What is Bitfinex?

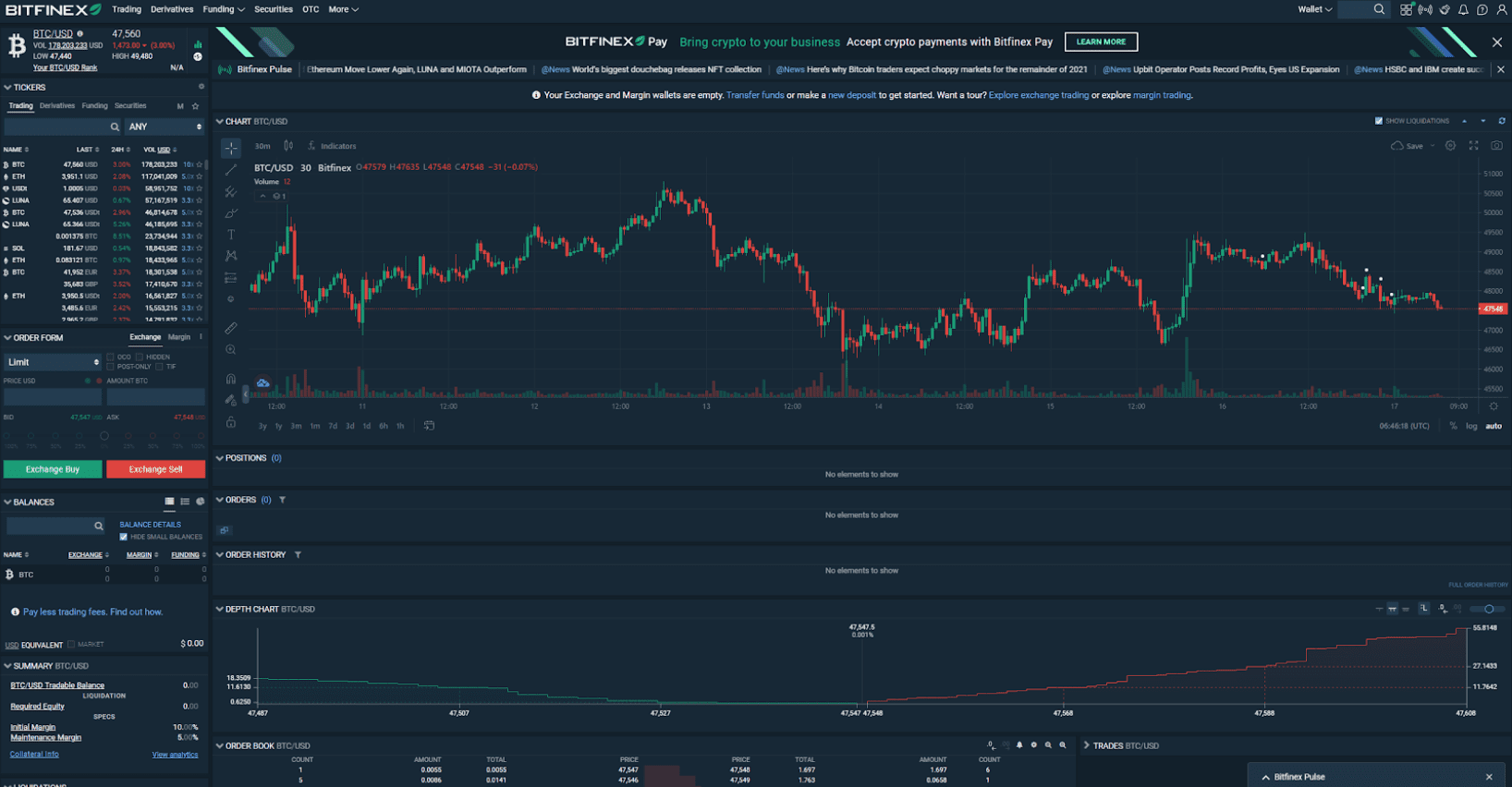

Bitfinex is an advanced cryptocurrency exchange making it possible for users to feasibly trade and invest their money with the help of given options. Bitfinex offers a range of different tools and features when it comes to professional trading. Users with little to no experience can also start trading and investing due to a friendly interface and premium support.

As for the origin of the platform, it was founded all the way back in 2012 in Hong Kong. But now, Bitfinex is owned by iFinex, and they are the ones managing and operating the whole exchange within the premises on the British Virgin Islands. Bitfinex is considered an excellent option for experienced users due to the pro trading options available. Beginners will also find it very convenient to start trading due to availability of spot trading along with quick buy and sell options.

My Overall Thoughts on Bitfinex

Bitfinex is not a new crypto exchange as it started when crypto was not yet popular, back in 2012. They have served millions of traders and investors since then, and the platform is still growing. Bitfinex has unquestionably made it easier for investors and traders to buy, sell, and trade crypto with many of the options available on the platform. But if you are wondering what reasons would make different traders and investors use this platform, then they are mentioned below:

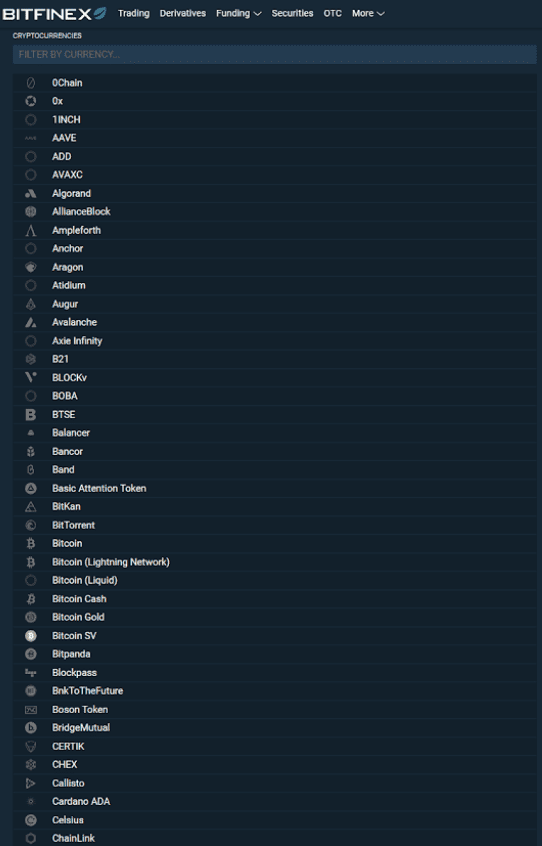

1) All-in-one platform: It doesn't matter if you have just entered the cryptocurrency field or you have been trading for years, Bitfinex has options for all. If you are a newbie, you can easily explore over 150 cryptocurrencies and buy or trade them as you want. If you are a dedicated cryptocurrency trader, there are several markets for you to get started with, and low maker and taker fees.

2) Hassle-free deposits and withdrawals: Some dedicated crypto trading platforms do not support fiat deposits or withdrawals. Bitfinex does not have this problem, and offers several options for both depositing and withdrawing.

3) Extra features and solutions: Bitfinex is not just a simple crypto exchange, it has built itself into something more. For the convenience of their customers, Bitfinex allows users to lend or borrow money quite easily. Staking is also supported on Bitfinex so you can earn interest on your cryptocurrency while you HODL. Lastly, there are mobile apps to make trading, buying and selling even easier.

One of the concerns that some crypto traders have is the level of security. It is true that a breach happened in 2016, but Bitfinex has taken a lot of precautionary steps since then, and has managed to remain secure, with no further incidents.

Key Features & Advantages of Bitfinex

Let's check out the premium advantages of Bitfinex mentioned below and evaluate if they are right for your needs.

Negatives & Disadvantages of Bitfinex

There are some critical aspects where Bitfinex can actually improve their service. Click on each of the jumplinks to learn more about how they can affect your experience.

What Services does Bitfinex offer?

If you want to find out everything about Bitfinex, then dive into the details below.

Easily purchase cryptocurrency: Bitfinex allows their users to purchase different cryptocurrencies relatively easily and quickly. All you have to do is select a payment method as per your preferences and buy the coin you want. It's also up to you if you decide to purchase with fiat currencies or other cryptocurrencies. It is well-suited to those who are new to the crypto industry and want to buy and hold different coins without messing around with the complicated features of the exchange.

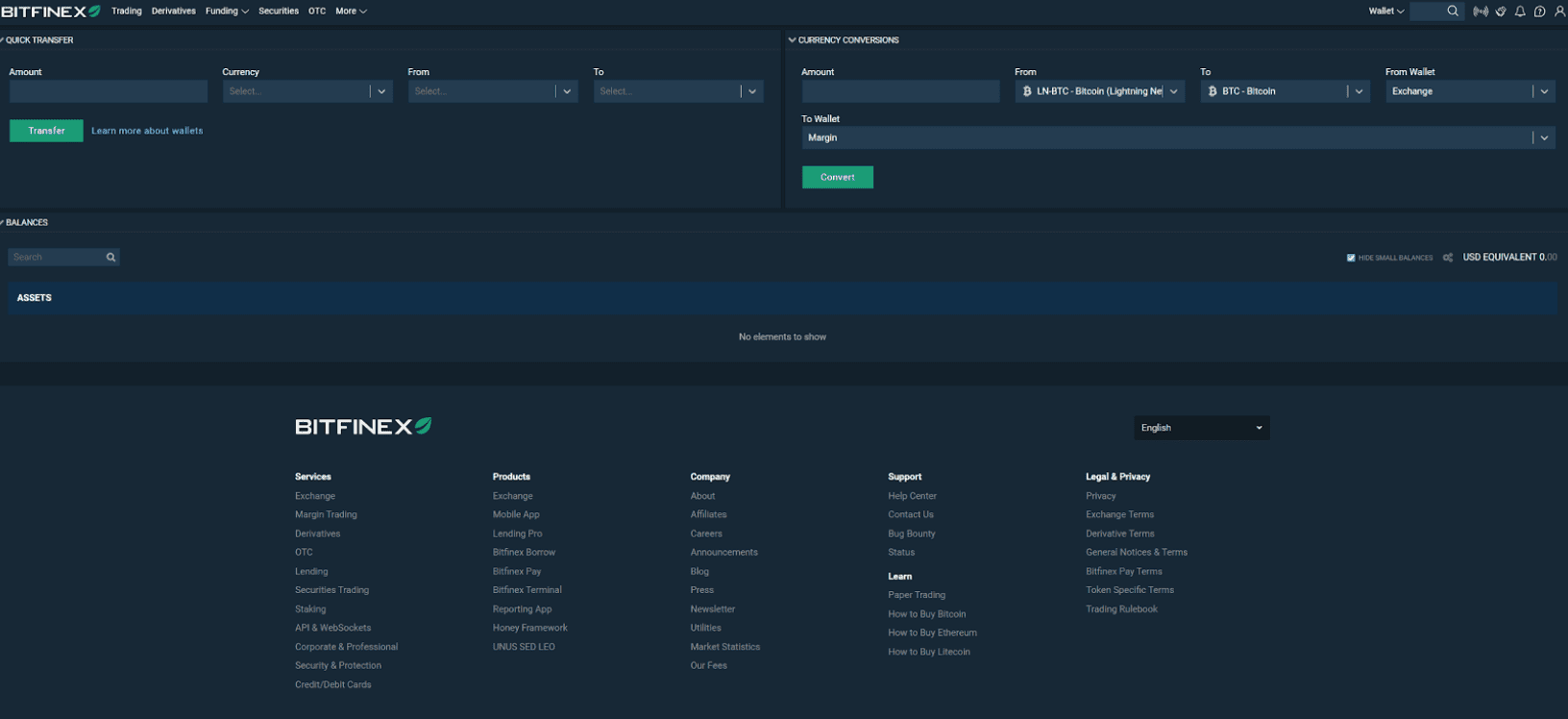

Convenient swaps and account transfers: What if you find that a particular coin is performing better than the one you are currently holding? In that case, you might want to quickly swap your coins without facing delays or problems to gain the maximum profits. The good news is, Bitfinex has a swapping system integrated into their platform that allows their users to exchange crypto quickly. You can also easily transfer your crypto coins between the accounts on the exchange without having to withdraw and then deposit again.

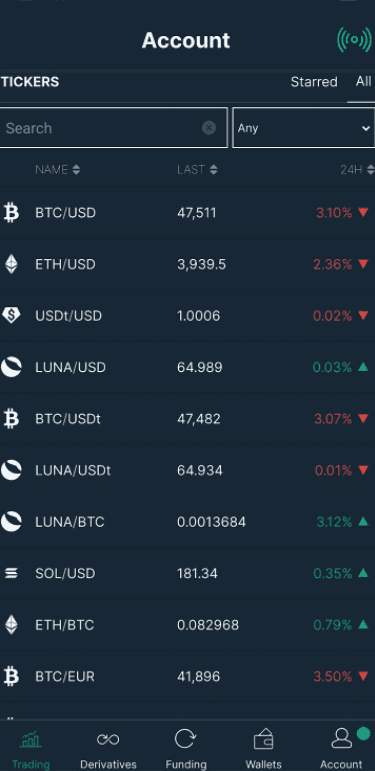

Professional mobile app: If you do not want to limit yourself to a desktop computer when it comes to crypto trading, you definitely need a mobile app to access your funds and trading activities. With Bitfinex, you won't have to worry about this factor as the platform has professional mobile apps available for both Android and iOS. Whether you own an iPhone, iPad, or Android phone, you will be able to download the apps from their respective stores easily and free of charge. Once you have installed the app, you can sign in with the same login details you use for the desktop, and your accounts will be accessible on any device.

More than 150 cryptocurrencies supported: If your crypto portfolio only has one or two coins in it, then you might want to expand a little with the help of Bitfinex exchange. Bitfinex offers a massive range of cryptocurrencies, and users can access them all for investing or trading purposes. You can either directly buy the cryptocurrencies with fiat, or you can exchange them with any other coin you want. As for trading, there is a whole market available for you to explore and check out various cryptocurrencies right away. And don’t worry, Bitfinex also adds crypto coins on a regular basis depending on the demand and potential.

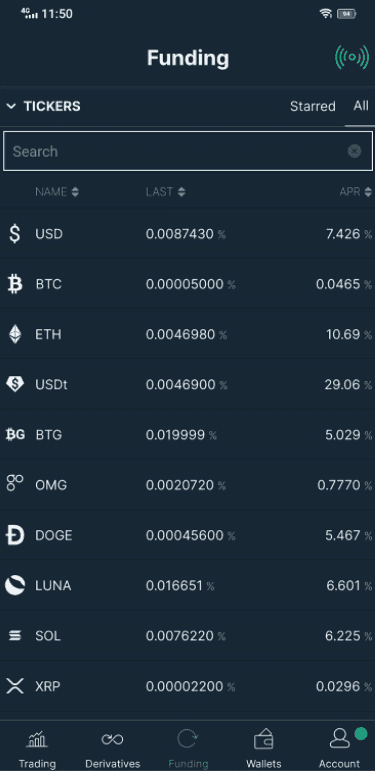

Staking available for a number of cryptocurrencies: We all know how saving accounts work and how a bank can offer you a particular annual interest rate on your funds. Have you ever considered the same scenario with your cryptocurrencies? If not, then it might be time you do, to take advantage of passive crypto income.

There are many exchanges and platforms that have started offering their users the option to stake their coins. Bitfinex is one of these exchanges, and users can earn interest on their coins rather than letting them sit idly for an extended period. The best thing is, Bitfinex supports a few coins that can be staked on their platform, such as Tron, Cosmos, Solano, Cardano, and a few others. As for the annualized interest rate, it varies between 1.5% and 10%, depending on the coin.

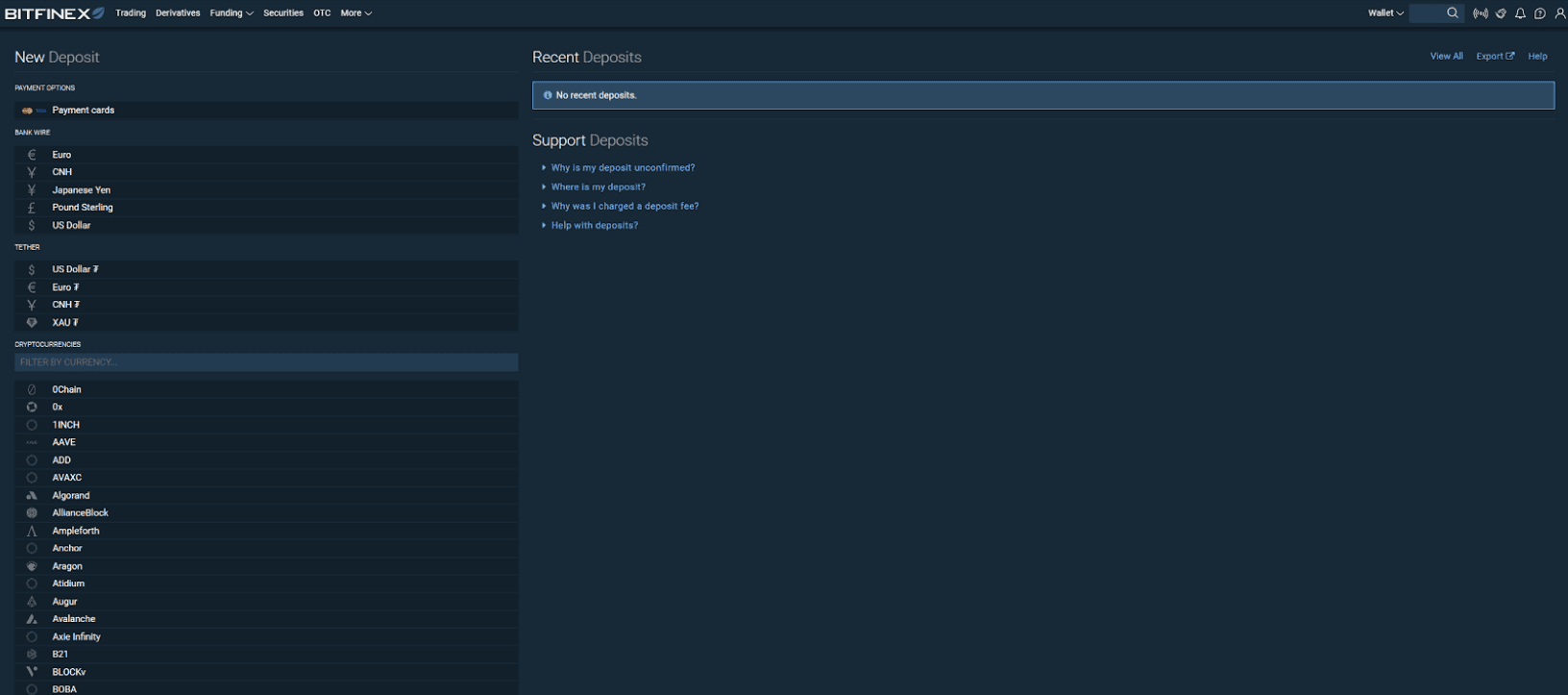

Several deposit and withdrawal methods available: One of the major problems users face with crypto trading platforms is difficulty withdrawing and depositing their funds. To tackle this issue, Bitfinex has integrated different depositing and withdrawing methods in their exchange to make it possible for everyone to easily conduct transactions.

Let's talk about the deposit methods: users can simply deposit funds directly through a wire transfer. Bitfinex supports several fiat currencies like USD, EUR, GBP, JBY, and a few more. Another option is to purchase cryptocurrency using Visa or Mastercard. The last option is to use crypto wallets to transfer your coins onto Bitfinex without any issues. As for the withdrawal methods, you can use wire transfer or express bank wire transfer to withdraw fiat currency.

Also, it is important to note that it's necessary for users to fully verify their accounts on Bitfinex before they can access all the deposit and withdrawal methods.

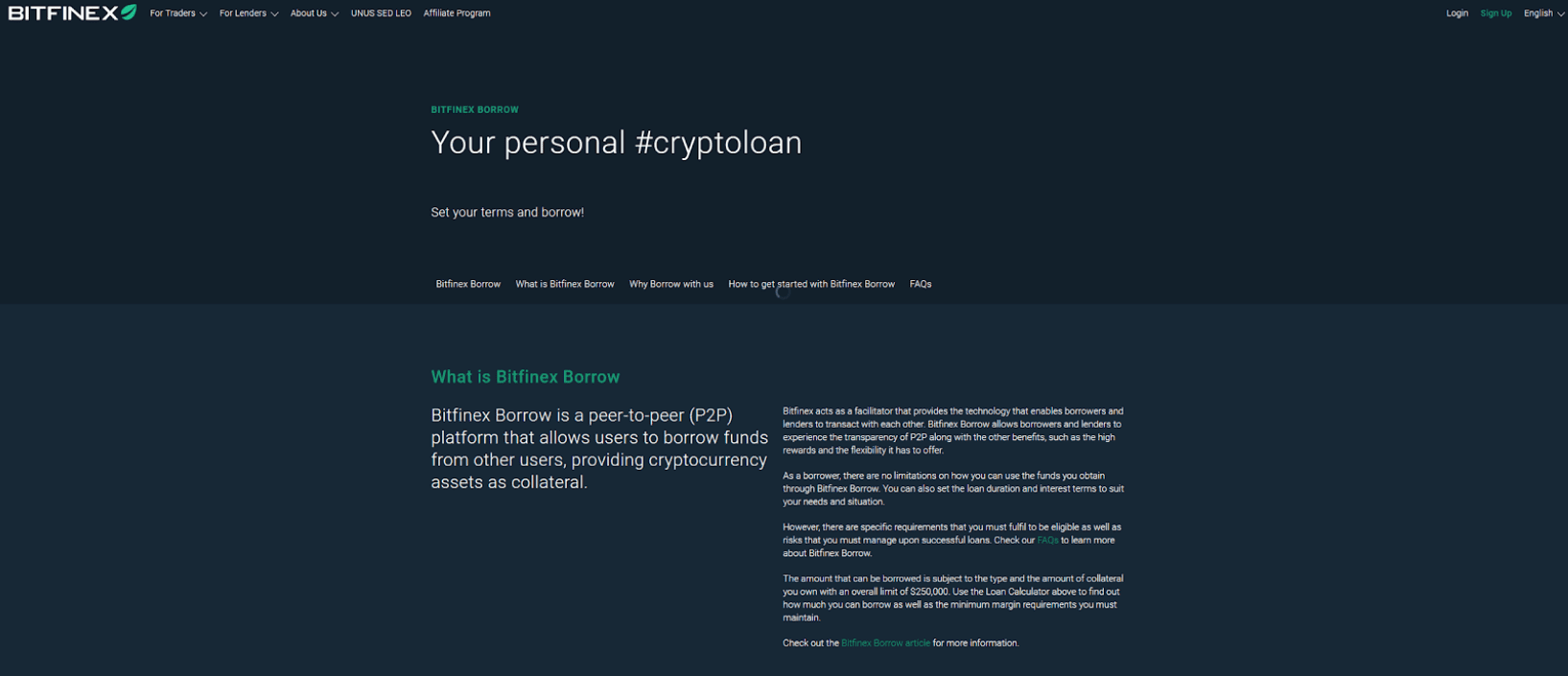

Crypto lending and borrowing: Bitfinex has a P2P loan system that allows users to lend or borrow funds from each other. In simple words, Bitfinex does not give loans to the users themselves; instead, other users who are willing to be lenders do so.

You can borrow different cryptocurrencies on the platform, along with USDT. You also get the option to go with fixed-rate loans or variable loans. Do remember that the interest rate can go as high as 30% depending on the amount you are going to borrow, the time period, and the nature of the loan. It is a better idea to thoroughly check out the interest rate and policies before opting for any loan.

If we take a look at the lending mechanism, users can lend different cryptocurrencies, including BTC, ETH, and ZRX, and withdraw their earnings once the agreed period is over.

Various trading markets and options: While Bitfinex does not have the greatest market diversity on their exchange, they still have options to fulfill the requirements of most traders. Traders can explore different markets and perform their trading activities without restrictions. Those markets include future, spot, derivatives, OTC, securities, and margin trading. Now it is up to you, your experience, and your skills to go with any suitable market and start trading professionally.

Unlimited affiliate rewards: If you have a great social network following that trusts you and your moves, then you can earn plenty of rewards through the Bitfinex affiliate program. Bitfinex offers up to 18% of rewards on first-degree referrals, depending on the margin and funding, and usual trading. Bitfinex also claims that the earnings of their users grow along with their referrals due to their unique rewards system.

Bitfinex Pay for quick and easy crypto payments: Whether you are trying to shop online or receive payments from your clients, Bitfinex Pay can make everything easier for you with its integration. Bitfinex Pay is a simple widget that makes it possible for users to use their Bitfinex account or wallet to purchase different things from various stores. Users can also use it as their on-the-go receiving wallet, without any type of processing fee.

What I don't like about Bitfinex

Before making any solid decision about going with Bitfinex, I would suggest you take a look at its cons too. It will help you decide if you are making the right choice or not for your individual needs.

Security concerns: If we take a look at the past of Bitfinex, it has actually not been that great. In 2016, the exchange was hacked, and about 119,756 BTC were stolen that is worth more than a billion dollars now. Since then, Bitfinex has been more restrictive than ever, and they have tightened their security measures too, but the past always leaves a spot.

Not available in the USA: Yes, Bitfinex is yet another crypto exchange that strictly prohibits residents from the United States from using their platform. The underlying reason is that the US has quite a lot of rules and regulations when it comes to financial activities. Of course, not every exchange can keep up with their demands, and thus, they simply restrict US users from joining their platform. If you are based in the USA, you can find a list of the best crypto exchanges in the US here.

No Live Chat support: It definitely is quite an inconvenience to wait for hours just to get a reply to your concern. Bitfinex has not come up with a solution for that. The exchange still goes with the old-school way of emails to solve their users’ concerns, rather than going with the live chat support that is quick and efficient.

Bitfinex Fees

Bitfinex Deposit Fees

Bitfinex offers several options to its users to deposit funds into their accounts. If you are depositing cryptocurrency, there will be no fee. If you are going to deposit with bank wire option, the exchange will charge you 0.1% of your transaction, with a minimum fee of $60/ €60. This is quite expensive, because if you are depositing only a few hundred dollars, you still need to pay the minimum $60 fee, instead of 0.1%.

If you want to purchase crypto using Visa/Mastercard, you will need to check the individual fee at the time of payment, because it varies by third-party payment processor.

Bitfinex Trading Fee

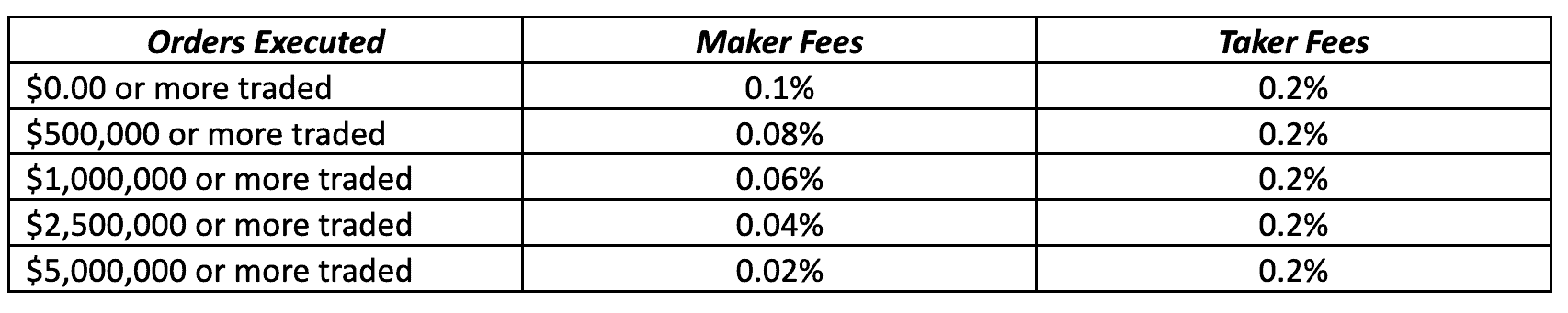

The base trading fee of Bitfinex for makers is 0.1% and 0.2% for the takers. But one very crucial thing to note here is that the traders can get massive discounts on their trading fee if the volume traded exceeds the specified amount.

You can take a look at the chart below for reference:

Bitfinex has a different fee structure for its derivatives trading. The base fee for makes starts from 0.02%, and the taker fee starts from 0.0650%.

Bitfinex Fiat Withdrawal Fees

When it comes to fiat withdrawals of Bitfinex, the users have to pay a flat fee of 0.1% of their withdrawal amount (minimum fee of $60). In case you want your funds to be in your bank account within 24 hours, Bitfinex offers its users express wire transfer, with a fee of 1% of the total withdrawal amount (minimum $100 fee).

Bitfinex Crypto Withdrawal Fees

Bitfinex does not have a fixed withdrawal fee for cryptocurrencies. The platform charges a flat fee for each different cryptocurrency on their platform. There are some coins that are free of charge, and you can check the fee schedule here to determine the fee for any particular coin. f you send cryptocurrency to another Bitfinex account, it will be free of charge.

Pros and Cons of Bitfinex

- Over 150+ cryptocurrencies supported

- Easily buy, sell and swap cryptocurrency

- Mobile app available for convenience

- Borrow and lend crypto on the P2P market

- Staking available on several coins, so you can earn interest on your crypto

- Expensive deposit and withdrawal fees (minimum $60)

- Not available in the USA

- No Live Chat customer support

Verdict

Bitfinex can be an excellent pick for anyone who has just started their crypto or trading journey. The friendly interface will allow you to explore every option without confusing yourself with others. The best thing is, you can simply buy and hold cryptocurrencies too on the platform if you do not want to trade.

Users can even earn premium rewards and interest rates through their affiliate program and staking, respectively. In case of any problem, users can also get in touch with the Bitfinex support team, but unfortunately it is only via email, as there is no Live Chat support. If you are in the USA and you want to use a crypto exchange, you need to find another one, as Bitfinex does not support US residents. You can have a look at the best crypto exchanges for US residents by clicking here, or also take a look at the comparison table below.

Comparison Table of the Best Crypto Exchanges in the USA

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Frequently Asked Questions

There are tons of crypto exchanges that were compromised in the past. But the vital thing to consider is how they dealt with them. As for Bitfinex, the exchange has taken many security measures to make it perfectly secure and safe for users to use.

Unfortunately, Bitfinex has restricted US residents from using their platform. This is mainly due to the policies and laws of the United States that every platform has to follow in order to operate there. Instead, you can use one of the top crypto exchanges in the USA.

While Bitfinex does have different trading options, they lack when it comes to various markets. In the end, if you are comfortable trading with limited options, you will face no problems, but if you are looking for tons of advanced markets, you might want to choose a different exchange, such as Binance or KuCoin.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.