Disclaimer: BlockFi has paused withdrawals in Dec 2022 and is preparing to file for bankruptcy. Therefore we can no longer recommend the Gemini Credit Card to our readers.

We recommend you look at our article on the best crypto credit cards to see alternative options.

BlockFi has been on a mission to improve the banking industry structure. Launched in 2017 as an independent lender, the exchange aims to provide users with easier access to their most basic financial services by offering institutional-grade services and benefits. Today, BlockFi is one of the fastest-growing crypto finance exchanges, offering a variety of services focusing on lending, borrowing, and investing features. They have offices in New York, Singapore, New Jersey, Poland, and Argentina.

Aside from basic crypto services like buying, selling, trading, earning, and borrowing, BlockFi also introduced their all-new credit cards that take payment of your everyday expenditures to a whole new level. With BlockFi credit cards, you can earn crypto and enjoy many other benefits on every single transaction. Keep reading to learn more about BlockFi credit cards.

What to know before you get one?

As the BlockFi card is a credit card, it might affect your credit score if you get one. But if you are pre-approved, you won’t have to deal with a change in your credit score. BlockFi credit cards come with VISA benefits, meaning you can use the card anywhere in the world where VISA cards are accepted. As of now, BlockFi credit cards are only available for US residents, excluding some states. So, make sure that you are living in a qualified state before you apply for one.

Again, as it is a credit card, you have to pay a standard variable APR at the end of the month based on the amount you spent. BlockFi claims to have no transaction fee on their credit cards, but you might face penalties for late payments and other similar charges.

Key features and advantages of BlockFi Credit Card

BlockFi credit cards are certainly not like the usual credit cards you would find on the internet. They come with a unique, reward system and even offer better cash back returns, making it possible for you to earn a lot more on every single purchase. Thanks to their VISA support, it is now possible to use your BlockFi credit card with merchants from all over the world.

Take a look at the list below of the other benefits of BlockFi credit cards.

Negatives and disadvantages of BlockFi Credit Card

BlockFi credit cards are competitive, convenient, and better than most credit services currently available. However, there are a couple of things about their credit cards that I think should be improved:

A brief look into the benefits of BlockFi Credit Card

Take a look below to find out the complete advantages and benefits of BlockFi credit cards:

Use internationally with millions of merchants: One of the best things about BlockFi credit cards is that they are VISA signature cards and can be used internationally. Thanks to the enabled VISA support, they will work for millions of merchants who support VISA cards.

With your BlockFi VISA card, you can make your traveling experience a lot easier, get instant access to exclusive deals from all over the world, and enjoy premium dining experiences. Buying groceries from a local store, going on an international trip, or purchasing something off the internet – your BlockFi VISA card will work flawlessly for all of these.

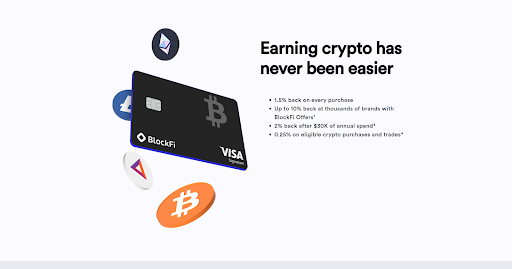

Unlimited 1.5% cash back on all transactions: Credit card companies offer flashy cash backs and rewards, but only for a certain period or a limit, leaving users with little to no benefits. This is not the case with BlockFi credit cards: regardless of how much you spend, you will always get 1.5% cash back in crypto on each of your transactions. All rewards are recorded in your BlockFi account and paid to you promptly.

Plus, the cashback percentage is pushed to 2% if your yearly spendings exceed 30k, making it even more beneficial for you to use your BlockFi credit card. So yes, it’s a smart move to get a BlockFi credit card and enjoy never-ending rewards on all your purchases.

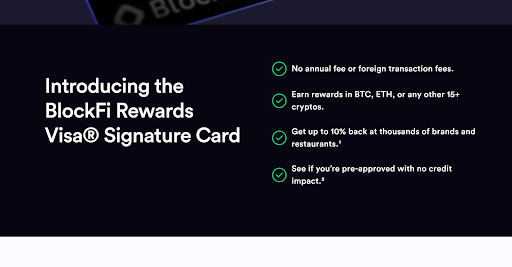

Get rewarded in 15+ cryptocurrencies: Traditional rewards are paid in fiat currencies, which can devalue over time, making the entire earned rewards seem worthless. Again, this is not a problem with BlockFi credit cards. Every time you make a purchase with your BlockFi credit card, you are rewarded with a crypto asset.

There are over 15 cryptocurrencies available on the platform that you can be rewarded with. You can go with Bitcoin, Ethereum, or any other popular crypto asset to be rewarded as per your preferences. Going with the crypto asset that has potential would also benefit you a lot in case its value increases over time. This means you will be able to grow your rewards by doing practically nothing.

Fee-less transactions and usage: One of the reasons people don’t get or use credit or debit cards is the fee that they come with. In most cases, you have to pay a specific percentage of the transaction as a fee along with the separate annual charges, which vary depending on the service you have chosen. With BlockFi credit cards, the overall experience is totally free of cost. You don’t have to pay foreign transaction fees, which can save you a lot of money in case you travel a lot or order things internationally. There is no maintenance fee or annual fee. Just make sure to keep the standard variable APR in mind.

Up to 10% cash back with BlockFi offers: Besides the 1.5% and 2% cash back on all of your transactions initiated with a BlockFi credit card, you can get up to 10% cash back, thanks to the exclusive BlockFi offers through thousands of brands. 10% is unquestionably a huge percentage, and you get back a great deal of money if you shop a lot, eat out, or do other activities. Furthermore, the 10% cashback offer is valid for the merchants available worldwide as long as BlockFi has partnered up with them.

Control your card with BlockFi mobile app: In order to provide their users with full control over their BlockFi credit card, the platform has also designed efficient and fast mobile applications that you can download. Just log in to the BlockFi mobile app, and you can manage your card right away. BlockFi mobile applications are available for Android and IOS devices and can be downloaded from their respective application stores.

With those applications, you can block your card temporarily, check transactions, and manage other things pretty much instantly. You can manage your card on the go without having to access your laptop or desktop computer.

No impact on credit score if pre-approved: Many people take their credit score seriously, and everyone actually should. If you are one of them, you would think long and hard before opting for a credit card due to the consequences it can bring to your credit score. But the thing with BlockFi credit cards is that they have zero impact on your credit score if you are pre-approved. You can go through the pre-approval process and see if you qualify for a BlockFi credit card. In case of soft pull regarding your credit history, there will be no impact on your credit score. For hard pull, there might be some impact that you will have to keep in mind.

Security and fraud protection with VISA: VISA is known for its premium security and fraud protection precautions, offering their users peace of mind when using their cards. As BlockFi credit cards are actually VISA cards, you can also enjoy the security benefits offered by VISA and spend without worrying about being victimized by fraudulent activities. With the advanced authorization system anti-fraud detection system, VISA monitors all the suspicious activity on your card and reports these directly to you. Online purchases have also become secure through VISA protection as it ensures that your card is being used at secure sites.

Things I don’t like about BlockFi Credit Card

BlockFi credit cards also have some issues that should be taken into consideration by the platform and enhanced to provide a seamless experience to everyone. Take a look below to find out what I don’t like about BlockFi credit cards:

Only US users are supported as of now: BlockFi credit cards are only available for residents of the United States. The platform has specified a few US states where the users cannot claim their card due to certain policies, regulations, and laws. Considering BlockFi is a global platform, it is a shame they do not offer their credit cards to the whole community. They might have some plans for the future to start offering their credit card services to other jurisdictions, but as of now, no news has been shared regarding this concern.

So, if you are from outside of the US, you will have to find an alternative to a BlockFi credit card. Or you can just wait for them to start offering their credit card services in your country.

Rewards are available after a month: BlockFi credit cards offer good rewards for their users, but the catch is they are available at the end of each month for you to withdraw or use. A 30-day wait may be too long for many users. There are credit card services that instantly deposit the rewards into your accounts, but BlockFi is still far behind in this aspect. They will have to work this feature out and consider the feasibility of their users claiming their earned rewards sooner.

BlockFi Credit Card Fees

BlockFi Credit Card Ordering Fee

If you qualify for the BlockFi credit card, you can get a BlockFi credit card for free. There is also no charge for having your card delivered to your home.

BlockFi Credit Card Transaction Fee

There is no international transaction fee if you are using a BlockFi credit card. You can freely shop internationally, pay online, dine, travel, or do whatever you want without worrying about the transaction fee.

BlockFi Credit Card Annual Fee

BlockFi does not charge an annual fee from their users.

The interest rate on BlockFi Credit Cards

The annual percentage rate for purchases through your BlockFi credit card varies between 14.99% to 24.99%.

BlockFi miscellaneous fees

BlockFi charges a flat fee of $25 for late payments. As for the returned payments, the platform charges $37 per returned transaction.

Pros and Cons of BlockFi Credit Card

- Use worldwide with VISA support

- Get rewarded in over 15 cryptocurrencies

- Up to 10% cash back with brands

- No annual or transaction fee

- Safe, secure, and protected

- Currently available for US users only

- Long waiting period for claiming rewards

Summary

Getting rewarded in cryptocurrencies rather than fiat assets is something new for the finance or credit card industry, and the people who understand blockchain or crypto assets are benefiting from it. The concept is simple: you can grow your rewards over the period as crypto assets are volatile and hold much more potential to grow. Pretty much every single crypto asset has grown exponentially in the past few years, and the biggest example is Bitcoin. That is why you can earn up to 10% cash back rewards with BlockFi and the brands they have partnered up with. You can dine, shop, and travel and get amazing rewards at every single one of your stops and get something in return.

There is no annual fee, no transaction fee, and even the standard variable rates are competitive. If you are living in the US and want to enjoy the benefits of a credit card in a unique way, BlockFi is the way to go. Sign up to BlockFi, evaluate your credit score, and apply for your BlockFi credit card now!

If you want to consider other options, read our article on the best crypto credit cards.

Frequently Asked Questions

A- Yes, BlockFi credit cards can be used internationally with millions of merchants who accept VISA cards.

A- BlockFi requires their users to have a good to excellent credit score in order to be eligible for a BlockFi credit card.

A- You can earn over 15 popular cryptocurrencies with BlockFi credit cards, including Bitcoin and Ethereum. Choose what asset you want to be rewarded with.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.