What is Crypto.com Card?

Crypto.com Visa debit card is one of the best crypto debit cards available, thanks to its generous cashback on everyday purchases, as well as plenty of additional rewards and perks. Best of all, it is free to use, and available to anyone with a Crypto.com account.

Some people refer to the Crypto.com card as a credit card, but it is actually a debit card. With a crypto credit card, you can spend money, and then pay it back later. On the other hand, with the Crypto.com debit card, you pre-load your card using fiat or cryptocurrency, and make purchases with your own funds.

In this review, I will take you through my personal experience with the Crypto.com card, the pros & cons, fees, rewards, and more, so you can decide whether you should sign up for one yourself.

Features of the Crypto.com Visa Card

FREE Crypto Cashback

The biggest reason that most people (myself included) are drawn to the Crypto.com card is that you receive crypto cashback on each purchase you make. The amount you receive will depend on which tier of card you have (explained below), and ranges from 1% to 5%.

Personally, I have the Royal Indigo card, with 2% cashback: this means that every time I use my Crypto.com card, I receive 2% back in CRO (Crypto.com's native coin). When I buy a $100 item, I receive $2 worth of CRO. I prefer to HODL my CRO, but other people prefer to immediately exchange it for fiat currency, or even another cryptocurrency, such as BTC or USDT.

I am essentially receiving free crypto when I make purchases as usual, and this builds up over the long term. I have used my Crypto.com Visa card for around 2 years now, and I have earned a few hundred dollars in CRO cashback.

Rewards and Perks

Besides the cashback, Crypto.com card users have access to a range of rewards and perks, which are dependent on the level of card you have (see below). These are some of the benefits of having the Crypto.com Visa card:

FREE Spotify (100% cashback)

FREE Netflix (100% cashback)

FREE Amazon Prime (100% cashback)

Expedia (10% cashback)

Airbnb (10% cashback)

FREE Airport Lounge access

I personally enjoyed free Spotify and Netflix, but note that for some tiers this is only available for the first 6 months.

I also travel a lot, so having free airport lounge access is great. Free food and drinks, and a comfy place to wait for my flight are excellent perks to have.

Spend Your Crypto Easily

If you have made profits from getting into crypto early, then you may be wondering how you can use it to make purchases or pay for services. While most crypto exchanges require you to sell your crypto to fiat, and then withdraw it to your bank account before you can use it, Crypto.com makes it much simpler.

With the Crypto.com Visa card, you can load it with crypto straight from your Crypto.com app.

Not only is it easy to load your card, but it is super convenient to use it when paying for goods or services. You can use the physical metal card, or the digital card, which can be added to Google Pay and Apple Pay for extreme convenience. Whether you like to shop in-store or online, even internationally, Crypto.com card makes it easy and hassle-free.

Withdraw Money Easily

You can use your Crypto.com Visa card to withdraw money from any ATM around the world. This is convenient if you want to convert your crypto to fiat easily, and is also great for travelling overseas. Instead of having to convert your currency before your trip, you can simply withdraw the local currency using your Crypto.com Visa card. Remember, you can use either fiat or crypto to top up your Visa card, so you don't have to spend your crypto if you prefer to HODL for the long term.

Depending on your tier of card, you will receive up to $1,000 of free ATM withdrawals per month, and after you have reached this limit, there is a small charge of 2% per transaction.

Crypto.com Card Tiers

Crypto.com offers 5 tiers of Visa debit cards, which have different benefits and CRO cashback rewards. What determines which tier of card you receive is the amount of CRO you stake (for a minimum of 180 days).

If you look at the table below, you will see the highest tier is Obsidian, which gives 5% CRO cashback on all purchases. However, this requires $400,000 USD worth of CRO to be staked for 180 days. This is out of the realm of most crypto investors, but targets those who are ultra wealthy, or have made a fortune from crypto. The benefits are the highest you will receive from Crypto.com, and includes 'Private jet partnership'. However, when I did some research into what this means, they give you a bottle of Dom Perignon and 1 way ground transport after your private jet flight. This is not much of a benefit, for someone who is paying thousands of dollars for private jet flights, and staking $400,000 of CRO to receive this card.

Most Crypto.com cardholders opt for the Jade Green/Royal Indigo card (myself included). The required amount of CRO you need to stake is $4,000 which is reasonable, and rewards you with 2% cashback on all purchases. You also receive 100% cashback on Netflix and Spotify for 6 months, as well as free airport lounge access around the world.

If you do not want to spend any money staking CRO, you can choose the Midnight Blue card. This card doesn't come with any CRO cashback or any rewards, but you can benefit from being able to spend your crypto easily, as well as withdrawing from ATMs around the world.

Card Tier | CRO Rewards | Benefits | CRO Lockup |

|---|---|---|---|

Obsidian | 5% | Free Spotify, Free Netflix, Free Amazon Prime, 10% cashback Expedia, 10% cashback Airbnb, Free Airport Lounge Access + 1 guest, Private Jet Partnership | $400,000 |

Icy White & Frosted Rose Gold | 3% | Free Spotify, Free Netflix, Free Amazon Prime, 10% cashback Expedia, Free Airport Lounge Access + 1 guest | $40,000 |

Jade Green & Royal Indigo | 2% | Free Spotify (6 months), Free Netflix (6 months), Free Airport Lounge Access | $4,000 |

Ruby Steel | 1% | Free Spotify (6 months) | $400 |

Midnight Blue | - | - | $0 |

My personal experience with Crypto.com card

I will go through my own experience applying for and using the Crypto.com card, and highlight both the good and bad points that I have found.

Application Process

The application process is very simple, first I signed up to Crypto.com app, then applied for a new card in the menu.

Depending on which tier of card you would like, you need to purchase and stake a set amount of CRO coins. I chose the Royal Indigo card which requires $4,000 USD worth of CRO. Note that this amount will vary depending on your country. For example, if you are in Australia, to receive the same Royal Indigo card, you need $5,000 AUD of CRO.

I bought $4,000 of CRO, then staked it for the minimum 180 days as required in order to apply for the Crypto.com card.

Verification and Approval

The next step is to verify my address and ID, which was done by uploading a driver license, as well as utility bills. I submitted my documents immediately, and it took about a week before they were approved. This time can vary depending on how busy Crypto.com is, but from what I have heard from other users, around 1-2 weeks is the current wait time for approval.

Card Delivery

Once my card was approved, I could access the digital version of my card immediately. This means I could use it straight away for online purchases. I also added my card to Google Pay, to spend in-person at any store that accepts Visa payments.

The physical metal card took around 3 weeks to arrive, but it is not really needed when I already have the digital version. The only times I need the physical card is when claiming free airport lounge access. However, lots of Crypto.com card users like carrying it around, as it is a beautiful metallic card that looks and feels extremely premium when using it to pay for items in person.

Loading Crypto.com Card

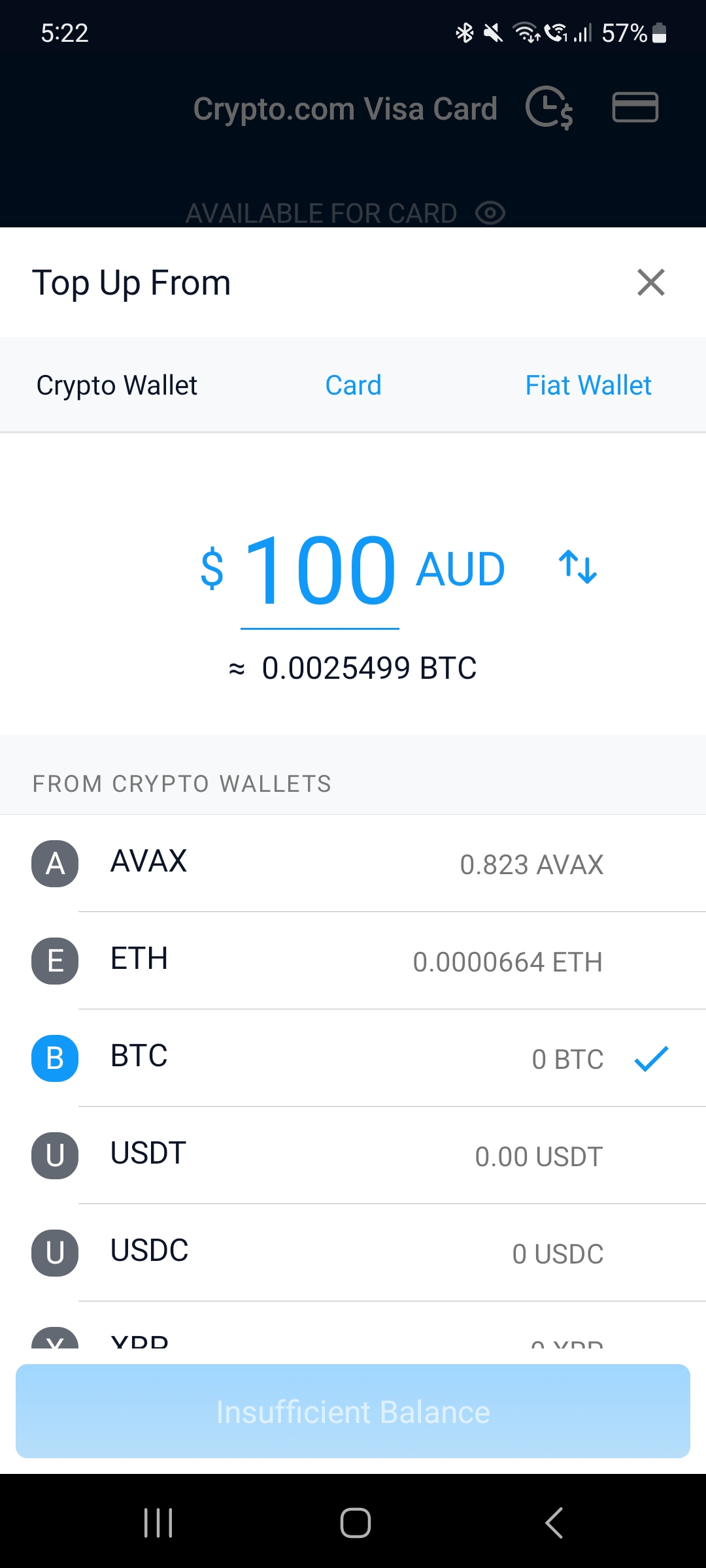

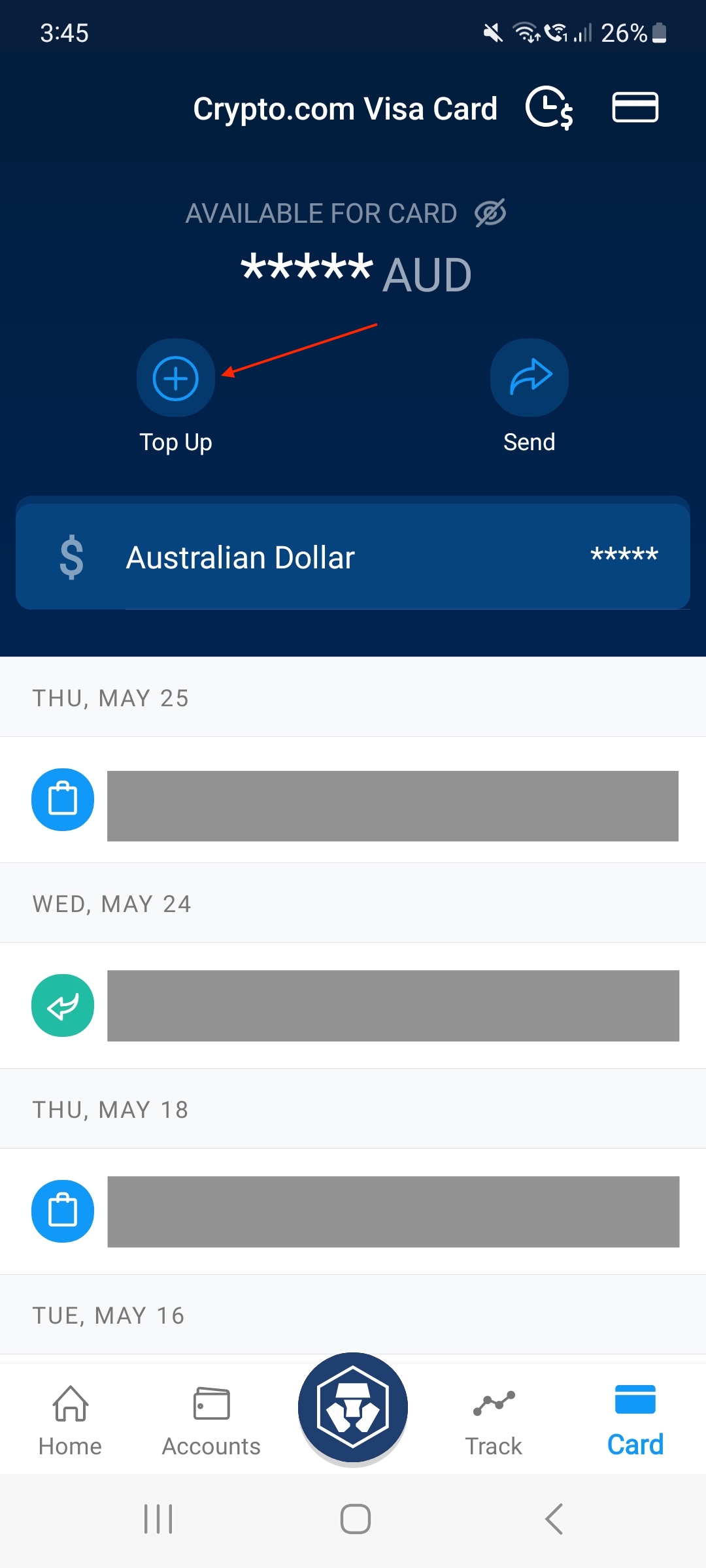

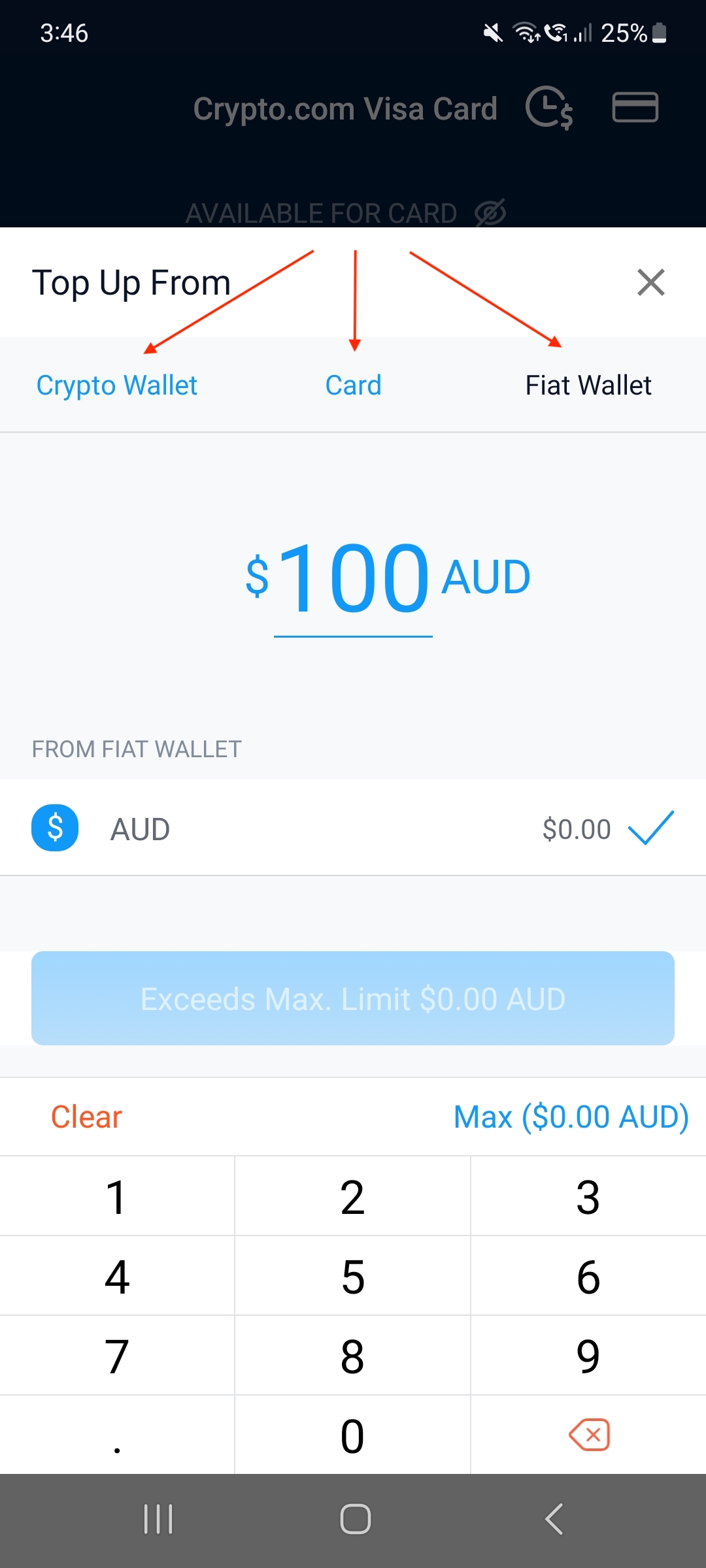

Loading my Crypto.com card was extremely easy. Simply navigate to the card in the app, then click the 'Top Up' button (see screenshot below left). Then you will see several options for topping up the card, either using Crypto, Credit Card, or using Fiat Currency.

I have used each of the methods and they all work seamlessly. When topping up using fiat currency, you will need to deposit fiat into your Crypto.com account first. It states that it can take up to 4 business days to transfer, but every time I have used it, the transfer has been made in under 5 minutes.

Paying with Crypto.com Card

I use Crypto.com to pay for all my online purchases, which is extremely straightforward. Simply type in the Crypto.com card number, expiry and CVV number where the website asks you to input payment details, and it will work just like a normal debit card.

For in-store purchases, I use my Crypto.com card in Google Pay. It is extremely convenient as I don't need to carry my card or wallet anywhere, and use my phone to pay. If you prefer using the physical card, that is also available to use in store.

Receiving CRO Cashback

After making any purchase, whether online or in-store, the Crypto.com app will notify me saying that I received CRO cashback, and the equivalent amount in USD. This is automatically added to my CRO wallet in the Crypto.com app, there is no additional step needed to claim this crypto or move it anywhere. I leave my cashback as CRO, in the hopes that it will grow in the coming years, but if you prefer, you can sell the CRO for fiat currency, or other cryptocurrency whenever you like.

Benefits of Crypto.com Card

Besides receiving 2% cashback on all my purchases, I used the 6 months of free Spotify and Netflix. Be aware that you need to pay for your subscription using your Crypto.com card, and then you will receive the payment amount back in CRO immediately after the monthly purchase. Keep in mind the maximum monthly reimbursement is $13.99 USD for Spotify and $13.99 USD for Netflix.

I also enjoy using my Crypto.com Visa card to gain free access to Airport Lounge's around the world. All you need to do is show the Lounge staff your Crypto.com card, and you can enter for free, enjoying all the food and drinks you like!

Overall Thoughts

I enjoy using my Crypto.com Visa card, as I know that I am slowly building my crypto portfolio with every purchase that I make. Even though 2% cashback may not sound like much, over the course of a few years, it adds up. Also, if you take into account the fact that the value of CRO may rise in the future, the amount I have saved through cashback could possibly turn into thousands of dollars.

It is extremely easy to use, and the best thing is that there are no initial sign up fees, annual fees, or transaction fees to use the card (besides if you withdraw from an ATM, after reaching your monthly limit). The only downside of the Crypto.com card is that you need to have your CRO staked for a minimum of 180 days to receive the card and associated benefits. After the 180 days has expired, you can withdraw your CRO and continue to use your card, however, your cashback and benefits will be reduced.

Crypto.com Card Pros and Cons

- Crypto cashback on all your purchases

- Benefits such as Free Spotify, Free Netflix, Free Amazon Prime, Free Airport Lounge access, and 10% cashback on Expedia and Airbnb

- Spend your crypto easily in-store or online

- Withdraw money from ATMs all around the world

- Crypto.com card can be added to Google Pay and Apple Pay

- High staking requirements to receive cashback and benefits

- Not available in all countries

Crypto.com Card Fees

Application Fee

There is no cost involved to apply for the Crypto.com Visa debit card.

Annual Fee

$0 annual fee, unlike many credit cards.

Transaction Fee

There are zero fees involved when making purchases with your card.

ATM Withdrawal Fee

There is a 2% transaction fee to withdraw from an ATM if you have exceeded your monthly fee-free limit. The fee-free limits are as follows:

Crypto.com Visa Card Tier | Monthly Fee-Free Limit |

|---|---|

Obsidian | $1,000 USD |

Icy White, Frosted Rose Gold | $1,000 USD |

Jade Green, Royal Indigo | $800 USD |

Ruby Steel | $400 USD |

Midnight Blue | $200 USD |

Upgrade Fee

To upgrade your card, you need to stake the required amount. For example, if you have the Ruby Steel already and you want to upgrade to Jade Green, you need to stake $4,000 USD. Once you have done that, you can continue to use your existing Ruby Steel card, and you will receive the upgraded cashback and benefits. However, you will not receive a physical Jade Green card unless you pay $50.

Lost or Stolen Card Fee

$7 to replace the Midnight Blue card, $50 to replace all other tiers.

Account Closure Fee

If you spend your card's balance to zero, there is no fee.

However, if you have funds on your card and you wish for it to be returned, there is a $50 processing fee.

Staking Requirement

Besides the Midnight Blue card, there are staking requirements that need to be met in order to receive a Crypto.com Visa card. The amount will depend on which tier of card you want to apply for. See here for the different tiers.

Conclusion

The Crypto.com card is an excellent card for spending crypto or fiat currency, and the best part is you receive cashback (paid in crypto) every time you use your card to pay. It is free to apply for and use, with no annual or transaction fees, and it is super convenient, because you can add it to your online wallets like Google Pay, Apple Pay, or Samsung Pay. The only negative about this card is the requirement to stake CRO for extended periods to continue to receive cashback. However, if you are bullish on the future of Crypto.com and CRO, then you will not mind staking it for the long-term.

If you are interested in learning more about Crypto.com app before signing up for the card, read my full review of Crypto.com here.