Best cryptocurrency exchanges in USA for 2024

- eToro – Best Crypto Exchange

- Pionex – Free Trading Bots

- Coinmama – Best for Speed and Ease of Use

- Gemini – Most Secure Cryptocurrency Exchange

- Uphold – Wide Range of Assets

- Crypto.com - Best for Staking

- Coinbase - Excellent for Beginners

- Kraken - Plenty of Features

- KuCoin - Trade Over 700+ Coins

- Localbitcoins.com

- Cash App

- Skrill crypto options

Best cryptocurrency exchanges in USA for 2024

- eToro – Best Crypto Exchange

- Pionex – Free Trading Bots

- Coinmama – Best for Speed and Ease of Use

- Gemini – Most Secure Cryptocurrency Exchange

- Uphold – Wide Range of Assets

- Crypto.com - Best for Staking

- Coinbase - Excellent for Beginners

- Kraken - Plenty of Features

- KuCoin - Trade Over 700+ Coins

- Localbitcoins.com

- Cash App

- Skrill crypto options

Best cryptocurrency exchanges in USA for 2024

| Exchange | Rating | Fees |

| eToro | 9.9 | 0.30% |

| Pionex | 9.8 | 0.20% |

| Coinmama | 9.6 | 0.30% |

| Gemini | 9.4 | 0.50% |

| Uphold | 9.4 | 1.30% |

| Crypto.com | 9 | 0.80% |

| Coinbase | 8.8 | 0.10% |

| Kraken | 8.5 | 0.30% |

| KuCoin | 8.4 | 0.90% |

| Localbitcoins.com | 8.3 | 0.60% |

| Cash App | 7.6 | 0.35% |

| Skrill crypto options | 7 | 2.20% |

If you want to get your hands on some cryptocurrency, it is so easy these days, with hundreds of crypto exchanges available in the US. There are so many options available, that the difficult part is knowing which platform to choose. You need to pick one that is secure and legitimate, and we have done the hard work for you. We have compared and tested many exchanges, and compiled this list of the best crypto platforms in the US, that are all safe to use. These are the best crypto exchanges in the US in 2024.

| Crypto Exchange | Features | Score | More |

|---|---|---|---|

Best Overall  | ☑️ Huge range of 1,520+ coins and 2,110+ trading pairs ☑️ Deepest liquidity, almost 10x higher than Bybit, Binance, KuCoin, Huobi, and OKX ☑️ Free crypto trading bots and Copy Trading are available | 9.9 | Open AccountRead More |

Wide Range of Assets  | ☑️ Supports 125+ cryptocurrencies, 27 fiat currencies and 4 precious metals ☑️ Trade from one asset to any other asset ☑️ Fees incorporated into spreads, which are quite reasonable compared to industry standards | 9.6 | Open AccountRead More |

Best for Speed & Ease  | ☑️ Allows customers to buy crypto instantly, with no need to pre-fund account ☑️ Various payment methods including debit/credit cards, wire transfers, Google Pay and Apple Pay ☑️ Serves 15 cryptocurrencies to over 2 million customers | 9.5 | Open AccountRead More |

Best for Staking  | ☑️ Supports more than 250+ cryptocurrencies & staking for over 40+ coins ☑️ Crypto.com has their own coin (CRO) that has plenty of benefits when staked ☑️ Crypto.com Visa debit card with up to 5% cashback on purchases and additional benefits, such as Airport Lounge access | 9.3 | Open AccountRead More |

Best USA Cryptocurrency Exchanges for 2024: Reviews

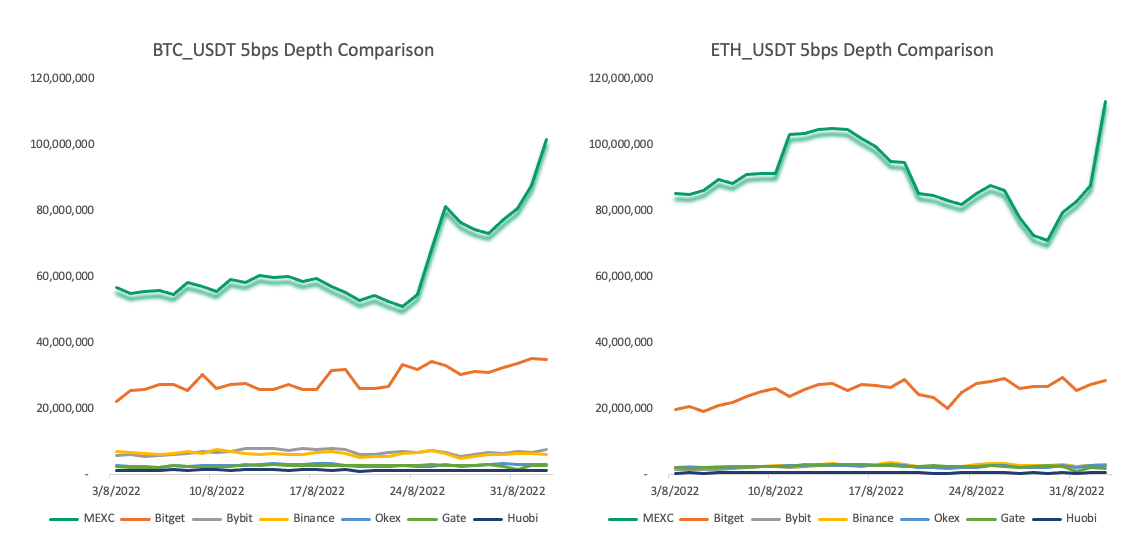

Best Overall in the USA: MEXC Crypto Trading Platform

MEXC is the best crypto exchange in the US. It is perfectly suited for users of all experience levels. Beginners who are completely new to crypto can instantly purchase crypto using fiat currency. Intermediate crypto traders will love spot trading with 0% fees on 11 major pairs, and using the copy trading feature. Experienced traders have plenty to choose from, including futures trading, margin trading (up to 200x leverage), and automated trading bots.

MEXC offers an unbelievable range of over 1,520 coins, with more than 2,110 trading pairs. The trading fees are low, with 0.1% fees for spot trading, and 0.01/0.05% (maker/taker) fees for futures trading.

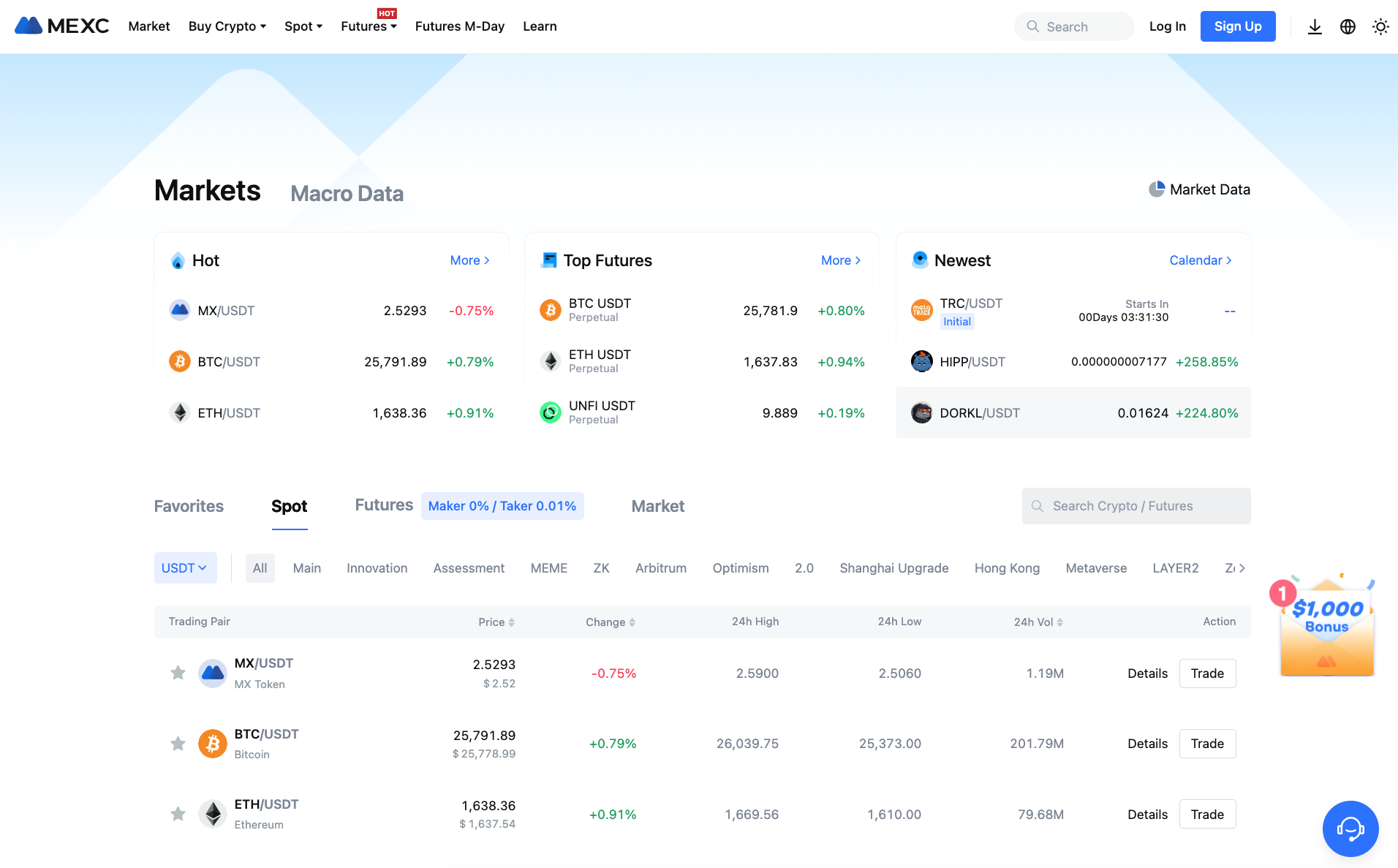

MEXC is known for its extremely deep liquidity, and you may be surprised to learn that it dwarfs the world's largest crypto exchanges, including Bybit, Binance, KuCoin, and Huobi. Take a look at the liquidity comparison for BTC/USDT and ETH/USDT in the graphs below. You can clearly see MEXC has more than double the liquidity of the closest crypto exchange Bitget, and around 10x compared to the other large platforms.

If you would like to sign up to MEXC, be sure to use the link here. This gives you exclusive access to FREE $30 USDT, plus 10% off all your trading fees on your account. One thing to note is that MEXC blocks US IP addresses, due to local restrictions. However, since there is No KYC required, you can easily use a VPN set to Australia to access MEXC.

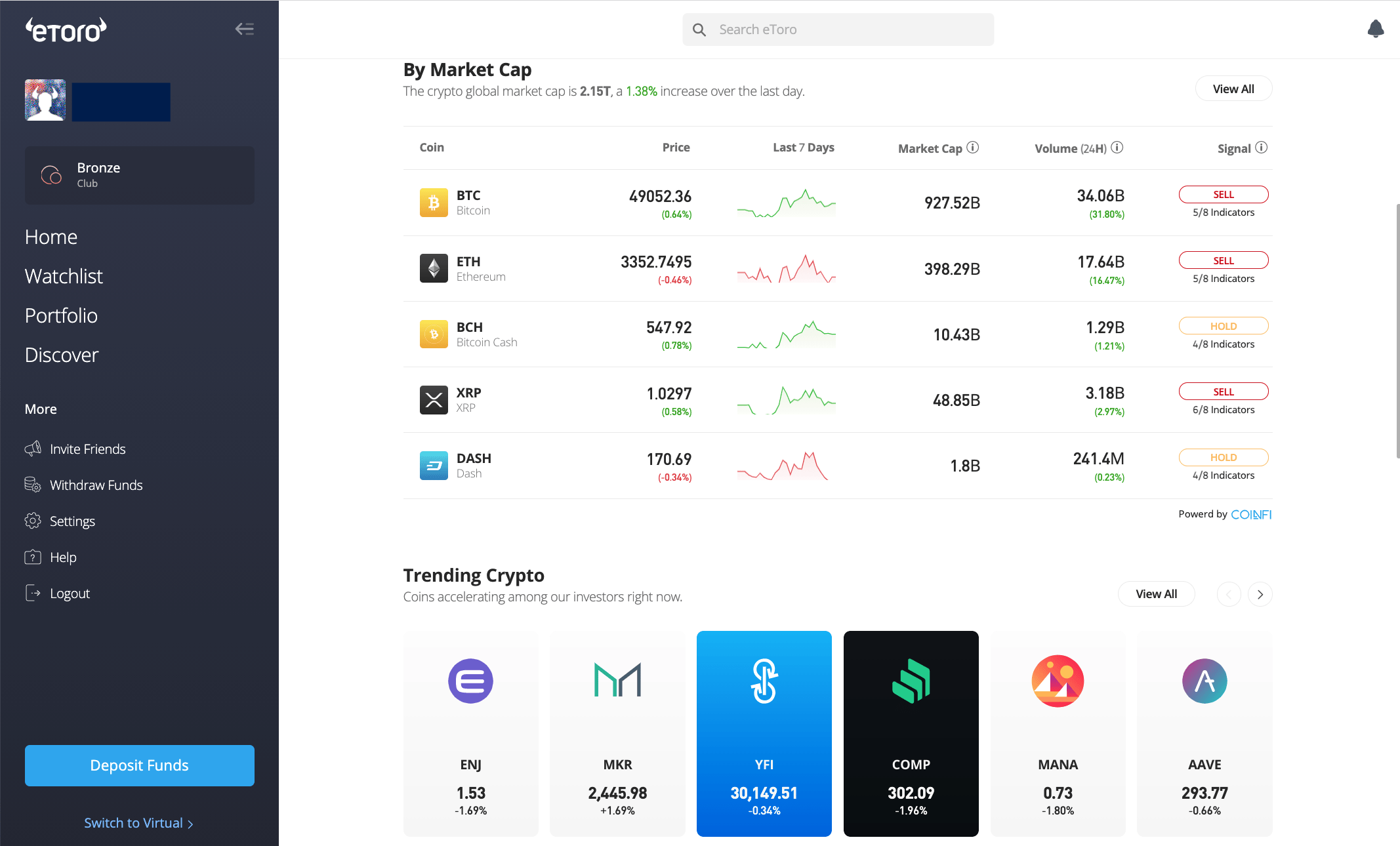

Best for Beginners: eToro USA Crypto Broker

eToro is the #1 choice for beginners to cryptocurrency. Not only is the platform user-friendly, but it even includes a Demo account where you can learn how to trade risk-free. Users receive $100,000 virtual money to practise trading with, so you can try it out and see if it's right for you, before depositing your real money. eToro is registered with FinCEN in the USA and is a globally recognized broker, so you know your funds are secure with them.

eToro has a focus on social trading, so users can interact with others in the cryptocurrency community, and even set up the CopyTrader feature - they can set their account to automatically copy the exact trades of a successful trader.

eToro's trading fees are 1%, which is a little higher than the industry average, but is not unreasonable. Overall, eToro is an excellent choice for a beginner or a casual investor. If you consider yourself a serious trader, then I would suggest one of the other alternatives where you get a more competitive high-volume trading fee structure and wider selection of altcoins.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

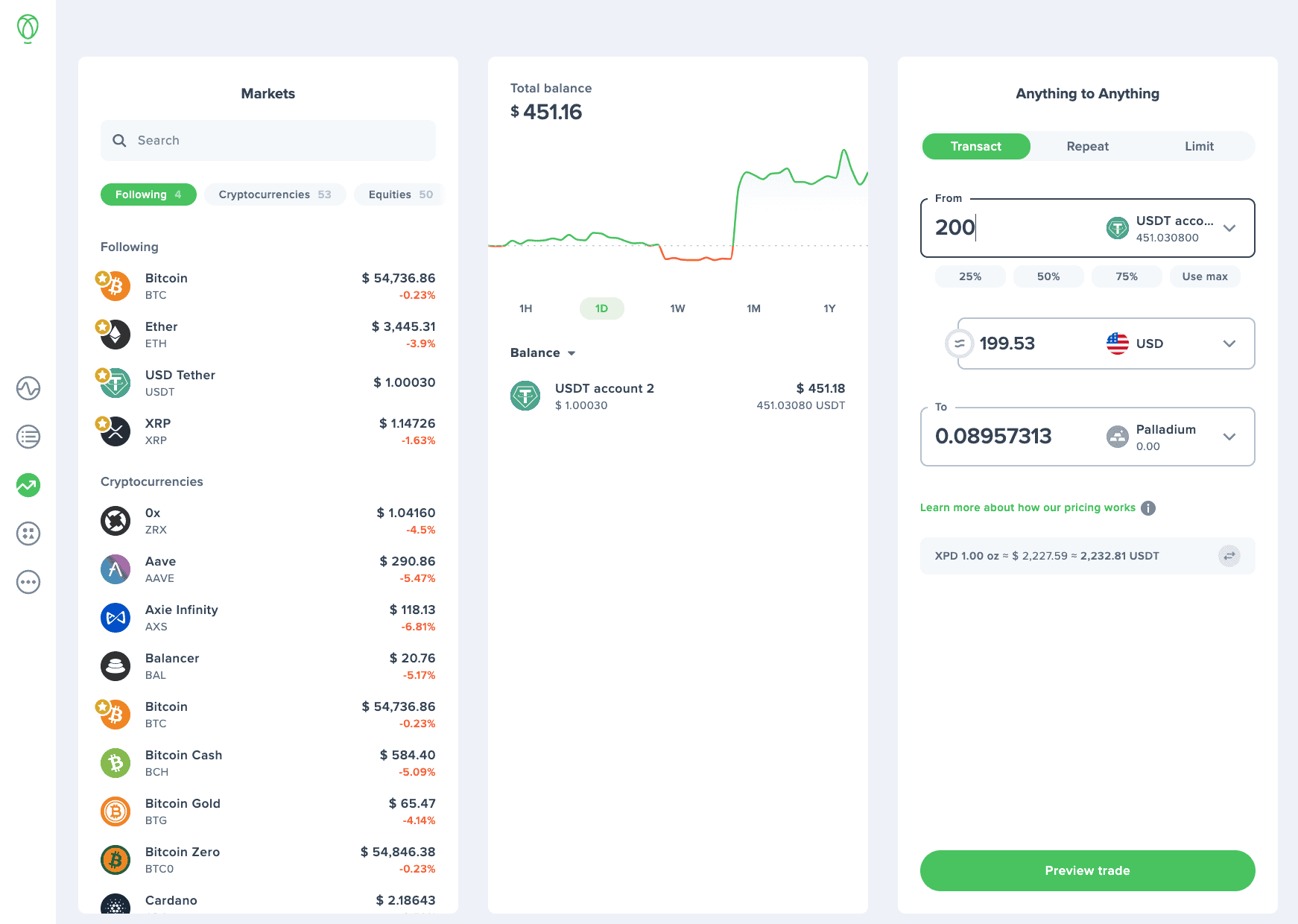

Offers Wide Range of Asset Classes: Uphold Crypto Exchange

Uphold was founded in 2015 as not just a cryptocurrency exchange, but also a broker for forex and precious metals, making the platform an excellent one for those that want to diversify their portfolio beyond cryptocurrency. This platform supports over 125+ cryptocurrencies, 27 fiat currencies and 4 precious metals, with a unique ability to trade between any two assets. For example, you can buy Gold using your ADA or trade your Ether for Euros, quickly and easily.

Uphold also allows users to access financial services that are not possible from their bank. For example, you can receive payments from your employer to your Uphold account in any currency, fiat or digital, or even a combination of currencies, for example 50% USD, 30% Euro and 20% Bitcoin. Sending money to your friends and family around the world is also extremely easy. Transactions are instant and free, and you can send any fiat or cryptocurrency. Uphold also has a Debit card that you can use at nearly 50 million merchants and ATMs worldwide, with no foreign transaction fees. You even earn 1% Cash Back in USD on any USD-sourced purchases and 2% back in the crypto used for every purchase with the Uphold Debit card.

Uphold does not charge any commission on trades, but includes fees in the spread. Spreads vary based on the coin, and they are quite reasonable. For Bitcoin and Ethereum, the spread is only 0.8% - 1.2%. Uphold is a great choice for those that want to invest in cryptocurrency, as well as dabble in some other options, such as foreign exchange and precious metals (gold, silver, platinum and palladium).

Uphold Disclaimer: Assets available on Uphold are different per region. All investments and trading are risky and may result in the loss of capital. Cryptoassets are largely unregulated and are therefore not subject to protection.

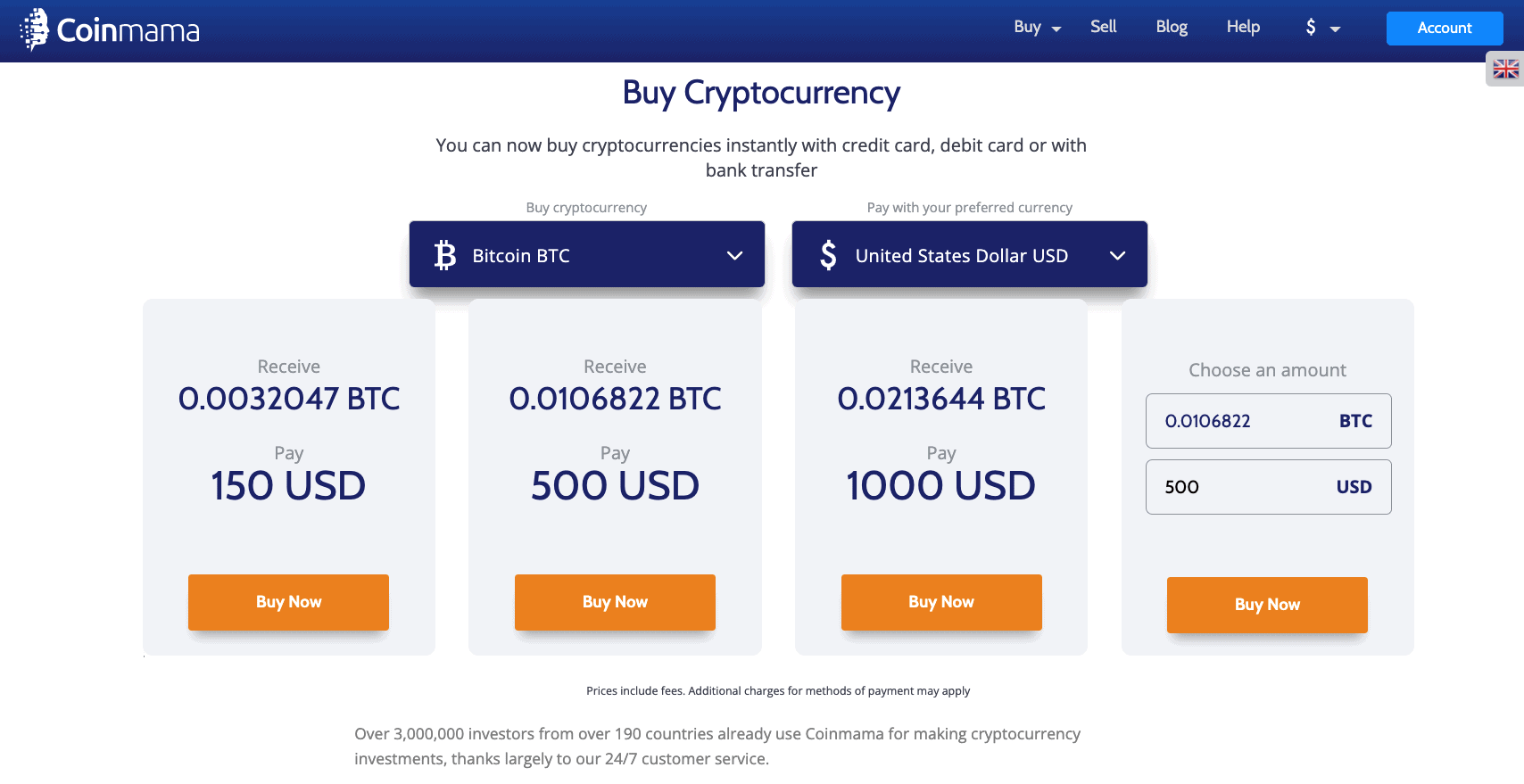

Best for Speed & Ease: Coinmama Cryptocurrency Marketplace

Coinmama is perfect for those who want to buy cryptocurrency instantly and easily, with no pre-funding of the account, and coins going straight to your personal wallet. Selling crypto is also fast and simple, even if you bought it on a different exchange, and your payment goes direct to your bank account. Coinmama is safe, because it never holds users' funds nor does it store any payment details. Users always have complete control of their crypto assets and fiat funds.

Coinmama does have a wide spread on top of their high fees (from 3.90%) and they only have a limited range of 15 different cryptocurrencies. Coinmama makes it onto this list because of their speed and ease of use.

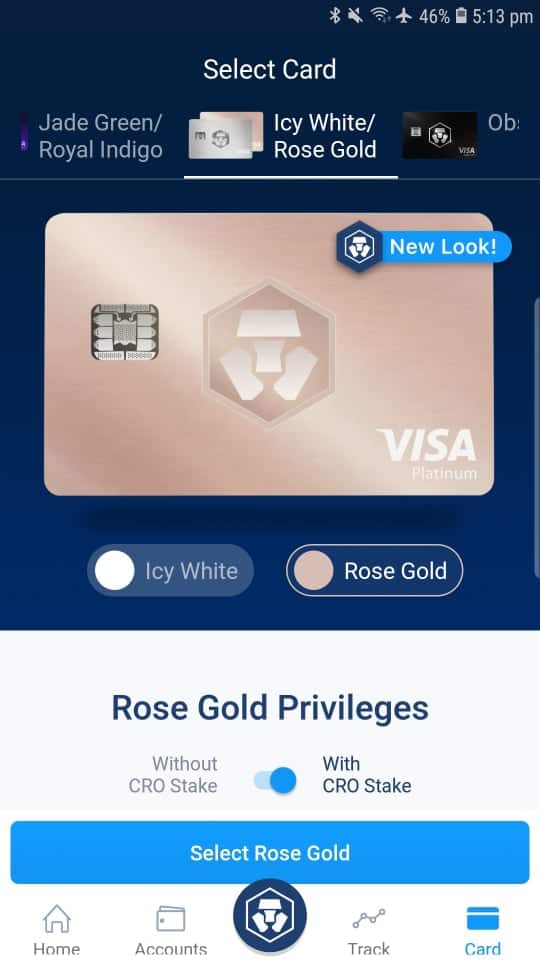

Best for Staking: Crypto.com App and Exchange

Crypto.com is an excellent crypto platform with its desktop exchange and the mobile app offering over 250+ different cryptocurrencies, with the option to stake over 40+ coins. Crypto.com users can enjoy up to 14.5% interest on coins they stake. Staking periods can be locked for 1 month, 3 months, or flexible, and the amount of CRO coins you have staked will affect how much interest you receive on your other staked coins.

CRO is Crypto.com's own coin, and it has plenty of benefits that make it a worthy coin to stake. If you stake CRO on the desktop exchange, you receive 10% APR interest paid daily, CRO rebate when you pay trading fees with CRO, and cashback when you use Crypto.com Pay. If you stake CRO on the mobile app, you receive up to 12% APR, a premium metal Visa card, where you receive up to 5% cashback on purchases (paid in CRO), rebates on subscriptions (Netflix, Spotify) and bookings (Expedia, Airbnb), and better APR in Crypto Credit and Crypto Earn.

Related articles: Crypto.com vs Coinbase

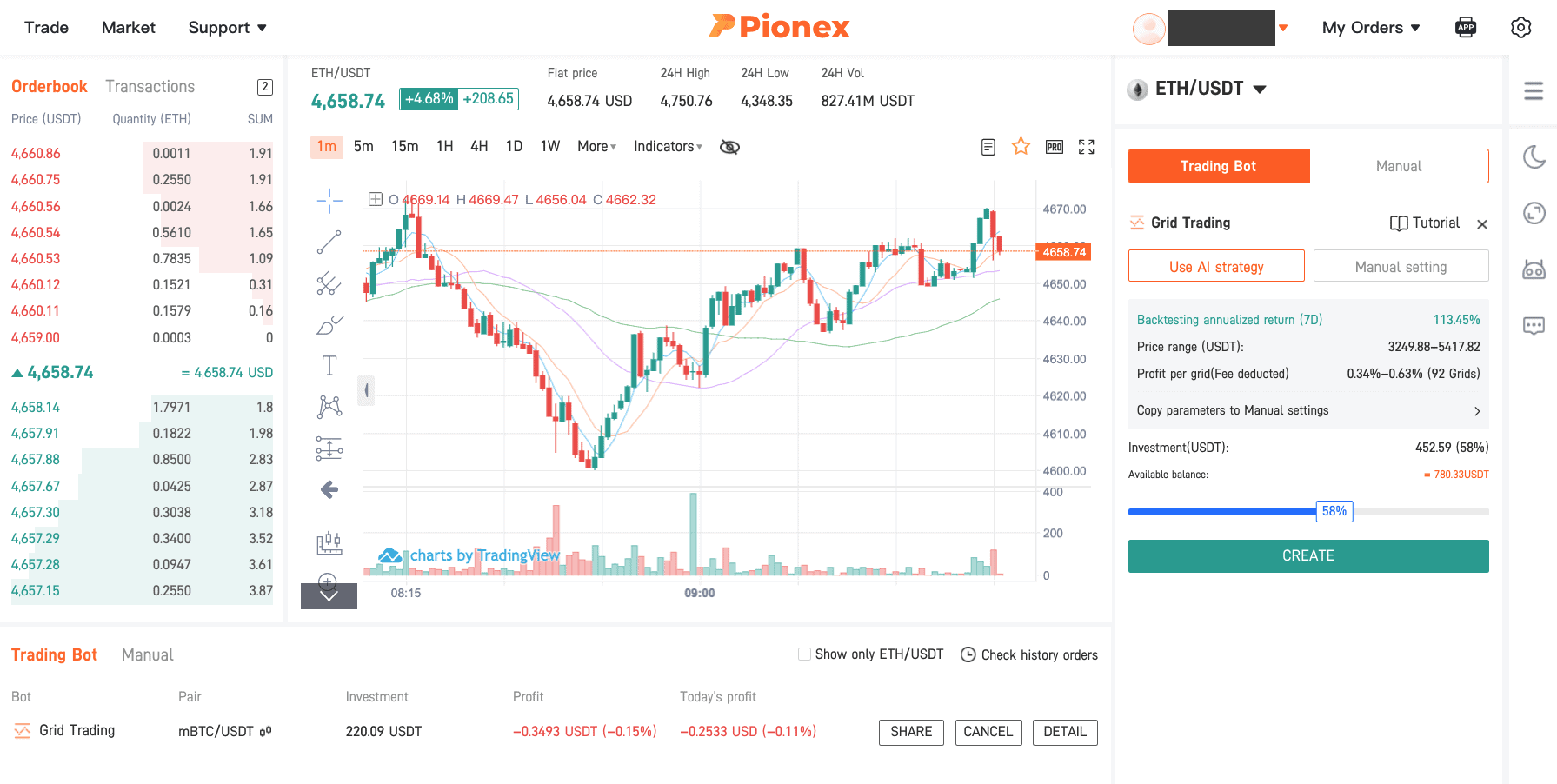

Free Trading Bots & Low Fees: Pionex Crypto Platform

Pionex is one of the newer cryptocurrency trading platforms, established in 2019. It focuses heavily on automated trading, with 16 free built-in trading bots. This allows you to continually make trades whether you are asleep or away from your computer, based on certain parameters set by the bots. Pionex boasts that you can receive up to 270% APY when you trade using their bots. Pionex's bots are simple to use, with detailed tutorials to explain how each bot works, and what each one is best used for. If you prefer to trade manually, that is also an option for you.

Pionex's trading fees are the lowest you can find on the market, at just 0.05% per trade, whether you are a maker or a taker. Your trades will be filled quickly as Pionex aggregates liquidity from Binance and Huobi Global. US residents can trust Pionex, as it holds an approved Money Services Business license from FinCEN.

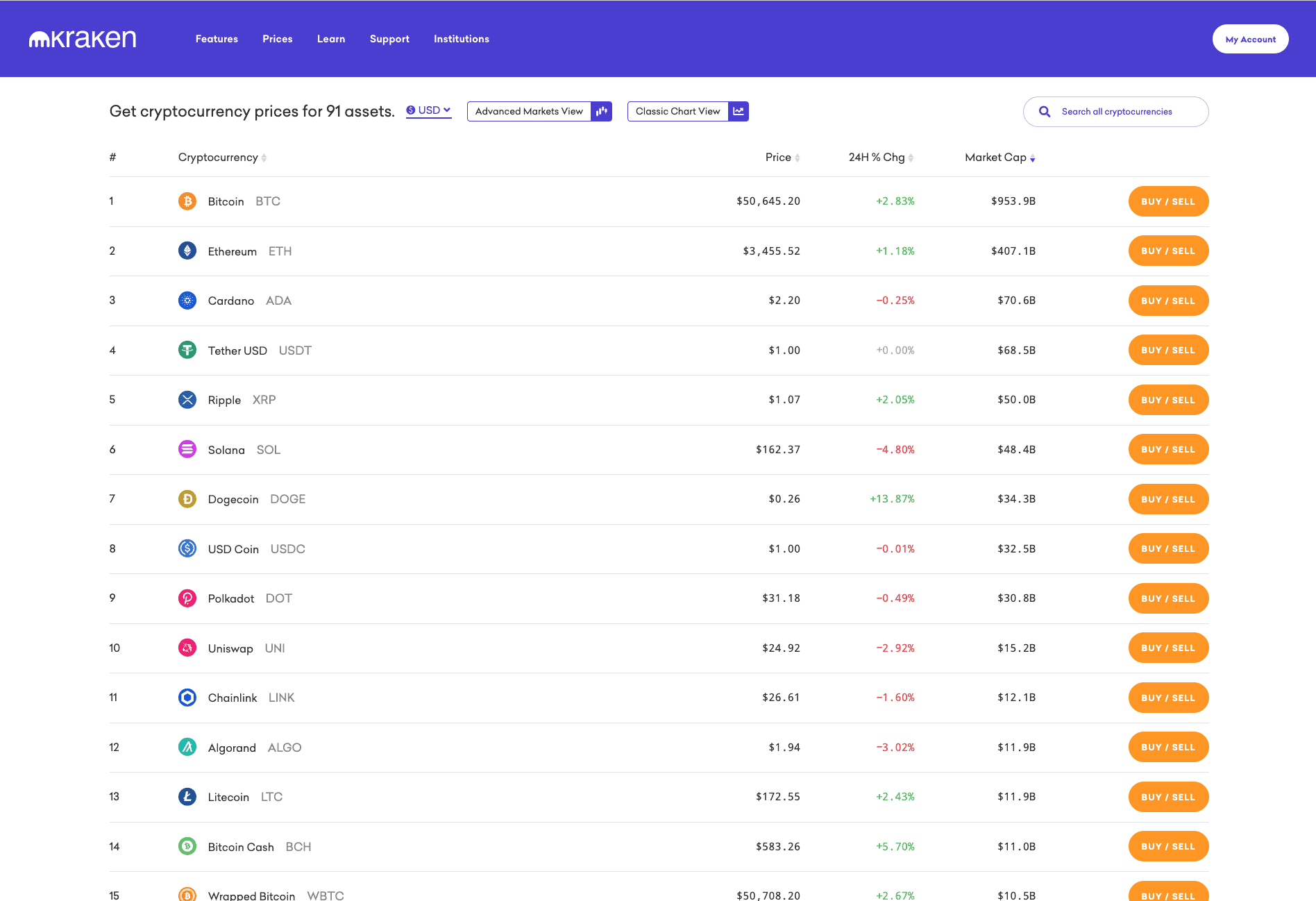

Best for Low Fees: Kraken Cryptocurrency Exchange

Kraken is a US based cryptocurrency spot exchange that also offers margin trading and futures contracts. The low fees, excellent security measures and additional features, like staking and forex trading have made it one of the most popular exchanges in the world over the last 10 years.

Kraken is also very easy for beginners to use, with a simple interface, and 24/7 live chat available in case you ever need assistance. Kraken offers more than 185+ cryptocurrencies, and you can easily access this exchange via your mobile or desktop, making it extremely convenient t ouse.

Related articles: Kraken vs Coinbase, Kraken vs Gemini, Kraken vs KuCoin

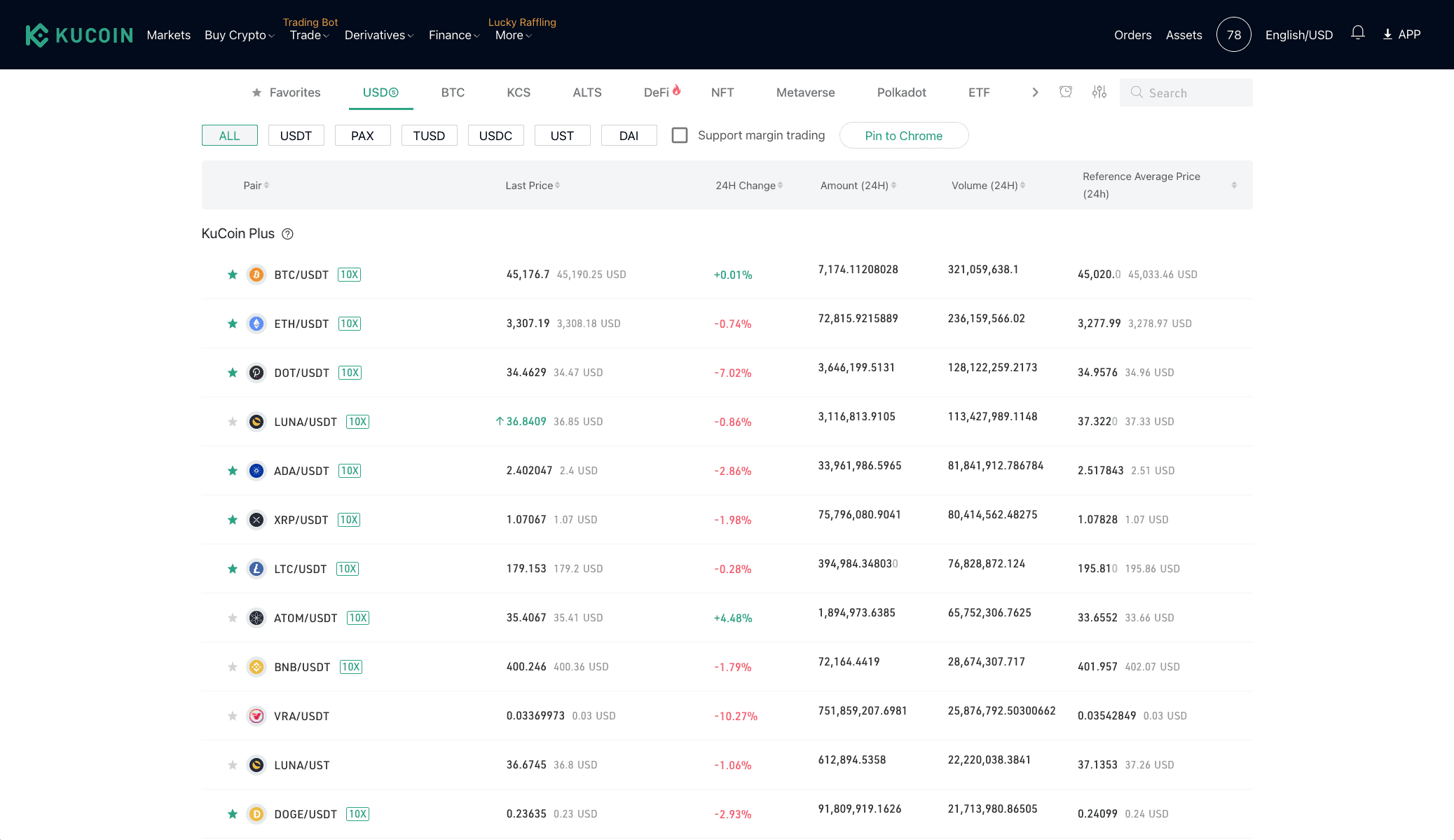

Best for Altcoins: KuCoin Cryptocurrency Exchange

KuCoin is well-known for its exceptionally wide range of cryptocurrencies (over 700+ altcoins) and extremely competitive trading fees of just 0.1%. If you pay with KCS (KuCoin's own coin) you also receive 20% discount on your trading fees.

KuCoin also offers plenty of features that any experienced crypto trader will enjoy. Margin trading, spot trading, P2P marketplace, futures trading, crypto lending, and staking are all supported on this exchange. Read our full review to learn more about KuCoin.

Related articles: KuCoin vs Kraken, KuCoin vs Coinbase, KuCoin vs Binance

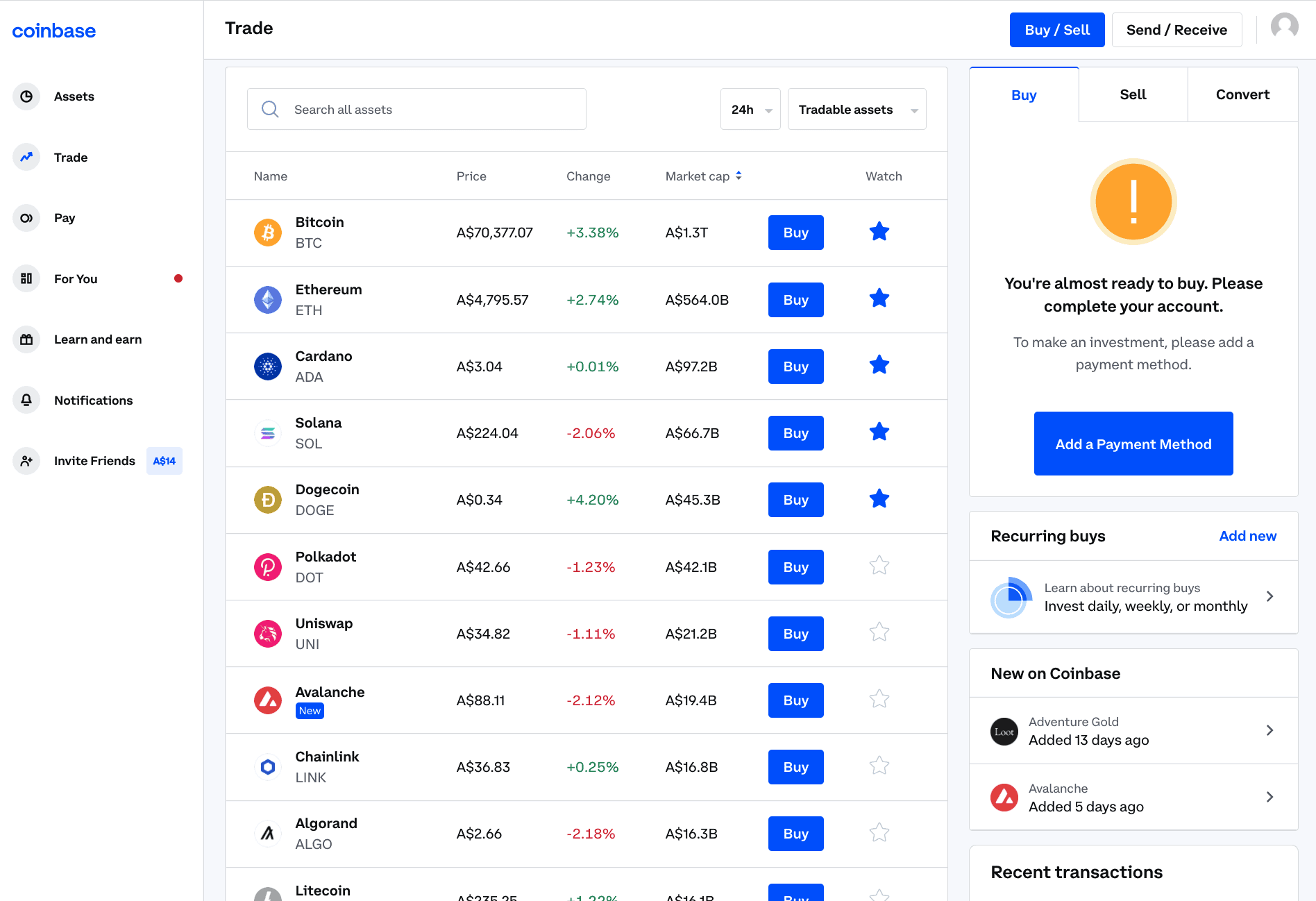

Runner-up for Beginners: Coinbase Digital Currency Exchange

Coinbase is the largest cryptocurrency exchange in the USA, and is popular around the world. The exchange has over 110 million users worldwide, and offers access to over 160+ cryptocurrencies.

The main reason Coinbase is so widely used is the user-friendly nature of the platform. It has a basic layout, simple registration, various deposit methods, and crime insurance cover against cybersecurity breaches.

Buying and selling crypto is extremely straightforward, with a simple menu, and large buttons next to each cryptocurrency. We have heard from complete beginners who have managed to create an account on Coinbase and buy crypto in under 5 minutes, with absolutely no prior knowledge of cryptocurrency. This goes to show how much Coinbase caters to beginners.

One disadvantage of Coinbase is that the fees for buying crypto are above the industry-average, but in return you receive benefits such as ease of use, trust in the USA’s largest exchange, multi-layered security, and crime insurance cover.

Related articles: Coinbase vs Gemini, Coinbase vs Kraken, Coinbase vs KuCoin

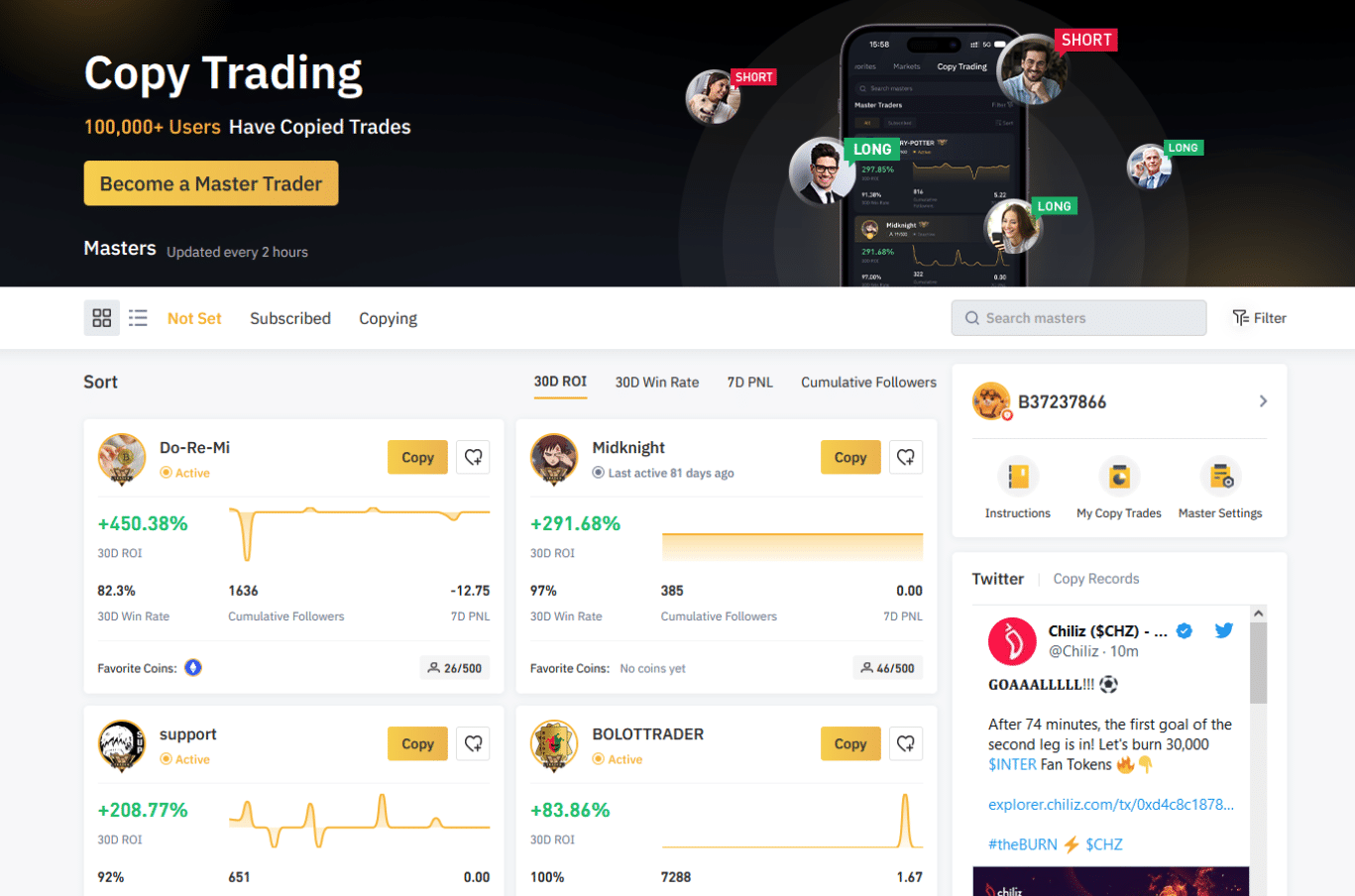

Best for Leverage Trading: BYDFi Crypto Exchange

BYDFi is the best crypto exchange for those who are interested in leverage trading, as it offers the highest levels of leverage, at 200x, when trading futures. Most other crypto trading platforms only offer a maximum of 100x or 125x, but BYDFi goes way beyond the competition. This gives traders the opportunity to maximize profits and trade with more flexbility.

Besides leverage trading, BYDFi also offers many other trading options, such as spot trading, with more than 400+ coins, a demo account so you can practise all your trading strategies risk-free, and even Copy Trading. Copy Trading is where you follow a successful trader on BYDFi, and every time they place an order or make a trade, BYDFi will automatically make the same trade for you on your account, even when you are offline or asleep.

BYDFi also offers two separate user interfaces to cater for beginners and experienced traders. The 'Classic' UI is perfectly suited for newcomers, with its simplified design. Necessary information is still displayed, but arranged in a less distracting manner to cater for newbies. The 'Advanced' UI provides users with a huge range of technical indicators, charting options, and tools, to determine the best time to place trades.

If you are interested in finding out more about BYDFi, read my full review here, or you can visit the official BYDFi website here.

Comparison Table of the Best Crypto Exchanges in the USA

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

How to Choose a Cryptocurrency Exchange

There are hundreds of different exchanges to choose from, each with their own set of advantages and disadvantages. How do you find the best cryptocurrency exchange for your needs? The best place to start is by researching as many different options as you can, learning about the features that each offers, and comparing the pros and cons of each one. When comparing crypto exchanges, it’s a good idea to compare the following factors:

Getting started can be confusing if you are new to crypto, while on the other hand, more experienced traders may want a platform that offers more advanced features.

Consider how you want to deposit money to the exchange and make sure that your preferred payment method is available. Most exchanges accept popular options like credit and debit cards or PayPal.

Consider whether you want to trade fiat-to-crypto, crypto-to-crypto, or a combination of both.

How much is it going to cost you to buy and sell crypto from the beginning to the end of the process on the platform? Remember to consider any fees associated with the payment method you plan to use, exchange rates, and any discounts you might be entitled to.

Be aware of any deposit and withdrawal limits that you may be subjected to when using the exchange. Minimum and maximum limits may apply.

Do you want to trade on a web browser, or do you prefer the option to trade from a mobile app? How easy will it be for you to access your exchange account wherever you are?

Does the exchange offer any discounts or rewards for those who meet certain guidelines, such as keeping up a certain trade volume each month?

Compare cryptocurrency exchange rates across a variety of different exchanges - you may be surprised to see just how much they can fluctuate.

The higher the liquidity of the exchange, the easier and faster it will be for you to complete trades. Larger crypto exchanges tend to have high liquidity levels.

Most platforms will require you to verify your identity before allowing you to begin trading. Are you happy to give out this information or would you prefer to use an anonymous platform?

When you deposit money into or withdraw money from the exchange, how long can you expect to wait for your transaction to complete?

Security should be a top priority when choosing a crypto exchange. Platforms without a range of high-security features such as two-factor authentication, strong account verification processes, 24/7 security monitoring, and offline secure storage for customer funds leave you vulnerable to hackers and fraudsters.

The crypto industry is still quite lightly regulated, and how an exchange is regulated will depend on where it is based. In the USA, crypto exchange operators must be registered with FinCEN and meet compliance and reporting obligations for anti-money laundering and counter-terrorism financing.

What is the customer support like on the exchange? Is there Live Chat support? Is a customer service team available at all times? How responsive and helpful are customer service agents?

Overall, you should look for an exchange that has a strong reputation for being reliable and secure. Read independent reviews and find out about as many user experiences as possible - both positive and negative - to find out what the exchange is doing well and where it could do better.

How to Use a Cryptocurrency Exchange

1. Buying Cryptocurrency with Fiat Currency

Imagine that you have $500USD available to buy Bitcoin with. Follow these steps:

- Compare and research crypto exchanges to find one that’s the right choice for you.

- Register and potentially verify your account on the platform, including providing any proof of ID and personal details required.

- Head to the ‘Buy’ screen once you’re set up.

- Select Bitcoin as the cryptocurrency you plan to purchase.

- Select your payment currency (USD in this case) and specify $500 as the amount that you want to spend.

- Choose your preferred payment method.

- Enter your payment details.

- Review the full details of your transaction. Check the amount of BTC that you’re purchasing and make sure that you are aware of any fees that apply.

- Click ‘Buy BTC’ if you are happy to proceed.

- The BTC will be deposited into your exchange wallet, or another address nominated by you once the transaction has been processed.

Check out our guide on how to buy bitcoin in the US.

How to Pay for Your Cryptocurrency

You need to deposit funds into your crypto exchange account to purchase crypto. Exchanges typically accept a wide range of different deposit methods, which may include:

Bear in mind that the payment methods will differ between exchanges, so it’s a good idea to check that an exchange accepts your preferred method before you sign up.

The Different Types of Cryptocurrency Exchange

The term ‘exchange’ is used for a variety of crypto trading platforms, which include the following:

Best for: Novices and those who want a quick, easy method of buying crypto.

Downsides: Can be more expensive compared to other options and might not always offer as large a cryptocurrency selection.

Cryptocurrency brokers will typically offer the simplest, most convenient option for purchasing digital currency. Using a broker is easy, it is like buying your crypto from a shop. The broker will purchase digital tokens and coins at wholesale rates, add their own margins, and sell them to you.

If you are looking for a quick and easy way into the world of buying and selling crypto, a broker could be the best platform for you. They are designed to be easy for anyone to use and you can make payments with your credit or debit card.

Is it Safe to Store Your Cryptocurrency on an Exchange?

Most cryptocurrency exchanges will provide you with a digital wallet to store your crypto when you open an account. It is possible to leave your crypto stored on the exchange, but there is a risk of you losing the funds if the site is hacked. Since the crypto exchange controls the private key to that wallet, you don't have total control of your digital assets.

A safer way to store your crypto after purchasing it from an exchange, is to transfer it to a personal wallet, either a hot wallet app, or a cold hardware wallet. Some crypto exchanges will require you to have your own wallet at the time of purchase, and the coins you purchase are sent directly to that wallet address.

Next Steps

There are hundreds of different crypto exchanges to choose from and not all of them are created equal. Similarly, individual crypto traders and investors will have different needs. This is why it’s essential to research the best exchange option for your personal needs, as the best exchange for one person might be a terrible choice for another. Check out reviews, compare features, fees, pros and cons of each exchange and determine how well they align with your preferences and requirements.

Frequently Asked Questions

Although laws and guidelines are gradually being implemented to protect consumers against fraud in this industry, it’s worth bearing in mind that plenty of dodgy exchange operators still exist. The best way to avoid scams is to research exchanges and ensure that they are reputable before signing up.

No, the cryptocurrencies available can differ greatly from one exchange to the next. Some platforms will only support as few as ten coins while others offer over 300. If you have a list of coins that you are interested in, it is best to research the exchange first to check that they are supported.

Yes, there are exchanges that support leverage trading. However, the USA has strict regulations regarding leverage trading, therefore it is usually not available to US citizens.

Yes you can trade in large amounts, and you may be entitled to trading fee discounts. It is worth considering using an OTC (over-the-counter) service to help you facilitate large crypto trades and avoid slippage.

In some countries, crypto exchanges are subject to strict regulations concerning counter-terrorism financing and anti-money laundering. Gathering certain details about customers is required in order to comply with these regulations.

You can use a site like CoinMarketCap that will show you the 24-hour trading volume for various crypto exchanges.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our privacy policy click here.