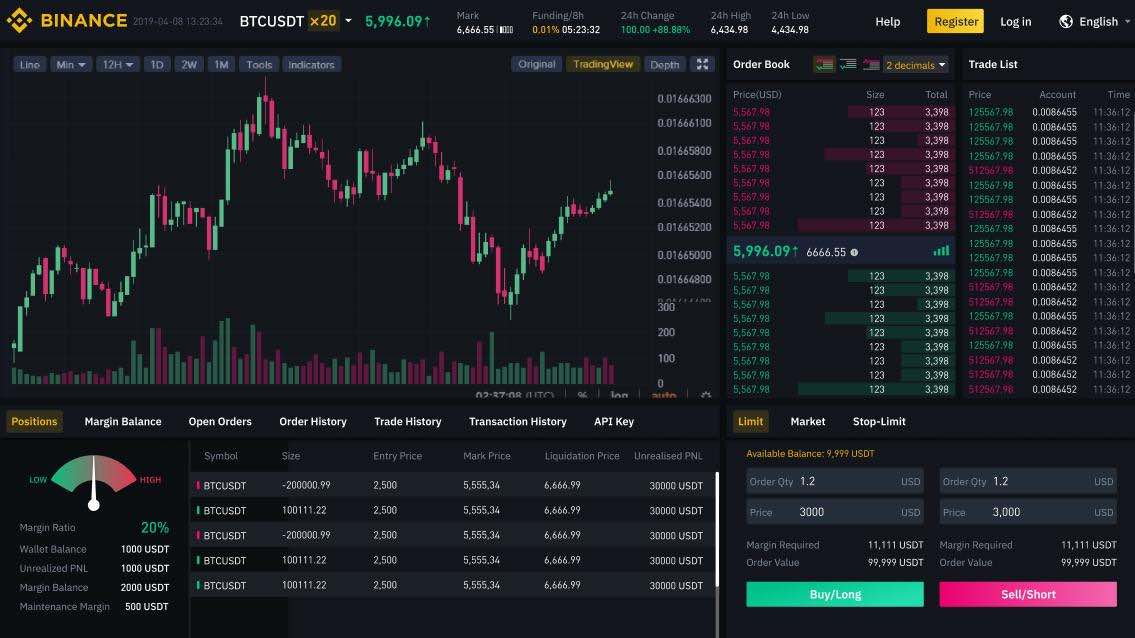

1. Binance

Binance offers users an attractive investment opportunity that is low-risk and low-volatility. With Binance's Interest-Bearing Stablecoin program, users can earn up to 14.8% APY on various stablecoins, including USDT, USDC, PAX, and TUSD (TrueUSD).

This innovative program guarantees cryptocurrency holders a safe, secure, and profitable way to earn interest on their digital asset investments. By offering added advantages such as insurance coverage and withdrawal flexibility, Binance puts its users at ease with the assurance that their funds are safeguarded from sudden market fluctuations or unexpected losses. Best of all, they can enjoy competitive returns on stablecoin holdings!

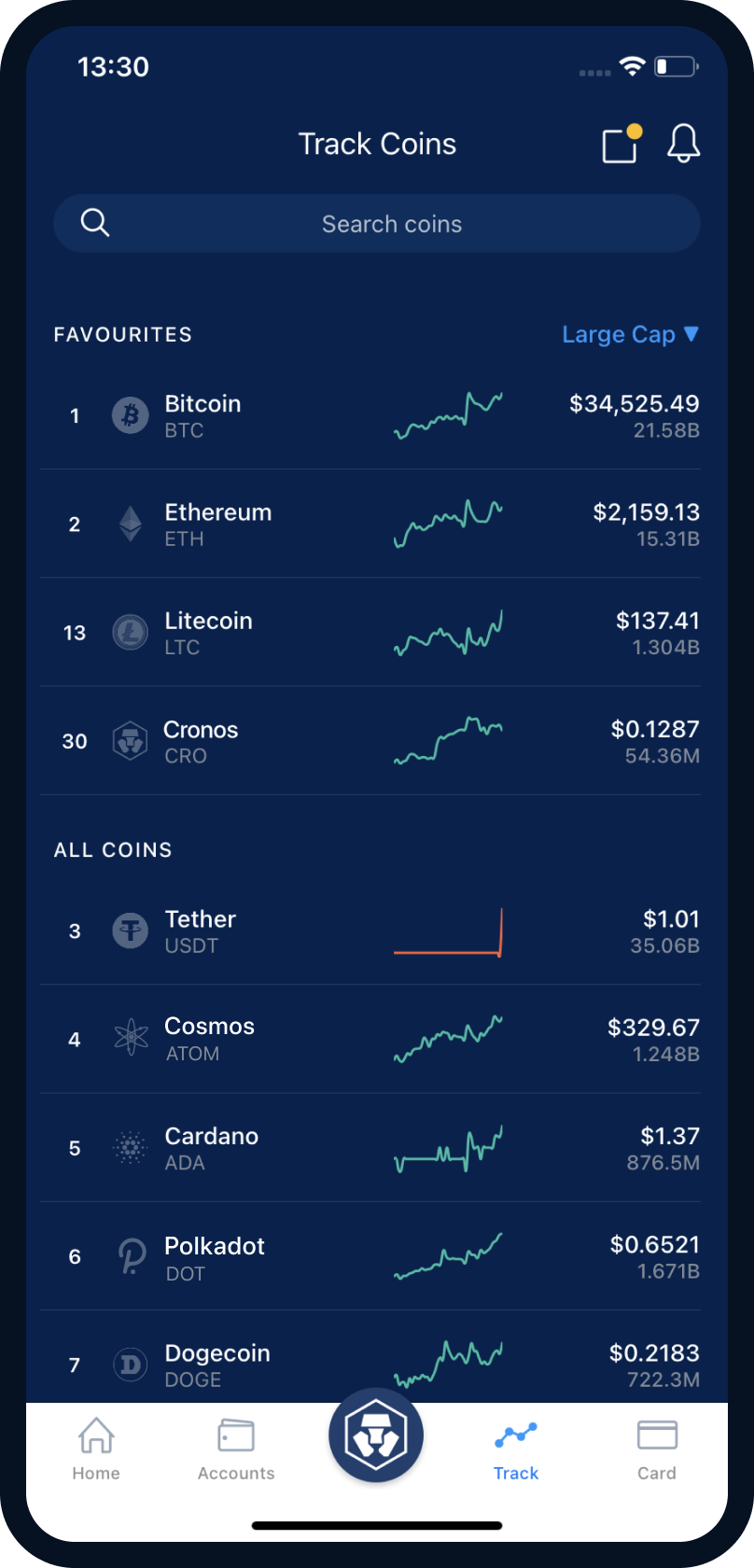

2. Crypto.com

Crypto.com is a highly rated, stablecoin exchange with extremely lucrative interest rates. It offers 3% APY for PAX and TUSD while Tether and USDC hit a high 6.5% - equally attractive incentives for any investor. What's even better is that these high yields are paid out daily! That's right: turn on your computer, check your account balance, and get guaranteed returns daily. The interest rate can be further increased if the amount of CRO tokens held in the holding account increases; those smart enough to take advantage of this option will hit a major jackpot! No strings are attached either; you can withdraw your accumulated funds anytime, no questions asked. A sweet deal indeed.

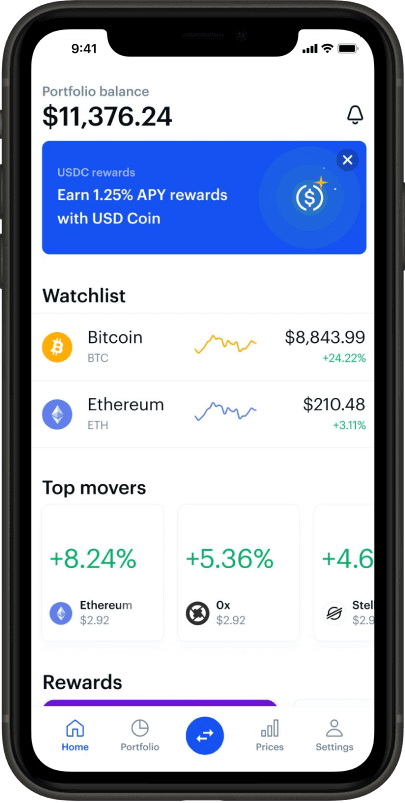

3. Coinbase

The Coinbase platform provides an exciting opportunity to users: they can generate a yield on their stablecoin holdings without having to actively manage them. From staking and lending to recurring purchase programs, this platform offers various ways of earning up to 5.75% APY on your investments! However, traders need to take into account the dynamic nature of yields since they can fluctuate depending on current market trends.

Get an extra return of up to 4% APY on your stablecoins when you use Coinbase's recurring purchase program! This amazing feature allows customers to buy stablecoins automatically every month and enjoy a nice yield at the same time. It's effortless, secure, and can help maximize your profits over time.

Conclusion

Investors can gain tremendous rewards by holding or depositing their assets in a stablecoin and earning the interest that comes with it. There are numerous options for individual investors and institutions. High APY rates may be available on some platforms, while others offer yield farming opportunities, staking, and liquidity mining through which they reap additional returns.

Making interest on stablecoins is an incredible way to take back some returns on your crypto assets, so it's worth considering.

Do note that it is essential to be aware of the risks associated with certain stablecoins due to their link to the underlying asset. Such risks can include alterations in policy or economic conditions, as well as liquidity issues, should there be a large-scale sale. Therefore, these changes may cause instability and lead to a decrease in the value of the stablecoin due to its exposure to inflationary pressures.

Frequently Asked Questions

Stablecoins are digital assets that maintain a stable value over time. They are designed to eliminate the risk associated with price volatility while offering an attractive way to earn passive income.

No, there are different types of stablecoins with varying levels of stability. The most common type of stablecoin is a USDC-backed stablecoin and PAXO standard, backed by U.S. dollars to maintain its price.

Interest rates vary from protocol to protocol; however, most offer either a fixed or variable rate of return.

Interest earned on stablecoins is typically gained through yield-generating DeFi protocols, such as lending protocols, liquidity pools, saving accounts, and yield farming. These protocols allow users to earn a return on their stablecoins by providing liquidity to the platform or lending their tokens to borrowers.

Yes, you can withdraw the interest you earned on stablecoins. However, checking with your exchange to see their policies regarding withdrawing interest earned is essential. Some exchanges may have specific requirements that need to be met before you can make a withdrawal.

Generally, there are no fees associated with earning interest on stablecoins, but your particular cryptocurrency wallet or exchange may have its fee structures that would apply.

FAQ

What are stablecoins?

Stablecoins are digital assets that maintain a stable value over time. They are designed to eliminate the risk associated with price volatility while offering an attractive way to earn passive income.

Are all stablecoins the same?

No, there are different types of stablecoins with varying levels of stability. The most common type of stablecoin is a USDC-backed stablecoin and PAXO standard, backed by U.S. dollars to maintain its price.

What are the types of interest payments offered?

Interest rates vary from protocol to protocol; however, most offer either a fixed or variable rate of return.

How is interest earned on stablecoins?

Interest earned on stablecoins is typically gained through yield-generating DeFi protocols, such as lending protocols, liquidity pools, saving accounts, and yield farming. These protocols allow users to earn a return on their stablecoins by providing liquidity to the platform or lending their tokens to borrowers.

Can I withdraw the interest I earned on stablecoins?

Yes, you can withdraw the interest you earned on stablecoins. However, checking with your exchange to see their policies regarding withdrawing interest earned is essential. Some exchanges may have specific requirements that need to be met before you can make a withdrawal.

Are there any fees associated with earning interest on stablecoins?

Generally, there are no fees associated with earning interest on stablecoins, but your particular cryptocurrency wallet or exchange may have its fee structures that would apply.