Key Takeaways

- AMP is a collateral token designed for secure and safe transfer of finances in real-world applications.

- Collateral managers and collateral tokens make the AMP ecosystem unique and more secure, allowing for multiple rules to be enforced on the same digital asset.

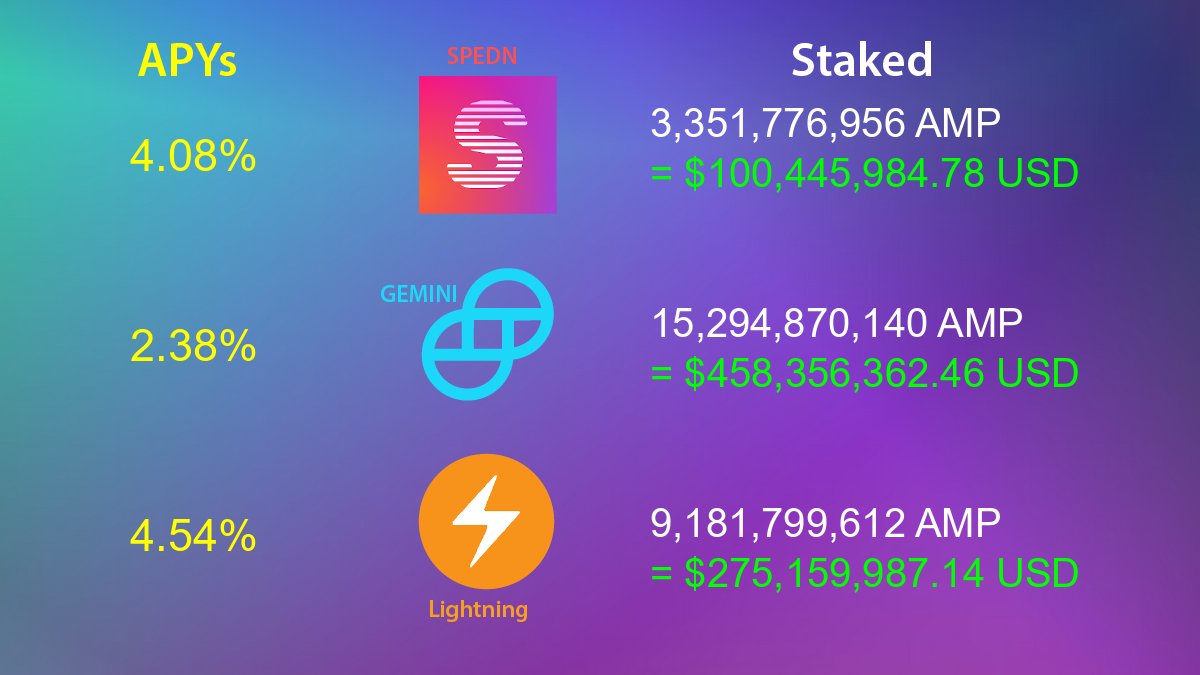

- Staking AMP on Flexa, Binance, or Coinbase can earn a sustainable APY for passive income, but there are risks to consider such as price volatility, high gas fees, and technical complications.

- AMP offers value and security to the payment industry and can be a solid investment or staking option.

Staking is the best option if you’re looking to earn passively from cryptocurrencies without the risk involved in trading, buying, selling, or mining. There are tons of crypto assets and tokens that you can stake on crypto exchanges and earn interest. AMP tokens have a proven record.

What is AMP Token?

AMP was built specifically as a collateral token to facilitate users in transferring finances in real-world applications securely and safely. An ERC-20-based token launched in 2020, AMP has become very popularity because of its unique use case and security mechanism. The AMP ecosystem can collateralize pretty much any type of payment transfer by staking the tokens and getting custody of the digital contracts.

AMP tokens also come with a new and improved collateral partition strategy which allows cross-chain interoperability, or the ability to transfer and share information across multiple chains. With cross-chain interoperability, you can preserve custody of the assets using AMP tokens as collateral without having to transfer the contracts to another chain. This new mechanism increases the safety of the staking collateral, and exterminates the risk of fraud as the contracts remain on the same chain.

What are collateral managers and collateral tokens?

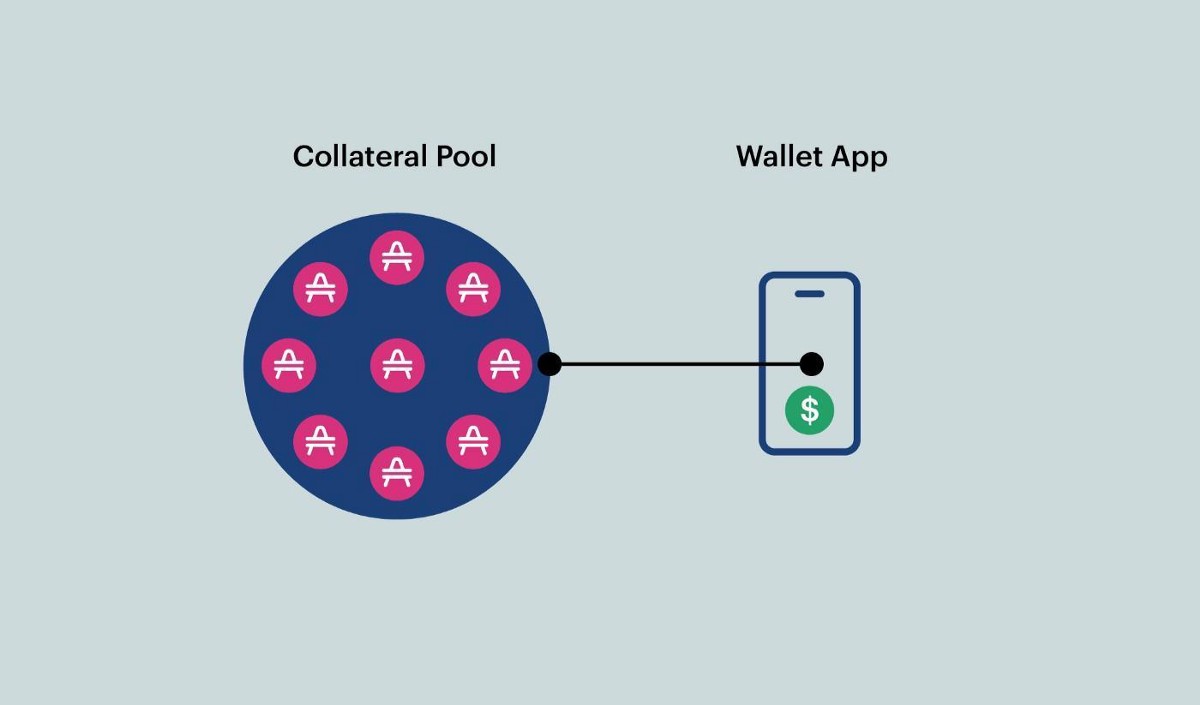

Collateral managers and collateral tokens are mechanisms or systems that make the AMP ecosystem unique and more secure. Collateral managers are smart contracts serve as escrow for the collateral and can be used in several partitions during the whole transaction. This mechanism can also be used to lock, divert, and release collaterals as per the requirements from the value transfers.

Collateral tokens can collateralize any transaction or application that is being initiated on the Ethereum blockchain or is verifiable on the same chain. This mechanism can be managed individually and separately by AMP contracts, allowing the contracts to enforce multiple and several rules simultaneously on the same digital asset. This procedure helps the users to stake AMP tokens without having to transfer them to a different chain.

Staking: The best way to make AMP Tokens

So, how can an everyday user benefit from the AMP tokens? The best way is to stake AMP tokens and earn a passive income with your investments within the ecosystem.

How does it work?

AMP, with the help of collateral pools available on the network, decentralizes the risk of the transfer of funds to a fraudulent or insecure network. With asset collateralization, any transaction, be it digital or fiat, are protected from possible risks with guaranteed safety. Whenever users stake AMP on any provided application, be part of the ecosystem and contribute in a pool, they are rewarded a percentage of Flexa’s network processing fees. The more you stake or contribute, the more you are rewarded in the end.

What’s the best place for AMP Token staking?

Flexa is the best place for staking AMP and providing your tokens as collateral. Flexa is the inventor of AMP tokens and a dedicated DeFi network to make global payments fraud-proof. Binance and Coinbase are among the third-party crypto exchanges that support AMP staking, and where you can easily earn sustainable APY for passive income. You can sign up on these exchanges, deposit or trade AMP, and stake your assets to start earning.

Are there any risks to crypto staking?

These are the risks associated with crypto staking that you should definitely consider:

Conclusion

AMP can be a solid investment, whether you are planning to hold the assets or stake them on a particular exchange, which is obviously the better choice. It offers value and security to the payment industry, and can be adapted by the entire financing system. Any crypto project that has a use-case in the actual world, such as AMP, is likely to prosper.