Key Takeaways

- The Metaverse is a new online world, more immersive than observing from a phone or computer.

- You can invest in the Metaverse by buying cryptocurrency linked to metaverse games, virtual real estate NFTs in a blockchain-based metaverse, or stocks of companies that focus on building a metaverse.

- Decentraland is the most popular metaverse game and their coin MANA is the most valuable metaverse-based cryptocurrency by market capitalization.

- Buying real estate in a game such as Decentraland is another way of investing in the Metaverse.

There has been growing talk about the Metaverse, especially after Mark Zuckerberg announced that Facebook will be rebranded as Meta in October 2021. Is the Metaverse going to be the next big thing? Could it be the future of the internet? No one can say for sure, but plenty of people are willing to invest in it now before it becomes mainstream. How can you invest in the Metaverse in 2024? There are several ways, which I will cover in this article. But first, we must answer the following question:

What exactly is the Metaverse?

The Metaverse is supposedly the next stage in the evolution of the internet, where users interact within a new online world, which is more immersive than simply observing through the screen of a phone or a computer. It is expected that Virtual Reality and Augmented Reality will play a role in immersing us in this virtual world. Many different companies are working towards building their own metaverse, for example Meta (Facebook) is working on hardware, and it already has the user base with its social platform, while Roblox and Electronic Arts are gaming companies that already have experience building simulated worlds. Then you also have blockchain-based metaverses (such as Decentraland and the Sandbox) which are decentralized, community-driven virtual worlds where you can purchase land as an NFT and build whatever you like on it.

How do I invest in the Metaverse?

There are a few main ways to invest in the Metaverse, and I will expand on each point in this article. Click on the jump links below to skip to that section.

Buy cryptocurrency linked to metaverse games

The first way you can invest in the metaverse is to buy cryptocurrency that is linked to blockchain games such as Decentraland and the Sandbox. In these games, you can walk around the virtual world that is created by the community and explore what others have built. The great thing about these games are that they are decentralized; there is no central authority running the place, or controlling what you can or can't create or do in your own space. Also, any land or objects you purchase within a game are NFTs and are yours to own indefinitely. Compare this to traditional computer games, where you pay in-game tokens or even real money to purchase items, but if the company no longer runs the game or decides to ban your account, you lose everything you paid for.

Decentraland (MANA)

Decentraland is the most popular metaverse game and their coin MANA is the most valuable metaverse-based cryptocurrency by market capitalization. Much of this comes from the first-mover position that Decentraland has, as the first-ever virtual world that is owned by its users.

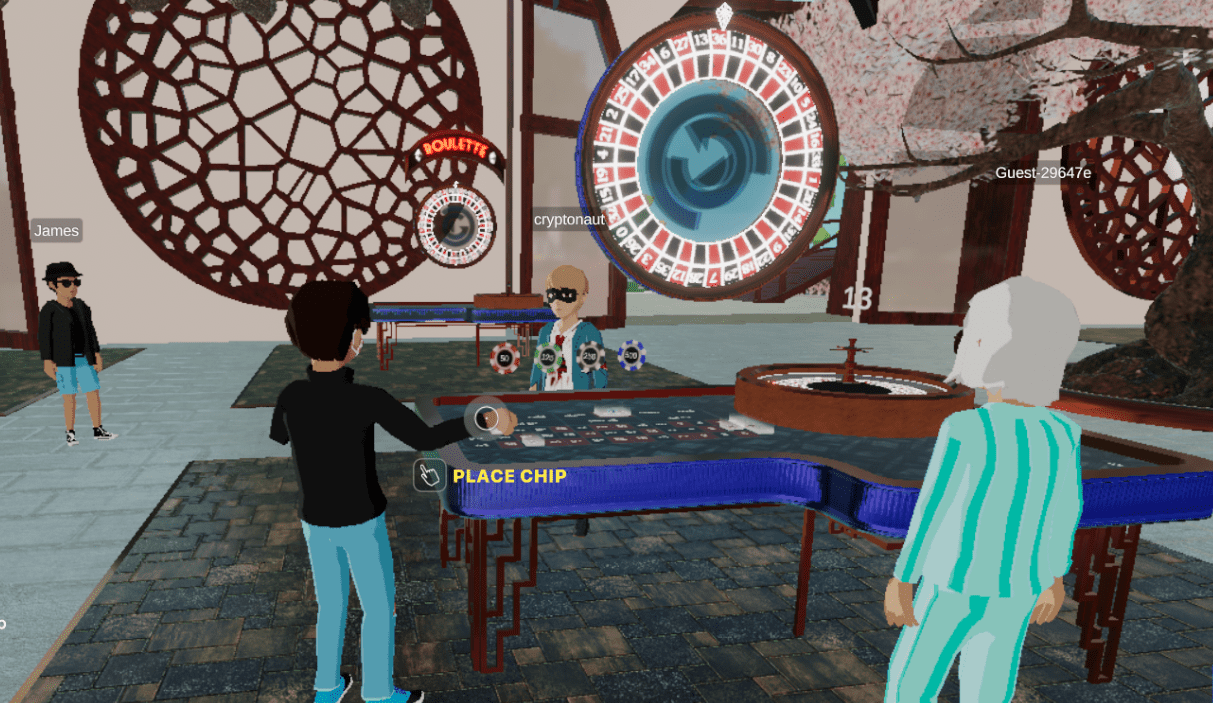

To interact with the metaverse of Decentraland, you need to use their native token called MANA. This can be used to attend events, or buy items in the virtual world, including land. You can also play games in Decentraland, which may incur an entrance fee, but you can win digital items in return. There are even virtual casinos found in Decentraland, where you can win MANA, which of course you can spend in the game, but you can also exchange for fiat currency on a crypto exchange. One of the casinos in Decentraland has even created jobs in this virtual world, by hiring people to greet users that enter the casino!

Decentraland has picked up lots of attention from large institutional investors, including Grayscale launching a Decentraland Trust in February 2021. This was an eye-opening move, as Grayscale typically invests in large-cap cryptocurrencies, which in fact MANA has now grown into. World-famous auction house Sotheby's has also immersed themselves into the metaverse, by recreating their London New Bond Street galleries in Decentraland. The designers copied the real original building brick by brick, and the virtual building features five gallery spaces where they showcase NFTs, and they conduct real auctions for NFTs from within the virtual world.

Currently there is not much going on in Decentraland, and the user base is not substantial. If it increases in popularity with more exciting events and features, and more people building impressive spaces within the virtual world, then it could bring an influx of new and recurring users. If this happens, the price of MANA could increase, as users need to purchase MANA to interact within Decentraland.

It is free to roam around Decentraland as a guest, so feel free to explore it before making an investment into it. If you decide you want to purchase MANA, you can find it on some of the top crypto exchanges or follow this step-by-step guide.

Other metaverse game cryptocurrencies

Besides Decentraland, there are other metaverse games, some with much more functionality but they haven't been around as long. They might end up being hugely popular, which means their cryptocurrency value could shoot up much more than MANA, but there is also a higher level of risk involved. Do your own research before investing in any of these cryptocurrencies, but some of them are SAND (the Sandbox), ILV (Illuvium), ATLAS (Star Atlas) and WILD (Wilder World).

Buy virtual real estate in the Metaverse

Buying real estate in a game such as Decentraland is another way of investing in the Metaverse. The concept might seem absurd at first, when you try to grapple with the idea of paying money for a space that you cannot live in, and doesn't exist in the physical world. However, if you think of it in terms of supply and demand, recognising that land is a finite resource in the Decentraland metaverse, then it can become a logical investment opportunity as the value should appreciate over time as more people want to purchase it. You can also rent it out, or build a game, shop or advertisement to generate passive income.

In Decentraland, the metaverse consists of only 90,601 'parcels' of land, each of which is a 16m x 16m square. These parcels are referred to as LAND, and are NFT's (non-fungible tokens). Once you own LAND, it is yours until you decide to trade it, and it's unique and cannot be replicated. You can also build an estate, which is an association of two or more adjacent parcels of LAND. They must be connected, for example they cannot be separated by a road or any other parcel or plaza. If you form an estate, you can build larger scenes that would stretch beyond one parcel.

In November 2021, an estate in Decentraland consisting of 116 parcels was bought by Tokens.com for $2.43 million. They plan to use this LAND which is in the heart of the Fashion Street District to expand into the digital-fashion industry. At the time of writing in December 2021, a single parcel of LAND sells for around $16,000, whereas just four months ago in August 2021, they would average about $5,000. Back in December 2017, one parcel of LAND would sell for just $100. You can check previous LAND sale prices here.

Where should you buy real estate in the metaverse?

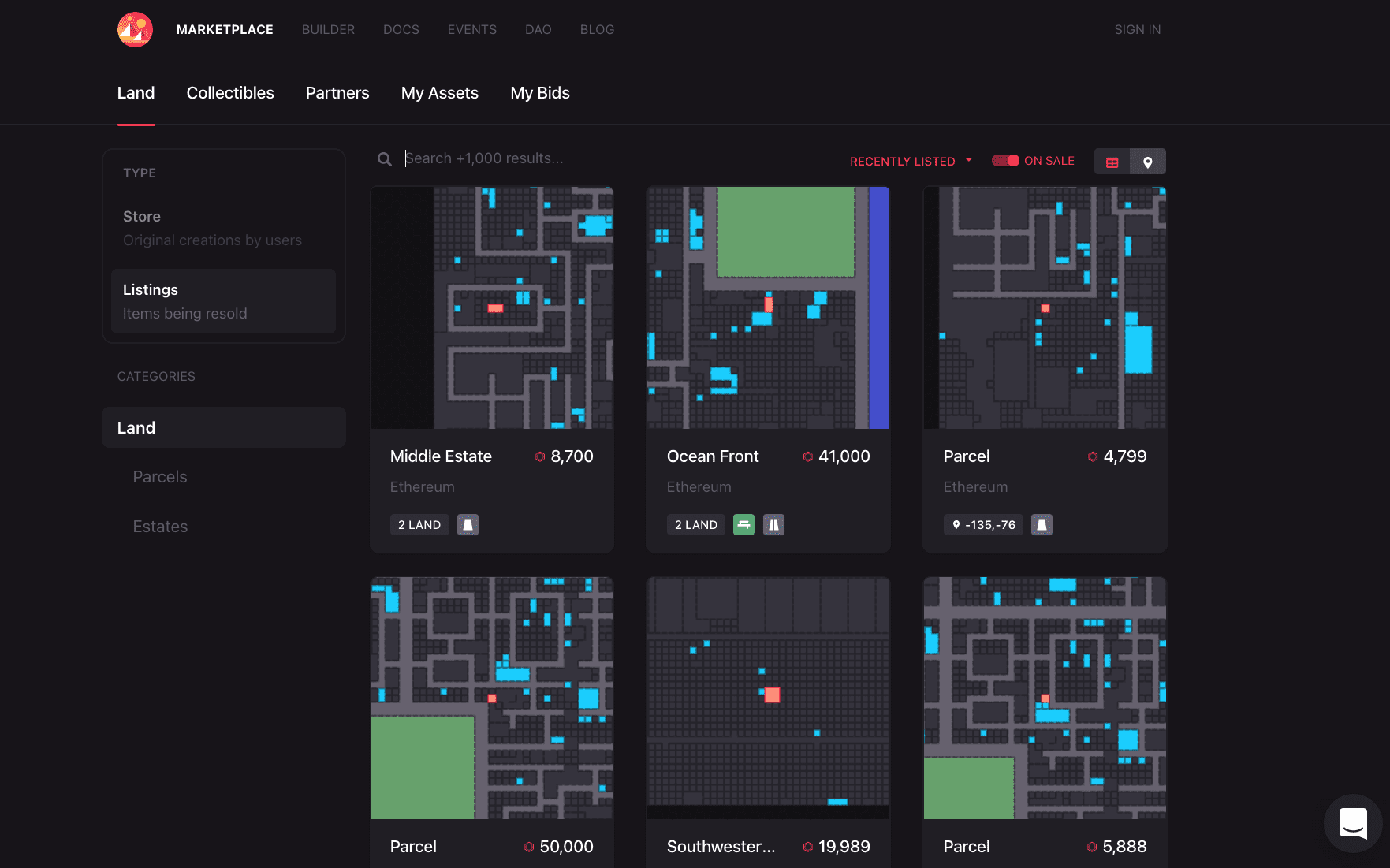

Just like in the physical world, the three most important factors when deciding where to buy virtual real estate is location, location, location. The Decentraland metaverse is not just a bare space filled with individual owners' parcels; they have created a world where there are private LAND owners as well as themed community districts, and roads that connect them. In the map below, you can see dark grey areas, which are privately owned LAND parcels, which can be traded on the Marketplace. The large purple areas are Districts, which are governed by sub-communities and stick to a specific design theme, for example Fashion Street, Vegas City and even Red Light District. The Green squares are Plazas, which is where players enter the Metaverse and therefore have high foot traffic. The light grey, straight lines are roads that connect different districts and plazas together. The most valuable real estate in Decentraland would be those that are near plazas (due to the high traffic passing through) and districts (which would attract a specific type of player to that area).

How to buy real estate in the Decentraland metaverse?

In Decentraland, it is easy to buy virtual real estate, or LAND as it is referred to in the game. All you need to do is go to the Decentraland marketplace and search for a parcel you want to purchase. Note that all of these parcels are sold on the marketplace by the current owner of the parcel, you cannot purchase any directly from Decentraland itself as they were all auctioned off in 2018.

To buy a parcel of LAND, you will need to pay using MANA, so if you do not have some, buy some from a cryptocurrency exchange first. You should be able to buy MANA from most of the exchanges in this list. You can view the location of the parcel in relation to the map of Decentraland, and you can also click to view the 3D version of that LAND from within the game. To give you an example, I clicked on one of the parcels that was on sale, and I could see the parcel including the house that's built on it, for sale. You can walk around, inside the house, and inspect each room if you like.

How to monetize your real estate?

Besides holding your real estate and waiting for it to increase in value, there are three main ways you can earn money on it in the meantime. First, you can lease your LAND to someone else that wants to build on your parcel. You can receive a monthly rental payment in MANA or ETH, or possibly a share in the revenue made from the business that is built on your real estate. The second option to monetize your parcel is to build something yourself, and sell the assets and LAND together. For example, you could build a house, a shop, or a gaming arcade which is ready to go for a new owner who wants to get started. Or you could build something that is aesthetically attractive that naturally draws players in, which means the potential buyer is purchasing LAND that comes with steady high-volume traffic. Finally, you could build a game, shop or an advertisement that provides a passive income stream. You could sell in-game NFT collectibles or clothing, or have a game where visitors have to pay to play.

Other places besides Decentraland to buy real estate

Decentraland is the most popular metaverse game at the moment, but it is not the only place to buy virtual real estate. Since the price of Decentraland LAND is already so high, you might be looking for other metaverses where you can buy lower cost real estate, and hope it increases dramatically in value in the next few years. Some other games where you can buy real estate are the Sandbox, Cryptovoxels, Somnium and Upland. Remember to do your research before investing in any virtual real estate, and don't buy anything that you don't understand.

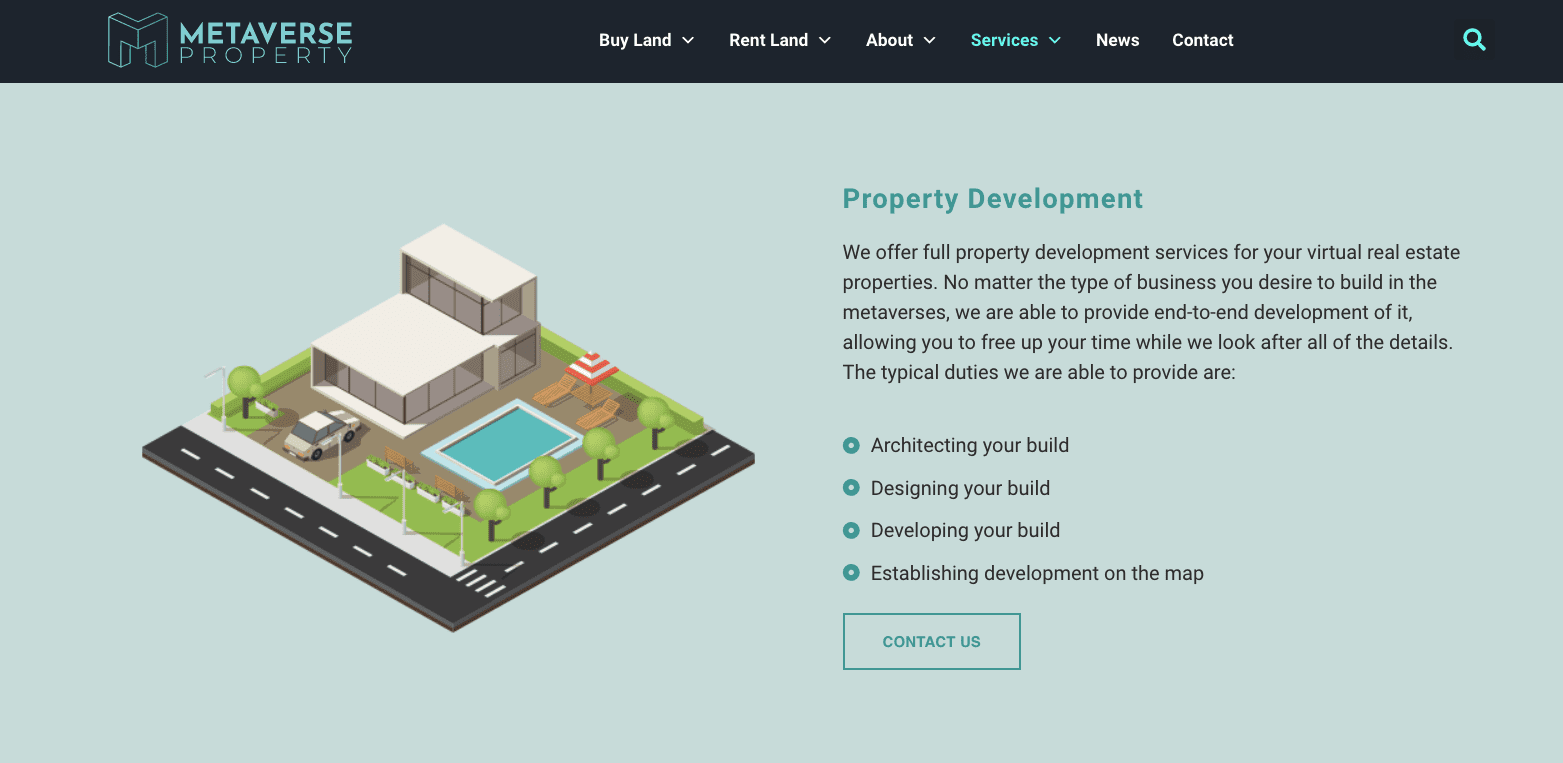

If you want to buy real estate using a virtual real estate company, Metaverse Property are the first in the world to offer this service. Not only can they help you buy or rent virtual real estate, they can also design and build your desired project for you, manage your property, collect rent from your property, and even assist in marketing.

Buy stocks of companies that are focused on building a metaverse

The final main way to invest in the metaverse is to buy stocks in the companies that are heavily involved in creating the Metaverse. Note that the decentralized metaverses described above are different from the one proposed by Mark Zuckerberg, as well as any other companies. The decentralized nature of those virtual worlds mean that no-one can control what is placed on any plot of land, nor can anyone take away any NFTs that you own. Although there are benefits of decentralization (for example, your collectibles are yours to keep forever, and your account cannot be shut down), it does come with some potential issues. With no central governing body, there is nothing to stop users posting obscene images, defamatory material, or inciting hatred against a certain group.

If you think that the most successful metaverse will come from a large company that has experience with building social platforms and virtual game worlds, and the ability to control how the metaverse operates, then maybe investing in one of these companies is the better option. The most obvious company is Meta Platforms (previously known as Facebook), which is a large part of the reason why there has been increased talk about the Metaverse in the first place. Meta Platforms may be the safest option, as it has a large user base of over 3.5 billion across Facebook, Instagram and Whatsapp, and has already made huge profits year after year.

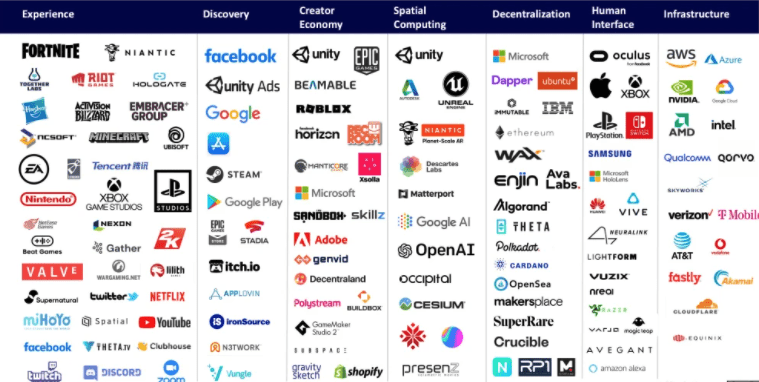

There are several gaming companies such as Roblox (RBLX), TakeTwo (TTWO), Electronic Arts (EA) and Activision Blizzard (ATVI) that all have experience building gaming worlds, and may be the one to create the best metaverse. If you want a lower risk exposure to cover all your bases, you could even invest in the Roundhill Ball Metaverse ETF (META ETF) which gives you exposure to the Metaverse by providing investment results that are closely linked to the performance of the Ball Metaverse Index. This is the first index in the world that is designed to track the performance of the Metaverse. It consists of a tiered weight portfolio of globally-listed companies who are actively involved in the Metaverse, including Nvidia (NVDA), Roblox (RBLX), Microsoft (MSFT), Meta Platforms (FB) and Unity Software (U) as their top 5 holdings.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our privacy policy click here.