Key Takeaways

- CoinLedger is the best overall due to its seamless integration with popular Australian crypto exchanges, ability to calculate gains, losses, and income reports, and various types of tax reports.

- TokenTax is also a great option for those using exchanges that aren't supported by CoinLedger, with total support for any exchange/wallet, DeFi and NFT support, and tax-loss harvesting tool.

- Koinly offers the biggest discount with their 30% discount link, while CryptoTaxCalculator is the lowest cost at $39 AUD with their 20% discount link.

- CoinTracker is the most advanced crypto portfolio tracker, and BearTax is excellent for high-frequency traders and trading bots, while TaxBit supports tracking NFT and DeFi trades.

As the new financial year is here, it's time to work out how much profits you have made from your crypto, and determine how much tax you need to pay. If you have not made many trades, then you can use our crypto profit calculator and crypto tax calculator to work it out. However, if you have made countless trades, you will need the help of crypto tax software. We have done our research and present to you the best crypto tax software for Australians.

✔️ Seamlessly integrates with the best cryptocurrency exchanges

✔️ Calculate gains, losses and income reports in AUD or any other currency

✔️ Create various types of tax reports

✔️ Free to use - only pay to view and download full tax report (Plans start from $49 USD)

✔️ Data from every crypto exchange or wallet supported - sync via API or upload CSV format

✔️ Tracks all transactions like capital gains, capital losses, and exchanges

✔️ DeFi and NFT support

✔️ Plans from $65 USD

✔️ Incredible compatibility - more than 400+ crypto exchanges and 100+ wallets

✔️ Easily see all your holdings and portfolio growth over time (across all your wallets/accounts) along with your tax liabilities

✔️ Historical crypto and fiat spot pricing data for 6+ years to ensure calculations are correct

✔️ Access essential features for FREE, or pay for a plan, starting from $41 AUD (Receive 30% discount with our link!)

Best Crypto Tax Software in Australia: Updated 2024

- CoinLedger - Best crypto tax software overall

- TokenTax - Supports data from every exchange and wallet

- Koinly - Biggest discount with our 30% discount link

- CryptoTaxCalculator - Lowest cost, at $39 (with our 20% discount link)

- CoinTracker - Most advanced crypto portfolio tracker

- BearTax - Excellent for high-frequency traders and trading bots

- TaxBit - Track NFT and DeFi trades

What is the best crypto tax program?

CoinLedger is the best crypto tax software for Australians. It is free to get started, and you only need to pay if you want to download or view the full tax report. If you decide to pay for a plan, the prices start from only $49 USD, which is very reasonable, considering how much time and energy it saves you from working it out manually. CoinLedger integrates seamlessly with the best crypto exchanges in Australia, such as CoinSpot, Swyftx, Bybit and Binance.

Best Crypto Tax Software in 2024

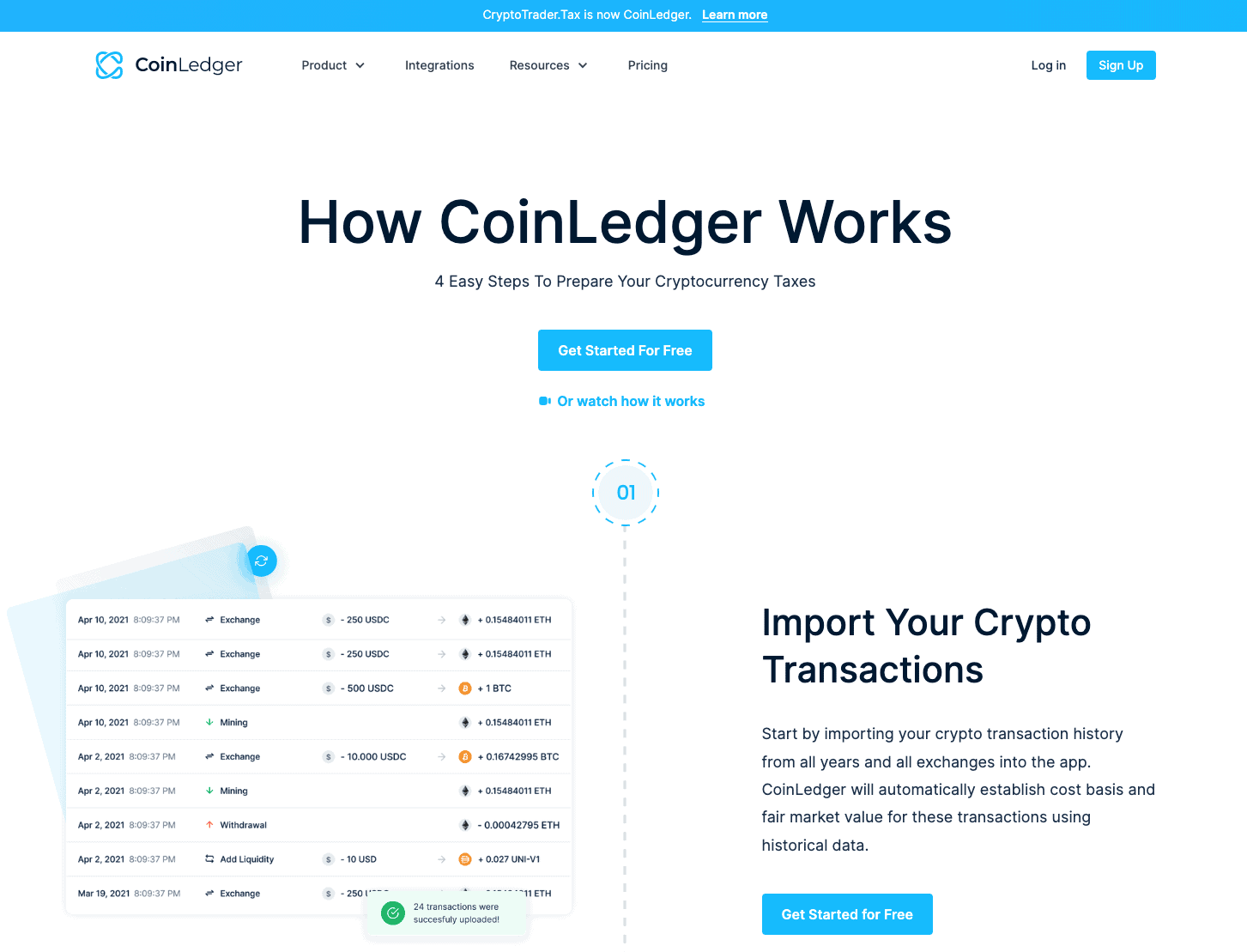

#1. CoinLedger - Best overall in Australia

CoinLedger is the top crypto tax software for Australian users. It is easy to use, and integrates seamlessly with the top Australian crypto exchanges. It only takes four easy steps to prepare your crypto tax, saving you time and energy. First you import your crypto transactions, add any crypto income (such as staking, gifts, mining or airdrops), generate a tax report, then import it into tax software or give to your accountant.

All their plans come with 14 day money-back guarantee, and they start from $49 USD (for 100 transactions), and go up to $299 USD for the top-tier plan.

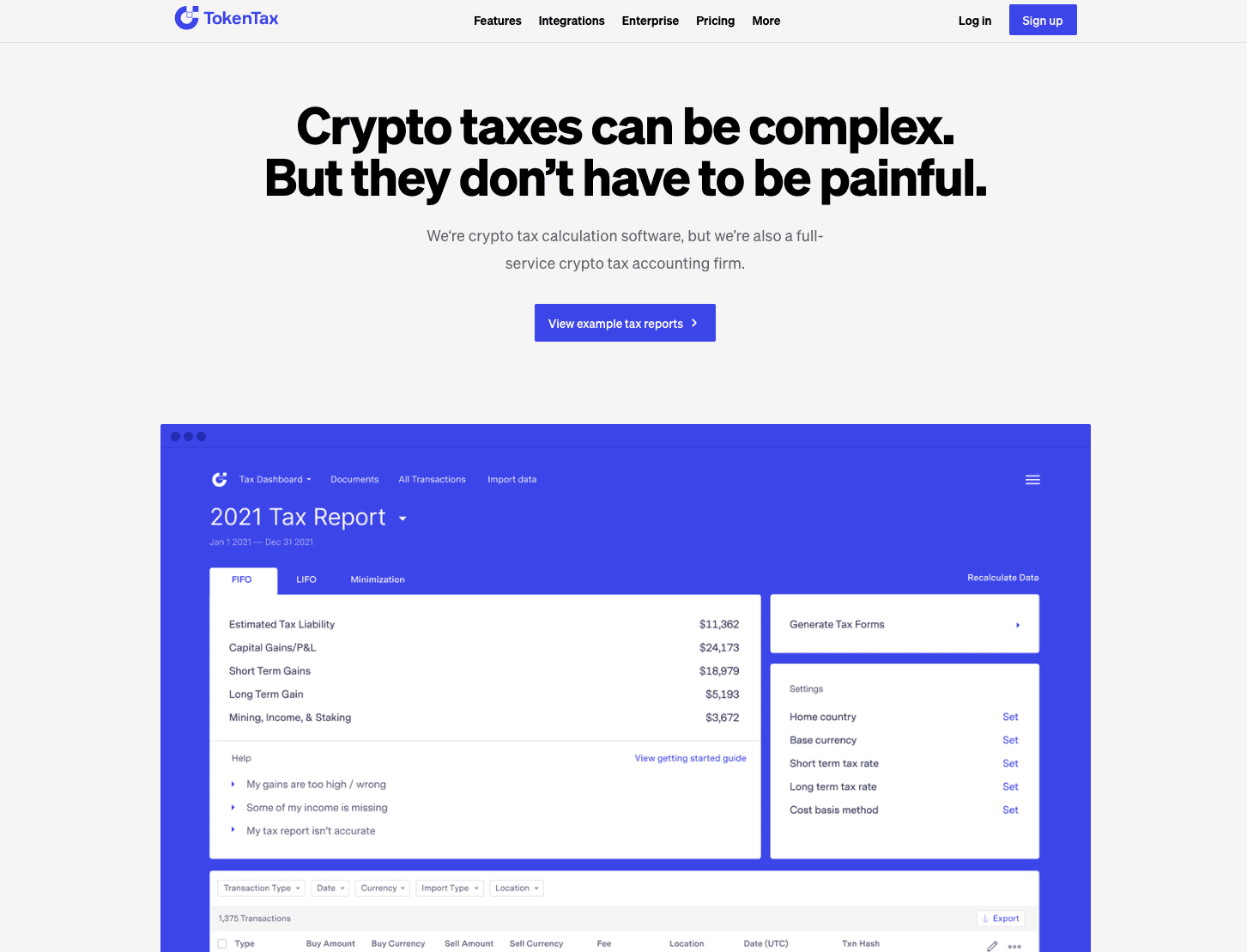

#2. TokenTax - Supports data from every exchange and wallet

TokenTax has support for every single exchange, blockchain, protocol, and wallet, which is perfect for those who are having a hard time finding tax software that is compatible. All you have to do is sync your transactions via API or upload them to TokenTax in CSV format. If you are an investor with complicated accounting, TokenTax even offers advanced reconciliation services from crypto-savvy tax professionals. They will help you to manage all complex data, such as missing cost basis, high transaction volume, and cross-chain transactions.

The price for the basic plan is $65 USD, but this is quite basic. There are other plans priced at $199, $799, and $3,499, which all have different features. Which one you decide on will depend on your personal needs.

#3. Koinly - Best discounted price ($41 AUD) with this link only - 30% discount

SUMMARY

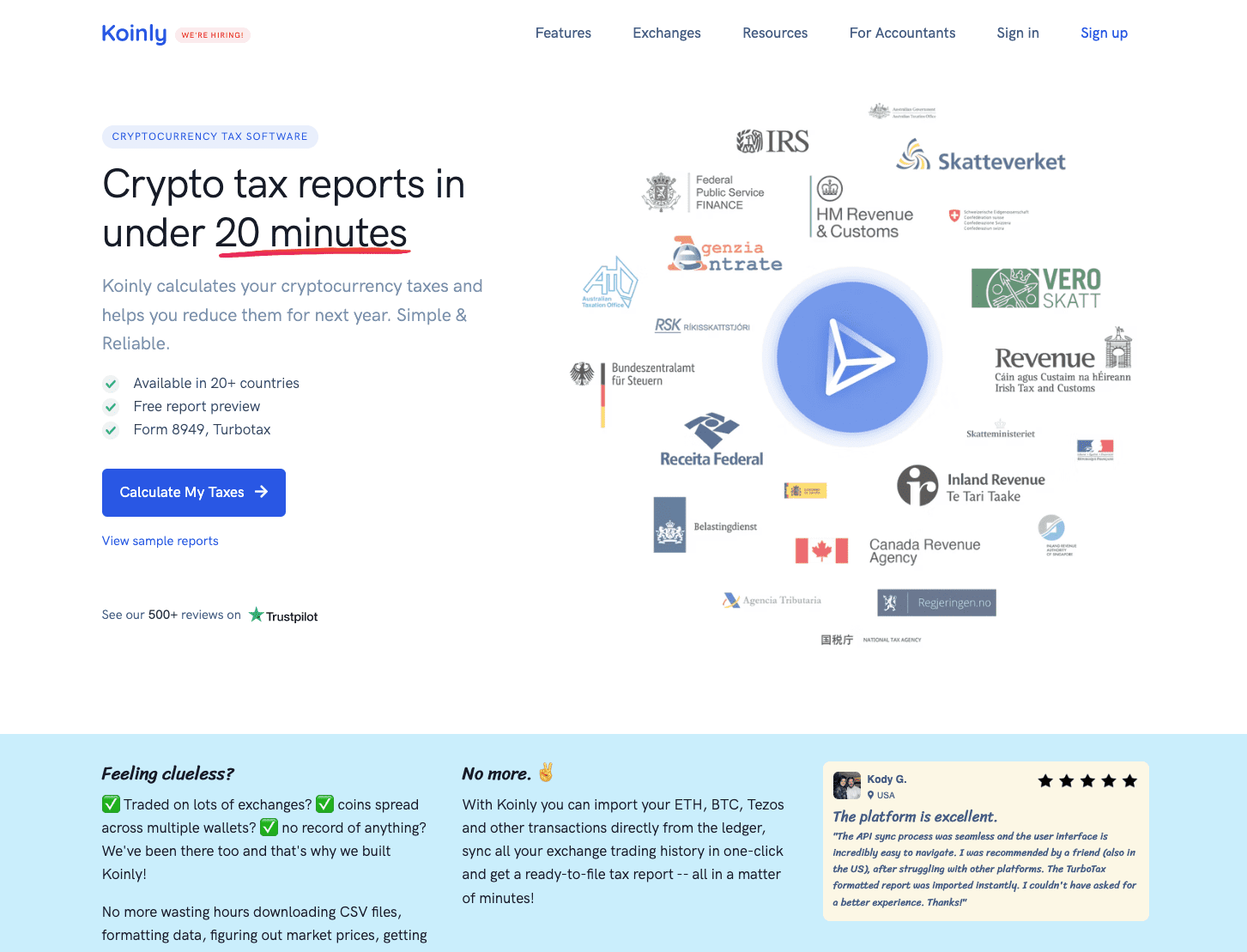

Koinly is the best option for those who are looking for a bargain. It offers the largest discount available, with our link. You will receive 30% discount off all Koinly plans.

PROS:

CONS:

Koinly is an easy-to-use and low-cost crypto tax software. It calculates your crypto taxes for you and provides in a report in less than 20 minutes. You can easily import your crypto trades either via API or CSV files, and covers advanced trading including DeFi, Margin trades and futures. Koinly relies on AI to detect transfers between your crypto wallets to keep track of the original cost. It has support for over 300+ exchanges and wallets, and you can easily track your portfolio and view your profit/loss for any tax year, free of charge.

If you are trying to save money, Koinly has a free plan which includes only the essential features. However, if you need a higher-tier plan, the prices are very affordable, and if you sign up here you receive a huge 30% discount on all plans! This means that the starting plan which is $59 AUD becomes just $41.30! which is much lower than all the other competitors in this article. There are also plans priced at $139 ($97.30 with discount) and $249 ($174.30 with discount), and which one you choose is dependant on your personal needs.

#4. CryptoTaxCalculator - Lowest cost ($39 AUD) with this link only - 20% discount

SUMMARY

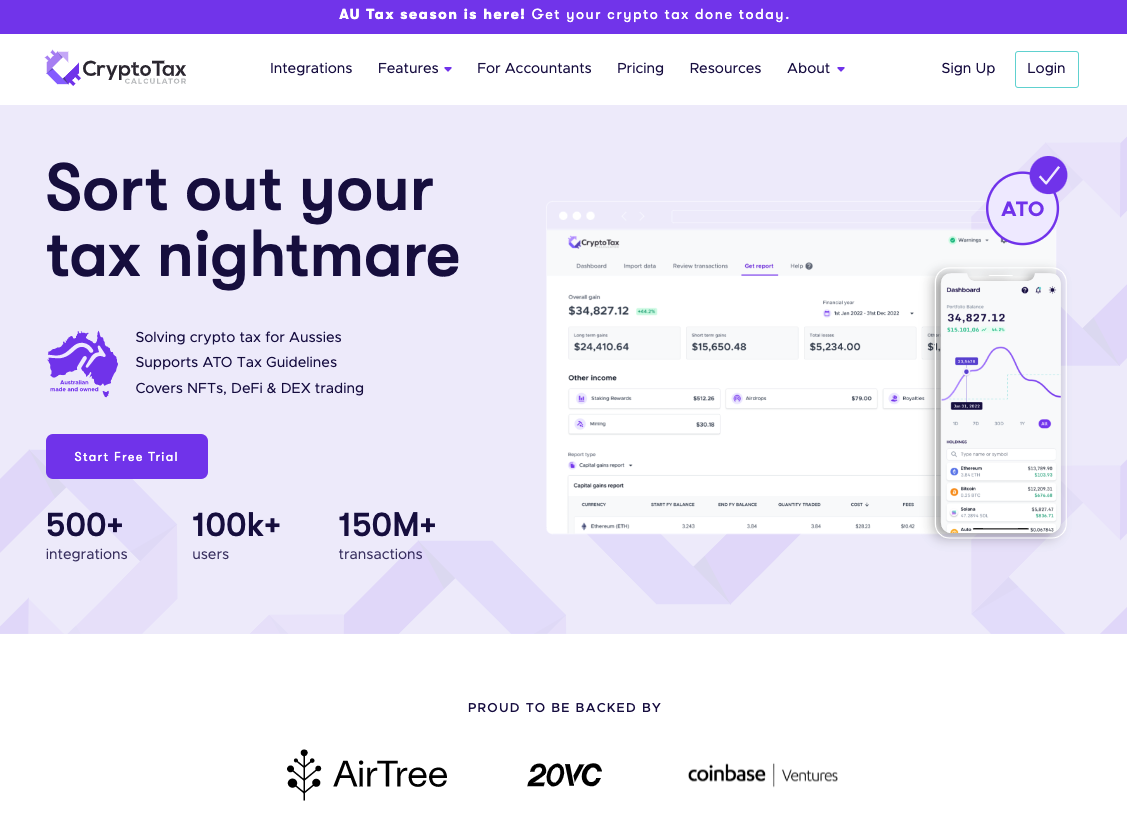

CryptoTaxCalculator is an Australian crypto tax software company that has the lowest priced plans, at just $39 with our 20% discount (when you sign up here).

PROS:

CONS:

CryptoTaxCalculator is an easy-to-use crypto tax software, perfect for beginners, and at an affordable price point. It is the lowest cost option in our list here, at just $39 when you use our 20% discount link. It provides detailed and accurate tax reports, that are easy for users to read and understand. It links to almost 500 different decentralised and centralised exchanges, so you are almost certainly able to link your data to this software.

The software works either via API or uploading CSV files. It is easy to import the data to CryptoTaxCalculator, and the user experience is top-notch. The plans start from $49 AUD, but with our link you receive 20% discount on all plans. This means the basic plan is discounted to only $39.20. If you have done a lot of trading in the last year, you may need a higher level plan. The next plan is $129, and supports up to 1000 transactions. This will be reduced to $103.20 when you use our discount. The higher tier plans come with additional features, like support for staking, mining, borrowing and lending, and cost $249 ($199.20 with discount) and $399 ($319.20 with discount) for 10,000 and 100,000 transactions respectively.

#5. CoinTracker - Most advanced crypto portfolio tracker

CoinTracker is the most advanced crypto portfolio tracker that analyses all of your trades at the same time and generates pin-point data for you. You can view your profits/loss data, tax gains, or tax returns through its server. CoinTracker also automatically optimises cost basis accounting methods and enables you to tax-loss harvest your portfolio to save thousands per year. Additional visibility into tax lots helps you make better trades.

It is free to use CoinTracker's entry-level plan, which is limited to 25 transactions, but if you have made more transactions than that, the next tier plan will cost you $89 AUD. There is also a premium option for $279 and if you have more than 1,000 transactions, you will need to check, as there are various prices based on how many transactions.

#6. BearTax - Compatible with top Australian crypto exchanges

BearTax is an easy-to-use crypto tax accounting software. The whole process has been simplified into a straightforward, three-step process that includes importing trade data via an API key or CSV file, reviewing the data that has been added to the platform, then downloading tax documents that can be imported into traditional tax reporting software such as TurboTax.

If you are a crypto beginner with less than 20 transactions, you can use the Starter plan for FREE. However, for most investors, you will need to pay, depending on the number of transactions you have made. The Basic plan is $49 USD which covers 200 transactions, then there is the Plus plan for $149 USD (up to 25,000 transactions), and the Pro plan for $499 USD (1 million transactions).

#7. TaxBit - Track NFT and DeFi trades

TaxBit (read review) is an extremely trusted crypto tax software, designed by CPAs and tax attorneys. It is trusted by the industry, and partners with and services many of the crypto industry's more reputable exchanges. TaxBit also works with some of the largest regulatory agencies around the world. It is independently SOC2 certified, and your data is also secure.

The pricing starts from $50 USD for the Basic plan, then $175 USD for Plus+ plan, and the Pro plan is $500 USD. Which one you need will depend on your personal needs.

Do I have to report my crypto gains?

Yes, you are legally obliged to pay tax on crypto gains once you have 'disposed' of any crypto, which includes, selling, trading for another crypto, using it, or gifting it to someone. You may think that you can get away with it, but many Australian crypto exchanges, eg: CoinSpot, Binance, and Swyftx report directly to the ATO. While some global platforms like KuCoin do not report to the ATO, this is still not a reason to avoid paying your taxes.

The ATO has sophisticated systems to track crypto gains, including access to bank transactions to and from crypto exchanges.

Frequently Asked Questions (FAQs)

Many of the crypto tax programs on this list have a FREE plan, with basic usability, or they may include a 7 or 14-day free trial on the paid plans, so you can get a hang of it. See our list above to find one that is suitable for you.

It is easy to keep track of your crypto tax with affordable software. All of the crypto tax programs in this article are excellent choices.

Yes, the ATO can track crypto cryptocurrency through information from banks, financial institutions and crypto exchanges. It is not a good idea to avoid paying taxes on your crypto, since it is illegal and you could be sentenced to imprisonment. The best way to track your crypto taxes is using a crypto tax software listed in this article.

This can vary greatly, depending on which software and plan you choose. Many will offer free basic plans, or a short trial on a paid plan. Compare our plans in this article to see which is right for you. The cheapest paid plans are around $40 AUD for 1 year, if you use our referral links to receive a discount.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read it here.