With global interest rates at all-time lows, many people are looking at alternative ways to grow their wealth. Cryptocurrency has becoming increasingly popular and mainstream, with huge gains in recent years on many different coins. Another way to build your investment is to earn interest on the cryptocurrency you own, especially if you plan on holding it for the long-term. With annualized interest rates of 3% for Bitcoin and 8% on stablecoins (such as USDC and USDT), your initial investment can increase substantially when compounded over a few years.

| Where to earn interest | Features | Score | Sign Up |

|---|---|---|---|

Earn interest on 350+ coins  | ☑️ Earn interest on a huge range of more than 350+ cryptocurrencies ☑️ High rewards when you lock crypto for 120 days ☑️ Largest crypto exchange in the world | 9.8 | Sign Up |

Best flexible staking rates  | ☑️ Highest rates for flexible staking ☑️ Dual asset mining and liquidity mining available to earn higher rewards ☑️ No KYC required to use this exchange | 9.5 | Sign Up |

Best mobile app for staking  | ☑️ Easy-to-use mobile app where you can earn interest on crypto in a few clicks ☑️ Earn interest on 20+ coins, with 3-month fixed term giving the highest rewards ☑️ Use the Crypto.com debit card to receive cashback in CRO coins on every purchase | 9.2 | Sign Up |

How do I earn interest on my cryptocurrencies?

You can earn interest on your crypto through staking, which is only available on certain coins, or on lending platforms. Staking is the process of setting aside your cryptocurrency which can be used to validate transactions made on the proof-of-stake blockchain. By locking your cryptocurrency, you earn more of that cryptocurrency, as a reward for contributing to the blockchain network. Lending platforms pay you interest on your cryptocurrencies as they use that to loan to others who want to borrow crypto. The borrower is not borrowing directly from you, they are borrowing from the platform and you are lending to the platform.

If you are interested in earning interest on crypto, but you haven't bought any yet, you can find our recommendations on the top crypto exchanges to make an informed decision.

Where do I earn interest on crypto?

There are lots of different cryptocurrency exchanges and lending platforms that you can use to earn interest on your crypto. It can be hard to decide which one to use, because you aren't sure which ones to trust, or if the interest rates are misleading. We have written this article to help you determine which one is best for your needs.

What to consider when choosing where to earn interest on my crypto?

There are many factors to consider when looking to earn interest. Some of the main ones are listed here:

We have included a quick comparison table of the top places to earn interest on your crypto. For more detailed information on each of them, keep reading below.

Best places to earn interest: Individual Breakdowns

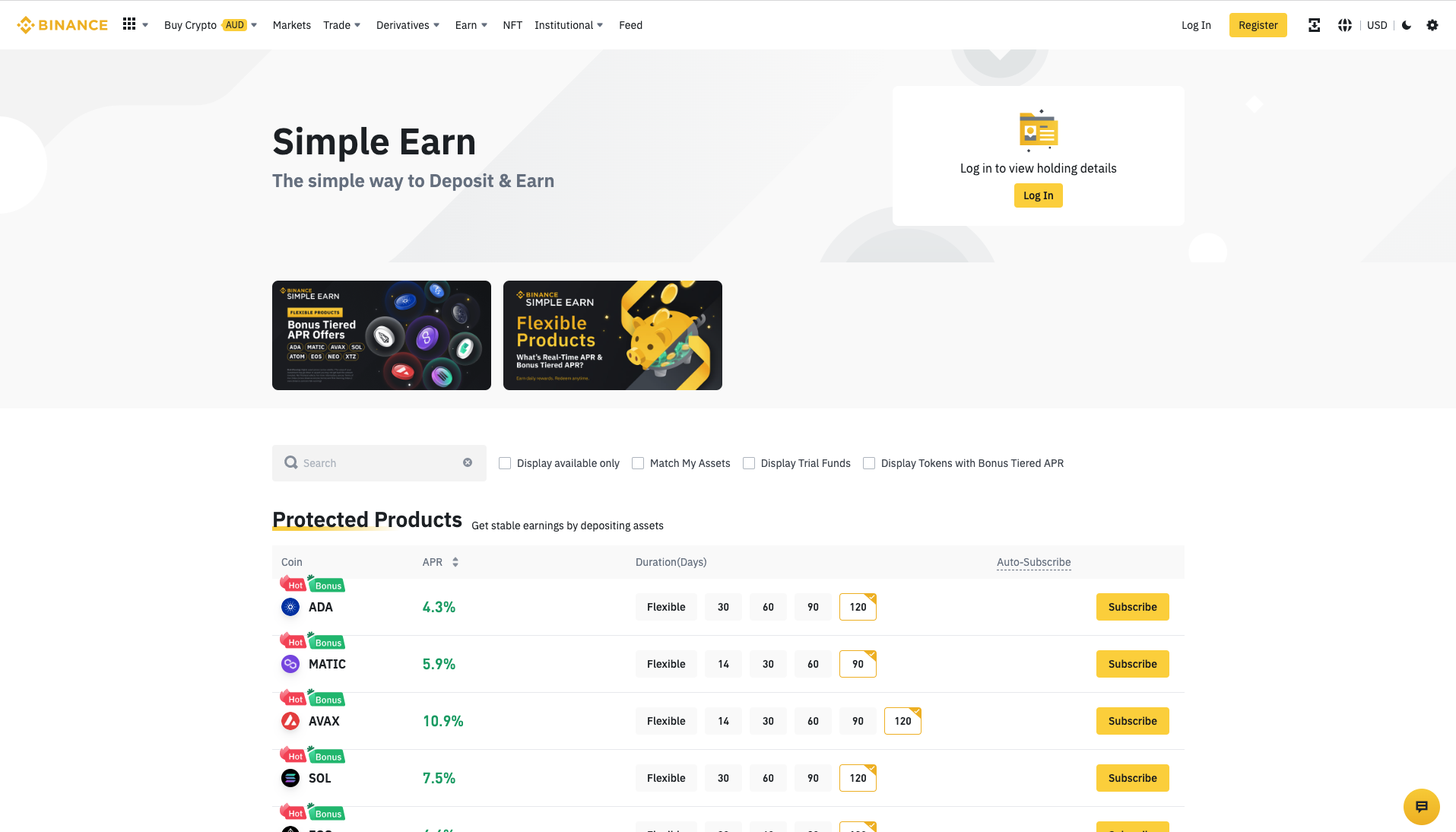

#1. Binance - earn interest on 350+ coins

Binance is the largest cryptocurrency exchange in the world based on trading volume, and it offers over 600+ cryptocurrencies, with the ability to earn interest on over 350+ of them. Serious traders love Binance as they offer so many different coins and advanced trading options. If you are already a user of Binance, or if you plan on investing in a wide range of crypto and want to earn interest on many of them, this is a great platform for you. You can read our detailed breakdown of Binance here, if you want more information about their full range of features.

The interest rates on Binance are high, and you have the option to lock it for 120 days to receive the maximum yield. If you prefer shorter durations, you can lock or 90 days, 60 days, 30 days, and for some coins 14 days. To stay in total control of your crypto, you can choose flexible staking, where you can sell, trade or transfer your crypto at any time.

To give you an example of the interest rates at the time of writing, if you stake SOL for 120 days, you receive 7.5% APY, and it reduces to 5.9% APY if you stake for 30 days. If you prefer to keep it flexible, the rewards are only 0.58% APY, with a bonus 1% APY for the first 220,000 SOL that you stake.

You can also stake stablecoins such as USDT and BUSD, but there is no locked duration, only flexible staking is supported. For BUSD, the rewards are 2.89% APY, + 2% APY bonus for your first 500 BUSD. For USDT, the rate is 1.64% APY, + 1.5% APY bonus for your first 500 USDT.

The downside of Binance is that it isn't available in the US. There is a sister site called Binance.US but they have limited features, and in terms of earning interest, they only have access to 7 coins: QTUM, EOS, ONE, VET, XTZ, ATOM & ALGO. If you are from the US, we suggest you use Crypto.com, which is an easy-to-use app for earning interest, and available for US citizens.

- Buy, sell and trade over 600+ different coins

- Earn interest on more than 350+ cryptocurrencies

- Higher interest rates if you lock coins for 120 days

- Largest cryptocurrency exchange in the world by trading volume

- Not available in the USA

#2. Bybit - Best for flexible staking

Bybit is one of the top crypto exchanges in the world, with over 10 million users, and it has various options to earn interest. You will find fixed duration and flexible staking, and from our experience, Bybit is best for flexible staking. The rewards are much higher than Binance when you compare flexible staking, for example you receive 3.3% APY on Solana (compared to Binance: 0.58% + 1% bonus APY). If you choose flexible staking for USDT, you receive 5.5% APY, much higher than Binance's rate of 1.64% + 1.5% bonus APY.

When it comes to fixed term staking, Bybit's rewards are not as high as Binance. Also, the fixed durations are a maximum of 30 days, you cannot lock it for 120 days like on Binance. Therefore, if you want to maximize profits from crypto staking, Binance locked terms are the better option.

Bybit also offers some other options such as liquidity mining and dual asset mining, which comes with much higher reward rates. For example, liquidity mining of USDT can earn you between 0.71% to 28.03% APY, and dual asset mining has 0.27% to 454.68% APY. However, this is recommended for advanced users only, and you need to be aware of the risks involved, and how it all works. You can read about dual asset mining here, and liquidity mining here.

While Bybit is not technically allowed in the US, there is no KYC required, so you can sign up anonymously, without any ID. This means that if you use a VPN set to Australia, you can sign up to Bybit and earn interest. This is a good option for US citizens who can't access either Binance or Bybit.

- Dual asset mining and liquidity mining to access much higher levels of interest

- Flexible and fixed term staking with decent APY

- No KYC required, so you can sign up quickly and earn interest anonymously

- Reliable crypto exchange with more than 10 million users

- Not available in the US, unless you use a VPN

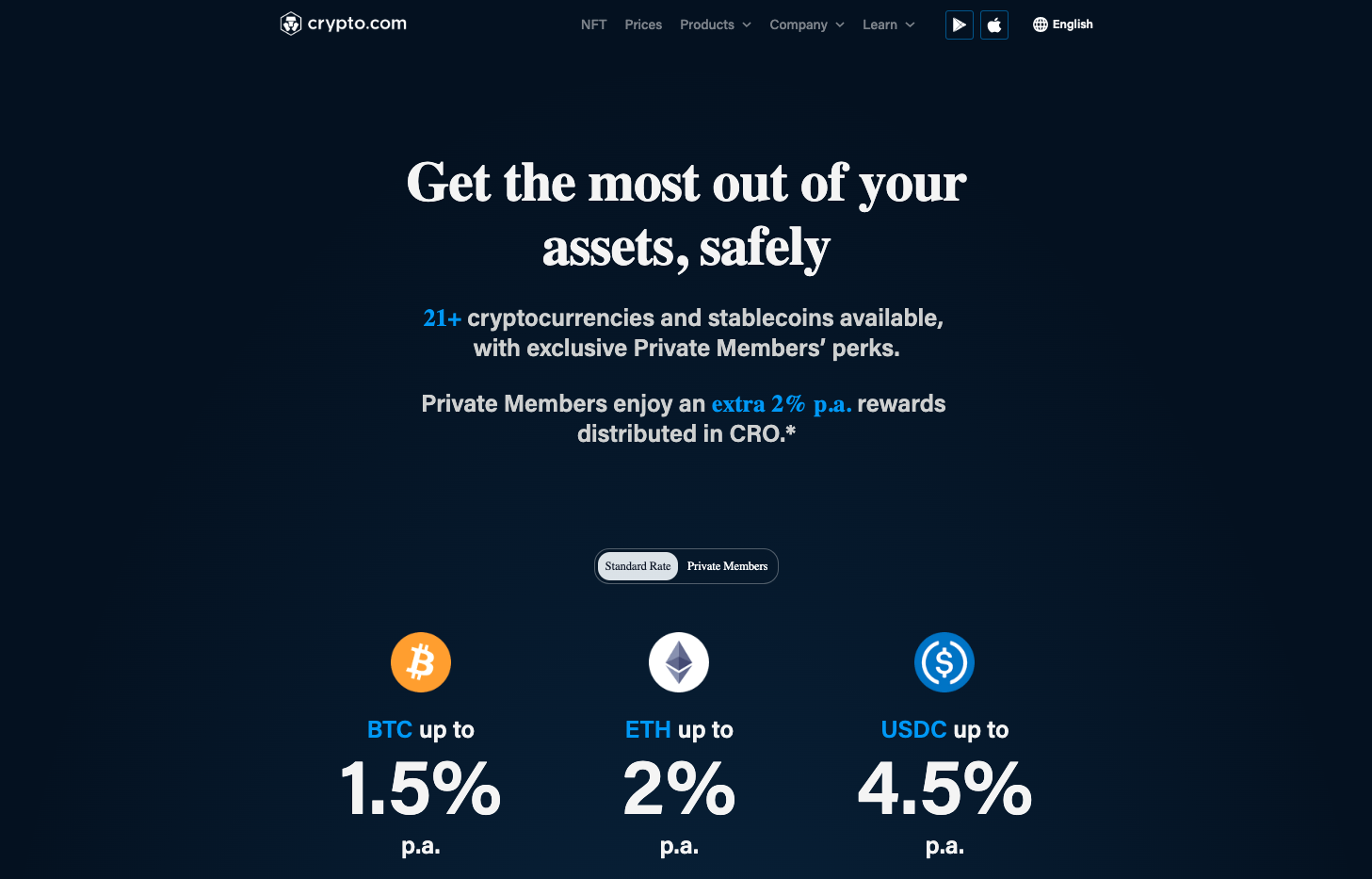

#3. Crypto.com - earn crypto cashback on Visa purchases

Crypto.com is one of the best crypto exchanges and allows users access to buy over 250+ different coins and earn interest on 20+ of them. It is best used on a mobile device, where you can easily buy, sell and swap your cryptocurrencies. One standout feature of Crypto.com is the Visa debit card they offer to users. There are different tiers of Visa cards (based on how much of their token - CRO - that you stake), which you load up with your base fiat currency and spend at any online or brick and mortar store that accepts Visa. Each time you make a purchase, you will receive a percentage cashback in CRO coins! The highest level is 5% cashback, but even if you get the basic card (with just $400 staked CRO required), you will earn 1% cashback in CRO for every purchase you make. This is free cryptocurrency that you can stake to earn additional interest, or convert to fiat or another cryptocurrency.

The interest rates you can earn vary depending on each coin, and also if you fix it for 1 month, 3 months, or prefer to leave it flexible. An example is 4.5% APY on USDT if locked for 3 months, 3% if locked for 1 month, or 0.4% if you keep it unlocked. If you have more than $4,000 of CRO coins staked, you can also access higher interest rates, for example 6.5% APY on USDT (locked for 3 months) and if you stake more than $40,000 CRO, the rewards are 8.5% APY (locked for 3 months).

Crypto.com is also a great choice if you frequently use a debit card, because the cashback on each purchase adds up and further grows your portfolio in addition to the interest you earn on your coins. There is also a Supercharger feature where you can earn interest on your CRO coin. Your interest is paid out in the coin they are offering at the time, which changes every 2 weeks. The estimated APY of the coins can be as high as 28%, and some of the popular coins they have had in the past include: BTC, ETH, AXS, SHIB, DOGE, UNI, LUNA and DOT. If you want to find more about Crypto.com, read our detailed review here.

- Buy, sell and swap over 250+ different coins

- Earn interest on 20+ cryptocurrencies with the option to lock for 1 or 3 months to access higher rates

- Visa debit card to earn up to 5% cashback on your everyday purchases

- Supercharger feature to earn new coins

- To access competitive interest rates you need to lock your cryptocurrency for 3 months

#4. Nexo - best wallet for earning crypto interest

Nexo is a cryptocurrency wallet that does much more than just safely store your coins. You can use it to buy crypto instantly with card, swap between coins, and earn interest on any of their 33 cryptocurrencies. Nexo's security is world-class, with storage in Class III vaults, ISO 27001:2013 compliance, military-grade 256-bit encryption and biometric-based identity verification.

Nexo also has an excellent sign-up offer, with FREE $25 of BTC if you sign up with this link and deposit $100 for at least 30 days.

Nexo has decent base rates of interest that can be increased in several ways. The base interest rate for stablecoins is 8% and for all other cryptocurrencies ranges from 3% for BTC up to 20% for AXS. The first way you can increase your interest rate on non-stablecoins is to lock it for 1 month to receive 1% bonus.

The second way to increase your interest rate is by receiving your interest in Nexo's own token, called NEXO. If you opt for this option, you receive an extra 2%, but remember you are being paid in NEXO and not in the base currency you have stored (eg: you store BTC but get paid in NEXO). You can always swap NEXO for other coins that you like. This feature is not available to US citizens and residents due to regulatory restrictions.

The final way to earn extra interest is based on your loyalty level. This is based on the percentage of NEXO tokens you have staked compared to other coins in your Nexo wallet. If 1-5% of your wallet is NEXO tokens, then your interest rate on stablecoins is 8.25% and other coins is 4.25%. At the highest loyalty level (if more than 10% of your portfolio is staked NEXO) you will receive 10% on stablecoins and 5% on other coins. Remember you can still enjoy extra interest by locking for 1 month and being paid in NEXO tokens.

- Nexo is a wallet where you can buy, store and earn interest on 33 cryptocurrencies

- High base interest rate of 8% on stablecoins and 3% - 20% on other coins

- Receive 1% bonus interest for 1-month fixed terms, 2% bonus by earning interest in NEXO, and extra interest depending on how much NEXO you have staked

- Easily swap your coins within the wallet

- Earning interest in NEXO not available for US citizens and residents

Where can I earn the most interest on my crypto?

The interest rates change all the time, and depend on fixed or flexible options. Binance and Bybit usually have the highest rewards for staking your crypto.

Is earning interest on crypto safe?

With such high interest rates, it can sound too good to be true. What is the catch, what are the drawbacks to earning interest on crypto and is it safe? There is a risk involved when you earn interest on your crypto because your coins are not in your personal wallet and therefore not in your total control. The amount of risk involved is dependant on the site you choose to deposit your coins. The main risks you need to be aware of is hacks and borrower defaults.

Platforms that do not have robust infrastructure or security measures are at greater risk of being hacked. You need to choose a site that has high levels of security to minimize your chances of losing your assets.

In terms of borrower defaults, this is based on who your platform lends to. If they are clear about their lending standards and have stringent requirements for their borrowers, the risk of default is lowered.

Remember to do your own research into any platform you decide to use, and weigh up the risks before placing your cryptocurrency into any site to earn interest. It is also a smart idea not to put all of your cryptocurrency in any one platform, in case anything goes wrong.

Is earning interest on crypto taxable?

You need to check your local laws for cryptocurrency and taxation, but in most cases, yes you will need to report any interest earned as income. Generally you need to note the market value of the earnings at the time you receive it. Please note that this is not financial or tax advice, and you should seek the advice of a tax accountant to work out the details for your personal situation based on your geographical location.

Where do I buy cryptocurrency?

If you don't yet own any cryptocurrency, you can purchase it from any of the best cryptocurrency exchanges. Some of the crypto exchanges also allow users to earn interest on their crypto from within their platform, making it easy. For example, Crypto.com offers over 250+ different coins that you can buy, and you can start earning interest on 20+ of them straight away from within the mobile app. If you want to read more about Crypto.com, you can have a look at our full review here.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our privacy policy click here.