What is CoinSpot?

CoinSpot, founded in 2013, stands as one of the longest-standing cryptocurrency exchanges in Australia. Over the past decade, it has solidified its reputation as a highly secure and trustworthy platform. Despite the emergence of competitors like Swyftx and other leading Australian crypto exchanges, CoinSpot maintains its position as the largest and most widely used crypto platform, boasting a user base exceeding 2.5 million Australians.

CoinSpot supports more than 430+ cryptocurrencies, has a crypto debit card, NFT marketplace and a user-friendly interface with 24/7 live chat support. At Marketplace Fairness, we have also secured an exclusive signup offer for our readers: $20 FREE Bitcoin when you register with our link.

My Overall Thoughts on CoinSpot

CoinSpot is one of the best Australian crypto exchanges and is my #1 choice for investors who are after ease-of-use and peace of mind when trading. These are the 3 top reasons I recommend CoinSpot to Aussies:

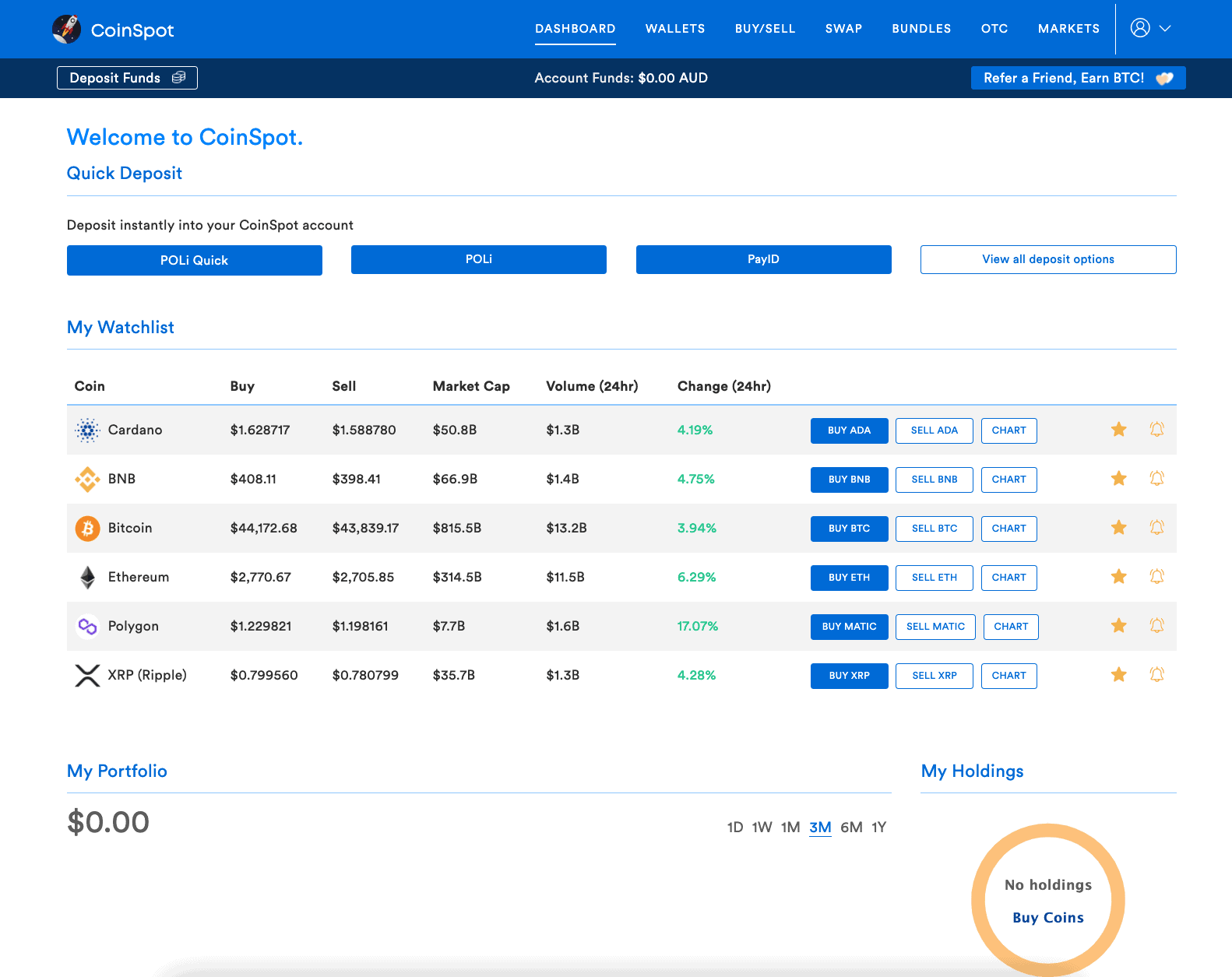

1) CoinSpot is an extremely user-friendly platform that makes it simple for even a complete beginner to buy and sell crypto directly with AUD. The interface is easy to navigate on both the desktop site and mobile app. An excellent feature for any new user is 24/7 Live Chat support with a real person. When you need assistance, the last thing you want is a bot who runs you in circles, or an email ticket where you wait days for a response. CoinSpot also ranked #1 in my real-world customer support test, and you can see the results here.

2) CoinSpot is Australia's most trusted and secure crypto exchange, having undergone the most audits, and is the first Australian exchange to receive the coveted ISO 27001 certification. It is registered with ASIC and AUSTRAC, to prevent money laundering and terrorism financing, and maintains industry best-practice by securing a vast majority of assets in highly secure offline locations. You don't need to worry about CoinSpot losing or stealing your money, or filing for bankruptcy like other exchanges have done in the past.

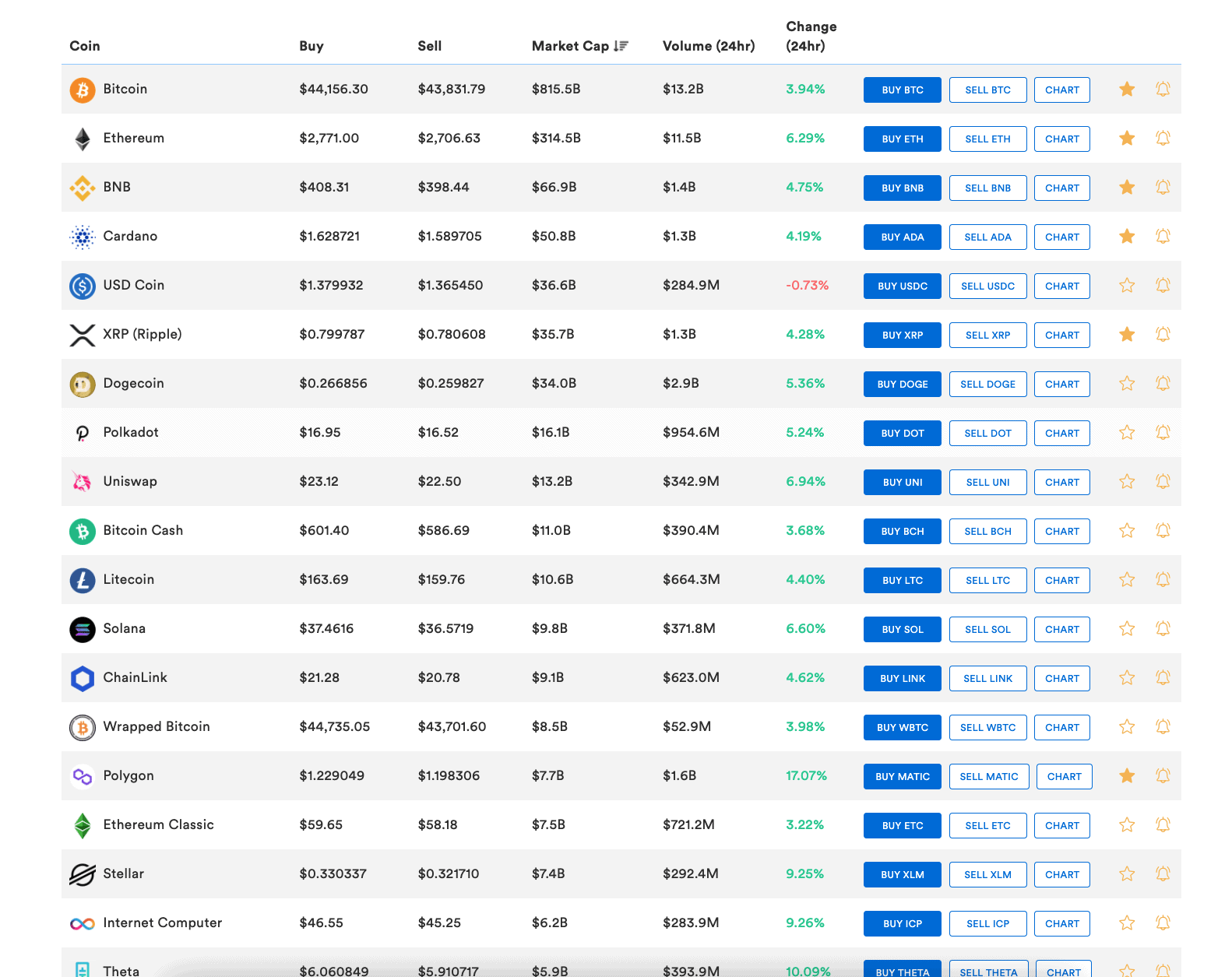

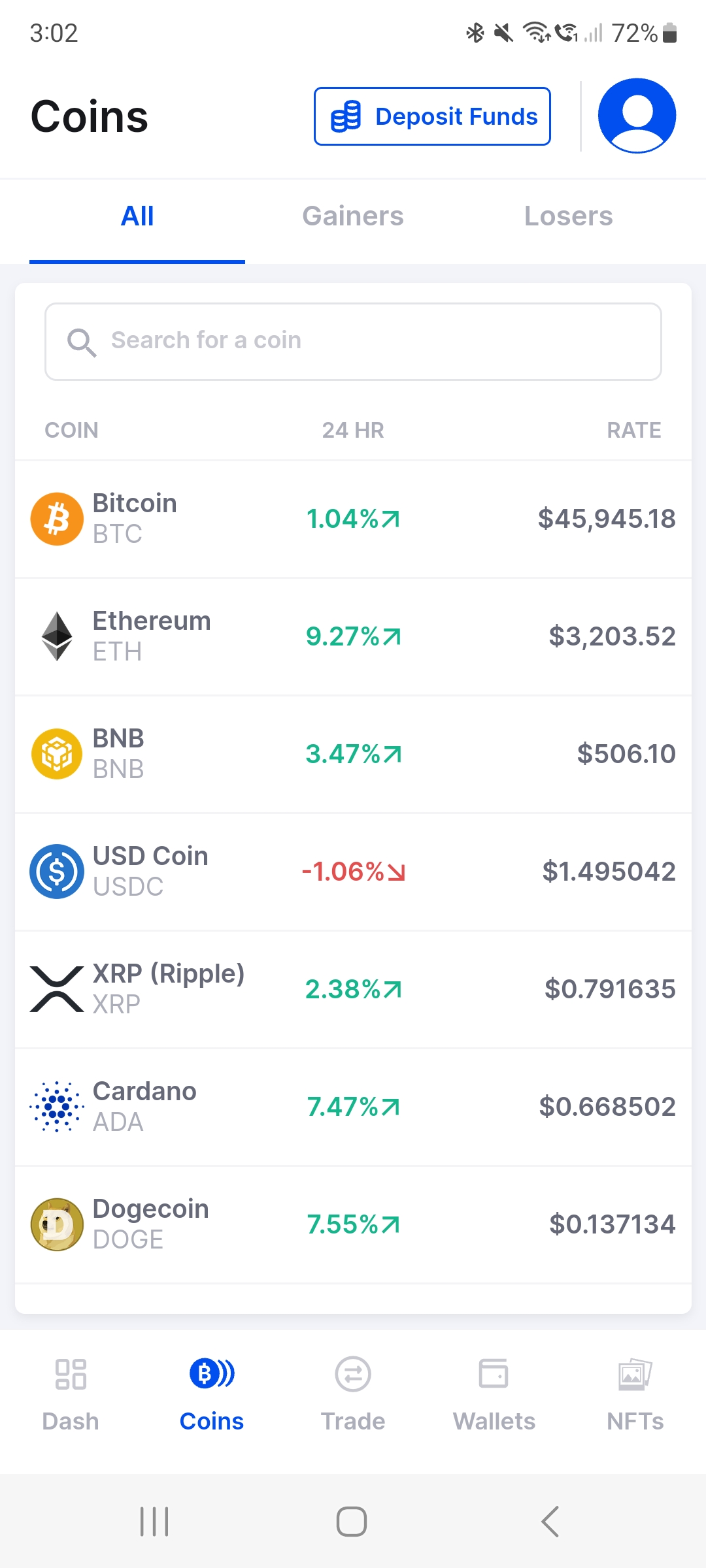

3) CoinSpot's list of over 430+ different cryptocurrencies is one of the widest ranges in Australia. You will find all of the major coins, such as BTC, ETH, LTC, XRP, BNB, DOGE as well as many small altcoins that you may not have even heard of.

CoinSpot's primary focus is to provide a user-friendly experience for new and intermediate cryptocurrency investors, and this has led to some criticism regarding the absence of advanced markets like derivatives trading. If you are an experienced trader seeking derivatives and margin trading options, it is recommended to explore platforms such as Bybit or MEXC.

However, with its reputation as the most trusted and secure exchange in Australia, along with a user base exceeding 2.5 million individuals and access to a 430+ cryptocurrencies, CoinSpot remains one of the top exchanges in the country. Don't forget to sign up using this link to receive $20 Bitcoin for free.

Key Features & Advantages of CoinSpot

Let's take a look at some of the key features that make CoinSpot one of Australia's most popular crypto exchanges:

Negatives & Disadvantages of CoinSpot

CoinSpot is an excellent crypto exchange for Australians, but there are a couple of downsides to consider when deciding if it is the right platform for your needs:

Comparison Table of the Best Crypto Exchanges in Australia

What Services Does CoinSpot Offer?

Given the huge number of cryptocurrency exchanges available in Australia, it can be difficult to evaluate all the options. To simplify the process for you, I've spent hours testing and reviewing CoinSpot and found the key features that distinguish CoinSpot from the competition. Here are the reasons why this exchange stands out as a top choice in 2024:

Buy crypto instantly with AUD: As an Australian exchange, one of CoinSpot's most convenient features is the ability to buy crypto instantly using AUD. Depositing AUD into your CoinSpot account is free and the process of buying crypto is really straightforward. In fact, after registering my CoinSpot account, I managed to buy crypto in under 2 minutes.

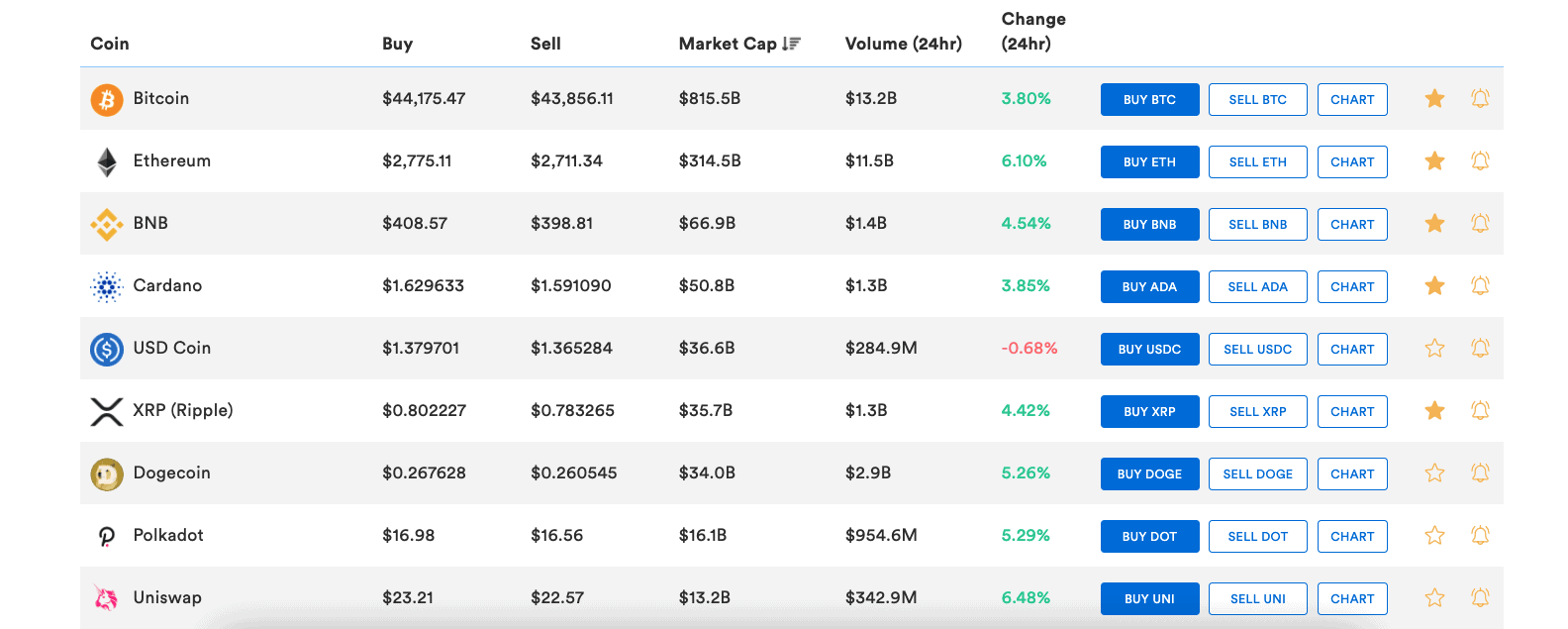

CoinSpot offers the convenience of instant crypto purchases, allowing you to acquire any of the 430+ coins with a simple click of the "Buy" button. Unlike other exchanges where you must engage in market trading and wait for another trader to fulfill your order, CoinSpot operates as a broker, selling cryptocurrencies directly to the user, expediting the transaction process.

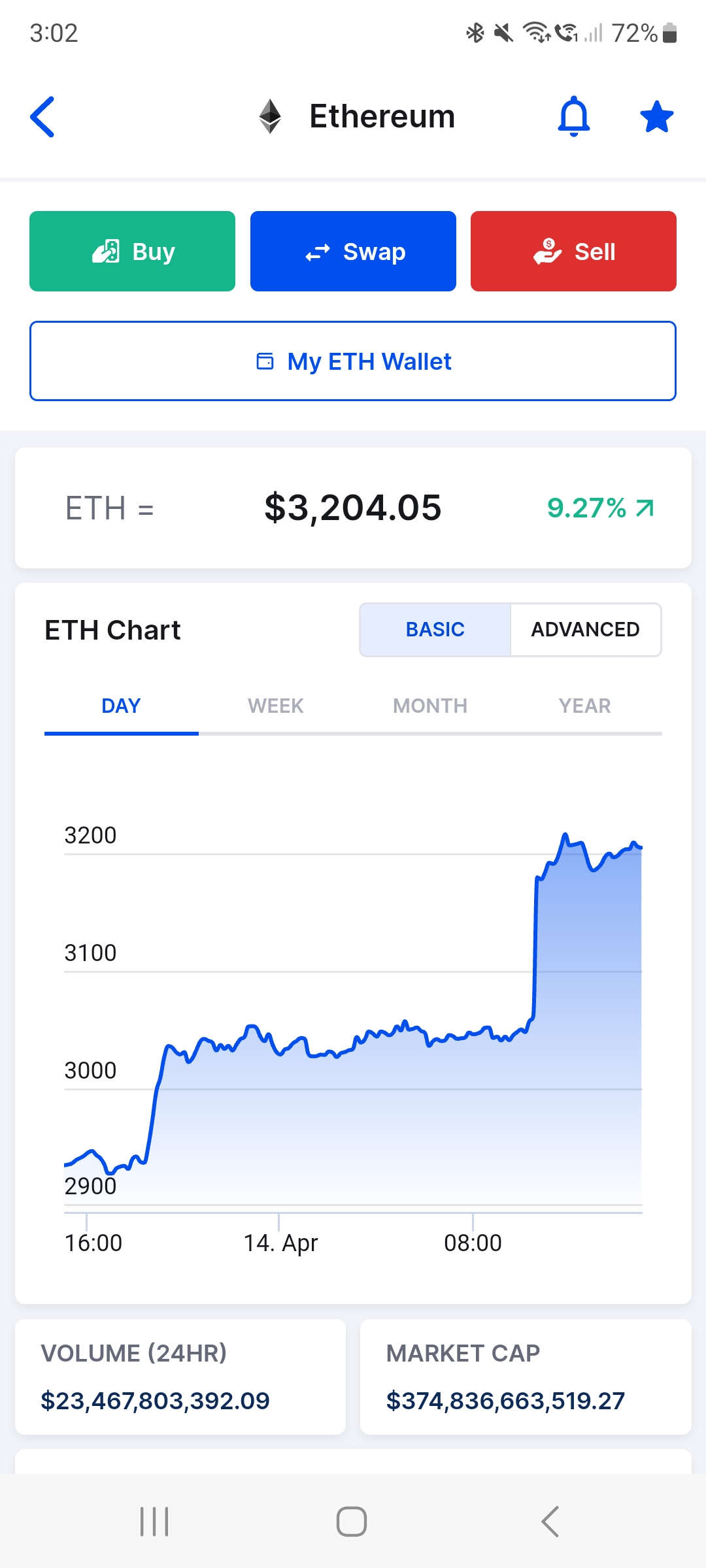

Simple user interface: CoinSpot's user-friendly and intuitive interface makes it really accessible for beginners to the world of cryptocurrency. For experienced crypto traders, the platform offers an additional price chart window that can be conveniently accessed from the Dashboard at all times, facilitating technical analysis. This feature is accessible on both the CoinSpot app and the desktop version.

One of the most appreciated features among CoinSpot users is the ease of buying and selling. The inclusion of hotkeys on the dashboard enables quick and efficient transactions, with the current live price displayed alongside. Additionally, users can scroll down to view their coin portfolio, simplifying the process of tracking the performance of their personal investments.

Over 430+ supported cryptocurrencies: CoinSpot not only provides support for all the major cryptocurrencies, as expected, but it also offers a diverse selection of over 430+ different coins, including many that are not available on other exchanges. If your intention is to only invest in popular coins like BTC, ETH, ADA, and BNB, this might not be of great value to you. However, if you are on the lookout for unique and lesser-known coins, CoinSpot is your best bet. I was pleasantly surprised to discover numerous altcoins I had never heard of while exploring CoinSpot's list of assets.

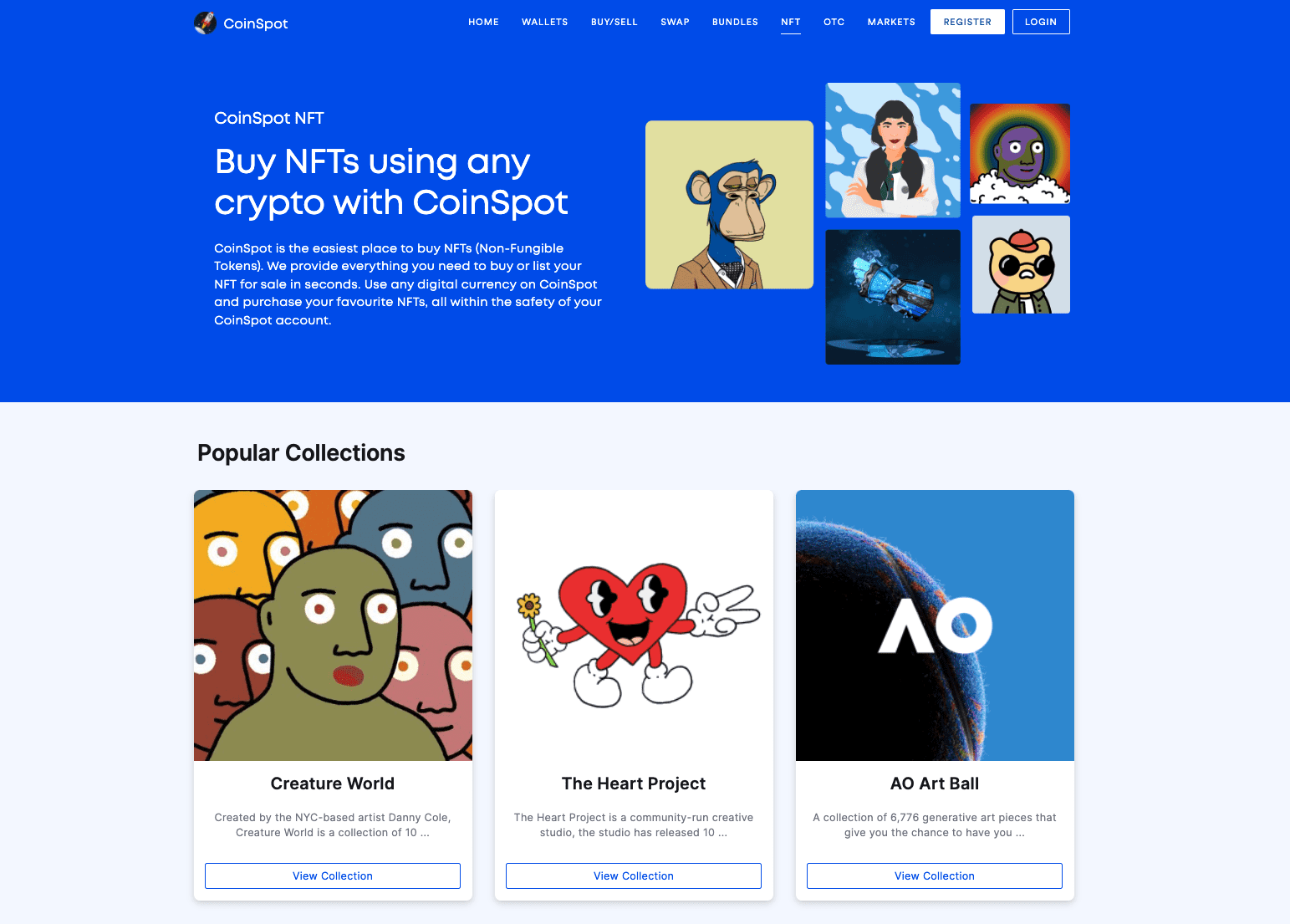

NFT Marketplace: CoinSpot's introduction of an NFT Marketplace on their platform is a highly welcomed addition for the Australian crypto community. While NFTs have gained widespread recognition, it hasn't always been this straightforward to purchase them. Based on my personal experience with NFT purchases, the most common method involves signing up on platforms like OpenSea, linking a wallet, and then acquiring NFTs using ETH exclusively.

However, CoinSpot has significantly streamlined the entire process. You can now purchase NFTs directly from your CoinSpot account, utilising any cryptocurrency of your choice. Furthermore, if you wish to sell an NFT, you can also do so directly through CoinSpot. I personally tested this feature and found the buying and selling process to be exceptionally smooth and user-friendly, akin to acquiring cryptocurrencies from the exchange.

CoinSpot Mastercard: CoinSpot has introduced a complimentary debit card for its users, providing the capability to spend your crypto both online and in physical stores, wherever Mastercard is accepted. The process is as simple as adding the card to your Google Wallet or Apple Pay on your phone. This represents a significant stride towards spending crypto as effortlessly as fiat currencies. I personally tested this card and encountered no issues at any merchants, whether in physical stores or online. For a comprehensive review of the CoinSpot Mastercard, you can read my in-depth article here.

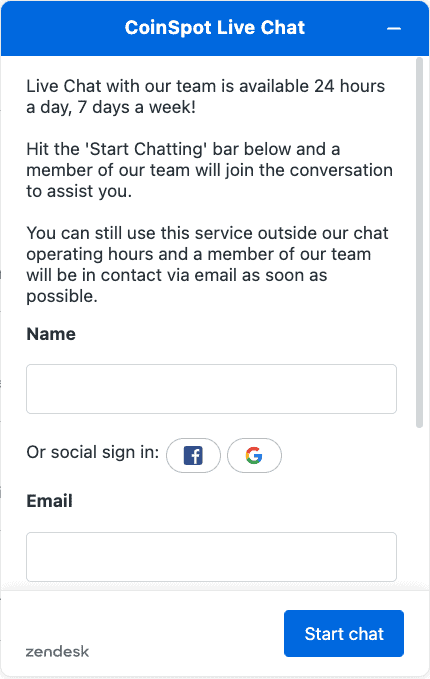

Customer support: Through my extensive experience reviewing cryptocurrency exchanges, I have examined countless platforms, and I consistently find that the most effective means of reaching customer support is through live chat. Emails and ticketed responses typically entail waiting for several days, which can be frustrating, making live chat the preferred option.

CoinSpot stands out in this regard by offering industry-leading 24/7 live chat support. In fact, it was the first Australian crypto exchange to introduce this feature, subsequently inspiring several other exchanges to follow suit. When I personally assessed the responsiveness of CoinSpot's live chat team, I was thoroughly impressed. I was able to engage with a real person within seconds, without the need to navigate through a bot first. There was no waiting queue, and the agent efficiently resolved my query. In fact, CoinSpot placed #1 in my in-depth real-world test on Australian crypto exchanges' customer support. You can read about the results here.

If you require specialised support, you can email the support team, who will respond to your issue once they get to your query.

Additionally, CoinSpot offers a comprehensive information centre with regular articles and tutorials for newcomers and has a FAQ section to assist new investors in buying Bitcoin and other cryptocurrencies.

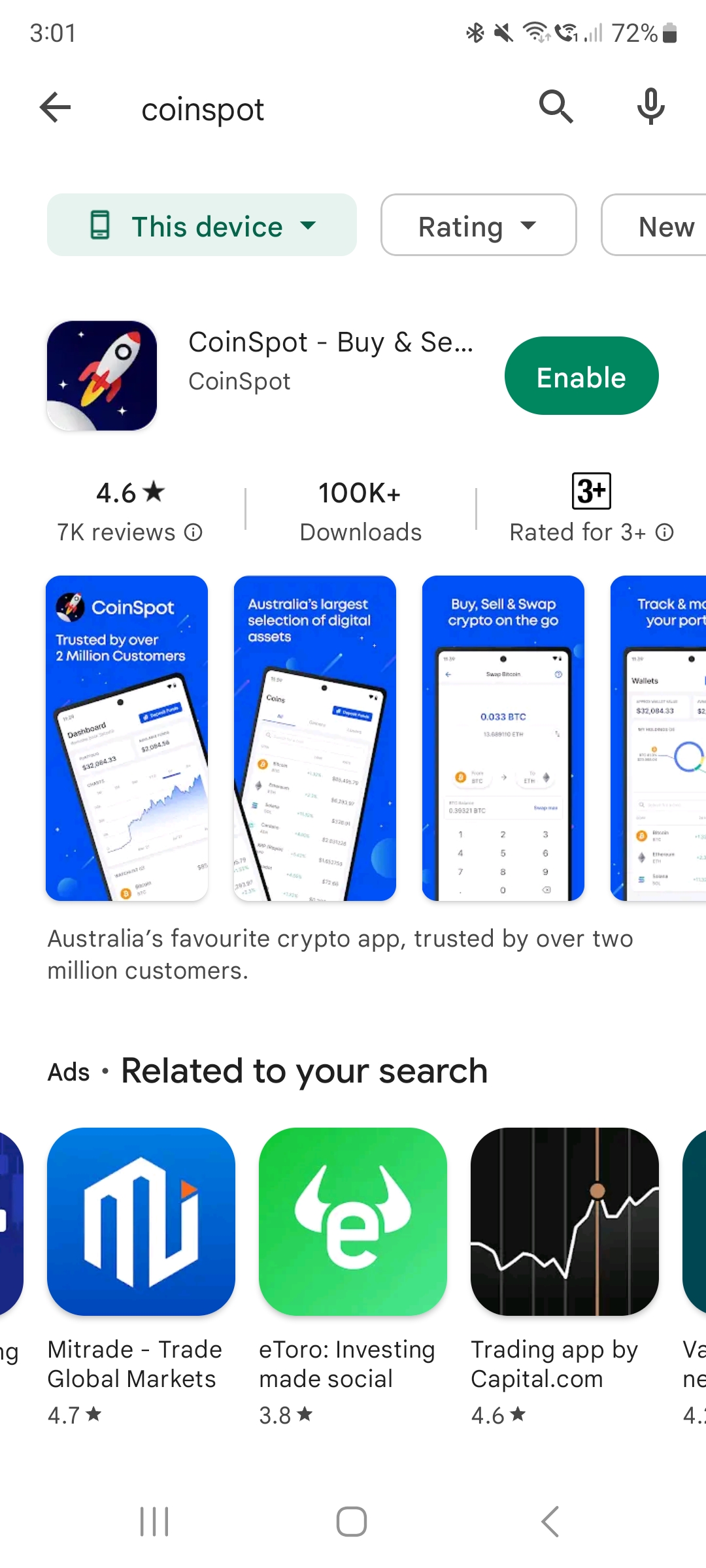

Android and iOS apps: CoinSpot offers a user-friendly mobile app designed for both iOS and Android devices, providing users with the convenience of buying, selling, and trading cryptocurrencies on the go. The CoinSpot app grants users access to their accounts, real-time market data, and seamless management of their cryptocurrency portfolios.

Additionally, the app incorporates essential features such as a built-in cryptocurrency wallet for secure storage, two-factor authentication for heightened security, and an intuitive interface that caters to both novice and seasoned traders. This mobile app serves as a powerful and convenient tool for cryptocurrency enthusiasts, enabling them to efficiently manage their investments while staying informed about the latest market developments regardless of their location.

Security is #1 priority: CoinSpot distinguishes itself as the safest cryptocurrency exchange in Australia, proudly earning the internationally recognised ISO 27001 certification for information security—a pioneering achievement among Australian exchanges. To attain the ISO 27001 standard, mandated by the International Organization for Standardization (ISO), CoinSpot underwent an external audit conducted by SCI Qual International, an accredited JAS-ANZ certification body.

SCI Qual conducted an exhaustive examination of CoinSpot's Information Security Management processes and practices. This encompassed procedures concerning the management of various aspects, including digital asset storage, employee information, contractor details, supplier data, client information, product specifications, operational processes, and intellectual property. These rigorous policies and measures are meticulously implemented to thwart unauthorised access, usage, alteration, or compromise of the organisation's information management systems.

In addition to ISO 27001 certification, CoinSpot adheres to industry best practices by securely storing the vast majority of its assets in highly fortified offline locations, further reinforcing its commitment to safeguarding user assets and data.

As a user, you can take security into your hands and customise your account with Two-Factor Authentication, custom withdrawal restrictions, anti-phishing phrases, geo-lock logins and session timeout settings to suit your needs. To find out more details about the security features of CoinSpot, click here.

Referral program: CoinSpot's referral service gives its customers the opportunity to earn $10 in Bitcoin right after making their very first AUD deposit without any additional trading fees. To get that, all you need to do is share a unique referral code with your friends or family. Once they register a CoinSpot account, get verified and make their first AUD deposit, you will receive your free $10 in Bitcoin.

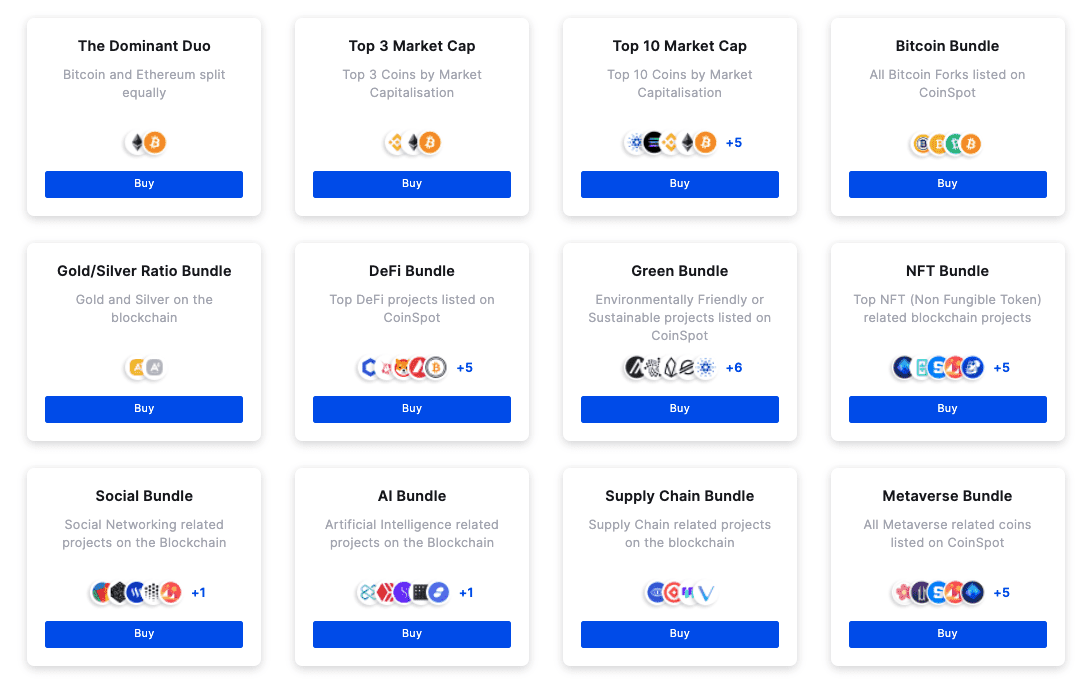

CoinSpot Bundles to diversify your portfolio: The inherent volatility of cryptocurrencies demands careful precautions, including the establishment of price alerts and stop-loss orders. CoinSpot provides a distinctive and highly beneficial service known as CoinSpot Bundles, enabling users to acquire a diverse array of assets in a single transaction. This not only enhances portfolio diversification and risk mitigation but also streamlines the process, reduces transaction fees, and establishes an average cost across a selection of coins, effectively simplifying and optimising the investment experience.

My personal favourite is 'Top Ten Market Cap' which is exactly as it sounds - the top ten biggest coins based on their market capitalisation. I find this to be a good buy because it includes all the popular coins that I like to buy anyway, such as BTC, ETH, BNB, ADA and it spreads out risk to reduce volatility. In the image below, you can see all the Bundles offered by CoinSpot.

What I Don't Like About CoinSpot

Here are a couple of points that could be improved with CoinSpot. Let's have a look and see if they affect your experience or not.

No advanced options such as derivatives or margin trading: Since CoinSpot is built for ease of use, there are no derivatives such as futures trading which are targeted towards experienced traders. If you are a newcomer to crypto this will not be an issue, but if you are a serious trader, you may find CoinSpot lacking in options.

Coinspot Fees

CoinSpot Deposit Fees

CoinSpot offers a range of deposit methods, and the most popular options (PayID and Direct Deposit) are free of charge. Card deposits incur 1.88% fee and cash deposits at a newsagent has a 2.5% deposit fee.

CoinSpot Transaction Fees

There are different transaction fees for CoinSpot, and I'll explain the difference here.

Market Trades: 0.1% fee - With market trades, you set a price that you want to buy or sell your crypto at, and it will be filled when another user wants to meet that order. CoinSpot does not offer all 430+ coins in the market trades, it has 15 options at the time of writing, but they cover most of the major coins. These include BTC, LTC, ETH, XRP, ADA, GAS, NEO and more.

Instant Buy/Sell: 1% fee - There is a set price by CoinSpot for each coin you wish to buy/sell, and you don't need to wait for a buyer somewhere else in Australia to buy your cryptocurrency. CoinSpot will complete that transaction for you right away. The good thing is you don't need to worry about price fluctuations while you wait for your order to be filled, and you can buy/sell all of the 430+ cryptos offered by CoinSpot.

OTC Trades: 0.1% fee - Members who perform high-volume transactions can use the OTC (Over-The-Counter) Trading Desk, which has instant settlement. This is the recommended option for transactions of $50,000 AUD or more.

Advanced Trading Tools: 1% - This is for experienced traders that like to use tools such as Recurring Buy, Take Profit, Stop Loss and Limit Orders.

CoinSwap: 1% - The ability to buy and sell coins with instant liquidity from one coin to any other coin on the platform. There are many unique trade pairs that are not available on most markets.

CoinSpot Withdrawal Fees

CoinSpot's fee structure for withdrawing AUD to an Australian bank account is notably favorable, as there are no associated fees. I personally initiated a withdrawal to my bank account, and I received the funds within a single day. Furthermore, I can confirm that no fees were deducted from the withdrawal, highlighting the cost-efficiency and user-friendly nature of CoinSpot's withdrawal process for AUD transactions.

If you are sending coins to wallets outside CoinSpot there is a standard transaction (mining) fee which is based on the asset and how busy the network is. The fee will be listed on the wallet page. When I transferred Bitcoin from CoinSpot to my Ledger Nano X, I found the fee reasonable.

Pros and Cons of CoinSpot

- Most secure crypto exchange in Australia

- Simple interface for new users

- Over 430+ cryptocurrencies available

- Crypto debit card so you can spend your crypto like cash

- 24/7 support via Help Desk & Live Chat

- NFT Marketplace

- No advanced trading markets such as derivatives

- Credit/debit card deposits incur a fee of 1.88%

CoinSpot Security and Safety

When evaluating cryptocurrency exchanges, prioritising security features is of paramount importance to safeguard your assets and investments. CoinSpot, with its early establishment in the Australian cryptocurrency landscape, has established itself as the most secure platform in the country. A significant testament to its commitment to security is its distinction as the first exchange to receive the ISO 27001 certification. To attain this esteemed standard, in accordance with the International Organisation for Standardisation (ISO) requirements, CoinSpot underwent a comprehensive external audit conducted by SCI Qual International—an accredited JAS-ANZ certification body. This stringent certification process underscores CoinSpot's unwavering dedication to providing top-tier security for its users' cryptocurrency holdings and information.

The certification process requires an in-depth investigation and ongoing audits of Information Security Management processes and practices. This includes processes relating to the management of; digital asset storage, information relating to employees, contractors, suppliers, clients, products, processes, and intellectual property. These stringent policies are designed to eliminate unauthorised access, use, destruction, modification or closure of the organisations information management systems.

CoinSpot is an industry leader with its security; it secures a vast majority of assets in highly secure offline locations, and has a variety of customisation options in your personal account to prevent unauthorised account access:

Verdict

For Australians, CoinSpot is definitely one of the best exchanges for buying cryptocurrency. For me, it comes down to three main things:

1. Security: CoinSpot is the most secure and trusted crypto exchange in Australia, so you can invest and trade with peace of mind.

2. User-friendly: CoinSpot has a simple interface that is easy for beginners to use, and depositing and withdrawing is free and easy. Even though the interface is simple, CoinSpot still incorporates many features that experienced traders want in a crypto exchange, such as a crypto debit card and an NFT marketplace.

3. 24/7 Customer support: This might not be a feature you consider when you choose a crypto exchange, but it is so frustrating without it. When you need an issue resolved, you want it done ASAP, not wait days for a generic email reply.

If you want to do some more research about the best crypto exchanges for Aussies, have a read here. I also conducted a comparison test using personal accounts on CoinSpot and 3 other Australian crypto exchanges (Digital Surge, Swyftx and Independent Reserve). To see the results from that test, click here.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this breakdown.