Stablecoins have become quite popular in the world of cryptocurrencies because they tend to offer the best of both worlds - instant and secure processing, as well as stable valuations of fiat currencies.

Since they are backed by a reserve asset, they tend to offer price stability, which is a great advantage over other coins. In bear markets, or sideway trending periods, many crypto investors like to convert their crypto to stablecoins so they are not losing value on their coins. Then when a bull market starts again, they have stablecoins at the ready to trade for other cryptocurrencies.

Investors like to earn interest on stablecoins while they await the next bull run, so their money is working for them instead of sitting stagnant. In this article, we will talk about the platforms that provide the best stablecoin interest rates.

| Where to earn interest | Features | Score | Sign Up |

|---|---|---|---|

8% APY on stablecoins  | ☑️ Highest interest of 8% APY on stablecoins such as USDT & USDC ☑️ Earn interest straight from your crypto wallet for added security | 9.8 | Sign Up |

Best crypto exchange for staking  | ☑️ Fixed and flexible staking to earn interest on stablecoins ☑️ Dual asset and liquidity mining options available for experienced investors | 9.6 | Sign Up |

Easy to use app  | ☑️ Buy stablecoins on your phone and earn interest straight away ☑️ Lock your stablecoins for 1 month or 3 months and receive higher APY | 9.5 | Sign Up |

Biggest range of coins  | ☑️ Invest safely at the largest crypto exchange in the world ☑️ Buy stablecoins for only 0.1% fee, and begin staking | 9.2 | Sign Up |

Best places to earn interest on stablecoins:

#1. Nexo - Highest stablecoin interest rates

Nexo is the best choice if you want high returns on your stablecoins. The base rate is 8% APY flexible staking, on USDT, USDC, BUSD, DAI, USDP, and TUSD. This is the highest rates we have seen on any stablecoin staking, but note that this is only for the first $100,000 for each of the coins above. If you deposit more than $100,000, the rate for the additional coins halves to 4%.

If you prefer staking stablecoins of a different fiat currency besides USD, Nexo offers EURx and GBPx. These have a base rate of 4% APY for flexible staking, and 8% APY if you lock it for three months. USDx is also available with the same rate (4% APY flexible and 8% APY locked). The good thing about these three stablecoins is that there is no limit of $100,000, so if you have large amounts, you can still earn the maximum 8% APY rate.

Another great reason to use Nexo is that it's a cryptocurrency wallet, so it keeps your funds safe and off any crypto exchange. It has world-class security, with military-grade 256-bit encryption, storage in Class III vaults, and ISO 27001:2013 certification.

If you want to sign up to Nexo, register using our link and receive $25 FREE Bitcoin when you deposit $100 for at least 30 days.

- Flexible staking, with high interest rates of 8% APY for stablecoins

- Earn interest on USD, EUR, and GBP stablecoins

- Extremely secure cryptocurrency wallet

- Convenient and easy to use

- Staking more than $100,000 of a coin has lower rewards of 4% APY

#2. Bybit - Best crypto exchange for stablecoin interest

If you prefer earning interest on a crypto exchange, Bybit is the best choice for you. It is easy to buy stablecoins directly on the exchange, and then earn interest on it, without having to transfer it to another platform. You can earn interest on USDT, USDC, and DAI on Bybit, with flexible and fixed term options.

At the time of writing, USDT has flexible staking with 5.5% APY rewards, but this is capped at 500 USDT. For between 500 to 1,000 USDT, the rate is only 1.5% APY and for amounts over 1,000 USDT, the rate drops to 0.28% APY. If you have large amounts of USDT, we recommend using the fixed term option with no maximum limit, and the rates are 2.5% - 3% (30 to 60 day locked period).

USDC has flexible staking at 8% APY, but this is limited to the first 500 USDC. If you have between 500 and 5,000 USDC, the rewards are 2% APY, and above 5,000 USDC the rates are 1.2% APY. There is no fixed term option for USDC.

You can earn interest on DAI, with 3% APY on your first 1,000 DAI, and 0.5% APY for any amount over that. You can also choose to fix it for 30 - 60 days, for 2.5% - 3% APY.

Other interesting features on Bybit are the dual asset mining for USDT, and liquidity mining for USDT and USDC. These are for experienced users only, and come with added risk. However, the returns can be much higher. For example, liquidity mining on USDT can earn you up to 25.98% APY, and dual asset mining can be as high as 485.73% APY!

- Easy to buy crypto and earn interest all from the exchange

- Fixed term and flexible options available

- Dual asset and liquidity mining supported, for much higher rewards

- For flexible staking, the rewards decrease dramatically for amounts over $500

#3. Crypto.com - Best app for stablecoin interest

Crypto.com is the best mobile app for staking stablecoins as well as other cryptocurrencies. It is intuitive, and has a simple layout that is even easy for beginners to use. Buying stablecoins is easy, and you can do so using credit card or by transferring fiat to your app and making a direct trade.

You can earn interest on a few stablecoins: USDT, USDC, PAX, and DAI. There used to be stablecoins in other fiat currencies, such as AUD and GBP, but they are no longer available.

Crypto.com has the option for flexible staking, which means you can withdraw your crypto at any time. However, when you use this, the interest are quite low, at 0.4% APY for USDT, USDC, and DAI, and only 0.1% for PAX. However, if you lock the coins for 1 month or 3 months you will be rewarded in higher rates. For example, you receive 3% APY if you stake USDT for 1 month, and 4.5% APY if you stake USDT for 3 months.

Additionally, if you stake more than $4,000 of Crypto.com's coin (CRO), you can earn higher interest. At the time of writing, if you stake $4,000 or more of CRO, you will earn 6.5% APY on USDT and USDC if you lock it for 3 months. Check Crypto.com official site for the most up-to-date rates.

- Easily buy stablecoins on your phone and start earning interest

- If you stake Crypto.com's token (CRO) you receive higher returns on your stablecoins

- Stake over 21+ coins, including various stablecoins

- Straightforward mobile app that you can use for all your crypto needs

- Low rewards for flexible staking

#4. Binance - Biggest range of coins to stake

Binance is the world's largest crypto exchange based on trading volume, and we recommend this to users who want a safe and reliable platform to earn interest on their stablecoins. There are very low fees on Binance, of only 0.1% for spot trading, so you can easily buy stablecoins using fiat currency, and then begin staking it to earn interest right away on the platform.

Binance has several stablecoins, such as USDT, DAI, and their own stablecoin Binance Dollar (BUSD). The highest interest rates for stablecoins on Binance is BUSD, with 2.97% APY + bonus 2% APY for the first 500 BUSD. Unfortunately there are no fixed options available for staking stablecoins on Binance, so there is no way to receive higher rewards.

The good thing about staking on Binance is that you can earn interest on other cryptocurrencies besides stablecoins. With more than 350 coins to earn interest on, you can diversify your staked assets as you HODL for the next bull run.

A downside to Binance is that it is not available in the US. If you live in the US, you can consider using Crypto.com app instead.

- Stake your stablecoins at the largest crypto exchange in the world

- Earn interest on over 350 cryptocurrencies as well as stablecoins

- Purchase stablecoins with low fees of 0.1% and begin staking on the exchange

- Not available in the US

- No locked staking for stablecoins

#5. Stargate - Earn interest on stablecoins with DeFi

Stargate is a liquidity transit protocol that allows you to exchange native assets. However, what attracted most of its users is that it allows you to stake stablecoins and receive awards in STG, which is also Stargate’s native crypto.

The platform supports BUSD, USDT, DAI, and USDC stablecoins, and allows an interest rate of up to 6.81% APY at the time of writing.

The only downside we noticed about Stargate is that it might not be the ideal choice for beginners and entry-level investors.

- Interest rates of up to 6.81%

- Low fees for most coins

- Not an ideal choice for beginners

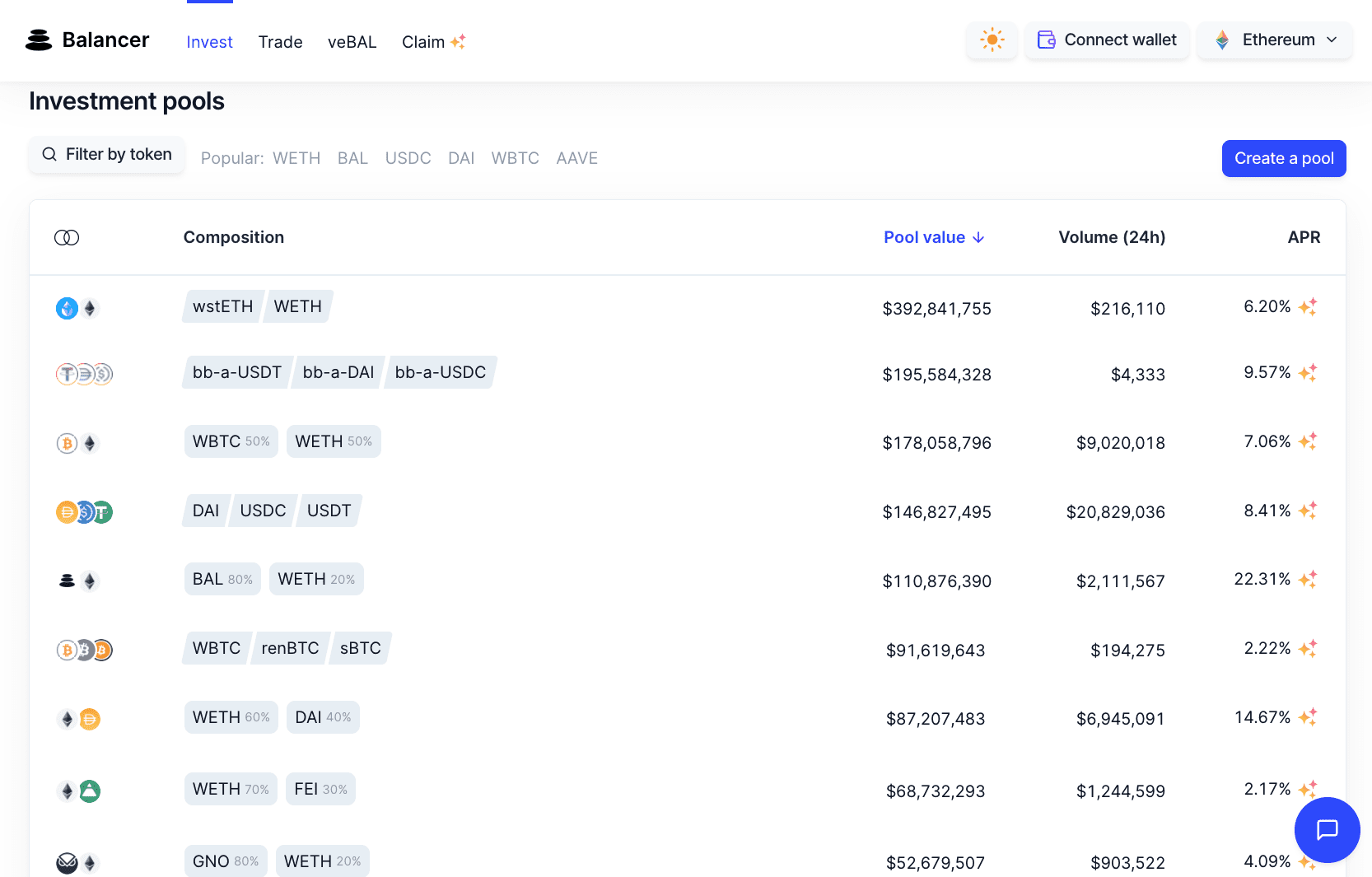

#6. Balancer - Another option for stablecoin interest

Built on the Ethereum blockchain, Balancer implements the AMM model, rather than the typical bidding that most systems adopt. Its protocol supports several assets, unlike Uniswap, for example, which supports only two.

However, although it supports up to eight assets in the same liquidity pool, you don’t need to have all the assets to invest in it. Having only one of the assets is just enough. Now, depending on the liquidity pool, the APY can range between 5% and 30%, but practically, the average interest rate is around 13%. Note also that Balancer supports BUSD, USDT, and USDC stablecoins.

When you choose the investment pool after connecting your wallet, the platform will give you an estimate of the potential stablecoin yield for the current week, which can be quite useful.

Balancer Pools are very customizable, so the fees can vary a lot between pools. They can range between 0.0001% and 10%, but the Smart Order Router will take the fees into consideration when determining the optimum price to be offered.

- Very simple to use

- APY can reach 30%

- Fees may vary a lot, due to the high customizability of pools

All of these platforms offer some great features and advantages compared to most of the other places where you can invest in stablecoins. Nexo is our top pick overall, due to high interest rates (8% APY) and ease of use. However, you can’t go wrong by choosing any platform from this list, since they are currently the best options to earn interest on stablecoins.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our privacy policy click here.