IG was founded in London in 1974 and is publicly traded (LON: IGG), it is also regulated in six tier-1 jurisdictions which makes it a very safe broker (low risk) for forex and CFDs trading. IG only supports forex trading for its U.S. based customers. IG is popular with beginners and advanced traders alike, beginner traders will like IG’s simple and easy to use mobile and desktop platforms. IG's selection of indicators and charting tools makes them popular with advanced trading.

What type of IG account can I open?

Your country of residence will determine what type of products you will have access to.

Countries | Products |

|---|---|

Austria, Denmark, France, Germany, Ireland, Italy, Netherlands, Norway, Portugal, Romania, Sweden | Forex, CFD, Options |

UK, Ireland, Malta, Cyprus, Australia + some smaller countries, like Gibraltar, the British Virgin Islands, etc. | Stocks, forex, CFD |

USA | Forex |

Rest of world | Forex, CFD |

What are the deposit options at IG?

You can deposit through one of the following methods:

- Bank transfer

- Debit cards

- PayPal (not accepted in US)

IG do not charge any deposit fees.

What are the withdrawal options at IG?

Again IG does not charge any fees for withdrawals (except in the US where it is $15) and you can withdraw using any of the follow methods:

- Bank transfer

- Debit cards

- Electronic wallets (not accepted in US)

IG web trading platform:

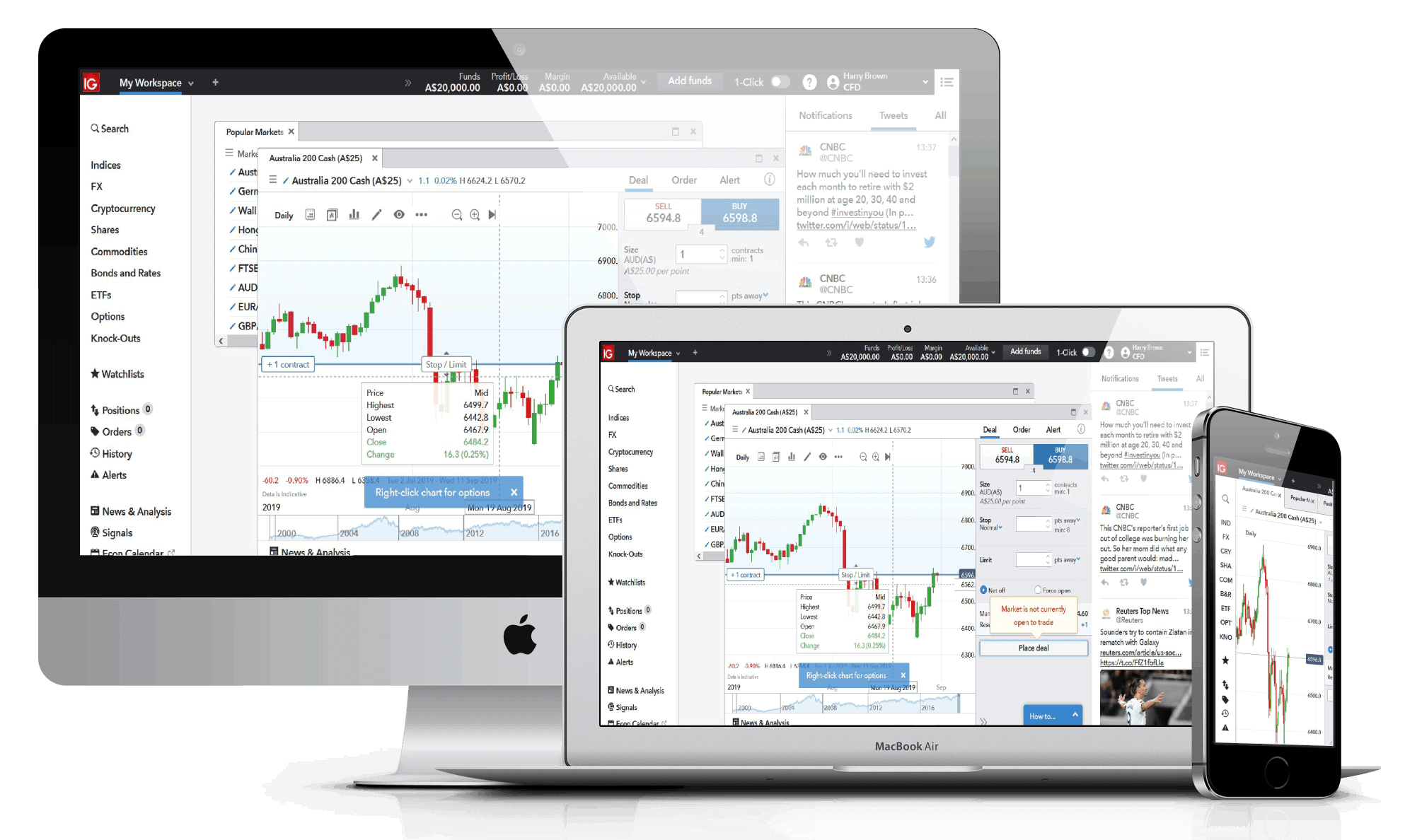

IG provides you with two options, you can use their own web trading platform or you can use the thrid party software MetaTrader 4. We tested the IG web trading platform and we were impressed, it was very intuitive with clear fee reports and incorporates a two factor authentication for safer trading. It provides all the standard order types and has advanced alert and notifications settings.

Is IG safe?

Our research makes us think IG is extremely safe, their parent company is listed on the London stock exchange and they are regulated by the following top tier financial authorities:

- UK – Financial Conduct Authority (FCA)

- Germany – Federal Financial Supervisory Authority (BaFin)

- Switzerland – Swiss Financial Market Supervisory Authority (FINMA)

- USA – National Futures Association (NFA)

- Australia – Australian Securities and Investment Commission (ASIC)

- New Zealand – Financial Markets Authority (FMA)

- Singapore – Monetary Authority of Singapore (MAS)

- Japan – Japanese Financial Services Authority (FSA)

- South Africa – Financial Sector Conduct Authority (FSCA)

- UAE – Dubai Financial Services Authority (DFSA)

- International – Bermuda Monetary Authority (BMA)

IG Fees:

Forex fees:

IG forex benchmark fees of a $20,000 30:1 long position held for one week (this is based on IG UK)

Product | Fee |

|---|---|

EURUSD benchmark fee | $17.5 |

GBPUSD benchmark fee | $11.0 |

AUDUSD benchmark fee | $12.2 |

EURCHF benchmark fee | $9.1 |

EURGBP benchmark fee | $17.6 |

IG Pros and Cons:

- Competitive spreads. IG spreads starting from 0.8 pips which means forex trading at IG is priced very competitively

- Educational resources. IG provides a demo account so you can practice for free, additionaly they provide tons of content to help you learn.

- Flexible forex trading. You can trade using your computer, tablet or mobile on IG’s web trading platform or MT4.

- Large selection. IG provides access to over 80 currency pairs.

- 24-hour customer support.

- Low maximum leverage. IG offers a low maximum leverage of 50:1, this is US regulation but is still a con for us. Using IG outside of the US you can get bigger leverage

- Limited features for US users. While IG offers CFD trading & more overseas, US users are restricted to forex trading.

To read our privacy policy please visit here.

Trading foreign exchange on margin carries a HIGH LEVEL OF RISK, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not invest money that you cannot afford to lose.