What is Compound Finance?

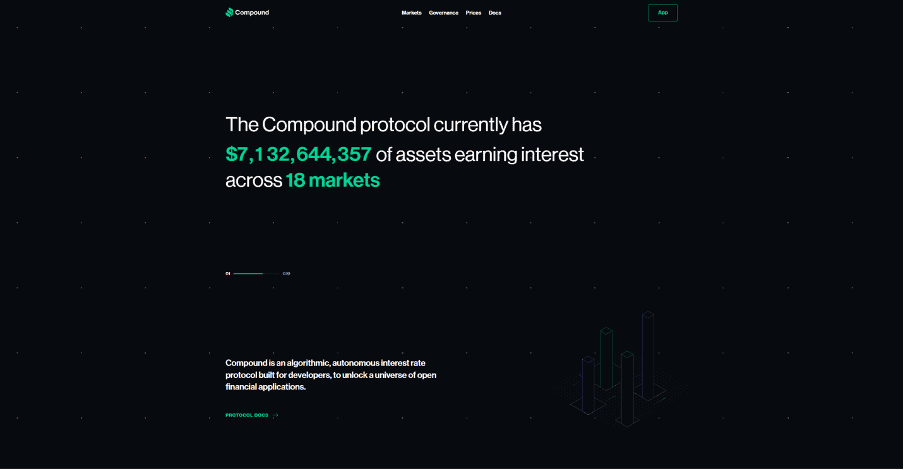

Compound Finance is a decentralized cryptocurrency platform and an autonomous interest rate protocol that allows developers and investors to earn money and explore financial opportunities with the help of a lending and borrowing mechanism. Compound Finance claims that the legal financial system that most countries follow has become old, slow, inefficient and worthless. Compound Finance is trying to change that by offering what the banking sector cannot in terms of benefits and interest rates.

Compound Finance was started in 2018, and it is currently headquartered in San Francisco, California. It focuses on bringing a perfectly secure decentralized exchange with no bugs that could compromise user experience. Compound Finance works mainly on the Ethereum network and offers lending and borrowing services. The exchange even has its own governance token, called COMP, that users can claim to have voting rights. It is quite simple to use Compound Finance, as the exchange has a user-friendly interface and hassle-free processes.

My Overall Thoughts on Compound

Compound Finance does not have limitless investment opportunities or massive diversity. The platform focuses on two aspects: lending and borrowing. While users can enjoy great interest rates and premium COMP rewards on these services, there are few other options. But the things that set Compound Finance apart from many other crypto platforms are its simple interface, great crypto wallets support, community forum, lack of fees and high returns.

The platform is also audited and verified, which makes it even safer. You can even earn a bounty of over $100K just for finding a bug. But the following aspects are the ones that I think benefit people the most:

1) You can buy or lend popular assets: Many crypto investors invest their money exclusively in popular crypto projects to reduce the risk of losing money or falling prey to rug pulls. Compound Finance supports a few of those popular crypto assets in its lending and borrowing program. This means you won’t have to go out of your way to buy new assets just to invest on the platform.

2) It has great overall rewards: Compound Finance offers attractive rewards. You can even get 2.5% monthly returns on a specific asset. Compound Finance also awards governance tokens to those who lend or borrow on the platform. If you aren’t interested in voting rights, these tokens can be exchanged for any other asset.

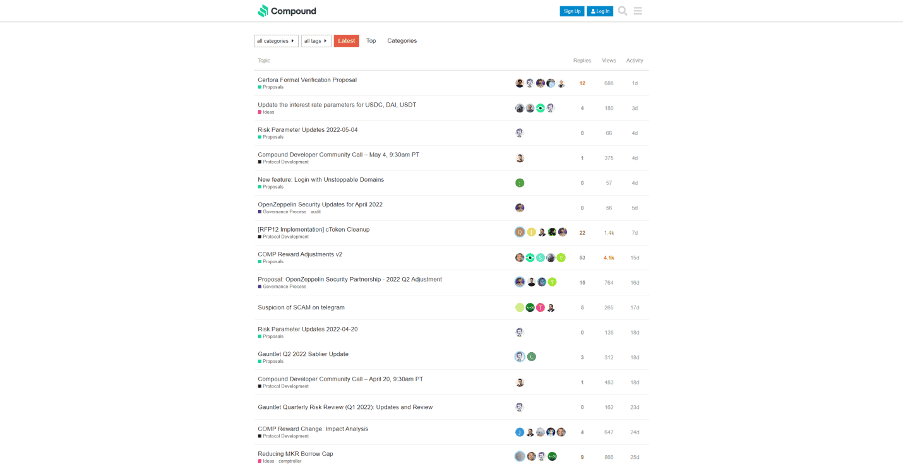

3) There is a helpful community forum: To help users out with their problems, Compound Finance has created a community forum. There are a lot of active users on the forum who can help you address your concerns. Users can also discuss opportunities and strategies.

On the other hand, Compound Finance needs to work on adding more tokens to the platform to offer diversity. It would also be helpful if the platform created a mobile app.

Key Features and Advantages of Compound

When it comes to traditional banks and other financial institutions, Compound Finance thrashes the competition by miles with what it offers and how it benefits common people. It gives users the chance not only to earn passively but also to govern and manage the platform. This builds trust among the community and allows users to make financial decisions without worrying about scams and other security concerns.

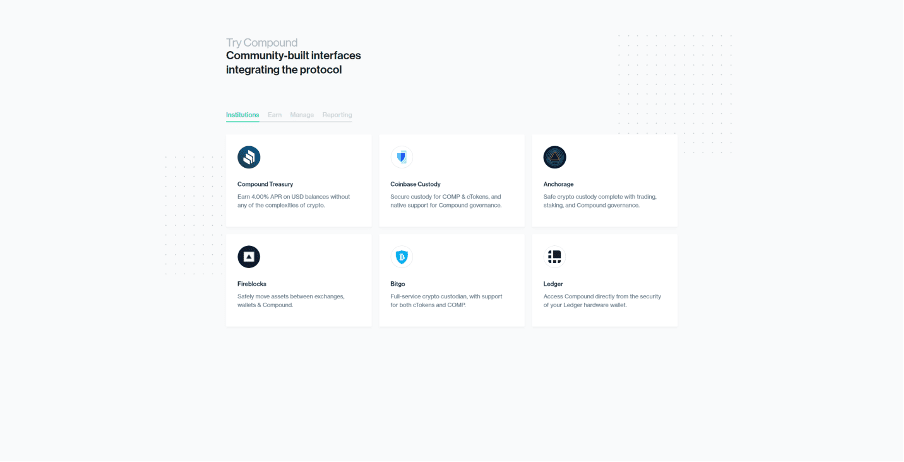

The Compound protocol has also been integrated on many community-built interfaces. These affiliated interfaces are listed on the Compound Finance website, so you have access to all of them in a single place. These features allow users to try out several ways to increase their potential earnings and give them better insights. But the services offered by Compound Finance do not end there! To get a fuller idea of what Compound Finance offers, take a look at the list below.

Negatives and Disadvantages of Compound

There are a few negatives about Compound Finance to keep in mind when considering its services. Of course, the platform’s focus necessarily narrows its services, but that can severely affect user experience. Read about the negatives and disadvantages of Compound Finance below:

What Services Does Compound Offer?

Compound Finance does not have tons of features and options. Rather, it focuses on providing the best services in a specific section of the industry: providing earning opportunities through lending. Users can claim amazing interest rates and governance tokens.

Compound Finance is super easy to use due to its structure, and users can get started on the platform within seconds. The premium community support and high-level security also offer peace of mind. And, of course, you cannot separate Compound Finance from its protocol. But there is more to the platform, which you can learn about below:

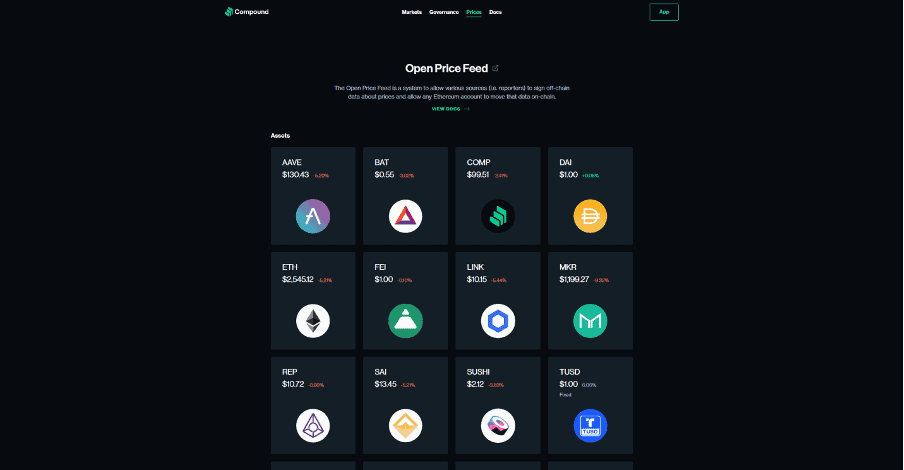

10+ popular crypto assets: Compound Finance users can borrow or lend more than ten popular crypto assets on the platform, including ETH, AAVE, WBTC, UNI, DAI, TUSD and a few others. Investing in popular crypto assets generally has lower risk than investing in many altcoins or meme coins. The best thing about having a small selection of crypto is that users do not have to spend lots of time understanding different or new assets.

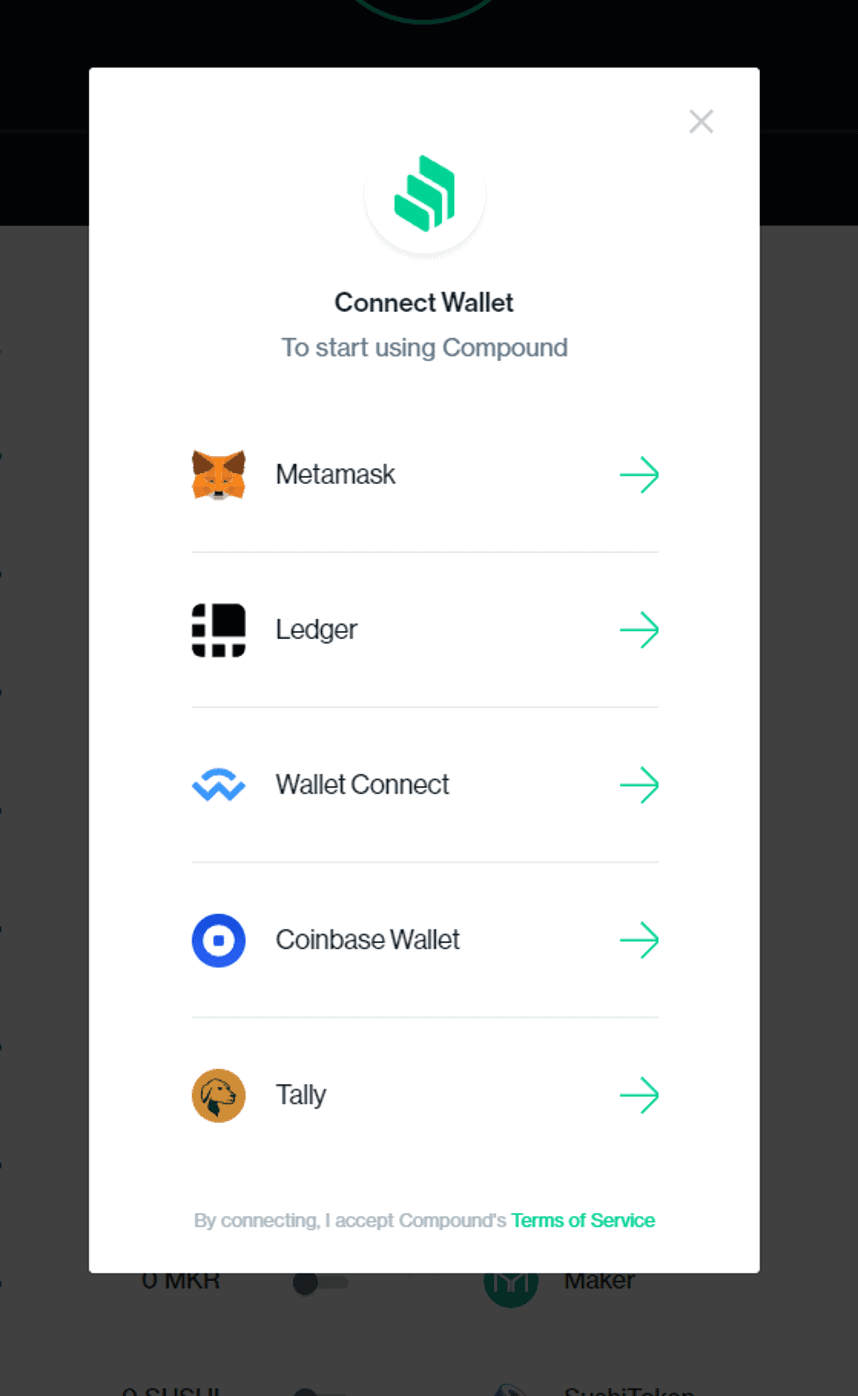

Connect crypto wallets with ease: To start using Compound Finance, users must connect a crypto wallet to the platform. Compound Finance supports several popular wallets, such as Metamask, Ledger, Coinbase and Tally. Users can connect these wallets within seconds and access their funds without any hassle. This is a convenient feature because users don’t have to create a whole new wallet or spend extra time connecting their already existing wallet to the platform.

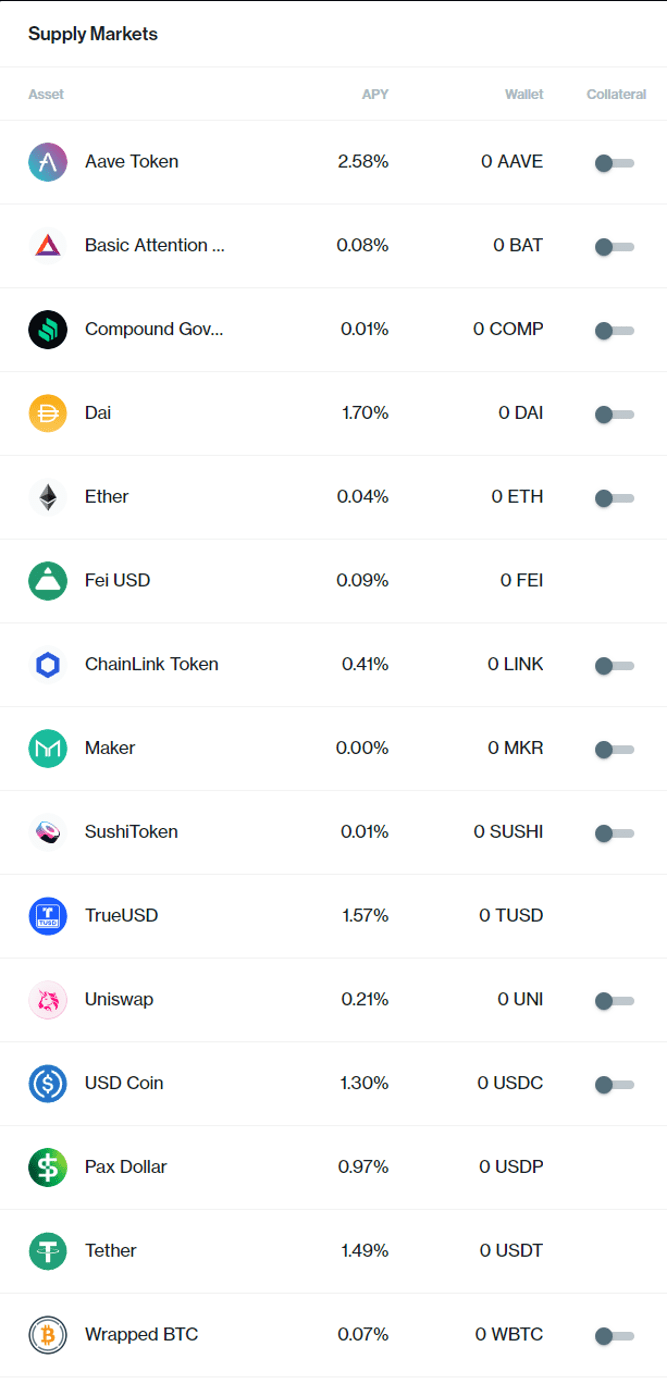

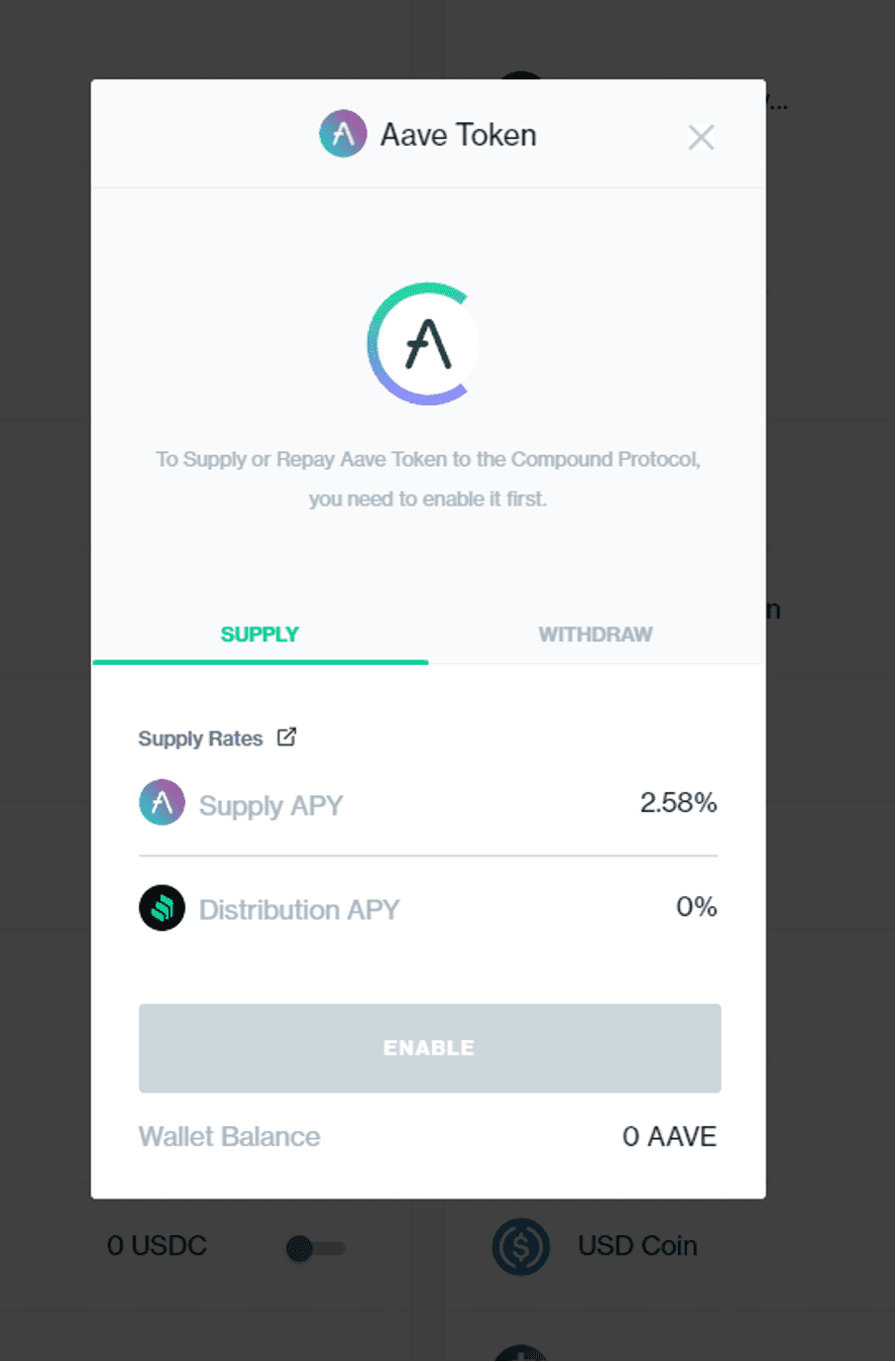

Lend assets: The main way to earn money on Compound Finance is to lend assets and earn interest on them. The interest rates depend on the asset and overall market conditions. Compound Finance offers above-average interest rates, which means users earn significantly more than they would with a traditional banking account.

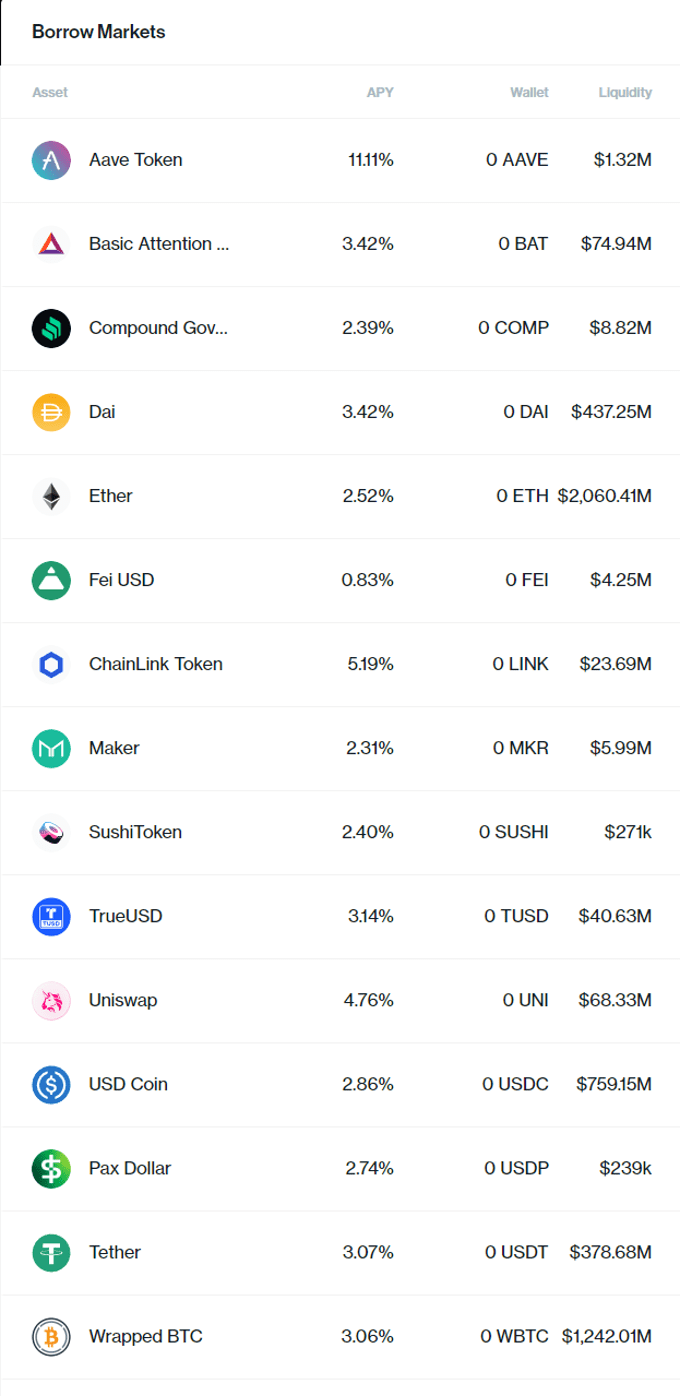

Borrow assets: Users on Compound Finance can also borrow a variety of assets. These assets have flexible interest rates and repayment periods. The benefit of borrowing through Compound Finance is that it eliminates the hassle of visiting a bank and signing forms. Users can simply get their hands on an asset within minutes, no questions asked. However, Compound Finance imposes a borrowing limit dependent on how much you have lent on the platform. The more you invest, the more you will be able to borrow.

High overall returns and earnings: Compound Finance offers up to 2.58% monthly returns on some assets. The other popular assets also yield high monthly returns. The returns are definitely above average when compared to both banks and most crypto accounts, which usually offer below 1%.

Simple interface: The interface of Compound Finance is very simple and beginner friendly. The features and options are laid out neatly and are easy to access, with no complications or confusing labels. This means users with no experience in the crypto industry can get started right away. Users can also save time, since they will not have to spend hours watching videos or reading blogs just to understand how Compound Finance works.

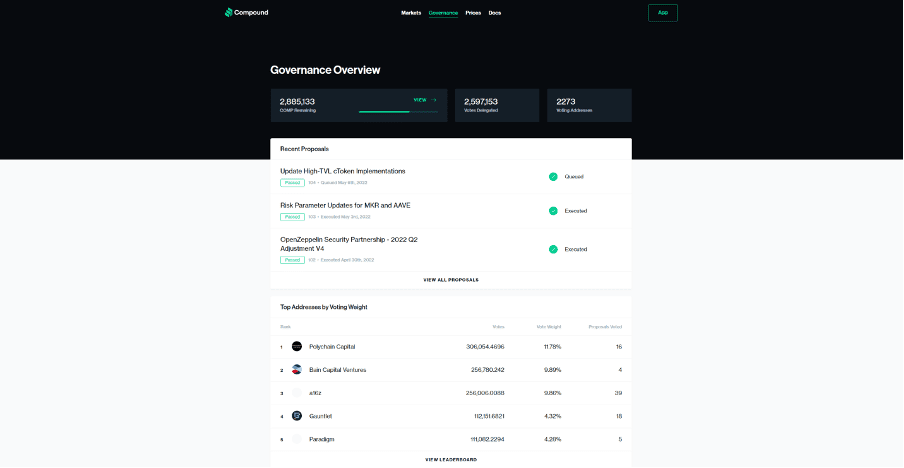

Earn COMP to govern the platform: When users lend or borrow assets on Compound Finance, they are awarded COMP, the governance token of the platform. COMP tokens give users power to govern the platform and make changes in assets, distributions, pools, fees and other aspects through voting. Users can also exchange COMP for any other asset if they would rather withdraw funds. COMP tokens are awarded alongside the borrowed asset or earned interest, offering users a second income stream without investing more.

Community-built interfaces with Compound protocol: The Compound protocol is trusted in the blockchain industry, and several community-built interfaces have integrated the protocol to help users invest with ease, to assure their safety and security, and to create a pleasant experience. Some institutions that have integrated the protocol are Ledger, Fireblocks, Argent and OKX.

These community-built interfaces offer many more investment opportunities in a safe environment along with the ease of controlling and managing assets through a dashboard.

These types of interfaces help users to find the perfect blend of security, investment opportunities and asset management while incorporating the great rates offered by Compound.

Audited and verified exchange: Compound Finance claims to be one of the most secure protocols in today’s era, and several auditing companies have verified the claim. This ensures that the platform is safe and secure and can provide you peace of mind regarding your money. You will not have to worry about losing your funds through massive breaches or hacks, since the platform has taken major steps to avoid such situations.

Massive bug bounty: The Compound Finance website states that literally anyone who finds a bug on the platform will be rewarded with the massive amount of $150,000. This bug bounty benefits common users as well as those who can perform technical analysis of the platform to find a flaw. Users can rest assured that the platform is confident enough in its security to offer such a big bug bounty.

Many crypto exchanges and platforms don’t even have a bounty program, but Compound Finance wants its users to be 100% sure that the platform will perform as expected.

Community support forum: There is a separate Compound Finance forum where users can have their questions answered. The biggest benefit to a forum is that users can interact with each other to get a variety of solutions, opinions and thoughts in a single place without waiting for days to get an answer from the officials of the platform.

Things I Don't Like About Compound

With all the benefits of Compound Finance there are a few negatives. Keep them in mind before deciding to invest in the platform.

Not the best variety of assets: While Compound Finance offers several popular cryptocurrencies, diversity within those assets is not the best. There are only about 15 assets available, which is quite a bit lower than the industry standard. This can mean you compromise on your experience.

If Compound Finance introduces more crypto assets in the future, it will attract many more investors.

No mobile app: Considering how advanced Compound Finance is, users would expect a dedicated mobile app. But unfortunately, this is not the case. If you want to use Compound Finance on your mobile device, you must access it through the web browser or use another interface that integrates the protocol.

Compound Finance Fees

Compound Finance Transaction Fees

Compound does not charge users to deposit or withdraw funds from the platform; instead, users pay the transaction fee or miner fee, which varies depending on the day you make the transaction, the time and the overall conditions of the market.

Gas Fee

The gas fee is implied whenever someone mints, transfers, borrows, liquidates, repays or redeems on the platform. The gas fee varies depending on market conditions.

Pros and Cons of Compound Finance

- Easy lending and borrowing

- Great interest rates

- Free COMP rewards

- Simple interface

- Support forum

- No mobile app

- Not the best diversity in tokens

The Verdict

If you have the right assets, Compound Finance can generate a passive income stream for you. All you have to do is lend your assets and you’ll receive attractive returns as well as governance tokens. Users can also borrow on the platform with the right use of collateral.

It is also pretty easy to get started on Compound Finance, as you simply connect your cryptocurrency wallet and you are good to go. The premium security and audits also ensure that your money is always safe. If you need any guidance, there is a whole community that can help you through the forum. So if you do not mind having a few, high-quality investment opportunities, Compound Finance can be the right place for you.

Frequently Asked Questions

Compound Finance is available to the whole world, as long as you have a crypto wallet that is supported on the platform.

Compound Finance is a legit blockchain project that allows users to lend and borrow crypto assets and benefit through liquidity pools. They have been in the industry since 2018.

Compound Finance claims to be one of the most secure crypto platforms. It also claims to be audited and verified by several security companies. It also offers a bounty to anyone who finds a bug.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.