Cryptocurrencies have boomed in popularity in the last few years, and many Canadians are looking to get some crypto of their own but aren't sure where to start. The easiest way to buy crypto such as Ether (ETH) and Bitcoin (BTC) is to use an exchange. There are many options available, with many scams that are out to steal your money, so you need to ensure you choose a legitimate platform. To help you find the best exchange for your personal needs, I have compared dozens of popular cryptocurrency exchanges and come up with a list of the best ones for Canadians in 2024.

| Crypto Exchange | Features | Score | Sign Up |

|---|---|---|---|

Best for Canadians  | ☑️ Huge range of 2,300+ coins and 2,110+ trading pairs ☑️ Deepest liquidity, almost 10x higher than Bybit, Binance, KuCoin, Huobi, and OKX ☑️ Free crypto trading bots and Copy Trading are available | 9.9 | Open Account |

Best for Beginners  | ☑️ Easily deposit CAD instantly & get access to 15 cryptocurrencies ☑️ Secure, Toronto-based company since 2016 (high trust-rating) ☑️ Offers a wallet, an app and round the clock customer support | 9.7 | Open Account |

Lots of Services & Coins  | ☑️ World renowned exchange, offers over 600+ cryptocurrencies and low fees (0.10%) ☑️ Buy cryptocurrencies quickly using your debit or credit cards (CAD supported) ☑️ Binance offers advanced trading choices, staking services and more | 9.5 | Open Account |

Best for Security  | ☑️ Supports CAD deposits and charges 0% deposit fees ☑️ Very competitive trading fees of just 0.2% ☑️ Funds are held in a national bank's facility | 9.4 | Open Account |

How I Chose the Best Crypto Exchanges

I looked at a range of factors including user-friendliness for beginners, fees, ease of fiat purchases, selection of cryptocurrencies available, and advanced trading features to select one that stands out for each category.

Please note, this is not an exhaustive list of all cryptocurrency exchanges available in Canada. There may be some exchanges that are better suited for certain currencies or situations, depending on your own circumstances.

Best Canadian Crypto Exchanges

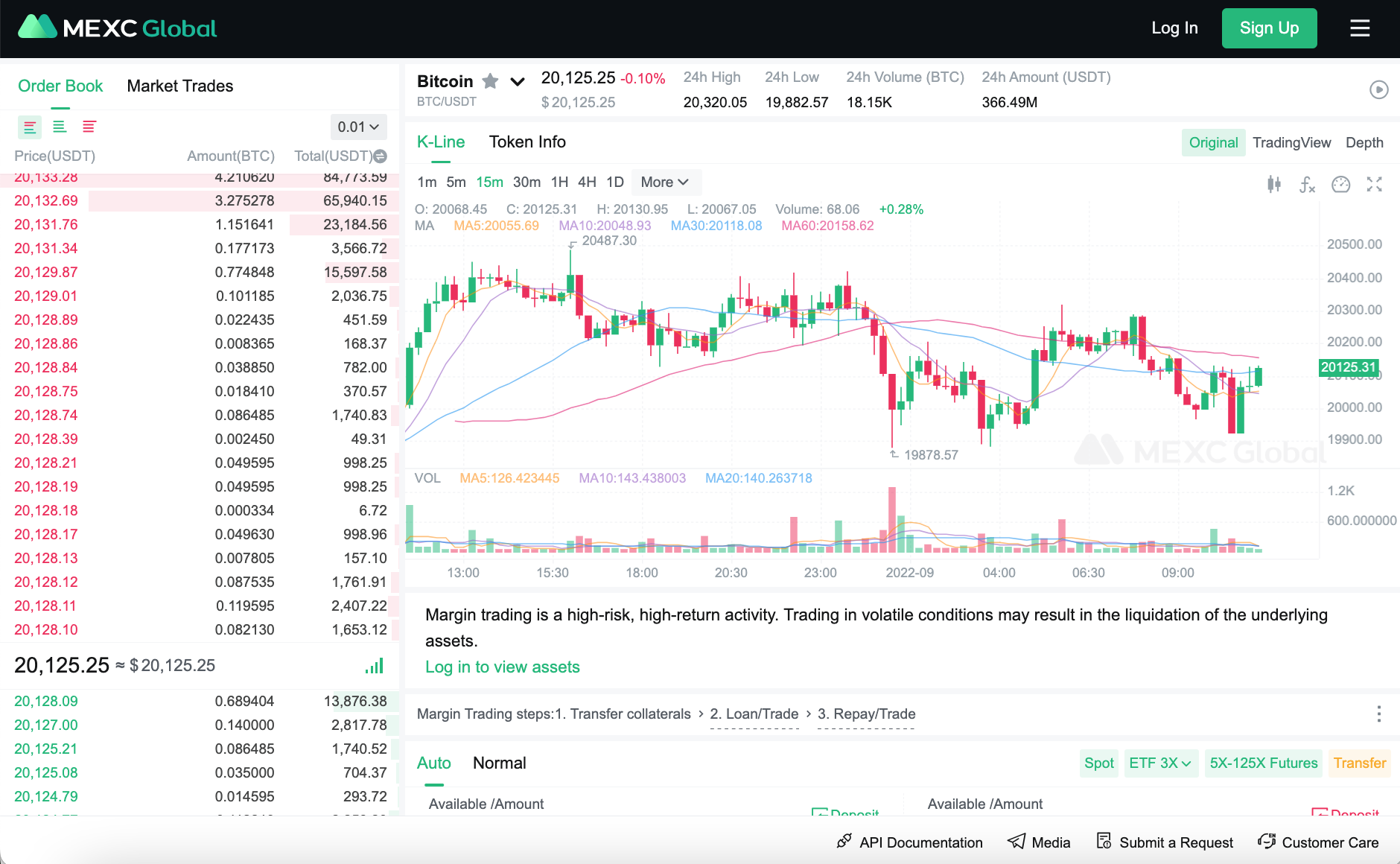

#1. MEXC: Best for Canadians

MEXC is my #1 choice for Canadians, particularly those who are serious about crypto trading. If you plan to trade a lot, and want a range of markets, then MEXC is definitely the exchange for you. It has over 2,300+ cryptocurrencies, and 2,110+ trading pairs, with low trading fees. If you like spot trading, the fees are 0%, and if you prefer futures trading, the fees are 0% for makers and 0.01% for takers. You can also take advantage of this unique limited offer, where you can claim 10% off all your trading fees and receive $30 FREE USDT using our link.

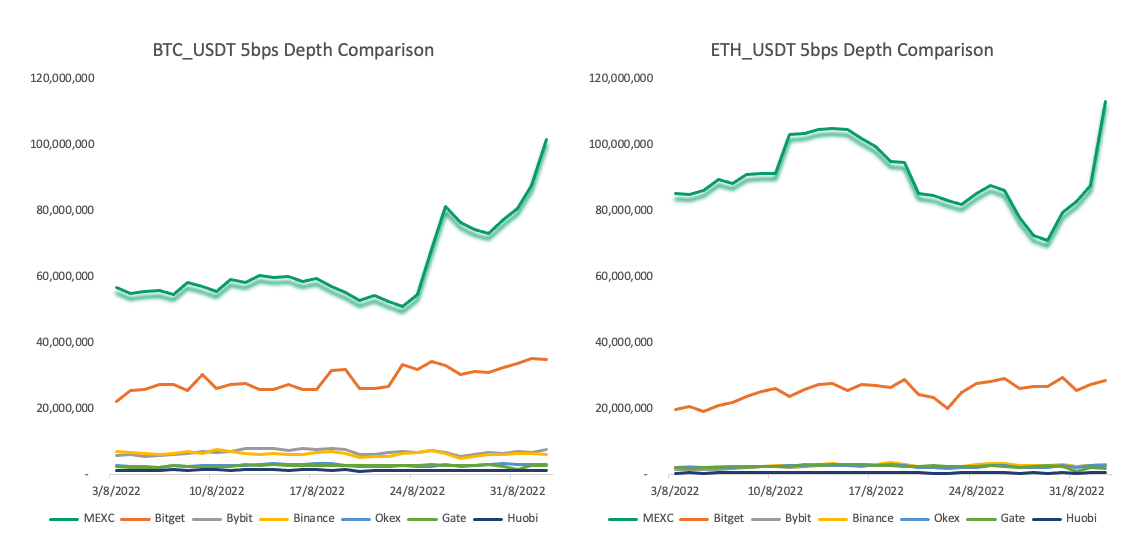

Besides low fees and huge collection of coins on offer, MEXC also proudly has the deepest liquidity of any crypto trading platform. Even when you look at the world's largest exchanges, like Bybit, Binance, KuCoin, and Huobi, they don't come close to MEXC. The graphs below clearly demonstrate the difference in liquidity of BTC/UST and ETH/USDT between MEXC and the main competitors.

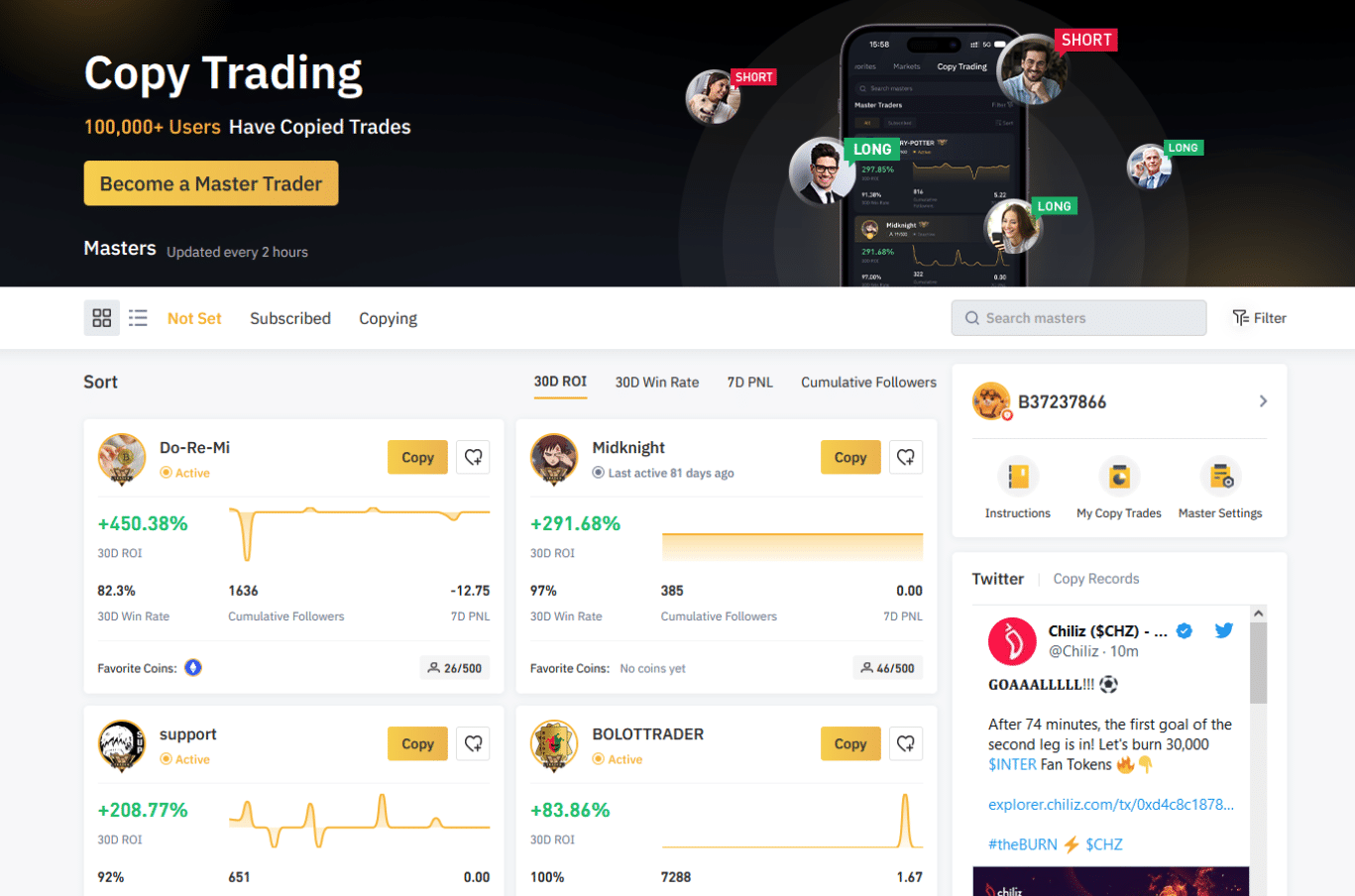

MEXC offers spot trading, derivatives trading, P2P market, and margin trading (up to 125x leverage) on its platform. If you are someone that likes to use automated systems, MEXC offers trading bots for free so you can continue to make profitable trades even when you are offline. If you don't trust bots, and you would rather follow a real human investor, you can use the copy trading feature. This lets you find a profitable investor, and automatically copy all of their exact trades, as soon as they make them.

If you would like to register on MEXC, use my link and receive $30 FREE USDT plus 10% discount on all your trading fees!

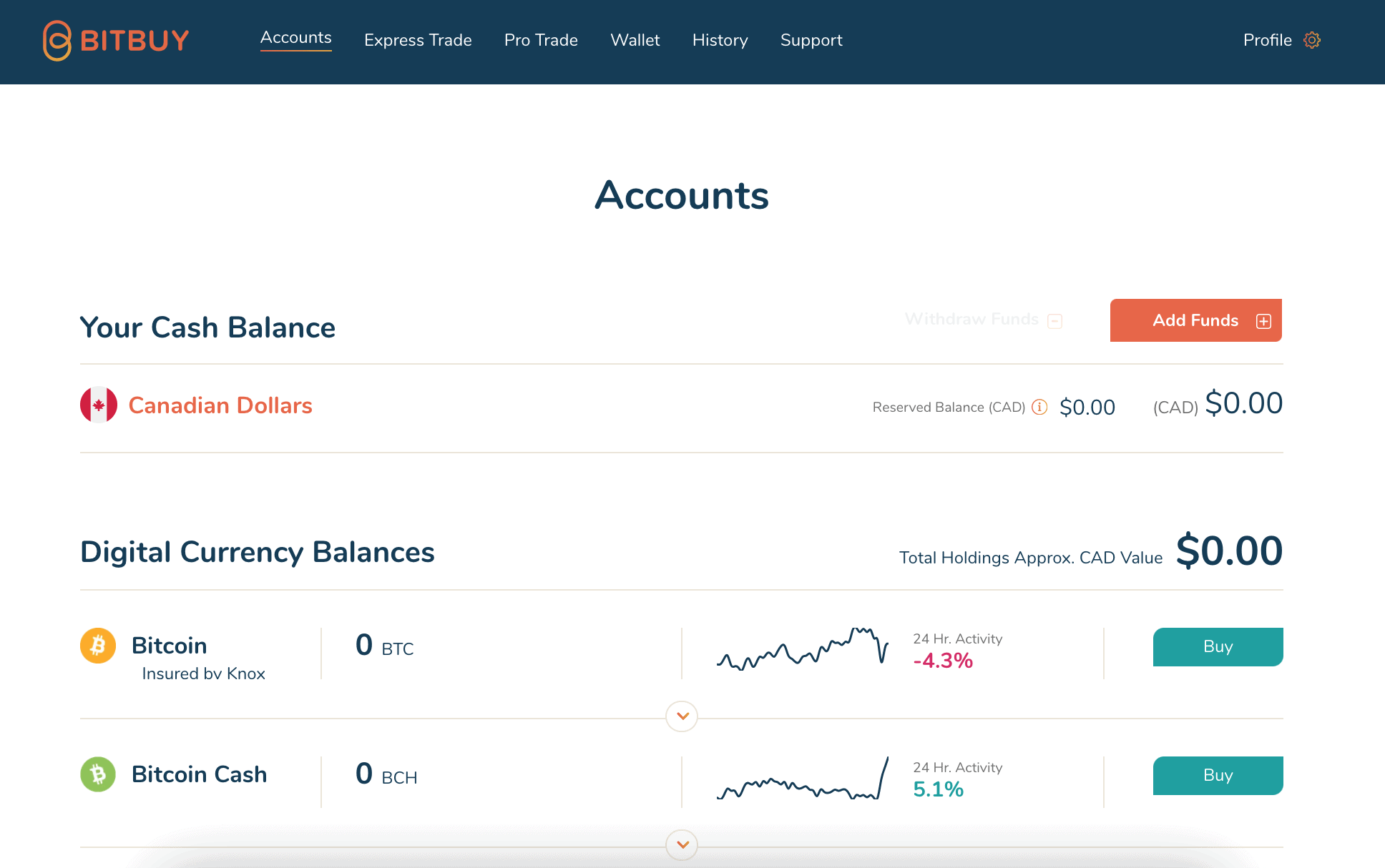

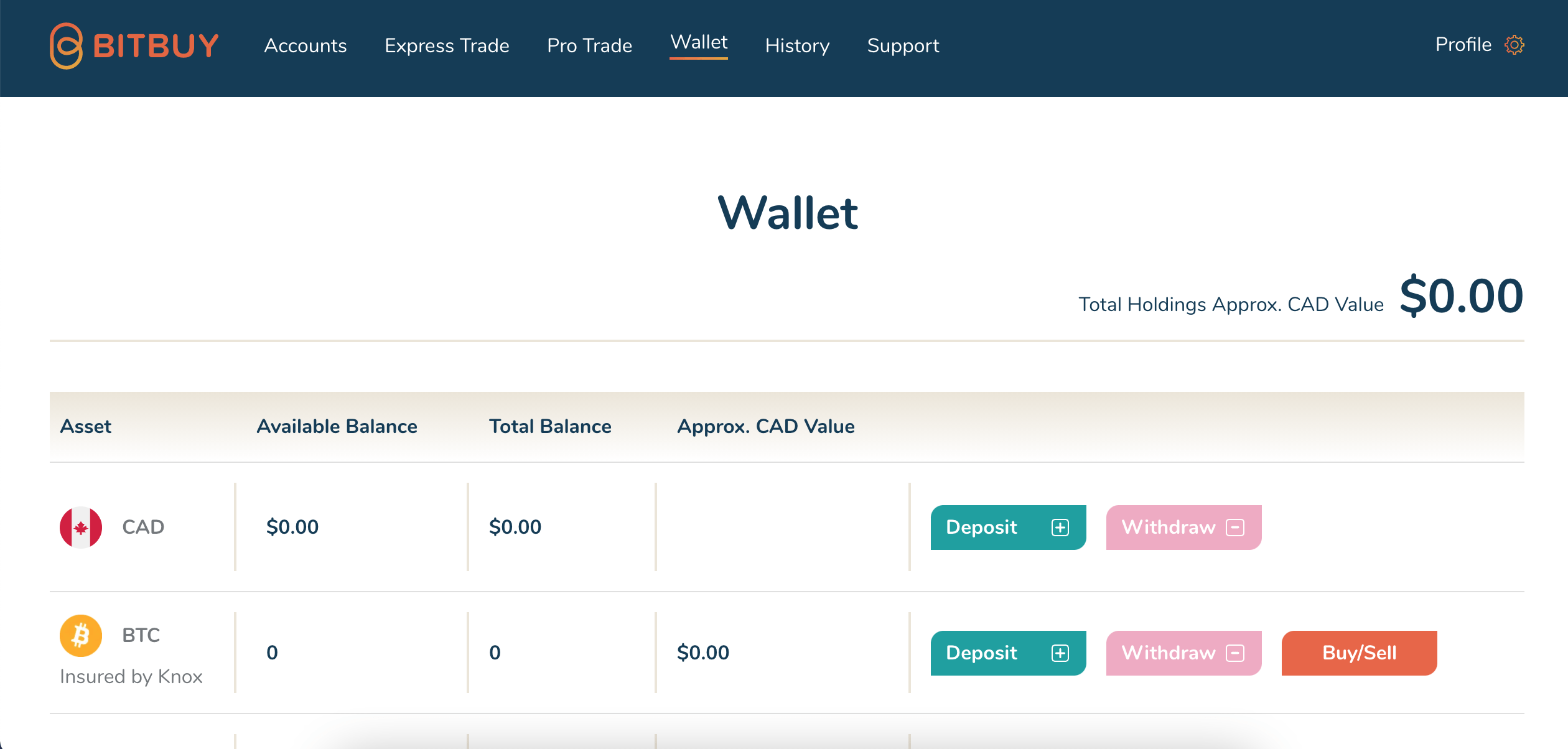

#2. Bitbuy: Best for Beginners

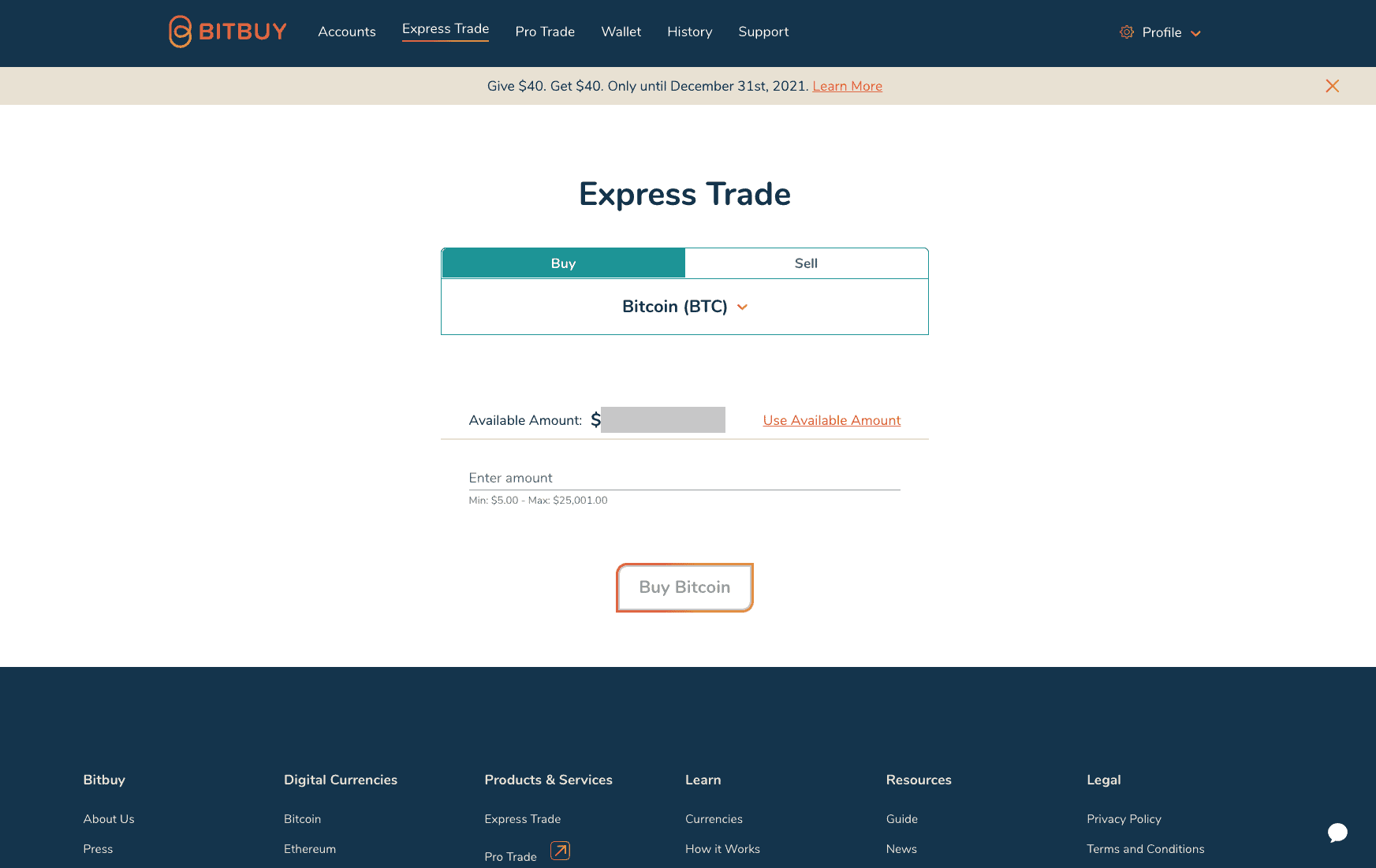

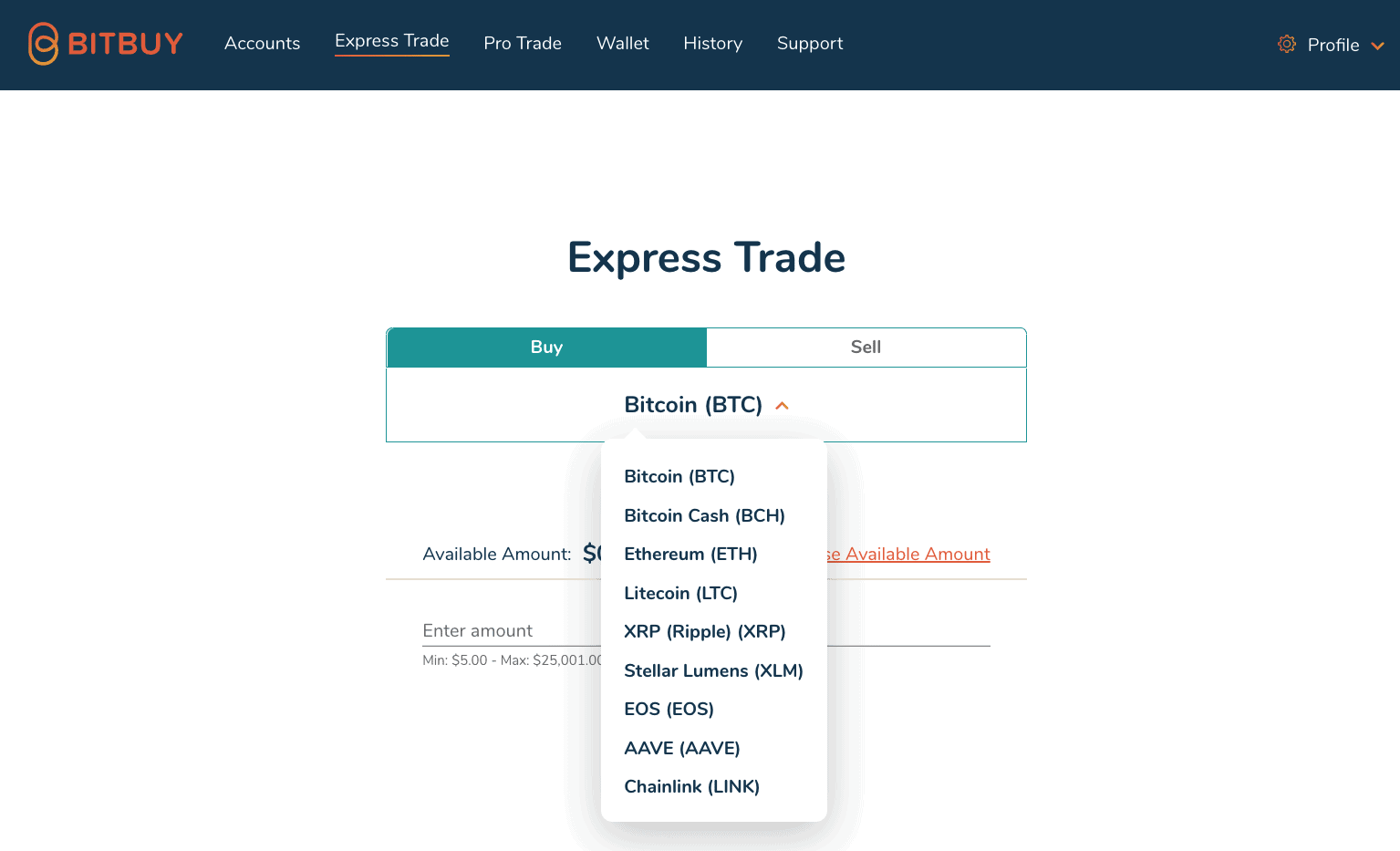

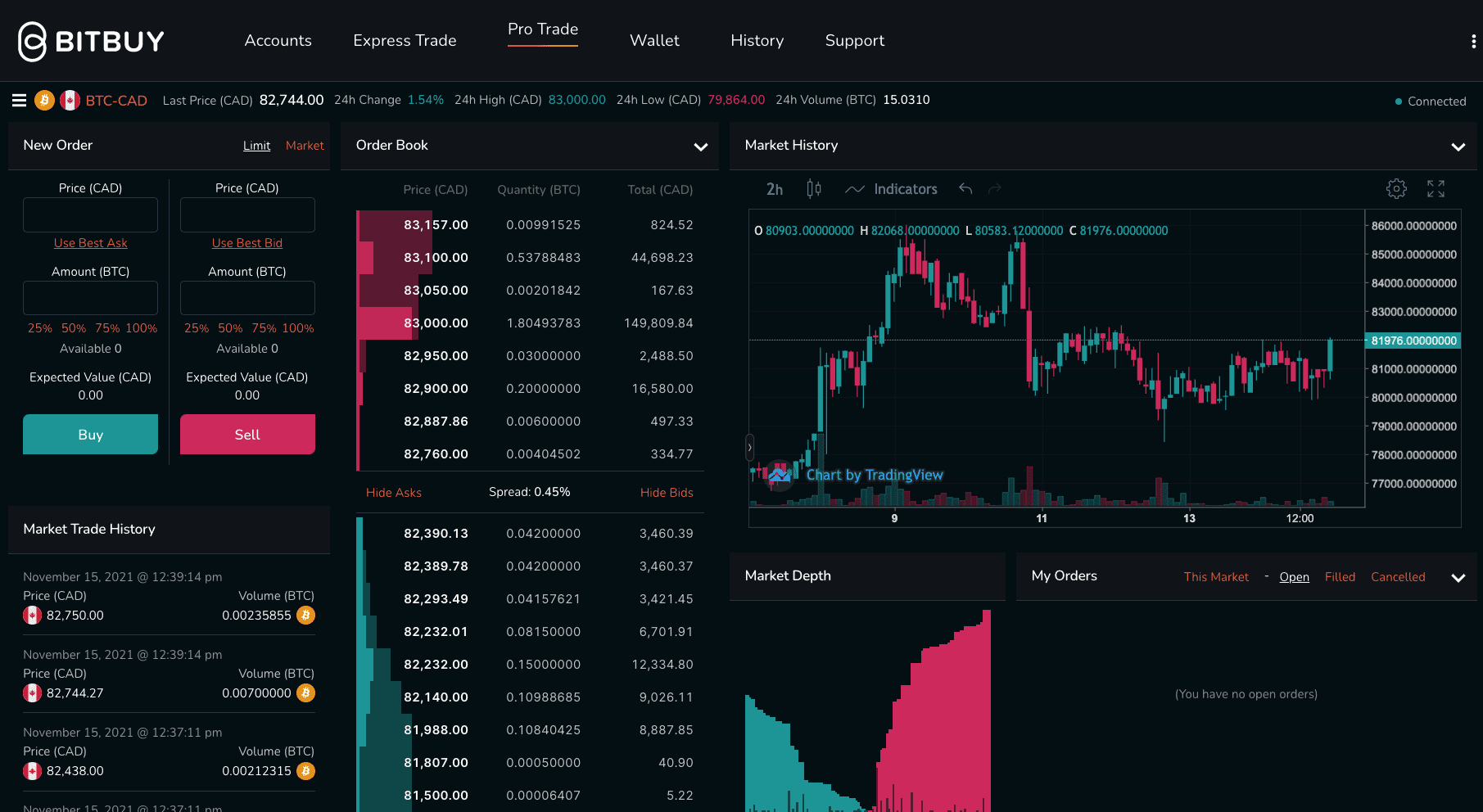

The reason Bitbuy comes #1 for beginners, is because it ticks all the boxes for new crypto investors. With Bitbuy's user-friendly interface, you can easily buy and sell 17 of the most popular cryptocurrencies with the Express Trade feature, which is perfect for beginners. For more experienced traders, the Pro Trade function gives access to advanced charts from TradingView, and there are even options for OTC trades and an API to automate your trades.

As outlined in my Bitbuy review, the exchange was founded in Toronto and allows Canadians to deposit CAD for free, through wire transfer or Interac e-Transfer. They are registered with FINTRAC as a Money Services Business, and they are the most secure and trusted exchange in Canada. Their servers are secured across multiple world class cloud providers and disaster recovery locations. All providers are ISO, SOC, and FIPS 140-2 compliant. Bitbuy’s privately maintained codebase keeps core components closed source, so your intellectual property is safe from prying eyes. I personally give Bitbuy a high trust rating, along with over 350,000+ Canadian investors.

If you find the number of cryptocurrencies lacking, you may want to check out international exchanges like MEXC that have over 2,300+ different coins.

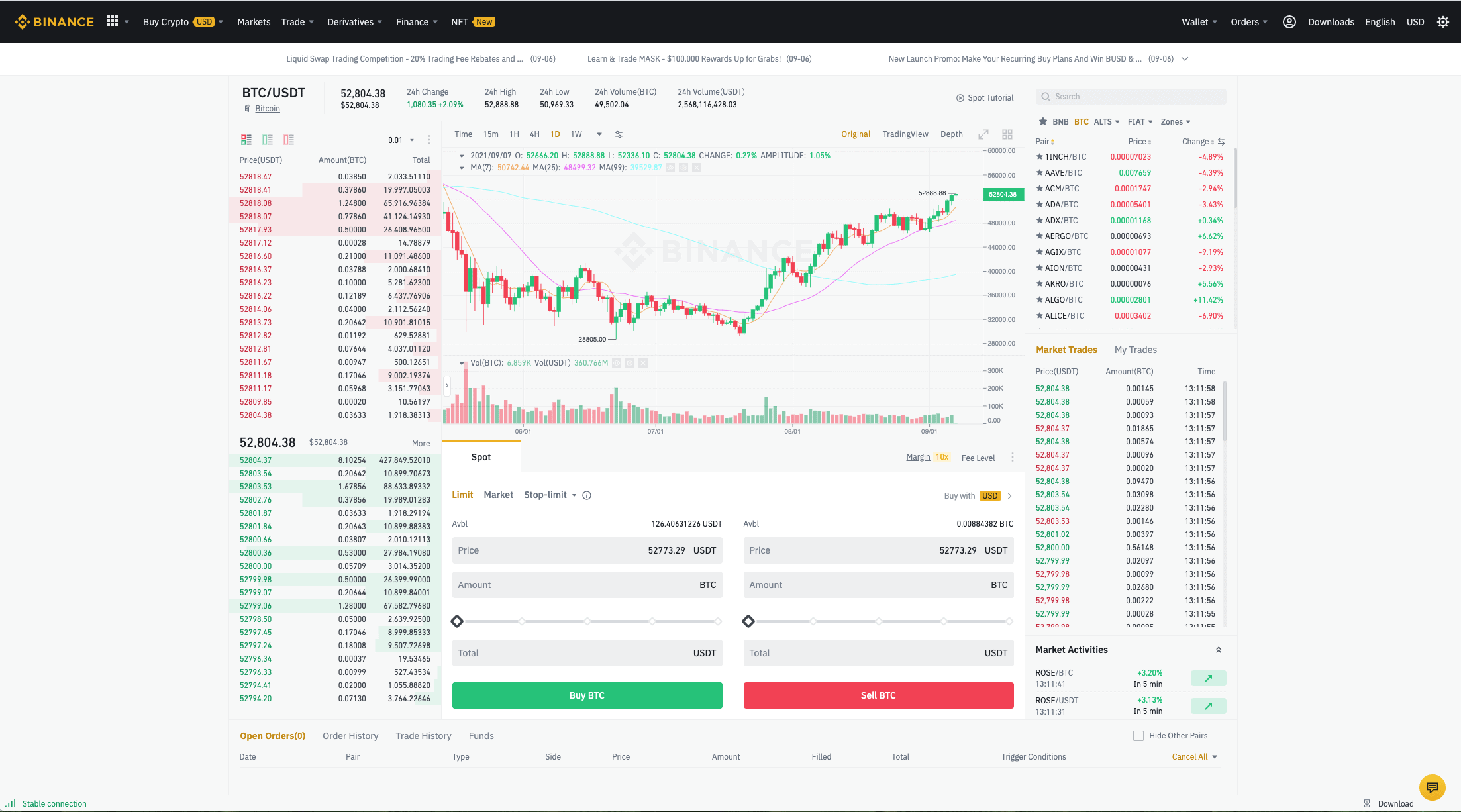

#3. Binance: Lots of Services and Coins

Binance is one of the most popular exchanges in the world and the largest in terms of trading volume, and it's easy to see why. They offer a ridiculous number of services and over 600+ different cryptocurrencies, with new coins added each month. Customers can buy crypto directly on the Binance platform using Swift bank transfer, debit/credit cards, or a third-party payment system called Paxos. After you own crypto on the platform, you can trade it into other cryptos in three different views: Convert, Classic, and Advanced. Each view increases in complexity depending on how much info or how many options you want offered on your screen.

If you sign up with Binance, you get access to futures markets, margin trading, crypto lending, a P2P marketplace, a Visa card, and much more. All of these services are offered with super-competitive trading fees (max 0.10%) with an easy way to reduce fees simply by paying with their native coin BNB. Binance really is an extremely feature-rich playground for experienced crypto traders. Binance also accepts deposits in CAD now, making it more accessible for Canadians

The downside to Binance is their lack of customer support, which is not surprising considering how large their operation is. It can be very frustrating if you experience an issue as you can only receive automated bot support that is not helpful in certain situations.

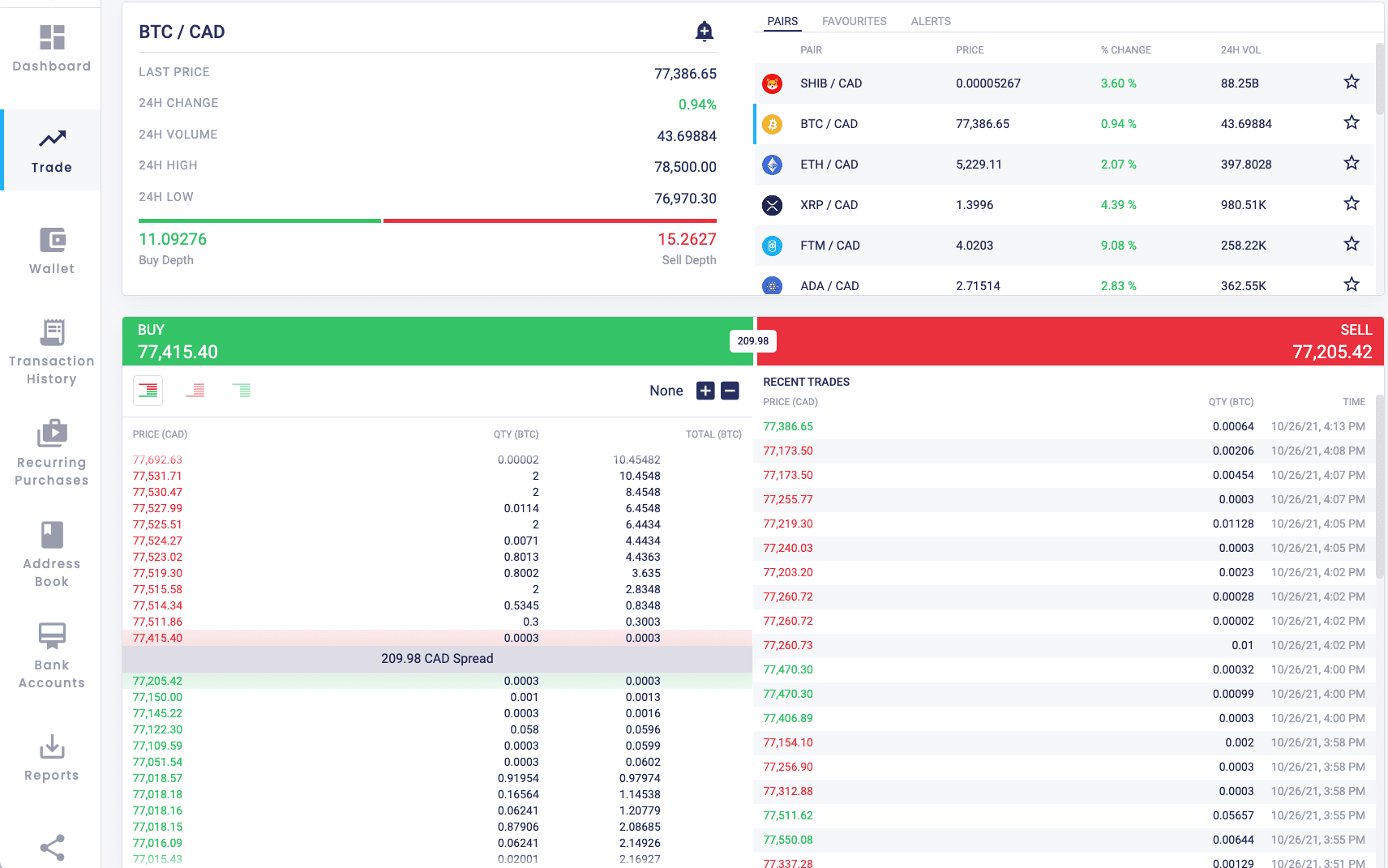

#4. NDAX: Best For Security

Founded in 2018, NDAX's primary focus was to provide secure, easy and fast crypto trading to Canadian individuals and institutions. They have succeeded with building a platform that is excellent for both beginners and advanced traders alike. NDAX is registered with FINTRAC, and has security standards among the highest in the Canadian FinTech industry. The majority of their digital assets are held offline in cold storage, partnered with Ledger Vault, the global leader in crypto security and infrastructure solutions.

With low trading fees of just 0.2% and 24/7 Customer Support by live chat and email, NDAX is an exchange that really looks after their users. They even offer FREE $10 signup bonus when you register with this link.

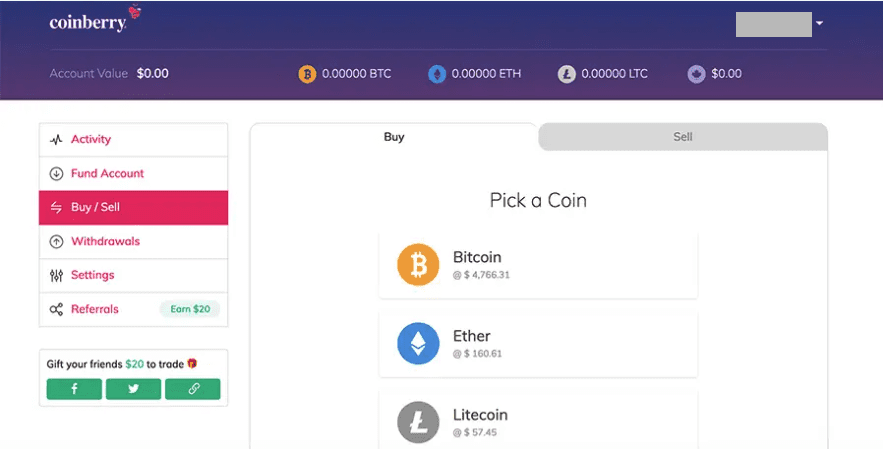

#5. Coinberry: Fully compliant Canadian exchange

Coinberry is a Canadian crypto exchange founded in 2017, with a focus on making it simple for Canadians to buy and sell cryptocurrency. They started off with only a few coins on offer, but have now expanded to support 37 of the most popular cryptocurrencies. Coinberry is registered with FINTRAC, complying with all their strict AML/KYC obligations, and they have institutional-grade crypto protection. Coinberry's digital assets are protected by Gemini Trust Company and they even have insurance to protect against internal threats, for example unethical and dishonest behaviour from employees.

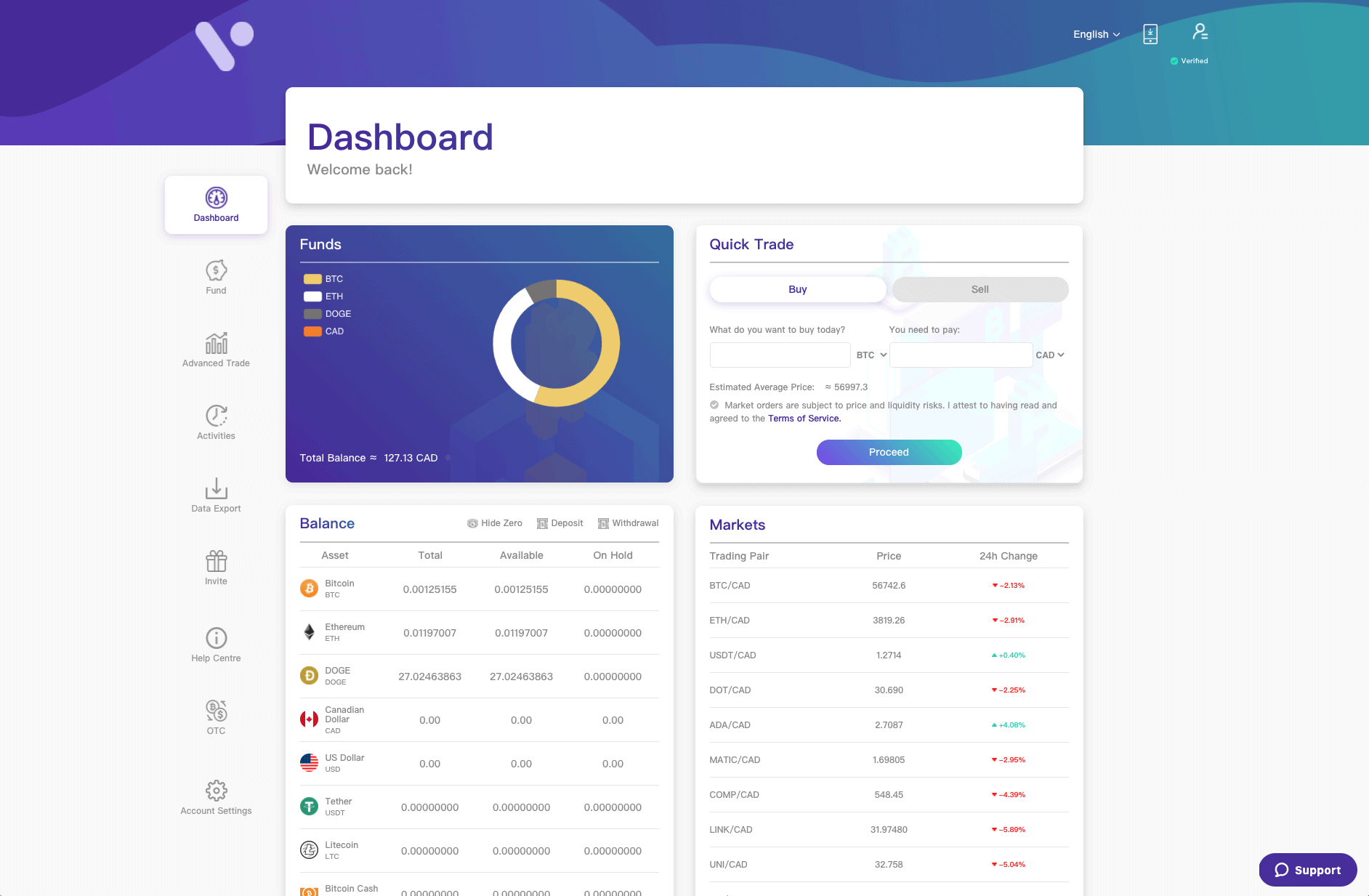

#6. VirgoCX: No Trading Fees

VirgoCX was founded in Toronto, Canada in 2018, and has quickly grown into a popular crypto exchange for Canadians. The standout feature of this platform is there are 0% fees on all trades! There is no commission or hidden fees when buying or selling cryptocurrency, nor do you have to pay deposit fees. You only pay a low 0.5% fee on fiat withdrawals from your VirgoCX account.

VirgoCX has a very simple and modern interface which is perfect for new users, and offers 23 of the most popular coins which is enough for most investors that are looking to begin their crypto journey. VirgoCX accepts fiat deposits and withdrawals in CAD and USD, using Interac e-Transfer and wire transfer.

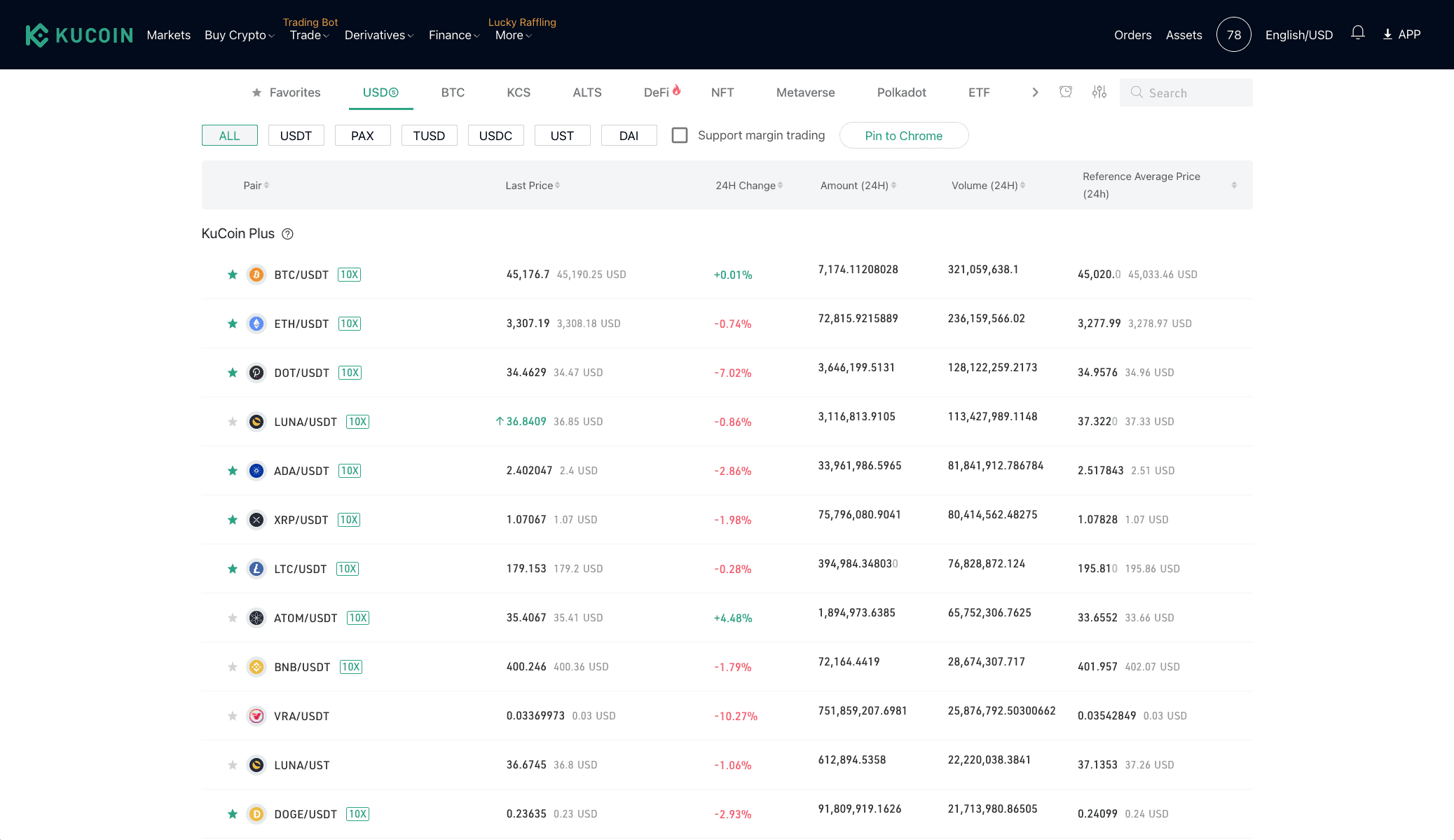

#7. Kucoin: Best for Altcoins

Kucoin is famous for its impressive range of cryptocurrencies (over 700+ altcoins) and extremely competitive fees (from 0.1%). They also offer a rewarding loyalty scheme that allows traders to earn their own native cryptocurrency (KCS). KuCoin has an extensive array of additional features that experienced traders will love. Margin trading, Spot trading, P2P marketplace, Futures trading and Crypto lending are all available on this platform. To learn more, read our KuCoin review.

#8. BYDFi: Best for Leverage Trading

For those interested in leverage trading, BYDFi stands out as the premier crypto exchange. It sets itself apart by providing the highest levels of leverage, reaching an impressive 200x for trading futures. Unlike most other leverage trading platforms that offer a maximum of 100x or 125x leverage, BYDFi surpasses the competition by a significant margin. This remarkable feature empowers traders to optimize their profits and trade with exceptional flexibility.

In addition to its leverage trading capabilities, BYDFi presents a wide range of trading options to cater to diverse needs. Spot trading is available for more than 400+ coins, allowing users to engage in direct trading of various cryptocurrencies. Moreover, BYDFi offers a demo account, enabling traders to practice their strategies without any risk. Another notable feature is Copy Trading, where users can follow successful traders on BYDFi. With this functionality, every time the followed trader places an order or executes a trade, BYDFi automatically replicates the same trade on the user's account, even when they are offline or asleep.

In addition, BYDFi provides distinct user interfaces tailored to both beginners and experienced traders. The 'Classic' UI is specifically designed for newcomers, featuring a simplified layout that presents essential information in a less overwhelming manner. This user-friendly interface caters to those who are just starting their trading journey. On the other hand, the 'Advanced' UI is designed for experienced traders, offering an extensive range of technical indicators, charting options, and tools. With these powerful features, users can effectively analyze market trends and determine optimal trade entry and exit points.

If you wish to delve deeper into BYDFi and explore all the features, I encourage you to read my comprehensive review here, or you can visit the official BYDFi website directly for more information.

#9. CoinSmart: Another Alternative

CoinSmart allows Canadians to buy crypto using a range of deposit methods: credit/debit cards, Interac e-Transfer, bank wire payments and bank drafts. When you sign up for the first time, you will need to go through the verification process, which usually takes just a few minutes. Most payments will be processed on the same day, and you can access card payments in your account immediately. You can withdraw CAD directly into your bank account. CoinSmart also offers 24/7 customer support and you can get in touch with the customer service team using a variety of contact methods.

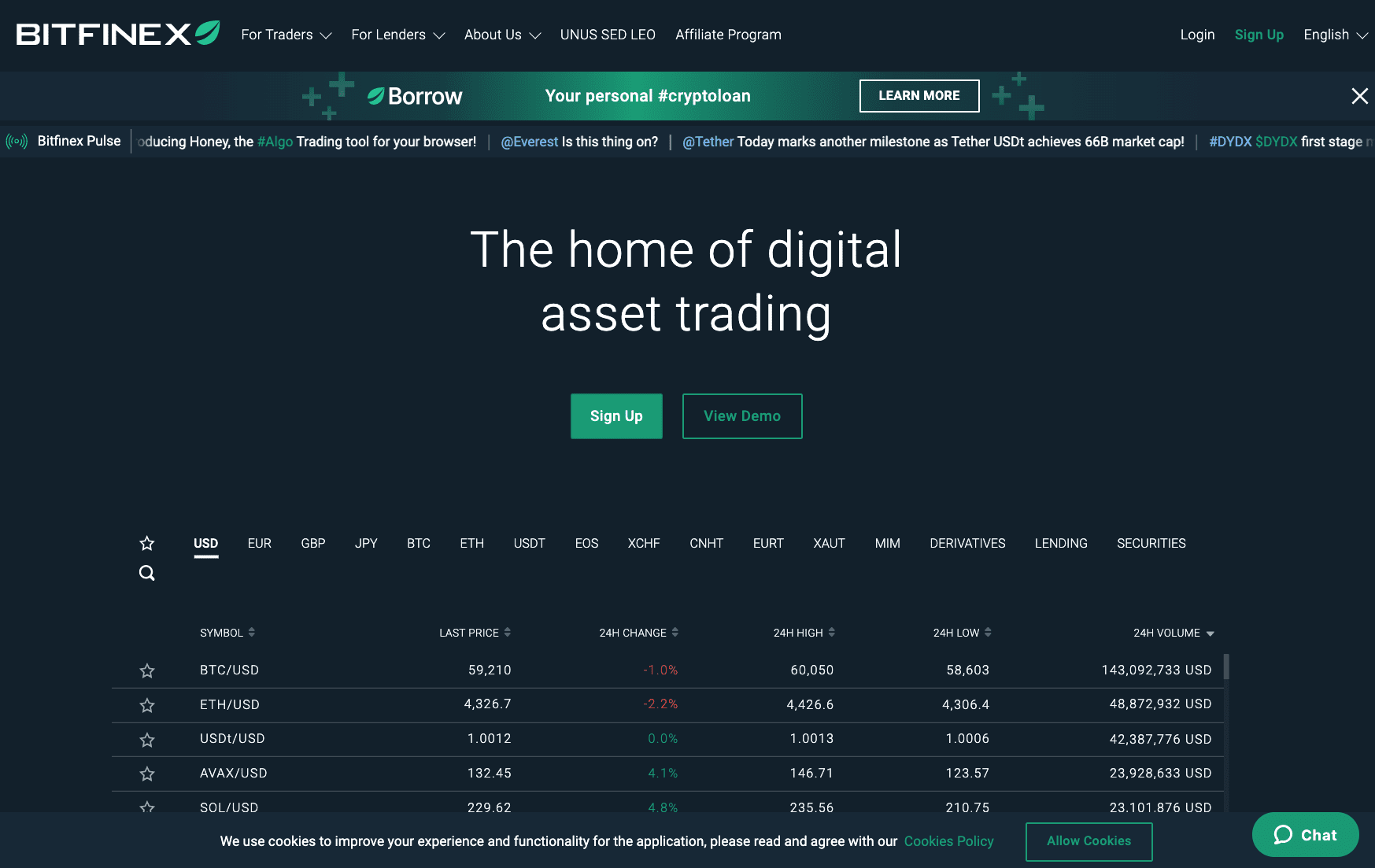

#10. Bitfinex: Best for Serious Trading

Bitfinex offers one of the most liquid cryptocurrency markets, and you can buy, sell and trade more than 150 different coins.

Comparison Table of the Best Crypto Exchanges in Canada

Is it Safe to Store Cryptocurrency on an Exchange?

Cryptocurrency is stored in digital wallets. When you open an account with a crypto exchange, most of them will automatically provide you with a wallet. You can keep your crypto on the exchange, or send it to an external wallet for safer storage.

Storing crypto long-term in an online exchange is not recommended. This is because the exchange holds the private key to your wallet, leaving you without total control of your funds. Your crypto assets are also at risk if the exchange is hacked.

How to Choose a Cryptocurrency Exchange

With hundreds of different exchanges to consider, what are the steps involved in finding the best one to suit your needs? The best thing to do is to spend some time researching a wide range of platforms, comparing the pros and cons of each option. It’s a good idea to know what you are looking for before you start, since the best exchange for you will depend on your personal needs and circumstances.

When comparing cryptocurrency exchanges, keep the following factors in mind:

If you are a newcomer to crypto, you will want a user-friendly interface that is simple to use, while more experienced traders usually prefer a platform that offers more advanced tools and features.

Consider how you want to deposit money into your online account and check that your chosen payment method is available. Most exchanges accept popular options like Interac e-Transfer, Wire Transfer or credit/debit cards.

Do you want to purchase crypto with CAD, trade crypto-to-crypto, or a combination of both? Different exchanges offer different trading options.

Some crypto exchanges have hundreds of different cryptocurrencies available to buy, sell and trade, while others only offer a handful. Consider the coins that you want to trade and check that the exchange has it on offer before signing up.

Check all the fees associated with the exchange. Deposit fees, trading fees and withdrawal fees all add up, so work out which is the most cost effective for your needs.

Check for any deposit and withdrawal limits that may apply when using a crypto exchange. If you plan on trading a very large or very small amount, you need to check the maximum and minimum limits.

Will you be trading crypto from a desktop, mobile app, or both? Check that the exchange you want to use supports your chosen devices.

If you are a frequent trader, you may want to choose an exchange that offers discounted trading fees for high-volume traders. Some exchanges offer discounted fees if you pay using their own cryptocurrency.

Compare cryptocurrency exchange rates (prices) across several different exchanges - one platform may have lower trading fees, but charge more per coin, so you need to work out the best option for you.

The more liquidity an exchange has, the quicker it will be to complete trades. Larger crypto exchanges tend to have higher liquidity than smaller ones.

Many crypto exchanges require identity verification before you can trade. Are you OK to give out your personal details, or do you prefer a platform that doesn't require full verification?

If you need quick access to your money, you will want an exchange that has quick deposit and withdrawal processing times. You don't want to be waiting for days for a deposit to be processed, in which time the price of all the coins have changed.

Security should be your #1 priority when looking for a crypto exchange. Look for a platform with multi-layered security including two-factor authentication, strong account verification processes, 24/7 security monitoring, and offline cold storage of crypto assets.

The cryptocurrency industry is still quite lightly regulated, and the extent to which it is regulated is based on where the exchange is headquartered. Canadian exchanges have stricter regulations, and are registered with FINTRAC as a Money Services Business, whereas some international exchanges have looser reporting obligations.

What is the customer support like on the exchange? Is there Live Chat support or can you only access help via an automated bot or email support?

Choose a crypto exchange that is well-known, and has a good reputation for being trustworthy and secure. Read many different reviews to find out about as many user experiences as you can, both the good and the bad.

How to Use a Cryptocurrency Exchange

Purchasing Crypto With CAD:

In this example, let’s assume that you’d like to buy Bitcoin and have CAD$500 available to spend. Follow these steps:

- Research and compare cryptocurrency exchanges to find one that you feel is a good fit for you.

- Register for an account and verify your account if needed by providing personal details and proof of your ID.

- Head to the ‘Buy’ screen.

- Select Bitcoin to purchase.

- Select your payment currency (CAD) and enter the amount that you want to spend ($500).

- Choose your payment method, such as bank transfer or debit card.

- Enter the relevant payment details to make the payment.

- Review the full transaction details. Check the fees and make sure that you are happy with the amount of Bitcoin you’re purchasing.

- Click ‘Buy BTC’ if you are happy to continue.

- The Bitcoin will be deposited into your exchange wallet or sent to an external wallet address provided by you once the transaction has been processed.

If you want to buy cryptocurrency with USD in America then read our guide.

How to Pay for Your Cryptocurrency

Before you can trade on a cryptocurrency exchange, you will need to deposit funds. There are many different methods that may be accepted, including:

Different platforms support different payment methods, so double-check that your preferred method is accepted before you open an account.

The Different Types of Cryptocurrency Exchange

Brokers

Best for: Novices and people who want an easy, quick way to trade digital currencies

Downside: May not offer as wide a selection of crypto, and can often cost more compared to other options

Brokers offer the most convenient and simplest method of purchasing digital currencies. Purchasing BTC, ETH, or altcoins from a broker is similar to purchasing from a shop. The broker will purchase the coins at wholesale rates before selling them on to you with their own margin added on top. They offer a fast, easy, and straightforward way to get into cryptocurrency trading with platforms that are easy to use and allow you to purchase cryptocurrency with your everyday fiat currency.

The Difference Between Centralized and Decentralized Exchanges

You may have come across the concept of decentralized cryptocurrency exchanges if you have been researching your options. Decentralized exchanges (DEXs) allow you to trade cryptocurrency directly with other users. They are hosted on a network of distributed nodes, meaning that there is no central failure point to be targeted by hackers, and server downtime is a non-issue. Trades on these platforms are typically carried out using smart contracts allowing you to trade directly from your online wallet and retain control of your currency by avoiding transferring it onto the exchange. If you want to buy from the USA you should read our guide on the best exchanges in the US.

Next Steps

Every cryptocurrency exchange is different, and each individual will have different needs and requirements when it comes to trading. This is why it’s essential to conduct your own research; what works well for somebody else might not be the best option for you. Check out my reviews on a range of the best cryptocurrency exchanges in Canada and worldwide to compare fees, advantages, and disadvantages. The more information you have, the easier it is to figure out if an exchange meets your trading requirements.

Our Methodology for Finding the Best Exchanges

I looked at a range of cryptocurrency exchanges to examine a range of features including beginner-friendliness, cryptocurrency selection, fiat currency purchase suitability, advanced trading features, and more. Bear in mind that this isn’t an exhaustive list - there may be other exchanges better for your circumstances.

How I Compared Various Categories

Beginner-Friendliness

I determined the level of beginner-friendliness by looking at exchanges that offered a range of features suitable for novices including providing a managed crypto wallet, offering direct fiat purchases, a clean, intuitive user interface, quick sign-up processes, and a reputation for good customer support.

To rank in this category, I decided that a platform had to allow customers to purchase crypto directly from the exchange rather than dealing with other traders on the open market. Exchanges with specific legal customer protections and strong regulations were preferred.

Fiat Currency Purchases

To be eligible for ranking in this category, exchanges needed to offer fiat currency purchases. I compared platforms across factors such as variety of payment methods, deposit fees, cash payment facilities, and quick or instant processing.

Fees

To rank an exchange in this category, I looked for platforms that charge no more than 0.1% per trade. I also checked for any hidden costs, such as large deposit or withdrawal fees, or wide spreads. Some exchanges also had options to reduce trading fees based on trade volume or by paying using their native cryptocurrency.

Cryptocurrency Selection

To rank in this category, exchanges were judged on the range of cryptocurrencies available to purchase. I also considered the speed at which exchanges listed newly released digital currencies, and how often they were the first to list a new crypto.

Suitability for Active Trading

Here, I considered a range of factors such as liquidity, fees, cryptocurrency selection, the option to go both long and short on crypto, the range of advanced trade types available, access to leverage, and API or bot trading support.

Frequently Asked Questions

NDAX is the safest crypto exchange for Canadians. It is registered with FINTRAC, and has security standards among the highest in the Canadian FinTech industry. The majority of their digital assets are held offline in cold storage, partnered with Ledger Vault, the global leader in crypto security and infrastructure solutions.

Yes, it is legal to buy, sell, trade, and own cryptocurrency in Canada.

There are many crypto exchanges available in Canada, and MEXC is my #1 top recommendation.

Yes, it is legal to trade cryptocurrency in Canada.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our privacy policy click here.