Key Takeaways

- Short selling in cryptocurrency refers to selling coins with the intention of buying them back when their price drops, in order to make a profit.

- Short selling can be risky, but can be used for profit if done properly.

- Short selling can be beneficial if an investor believes a currency is in a price bubble, if an investor wishes to leverage volatility, or if an investor is hedging risk.

- There are various methods to short sell crypto, such as direct short selling, futures markets, contracts for difference, crypto put options, and prediction markets.

You might have noticed that the crypto market is quite volatile. The value of any coin might significantly rise or drop in a short period of time, and the value of some coins even changes throughout the day. However, the volatility of the crypto market doesn’t necessarily have to be a bad thing, especially if you know how to short crypto properly. In this article, we will clarify everything that you need to know about shorting crypto.

What does Shorting or Short Selling Crypto Mean?

Basically, shorting crypto means selling coins at a higher price, and then buying them again when their price drops. That way, you don’t actually own the coins that you intend to profit from.

To properly understand shorting crypto, let’s talk about crypto long and short positions. Going long means buying crypto at a lower value with the intention of selling it when its value goes higher.

Shorting, however, means that you borrow crypto and sell it at a current price, expecting it to fall. Then, you buy the crypto when its price falls, and make a profit. Basically, the profit you make is a difference between your selling and buying prices.

For example, let’s say that the current value of BTC is $45,000, and you expect its price to fall in the next few days. You borrow one BTC and sell it for the current price. A few days later, the price of BTC is $40,000, so you buy one BTC and return it to the broker. That way, you have earned $5,000, minus the interest that you have to pay for borrowing the coin.

Obviously, shorting crypto can be quite risky, but there is also a potential for gains. That’s why you need to do proper research before shorting crypto, and do it only if you are sure that its price will fall.

Why Should I Short Sell Crypto?

Although it can be risky, there are a few reasons why you might want to short sell crypto, depending on how much you intend to earn and on the kind of research you have done.

Valuation

At some point, a certain currency might be in a so-called price bubble or have a very high value at the current moment. If you have done proper research and are positive that its price will definitely drop in the future, you might want to short sell that specific coin for potential profit.

Volatility

The volatility of crypto might be a reason for concern, but it can also be leveraged for gaining profit. It is obvious that crypto’s value can rise as quickly as it can fall, but if you have an appetite for risk, you can use it as an opportunity to gain some profit. Obviously, you should be knowledgeable about changing trends and be sure to do proper research and analysis.

Hedging Risk

Crypto’s volatility can be excellent for short selling, but it also affects long positions negatively. That’s why, if you have crypto that you believe will lose its value soon, you might decide to short sell it. If you do everything right and your assumptions are correct, short-selling crypto will reduce or even exceed your long position’s losses.

How to Short Sell Crypto

As mentioned, the cryptocurrency market is very volatile, so before you start short-selling your crypto, you will need to find a trend. Many factors can affect the price of any coin, such as politics and the influence of notable people.

You should study current trends, such as a sudden interest on the part of a highly developed company. Then, you will need to open a margin trading account, and also check your country’s regulations, to make sure you are not violating any legal guidelines.

So, let's see how you can short sell crypto using different methods.

Direct Short Selling

This is one of the first methods that most people who want to short crypto come across. Basically, it means borrowing the crypto at a specific price and then selling it. Then you wait for the price to drop, buy it again, and return the borrowed crypto. That way, you earn the difference between the two prices.

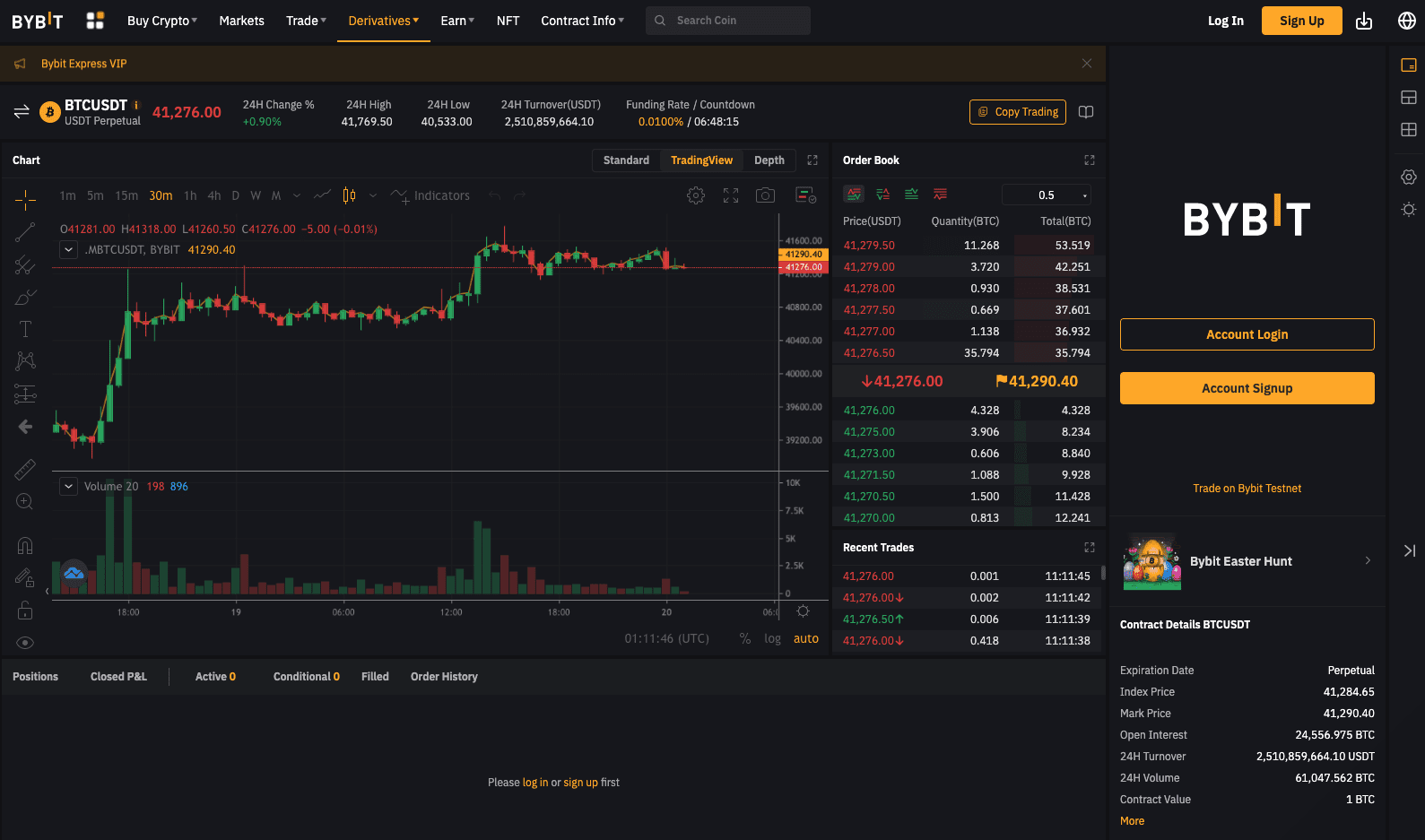

Futures Markets

Some coins have future markets, in which you agree to buy a security in a contract, which specifies the price and the time at which it will be sold. Basically, you bet on the price of a security to rise, so that you earn a profit when the security is sold. Bybit and Margex are our top recommended futures trading platforms.

Contracts for Difference (CFDs)

One of the most popular ways to sell crypto is to do that via contracts for difference. It means betting on whether the price of the asset will increase or drop, without actually owning the asset. However, you will still need to deposit a certain amount of money to guarantee that you will be able to buy the asset at the price you are betting on. Also, this method carries a huge risk if the price of the crypto goes in a different direction from your prediction. eToro is our recommended crypto exchange for CFD trading.

Please note: eToro USA does not offer CFDs, only real Crypto assets available.

Crypto Put Options

This method is interesting because, in some way, it allows you to short sell your crypto almost risk-free. It basically allows you to purchase crypto at the predefined price and time, but it’s not an obligation to buy it.

For example, if you think that the price of a certain coin will drop in three months, you can buy a put for three months at a certain price. If the price of that coin goes below the price on the predetermined date, you will earn a profit. However, if it remains high, you will only lose the fee you paid for holding the option.

Prediction Markets

Prediction markets are a great way to sharpen your skills with short-selling crypto while interacting with other investors. What you do is predict that certain crypto will increase or decrease by a certain percentage or margin.

Then, some other investor has to take you up on that bet, and if the price really goes as you predicted, you earn a profit. FTX is our pick for prediction markets, and you can read the full review of FTX here.

What are the Risks of Shorting Crypto?

Shorting crypto can be an excellent way to earn money, but it also poses certain risks. Let’s take a look at the downsides of shorting crypto.

Losses are Limitless

When you buy crypto and hold it until it reaches a higher price in the future, the only risk is that the crypto doesn’t reach the price you wanted it to. Once you buy crypto, it’s yours and you can hold it as long as you wish.

However, it is much different if you want to short sell your coins. The price might keep rising, and you might need to borrow it at a much higher price to cover the costs.

Margin Interest

Obviously, when short-selling crypto, you don’t actually own the currency. You borrow it from a broker, and you need to pay interest for as long as you hold it. If the currency value doesn’t drop according to your predictions, you might need to hold it much longer, while paying the interest. That way, the ratio of the money you earn and the interest you paid might not be in your favor.

Tips on Short Selling Crypto

Now that you know everything about short-selling crypto, including all the advantages and disadvantages, it is up to you to decide whether it’s a good or bad choice for you. If you still intend to give it a try, make sure to check the following tips on short-selling crypto.

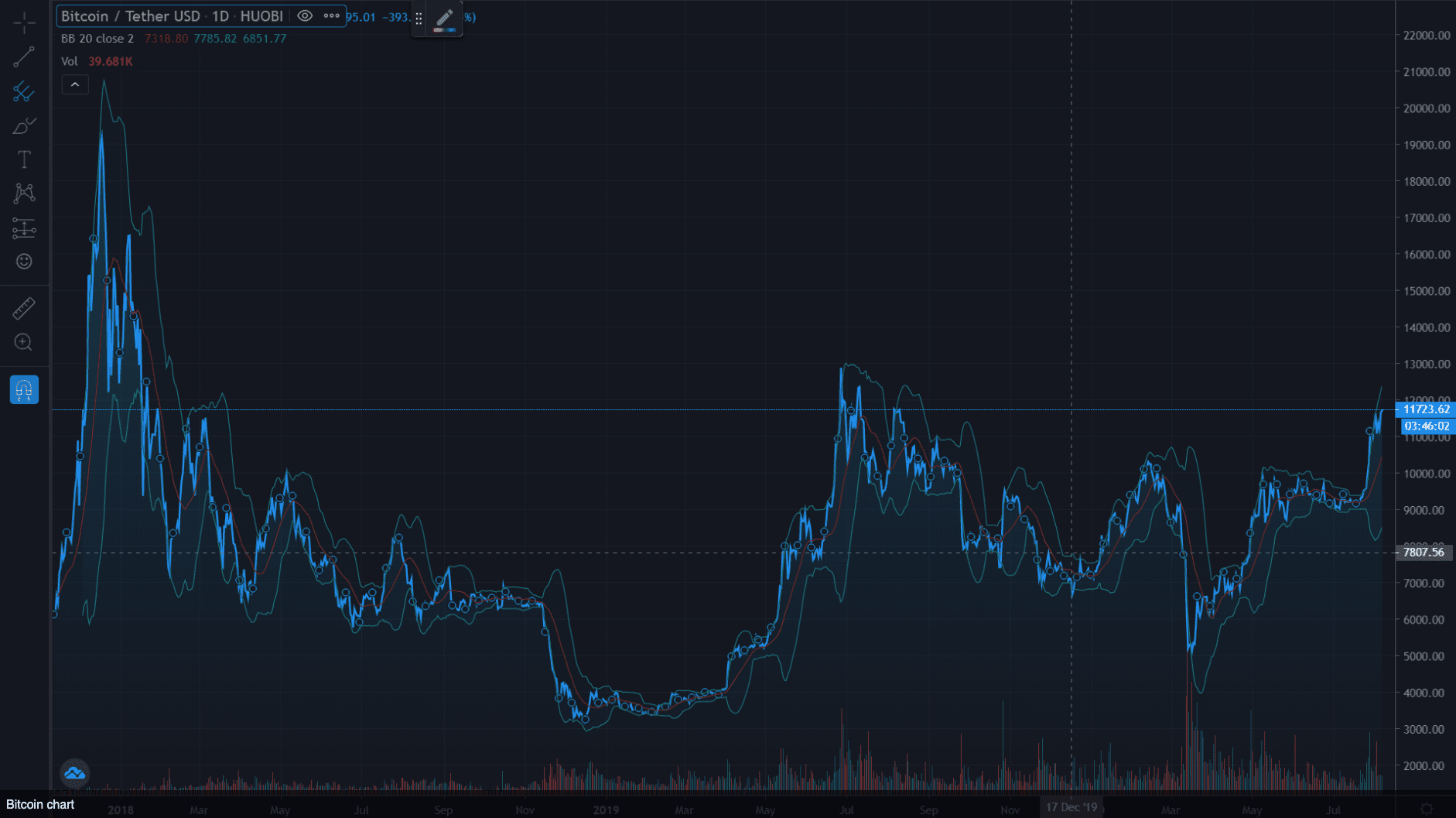

Use Technical Analysis

A great tip for short-selling crypto is to use real-world data, such as looking at how the crypto performed in the past, including its movement and volume. That way, it will be easier to predict how a certain coin will behave in the future.

According to Dow Theory, the pricing in the market depends upon many factors, such as regulations, current, past, and future demand, traders’ expectations for the future, and similar. In most cases, the movement in the crypto market is not random and usually follows a certain trend.

Indicators that can help you predict the movement in the crypto market are the Average Directional Index, Bollinger Bands, Standard Deviation, and the Relative Strength Index. These will help you measure how strong a trend is, show whether the value of the coin is high or low, show you the historical validity of investments, and indicate momentum in technical analysis.

Keep Track of the News

This includes not only crypto-news but also news related to government crackdowns and regulations. All of these can lead to drastic changes in the crypto market. If you suspect something big is about to happen, you can short your crypto in the bear market.

Short Crypto During Rallies

Sudden rallies are an ideal time to short your crypto. When it happens the coins are overbought, mainly due to the fear of missing out. After the hype is gone, the crypto slowly comes back to its original value, allowing you to make some nice profits.

Use Fundamental Analysis

Some experts state that it is not useful to use fundamental analysis on crypto, since crypto markets are relatively new. Fortunately, you can still use some FA to increase your chances of making the right decisions.

You need to understand what drives the supply and demand of the coins you are interested in. Some variables might include news, market sentiment, and similar.

Transaction Count and Value

Transaction count will give you an idea of what is happening on a network so that you can use moving averages and predict how the activity that surrounds a certain asset changes over time. However, use transaction count with caution, since there is no guarantee that the transaction count is high due to a certain reason, or something entirely different.

Transaction value tells you how many transactions were performed in a certain period of time. It can be a very useful measure in predicting how and when the price of certain coins will change.

Where to Short-Sell Crypto?

When short-selling crypto, you need to look for platforms that offer high trading volume for maximum liquidity. Some great platforms worth mentioning are Bybit, Binance, and Kraken.

You can start by creating a margin account and searching for the Bitcoin to USD trading pair interface. You can also start automatic borrowing, so if the price drops, the coins that you borrowed will be repaid automatically. On the other hand, if the price gets higher, you will need to manually repay the borrowed crypto.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read it here.