Key Takeaways

- NFT sales are rebounding strongly, with almost one billion dollars in sales in January 2023, a 42% increase from the previous month, and transactions spiking by over 20% in that same month.

- Ethereum remains the leading blockchain for NFTs, with $784 million in January transactions, followed by Solana with $150 million. Bored Ape Yacht Club (BAYC) had nearly 14% of all collection sales, at $71 million, and Mutant Ape Yacht Club had $58 million.

- According to a Dibbs survey, 52% of people invest in NFTs so that digital art can be used in other digital media, and 84% would buy an NFT if they could exchange it for something physical. Of the top 100 collections in the world, 66% are only digital.

- While 63% of people buy NFTs “just to make money”, over half of those respondents have actually lost money. Additionally, only 60% of people would “consider” buying an NFT, even if they already had an affinity for the company.

If you knew or read anything about the bath that NFTs as a whole took in 2022, with an 80% drop [1], then you might also be aware to buy when prices are low; at least that’s what other investors have already done: NFT sales are making a comeback. In fact, in January 2023 alone, sales erupted to almost One Billion Dollars. That’s a 42% jump from the last month of 2022. And transactions spiked by over 20% in that same month [2].

In this article, we’ll focus on some of the nitty-gritty on the NFT marketplace. If you’re looking for some of the best ways to get started, we have the best individual markets ready to go for you.

A big shakeup in NFTs also came this year when Bitcoin announced it would add them to their blockchain. But the raw numbers from the beginning of the year indicate that Ethereum and Bored Ape Yacht Club (BAYC) are still the big dogs in NFTs.

- Ethereum was the blockchain of choice for NFTs, with $784 Million of the January transactions.

- The next leading blockchain was Solana, with only $150 Million.

- BAYC had nearly 14% of all collections sales, at $71 Million, a jump of 45% since 12/2022.

- BAYC's sales are bolstered by having four of the top five most expensive NFTs of January:

- #5,840 for $796,444

- #4,025 for $613,501

- #8,483 for $581,845

- And #8,483 for $490,333

- The next largest collection was Mutant Ape Yacht Club, with $58 Million, a jump of almost fifty percent.

Other historic numbers are expected for the market as a whole. According to Yahoo News [3], the market in 2022 was a staggering $19.4 Billion, with an expected 24.32% expected compound growth rate.

Some historic data can be used for context. We can use these figures to extrapolate to today’s averages.

- In 2021, 33% of NFT original sales were less than $100.

- With 20% being $100 to $200, that means over half of all NFTs were under $200.

- NFT sales went from $400 Million at the beginning of 2021 to over $2 Billion by the end of that year [4].

- Forbes in 2021 reported the total market worth over $7 Billion.

- Reuters, on the other hand, reported that sales in the third quarter alone hit $10.7 Billion [5].

- According to a recent Twitter survey, 63% of people buy NFTs “just to make money”.

- However, over half of those respondents have actually lost money [6].

Dibbs Survey

Dibbs is a built-in community of people keen on NFTs and other blockchain financial innovations. They conducted a Metaverse affiliated survey [7], and the results are insightful, not only for their raw data, but also for comparisons within the data.

As an example, 52% of people invest in NFTs so the digital art can be used in other digital media, i.e., video games or virtual universes. Meanwhile, 84% would buy an NFT if they could exchange it for something physical.

When we see a comparison to actual market performance, we see yet another nuance: of all the top 100 collections in the world, 66% of them are only digital. That means that while 8 out of ten users would like the physical option attached, only a third of the market has responded to that, indicating a growth need.

In that growth area, the top four physical benefits or items, as identified with OpenSea Research, are:

- Physical objects represented by the digital token.

- Tickets or access to events not available without digital token.

- Unrelated merchandise unlocked by digital token (watches, clothes, etc.)

- Using tokens as actual proof of ownership of land or real estate.

With this kind of discrepancy within the already avid community, it’s no wonder that there are challenges to entering the market. In fact, only 60% of people would “consider” buying an NFT, even if they already had an affinity for the company.

Here are some of the other raw data from the survey.

- Nearly half of survey respondents, 47%, are in favor of financial regulations in NFTs.

- Regardless of application, 57% of people see block-chain technology as essential for the betterment of society.

- Only 80% of “enthusiasts” have ever even owned an NFT. By type, they are:

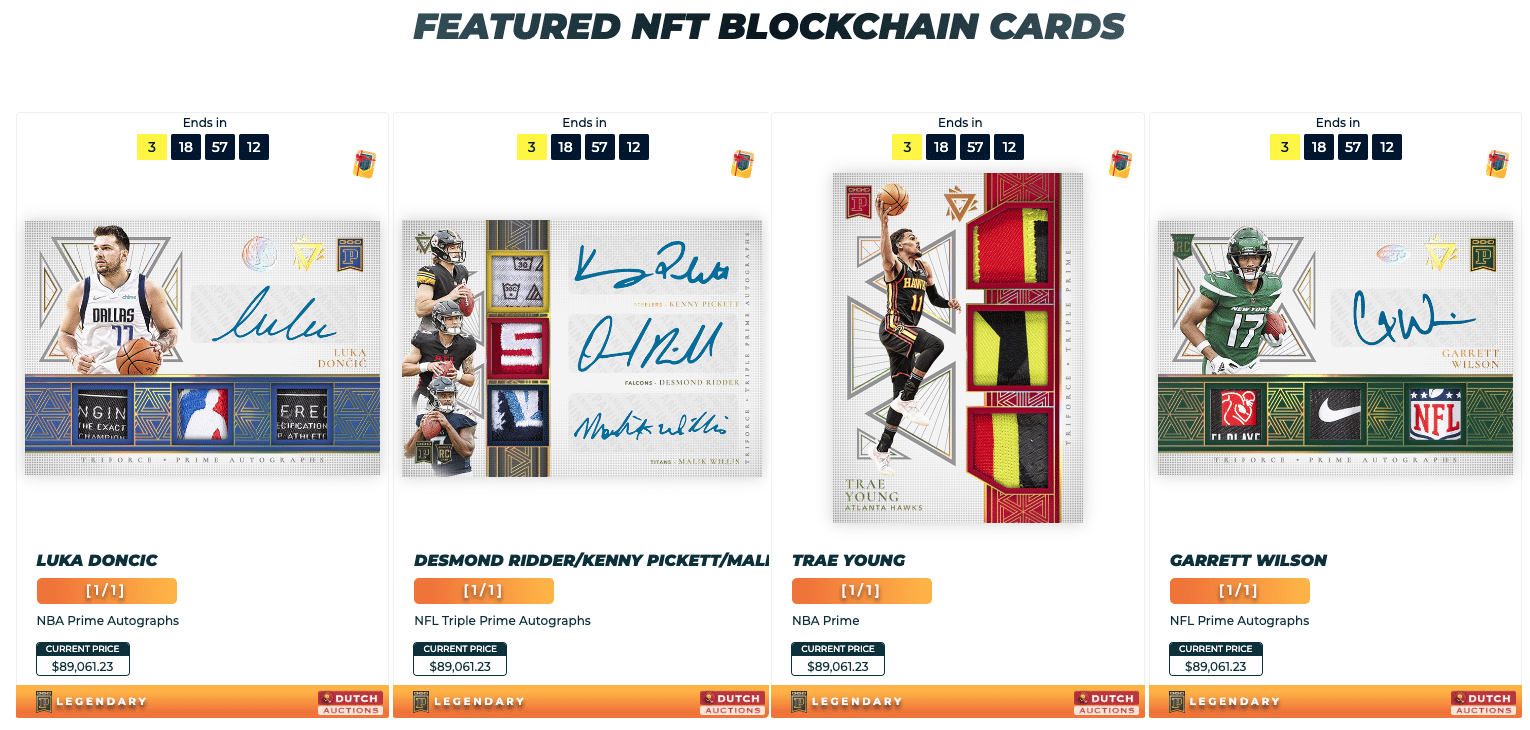

- 18% sports memorabilia, like cards.

- 19% artwork.

- 14% images taken from sports events.

- 10% were music.

Respondents also hinted at some mature understandings of the market. These perceptions are key because they tell a more nuanced story of the people actually engaged in NFTs, versus the story that might be hitting the airwaves on cable news.

- 49% of enthusiasts think there is some degree of over-hyping the NFT market.

- Only 29% disagreed with that statement.

- The two biggest problems insiders see with NFTs is purchasing crypto (36%) and setting up the wallet (35%).

- On the other hand, things that outsiders see as difficult are actually relatively easy for those in the know: only 16% felt that transferring collectibles was a barrier to entry, and only 7% felt that viewing NFTs was a problem.

Dibbs can also offer unique tracking of NFTs using OpenSea data. Here are some of the trading and volume stats they’ve been able to track.

- Multiple-use collectibles represent 64% of the top 100 collections.

- Collections that can be used multiple ways also take up 73% of all trading volume.

Conclusion

NFTs remain difficult to analyze, being they are the unique world where art and digitization have met. They’ve proven able to weather a storm, as the losses in 2022 have been replaced by record sales in early 2023, showing that NFTs are not dead. As the niche becomes the norm, we can expect more data for analysis, but until then, NFTs will remain as inscrutable as the blockchains which ensure their individuality.

References