CoinSpot is one of the best choices of crypto exchanges for Aussies, while Coinbase is the largest American crypto exchange. Even if you're living in Australia, you might have read about Coinbase due to its popularity in the States, but which is the better choice for Australians? I have compared the two exchanges thoroughly in several aspects, so you can see for yourself. Spoiler alert: CoinSpot is the winner, with several deposit options, much lower trading fees, 24/7 Live Chat support and the highest levels of security and auditing. You can also receive $20 FREE Bitcoin when you sign up with our link here.

Cell |  |  |

Fiat Currencies | AUD | AUD, USD, EUR, GBP, CAD, MXN, HRK, CZK & 10+ more |

Number of Coins | 430+ | 160+ |

Buy/Sell Fees | 1% | 4.49% |

Daily Deposit Limit | $100k | starts from $375/wk |

Deposit Methods | Cell | Cell |

Direct Deposit | ||

PayID | ||

POLi | ||

PayPal | ||

Credit Card | ||

Debit Card | ||

BPAY | ||

Cryptocurrency | ||

Cash | ||

Features | Cell | Cell |

User-friendly | ||

Mobile app | ||

Demo mode | ||

Live Chat | ||

Security | Cell | Cell |

2FA | ||

Biometric security | ||

AUSTRAC registered | ||

ISO 27001 certified | ||

Offline cold storage | ||

Website |

Cell |  |  |

Fiat Currencies | AUD | AUD, USD, EUR, GBP, CAD, MXN, HRK, CZK & 10+ more |

Number of Coins | 430+ | 160+ |

Buy/Sell Fees | 1% | 4.49% |

Daily Deposit Limit | $100k | starts from $375/wk |

Deposit Methods | Cell | Cell |

Direct Deposit | ||

PayID | ||

POLi | ||

PayPal | ||

Credit Card | ||

Debit Card | ||

BPAY | ||

Crypto | ||

Cash | ||

Features | Cell | Cell |

User-friendly | ||

Mobile app | ||

Demo mode | ||

Live Chat | ||

Security | Cell | Cell |

2FA | ||

Biometric security | ||

AUSTRAC registered | ||

ISO 27001 certified | ||

Offline cold storage | ||

Website |

- Multiple deposit options

- Lower trading fees of 1%

- Most secure and trusted exchange in Australia

- Over 430+ cryptocurrencies to buy or sell

- Live Chat support team

- AUD is the only fiat currency supported

- Insurance against cybersecurity hacks

- Easy-to-use interface

- Offline cold storage of assets

- Cannot sell your crypto in Australia

- Extremely high transaction fees of 4.49%

- Only debit cards supported

CoinSpot vs Coinbase Fees

CoinSpot is the better option by far when it comes to fees. Continue reading on to see the fee structure for both of these crypto exchanges.

Deposit Fees

CoinSpot charges ZERO fees on AUD deposits using POLi, PayID, or Direct Deposit (via OSKO). If you prefer to deposit using BPAY, it will incur a 0.9% fee, and if you choose cash deposit, the fee is 2.5%.

Coinbase works slightly differently, in that you don't need to pre-fund your account by depositing money first. When you wish to buy crypto, you simply pay using your debit card at the time of purchase. Coinbase only accepts Debit cards for payment (it no longer accepts credit cards), and charges a high fee of 3.99% per transaction.

Trading Fees

CoinSpot charges 1.0% fees when buying or selling cryptocurrency.

Coinbase charges 0.5% fees, PLUS the 3.99% debit card fee on each transaction. In total, your fee when you buy crypto is 4.49%. Also note that you will NOT be able to sell cryptocurrency on Coinbase in Australia. Currently, you can only purchase crypto and send it to an external wallet or another crypto exchange. Read here to find out why this is the case for Australians.

Withdrawal Fees

CoinSpot charges ZERO fees for AUD withdrawals to Australian bank accounts.

Coinbase does NOT allow any fiat withdrawals in Australia, since you CANNOT sell cryptocurrency. Please be aware of this major limitation if you choose to use Coinbase. Coinbase's help article explains why this is the case.

Winner - CoinSpot

CoinSpot wins when it comes to fees. The trading fees of 1% are much cheaper than Coinbase (4.49%). Additionally, Coinbase does NOT allow sale of cryptocurrency in Australia, so you won't be able to cash out or withdraw fiat currency from the exchange.

CoinSpot vs Coinbase Deposit Methods

CoinSpot offers a variety of methods to deposit funds into your account, including Direct Deposit, PayID, POLi and cryptocurrency, which are all free of charge. You can also elect to deposit via BPAY or cash deposits at a newsagent.

When you use Coinbase, you don't deposit money beforehand to fund your account, you simply use your debit card for payment of the coin at the time of purchase. For Australians, Coinbase only supports Debit cards as payment. Credit cards used to be accepted, but are no longer, according to Coinbase in their article.

Winner - CoinSpot

CoinSpot comes out on top due to its variety of deposit methods, whereas Coinbase only accepts debit cards, incurring a 3.99% fee.

CoinSpot vs Coinbase Features

CoinSpot and Coinbase are two well-established cryptocurrency exchanges that boast a ton of features. I won't go in-depth about every service they offer, but if you are interested in that, click on my reviews for CoinSpot (here) or Coinbase (here). Instead I am going to talk about the features that set them apart from each other.

CoinSpot's customer service is excellent, with support available 24/7 via Live Chat. I have tested the Live Chat a few times, and I am always chatting to a real person (no bots) within a few minutes. I have always found the Support team to be friendly, professional, and competent in solving my issues. Coinbase on the other hand does not offer Live Chat support, which is an area they could improve in.

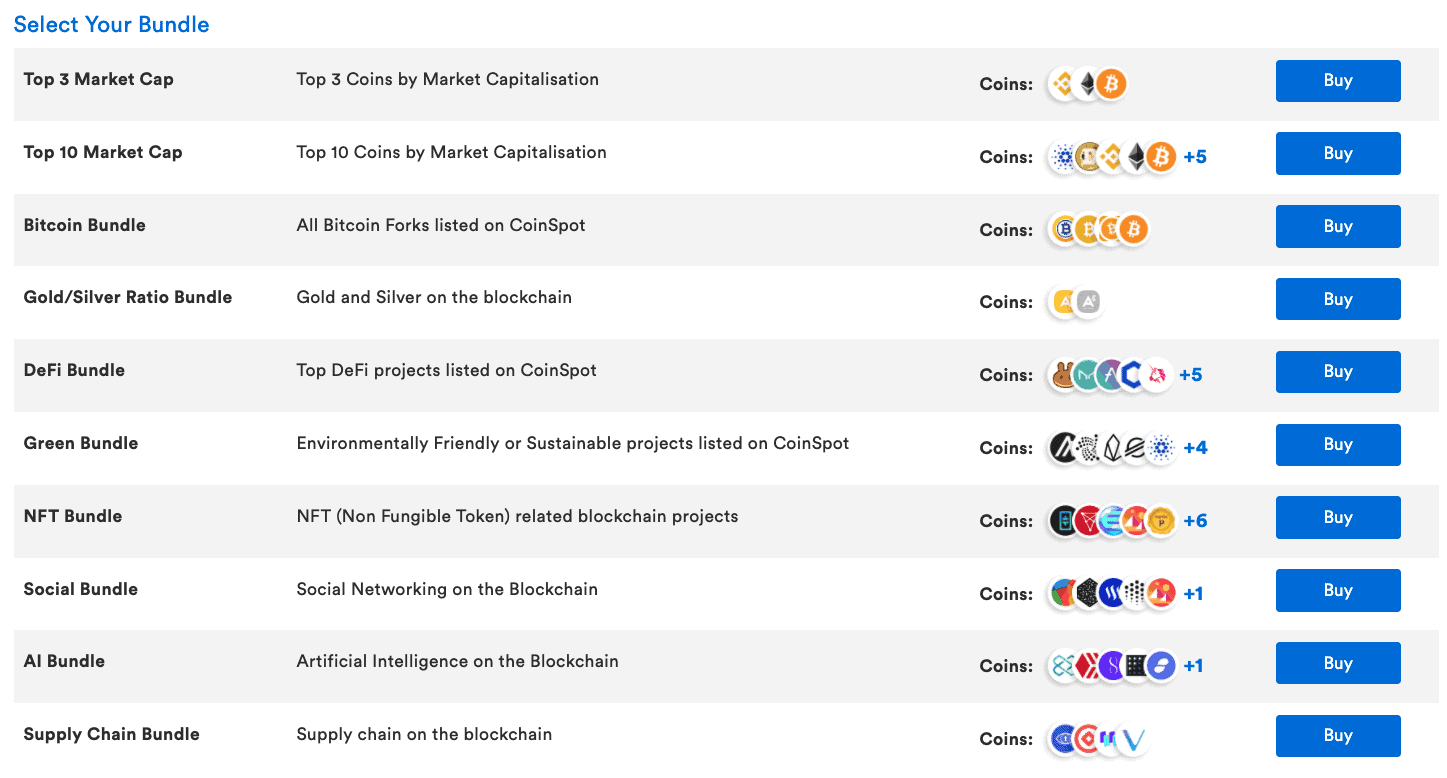

CoinSpot has a really useful service called CoinSpot Bundles which you can use to diversify your portfolio. You are able to buy a variety of coins in a single transaction, which spreads out the risk, minimises fees, and affixes an average cost over several cryptocurrencies.

I like the 'Top Ten Market Cap' Bundle which is just what it sounds like - the top ten biggest coins based on market capitalisation. This is great for me because it encompasses the popular coins that I like to buy anyway, such as BTC, ETH, BNB, ADA and spreads out risk to reduce volatility. Here are all the CoinSpot Bundles currently available.

CoinSpot also offers users an easy way to invest in NFTs with their NFT marketplace. You can browse various collections and use any cryptocurrency you own to make your purchase.

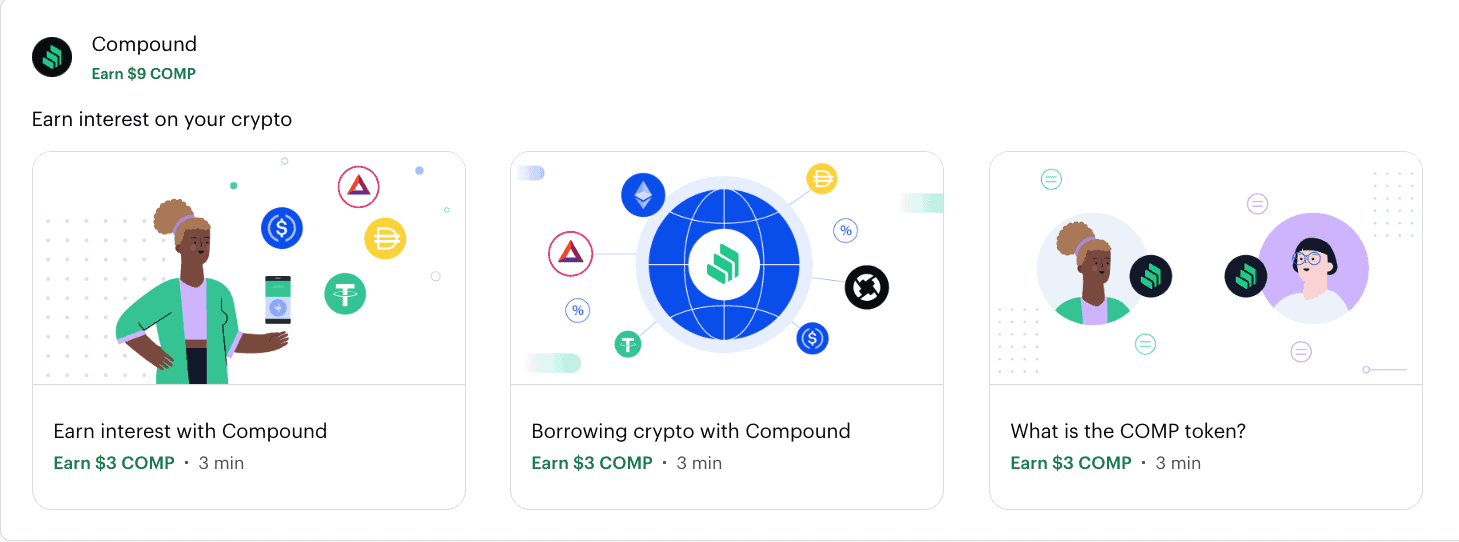

Coinbase has a unique feature on their platform called Coinbase Earn. You can earn free crypto while you are watching a video teaching you about cryptocurrency! These are only short videos, that reward you upon completion. An example of rewards currently available, is that you can earn $9 of COMP crypto by watching three short videos (3 minutes each).

Coinbase has a popular Wallet app that is available for download on mobile devices, both iOS and Android. On the Google Play store, it has over 1 million downloads and a 4.3-star rating from 24K reviews. With the Coinbase Wallet users can store crypto securely, and also access a wide range of decentralised innovation. You can participate in airdrops and ICOs, collect NFTs, browse decentralised apps (DApps), and send crypto to anyone, anywhere on the planet.

Winner - CoinSpot

CoinSpot wins because it has more features, such as 24/7 Live Chat support and an NFT marketplace.

CoinSpot vs Coinbase Security

Security is always a high priority for any top crypto exchange, and both CoinSpot and Coinbase are leaders in this respect. CoinSpot's multi-layered security incorporates Two-Factor Authentication (2FA), custom withdrawal restrictions, anti-phishing phrases, geo-lock logins, session timeout settings and offline cold storage of the vast majority of its digital assets. CoinSpot is registered with AUSTRAC, fulfilling its strict AML/KYC obligations, and is a certified member of Blockchain Australia, so it's fully compliant with the Australian Digital Currency Industry Code of Conduct. CoinSpot also boasts that it is the most secure and audited exchange in Australia, and is the only one with the ISO 27001 certification.

Coinbase's extensive security includes 2FA (2-factor authentication), biometric logins (fingerprint and face ID), and data encryption, with USB drives and paper backups distributed geographically in safes and vaults around the world. Every employee at Coinbase has also passed a criminal background check, and their hard drives are encrypted. Coinbase stores 98% of its digital assets in offline cold storage, and even carries crime insurance cover to protect the digital assets held across their storage systems against losses from theft, including cybersecurity breaches. If Coinbase is hacked and your cryptocurrency is stolen, Coinbase will endeavor to cover you for the losses. To find more information, read about Coinbase's insurance.

Winner - CoinSpot

This is a close one, because both CoinSpot and Coinbase have extremely good security features. CoinSpot wins in the end because it is an Australian exchange, so it has the AUSTRAC registration, as well as ISO 27001 certification.

Verdict - CoinSpot

CoinSpot is one of the best Australian crypto exchanges, and Coinbase is one of the top USA crypto exchanges, but when it comes to a comparison for Aussie investors, CoinSpot wins by far.

CoinSpot has lower fees, various deposit methods, and Live Chat customer support that makes it one of the best exchanges in Australia. Unfortunately for Coinbase, even though it has immense popularity in the US, it isn't really suitable for the Australian market. Coinbase has some serious limitations in Australia, only accepting debit card purchases, along with the high 3.99% fee. Add that on top of the 0.5% transaction fee and you are losing 4.49% on every transaction - almost 4.5x the fee on CoinSpot.

Coinbase also has another big problem for Aussie customers. It isn't possible to transfer fiat currencies onto your debit card, and because of that, Australian users will not be able to sell digital currency. On Coinbase, Australians can only buy crypto and transfer it to a personal wallet, or send to another exchange if they want to sell it.

Overall Winner - CoinSpot

Low fees, NFT marketplace, 430+ coins, and 24/7 Live Chat support means CoinSpot is the winner in this head-to-head comparison. Sign up with this link to receive $20 FREE Bitcoin as a welcome offer.

Still Researching?

To find out more about CoinSpot and Coinbase, you can check out my detailed reviews of CoinSpot (here) and Coinbase (here). If you would like to read about other Australian crypto exchanges, click here to see my comprehensive overview. I have put a comparison table below for you to see a snapshot of the important details.

Comparison Table of the Best Crypto Exchanges in Australia

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this breakdown.