Top 9 Forex brokers in Australia 2024

For any Forex trader, a good broker is an essential tool. The tools that forex brokers provide to you will determine the experience that you have as a trader. For traders based in Australia, there are a number of good options and plenty of reputable brokers that you can trust.

We have compiled details on five of the best Forex brokers in Australia (although plus500 is a CFD provider) and provided a beginner’s guide to what the forex market is and how it works.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money

| Image | Product | Features | Price |

|---|---|---|---|

Best Australian forex broker  | TMGM ✔️Low trading fees ✔️Offers Forex, CFD and Crypto ✔️Easy account creation & deposit | 9.7 | Open Account |

| FXCM ✔️Offers FOREX, CFD, metals, cryptocurrency and commodity trading ✔️ASIC regulated ✔️Fast, hassle free withdrawals | 9.5 | Open Account |

Best for Crypto derivatives  | Eightcap ✔️Award-winning Crypto derivatives offering ✔️Ultra-low spreads across 400+ financial assets ✔️ASIC, FCA, CySEC and SCB regulated | 9.3 | Open Account |

Best for CFD trading  | Plus500 ✔️70 global currency pairings (CFDs) ✔️They offer commodities, cryptocurrency, index, stock (all tradable through CFDs) ✔️$0 commissions | 9.3 | Open Account |

| FP Markets ✔️ASIC Regulated ✔️Powerful platforms: MT4/MT5, IRESS & WebTrader ✔️Access over 10,000 Share and Stock CFDs on Global Exchanges | 9.2 | Open Account |

| Vantage FX ✔️Low-fee CFD provider ($2 per lot) ✔️300+ CFD products offered ✔️ASIC registered | 9 | Open Account |

| Fusion Markets ✔️Asic regulated ✔️Offers Forex, CFD, Crypto ✔️Offers users MetaTrader 4 | 8.8 | Open Account |

| Axi ✔️ ASIC regulated ✔️Offers FOREX, CFD, metals, cryptocurrency, and commodity trading ✔️ Up to 400:1 leverage | 7.7 | Open Account |

| Pepperstone ✔️ASIC regulated ✔️66 currency pairs, 6 crypto CFDs, 15 Index CFDs & more ✔️500:1 Leverage offered | 8 | Open Account |

| City Index ✔️ASIC regualted ✔️Offers Forex, commodities, cryptocurrency, stock CFDs, index CFDs ✔️Offers MetaTrader 4, At Pro, Advantage Web | 8 | Open Account |

#1 Forex Broker in Australia: TMGM - Ultra Fast Execution Speed

TMGM was founded in Australia in 2013. TMGM is regulated by the Australian Securities and Investments Commission (ASIC) and has secured multiple trading licenses from different regulators. Early on, the founders of TMGM set out to formulate a ‘one-stop shop’ for all traders to have access to the most competitive prices, cutting-edge technology, and limitless trading products. Over the years, TMGM has proven itself to be a leader in CFD online trading.

TMGM trading fees

When evaluating the forex brokerage landscape, TMGM ranks as one of the lowest-cost options available. With access to over 12,000 trading products, 50+ FX pairs, spreads from 0.0 pips, 10+ Tier 1 liquidity providers and up to 1:30 leverage, TMGM provides its traders with unlimited access to the market with the most competitive fees.

TMGM non-trading fees

Header | #1. Fusion Markets | #2. TMGM | #3. City Index |

|---|---|---|---|

Account fee | No | No | No |

Inactivity fee | No | No | Yes |

Withdrawal fee | $0 | $0 | $0 |

TMGM currency pairs

Header | #1. Fusion Markets | #2. TMGM | #3. City Index |

|---|---|---|---|

# Currency Pairs | 86 | 55 | 84 |

TMGM additional products

As shown, compared to other leading brokers on this list, none compare to TMGM in terms of the wide range of asset classes.

Header | #1. Fusion Markets | #2. TMGM | #3. City Index |

|---|---|---|---|

Stocks | |||

ETF | |||

CFD | |||

Crypto |

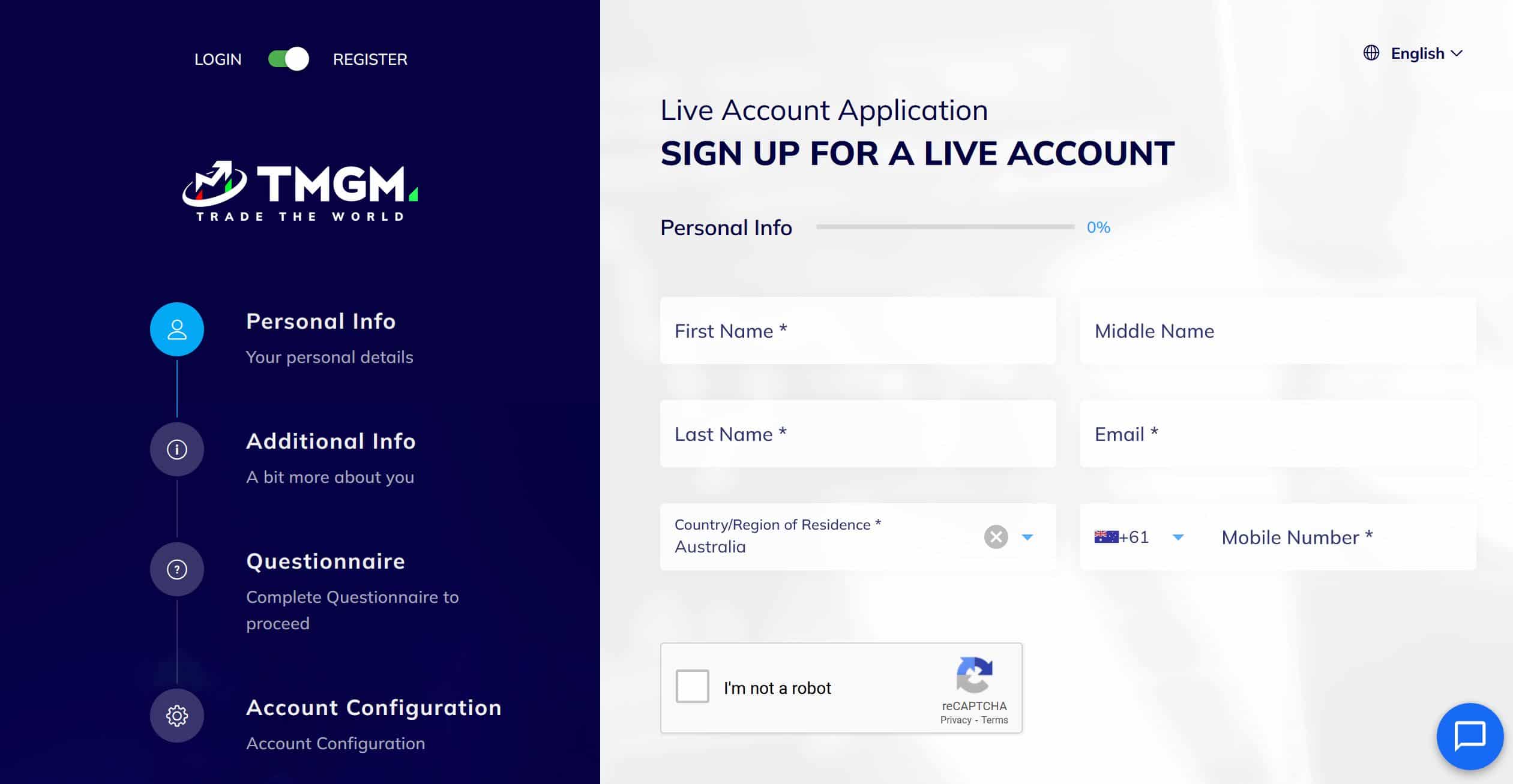

TMGM – Account set up

Header | #1. Fusion Markets | #2. TMGM | #3. City Index |

|---|---|---|---|

Minimum deposit | $0 | $100 | $0 |

Time to open account | 1 day | 3 min + KYC | 1 day |

TMGM – Deposits and withdrawals

A TMGM client can expect zero additional fees (apart from commission fees), regardless of their account type. This is a part of TMGM’s goal to make trading affordable and accessible to all investors alike.

TMGM – Technology

TMGM utilises the most proven and cutting-edge trading platforms in the forex trading space to equip their clients access to the most advantageous technology at their fingertips. These technologies include the MetaTrader 4 and MetaTrader 5 platform, in addition to the iRESS platform - providing live price feeds, technical charts, analytical tools, charting tools, and a news feed (available on multiple operating systems, including Windows, Mac OS, Android and iOS devices). Furthermore, TMGM is an Electronic Communications Network (ECN) broker, resultingly forming an interactive market between participants whereby traders buy and sell orders are matched to the best available price from several other market participants.

TMGM – Regulation

TMGM has secured three trading licenses: Australian Securities and Investments Commission (ASIC), the Financial Markets Authority in New Zealand (FMA), and the Vanuatu Financial Services Commission (VFSC). To further solidify their validity, TMGM client funds are segregated and held by National Australian Bank, with their liabilities safeguarded with Civil Liability Insurance.

Summary

Overall TMGM is the #1 Forex Broker in Australia with low trading fees and a range of products across Forex, CFD and Crypto. TMGM is trusted and regulated by ASIC with 5 star reviews. It’s quick and easy to open an account and make a deposit.

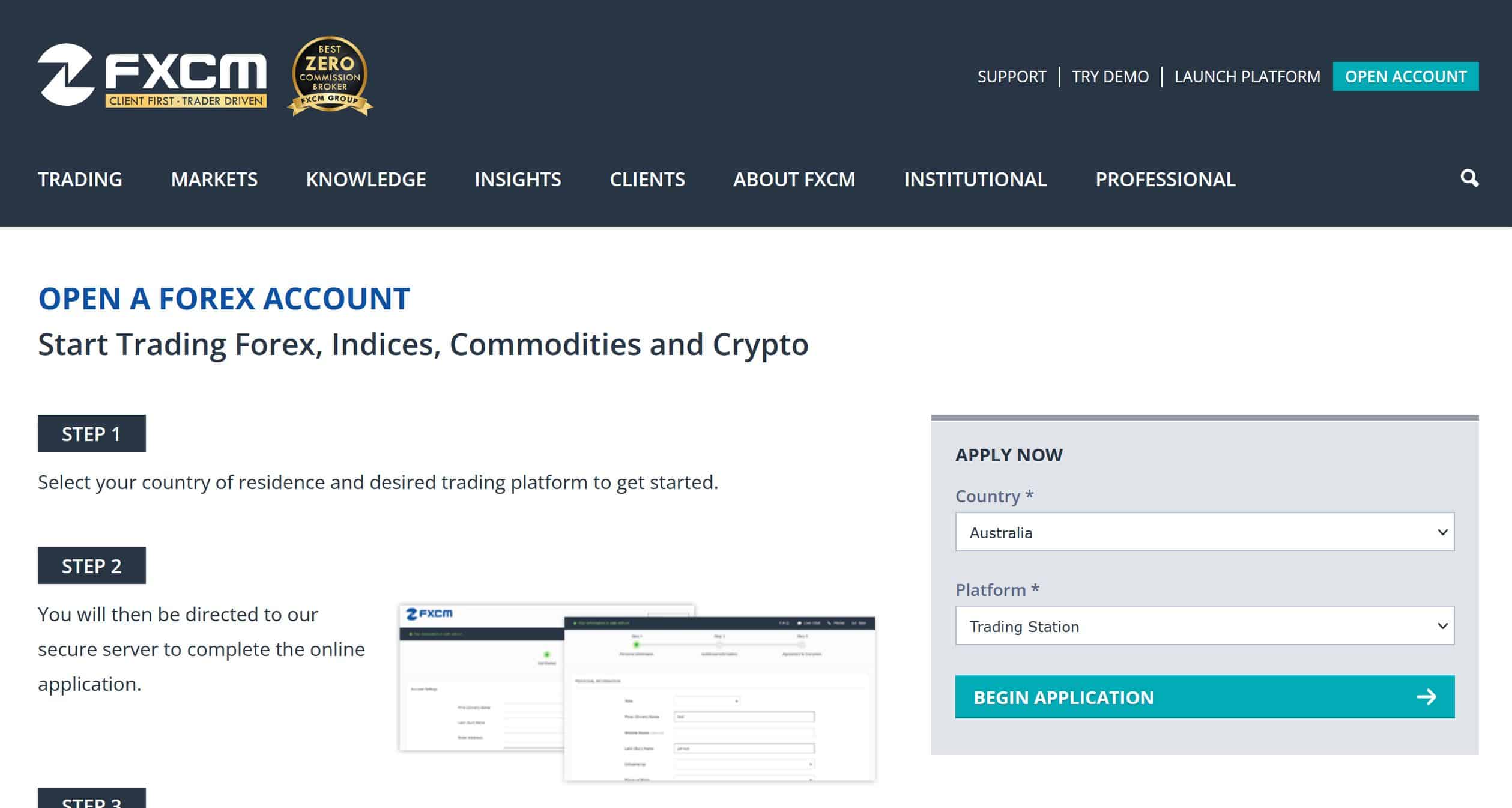

#2 Forex Broker in Australia: FXCM - Most Trusted Broker

FXCM is a global forex broker since 1999. Because they operate across the globe, FXCM is regulated by a number of different financial authorities. These include the FCA, ASIC, and CYSEC for the EU. All in all, the low fees and high quality educational tools make it worth trying. Thanks to their long track record of providing a reliable service, FXCM is generally regarded as one of the safest brokers out there.

We have FXCM in second place but would not hesitate to recommend them to anyone.FXCM Fees

Header | #1. Fusion Markets | #2. TMGM | #3. FXCM |

|---|---|---|---|

Account fee | No | No | No |

Inactivity fee | No | No | Yes |

Withdrawal fee | $0 | $0 | $0 |

FXCM Account Opening

Header | #1. Fusion Markets | #2. TMGM | #3. FXCM |

|---|---|---|---|

Minimum deposit | $0 | $100 | $0 |

Time to open account | 1 day | 3 min + KYC | 1 day |

FXCM Additional Products

Header | #1. Fusion Markets | #2. TMGM | #3. City Index |

|---|---|---|---|

Stocks | |||

ETF | |||

CFD | |||

Crypto |

A smooth opening process and low fees make this an attractive option for people who are new to trading and experienced traders alike. The presence of some extremely high-quality research tools and charts will appeal to some users.

#3 Forex Broker in Australia: Fusion Markets - Known for low trading fees

As shown, compared to other leading brokers on this list, none compare to TMGM in terms of the wide range of asset classes.

Fusion Markets has been operating since 2010 when the business was founded in Australia. Fusion Markets are registered with all the relevant local authorities. In addition to being regulated by the Australian Securities and Investments Commission, they are also subject to regulation by the Vanuatu Financial Services Commission, depending on the residency of the user.

Fusion Markets trading fees

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

EURUSD benchmark fee | $12.8 | $10.5 | $12.8 |

EURGBP benchmark fee | $7.0 | $7.7 | $11.8 |

In terms of fees, Fusion Markets is one of the best options out there. Comparing fees directly doesn’t really work when it comes to the forex market. However, by using figures for the average trade fee across the board, it is possible to build an objective metric that we can use to compare brokers. Using this metric, Fusion Markets offers relatively low fees.

Fusion Markets non-trading fees

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

Account fee | No | No | No |

Inactivity fee | No | No | Yes |

Withdrawal fee | $0 | $0 | $0 |

Fusion Markets currency pairs

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

# Currency Pairs | 86 | 44 | 84 |

Fusion Markets - Additional Products

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

Stocks | |||

ETF | |||

CFD | |||

Crypto |

As well as great value, Fusion Markets has an intuitive user interface and comprehensive charting capabilities. This is a platform that new traders and experienced traders alike can enjoy.

Fusion Markets - Account setup

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

Minimum deposit | $0 | $500 | $0 |

Time to open account | 1 day | 1 day | 1 day |

Fusion Markets - Deposit & Withdrawing

Fusion Markets do not charge fees for deposits and the majority of withdrawal methods. You can use a bank transfer, credit/debit cards, and electronic wallets for transferring money but the withdrawal can be slow.

Fusion Markets - Withdrawl fees and options

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

Bank Transfer | |||

Credit/Debit card | |||

Electronic wallets | |||

Withdrawal fee | $0 | $0 | $0 |

Overall I recommend Fusion Markets to anyone, it's an Australian based broker, regulated by the ASIC and has the lowest fees around, the downside is they lack in-depth research tools and have a slow withdrawal period. I small price to pay for trust, regulation and low fees.

74-89% of retail CFD accounts lose money

#4 Reviewed Australian Forex Broker - City Index

City Index is a global forex broker and has been in the game since the early 80s. Because they operate across the globe, City Index is regulated by a number of different financial authorities. These include the FCA, ASIC, and the Monetary Authority of Singapore. All in all, the low fees make it worth trying. Thanks to their long track record of providing a reliable service, City Index is generally regarded as one of the safest brokers out there.

City Index trading fees

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

EURUSD benchmark fee | $12.8 | $10.5 | $12.8 |

EURGBP benchmark fee | $7.0 | $7.7 | $11.8 |

City Index non-trading fees

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

Account fee | No | No | No |

Inactivity fee | No | No | Yes |

Withdrawal fee | $0 | $0 | $0 |

City Index currency pairs

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

# Currency Pairs | 86 | 44 | 84 |

City Index additional products

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

Stocks | |||

ETF | |||

CFD | |||

Crypto |

A smooth opening process and low fees make this an attractive option for people who are new to the game. The presence of some extremely high-quality research tools will appeal to some users. There is no minimum balance and no withdrawal fees. Inactivity fees will be incurred after a year, however.

City Index account setup

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

Minimum deposit | $0 | $500 | $0 |

Time to open account | 1 day | 1 day | 1 day |

City Index - Withdrawal fees and options

Header | #1. Fusion Markets | #2. ATFX | #3. City Index |

|---|---|---|---|

Bank Transfer | |||

Credit/Debit card | |||

Electronic wallets | |||

Withdrawal fee | $0 | $0 | $0 |

Unfortunately, City Index only has a limited range of product options to choose from. The desktop platform is also difficult to get to grips with. But overall City Index still makes it into the top three, a highly recommended CFD and forex broke that is regulated by many financial authorities including the top-tier UK FCA. Its parent company, GAIN Capital is listed on the New York Stock Exchange.

71% of retail CFD accounts lose money

Understanding The Forex Market

Today, forex trading can be undertaken in a number of different ways. In addition to the conventional currency exchanges that function like stock markets, there are also currency exchange booths available in stores. Of course, traders today also have the option of using a smartphone and or laptop to trade currencies on the forex market.

The key to the forex trading experience is the forex broker/CFD provider. The broker provides the platform through which you exchange currencies with other traders. It is essential that you trust the broker that you use, although this isn’t an issue with any of the major providers. The more important metric for most people is going to be the user interface, which determines how easy it is to make trades. However, there are a number of things that you need to consider when making your decision.

Most currency transactions occur on what is known as ‘over the counter’ markets. OTC markets are unregulated, meaning that it is down to you to decide how trustworthy the other people you trade with are. Of course, going to a bank or business to exchange your currency is safer than exchanging currency with someone on the street.

Using a forex/CFD broker significantly reduces your risk when you are trading currencies. There is little to no risk in taking your currency to a bank or a currency exchange on the street if you want to simply exchange one currency for another for when you go on vacation. However, if you want to trade currencies regularly, it makes much more sense to use a broker.

Why is forex trading popular in Australia?

There are several reasons that forex trading has proven to be popular, especially among more inexperienced traders.

Anyone can understand the forces behind currency fluctuations, whereas the movement of stocks and shares requires in-depth knowledge.

Leverage trading makes it possible for traders to trade with more money than they actually have on hand. Although, this also multiplies their potential for losses.

The forex market is open 24 hours a day for 5 days a week, enabling traders to choose their own schedules.

Currencies are very important to our daily lives and in times of extreme turmoil, holding currencies of different denominations can be hugely advantageous.

While forex trading is generally easier to understand and execute than trading in stocks and shares, it is still a challenging undertaking. As with any investment market, if you are unprepared then you can end up in serious financial trouble. It is important that you understand exactly what you are getting into before you start trading.

Currency conversion vs forex trading

Currency conversion and forex trading are two different processes. Currency conversion accounts for the OTC exchanges that we mentioned earlier. This is where you simply exchange one currency for another. Crucially, you actually possess both currencies.

With forex trading, you aren’t actually converting currencies. The broker will hold currency reserves and will store information about who has what in their account as users make trades with one another. If you execute a trade that converts your USD into GBP, then your account will be updated to reflect that you have less USD but more GBP. The assets that backup the trade are still held by the broker, they don’t move.

Basic Lingo

Here’s the lingo that you need to know when you get started with forex trading. Don’t worry, it’ll all become second nature before long.

Long position: A bet that the price of a currency will go up.

Short position: A bet that the price of a currency will go down.

The bid and ask: In a GBP/USD pair, the bid is the price that you can sell each currency at. You can open a trade at the bid price and, if the value of the currency drops below this price, you can make a profit on the sale. The ask is the same but in the other direction. If you want to bet on the price increasing, then open a bet at the asking price.

The spread: the difference between the bid and the ask.

The pip: The smallest amount of a currency pair that you can buy or trade on the forex market.

Leverage trading: Trading that borrows funds from the broker to enable traders to bet more than they have in their accounts. Losses are amplified accordingly.

A lot: The standard number of units of base currency that are in a forex contract.

Rollover: When a position is rolled over it means that the broker has closed your previous position and opened a new one for you. There is a fee associated with this process.

Forward forex contract: A contract traded on the OTC market to be executed at a future date but using the currency prices at the time the contract was signed.

Futures forex contract: An agreement on the regulated forex market to execute a trade at a future date according to terms outlined in the agreement.

What drives market prices?

There is a wide range of factors that determine the strength of a currency. The relative values of currencies are heavily influenced by global economics and geopolitics. Because of this, currency markets are wildly unpredictable. As the Covid-19 outbreak has shown, there are plenty of unpredictable events that can dramatically impact currency markets.

Despite this apparent chaos, there is some order to forex markets and there are economic calendars that serve as reasonably accurate predictors. Nevertheless, the factors affecting currency markets are myriad and complex.

| Image | Product | Features | Price |

|---|---|---|---|

Best Forex Broker  | Pepperstone

| 9.9 | Open Account |

| Plus500

| 9.1 | Open Account |

| Fusion Markets

| 8.8 | Open Account |

| Axi

| 8.6 | Open Account |

| City Index

| 8 | Open Account |

To learn about our privacy policy click on this page.

ASIC regulated

ASIC regulated