Established in 2001, Forex.com is a global forex and CFD trading broker dedicated to serving their users with the best tools and experience available in the industry. A recipient of several best forex broker awards, the full-fledged forex trading platform has built up its reputation through years of seamless service. It is a globally regulated broker, thanks to their affiliates.

Forex.com claims to be registered with the Commodity Futures Trading Commission (CFTC). With the robust bank review and monitoring guidelines set by parent company StoneX Group, they ensure full security and immunity of traders’ funds.

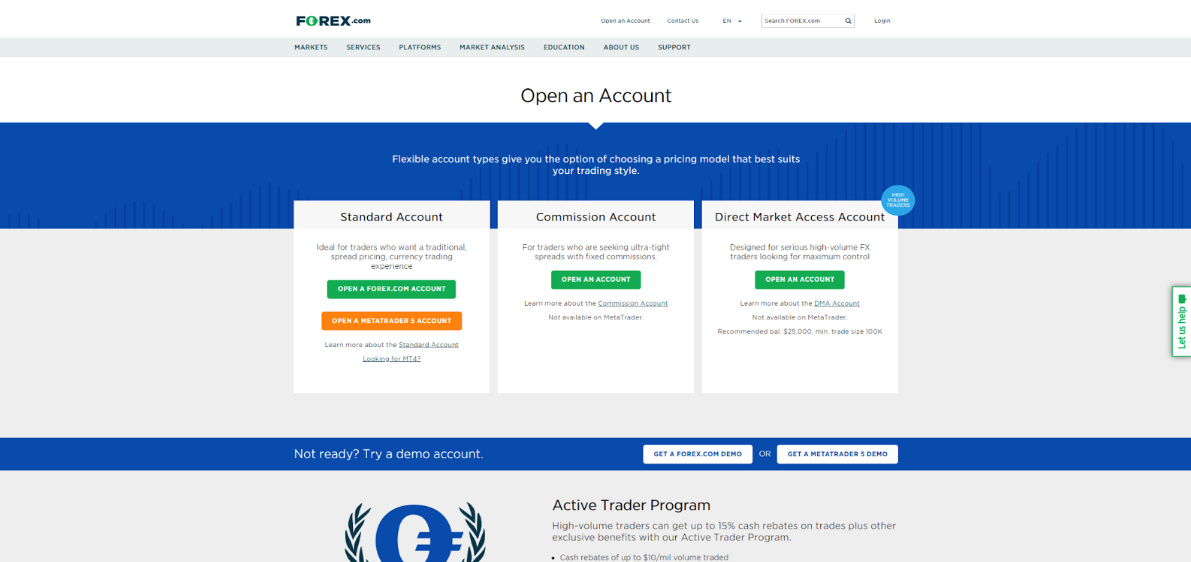

There are several markets available on the platform: FX, commodities, and futures. To get started with this broker, you have to open either a standard account or the commission-based account or direct account, explicitly designed for high-volume FX traders.

My Overall Thoughts on Forex.com

As an FX trading platform, Forex.com has also done quite well in other high-demand aspects of the professional trading community. Aside from the multiple trading markets integrated into the platform, they also offer a number of analytical tools and third-party trading services which give them the edge over other FX brokers on the internet. The platform allows you to choose between multiple account types or simply learn trading with the demo accounts.

The diversity in trading markets and assets or pairs is perfect for traders who do not want to be bound to a single market. Check out what I like the most about Forex.com:

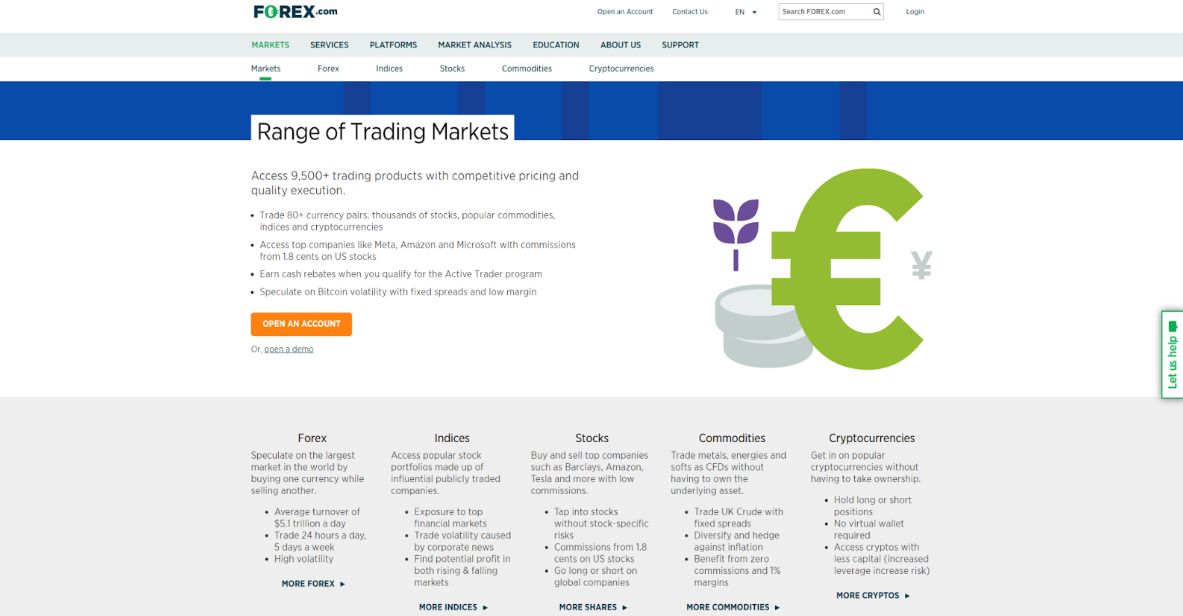

1) Availability of several markets: Forex.com is not just an FX platform. they also offer market indices, stocks, commodities, and even some cryptocurrencies. Each of the markets contains a good number of assets or pairs that you can trade.

2) Order execution system and trading layout: Forex.com has one of the best order execution systems, which support several order types and give a free hand to the traders to set up their orders. The advanced trading layout comes with countless functions that can help you analyze the markets better.

3) Learning content and material: Forex.com provides detailed learning content, webinars, and courses for traders.

However, Forex.com should make their registration process a little faster and less troublesome. Also, they should make some changes in the layout and account types to help beginners get started without confusion.

Key features and advantages of Forex.com

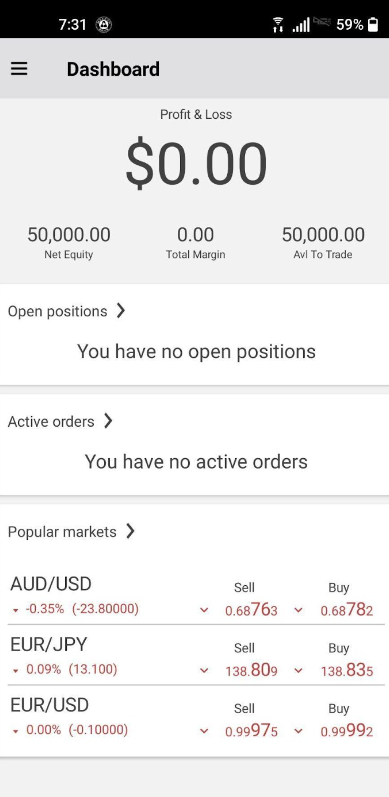

Forex.com provides traders with multiple account types to choose from. You can test drive a demo account, explore their services, and even trade with virtual money without making any kind of deposit.

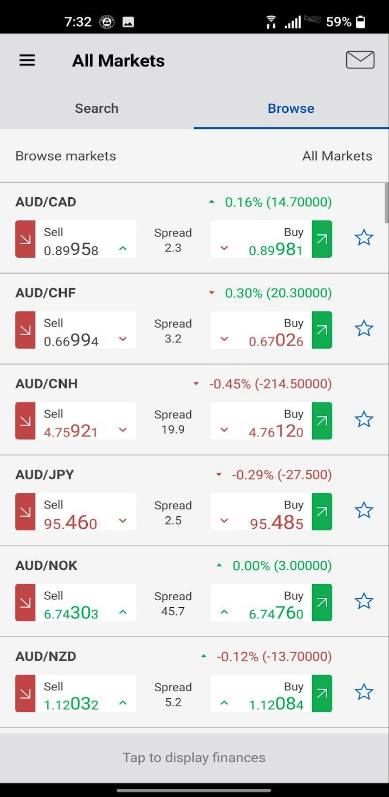

Forex.com offers multiple markets to trade in. Aside from FX, you can also trade commodities or enhance your profits by going with the futures. Check out their comprehensive offerings:

Negatives and disadvantages of Forex.com

What services does Forex.com offer?

Forex.com has a wide range of services, which include a number of markets, each with a good quantity of assets that you can trade right away. There’s one special thing about Forex.com that differentiates it from others: beyond the trading aspect, the platform is designed to be educational, convenient, helpful, and analytical. Only one section of the broker covers the markets, and the rest are targeted toward analysts, learners, and explorers.

Forex.com offers a forex trading experience that is probably second to none. Aside from their own trading layout, they also allow traders to connect their accounts with different MetaTrader versions and trade with third-party tools. There are many other useful Forex.com services that you can check out below.

Flexible account types to choose from

You can go with a simple standard account or open a MetaTrader 5 account which can help you explore third-party tools without any interference. A commission account or direct market access account are also available to enable you to continue your high-volume trading with maximum control without compromising your experience. A demo account is available for beginners who want to learn how to trade and execute orders using virtual money.

Whether you’re a regular trader or have tons of money to invest in the FX, stocks, or any other market, Forex.com has a solution for you.

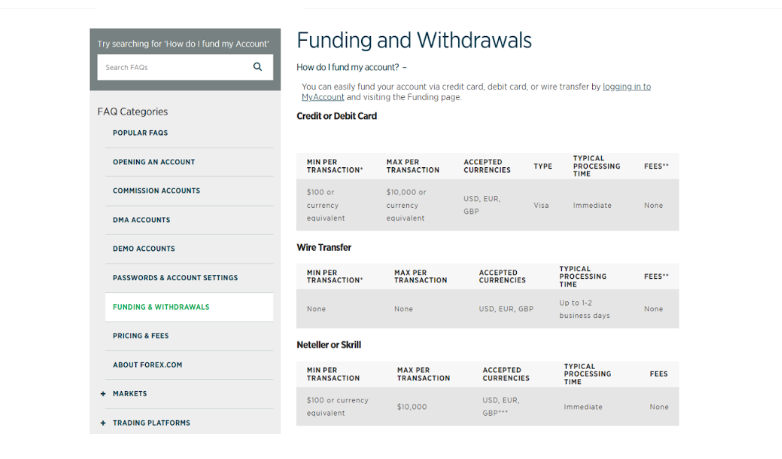

Easy and convenient deposit methods

For a hassle-free start on the platform, Forex.com offers convenient deposit methods that you can use and top up your account with the funds you have.

Forex.com accepts credit and debit cards, direct bank deposits, international wire transfers, and even some e-wallets like Skrill, Neteller, or PayPal, depending on the region you are living in. The quickest methods are credit or debit card deposits, as your transaction will be instant and you will be able to start trading on the platform right away. Direct wire transfers or bank deposits might take some time due to the verification process.

Unlike other FX brokers that offer a meager variety of deposit methods or offer methods that are not readily available worldwide, Forex.com provides global payment solutions for their users.

The diverse range of markets and assets

Forex.com is considered one of the best brokers simply because they do not target a particular market or community, creating diversity in everything they bring to the trading community. They have a lot of markets available, each with a good number of assets that you can trade individually.

Forex.com has over 80 pairs of popular fiat currencies and offers more than 15 of the world’s top indices. Their over 9000 stock assets allow traders to trade top, popular, and S&P stocks to their liking. If you want to take your chances in other markets, commodities and cryptocurrencies are also available in the platform.

The various markets and assets offered by Forex.com allow traders to diversify their portfolio and equally divide the risk among their investment for better chances of winning and getting more profit.

Trade anywhere with mobile applications

We live in the era of portability, where everything is more handy, easier to access, and convenient to use. The same scenario has also been implemented for trading activities as many brokers now offer mobile applications to let traders access their portfolios within seconds.

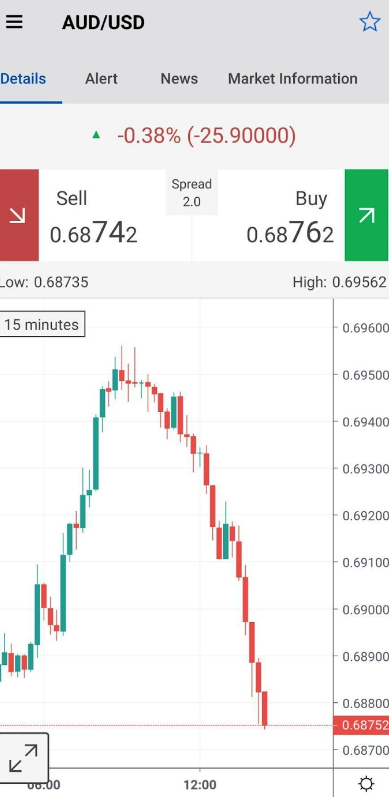

Forex.com offers trading-dedicated mobile applications that can be downloaded by traders on their Android or IOS phones. The best thing about their mobile apps is that you can trade and execute orders with them, too. The apps come with an advanced charting system along with the tools you might want to use. You can also access all of your account management tools and have all the features at your fingertips.

Increased profits with margin trading

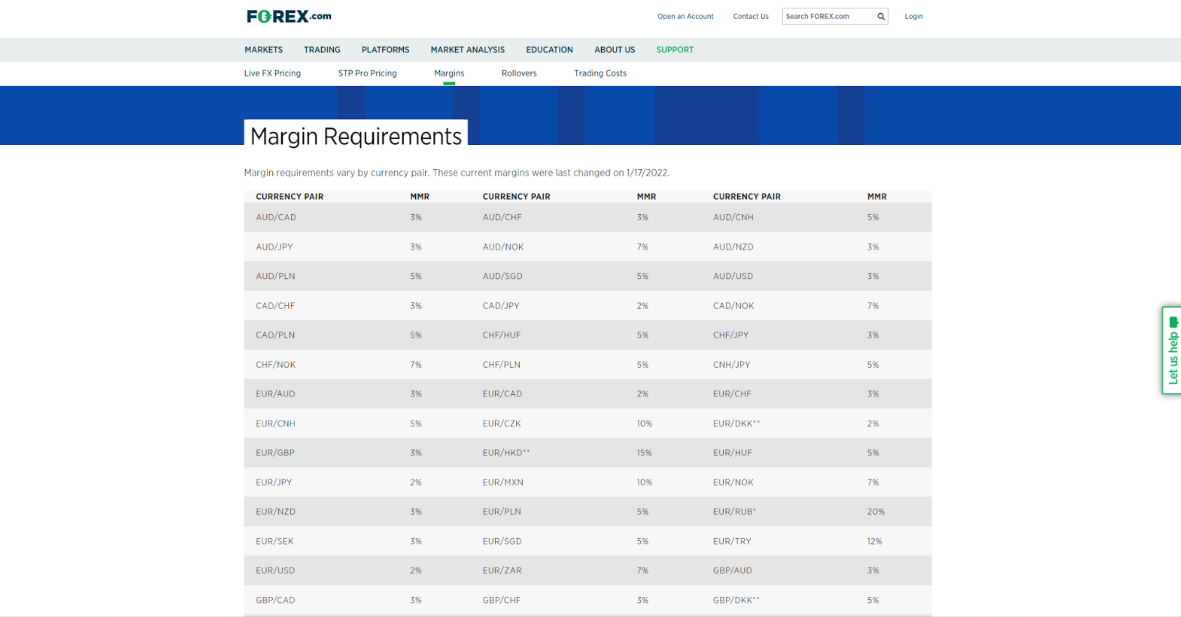

Margin or leverage trading has proven to be beneficial for traders with low equity. This is why Forex.com has brought this type of trading on their forex market platform.

Margin or leverage trading increases your initial capital by multiple folds, depending on the leverage you have chosen. Even if you have a low amount to start trading with, you can increase it with margin trading for better profits. You can choose a margin anywhere between 3% to 20%. You need to fulfill some requirements before you can margin trade on the platform.

So, if you are short on funds and are not willing to risk a big amount out of your whole equity, you can start low with margin trading and trade accordingly. Remember, margin trading comes with higher risks with high rewards.

Customizable and professional trading layout

The Forex.com trading layout is certainly not the casual type with a simple chart and a few options. They have designed their trading layout in a way that would allow the traders to customize their trades and enjoy precise, fast charts of every asset or pair they select.

For starters, you will find a chart on their trading interface that is provided by TradingView, one of the most advanced, credible, and professional charting services globally. Through those charts, you can evaluate your assets and make the right decisions for your trades. TradingView also offers over 60 indicators, more than 10 chart types, and many other features that you might need as a professional or advanced trader. Additional features allow you to manage your portfolio, access analytical tools, check out market commentaries, and analyze everything with ease.

Advanced order execution and settings

Order execution can be more complicated than you might think due to the order types and different settings involved. An advanced order execution layout is crucial to let professional traders open positions as per their preferences.

Forex.com offers several order types, which include market, limit, stop, OCO, trailing stop, and a few more. You can also set alerts, put in a specific order price and quantity, and enable hedging. The alert function lets you know when the asset or the pair has reached the desired price or target, allowing you to take action quickly.

Along with the professional trading layout, you can also enjoy a premium order execution system and set up your trades with several options.

Premium analytical and charting tools

Forex.com has a separate section dedicated to the analytical tools and charting tools they offer. These tools can help you have better insights into the markets and make better decisions.

You can access their advanced charting system to create personalized layouts. With market analysis tools, you can have technical insights into the data, plan your trades, and have a clear and detailed explanation of each idea.

A wide variety of resources and educational content

Forex.com provides a wide variety of free resources and educational content, including free courses based on traders’ skill level and trading goals and webinars. You can learn concepts, themes, risk management, analysis, strategies, and execution.

Unmatched security, licensing, and trust

Forex.com is licensed and registered in different jurisdictions, enabling the broker to provide their users with a safe, secure, and trusted trading environment.

Forex.com claims that all users’ funds are stored in top-tier banks with seamless security. They never engage in proprietary trading, and always use their own funds for hedging. They also have a strong regulatory framework and are registered in several jurisdictions. A subsidiary of StoneX group, with a strong balance sheet for the past years, Forex.com never compromises on their financial management and adjustments.

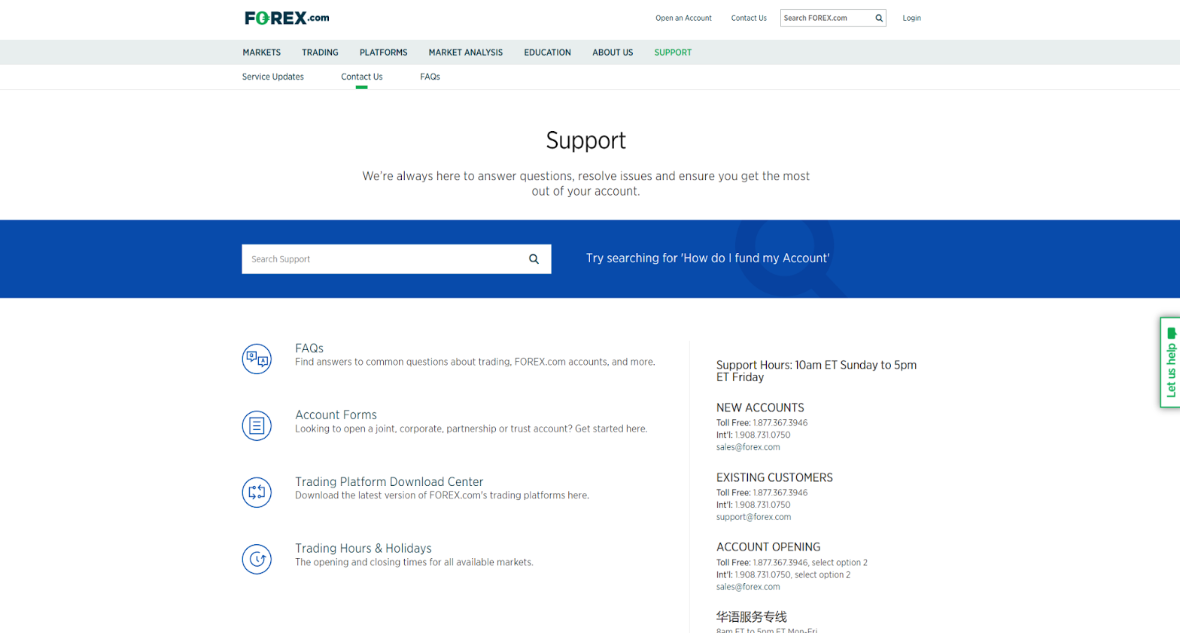

Good customer support service

If you have any kind of problem with their services or your account, you can call Forex.com, chat live with an agent, or send an email to get a solution.

You can solve your problems relatively quicker on Forex.com than on other forex brokers with old-school customer support methods.

Things I don’t like about Forex.com

Take a quick look below to find out what are the specific things I don’t like about Forex.com.

Troublesome and long registration process

Forex.com requires users to put in a lot of info before proceeding to the next registration step, where you will be asked to provide even more information. You also have to submit your official documents in order to verify your identity. The whole process of opening your account can take anywhere between 1 to 3 days. While these steps are necessary for user security and safety, the process can be optimized and streamlined.

Not very beginner-friendly

Forex.com is a trading platform designed for experts and experienced users. Even with the comprehensive educational content available, beginners are likely to get confused with the multiple choices available to create an account. There are so many complicated tools, analysis can also be troublesome, and of course, understanding different markets is not as easy as it seems. Even the fee structure can be a little difficult to understand as it does not work the same as cryptocurrencies where you have to pay a maker or taker fee.

Forex.com is not very beginner-friendly, but you gradually start learning by exploring their educational section and other features.

Forex.com Fees:

Forex.com Deposit Fee

All kinds of deposits, whether they are credit/debit card deposits, wire transfers, or e-wallets, are free.

Forex.com Withdrawal Fee

All kinds of withdrawals are free. Just make sure to keep the minimum withdrawal amount in mind.

Forex.com Inactivity Fee

The inactivity fee at Forex.com is $15, which is charged every month if your account has been inactive for more than 12 months.

Forex.com Trading Fees

Forex.com FX Trading Fee

Forex.com works on a spread basis. Spread is the difference between the market sell and buy price. You can get an idea of Forex.com FX trading fee by taking a look at the chart below:

Currency Pair | Lowest Price Possible | Typical Price |

|---|---|---|

EUR/USD | 1 | 1.5 |

USD/JPY | 1 | 1.6 |

USD/CAD | 1.3 | 2.6 |

Also, the fees mentioned above are for standard accounts, as these differ for users with commission and STP Pro accounts.

Forex.com CFD Trading Fee

There are two ways you can pay the CFD trading fee at Forex.com: through commission basis, and by accepting spreads. Commissions vary between 0.1% and 0.15%.

Forex.com Stock Trading Fee

Stock Market | Commission (Per Trade) | Margin |

|---|---|---|

UK Stocks | 0.08% | 5% |

US Stocks | 1.8 CPS | 5% |

European Stocks | 0.08% | 5% |

Hong Kong Stocks | 0.15% | 5% |

Forex.com Rollover Fee

The rollover rates at Forex.com vary widely depending on which asset you are trading when you have opened the position, the quantity, the buying/selling price, and what you intend to do. You can be charged around 0.5% to 3% as rollover rates for your long positions.

Forex.com Pros & Cons

- Multiple account types with demo account

- a great number of markets and available assets

- Professional and advanced trading layout with order executions

- Premium analytical and charting tools

- Broad resources and educational content

- Not a beginner-friendly platform

- Lengthy registration process

Is Forex.com Safe?

In a nutshell, yes, it is. Forex.com is listed in the NYSE and thus discloses publicly its financials, which are seen favorably by industry analysts.

It also has gained approval from several major regulators, including the NFA, CFTC, FCA, FSA, IIROC and CIMA.

It has a solid history of close to 20 years without any major liquidity events and only a few minor fines, including a $50,000 fine plus account adjustments due to a technical issue with their platform.

Their track record is solid and fair. In the few instances when they had technical issues, the trades/errors were reversed.

Conclusion

Forex.com is essentially a forex broker offering several tradable markets, diversified assets/pairs, an overall professional layout, a lot of account types to choose from, and countless tools and analytical tools. Being in the market for over two decades has definitely shaped the broker in a way that fulfills the demands of traders and enhances the whole trading system integrated into the platform.

Forex.com also has competitive pricing and supports MetaTrader, allowing traders to explore over 500 markets and diversify their portfolio. There are no issues with the integrity and credibility of the broker as Forex.com has won countless awards, and they are the subsidiary group of StoneX, one of the world’s biggest financial services organizations. You can get started right away by choosing the type of account and verifying your identity. If you are a beginner, make sure to check out their resources section.

Frequently Asked Questions

Forex.com is a global FX broker that is available in the US and most parts of the world. On your first visit to the platform, you can select the country you live in, and they will let you know if any of their services are available in your jurisdiction.

Yes! Forex.com is a trusted forex broker that has been in the business for a long time. They have won several awards and have been endorsed by different media outlets.

Forex.com fees are lower than those of most of the popular FX brokers on the internet.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to trade forex, stocks, indices, commodities, CFDs, or any other financial instrument, nor use any specific broker or trading platform. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our terms of service, click here.