Bitget and Coinbase are two well-known crypto exchanges available for crypto investing and trading. Bitget is a relatively new platform, founded in 2018, while Coinbase started its operations in 2012. With the disparity in years, Coinbase has garnered a large user base over 108 million, while Bitget has accumulated 2 million users.

In this informative article, we’ll compare the two exchanges and look at the features, fees, and security measures to give you an idea of which is better for your needs. Let's take a look starting with a quick comparison table.

Bitget vs Coinbase Comparison Table

Header | Bitget | Coinbase |

|---|---|---|

Number of coins | 300 | 160+ |

Deposit Fee | Free for crypto and BGB transfers. | - Free for swift and ACH transfers. - $10 for wire transfers. - £0.15EUR fee when making a deposit using SEPA. |

Trading Fee | - Spot trading: Free - Futures trading: 0.02%/ 0.06% - Maker/Taker fee | 0.5% + a varying Coinbase fee depending on amount traded. |

Withdraw Fee | Varies depending on the market status. | 1% to convert your crypto to cash plus other network standard fees. |

Deposit methods | Credit card, Apple and Google pay, and wire transfers. | Credit/debit card, Paypal, Fiat currency, Bank transfer (ACH), Cryptocurrency, Apple pay, Google pay, and SEPA. |

Pros | - Users can buy, sell or trade cryptocurrencies for free on the P2P marketplace. - Offers strategy trading for spot trading. - Supports spot, margin futures, and derivatives trading. - Allows copy trading. - The website offers a trading demo feature for novice traders. - It has an easy-to-use interface. - Lower fees than Coinbase. - Facilitates spot grid trading for automated trading. - Provides users with a secure wallet for storing digital assets. | - Supports 200+ coins - Its user interface is simple and intuitive. - Users can earn interest from holding cryptos, learning about crypto, and DeFi interaction. - Offers alternative platform (Coinbase Pro) for experienced traders. - Its coin wallet facilitates the storage of cryptos and NFTs and supports thousands of tokens and dApps. - Has an NFT marketplace. - The exchange offers a Coinbase card accepted by over 40 million merchants. - Its customer support is available via Email, live chat, and phone. - Facilitates businesses and personal accounts. - Crypto staking feature earns 7% APY. |

Cons | - Doesn’t offer a constant deposit fee. - NFT trading is yet to be implemented. | - Paid staking rewards are volatile. - Limited information on fee structures. |

Bitget Pros & Cons

- Offers strategy trading for spot trading

- Allows copy trading

- The website offers a trading demo feature for novice traders

- Facilitates spot grid trading for users who want to automate their trading

- Users can buy, sell or trade cryptocurrencies for free on the P2P marketplace

- Yet to fully facilitate NFT trading

- Lacks constancy on its deposit fee

Coinbase Pros & Cons

- Supports 160+ cryptocurrencies

- The platform has a simple, intuitive interface

- Users can earn interest from crypto holdings

- Has an NFT marketplace

- Customer support is available via email, live chat, and phone

- The fee structures are not clear

- Unstable staking rewards

Bitget vs Coinbase: Features

Bitget and Coinbase differ in their features. That’s why dissecting the features of both exchanges is significant since it helps traders identify the suitable exchange for them. Let’s look at the features each has to offer, make a comparison, and identify the better exchange.

Trading Markets

The trading market is an essential feature in the crypto exchange realm. When you look at Bitget and Coinbase trading products, you’ll find spot, futures, and margin trading.

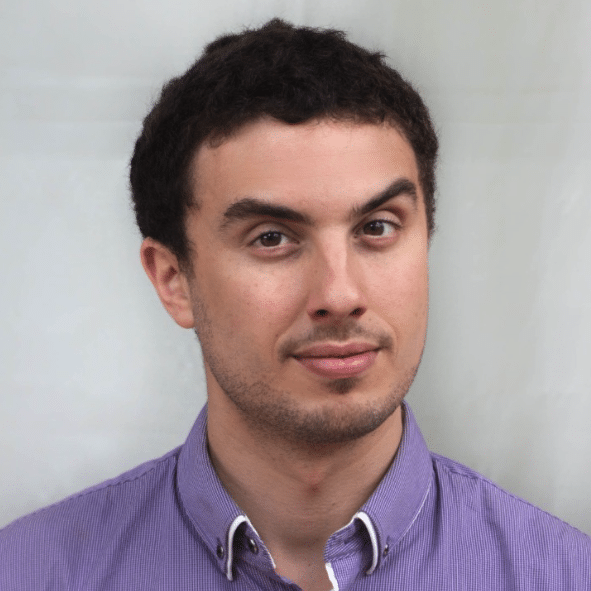

Bitget Spot Trading

For users that want to trade crypto instantly, Bitget offers spot trading. There are hundreds of coins on offer, and the large number of users on Bitget mean that orders are filled quickly.

The downside with Bitget spot trading is that it doesn't facilitate margin trading, which is common with many exchanges. Traders can only trade using their own funds.

Bitget Futures Trading

Besides spot trading, Bitget also offers futures trading, a derivative agreement to buy or sell crypto assets at a future date for an agreed price. Many traders prefer futures trading because it’s possible to leverage trade, offers higher liquidity, and has low fees of 0.02% for makers and 0.06% for takers. If you want to use the futures trading option with a defined settlement date that supports multiple currencies, Bitget offers Coin-Margined futures.

Another form of futures trading on Bitget is perpetual futures, a contract derivative with no expiration or settlement date. Bitget has two perpetual futures, which are traded and settled with their corresponding coins; they include USDT-M futures and USDC-M futures. For perpetual futures, users can hold leverage indefinitely until they realize the right time to sell, thus offering flexibility to exit contracts. It’s also a great tool for managing risks on existing investments and requires minimal capital to trade.

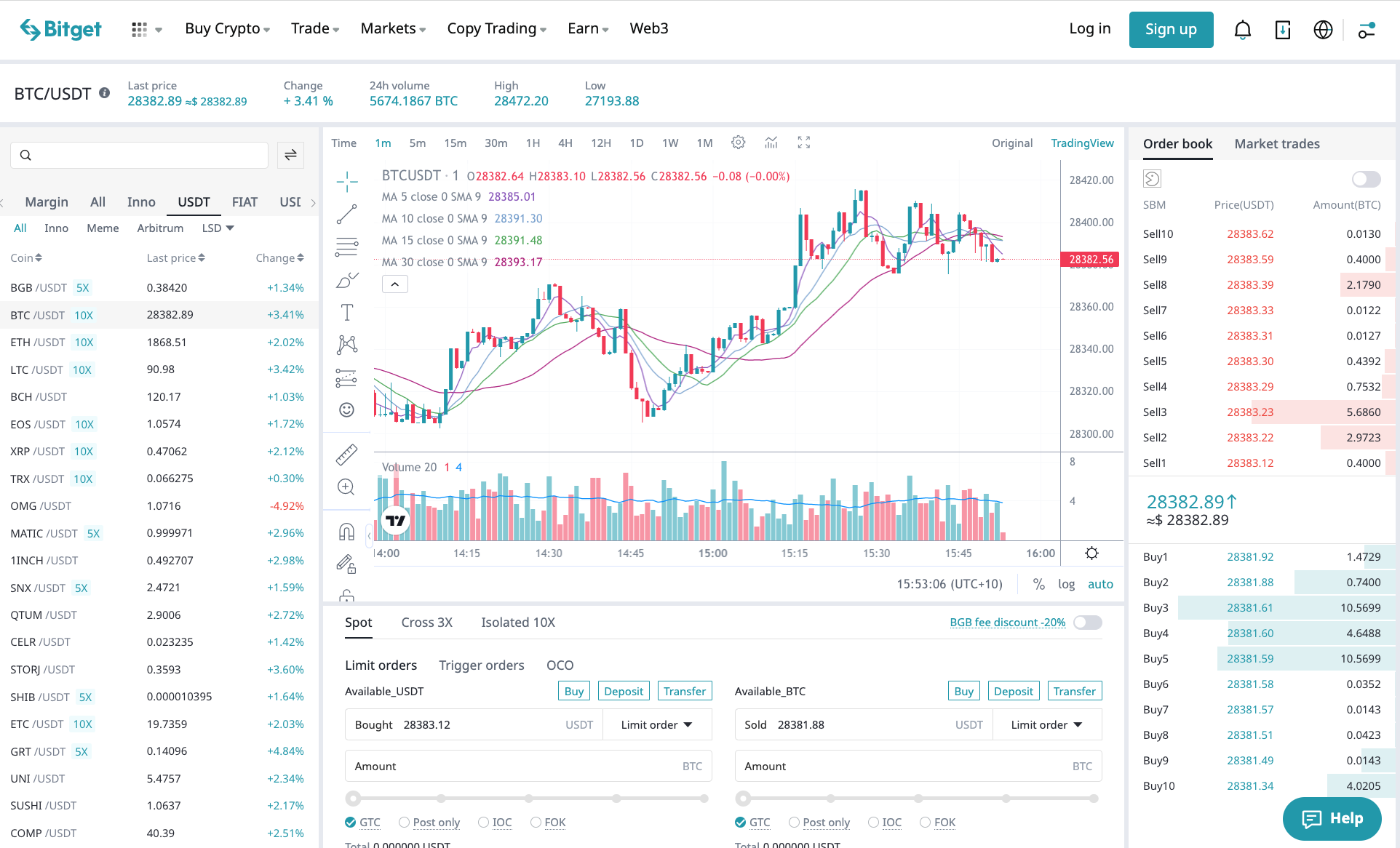

Coinbase Trading Markets

Crypto traders prefer trading on exchanges that offer deep liquidity, as it is easier to fill your trades. Coinbase is built around this functionality and is one of the the most liquid crypto spot trading platforms.

The ability to trade assets in high volumes on the Coinbase exchange is ideal for big businesses. This feature makes Coinbase the preferred option for brokerage firms since they can easily trade assets on the platform. It’s imperative to note that Coinbase is one of the few exchanges that allow crypto trading firms to trade cryptocurrency.

The futures trading on the Coinbase exchange is available under derivatives trading. If you want to trade perpetual futures on Coinbase, it’s easy. When you sign into the website, click buy, search for Perpetual Protocol, and tap on the result provided, where you’ll find the purchase option.

When you compare Bitget and Coinbase trading markets, each has its benefits and drawbacks. Both have spot and futures trading, but Bitget spot trading doesn’t support margin trading and leveraging, although you can find the option under futures trading. Coinbase exchange offers higher liquidity and more perpetual futures than Bitget. It also accommodates individual traders and businesses, making it the preferred option among crypto enthusiasts.

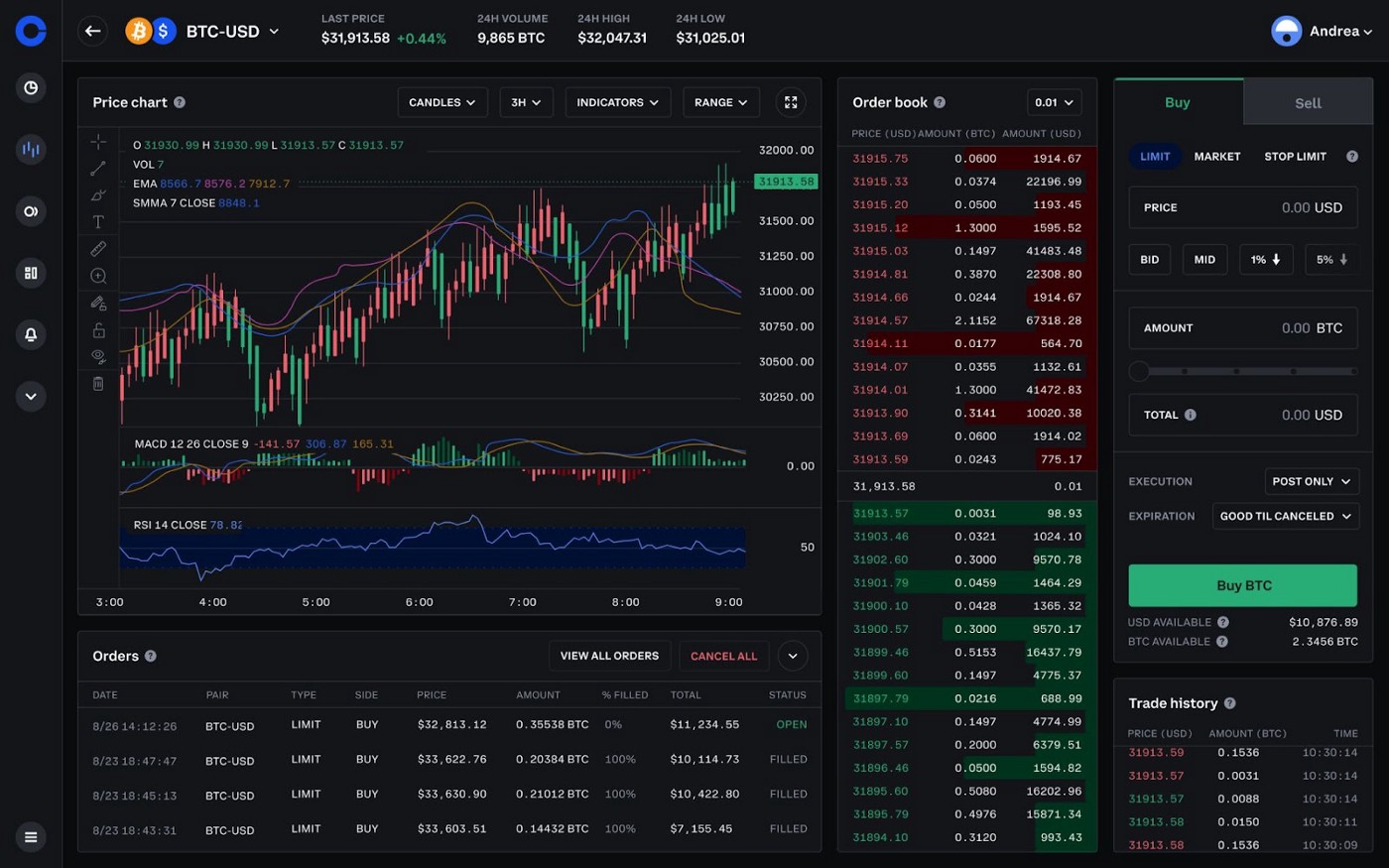

Margin Trading

In simple terms, margin trading allows traders to borrow crypto assets to trade. This feature is primarily available in futures trading, where traders can trade without having a lot of cash in their account. Bitget offers 50 margin trading pairs, with an impressive maximum leverage of 125x.

With Bitget, you get five types of margin trading: Initial, Maintenance, Variation, Available, and Risk Margin. The initial Margin represents the minimum equity a trader has to deposit before borrowing. The maintenance Margin is the minimum collateral maintained in a trader's account during the life of a contract, and it’s usually lower than the Initial Margin.

The Variation Margin, it’s the difference between the initial and maintenance margin. Lastly, Risk Margin is a contractual obligation a trader must meet.

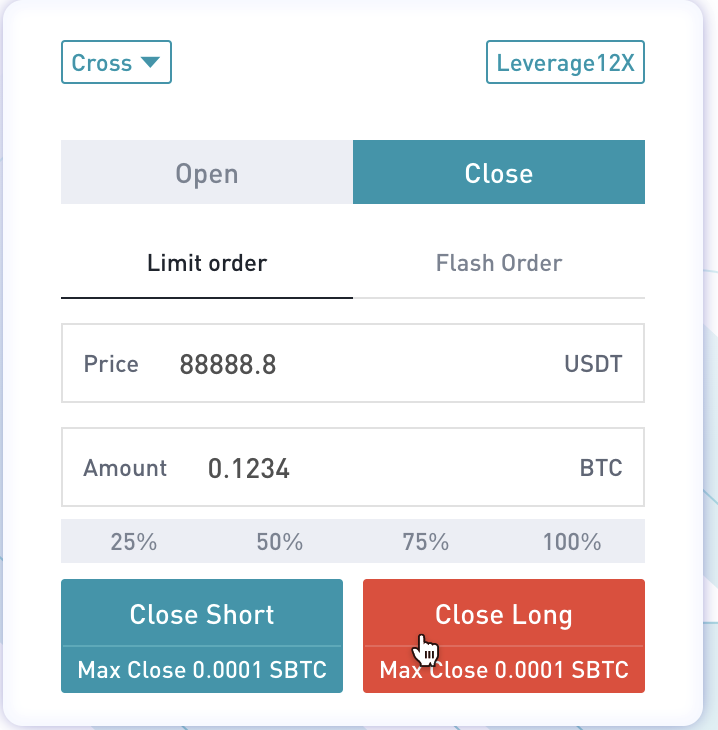

Bitget Margin Modes

There are two margin modes on Bitget; isolated and cross margin. Each trading position has a corresponding independent margin account for isolated margin mode. This mode minimizes the risk factor since traders can only trade one pair at a time using one account. With cross-margin, trading several Bitget pairs is feasible using one account or equity.

Because of the high-risk factor associated with margin trading, which can lead to traders incurring losses that exceed the initial investment, Coinbase no longer offers this feature to its users.

However, you can borrow cash using only Bitcoin as collateral, and the exchange allows you to borrow 40% of the Bitcoin’s value.

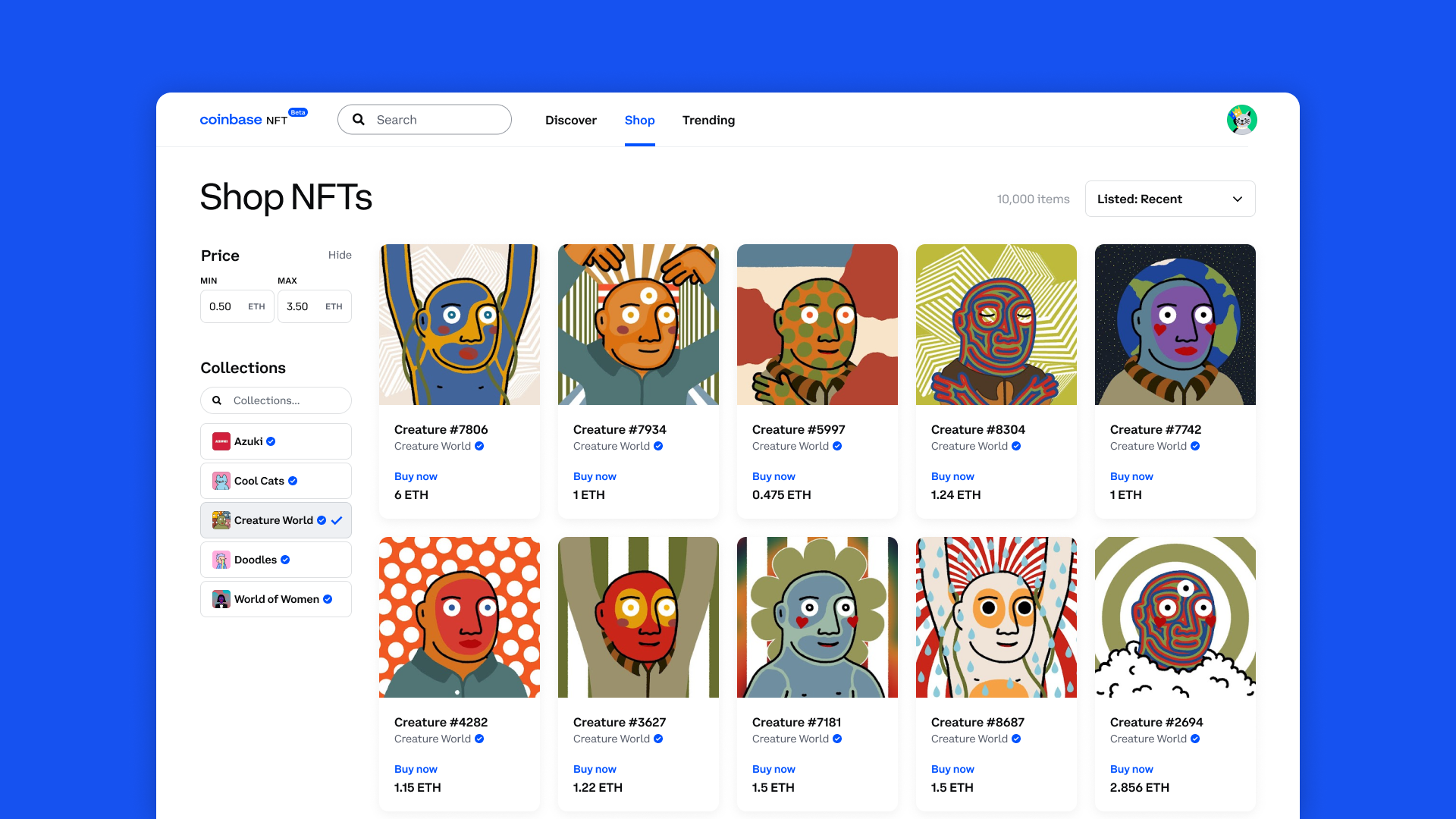

NFT Marketplace

The NFT industry has seen significant growth, and some exchanges are including NFT marketplaces on their site to attract a wider audience.

The Coinbase NFT feature is now available, and there are three unique selections for collectors and creators.

There's a drop option where creators can drop NFTs to sell, a shop option where you can search the type of NFT you wish to acquire, and a trending option that shows you the trending NFTs on the Coinbase marketplace.

Bitget is yet to offer NFT trading, but the feature may become available in the future.

Trading Automation

Automated trading in the crypto exchange marketplace is revolutionizing crypto trading. Even with limited knowledge, trading crypto is possible using bots which trade based on set parameters.

On Bitget, traders can access bots for futures and spot grid trading. Spot grid trading is a computable trading strategy where buying and selling are fully automated. Considering the exchanges market's volatility, bots help traders implement trades at all times of the day, even while you are asleep.

To implement them, you need to set buying and selling conditions, and the bots will execute these orders within a certain price range.

The same concept is applicable in futures grid trading, but the downside here is the risk involved if your assets lose value, resulting in greater losses.

When you look at all the features on Coinbase, you won’t find any automated trading bots. The platform hasn’t introduced bot trading, but it’s possible to use third-party bots that can sync with it.

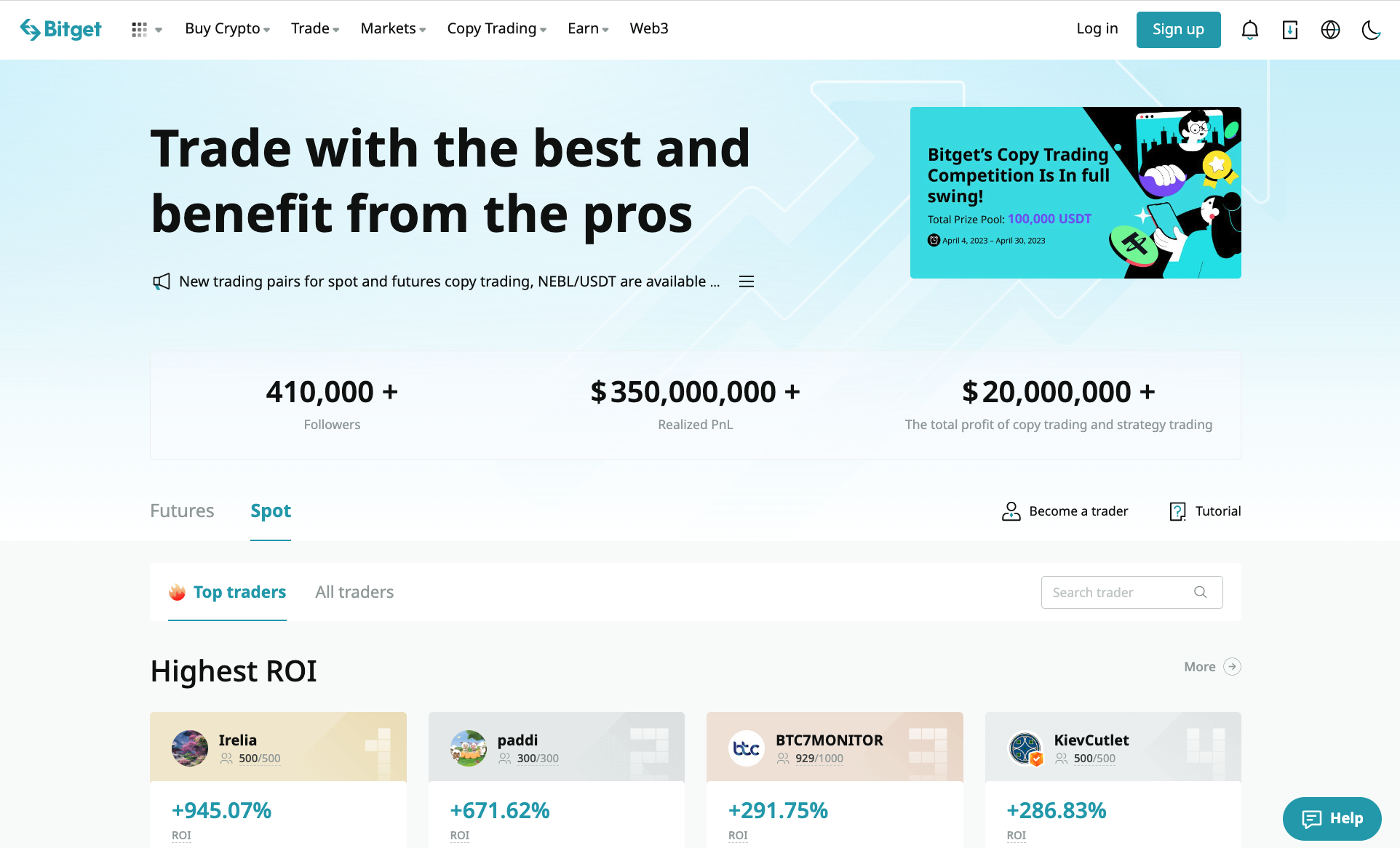

Copy Trading

Bitget offers copy trading, which is a form of trading that allows users to copy successful traders' behavior. To use this function, you first select the trader you wish to copy, by studying their performance using overall ranking and PNL. After you choose to copy them, Bitget synchronizes your trades so that your trades are exactly the same as the trader’s.

Earn

Most crypto exchange platforms allow traders to earn passive income in several ways. With Bitget, you can earn through savings, BGB, and launch pool. To earn through savings, traders deposit crypto in their accounts and earn 10% APY, but the interest varies depending on the cryptocurrency you deposit. For BGB, traders must invest in the various BGB products available on the platform and then wait for their earnings. To earn through Launchpool, users will put a stake in multiple Bitget products, consequently earning them new tokens.

Coinbase offers several ways to earn passive income. The most common are staking, and DeFi yields. In staking, your obligation is helping to make the platform's blockchain more sturdy through verifying and securing transactions then you get rewarded for assisting in the process.

To earn through DeFi yields, users lend their crypto to third parties and then earn a 7% APY, but the interest depends on the coin.

Bitget and Coinbase have unique ways to earn passive income for their users. They differ on the interest rates and the methods to earn interest; it’s up to the user to choose the one that works for them.

Features Summary

Cryptocurrency traders are always looking for exchange platforms that are user-friendly, secure, and offer more trading features to maximize investment. When you look at Bitget and Coinbase, each has strengths and shortcomings. With the five features listed above, Bitget offers all of them, thus allowing traders more flexibility.

For Coinbase, the lack of margin and automated trading makes it less appealing. However, Coinbase is easy to use, more secure, established, and has two distinct platforms. You’ll find the regular Coinbase site for beginners and the Coinbase Pro exchange for advanced traders.

Therefore, if it's down to features, Bitget gets the upper hand, but when it comes to usability, Coinbase takes the day.

Bitget vs Coinbase Deposit Methods

Coinbase supports fiat currency deposits, credit/debit cards, Paypal, bank transfer (ACH), cryptocurrency, Apple pay, Google pay, and SEPA.

Bitget doesn’t allow fiat deposits, but you can buy cryptocurrencies directly using fiat and then use the crypto to trade. The payment methods that Bitget accommodates include credit cards, Apple and Google pay, and wire transfers.

Regarding depositing methods, Coinbase has more to offer compared to Bitget.

Bitget vs Coinbase Fees

The fees charged on transactions are a huge deciding factor for users registering with an exchange. Here is a comparison of Bitget and Coinbase's fees.

Deposit Fees

Bitget doesn’t charge traders a deposit fee for crypto. When you make direct purchases using fiat currency, a third party service provider will charge a fee, but there is no fee from Bitget.

Coinbase calculates deposit fees depending on several factors. These are your location, payment method, the size of the order you place, and the market conditions. For example, Alchemy Pay (ACH) and SWIFT deposits are free, while for USD wire transfers, the fee is $10. For SEPA deposits, the fee is £0.15 EUR.

Trading Fees

Bitget charges a 0.02% standard maker fee and 0.06% taker fee for each trade on the futures market, but the fee fluctuates; hence it’s crucial to refer to Bitget's Fee Schedule Page for daily fee updates. For example, at times they offer promotional 0% spot trading fees.

The Coinbase trading fee is calculated depending on your current pricing tier when you place an order. There’s a standard 0.5% base fee plus a varying amount depending on your tier level or the amount you’re trading.

If you use Coinbase Pro the fees are lower, at only 0.5% for makers and takers, and with reduced fees based on the trading volume over the last 30 days. For example, if you exceed $10,000 in trading volume, trading fees drop to 0.35% (makers and takers).

Withdrawal Fees

Bitget's crypto withdrawal fees are never constant since the platform automatically adjusts the fees based on the market status. To get real-time withdrawal fees, visit the Bitget Fee Schedule Page. There are no fiat withdrawals accepted on Bitget.

Coinbase will charge you 1% to convert your crypto to cash when making a fiat withdrawal, and a network fee for crypto transactions.

Bitget vs Coinbase Security

Security in cryptocurrency exchanges is paramount. With the transactions the exchanges handle, accounts must have top-notch security encryptions. Bitget security is up to par with industry standards. It offers users a two-factor authentication system where traders must pass through two forms of authentication to access their accounts. Bitget has also implemented an anti-money laundering (AML) security feature and a Know Your Customer (KYC) system to help keep the exchange safe.

Being one of the largest crypto exchanges, Coinbase is very secure. It offers the best security tools to protect accounts against malware and hackers. The platform keeps users' accounts safe by using the 2FA, enhancing account protection, automatically locking accounts in case of suspicious activity, and offering a Coinbase vault to store your crypto.

When you compare Bitget and Coinbase security functions, Bitget has taken a step further to ensure the platform isn’t used by criminals to clean dirty money using AML. Coinbase, on the other hand, has focused more on protecting the user and their assets with a tool like Coinbase vaults and many others.

Both exchanges take security seriously, but in our opinion, Coinbase offers better security.

Bitget vs Coinbase Summary

When you compare Bitget and Coinbase features, Bitget has more to offer, giving traders more flexibility. However, when it comes to usability and security, many users prefer using Coinbase. Despite the features Bitget has, we find that Coinbase is the better option for new users, due to the simple interface. If you prefer an advanced trading experience, you can also access Coinbase Pro, a dedicated trading platform with lower fees.

If you plan on using either of these crypto exchanges, you can also take a look at our detailed Coinbase review or Bitget review. You may also enjoy our article on the best cryptocurrency exchanges in the US, or see the comparison table below.

Comparison Table of the Best Crypto Exchanges in the USA

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.