Due to regulations in Canada only a hand full of brokers are willing to be comply with regulations enough to be able to accept you as a customer. This means our list of options for you is short compared to other countries but don't worry, all our options are really good.

| Image | Product | Features | Price |

|---|---|---|---|

Best Canadian Forex Broker  | FXCC ✔️Spreads as low as 0.0 and No trading commission under one single account type ✔️Leverage up to 1:500 for Forex, Metals, Indices, Oil ✔️100% First Deposit Bonus | 9.8 | Open Account |

| TMGM ✔️Low trading fees ✔️Offers Forex, CFD and Crypto ✔️Easy account creation & deposit | 9.1 | Open Account |

Best for Crypto derivatives  | Eightcap ✔️Award-winning Crypto derivatives offering ✔️Ultra-low spreads across 400+ financial assets ✔️ASIC, FCA, CySEC and SCB regulated | 9.3 | Open Account |

| AvaTrade ✔️Offers Forex, CFD, Crypto ✔️Heavily compliant broker with licences in many geos ✔️Low trading fees | 9.2 | Open Account |

| Fusion Markets ✔️Regulated in multiple geos ✔️Offers Forex, CFD, Crypto ✔️Offers users MetaTrader 4 | 8.6 | Open Account |

1. FXCC- Best Canadian Forex Broker

FXCC is a low-cost broker enabling trading with spreads as low as zero pips and NO trading commission under one single ECN XL account type. EURUSD and USDJPY spread is even for mostly 50% of daytrading session. With no commission, it makes trading these currency pairs at no cost at all.

This broker is absolute leader in trading conditions. They welcome any trading strategy: scalping, news trading, hyperactive EAs. The business model is quite simple. Being an STP broker, FXCC gets rebates from liquidity providers with every transaction based on spread. Whenever a transaction is done at even price, the broker does not receive any rebate from LP.

With No Dealing Desk intervention, all trades are executed within 50 milliseconds.

Keen on providing transparent trading they also publish average effective spreads for most popular instruments on their website: https://www.fxcc.com/ where you can compare their historical spreads with other brokers.

- No minimum deposit

- Forex, Metals, Indices, Oil, Crypto. Max Leverage 1:500

- 100% First Deposit Bonus doubles the equity

- Spreads as low as ZERO with NO trading commission

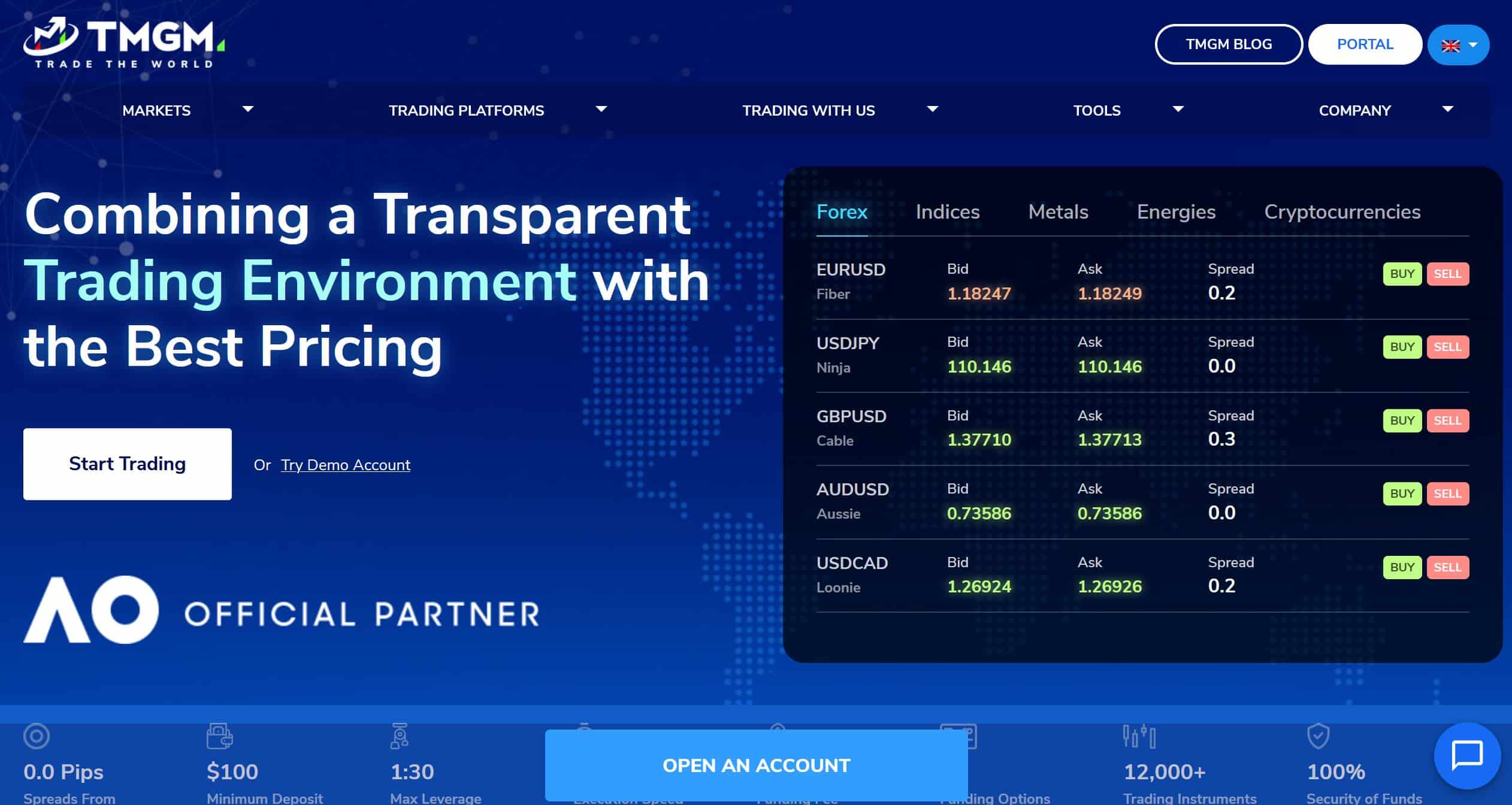

2. TMGM - Best Forex Broker In Canada

Developed for traders, by traders, TMGM specialises in CFD Online Trading with its clients at the forefront of all decisions. TMGM is a low-cost Forex Broker with deep liquidity and lightning speed execution technology. Being an ECN broker, TMGM offers the best available prices and cheapest trading conditions – resulting from transparent and efficient competitive price auctions in the market.

TMGM utilises the most proven and cutting-edge trading platforms in the forex trading space to equip their clients access to the most advantageous technology at their fingertips. These technologies include the MetaTrader 4 and MetaTrader 5 platform, in addition to the iRESS platform - providing live price feeds, technical charts, analytical tools, charting tools, and a news feed (available on multiple operating systems, including Windows, Mac OS, Android and iOS devices).

Founded in 2013, TMGM spent years on research and development to formulate the ideal ‘one-stop shop’ for all traders alike. From this, TMGM has effectively solidified itself as one of the leading Forex Broker, with operations in over 150 countries. With this, comes a need for validity – which TMGM excels at from their acquisition of three tier 1 trading licenses.

- Minimum initial deposit: $100

- Zero deposit and withdrawal fees

- Over 50+ FX pairs

- Spreads from 0.0 pips

- No requotes

- Up to 1:500 leverage

- 10+ Tier 1 liquidity providers

- Demo account and free training course

- 12,000+ trading products (forex, shares, indices, energies, precious metals, and cryptocurrencies)

3. Eightcap - Best Canadian Forex Broker

Founded in 2009, Eightcap is a multi-award-winning global FX and CFD provider. The broker is regulated in multiple jurisdictions, including ASIC, FCA, CySEC and SCB. They offer their clients access to over 400 financial instruments, including Forex, Indices, Shares, Cryptocurrency and Commodity CFDs. Eightcap has launched over 250 crypto derivatives, including coins, crypto-crosses, and crypto-indices, all with competitive spreads. Their offerings have been recognised within the industry, and as a result, Eightcap has won numerous awards in 2021, including Best Crypto Broker at the annual AtoZ Markets 2021 awards.

- Open an account with as little as $100

- Commission-free trading on Standard accounts

- Most extensive Crypto derivative offering with access to over 250+ Crypto CFDs

- Ultra-low spreads across all assets

- Regulated by ASIC, FCA, SCB, and CySEC

- 400+ assets across Forex, Indices, Shares, Commodities and Cryptocurrency

- 24-hour support, five days a week

- Eightcap clients can automate their trades with Captialise.ai

- Demo account available with live market conditions and virtual funds

4. AvaTrade - Best Canadian Forex Broker

Founded in 2006 AvaTrade operates all over the globe and is currently regulated in three tier 1 jurisdictions and three tier 2 jurisdictions, this means AvaTrade has gone to great lengths to being compliant and is an extremely low risk broker to use. They offer their customers the chance to trade both forex and CFDs.

AvaTrade offer users the industry favorite MetaTrader along with their own platform AvaTrade WebTrader and AvaOptions. If you're interested AvaTrade also offer ZuluTrade and DupliTrade for those who like to do social copy trading. AvaTrade are well known for have very competitive fees compared to their closest competitors.

- Minimum initial deposit: $100

- Average spread EUR/USD: 0.91

- Time to open account: 1 day

- Spread: as little as 0.6 pips

- Number of base currencies: 5

- Demo account: yes

5. Forex.com - Runner up Canadian Forex Broker

FOREX.com is owned by Gain Capital (GCAP), which trades on the NYSE. FOREX.com is well known for offering multiple types of trading platform, although most traders use MetaTrader 4 they can avail of Forextrader Pro and Web Trading. This makes them popular among traders who like to utilize different platforms, normally for more advanced automated trading programs.

Personally I really liked using their mobile app which is top quality compared to many of their competitiors and incorporates most of the options you get on desktop. They also integrated their research and investigation services into their app that allows traders to get real time data to help make their decisions.

- Account minimum: $100

- Pairs offered: 80+

- Average Spread: 0.2 pips - 1.0 pips

- Commissions: $0 – Variable starting at $60 per million traded depending on account

6. Fusion Markets - third place Forex broker in Canada

Fusion Markets is known for offering one of the world's lowest trading costs. Their spreads average around 0.0-0.1 pips and their commission of $2.25 per lot ($4.50 round turn) are the lowest we've found globally.

They also offer commission free US Share trading so you can trade in shares like Apple, Facebook, Google and other market leaders with $0 commission.

Further, they have $0 fees for deposit and you can start with as little as $10 if you like as they do not have a minimum account size despite being so low cost.

The last interesting point to mention is their copy trading platform, Fusion+. Fusion+ allows you to copy other successful Fusion clients, have others copy your trades or simply copy between your own Fusion accounts, all within a few clicks.

- Minimum initial deposit: $10

- Average spread EUR/USD: 0.1

- Time to open account: <10 minutes.

- Spread: as little as 0.1.

- Commission: $4.50 per lot. $0 on US Shares

- Number of base currencies: 5

- Demo account: yes

- Copy Trading: Yes

Types of Forex Orders

The forex market is similar to the stock market in that it uses some basic orders for buying and selling. These are:

Market order: This will fill the order at the best price available at the time, typically at the bid when buying currency pairs or at the ask when selling.

Limit order: This will fill the order only when it reaches a certain price.

Stop order: Your position will be exited using a market order once a specific price is hit.

Stop limit order: A limit order is used to exit your position once a certain price is hit.

Forex Trading and Risk:

Any investment and trading will usually involve some level of risk. Investing in stocks carries a risk of loss, and there are risks involved with owning a company, for example. However, forex trading carries some different types of risks. Some of the specific risks that are involved with forex trading include:

The instrument that investors and traders will use to capitalize on small movements in the price of currency can also lead to substantial price swings, which can result in margin calls. As a result, investors must add additional funds or margin costs.

Volatility or variability refers to the changes in price quotes for a currency pair over a time period. When volatility is high and the swings in prices are wider, opening or closing a position can be more challenging, since the prices are moving up and down.

Governments and central banks use interest rates as a means of increasing or decreasing the money supply within the economy. Since the exchange rate between a pair of currencies is typically determined from the supply and demand for each currency in the pair, changes to the interest rates of one or both of them can result in higher or lower movements in the pricing.

Governments will always back their native currencies, and when geopolitical events occur in a country, this will often be reflected in the currency prices. As a result, currencies from countries with a government that is at a higher risk of these events will often trade at a discount, while more stable and reliable governments tend to garner premiums.

A counterparty is the entity that provides investors with assets when they trade. There is some risk involved with these companies, including the risk of them defaulting and no longer being able to cover all of their transactions. However, regulators such as the IIROC in Canada will regulate these companies to make sure that they have an appropriate safety net in place for this situation.

The ability to sell relies on somebody being willing to buy. Participants in the market could be reduced by geopolitical events and more.

How We Made Our Selection:

Compared to the other areas of the world, Canada is somewhat limited in the number of forex brokers available. This is partly due to fragmented authorities between the provinces and guidelines that many believe to be unnecessarily complicated. However, the brokers that are available are excellent. We evaluated them based on the following:

Transaction Costs:

Brokers will often make more money in the spread between bid and ask prices for currencies. The smaller the difference between the bid and ask, the cheaper it is for investors to trade currency pairs.

IIROC Regulation:

The Investment Industry Regulatory Organization of Canada (IIROC) regulates brokers. They regulate the amount of leverage and stipulate the compensation that must be provided in the event of broker insolvency. It has put the Canadian Investor Protection Fund in place to compensate traders to up to one million dollars if the broker defaults. Currently, there are strict limits on the margin and leverage allowed in Canada, with a maximum of 2.2%.

To see our privacy policy feel free to read this page.