What is Balancer?

Balancer is a decentralized cryptocurrency exchange based on the Automated Market Maker (AMM) protocol. Balancer was founded in 2019, and the exchange has gained quite a bit of popularity due to its focus on concepts that can benefit both traders and investors. Balancer is much more than a simple crypto-swapping exchange, as it also allows users to invest their assets, rebalance their portfolios and earn through the platform.

Balancer works with three different cryptocurrency networks: Ethereum, Polygon and Arbitrum. It has a massive amount of overall liquidity, estimated at around 3.4 billion USD. This makes it possible for traders to get the best possible prices for the tradable assets on the exchange. Balancer is a permissionless decentralized exchange where users are in full control of their assets, so they don’t have to worry about losing their assets to a third party.

Our Overall Thoughts on Balancer

Balancer is an advanced automated portfolio manager and trading and investing platform with lots of opportunities to explore the cryptocurrency world. The exchange not only provides a friendly environment for traders but brings simplicity, feasibility and attractive opportunities to all users. Balancer allows users to build on the platform by launching their own tokens and creating pools.

Investment opportunities on the platform are quite good as well. Users can earn by joining one of tens of liquidity pools with a variety of assets or simply locking specific assets to earn free rewards, like native tokens to govern and gain voting rights. But there is more than all that to Balancer. First, we’d like to tell you what we love the most about the exchange:

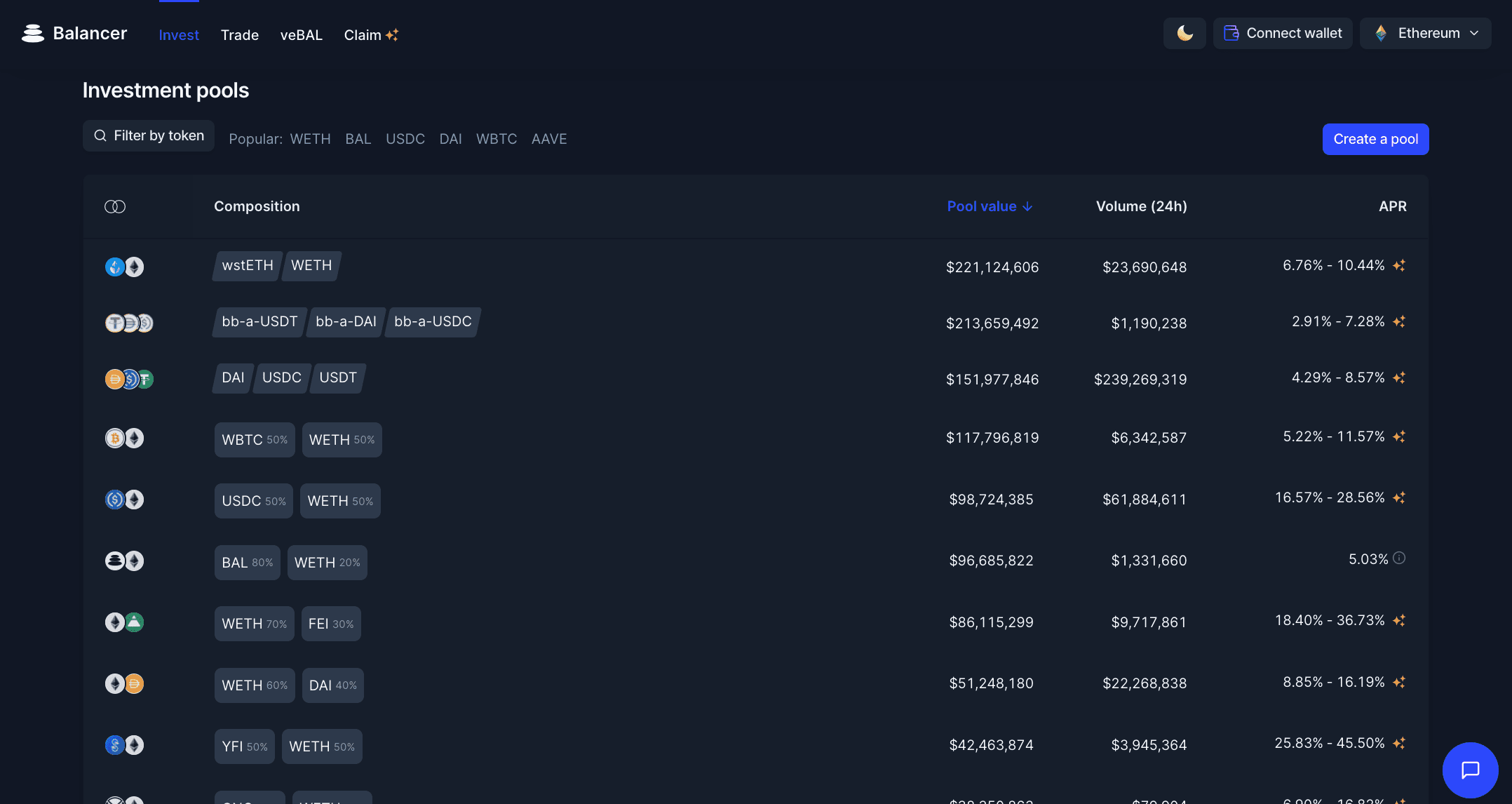

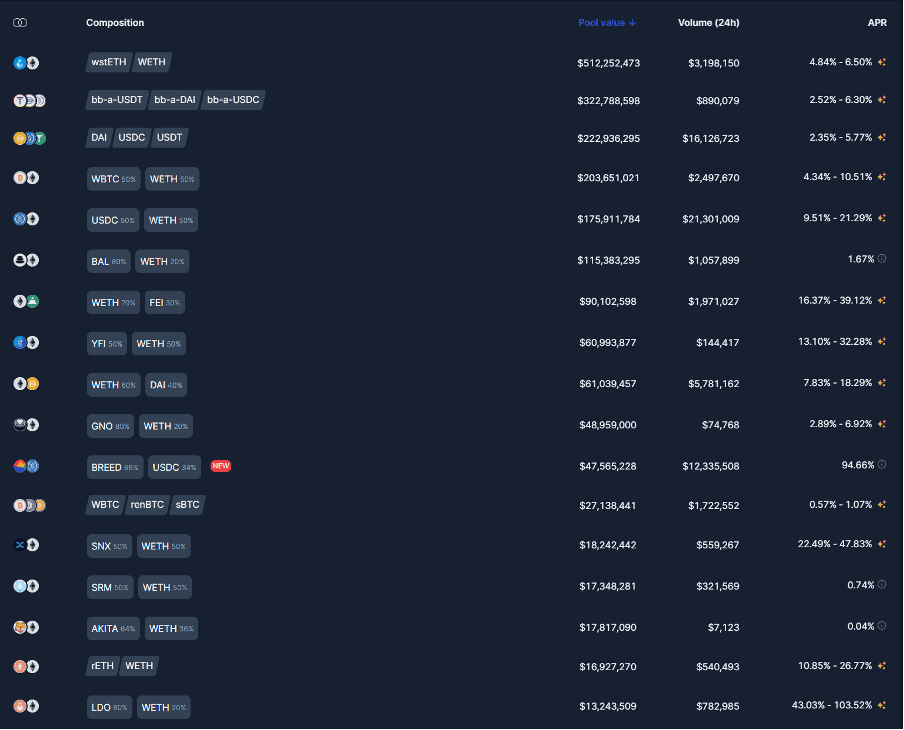

1) There is a great variety of crypto assets and liquidity pools: This aspect benefits both traders and investors who are looking to earn great APR. The exchange supports about 100 tradable cryptocurrencies, so it’s easy for traders to convert their assets into a different asset they desire. The liquidity pools have just as much variety, with no less than a hundred to choose from. Some even come with great rewards and a variety of tokens to diversify a user’s portfolio and reduce risk.

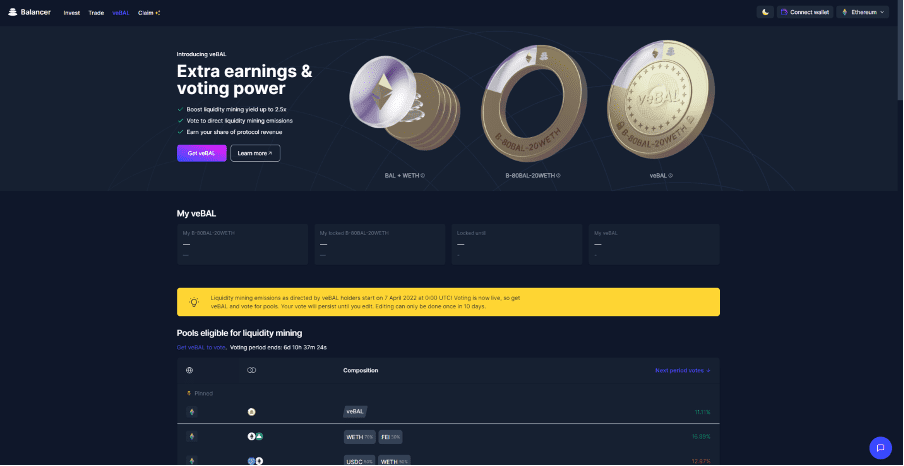

2) Users can earn BAL and veBAL: BAL is one of Balancer’s native tokens. It can be earned for free just by providing liquidity to the pools on the exchange. Users can also earn the platform’s other native token, veBAL, by locking a specific asset on the exchange. veBAL can be used to gain voting rights on the exchange and make changes to the platform along with other governing users.

3) Investors can earn massive interest rates: The interest rates from liquidity pools are massive. Some pools can give you up to 80% returns. Pools with higher returns have higher risk, though. If you want to play it safer, there are other opportunities that can still offer great returns and help you diversify your investments.

To be an even better exchange, Balancer just needs to work a little on its learning content and introduce a mobile app to ease up the user experience a little. Both aspects would help users use the platform more conveniently and easily.

Key Features and Advantages of Balancer

Balancer offers an immersive experience to all users, whether they plan to trade their assets or provide liquidity on the platform to earn excellent fees and rewards. Balancer provides a great variety of assets that can be traded or swapped. The same goes for the liquidity pools that users can invest their money in.

The exchange features a beginner-friendly layout with intuitive partitions so users can easily access the tools they are looking for. Even better, investors have access to free automatic portfolio rebalancing, even earning a fee from the traders on the other side. In short, you can put your crypto assets to work without doing anything literally and earn a great deal of money. But do the features of Balancer end there? Definitely not! Find all the features of the decentralized exchange below:

Negatives and Disadvantages of Balancer

Balancer offers unique benefits to its investors and traders, but the decentralized exchange comes with a few disadvantages. See below to learn more about what those are:

What Services Does Balancer Offer?

Balancer is comparable to some of the finest decentralized cryptocurrency exchanges out there. Not only can you earn a hefty sum through Balancer but you can rebalance your portfolio, earn free tokens, trade, avoid the gas fee and do much more. Even with so many options, Balancer is a beginner-friendly platform with a great, evenly distributed layout, which makes it easy for users to explore available services.

To understand Balancer’s services in more depth, look at the detailed list below.

Simple, beginner-friendly layout: Balancer has a simple exchange design compared to most other decentralized exchanges in the industry. It has divided the platform into different sections to allow users to easily find the feature they want and avoid wasting time.

Even if you are a beginner and don't know how to locate features on a decentralized exchange, you won’t have difficulties on Balancer.

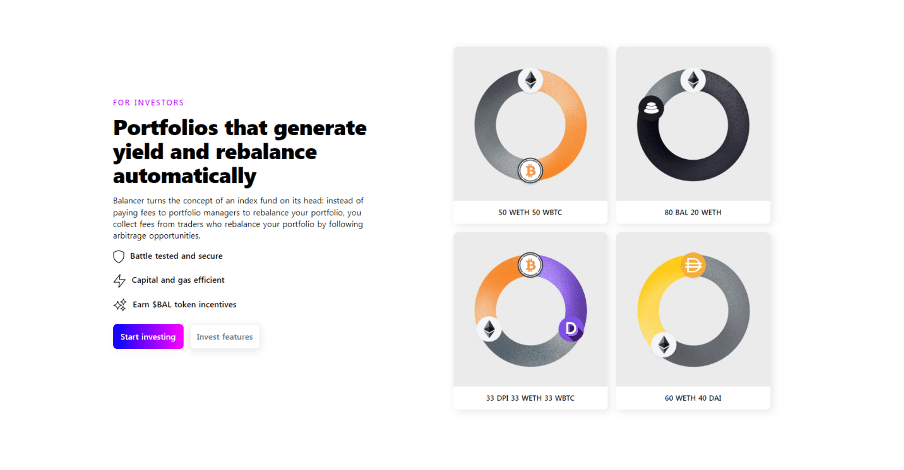

A good number of multi-asset liquidity pools: Balancer hosts a massive variety of liquidity pools in the investing portion of its platform. The liquidity pools available at Balancer are multi-asset, meaning you might find some pools with more than three or four assets in them.

Having many liquidity pools allows users to diversify their investments. It also gives them the opportunity to search for the best possible pools and consider the returns before making a concrete decision on what pool to invest in.

Investing equity in different liquidity pools also decreases the risk of impermanent loss and increases the chances of gaining profit during the locking period.

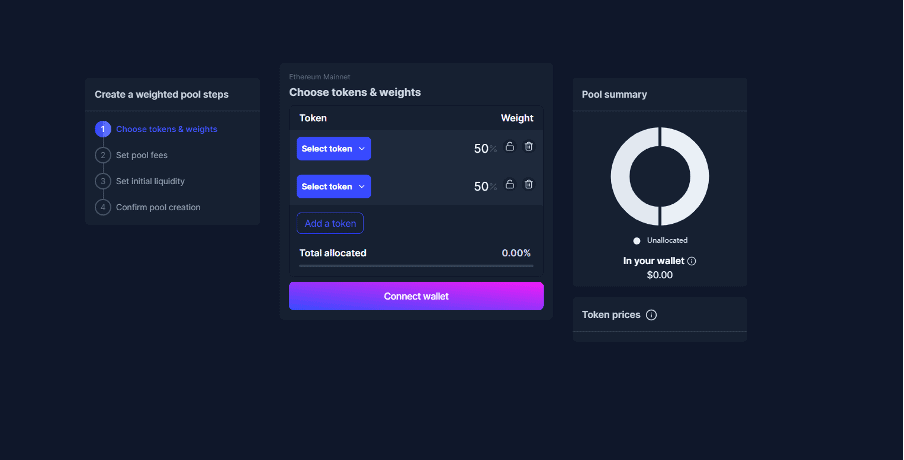

Create liquidity pools with easy customizations: Users can create their own custom liquidity pools on Balancer. A pool can contain up to eight different crypto assets with the division of your choice. Investors can earn a fair amount by creating liquidity pools, as they can set their own pool fee, set initial liquidity and allocate a portion of the pool to themselves, depending on the amount of funds they have. Users are not restricted when creating new liquidity pools on Balancer—you will have free reign to customize, add tokens and set the preferences.

Enormous APR rewards through liquidity pools: Some liquidity pools on Balancer have an APR of up to 80%. Even if you play it safe and invest your money in more stable liquidity pools, you can earn up to 20% with minimal risk, compared to the industry rivals. This means users earn a relatively high interest rate, since the usual crypto interest accounts offer merely 10% retribution to investors.

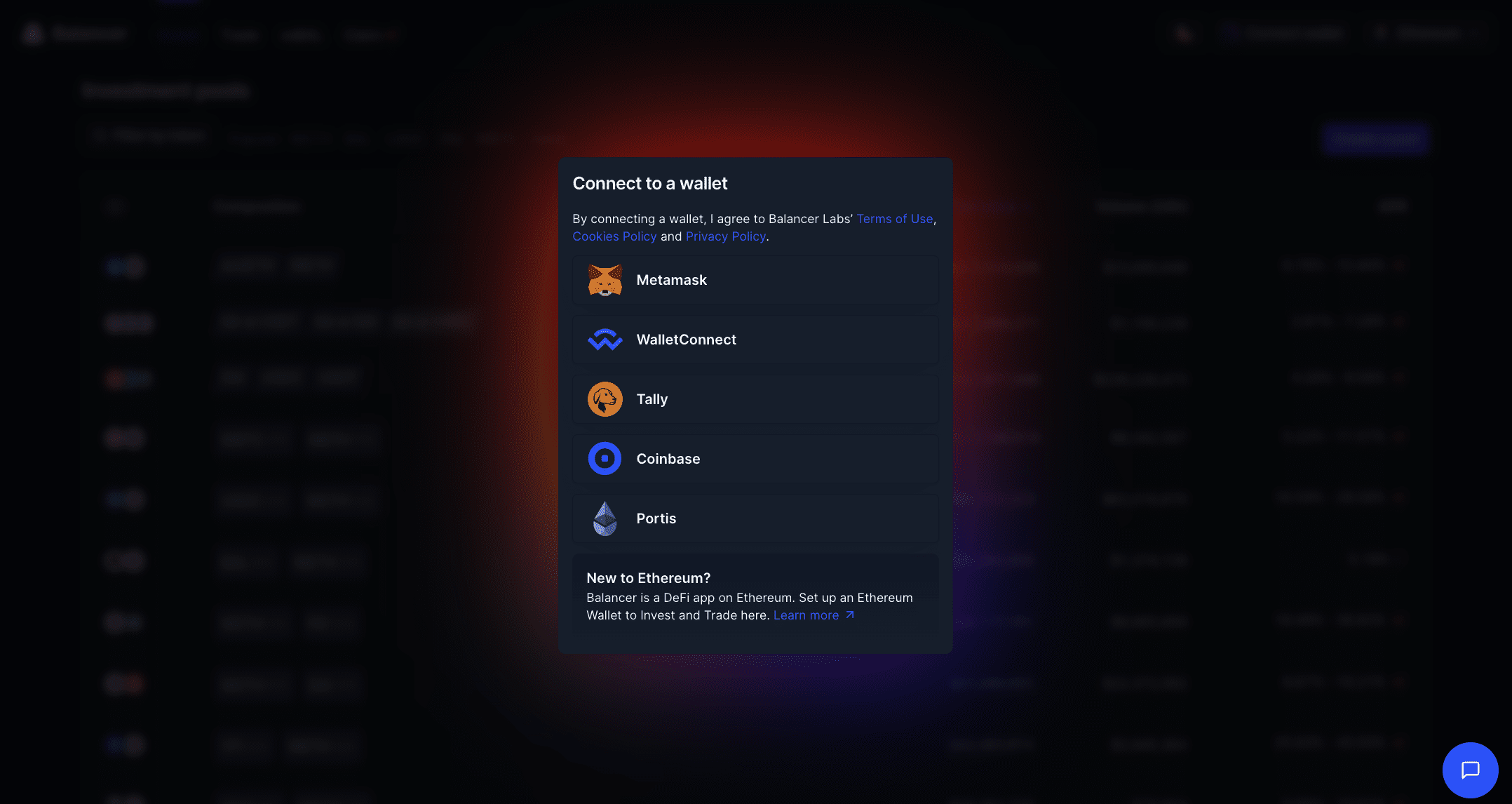

Quick crypto wallet connections supporting different networks: Users can easily connect several popular cryptocurrency wallets to Balancer, including Metamask, Coinbase, Tally and a few others. Balancer also supports three different crypto networks: Ethereum, Polygon and Arbitrum.

These connections allow users to access their funds conveniently through a range of crypto wallets so they can start investing and trading on the exchange. As the exchange supports several popular crypto wallets, users won't have to go through the hassle of creating and funding a new one just to get started on the exchange.

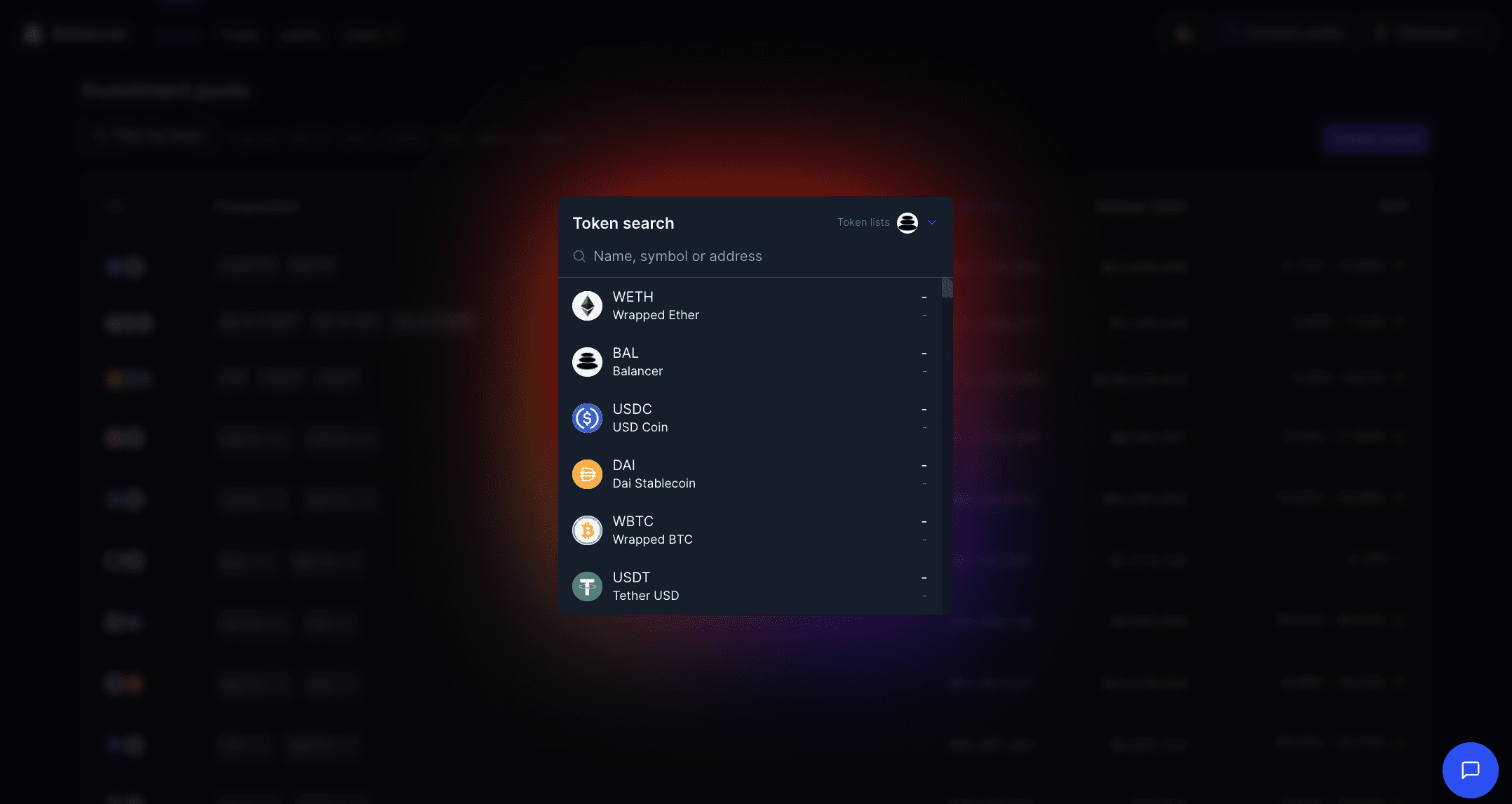

100+ cryptocurrencies to trade: Balancer offers an impressive amount of crypto assets for traders to utilize. The tradable crypto assets include almost all the popular and high market cap assets as well as some unique ones. This offers traders diversity and the ability to swap their assets into any cryptocurrency they desire.

The diversity in cryptocurrencies also helps users invest in liquidity pools by giving them a way to swap their tokens with ones that can be used in the liquidity pools offered by Balancer.

Free automated portfolio rebalancing: Investors on Balancer can have their portfolios rebalanced for free by traders following arbitrage opportunities. Rebalancing happens automatically and according to your designated targets. You will be able to maintain your asset allocation strategy and keep your investing style intact while investing in liquidity pools. It also allows you to save a hefty sum of money, as portfolio managers can be quite expensive. In fact, users collect fees from the traders who rebalance their portfolios.

Free distribution of BAL through investing: On Balancer, investors can earn free rewards based on their investments in liquidity pools. They are rewarded with BAL tokens, a native token of the Balancer exchange. Users can then swap their BAL tokens to withdraw different assets into their crypto wallets or hold them until the value goes higher and makes them even more profit. It is a nice perk to receive free rewards in addition to earning interest through the liquidity pools.

Lock and earn veBAL to get governance rights: Another method of earning free assets on Balancer is locking a specific asset for a defined period of time. By doing this, investors earn veBAL, another native token of Balancer. This token offers traders the rights to govern the exchange as they want.

Governance offers several benefits to traders, as they can vote to direct liquidity mining emissions, boost their yield up to 2.5 times and earn a fair share of their protocol revenue.

This is one of the perks of using a decentralized crypto exchange, which are operated by casual individuals and not third-party organizations.

Launch your own token: There are several building opportunities available on Balancer, including the chance to launch your own token with all the essentials and protocols integrated. You won’t have to search for the proper code or guidance, as it is all available right at the exchange. Balancer provides full access to the developer documents and GitHub code to help users create their own tokens with AMM logic.

Safe and secure decentralized exchange: Balancer is a safe and secure decentralized crypto exchange that allows full audits from third-party security companies. This assures users that their investments are safe with Balancer. Balancer even has a bounty program that rewards bug finders with 1000 ETH, the highest reward offered by any exchange.

Good customer support: Balancer has good customer support that is reliable, fast and efficient in all ways. There is a chat button on the corner of the exchange that allows users to quickly connect to the official team and get their problems sorted out. There are multiple agents available that promptly reply.

What We Don't Like About Balancer

There are a few negative things that you should keep in mind before planning on using Balancer. Learn more below.

No mobile app: Balancer is definitely not an old-fashioned decentralized exchange. It was released recently and it has a well-developed layout and design. But there is no mobile app. This can be a major letdown for users who would prefer to access Balancer through a dedicated mobile application instead of their mobile browser.

If Balancer wants to provide a perfect experience, it might have to come up with an adequate mobile app that saves time and is convenient for its users.

Learning content needs to be organized and improved: While there is learning content on Balancer, the material can definitely be organized and improved. For instance, there is no step-by-step guide walking users through using the exchange. Even the blog on the exchange focuses on details that might not be necessary for users. Balancer should offer educational content along with tutorials and guides that would help users.

Balancer Fees

Balancer Transaction Fees

Each transaction fee on Balancer depends on the chosen crypto network and its conditions. On a good day, traders and investors might have to pay just a few cents to process transactions. But on a day with heavy traffic, users might have to pay hundreds of dollars just to have their transaction processed.

Balancer Protocols Swap Fee

The protocol swap fee on Balancer varies depending on the fee set by the pool owner.

Balancer Trading Fee

Each pool on Balancer carries a different fee for swaps. Users can expect to pay anywhere between 0.0001% and 10% when swapping assets on the exchange.

Pros and Cons of Balancer

- A great variety of liquidity pools

- Get your portfolios rebalanced automatically

- Free BAL rewards

- Impressive APR rewards

- Earn veBAL to govern the exchange

- No mobile app

- Not the best learning content

The Verdict

Many investors have left the same old crypto interest rate accounts and jumped on decentralized exchanges like Balancer that offer a variety of liquidity pools in which to invest their money. Liquidity pools offer better returns and low risk, if you invest in the right pools. Balancer offers the best possible diversity within investment opportunities. Users can earn free tokens, too, while locking their assets or providing liquidity.

Not only that, but users can trade and build on the exchange. They can launch their own tokens, create pools and trade 100+ assets right on the exchange. All of these things make Balancer an excellent choice for casual traders and investors who are looking for better returns, diversity and automation.

Frequently Asked Questions

BAL and veBAL are the native crypto tokens of Balancer. While BAL can be swapped with any token, veBAL is specifically used to earn governance rights on the platform to make changes and modifications.

Balancer is a safe and trusted decentralized crypto exchange that has been working for a few years now.

Balancer was hacked in 2020, which resulted in the loss of $450k. But soon after, Balancer V2 was released with improved security features and functions to avoid hacks and breaches.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.