What is Gemini?

Gemini is a US-based cryptocurrency exchange founded in 2014 by the Winklevoss twins. It is regulated by the New York State Department of Financial Services (NYSDFS) and prioritizes security, with FDIC protection for USD. Gemini upholds the highest standards of security and operational compliance, having completed SOC 1 Type 1 & Type 2, and SOC 2 Type 1 & Type 2 examinations, and earning the ISO 27001 certification. Gemini is the world’s first cryptocurrency custodian and exchange to demonstrate this standard of financial operations and security compliance, and has never been hacked, making it one of the most secure US crypto exchanges around.

My Overall Thoughts on Gemini

Gemini markets itself as a crypto exchange that places security as the first priority, and wow, I can see they really mean it. Gemini's compliance and certifications are impressive; it is a New York trust company that undergoes regular bank exams and is subject to the cyber security regulations promulgated by the New York Department of Financial Services. They are the world’s first cryptocurrency exchange and custodian to complete a SOC 1 Type 2 exam, SOC 2 Type 2 exam, and earn an ISO 27001 certification. Besides their focus on security, they have loads of features that make it one of the best crypto exchanges. Here are three big reasons why I like Gemini:

1) Gemini is perfect for both beginners and advanced traders. New crypto investors can easily navigate the platform with easy buy and sell functions. Experienced traders can easily switch to the ActiveTrader option that provides a market to trade, full access to trading tools, advanced charts and lower fees.

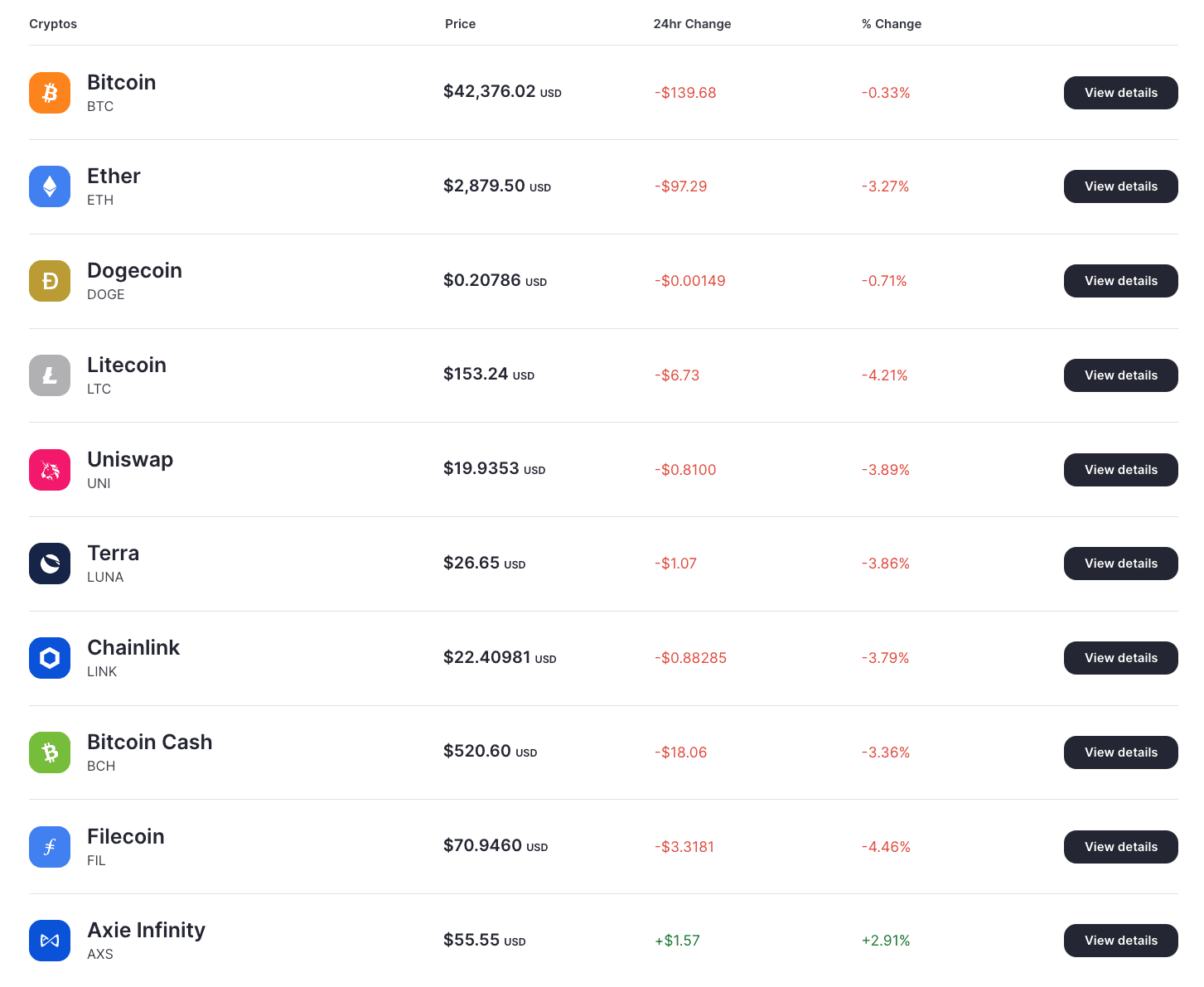

2) Gemini offers over 90+ cryptocurrencies to buy, sell or trade. Gemini offers new coins from time to time, so their range will continue to expand.

3) Gemini has excellent features that are hard to find on basic cryptocurrency exchanges. You can earn interest on your crypto, use Gemini Pay to spend your crypto in retail stores, use Gemini's mobile app to trade on the go, and more.

One issue I have to mention about Gemini is that although they offer over 90+ cryptocurrencies, they don't have some of the most popular ones. For example, ADA, XRP and BNB are top 10 coins by market capitalization, but you cannot buy them on Gemini. Other big cryptocurrencies like BTC, ETH, DOGE and LTC can be found on the exchange. Be sure to check the crypto you want to buy is available before signing up to Gemini. If it's not there, you can check some other top exchanges, eg: KuCoin, Coinbase or Coinmama.

In summary, if you are after a feature-packed crypto exchange with the highest level of security, compliance and certification, plus insurance cover, Gemini is the one for you.

Key Features & Advantages of Gemini

Gemini has plenty of great features which make it one of the best crypto exchanges in the USA. Here are the standout features that make Gemini a great choice.

Negatives & Disadvantages of Gemini

Here are some of the downfalls of Gemini to be aware of before you sign up. To find out more and see alternative crypto exchanges that do better in these aspects, click on the jump links.

What Services does Gemini offer?

There are so many different crypto exchanges out there, how do you choose one? One of the determining factors is the services offered on the platform. Gemini excels in this respect, with plenty to be excited about. Read on to find out what they offer.

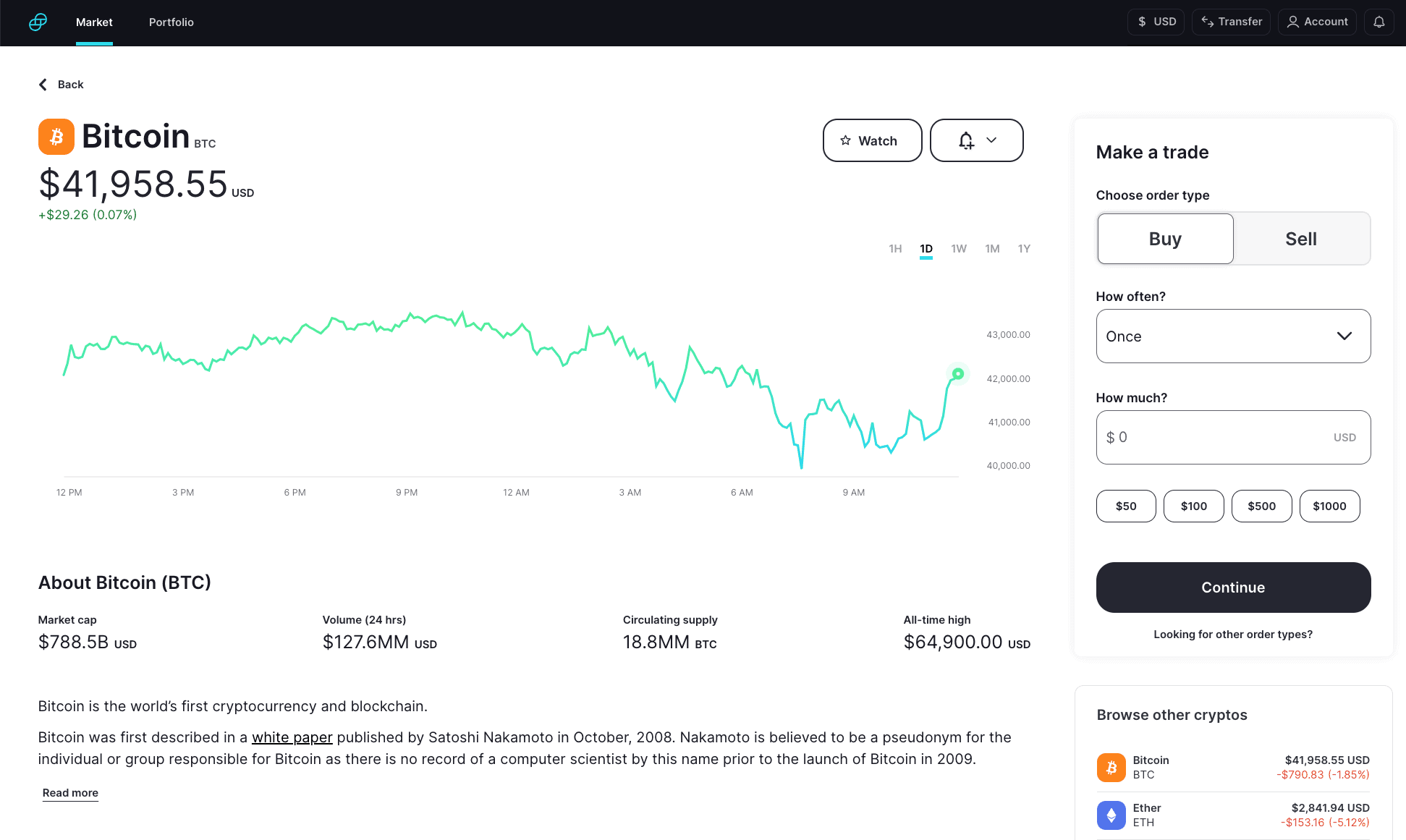

Buy and sell crypto easily with instant buy/sell: Gemini makes it easy for new investors to buy cryptocurrency; you can buy directly from the exchange using fiat currency. You can even set recurring buy orders (daily, weekly, twice monthly, or monthly) as a simple way to Dollar Cost Average your crypto purchases. Selling your crypto instantly is just as easy, all you need to do is click the Sell button next to the Buy button, and you can select how much you want to sell.

Free fiat withdrawals & ten free crypto withdrawals per month: Gemini offers fee-free fiat withdrawals which is a welcome change among the larger crypto exchanges. On top of that, they also give their users ten cryptocurrency withdrawals free of charge, each month! When you make a crypto withdrawal, there is always a transaction fee to cover mining costs; it is unheard of to have free crypto withdrawals. Gemini covers this cost for their users, with ten free withdrawals each month.

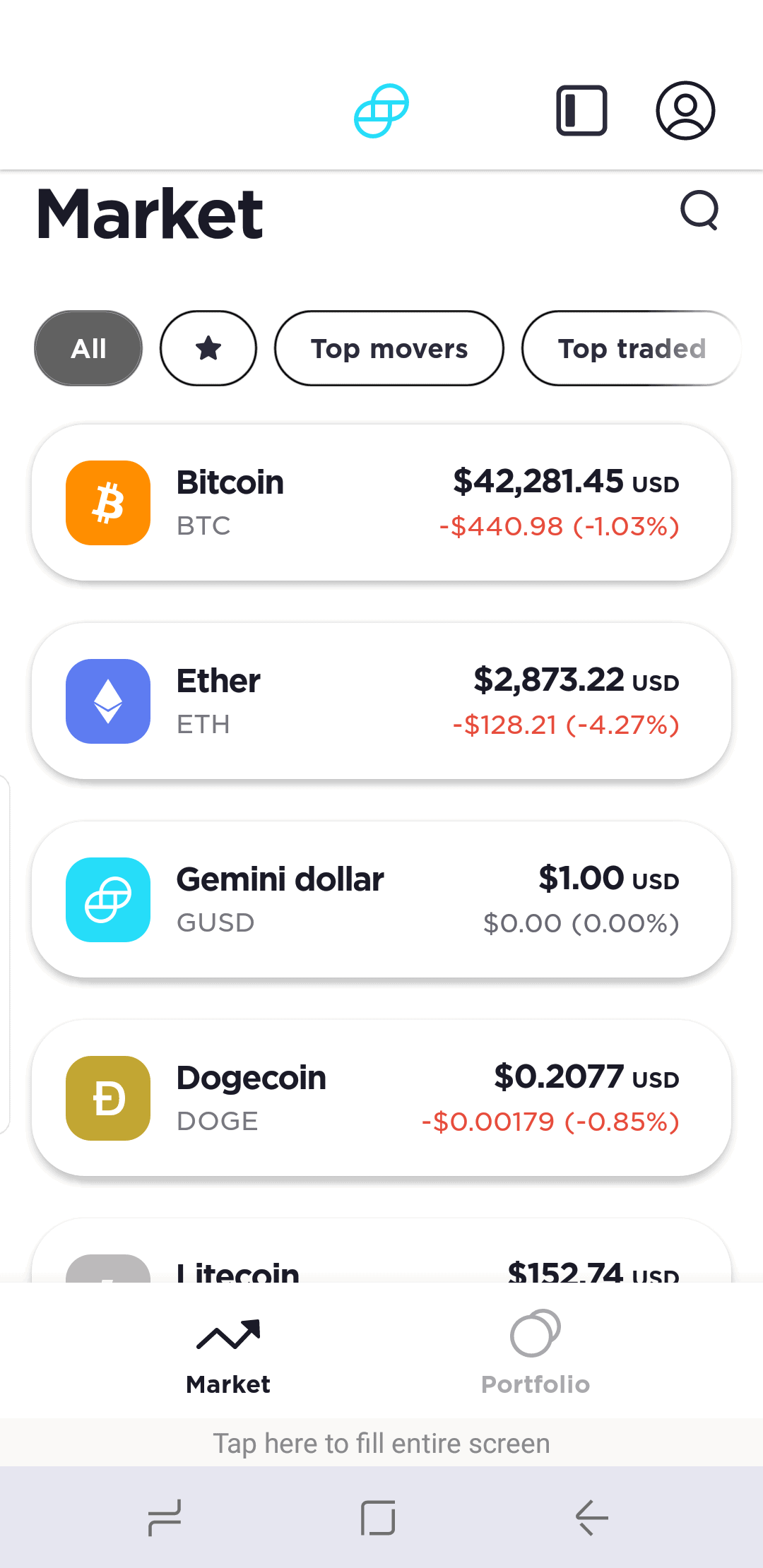

Over 90+ different cryptocurrencies: Gemini offers over 90+ different cryptocurrencies to buy, sell or trade. You can find some of the most popular coins such as BTC, ETH, DOGE, LTC, SHIB and BCH as well as DeFi cryptos like UNI, DAI and COMP.

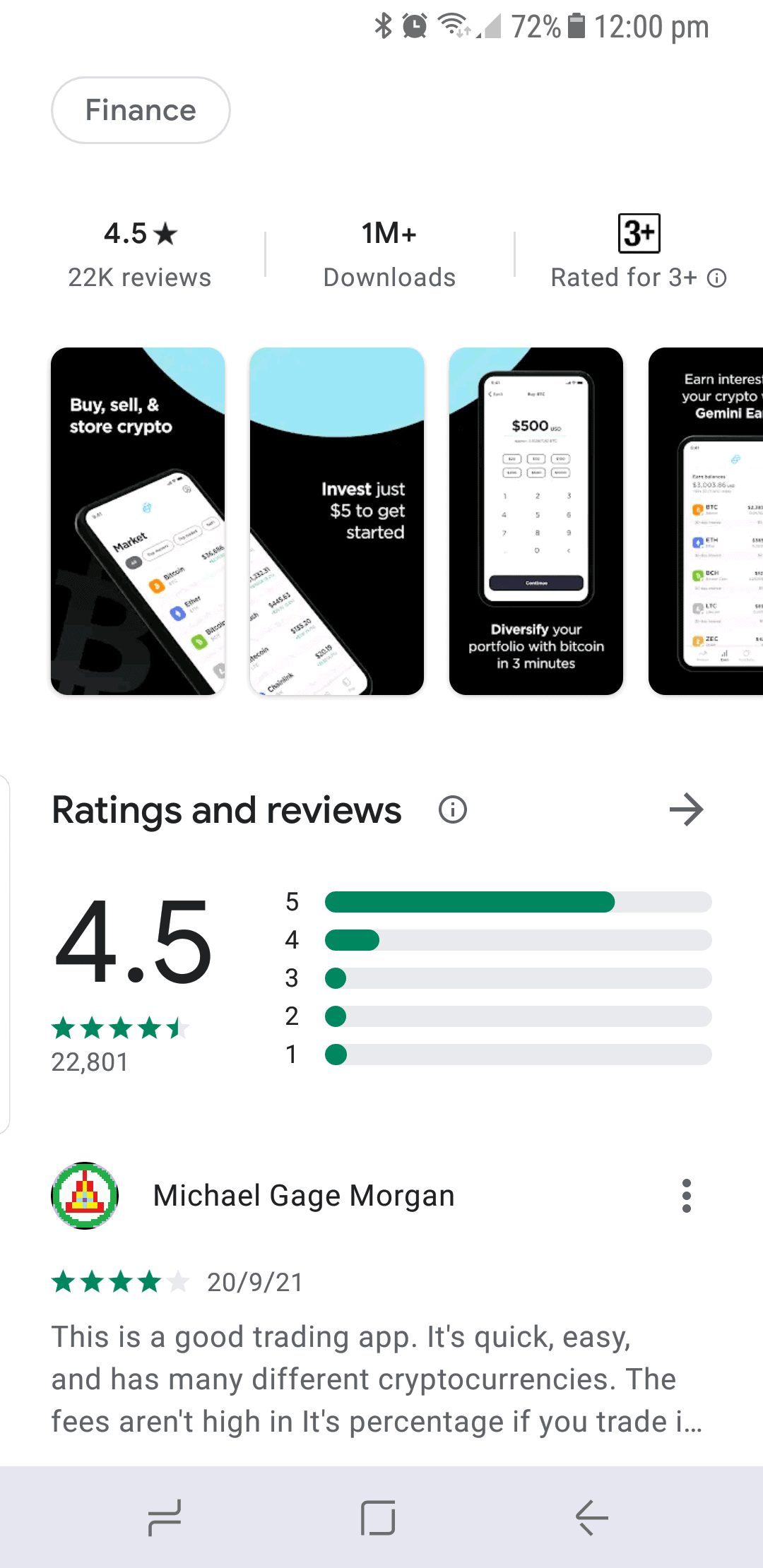

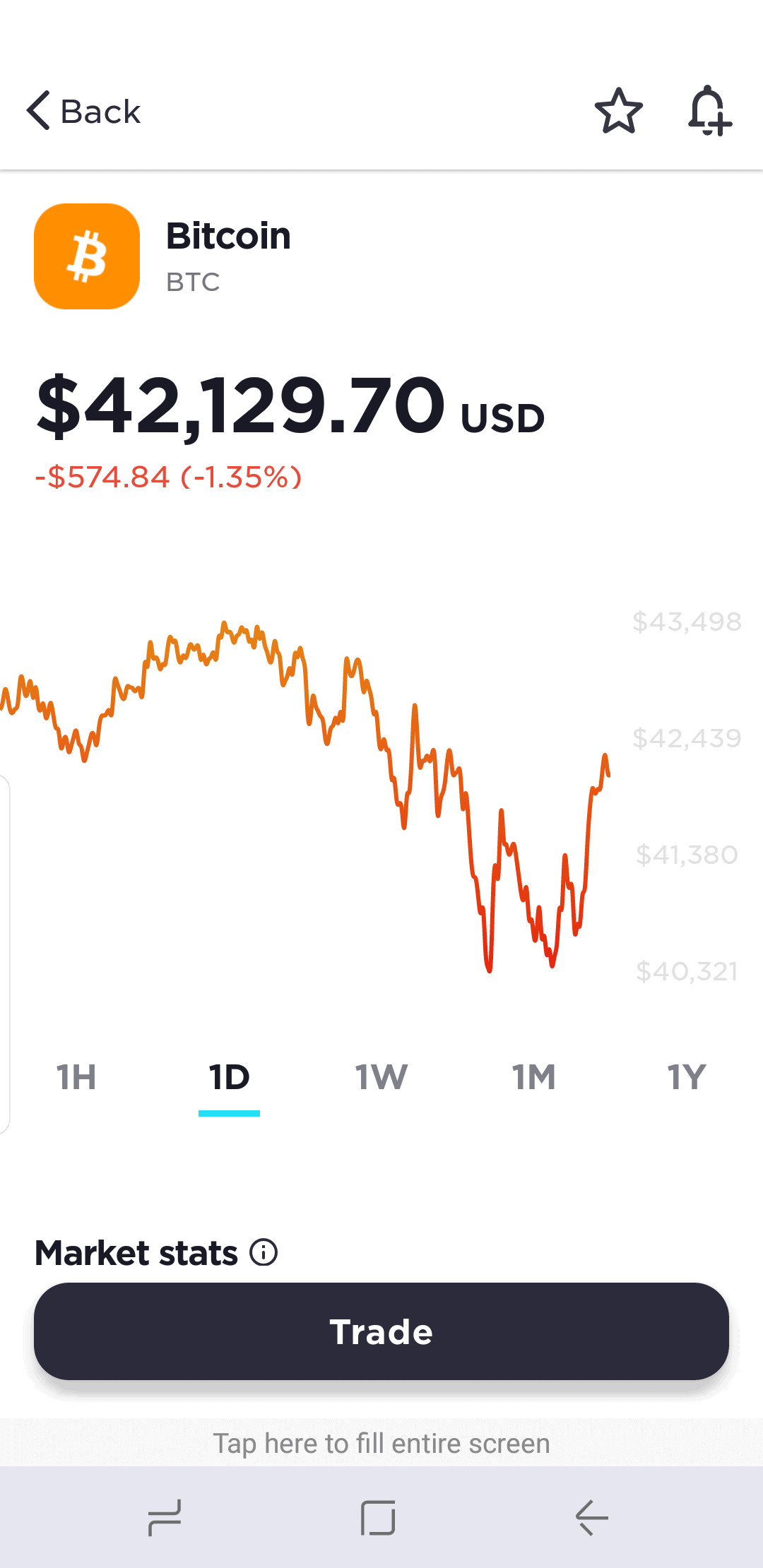

Mobile app for iOS and Android: Gemini has an app available for iOS and Android mobile devices, so you will be able to trade anytime, anywhere. It has over 1 million downloads on the Google Play store, with a rating of 4.5 stars from over 22,000 reviews. The app is simplistic and easy to navigate, an it even has a feature where you can scan the app to pay with crypto at retail stores.

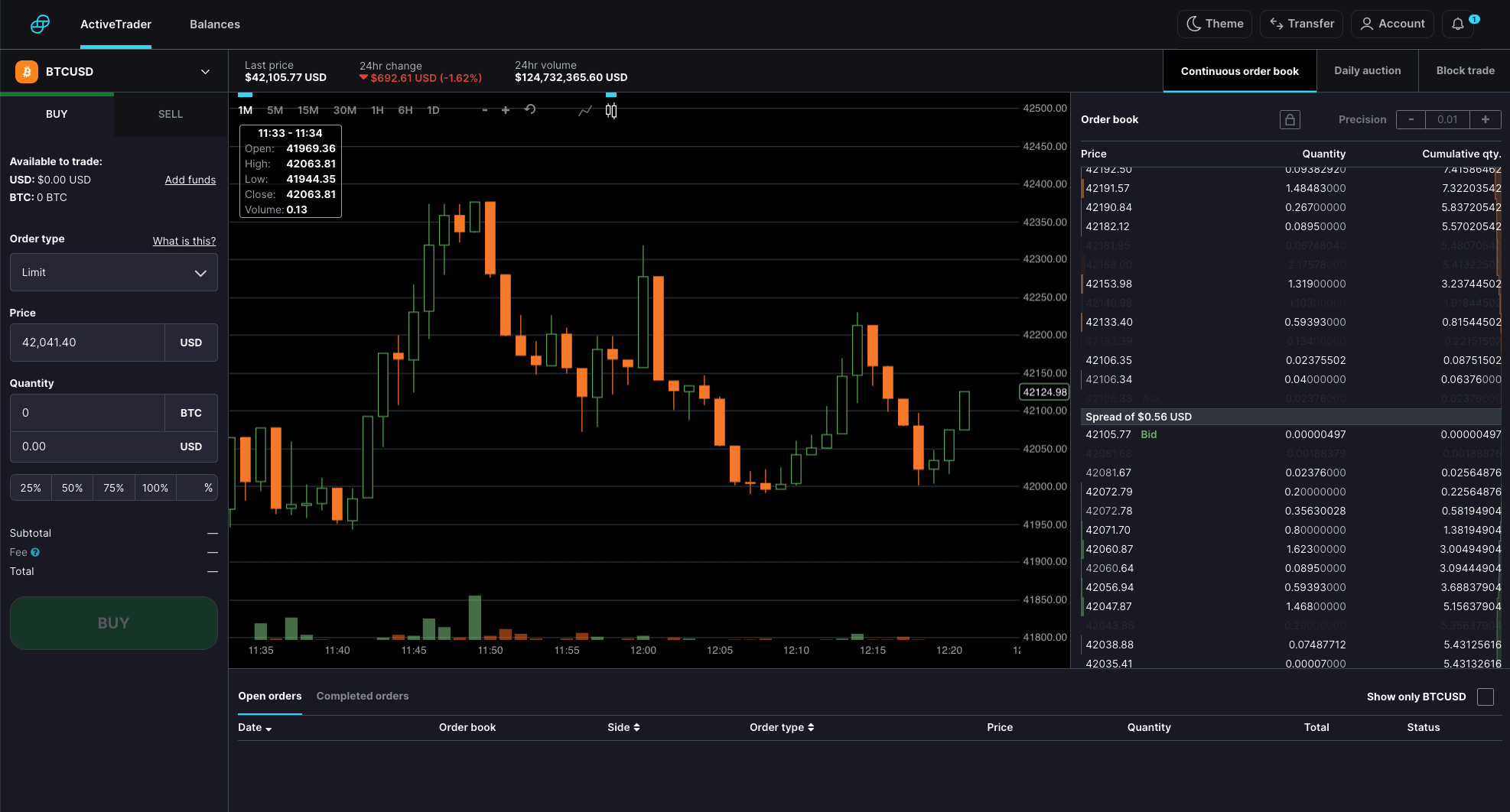

ActiveTrader option with all order types and advanced charts: For experienced crypto traders, the ActiveTrader setting will be more suitable. It is easy to switch to this setting. Simply click on Account, then Settings, and choose the ActiveTrader interface. This provides users with all the order types as well as candlestick charts. You are now buying and selling crypto on the market, as opposed to directly from the exchange, and you will incur lower fees.

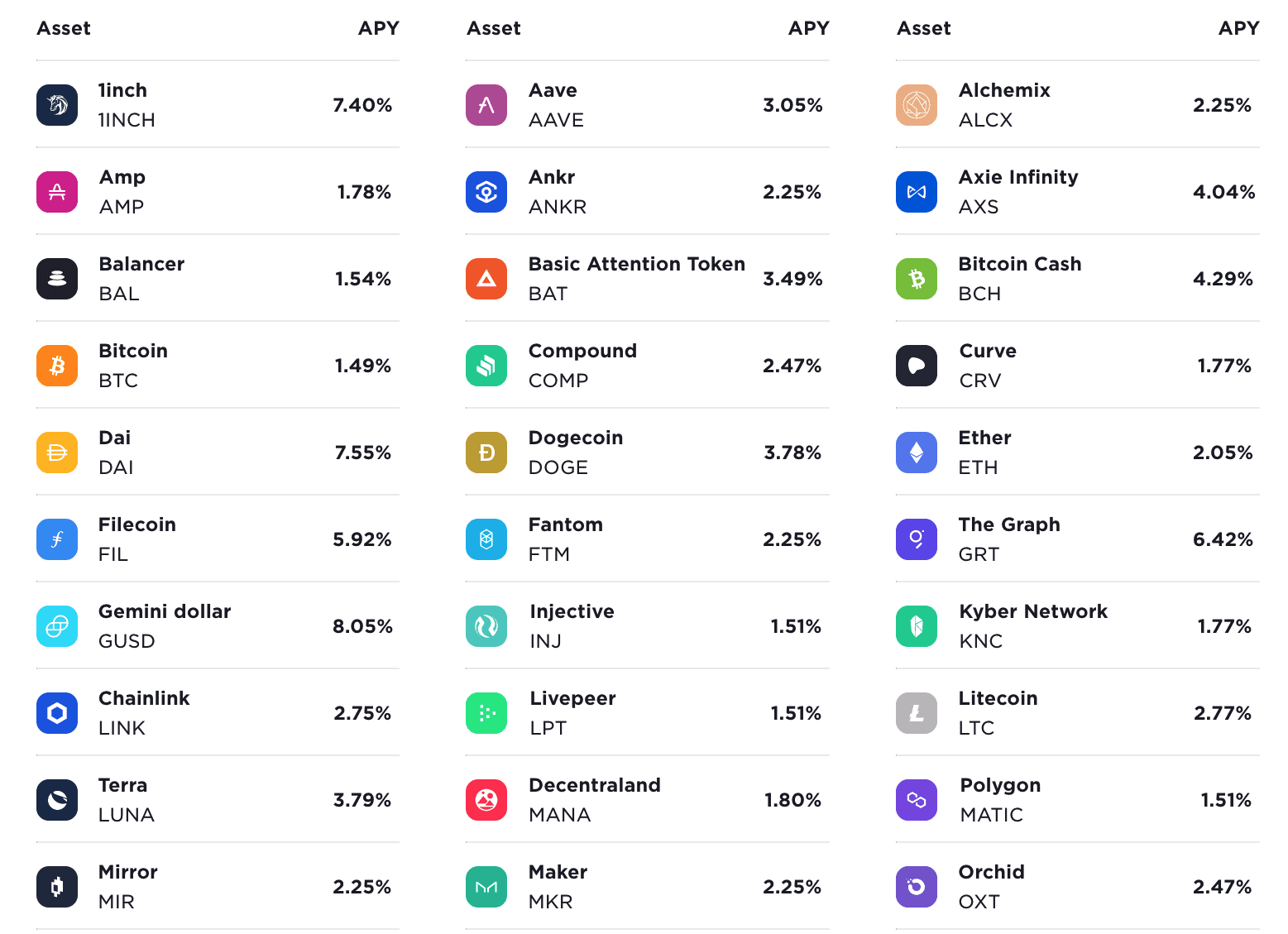

Gemini Earn - earn interest on your crypto: If you are not actively trading your cryptocurrency, and more of a long-term investor, you can grow your crypto investment on Gemini. Similar to earning interest in a bank account, with Gemini Earn you can earn crypto by opting in. The interest is paid daily, up to 8.05% APY, and you can withdraw your assets instantly. There are no minimum amounts, and no transfer or withdrawal fees. It is available in all US states (even New York) as well as Singapore. Here are some of the cryptocurrencies on Gemini and their interest rates.

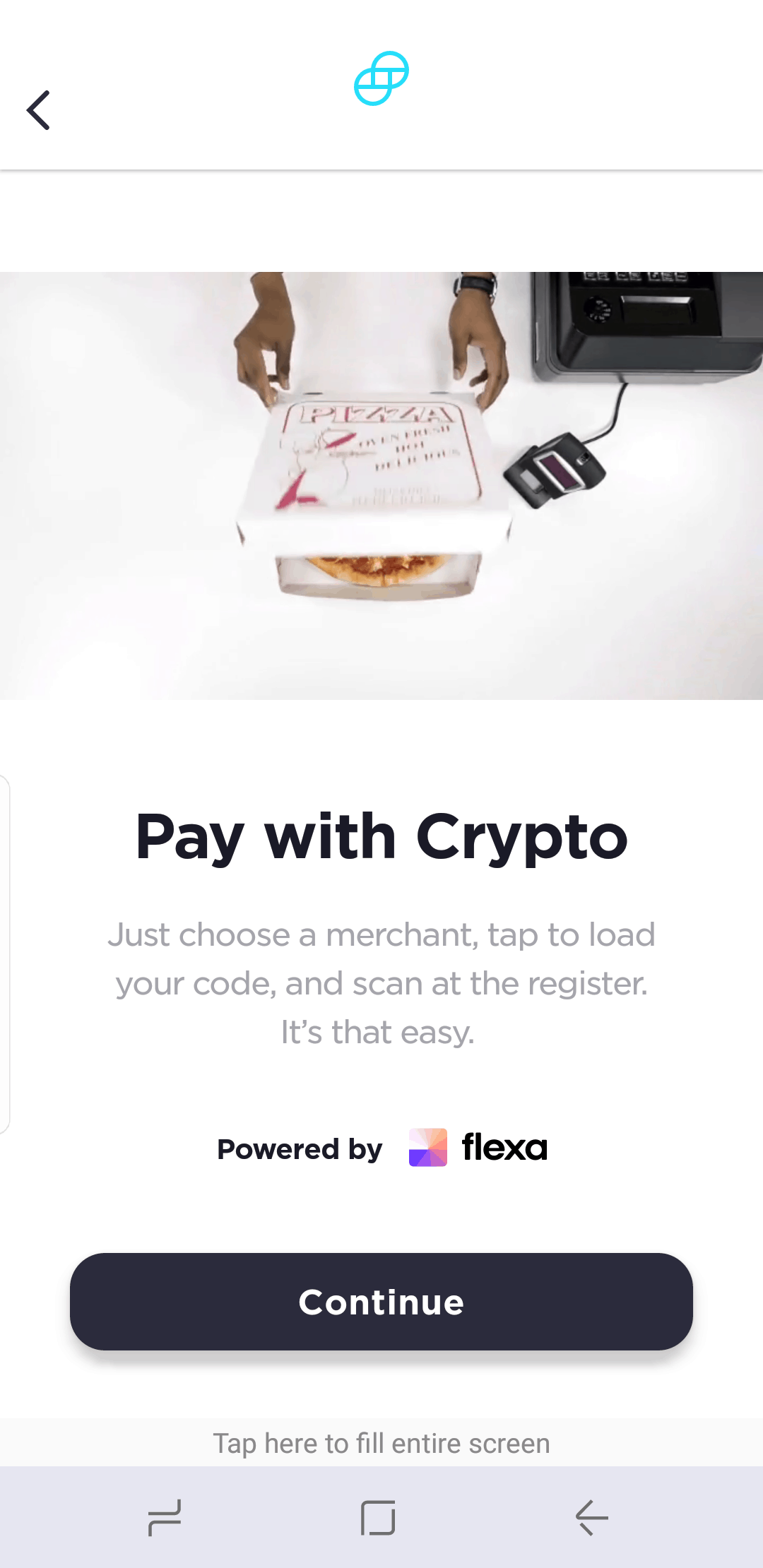

Gemini Pay - spend crypto in retail stores: Gemini allows you to spend your crypto at over 30,000 retail locations in the USA. There are no fees involved, transactions are private and it is simple to use. First step is to download the Gemini app, which is available for iOS and Android. Tap the Pay icon at the bottom of the screen, select the cryptocurrency you want to use, and scan your phone with the barcode reader.

Gemini Wallet - store your crypto safely with theft insurance: Gemini’s safe, secure wallet infrastructure supports all of their listed cryptocurrencies. Users can be confident leaving their money with Gemini, protected by their industry-leading security and protection plus insurance against theft.

Gemini Dollar (GUSD) - USD-backed stablecoin: Gemini has their own stablecoin (GUSD) that is always convertible to $1 on Gemini and is free to buy and sell. It can be used to trade and stake in DeFi, can be spent using Gemini Pay, and used to earn high yields in DeFi and through Gemini Earn. Gemini is a US company regulated by the New York Department of Financial Services, with GUSD reserves eligible for FDIC insurance up to $250,000 per user while custodied with State Street Bank and Trust.

Gemini Custody - institutional-grade crypto storage with insurance: If you are planning on holding your crypto as a long-term investment, Gemini Custody is a safe place for your digital assets. It is custom-built by technical experts in cryptography, finance and security, regulated as a New York State Trust Company and has $200 million in insurance coverage - the largest limit of any crypto custodian in the world. It is free to set-up with no minimum limits and flexible pricing, based on your custody requirements depending on activity volume, asset mix, and size of holdings. Gemini works with each customer to create tailored, unique price plans for their individual or multi-user accounts.

Industry-leading security and compliance: Gemini has always operated with a security-first approach, and it still holds true today; the exchange has never been the subject of a cybersecurity breach. Their security philosophy is based on three principles: defending against external threats, protecting against human error and guarding against misuse of insider access. For full details on how Gemini protects your funds, read here. Gemini maintains the highest standards of operational compliance, having completed SOC 1 Type 1 & Type 2, and SOC 2 Type 1 & Type 2 examinations, as well as being awarded the ISO 27001 certification. Gemini is the world’s first cryptocurrency custodian and exchange to demonstrate this standard of financial operations and security compliance.

What I don't like about Gemini

Some big cryptocurrencies like ADA, XRP, ETC are not available: Gemini has over 90+ cryptocurrencies, but it is missing some of the biggest ones, such as ADA (Cardano), XRP and BNB (Binance Coin). If you don't plan on investing in these coins, then it is not an issue, but be sure to check that the coins you want to buy are available on Gemini before you open an account. If you want to purchase ADA, XRP and BNB, try some other popular crypto exchanges such as KuCoin, Coinmama, Kraken and Coinbase.

Higher trading fees than some other crypto exchanges: Gemini's trading fees of 0.25% for makers and 0.35% for takers is not extremely high, but there are exchanges where you can pay less. KuCoin charges only 0.1% to trade, and Kraken charges 0.16% / 0.26% (maker/taker).

Lacks Live Chat support: Gemini's customer service is very limited. There is a chat bot that attempts to find you answers to simple questions, but for anything more complex, or a personal issue with your account, you need to contact Gemini using the contact form. There is no Live Chat functionality, which I'm disappointed with. If you are after a crypto exchange that has Live Chat with a real person, have a look at Kraken.

Gemini Fees

Let's have a look at the different fees that Gemini charges.

Gemini Deposit Fees

If you are depositing cryptocurrency into Gemini, there are zero fees incurred.

If you deposit fiat currency using ACH, there is no fee. Wire transfer is also free, but your bank may charge a fee. A debit card transfer will cost 3.49% of the total amount.

Gemini Instant Buy/Sell Fee

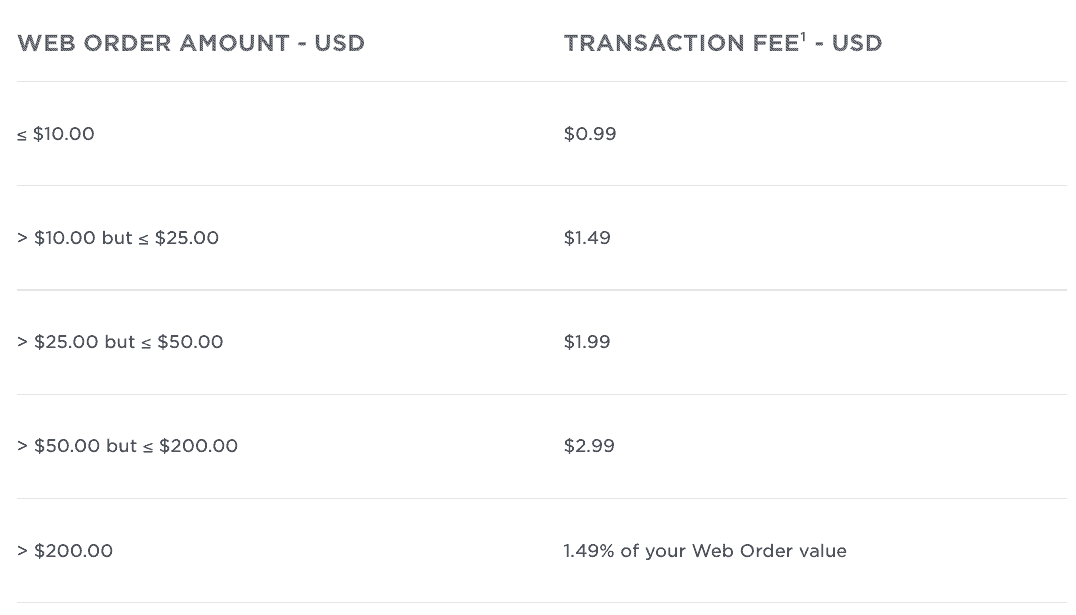

When you purchase or sell cryptocurrency directly on Gemini (not from the market), you will incur a 'convenience fee' of 0.5% plus a 'transaction fee'.

The transaction fee varies based on your order amount and the fiat currency. Below is the table of transaction fees for USD. For other fiat currencies, check the transaction fees here. For a purchase of cryptocurrency over $200 USD, the fee will be a total of 1.99% (0.5% convenience fee + 1.49% transaction fee).

Gemini Withdrawal Fees

Withdrawal of fiat currency from Gemini is free of charge.

If you want to withdraw cryptocurrency from the exchange, Gemini gives their users ten free withdrawals per month! When you send crypto on any exchange or from any wallet, there is always a transaction fee to cover mining costs; there is no such thing as free crypto transfers, but Gemini pays this fee for their customers for their first ten withdrawals each month. After you have used up your ten free withdrawals, the fee charged is based on the individual coin. Click here to check the withdrawal fee for the coins you are interested in.

Gemini Trading Fees

When you trade in the market (you will need to switch to ActiveTrader interface) you pay lower fees than buying crypto instantly from the exchange. The fees for Makers are 0.25% and Takers pay 0.35%. This fee can be reduced if you are a frequent trader based on your previous 30 days of trading volume. As you can see in the table below, extremely high-volume traders can reduce their Maker fees to 0.00% and Taker fees to 0.03%.

30-day Trading Volume (USD) | Maker Fee | Taker Fee |

|---|---|---|

$0 - $500,000 | 0.25% | 0.35% |

> $500,000 | 0.15% | 0.25% |

> $2,500,000 | 0.15% | 0.25% |

> $5,000,000 | 0.10% | 0.15% |

> $10,000,000 | 0.10% | 0.15% |

> $15,000,000 | 0.00% | 0.10% |

> $50,000,000 | 0.00% | 0.075% |

> $100 000 000 | 0.00% | 0.05% |

> $250 000 000 | 0.00% | 0.04% |

> $500 000 000 | 0.00% | 0.03% |

Pros and Cons of Gemini

- Extremely secure and compliant crypto exchange

- Free fiat withdrawals and ten free crypto withdrawals per month

- Mobile app available for iOS and Android

- Over 90+ cryptocurrencies available

- Insurance cover against theft of cryptocurrencies

- Some big cryptocurrencies (ADA, XRP, ETC) not available

- Higher trading fees compared to some other exchanges

- Poor customer service - no live chat support

The Verdict

Gemini is a long-established crypto exchange boasting the highest levels of security and compliance, with theft insurance to top it off. Free fiat deposits with ACH, free fiat withdrawals and ten free crypto withdrawals each month are attractive points on Gemini. Their instant buy and sell fees of 1.99% and market trading fees of 0.25% / 0.35% are not the lowest in the industry but they are reasonable. There are also many other features, such as Gemini Earn, Gemini Pay, Gemini Wallet and Gemini Custody that make this exchange worth using.

The biggest downside is that although Gemini offers 90+ coins, it is missing some of the really big ones, such as ADA (Cardano), XRP and USDT (Tether). Gemini does add new coins to its platform, so hopefully they expand their range to include these top coins in the future.

If you are looking at other crypto exchanges to use, you can take a look at the best crypto exchanges in the USA. I have included a comparison table below so you can see some of the important details.

Comparison Table of the Best Crypto Exchanges in the USA

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Frequently Asked Questions

Yes, Gemini is a legitimate and trustworthy US-based cryptocurrency exchange that was established in 2014 by the Winklevoss twins. It is a New York trust company, and is regulated by the New York State Department of Financial Services (NYSDFS).

Yes, Gemini is an extremely safe crypto exchange that has placed utmost priority on security. Gemini has passed SOC 1 Type 1 & Type 2 and SOC 2 Type 1 & Type 2 examinations, as well as receiving ISO 27001 certification. Moreover, it has insurance cover to protect its users' funds in the case of a cybersecurity breach.

Yes, Gemini is a trusted cryptocurrency exchange established in the USA in 2014 by the Winklevoss twins. It is a New York trust company, and is regulated by the New York State Department of Financial Services (NYSDFS). Gemini is an extremely safe crypto exchange that places security as the top priority. Gemini has passed SOC 1 Type 1 & Type 2 and SOC 2 Type 1 & Type 2 examinations, as well as receiving ISO 27001 certification. They also have insurance cover to protect its users' funds in the case of a cybersecurity breach.

Gemini is an extremely secure crypto exchange, and does everything it can to keep it safe from hackers. However, no matter how tight the security is, there is always the possibility that hackers can find a vulnerability in a crypto exchange. To this date, Gemini has never been hacked which is a good track record since its establishment in 2014.

Yes, Gemini is available in all 50 states of the USA. Gemini is a New York trust company and is regulated by the New York State Department of Financial Services (NYSDFS).

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.