Polygon, a Layer 2 scaling solution for Ethereum, has gained significant popularity in recent years due to its fast and inexpensive transactions. One of the main tokens on the Polygon network is MATIC, which serves as a utility token for various functions within the ecosystem. As more and more users adopt Polygon and MATIC, the question of where to stake MATIC becomes increasingly important. Staking MATIC allows users to earn rewards while contributing to the security and decentralization of the network. In this article, we will explore the best places to stake MATIC and the factors that should be considered when making a decision.

Best Places to Stake MATIC (Polygon) in 2024

- Binance - Best place to stake MATIC

- Bybit - Best for dual asset mining MATIC

- Crypto.com - Best app to stake MATIC

- KuCoin - Best for staking promotions with up to 12% APY

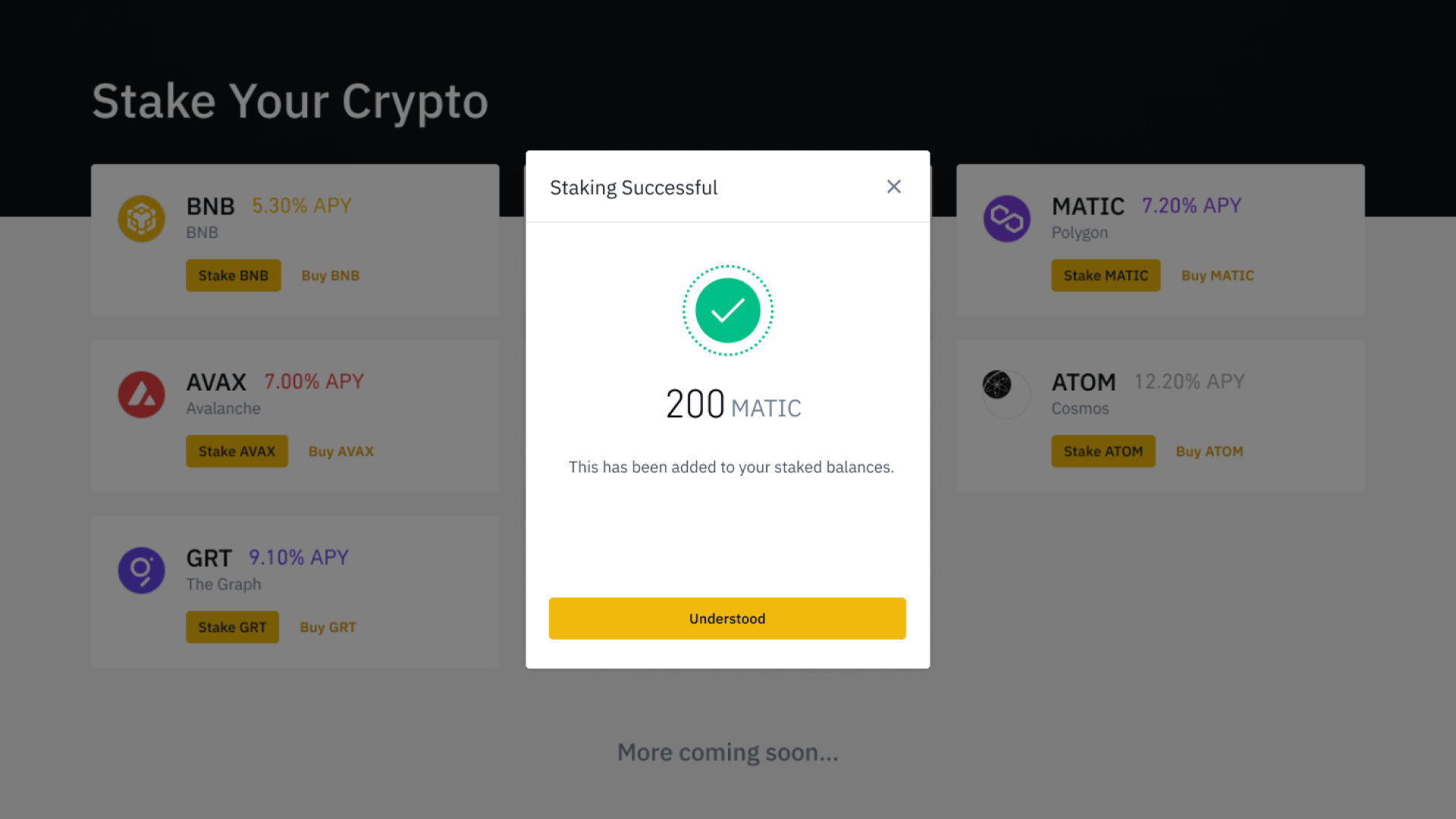

Where to Stake Polygon?

You will find that there are plenty of exchanges and platforms where you can stake MATIC. We have done the research for you and come up with our recommendations on which are the best. We look at various factors such as reward APY, ease of use, total supply, and more.

#1. Binance

Binance is one of the best places to earn interest on your crypto, due to the incredible range of 350+ coins available to stake. It has various fixed term options, as well as flexible staking for MATIC, so you can choose which best suits your needs.

At the time of writing, you will earn 5.9% APY for a 90 day term, 4.3% APY for 60 days, 3.9% APY for 30 days, and 2.69% APY for 14 days. If you prefer to keep your MATIC (Polygon) flexible, then the rate is 1.97% APY, with a bonus 2% APY for the first 4 million MATIC tokens.

When you stake MATIC on Binance, the rewards you receive is completely yours to keep, as there are no fees or commission charged at any point in the staking process. If you want to sell your MATIC, you can easily do so on Binance with low trading fees of just 0.1%, and you can reduce the fees by 25% if you pay fees using BNB (Binance Coin).

The main disadvantage of Binance is that it isn't available in the US. There is a sister site Binance.US but it has limited functionality. If you want to stake your MATIC in the US, we suggest Crypto.com.

#2. Bybit

Bybit is one of the best crypto exchanges in the world, and is our #2 recommendation for staking Polygon. At the time of writing, the rewards for flexible staking is 1.65% APY, with no option for fixed term staking. However, there are two other options available on Bybit for more experienced crypto investors; dual asset mining and liquidity mining.

This is not recommended for new investors, as there are risks involved, and it is more complicated than simple staking of Polygon. However, if you are confident to use these methods, you can reap great rewards. For example, currently you can earn 1.96 - 5.9% APY for liquidity mining, and a massive 20.52 - 200.88% APY for dual asset mining.

Bybit is also not permitted in the US, and if you try to access the site, you will be blocked. However, if you have access to a VPN, you can simply set the IP address to Canada and you can access the platform. There is no KYC required, so you can remain anonymous.

#3. Crypto.com

Crypto.com is the best mobile app for staking cryptocurrency, as it is convenient and simple to use. They are more than 250+ coins available to buy, sell, and trade, and you can earn interest on more than 21+ coins, including MATIC.

The base rate for staking MATIC (Polygon) is low if you choose the flexible option, at only 0.35% APY. However, if you lock it for 1 month, you receive 3% APY, and if you lock for 3 months, it is 5.5% APY. If you wish to access higher interest rates on staking MATIC, you can stake at least $4,000 of CRO (Crypto.com's coin), and then you will receive 7% APY (fixed for 3 months). If you are a true believer in Crypto.com and want to invest heavily in their coin, you can stake $40,000 of CRO, which will give you access to the highest rates for staking MATIC at 9% APY (locked for 3 months).

One point to note on Crypto.com is that if you stake more than $3,000 of MATIC, the reward rate drops to 0.5x the standard rate, and if you stake more than $30,000 of MATIC, you only receive 0.15x the standard rate for the amount above $30,000.

#4. KuCoin

KuCoin is another well-known crypto exchange, with more than 20 million users worldwide. The 'Earn' section on KuCoin is extensive, and you can stake Polygon here with varying interest rates. At the time of writing, there is a flexible staking option of 2% APY, as well as various promotions that last for a fixed duration. For example, there is a 30 day fixed rate promotion, with 12% APY, a 14 day promotion with 9% APY, and a 7 day promotion with 7.5% APY.

If you don't own any MATIC, you can easily buy it or trade it on KuCoin, with low trading fees of 0.1%, which you can reduce to 0.08% when paying with KuCoin's own token (KCS). Be sure to check the latest rates at KuCoin's website to see what promotions are available, and access the highest interest rates.

What is MATIC?

MATIC is a cryptocurrency that serves as the native token of the Polygon network, formerly known as Matic Network. Polygon is a Layer 2 scaling solution for Ethereum, which means it operates on top of the Ethereum network to increase its capacity and scalability. MATIC is used as a utility token within the Polygon ecosystem, serving various functions such as transaction fees, staking rewards, and governance participation. The Polygon network aims to provide a faster and more cost-effective alternative to Ethereum, and MATIC plays a crucial role in enabling this vision. MATIC has gained significant popularity in recent years, attracting a growing number of users and developers to the Polygon ecosystem.

What is the highest APY for staking Polygon (MATIC)?

The rewards offered for staking Polygon will depend on the platform you use, as well as the number of validators. You should always check the most up-to-date APY on various sites before you stake MATIC. At the time of writing, KuCoin offered the highest APY of 12%, but this was a limited promotion, and may not always be available. Excluding KuCoin's promo, Binance has the highest rates of 5.9% APY when locked for 90 days.

Pros of Staking Polygon

The most obvious advantage of staking MATIC is to receive passive income from your coins. This is the best way to make your crypto work for you if you plan on holding it for the long-term anyway.

You can also use your MATIC tokens to vote, and provide input to any possible changes to the network or new developments.

Besides benefiting you individually, staking MATIC means you are helping to maintain the Polygon network by keeping it secure and decentralized.

Cons of Staking Polygon

The primary drawback of staking MATIC is if you lock your coins for a fixed period. This means that during that term, you cannot withdraw, transfer, or sell your assets. While long-term HODLers will not be concerned with this, if the price changes significantly, some investors may wish they were able to sell their MATIC coins.

If the price drops and you aren't able to sell your MATIC, then the value of your assets will be lower, and may not recover in price for a long time. This is important to keep in mind before staking a large amount for a fixed term.

Conclusion

As Polygon (MATIC) is one of the most popular coins to stake, there are a lot of good platforms where you can earn rewards on your coins. Our #1 choice is Binance, but all of the exchanges in this list are legitimate and well-known platforms.

If you are interested in staking other cryptocurrencies, you can read our articles on where to stake ADA, ETH, SOL, SHIB, ALGO, AXS, and DOT.