Gemini claims to be the finest next-generation cryptocurrency exchange that adheres to all practices and regulations required by the law. They strive to comply with the highest level of fiduciary obligations, banking compliance standards, and capital reserve requirements. This is probably one of the main reasons why the exchange is trusted by millions of traders and investors from the United States and over 60 other jurisdictions globally. Gemini aims to provide their users with a safe, secure, elegant, and hassle-free crypto buying, selling, trading, and holding experience.

To take things to an even further level, the exchange introduced The Gemini Credit Card™, which certainly changed the perspective of how you get premium rewards with your daily spending. If you are looking for a credit card that would reward you in cryptocurrencies rather than the traditional cash back, the Gemini credit card is perfect for you. With its almost free transactions and cheaper fee structure, it will enable you to shop anywhere you want and get instant crypto rewards deposited into your Gemini account. Read this Gemini credit card review and see how it actually works.

Gemini Credit Card: A few things to keep in mind!

As it is a credit card, the Gemini credit card does not work like a debit card where you would be spending your cryptocurrencies held in your Gemini account for your everyday needs. You will have to pay the exchange back at the end of the period by suitable means or as per your preferences for what you have spent over the period. Only the rewards you will get will be in cryptocurrencies, which certainly are rare and can be beneficial in different ways. And of course, Gemini considers your credit score before issuing anyone their credit card, and you must be eligible to get one.

As of now, the Gemini credit card is only available for US residents. They might expand their services in the future, but they do not have any plans of doing so as of now. The Gemini credit card is a physical as well as a virtual credit card, and you can use either depending on where you are shopping. To order one, head to their credit card section and get it delivered to your doorstep.

Key features and advantages of Gemini Credit Card

If you’ve grown tired of using credit cards offering the same 1% or 2% cash backs on specific types of transactions, you’ll find the Gemini credit card a refreshing change. Now you can enjoy free international transactions and no-fee conversions with your Gemini credit card, making it significantly cheaper for you to shop all over the world. With the best interest rates, customizable cards, and countless other features, your experience with Gemini credit cards can be exceptional, affordable, and cheap.

But what does the credit card offered by Gemini actually come with? Let’s take a look at their key features and see what the advantages of using them are.

Negatives and disadvantages of Gemini Credit Card

Gemini credit cards have a few negatives that I think should be addressed by the exchange. Take a look below to find out where Gemini credit cards are lacking.

A brief look into the benefits of Gemini Credit Card

Let’s have a closer look at what is being offered by Gemini credit card and if you should actually get one. Make sure to keep all the aspects mentioned below in mind before you go and order one for yourself.

Use your Gemini credit card globally with Mastercard benefits: The Gemini credit card is a Mastercard. It means that you can use your Gemini credit card all over the world with the merchants that accept Mastercards. Of course, Mastercard comes with some benefits that can help you protect your purchases and avoid unauthorized transactions.

Mastercard is also popular for its partnerships with different brands and stores, and you can get exclusive rewards and cash backs when shopping with those specific brands.

Claim limited-time rewards and promotional bonuses: If you are interested in rewards and promotional bonuses, Gemini can certainly help you out. The exchange introduces different offers and bonuses for their existing credit card holders and the new ones who are interested in getting one for themselves. For instance, Gemini is offering a limited-time animated NFT to all of their cardholders who spend over $1,500 in their first month of activating the card.

If you miss this offer, don’t worry, as it is very likely that the platform will introduce another reward in the coming months.

Get instantly rewarded in cryptocurrencies: Instead of rewarding their users in fiat currencies, Gemini rewards their users in cryptocurrencies in order to give them a chance to increase the value of their rewards exponentially. You can get rewarded in BTC as well as over 60 other cryptocurrencies that are available on the exchange. You can simply select what crypto asset you want to be rewarded in, and Gemini will take care of the rest.

You won’t have to wait for your rewards for days to be deposited in your account. As soon as you initiate a transaction or swipe your card at a store, your rewards will be credited instantly to your Gemini account.

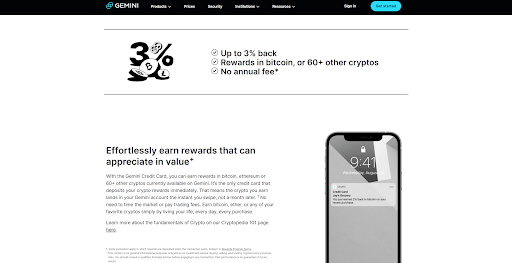

Up to 3% cash back rewards on different transactions: Gemini rewards their users with up to 3% cashback depending on the type of your transaction. If you are dining out and using your Gemini credit card, you will be rewarded 3% cashback on your selected crypto asset. If you are shopping for groceries, you will be rewarded with 2% cashback. As for any other types of transactions, you will be rewarded a fixed 1% cashback with your preferred crypto asset.

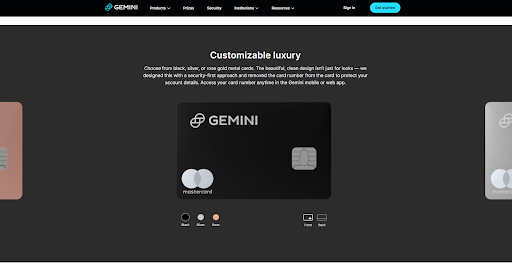

Highly customizable card: Customization might not be a very big deal for many people, but there are users who want everything to be perfect and as per their preferences. Gemini allows users to customize their luxurious Gemini credit card just as they want.

Gemini credit cards are not made out of polymer or plastic; they are highly durable metal cards. They are available in rose gold, silver, and black colors. To keep it simple, clean, sleek, and protected, the exchange does not print the card number on the card. This makes it secure and look professional and beautiful.

No annual, transaction, or reward-claiming fee: You might find many crypto exchanges offering credit or debit cards to their users with eye-catching rewards, but there is a catch many people don’t consider. Those exchanges charge a hefty annual card fee and even a fee on every single transaction through the card. That is not the case with Gemini credit cards.

Gemini does not charge their users any annual fee or transaction fee. You also do not have to pay anything for the rewards you get for initiating transactions through your card. The only fees that Gemini charges from their users are the standard variable APR, along with the late payment fees, which are certainly up to you.

World-class security and protection: Gemini is one of the very few exchanges that pride themselves on their security. The platform was started when the founders struggled to find a crypto exchange where they could manage their portfolio. So, they decided to create their own with the primary focus on security, safety, and protection. Since then, their employees and the complete workforce have been building a trusted and innovative security system to protect users.

When the same security system is combined with the ultimate protection offered by Mastercard, you can expect your Gemini credit card to be completely safe and secure to use anywhere you want. Also, Gemini provides real-time alerts and notifications regarding transactions.

Access virtual cards and have full control with mobile applications: Gemini mobile applications are available for Android and iOS devices, and you can easily download them from the respective application stores of your mobile device. These give you full control over your credit cards and how you use them. You can even disable your card whenever you want through the app in case you do not want to use it temporarily.

If you want to be extra careful with your online purchases, you can also get an absolutely free virtual card from the app and use it on the Internet. You can also keep track of all of your transactions and rewards through the app and see where you have spent the money and how much you have gotten back.

24/7 customer support: For problems regarding your Gemini credit card or any queries, you can get in touch with the Gemini support team, and they will get back to you immediately. The platform has also created a separate help center that covers all the basic questions and problems, and there is an AI bot that generates answers based on your questions.

Things I don’t like about Gemini Credit Card

There are a few things about Gemini credit cards that I do not really like. If you are planning to apply for one, make sure to take a look below and see what problems you might face.

Only available for US residents: If you are living in the US, you can skip this part and enjoy using your Gemini credit card. But if you live outside of the US, you won’t be able to get one for yourself as Gemini currently only supports US residents. The exchange itself is available globally, covering over 50 jurisdictions, but their credit card is restricted to the US only.

There have also been no updates regarding their plans to expand their credit card service for users from other countries. So, the only thing you can do if you are outside of the US is to get in touch with their support team and hope for the best.

An excellent credit score is required: No credit card company will provide you a credit card unless they examine your credit score and check out your history. With Gemini, your credit score needs to be excellent, which can be quite worrying for some users. Not everyone has a good or excellent credit score or has over 650 points, which are the basic requirements to get a Gemini credit card. What the exchange can do is ease up the requirements and let the users with average credit scores get their credit cards. Otherwise, they will be holding back a considerable number of users from using their services.

Gemini Credit Card Fees

Gemini Credit Card Ordering Fee

You can get your Gemini credit card for free. Simply apply for one, customize it, and have it delivered to your doorstep.

Gemini Credit Card Transaction Fee

Gemini does not charge their users any type of transaction fee. With other credit cards, you have to pay a certain percentage on any transaction, Gemini has kept their system fee-less. Also, there is no foreign transaction fee.

Gemini Credit Card Annual Fee

There is no annual fee on Gemini credit cards.

The interest rate on Gemini Credit Cards

The platform charges a variable APR from their users depending on their creditworthiness. You can expect to pay anywhere between 15.99% and 26.99% APR on your purchases.

Gemini Credit Card Late Payment and Returned Payment Fee

The late payment fee for Gemini credit card holders, can be up to $20. As for the returned payments, you can be charged up to $35.

Pros and Cons of The Gemini Credit Card

- Internationally usable with Mastercard support

- Get instant cryptocurrency rewards

- Up to 3% cashback

- Customize your card just as you want

- Efficient mobile applications with virtual card support

- Only available for the US users

- A high credit score is required

Conclusion

In an industry where security is the primary concern for millions of users, Gemini made sure to offer perfection and flawlessness in their credit card. They opted for Mastercard, which is already known for its seamless security and ID theft protection. It combines with the innovative security features of Gemini, making sure that all ends are safe and protected.

You have already seen how affordable it can actually be to use Gemini credit cards. Customization, full control through the app, virtual cards, and premium rewards are some of the things that you cannot ignore. Just make sure that your credit score is good enough before you apply for one.

If you are curious to see other crypto credit card options, read this article on the best crypto credit/debit cards.

Frequently Asked Questions

A- Gemini credit cards are only available for users residing in the US. The exchange might expand their services later on to other countries, but there seem to be no plans for that as of now.

A- Gemini credit card is absolutely free to get. There are even no annual or transaction charges. You just have to pay standard variable APR for your purchases.

A- Yes, Gemini credit cards can be used online with different merchants. You can also opt for virtual credit cards for internet purchases.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.