Bitget and Phemex are two crypto trading platforms that began operation in 2019. Since then, Bitget has garnered 2 million users, while Phemex has over 5 million active users.

Both exchanges provide their customers with a wide variety of trading products, including spot, contract, derivatives, and leverage trading. They also have notable security measures, support various payment methods, and offer multiple customer support options.

While they offer similar features, there are a few differences between the two platforms. Phemex comes out as the winner in this comparison, but read on to see if it is the right exchange for you.

Bitget vs Phemex Comparison Table

Header | Bitget | Phemex |

|---|---|---|

Number of coins | 300 | 300+ |

Deposit Fee | Free for crypto and BGB transfers. | Completely free. |

Trading Fee | Spot trading: 0.1% | - The trading fee is 0.06 (taker) and 0.01% (maker). - Spot trading is 0.1% for both maker and the taker. |

Withdraw Fee | Varies depending on the market status. | - 0.00057 for BTC withdrawals. |

Deposit methods | Credit card, hard currency, Apple and Google pay, and wire transfers. | Credit/debit card, bank transfer, debit or credit card, or crypto transfers. |

Pros | - Easy to use and navigate the platform - Low commissions fees and high liquidity. - Advanced charting tools with customizable indicators. - You can leverage up to 125X. - Has diverse payment methods. | - Wide range of exchangeable coins, +300. - Fast and secure trading. - Has an easy-to-use Interface. - Offers a variety of order types. - 24/7 customer support. - Offers advanced trading tools. |

Cons | - Spot trading doesn’t offer margin trading and leveraging. - Customer service replies take too long. | - Doesn’t support fiat currencies. - Offers less leverage than Bitget. |

Bitget Pros & Cons

- Low minimum deposit, only $10

- High liquidity

- Easy to use interface

- Offers advanced trading tools

- Multi-language support

- Customer support is not always reliable or fast

- Spot trading doesn’t support margin trading and leveraging.

Phemex Pros & Cons

- Offers high liquidity

- Multi-Currency Support

- Provides users with a wide range of educational resources

- High Security

- Processes all transactions fast

- Offers more trading coins (+300) and pairs (+250)

- Limited trading features

- Does not offer 24/7 customer support

Bitget vs Phemex: Features

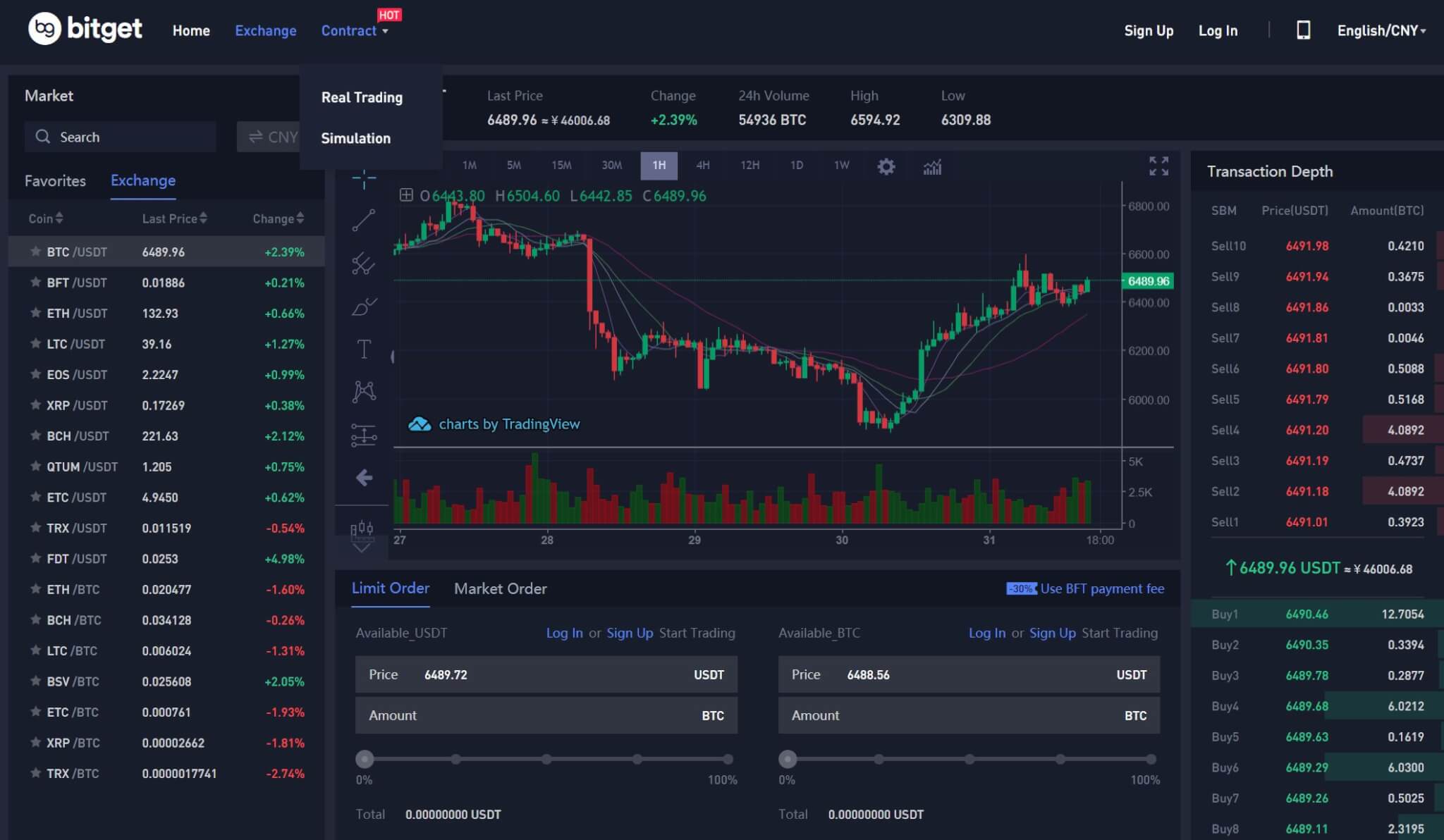

Bitget is a digital asset trading platform that provides users with a full range of trading services. It has an extensive range of features that makes it easy for users to trade and manage their digital assets. Bitget has a $9.8 billion daily trading volume ranking it fifth globally. It also provides users with a wide range of analytical and risk management tools to help traders make the most out of their trading activities.

On the other hand, we have Phemex, a cryptocurrency exchange offering users a unique digital asset trading experience. It offers derivatives contracts, offering access to futures and spot trading. The exchange is focused on providing the most advanced, fast, and easy-to-use trading platform for traders across the scope. According to the exchange, there are 300,000 transactions processed per second, accumulating to $10 billion daily trading volume.

Bitget Features

Spot and Margin Trading

1. Spot Trading

Bitget's spot trading is one of the most critical features offered by the cryptocurrency exchange platform. It allows users to buy and sell cryptocurrency instantly and securely. With the Spot feature, users can make quick and effective trades without waiting for the markets to open and close. Bitget’s spot trading offers over 200 trading pairs, and all have a high level of liquidity. Spot grid trading is available for traders who prefer bots to help in the staking process. Still, the exchange offers more automated trading bots to fit the trading needs of the diverse number of users on the platform.

Hence, if you wish to use the spot trading feature, you are guaranteed different tools to accommodate individual trading needs that you don’t find on many exchanges.

2. Margin Trading

Bitget's margin trading is a feature that allows users to trade cryptocurrencies using leverage, enabling users to make larger trades than the amount of funds they have. In simple terms, Margin trading allows traders to borrow funds as collateral for larger trades. With Bitget, users can access a wide range of margin lending products, including USDT margined futures and perpetual futures.

The Bitget USDT-margined future enables users to leverage up to 125x and take advantage of the trading strategies, such as short and long positions. However, since leverage allows traders to increase their potential profits significantly, it also opens doors for huge losses when leveraged positions move against the trader. Therefore it’s up to traders to use Bitget educational resources to learn how to use margin trading and develop sound trading strategies.

There are two main types of margin trading, cross, and isolated margin. Isolated margin is meant for novice traders, while Cross margin is better suited for users with long-term trading strategies. With isolated margins, pools are separated from each other; therefore, any loss only affects the isolated margin and not your initial margin. For Cross margin, the pools are connected, and both will be affected in case of a loss.

Hence, to mitigate losses while using Margin trading, users need an established risk management strategy.

User-Friendly Platform

Bitget provides users with an easy-to-use interface that is intuitive and straightforward. The platform is concise, allowing users to quickly and easily navigate its features, such as charting tools, live quotes, and market analysis tools designed to help them make informed trading decisions.

The platform also offers trading features such as automated trading and has a user-friendly mobile app, making it easy to access and manage digital assets. All these features make Bitget an excellent choice for traders of all experience levels, which is why many prefer this exchange platform.

Bonuses, Promotions, and Referral Program

The Bitget platform has a variety of bonuses and promotions to help traders get the most bang for their buck.

First, the exchange offers a generous sign-up bonus of up to $3 in coupons when a new user registers and deposits for the first time and a $50 coupon if your futures trading volume exceeds $10,000. Traders automatically get this bonus, so there is no requirement to trigger it manually.

The exchange also provides a trading competition in which the best-performing traders can earn rewards such as Bitcoin, Ether, or USDT. Participants can track their progress on the leaderboard and gain insight into their performance relative to other traders. Traders who deposit 100 USDT, trade a spot with that amount or more, and hold 100 USDT worth of BGB get a chance to win the Bitget Airdrop promotion.

Also, Bitget offers an attractive referral program where users can earn rewards for successfully sharing their unique Bitget links with friends, family, and other contacts. Those who sign up through your link will also receive a bonus, making it mutually beneficial to all parties.

Phemex Features

Spot Trading and Contract Trading

1. Spot Trading

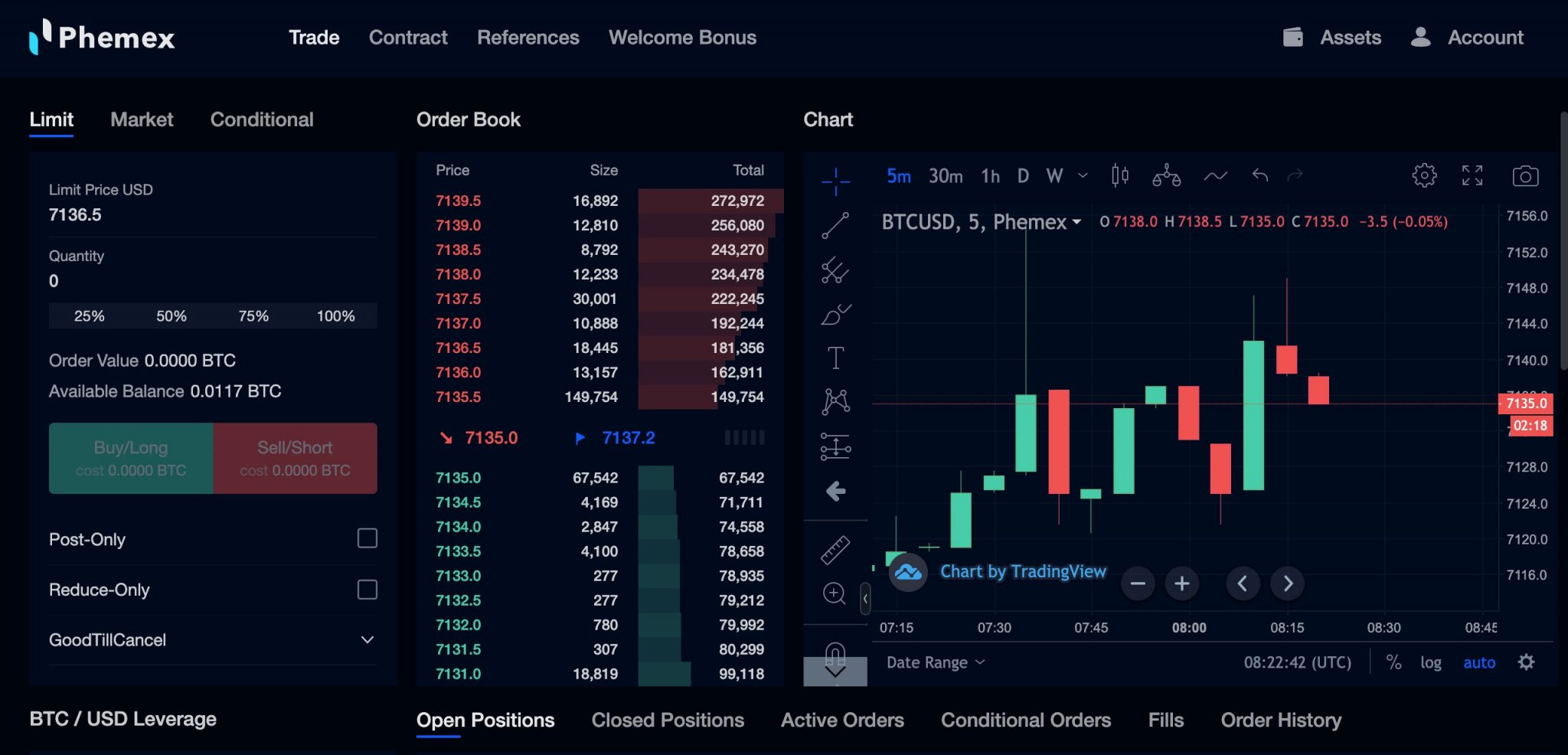

Phemex's spot trading feature allows users to trade digital assets quickly, securely, and with low fees. The order book is displayed clearly, allowing users to quickly access the best bids and offers for their trades.

Users also have access to advanced orders for price protection, allowing traders to pick their price point before executing the trade. You’ll also find limit orders, market orders, stop loss orders, take profit orders, and conditional orders.

Limit orders are placed on Phemex to buy or sell at a specific price or better. They are helpful when trading as they allow you to set the exact price you want to buy or sell at and fill the order when the market reaches your desired price. Market orders are placed on Phemex to buy or sell at the current market price. They are a popular choice for more experienced traders as they can take advantage of sudden market fluctuations. However, they can be risky if a trader fills it at far higher or lower than expected prices.

Conditional orders are orders placed on Phemex that allow traders to reduce risk by setting either a stop-loss or take-profit order. A stop-loss order limits how much loss a trader is willing to take, and a take-profit order can help traders lock in profits by limiting the profits they are willing to keep. Both orders can minimize the loss and maximize the gains depending on the market conditions.

2. Contract Trading

Phemex contract trading feature offers a secure and transparent way to trade digital assets and crypto contracts. With this feature, traders can access capital with a more significant margin than the initial investment to increase profit potential. When the trade is profitable, exchanges must pay more than the trader’s initial investment. But in the case of a bear market, the trader risks losing all the collateral.

Phemex contract trading allows traders to access a wide range of global markets and large amounts of liquidity to make fast, accurate trading decisions. The main benefits of Phemex contract trading are manageable risks, higher leverage, better security, and more trading options.

3. Perpetual Contract

The Phemex perpetual contract is a type of financial derivative product that allows traders to speculate on the price movements of cryptocurrencies. It is a type of futures contract that does not expire, meaning that traders can hold their position indefinitely.

This Phemex contract allows traders to take long or short positions on major cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, and many more. It also features up to 100x leverage, low fees, and a fast and secure trading platform. The contract also has a built-in insurance fund that protects traders from losses in the event of a flash crash. Phemex maintains the fund to cover the auto-deleveraging of any losing positions. Overall, the Phemex perpetual contract is an attractive option for traders looking to speculate on the price movements of cryptocurrencies. It offers a high level of liquidity, low fees, and an insurance fund to protect traders from losses.

Staking Feature

Phemex's staking feature allows users to earn passive income through staking their digital assets. Staking is a process by which users lock their digital tokens in a smart contract and receive rewards from the network in exchange for their commitment. With Phemex Staking, users can stake various digital assets. The rewards for staking through Phemex vary depending on your asset and the amount locked.

The platform offers rewards of up to 10% of the amount staked, depending on the asset. Its staking program is a great way to earn passive income with minimal effort. As long as users keep their tokens locked in the smart contract, they will continue to earn rewards without actively trading.

Furthermore, users can easily access and manage their staking activity through the Phemex platform, making it easy to keep track of rewards and monitor staking activity.

User-Friendly Platform

Phemex is a user-friendly cryptocurrency trading platform that offers the most comprehensive trading experience. It provides a wide range of features and tools to enable users to trade cryptocurrencies securely and efficiently. The trading platform is ideal for experienced and novice traders since it offers advanced order types and high liquidity.

Since the user experience is the cornerstone of Phemex, the platform is intuitive and easy to use so that traders can make informed decisions quickly and easily. Phemex also provides users with a wide range of educational resources, including tutorials, guides, and video tutorials, to help users understand the basics of trading and how to become successful traders.

Promotions and Bonuses

The Promotions and Bonuses offer traders numerous incentives to join and use the platform. These promotions include cashback rewards, deposit bonuses, and referral rewards.

Cashback rewards are available for traders who make a certain amount of trades. It’s usually in the form of a percentage of the trading fees paid for each trade. The reward is credited to the trader’s account and can be used to offset trading costs, but its validity is seven days from when you receive the reward.

Deposit bonuses are available for new traders who make a minimum deposit. This bonus is credited to the trader’s account and can be used to offset trading costs. Referral rewards are available for users who refer friends to the platform. It is in the form of a percentage of the trading fees paid by the referred trader.

Bitget vs Phemex

1. Fees

Bitget offers competitive trading fees for traders compared to other exchanges. For deposits, Bitget does not charge any fees when depositing digital assets. The deposit methods include fiat currency, VISA, MasterCard, Apple pay, and Google pay.

On trading fees, Bitget charges a 0.1% spot trading fee for all digital asset trades, applicable to both maker and taker.

The withdrawal fees vary; Bitget charges a network fee (set by the blockchain) for each digital asset withdrawal. The network fees fluctuate depending on the asset and market status.

Deposits on Phemex are free of charge. You can deposit funds through bank transfer, debit or credit card, or crypto transfers from external wallets.

The platform’s derivatives trading fee is 0.06% for takers and only 0.01% for makers. For spot trading, the fee is 0.1% for both maker and the taker. Phemex's trading fees will reduce if you reach certain trading volumes with their VIP program.

Phemex does not support fiat withdrawals, and the fee for crypto withdrawal varies. If you wish to withdraw BTC, the fee is 0.00057 BTC.

When it comes to Bitget and Phemex fees, Phemex has the upper hand since the fees are lower.

2. Number of Cryptocurrencies

Bitget offers users access to over 300 cryptocurrencies and 200 trading pairs. You'll find some of the most popular crypto assets, including Bitcoin, Ethereum, Litecoin, and some of the more native tokens like GNO.

Phemex boasts an even more comprehensive selection of digital assets with more than 300 different cryptos listed and 250 plus trading pairs. The trading assets include all major cryptos like Bitcoin, Ether, Litecoin, and Bitcoin cash, just to mention a few. The platform also allows for spot trading of 30+ cryptocurrencies, making it a good option for those looking for a place to manage their portfolio.

3. Security

Bitget is committed to providing crypto traders with a secure and safe trading environment. They have implemented robust security measures to ensure their clients’ funds are safe and secure. These measures include;

- Multi-Signature Cold Wallet: Bitget utilizes multi-signature cold wallets to store most of its client’s funds. It ensures the funds remain safe and secure, even if the system is compromised.

- Encryption of Personal Data: Bitget encrypts all users' personal data and never shares it with any third party.

- Regular Security Audits: The platform performs regular security audits to identify potential threats and vulnerabilities.

- 24/7 Monitoring: Bitget has a 24/7 monitoring system to monitor all activities and transactions on the platform.

- Secure Communication Protocols: Bitget uses secure communication protocols such as SSL and TLS to ensure data transmission safety.

- Verification and Authentication: All new users must undergo a strict verification and authentication process before using the platform.

The security of Phemex is also top-notch. The platform has implemented various security measures to protect users' funds, including multi-signature wallets, cold storage, and two-factor authentication.

- Multi-factor authentication: Phemex has implemented two-factor authentication (2FA) for all users. This technology requires users to enter a code sent to their phone or email every time they log into their account. It adds an extra layer of security and makes it harder for hackers to access user accounts.

- Cold storage: Cold storage is a process in which funds are kept in an offline wallet, not connected to the internet, making funds inaccessible even if the exchange is hacked.

- Encryption: Phemex encrypts all user data and communication to help keep it safe from potentially malicious actors.

- Regular audits: Phemex conducts internal audits to ensure that its security protocols are up to date and its systems are secure. Phemex also provides its users with educational resources on keeping their accounts safe, including advice on creating secure passwords and using two-factor authentication.

Lastly, Phemex has implemented an insurance policy that covers users in case of a hack or malicious activity. This ensures the protection of user funds or assets in case of an attack. Also, Phemex has a stringent KYC/AML process to know its users and protect its system against money laundering.

Bitget and Phemex have robust security protocols to protect their customers' assets. Both exchanges use cold storage to store most of their customers' funds, meaning the funds are stored offline in an inaccessible environment. The platforms employ two-factor authentication for user accounts and have anti-phishing measures. Therefore regarding security, it is difficult to determine which platform is better for traders. Depending on their risk tolerance, traders should take the time to consider the security protocols of both platforms before making their decision.

However, since Phemex has an insurance policy for its user's funds, it should be the best pick if you value your digital assets.

Bitget vs Phemex: Summary

Bitget is a global digital asset trading platform providing crypto trading services to diverse demography of traders. It offers various digital asset trading services, including spot trading, margin trading, futures trading, and perpetual contracts. It also provides diverse tools to help customers manage their portfolios and enhance their trading experience. Furthermore, Bitget uses an AI-driven system with a crypto economy that provides secure real-time market data, analytical insights, and advanced order management that incorporates autonomous AI to execute different trading tasks.

Its counterpart, Phemex, offers spot trading and perpetual contracts on various cryptocurrencies, including Bitcoin, Ethereum, Ripple, Litecoin, and other altcoins. The platform provides low trading fees and offers a range of order types, including limit orders, market orders, and stop orders. Phemex has various advanced tools and services, such as margin trading, options trading, and a sophisticated risk management system. It also has an AI-driven system that provides real-time market data, analytical insights, and advanced order management.

Both Bitget and Phemex offer advanced trading features and tools to help customers manage their portfolios and enhance their trading experience. However, Phemex is slightly better regarding customer asset protection as it offers insurance on customer funds and segregated asset accounts. It also provides more trading assets and pairs, and there are more methods of earning passive income on the platform when you compare it to Bitget’s.

Hence, our pick here is Phemex since the exchange offers more than Bitget.

Conclusion

If you are still considering these two exchanges you can read our Phemex review and Bitget review, to learn more about each platform. You can also read our articles on the best crypto trading platforms for day trading, top margin trading exchanges, or best crypto exchanges in the USA.