Key Takeaways

- Binance offers the highest rewards for staking Polkadot (DOT), with up to 16.9% APY for locking it in for 120 days.

- Bybit allows anonymous staking of DOT with flexible withdrawal options and offers a $10 BTC bonus for depositing at least $100.

- Crypto.com is a user-friendly mobile app for staking DOT, offering various staking options and higher rewards when staking its native coin, CRO.

- Risks of staking DOT include locked staking periods, the potential for exchange hacks, and fluctuating rewards.

Long-term crypto investors love buying cryptocurrencies that they can stake and earn interest. One of the most popular cryptocurrencies to stake is DOT (Polkadot). There are many different crypto exchanges where you can stake DOT, but we have done our research and come up with a list of the best ones in 2024.

Top Exchanges for Staking DOT in 2024

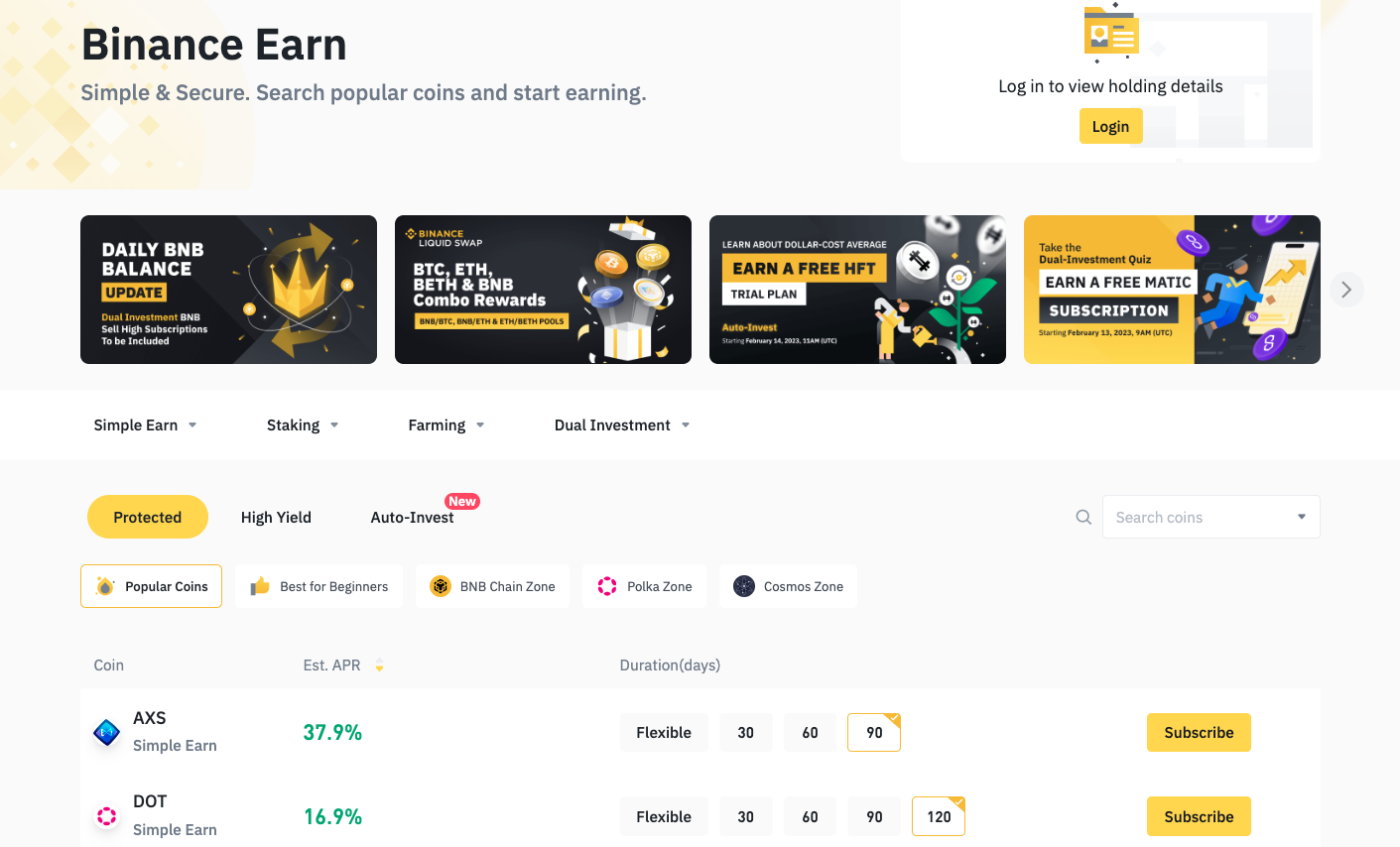

#1. Binance

Binance is our #1 recommendation for earning interest on various cryptocurrencies, because it has the highest rewards, and for Polkadot there is no exception. At the time of writing, you can receive up to 16.9% APY on DOT, when you lock it in for 120 days.

If you don't wish to lock it in for such a long duration, you can earn 13.9% APY locked for 90 days, 11.9% APY if you lock for 60 days, or 10.9% APY if you lock for 30 days. If you prefer to keep your DOT flexible so you can withdraw it at any time, you can earn 4.03% APY.

The biggest downside is Binance isn't available in the US. This is unfortunate as there are many crypto investors in the USA. If you are not able to access Binance to stake DOT, we suggest Crypto.com instead.

- High rewards for staking DOT

- Largest crypto exchange in the world

- Option to lock your Polkadot for longer durations and receive higher returns

- Not available in the US

#2. Bybit

Bybit is our #2 option for staking Polkadot, and part of this is that you can use this platform anonymously, since there is no need to submit KYC documents. The rewards for staking DOT are 1.77% APY at the time of writing, and this is for flexible staking, so you can withdraw your crypto at any time.

If you do not already own DOT, this is not a problem, as you can easily purchase some on Bybit using fiat currency. The trading fees on Bybit are extremely low, at 0.1% and they also have a special offer of $10 BTC FREE when you deposit at least $100. This means if you deposit $100 to buy DOT, you will also receive $10 of Bitcoin! All you have to do is sign up with our unique link.

Then downside of staking Polkadot on Bybit is that they currently do not have any fixed term options, but if they support it in the future, the rewards will be higher than those for flexible staking. The interest rates also change quite often, so be sure to check the rates on Bybit's Earn page on their website.

- Free $10 BTC when you deposit $100 or more

- Stake DOT anonymously, with no KYC required

- Flexible DOT staking

- Low trading fees of 0.1%

- No fixed duration staking available for DOT

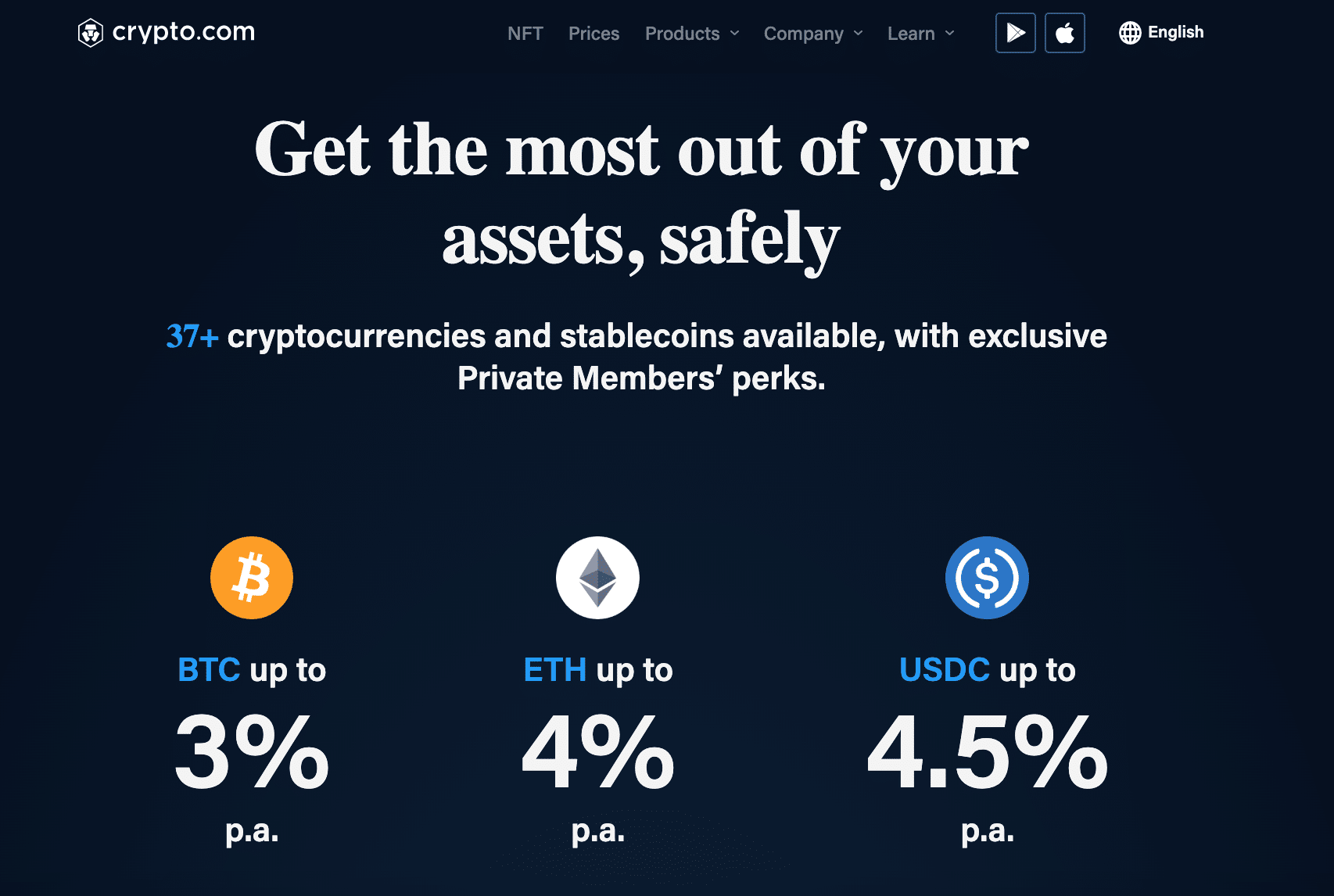

#3. Crypto.com

Crypto.com is an extremely convenient mobile app for staking, and is a great choice for beginners to staking DOT. It is easy to buy DOT on Crypto.com, using a credit/debit card, or by depositing fiat currency into the app. Once you have bought Polkadot, it only takes a few clicks to start staking it and earn decent rewards.

There are various options when staking on Crypto.com, for example you can keep it flexible, or lock it for 1 month or 3 months. If you keep it flexible, you will receive 1.15% APY, if you lock for 1 month you receive 8% APY, and if you lock for 3 months, you receive 11% APY. You can also increase these rates if you stake the app's native coin CRO. For example, if you have $4,000 of CRO staked, you will receive 12.5% APY on your DOT (locked for 3 months). If you have more than $40,000 of CRO staked, your rewards are a massive 14.5% APY!

One point to keep in mind if you plan on staking large amounts of Polkadot on Crypto.com, is that the interest rates mentioned above are only available for the first $3,000 staked. If you stake more than $3,000, you will only receive 0.5x the rewards rate of the first $3,000. If you stake more than $30,000, the rewards are only 0.15x the aforementioned rates.

- Excellent crypto staking app

- High reward rates when you lock for 3 months

- Increase the interest earned on DOT when you stake CRO

- High interest rates only available on the first $3,000 of DOT staked

#4. KuCoin

KuCoin is one of the largest crypto exchanges in the world, with more than 700+ cryptocurrencies available, and billions of dollars in trading volume each day. Of course, you can buy Polkadot on KuCoin, and the fees are very low, at only 0.1% when spot trading. Once you have purchased or traded some DOT, you can stake it by visiting the Earn section in KuCoin.

KuCoin offers flexible staking with rates of 7.2% APY, and if you choose to lock your DOT for 30 days, you will receive a high 12.2% APY. Remember that these interest rates fluctuate often based on market conditions and crypto trends, so check the website to see the current rewards.

The disadvantage of staking DOT on KuCoin is that they charge a commission fee of more than 15%.

- One of the world's largest crypto exchanges

- Buy or trade DOT easily, and then stake

- High rewards for flexible and locked staking

- Commission fee of over 15%

#5. Ledger Nano X Hardware Wallet

Next on our list is the Ledger Nano X, which is a more secure method of staking DOT, as it is a crypto hardware wallet, meaning your assets are stored offline. There is no risk of you losing your Polkadot if a crypto exchange goes bankrupt like FTX.

When you stake Polkadot on the Ledger NanoX, you can earn up to 14% APY, which is quite high, but you need at least 80 DOT coins to stake, whereas on a lot of crypto exchanges, the minimum is much lower.

Another drawback of using a Ledger to stake your DOT is that there is the upfront cost to purchase it. If you are simply looking for a place to stake DOT, then it is not the best solution, but if you plan on storing all your crypto on a hardware wallet for security, then it is a good investment. The price of Ledger Nano X will depend on your location, so click here to check the current prices.

- Extremely secure hardware crypto wallet

- No risk of losing your crypto due to a crypto exchange hack or bankruptcy

- Store all your crypto safely

- High upfront fee

#6. Bitfinex

Bitfinex rounds out our list of the best places to stake Polkadot. You can earn up to 7% APY staking DOT, and there are several other coins you can earn interest on too, such as ETH, ADA, ATOM, SOL, and XTZ. You can buy Polkadot straight from Bitfinex, and start staking right away within a few clicks. If you already have DOT on another crypto exchange or wallet, you can also deposit it into Bitfinex and begin staking immediately.

Have a look at the current reward rates on Bitfinex's official site to ensure you are getting a good return on your investment.

- Easily purchase DOT and start staking

- Up to 7% APY when staking DOT

- No minimum DOT required

- Rewards for DOT are not as high as some other options

What is Polkadot and DOT?

Polkadot is both a cryptocurrency and a blockchain platform that operates on the DOT token. Its unique design enables different blockchains to exchange messages and conduct transactions with one another without the need for a trusted intermediary.

Risks Of Staking DOT (Polkadot)

Whenever you deal with cryptocurrency, you should be aware of risks, particularly because the assets are so volatile, and the industry is largely unregulated. If we look at the risks specific to staking DOT, these are what you should be aware of:

Conclusion

Staking Polkadot is not just about earning additional passive income on your crypto, but it is also helping to build the future of the Polkadot ecosystem. It is a win-win situation, and if you choose any of the options on this list to stake DOT, you will not be disappointed.