Disclaimer: Below content does not apply to US users.

What is eToro Australia?

eToro is a popular broker established in 2007, offering Australian investors access to a range of markets within the one account. Users can trade stocks, ETFs and cryptocurrency.

The key aspect that sets eToro apart from its competitors is the focus on 'social trading'; they have a social media platform allowing users to interact with other traders, and even copy popular traders automatically move for move. This makes eToro a great place for beginner investors and traders to learn.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

My Overall Thoughts on eToro Australia

eToro is one of my favourite brokers with its modern interface, social trading, and wide array of investment instruments. It's easy to see how eToro has become so popular not just in Australia, but around the world. These are two of the my top reasons for using eToro:

1) Social trading makes eToro a fun place to trade. You can view, post and comment on the latest trading news or speculations with others in the eToro community, and the best social feature is CopyTrader. With CopyTrader, you can automatically copy the trades of any top-performing trader you like, replicating their trading in your portfolio. This means that even if you are a beginner trying to learn the ropes, you can still make smart trading decisions based on others' expertise.

2) eToro offers a huge range of investment markets, so you will definitely find some that are suited for you. They have 17 stock markets from around the world, including the most popular NASDAQ and NYSE, and 110 cryptocurrencies, which are not commonly found on other brokers.

One downside for Australians is that AUD deposits need to be converted to USD, incurring a currency conversion fee. The benefit is being able to access global stock markets and crypto.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Key Features & Advantages of eToro

eToro's popularity in Australia - and the rest of the world - is due to the many features offered on the platform. Here are some of the main features and advantages that come with choosing eToro.

Negatives and Disadvantages of eToro

Despite all the great features of eToro, there are a few disadvantages of the platform. To find out more information about these, click on the jump links below.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

What Services does eToro offer?

eToro has a lot of great services, which is why it has attracted so many Australian customers. Let's take a closer look at the best it has to offer.

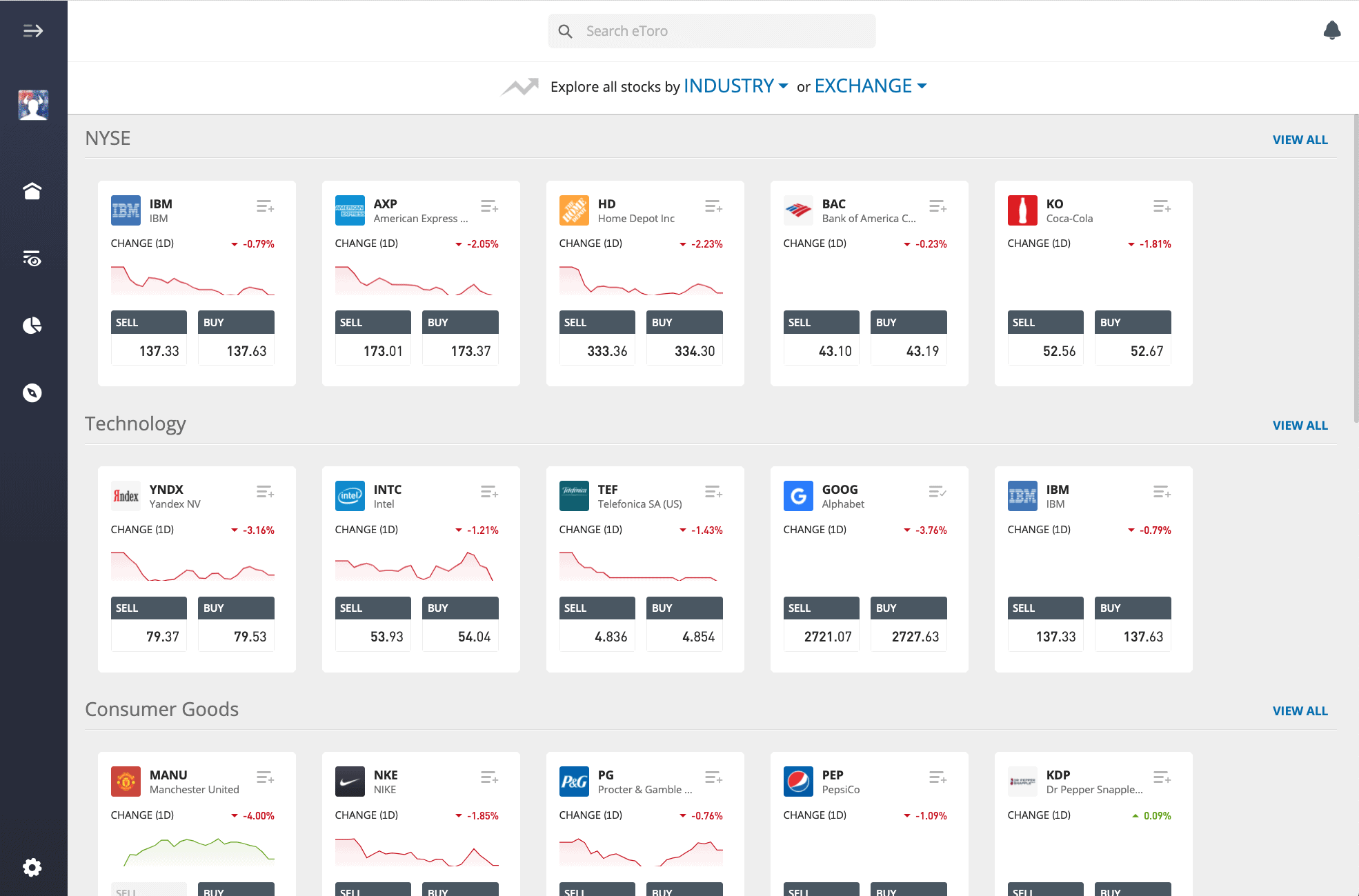

Access stocks from the USA and 15 other global markets: On eToro you can trade stocks from 17 different exchanges around the world, including the NYSE, NASDAQ and London. The interface is easy to use, and you can search specific stocks, or browse by Industry or Exchange. I found this to be an excellent feature, because it can be hard to access US stocks and other large markets when you don't reside in those countries. eToro makes it straightforward to invest in global companies.

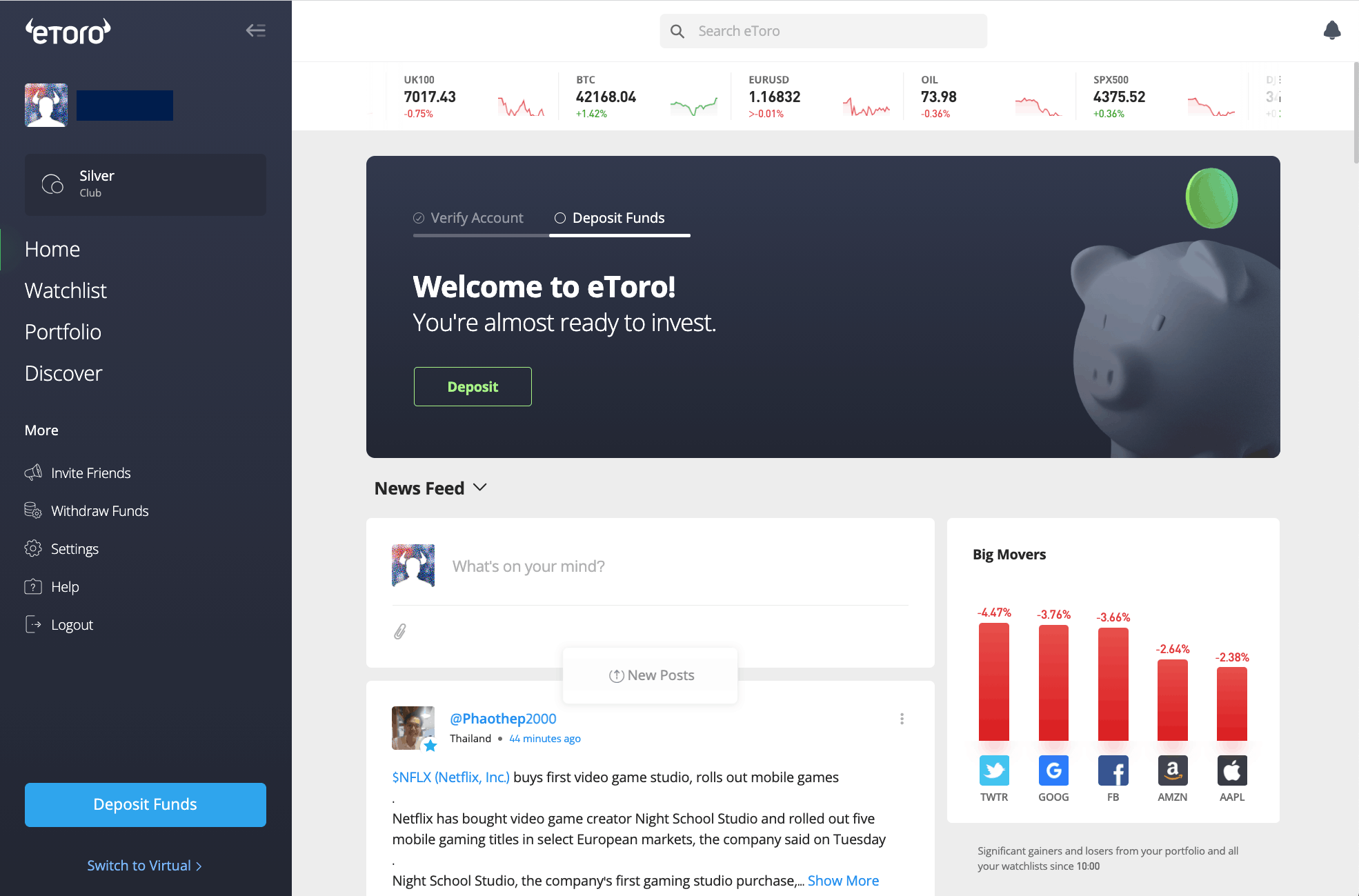

User-friendly interface: eToro has a simple and easy-to-use interface that is great for beginners and advanced traders alike. The home page (shown below) has key market prices and graphs scrolling along the top, social media news feed below, and the biggest movers from your portfolio and watch lists on the right. The menu on the left is straightforward - click Discover to begin investing in the markets of your choice.

I have reviewed various crypto exchanges and trading platforms and some of them can be quite overwhelming for a new user, but with eToro you won't have that issue. Many of our readers have remarked at how surprisingly simple it is to use, compared with other investing sites they have used in the past.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

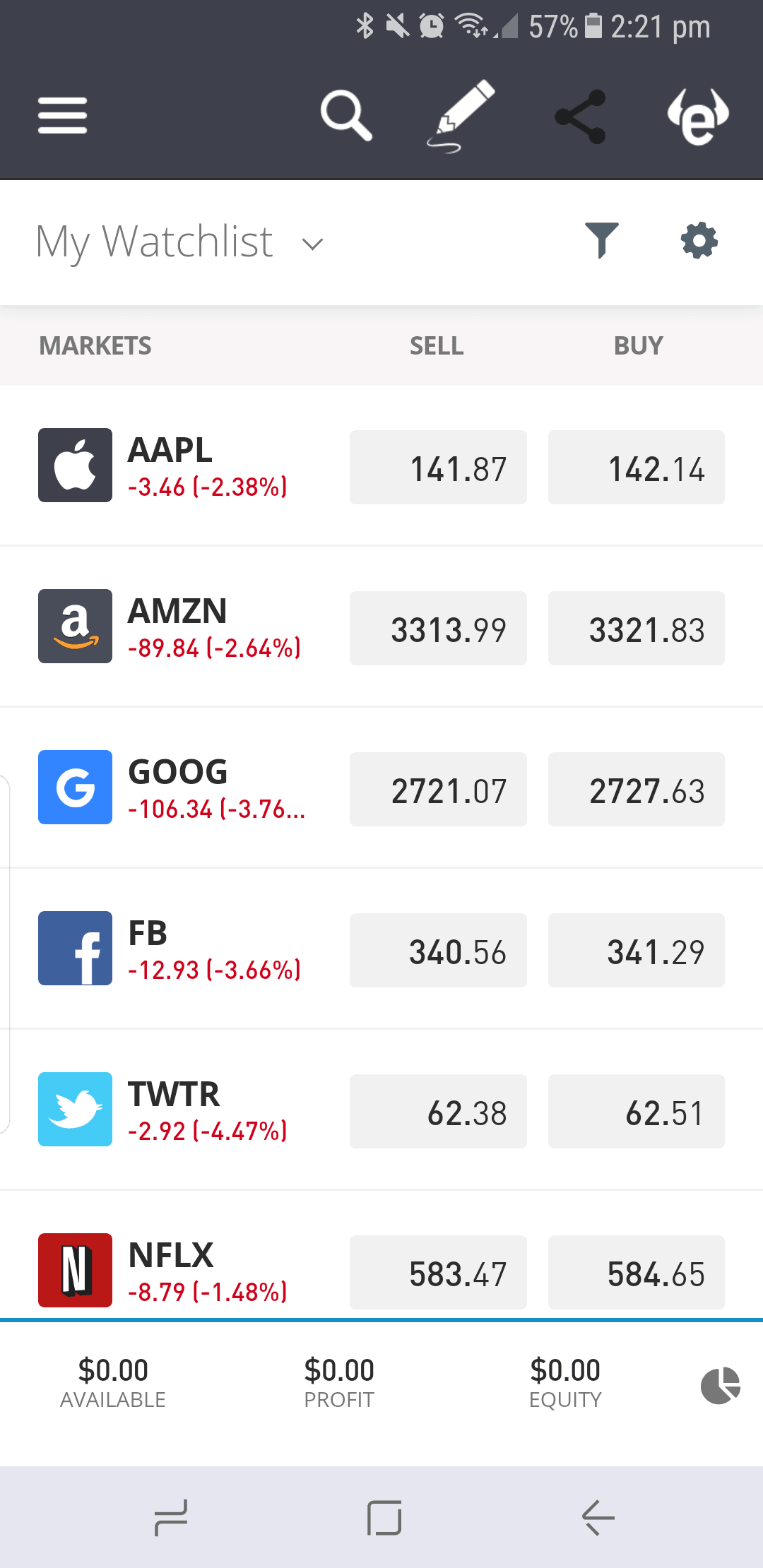

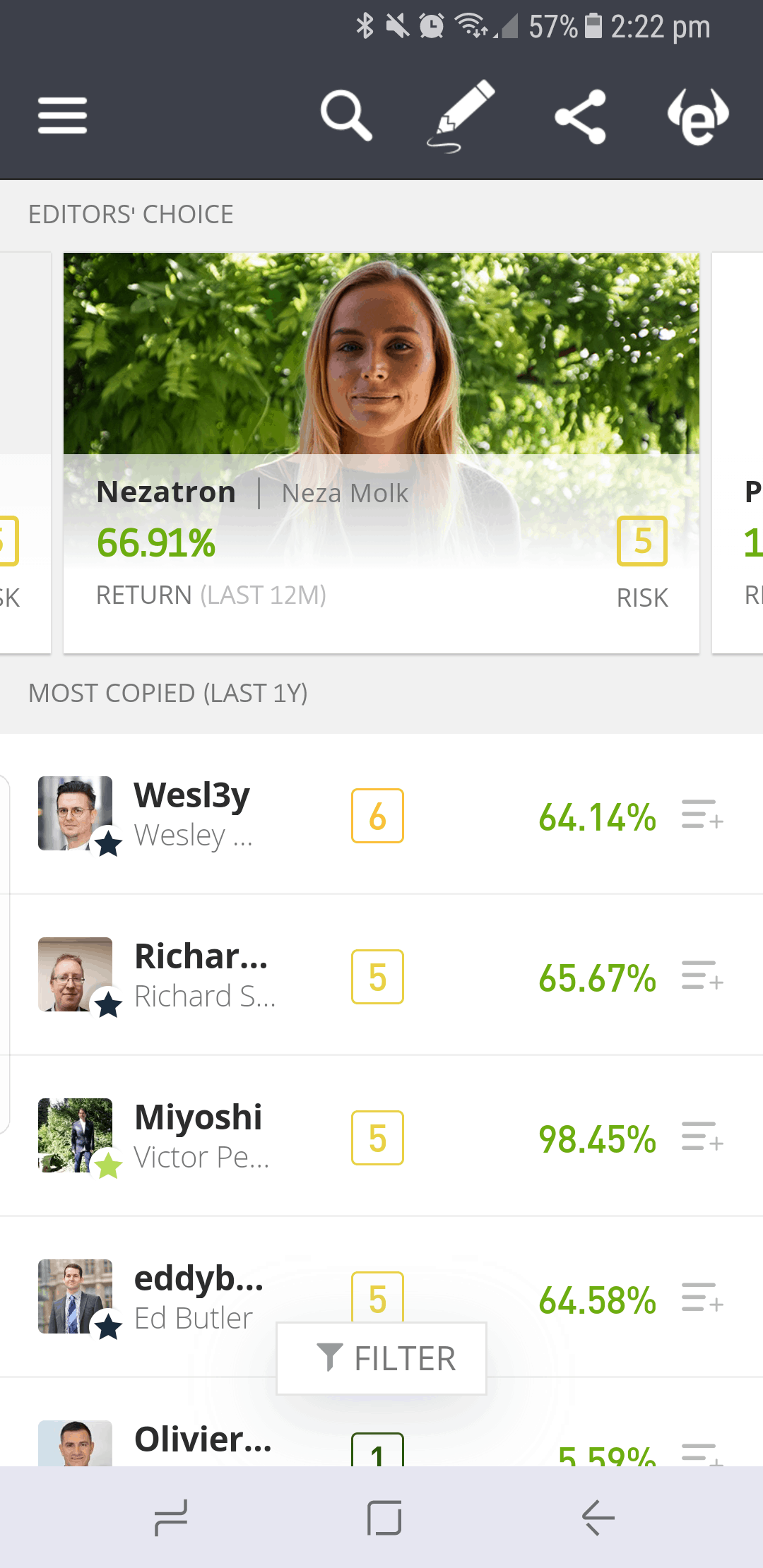

Mobile app for iOS and Android: eToro has developed an app for your mobile device to help you stay on top of your investments, anywhere and anytime. On Google Play store, eToro's app has over 10 million downloads, and is rated 3.8 stars from 128,000 reviews.

When I installed the app, I easily located my Portfolio, Watchlist, and News Feed. I also found popular traders to follow using the CopyTrade feature. The app also has the Demo account feature where you can practise trading with $100,000 virtual money risk-free.

Demo account - practise trading with $100,000 free virtual money: One of eToro's top features is the Demo account, which is easily activated with a toggle button. It is really useful, as you can practise trading with $100,000 virtual money, with zero risk. I found it a great way to get familiar with various analysis tools, experiment with different leverage amounts, and test out different trading strategies.

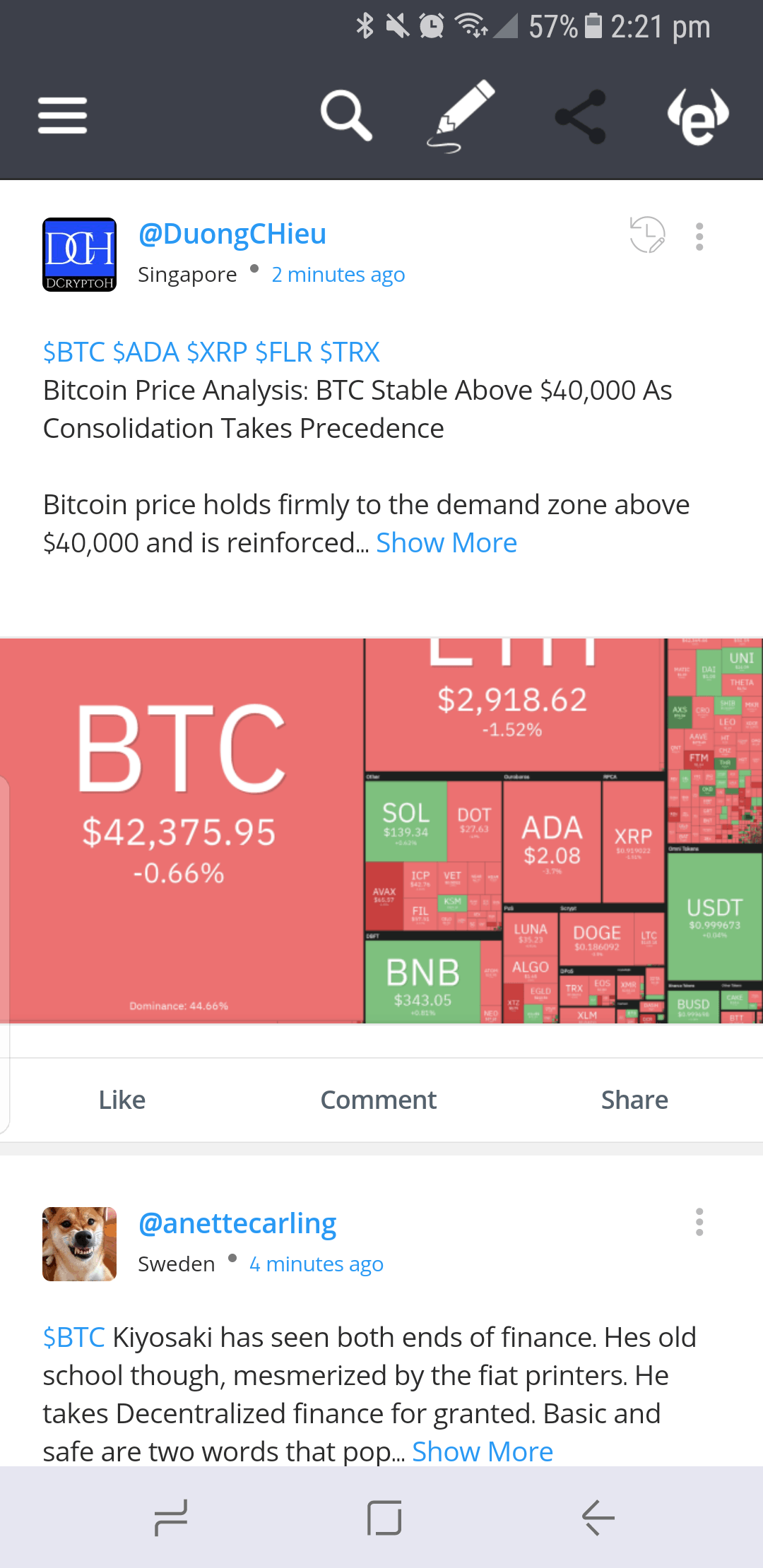

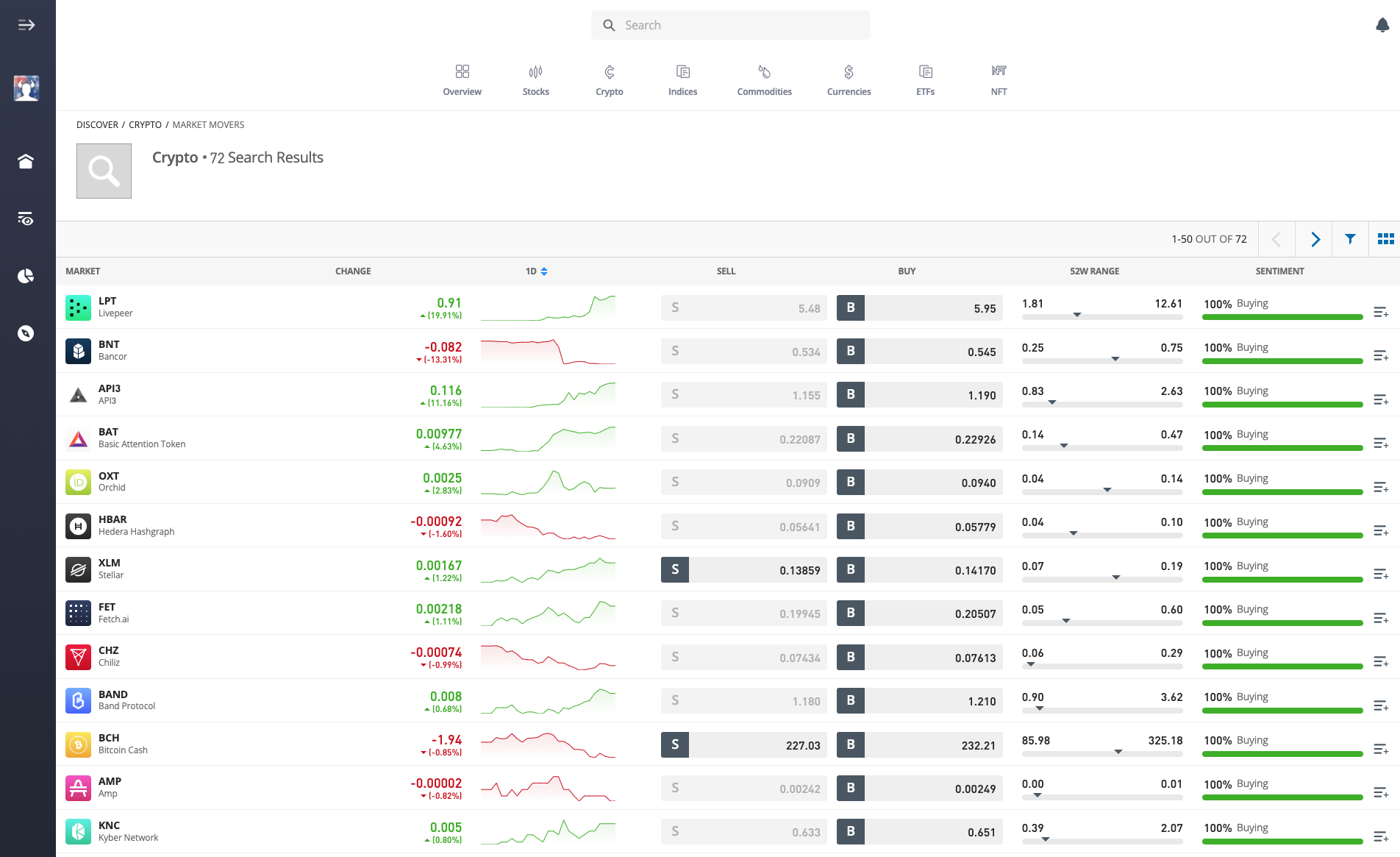

110 different cryptocurrencies available: Although eToro is not a dedicated cryptocurrency broker, it offers 110 of the most popular coins, which is impressive. You will find popular coins such as BTC, ETH, XRP, ADA, BNB and DOGE.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

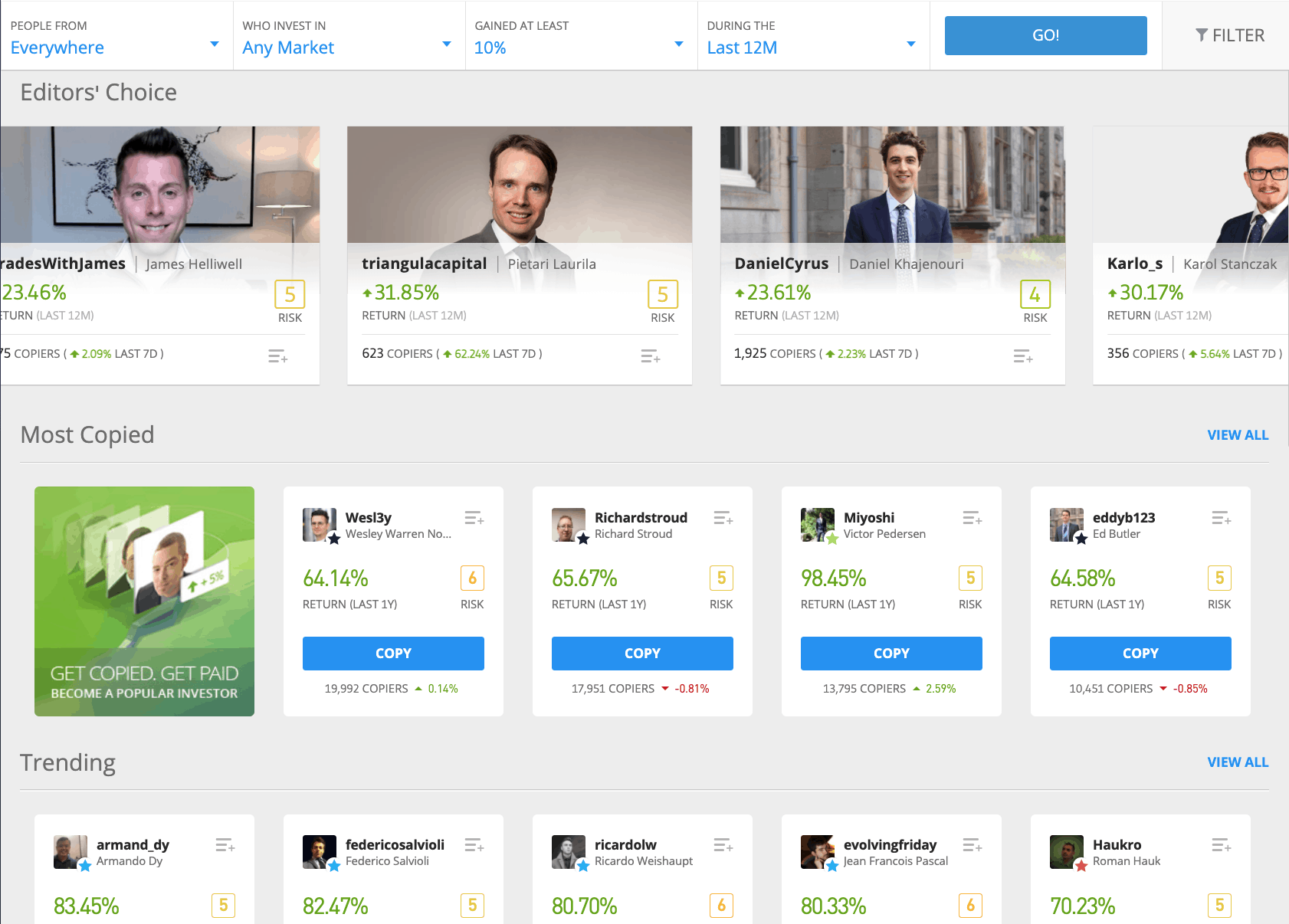

CopyTrader - automatically copy trades of top-performing investors: eToro has a unique feature allowing users to copy trades from successful investors. This is great for beginners learning the ropes, investors that are too busy to monitor the markets, or experienced traders that want to improve their returns.

I selected four traders with high returns over the last 12 months, and used the copy trading feature with them. Every trade made by them was automatically replicated in my own portfolio, and after a month, I experienced decent returns. Remember that past performance does not guarantee future performance, and you should conduct your own research before choosing to copy any trader.

Past performance is not an indication of future results.

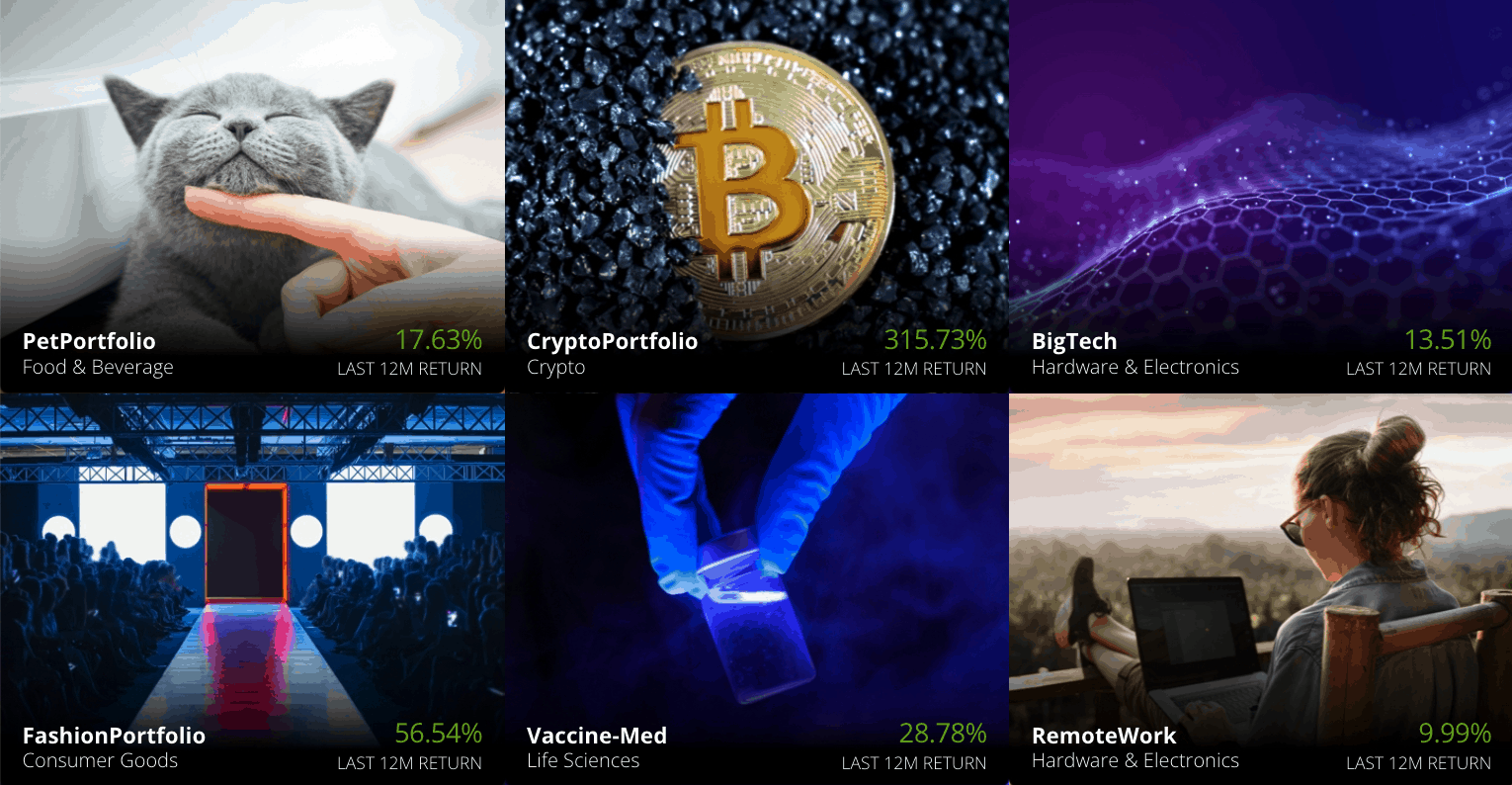

Smart Portfolio - invest in leading, ready-made portfolios: If you are unsure exactly which assets you want to invest in, eToro can help you with a balanced, professionally researched portfolio, focusing on particular market segments. These portfolios are based on elements derived from their values of research, knowledge, methodology, risk management and technology.

I browsed the portfolios and found a diverse range to invest in, such as Fashion, Tech, Crypto, and Health. Surprisingly, eToro does not charge any management fees to use this feature, which is a bonus.

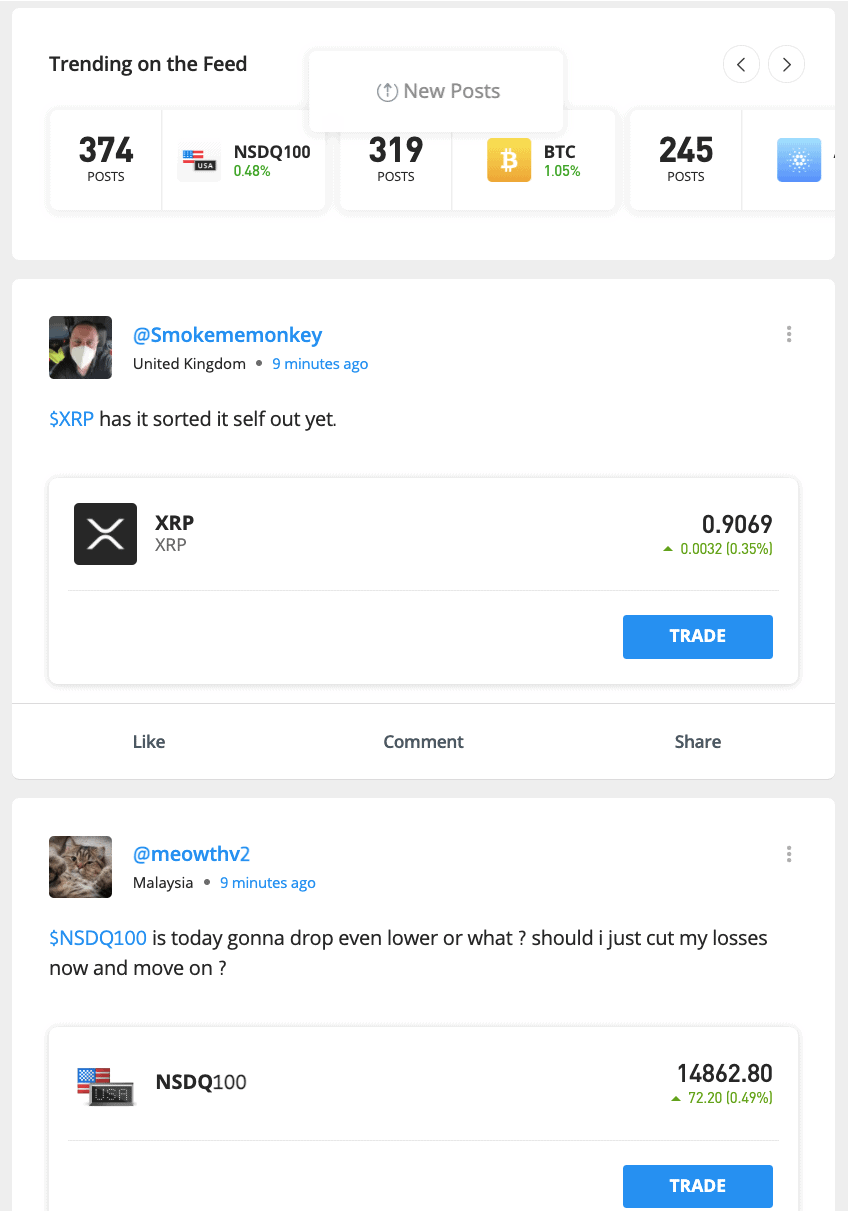

Social media platform allowing interaction with other traders: eToro is unique in that it has combined social media with trading, by implementing a News Feed on their site. I found it useful for connecting and interacting with other traders in the eToro community. I could seek advice and learn from others' trades, as well as provide my own insight to help newer investors. This is one aspect that really drew me to eToro and makes it stand out from other brokers.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

What I Don't Like About eToro

Currency conversion fee from AUD to USD: For Australian users, when you deposit AUD into the eToro trading account, there is a currency conversion fee to change your funds into USD. This can eat into your profits, and I would prefer if eToro supported trading in AUD.

The fees depend on your deposit method; for bank transfer, the conversion fee is 50 pips (deposit and withdrawal), and for credit/debit cards, POLi and PayPal, the conversion fee is 150 pips (deposit and withdrawal). For AUD/USD conversion, 50 pips equates 0.5% of the deposit/withdrawal amount, and 150 pips is 1.5% of the deposit amount.

Complex fee structure: There are many different fees charged on eToro and it is not clear or straightforward. There are currency conversion fees, variable trading fees (dependent on asset), withdrawal fees and inactivity fees.

Limited range of cryptocurrencies: eToro is not a purpose-built platform for trading cryptocurrencies, and that's why its range of 110 coins is limited compared to the best Australian crypto exchanges. If you are a dedicated cryptocurrency investor, then you might find other platforms to be more suitable. CoinSpot is a top choice, with over 460+ different coins and $20 free BTC.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro Fees

eToro Deposit Fees

It is free to deposit AUD into your eToro account, but you will incur a currency conversion fee since the funds need to be in USD to trade on the platform. The currency conversion fee for Bank Transfer is 50 pips (0.5% fee) and the conversion fee for Credit/Debit cards, PayPal and POLi is 150 pips (1.5% fee).

eToro Trading Fees

Cryptocurrency: 1% fee

eToro Withdrawal Fees

Withdrawals incur a flat fee of $5, with a minimum withdrawal amount of $30. There is also a currency conversion fee of 50 pips for bank transfer (0.5% fee) and 150 pips for other methods (1.5%).

eToro Crypto Transfer Fees

To transfer cryptocurrency from eToro, a fee of 0.5% will be charged, with a minimum fee of $1 and maximum fee of $50.

Other eToro Fees

Inactivity Fee: After 12 months with no login activity, eToro will charge $10 per month as an inactivity fee on any remaining available balance. No open positions will be closed to cover the fee.

Smart Portfolio: There is no management fee to use the Smart Portfolio feature.

Pros and Cons of eToro

- User-friendly platform with access to a wide range of investment instruments

- Stock trade on 17 markets (incl NYSE & NASDAQ)

- Invest in 110 cryptocurrencies

- Social Trading means you can interact with others and even copy their trades automatically

- Demo account where you can trade risk-free with $100,000 virtual money

- Currency conversion fee for deposits and withdrawals

- Complex fee structure

- Doesn't offer as many cryptocurrencies as dedicated crypto exchanges

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

The Verdict

eToro is an excellent broker that has built an easy-to-use platform for beginner investors and advanced traders alike. They cater to their users with a wide range of investment options, social trading, CopyTrader, Smart Portfolio and a Demo account. eToro is a great choice for Australian investors who want to access global stock markets and trading.

However, if you are interested in cryptocurrency trading in particular, and not the other markets, I suggest you use a dedicated Australian crypto exchange. eToro is not built specifically for cryptocurrency; this is reflected in their limited range of 110 coins and their high trading fees of 1%. eToro also charges a currency conversion fee from AUD to USD when you deposit, which will add another 0.5% - 1.5% on top (depending on deposit method). Compare this to CoinSpot, an Australian crypto exchange with 0.1% market trading fees, and $20 free Bitcoin, and you can see how eToro falls behind. Another option is Swyftx, with 422 coins and $20 free Bitcoin on sign up.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Frequently Asked Questions

Yes, eToro is a legitimate broker that has been established since 2007. In Australia, it is regulated by ASIC, and you can read about eToro’s success in the FinTech industry from top-tier publications, such as CNBC, TechCrunch, and The Telegraph.

Yes, eToro is a safe broker to use. On eToro, clients’ funds are kept secured in tier 1 banks, and all of their personal information is guarded under SSL encryption.

Yes, eToro is a trustworthy broker founded in 2007 and regulated by ASIC. Their customer support team is available 24 hours a day on trading days, meaning eToro clients always have someone to turn to if they encounter a problem or require assistance.

eToro is a safe platform, but there is always a possibility it can be hacked, no matter what security protocols are in place. With eToro, clients’ funds are kept secured in tier 1 banks, and all of their personal information is guarded under SSL encryption.

Yes, eToro can be used in Australia and it is regulated by ASIC.

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Social trading. eToro does not approve or endorse any of the trading accounts customers may choose to copy or follow. Assets held in your name. Capital at risk. See PDS and TMD.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.may not suffice as basis for investment decision.