Binance and KuCoin are two of the biggest players in the cryptocurrency market. Binance is the largest crypto exchange in the world based on trading volume, and KuCoin boasts an impressive 11 million users around the globe. These two exchanges have a similar business strategy and service. They both offer access to hundreds of altcoins that are otherwise hard to purchase. In addition to simply buying and trading crypto, they have loads of additional services such as futures markets, crypto lending, trading bots, P2P marketplace, margin trading, referral programs, and more. Their trading fees both start at 0.1% with options to reduce this as you move up the trading tiers or hold their native cryptocurrency.

With two exchanges so similar, how can you tell which is better, or which one you should use? I've conducted a thorough comparison of Binance and KuCoin looking at many aspects. Hopefully my findings assist you in making a decision on your crypto exchange. Long story short, Binance wins as it doesn't charge high fees to buy crypto with fiat, and you can withdraw fiat currency from the exchange, whereas you can't on KuCoin.

Cell |  | |

Fiat Currencies | USD, GBP, EUR, CAD, AUD, HKD, JPY & 35 more | USD, EUR, GBP, RUB, CNY, AUD & 40+ more |

Number of Coins | 600+ | 700+ |

Buy/Sell Fees | 0.1% | |

Deposit Methods | Cell | Cell |

Bank Transfer (SEPA) | ||

Bank Transfer (ACH) | ||

PayID | ||

Fedwire | ||

PayPal | ||

Credit Card | ||

Debit Card | ||

Apple Pay | ||

SWIFT | ||

Skrill | ||

SOFORT/iDEAL | ||

Cryptocurrency | ||

Features | Cell | Cell |

User-friendly | ||

Mobile app | ||

Live Chat | ||

Security | Cell | Cell |

2FA | ||

Biometric security | ||

ISO 27001 certified | ||

Offline cold storage | ||

Website |

Cell |  |  |

Fiat Currencies | USD, GBP, EUR, CAD, AUD, HKD, JPY & 35 more | USD, EUR, GBP, RUB, CNY, AUD & 40+ more |

Number of Coins | 600+ | 700+ |

Buy/Sell Fees | ||

Deposit Methods | Cell | Cell |

Bank Transfer (SEPA) | ||

Bank Transfer (ACH) | ||

PayID | ||

Fedwire | ||

PayPal | ||

Credit Card | ||

Debit Card | ||

Apple Pay | ||

SWIFT | ||

Skrill | ||

SOFORT/iDEAL | ||

Cryptocurrency | ||

Features | Cell | Cell |

User-friendly | ||

Mobile app | ||

Live Chat | ||

Security | Cell | Cell |

2FA | ||

Biometric security | ||

ISO 27001 certified | ||

Offline cold storage | ||

Website |

- Largest crypto exchange in the world based on trade volume

- Extremely low fees of 0.1% with a further 25% discount if you pay with BNB

- Mobile app available for iOS and Android

- Over 600+ cryptocurrencies available

- Additional features such as staking, NFT marketplace, margin trading, futures trading

- Not available in the USA; US residents need to use Binance.US

- Poor customer service - lacks live chat support

- Large crypto exchange with over 11 million users worldwide

- Extremely low fees of 0.1% with a further 20% discount if you pay with KCS

- Mobile app available for iOS and Android

- Over 700+ cryptocurrencies available

- Additional features such as crypto lending, trading bots, margin trading, futures trading

- High fees when buying crypto with fiat (3%-5%)

- Cannot withdraw fiat currencies

- Poor customer service - no live chat support

Binance vs KuCoin Fees

Although Binance and KuCoin are similar in terms of their business model, they do vary in their fees. Binance has a better fee structure compared to KuCoin. Take a look at the breakdown below.

Deposit Fees

When you deposit fiat currency into Binance, there may be a fee depending on the deposit method and currency. For example, there is no charge if you deposit Australian Dollars (AUD) using PayID/OSKO. On the other hand, if you deposit Hong Kong Dollars (HKD) using a bankcard, the fee is 3.50%. To check what the fees will be for your fiat currency and deposit method, click here.

KuCoin does not support fiat deposits. If you want to use fiat currency to buy crypto, you pay for it directly at the time of purchase, without depositing beforehand. The cost of a cryptocurrency purchase varies from 3% - 5%, depending on the payment method you choose. Click here to find out more details.

Cryptocurrency deposits on Binance and KuCoin are free of charge.

Trading Fees

Binance fees for trading start at a low 0.1%, with a 25% discount if you use Binance's token (BNB) to pay your fees. This makes your trading fee only 0.075% which is the lowest in the industry. You can buy crypto using fiat on the market, unlike KuCoin, where you can only trade cryptocurrencies. If you are regularly trading large volumes, and you own a lot of BNB, you can reduce your fees even further, based on this tiered structure.

KuCoin's trading fees also start at 0.1%, and similar to Binance, you can receive a discounted trading fee if you pay using KuCoin's token (KCS). However, the discount is only 20%, not 25% like Binance, which means you can reduce your fee to 0.08% per trade. If you are a large-volume trader, or you own a large amount of KCS, you can also further reduce your fees, on a tiered structure. Click here for information about the fee discounts.

Note that the trading fee on KuCoin applies to crypto-to-crypto trading only, as you cannot use fiat on the market. So although the trading fees are only 0.1%, you cannot buy Bitcoin with USD for only 0.1%. To buy crypto directly using fiat currency on KuCoin, there is a fee ranging from 3% - 5% based on payment method and payment channel. Even though the trading fee is very low, if you do not already own cryptocurrency, you need to pay a high percentage fee to buy your coins before you can trade.

Withdrawal Fees

On Binance, the fiat currency withdrawal fee varies depending on the currency and the withdrawal method. As an example, to withdraw Australian Dollars (AUD) by bank transfer is free of charge, while a withdrawal of Pound Sterling (GBP) using Bankcard incurs a fee of 1% fee. To find out the fees for your specific currency, click here.

Cryptocurrency withdrawals on Binance will incur a flat fee to cover the transaction costs of transferring the coins to your personal wallet. The fees are dependant on each cryptocurrency, which are listed here.

KuCoin does NOT allow withdrawals of fiat currency, which is one of the biggest downsides of the exchange. You can only withdraw cryptocurrency, with the flat fee based on the coin you want to withdraw. A full list of KuCoin's cryptocurrencies and their withdrawal fees are found here.

Winner - Binance

Binance is the winner in this section. Both Binance and KuCoin have low trading fees starting at 0.1%, but with discounted rates using their native tokens, Binance is lower at 0.075% vs KuCoin's 0.08%. Additionally, you can purchase crypto using fiat on Binance for only 0.1%, whereas on KuCoin the transaction fee to purchase crypto with fiat ranges from 3% - 5%. The biggest problem with KuCoin is that it does NOT allow withdrawal of fiat currency.

Binance vs KuCoin Deposit Methods

Binance and KuCoin both support a variety of deposit methods, to cater for customers around the globe. They both accept bank transfer (SEPA), credit card, debit card and cryptocurrency.

In addition, Binance supports bank transfer (ACH), PayID, SWIFT and SOFORT/iDEAL.

KuCoin also accepts PayPal, Apple Pay and Skrill.

Winner - Binance

Binance and KuCoin both offer a selection of deposit methods, but Binance is a close winner as it offers slightly more options than KuCoin.

Binance vs KuCoin Features

Binance and KuCoin are two feature-rich cryptocurrency exchanges that go above and beyond the basic needs of new investors. They are well-known for the number of services they provide; they both offer the popular advanced trading dashboard, P2P marketplace, margin trading, futures market, and the simple 'buy now' interface. If you wanted more details about all the features on each of the exchanges, look at my Binance review and KuCoin review. I will point out a few features on each of the two exchanges that make them stand out.

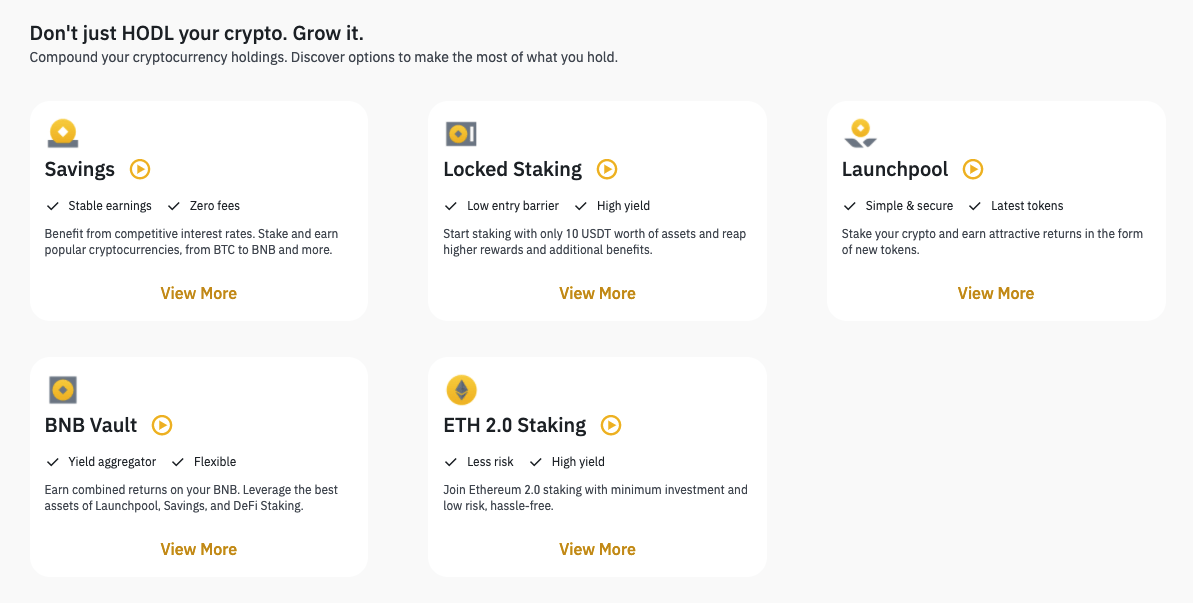

On Binance, you can earn interest on your crypto while you hold it on the exchange. It is a potential investment opportunity if you intend to HODL your crypto. These are the different staking options below.

Binance has developed a card in conjuction with Visa, which allows you to spend your crypto at 60 million merchants around the world. The card is free, with no administrative or processing fees, and on eligible purchases you can receive up to 8% cashback. Not only is this convenient, but it signals a shift of cryptocurrency towards the mainstream.

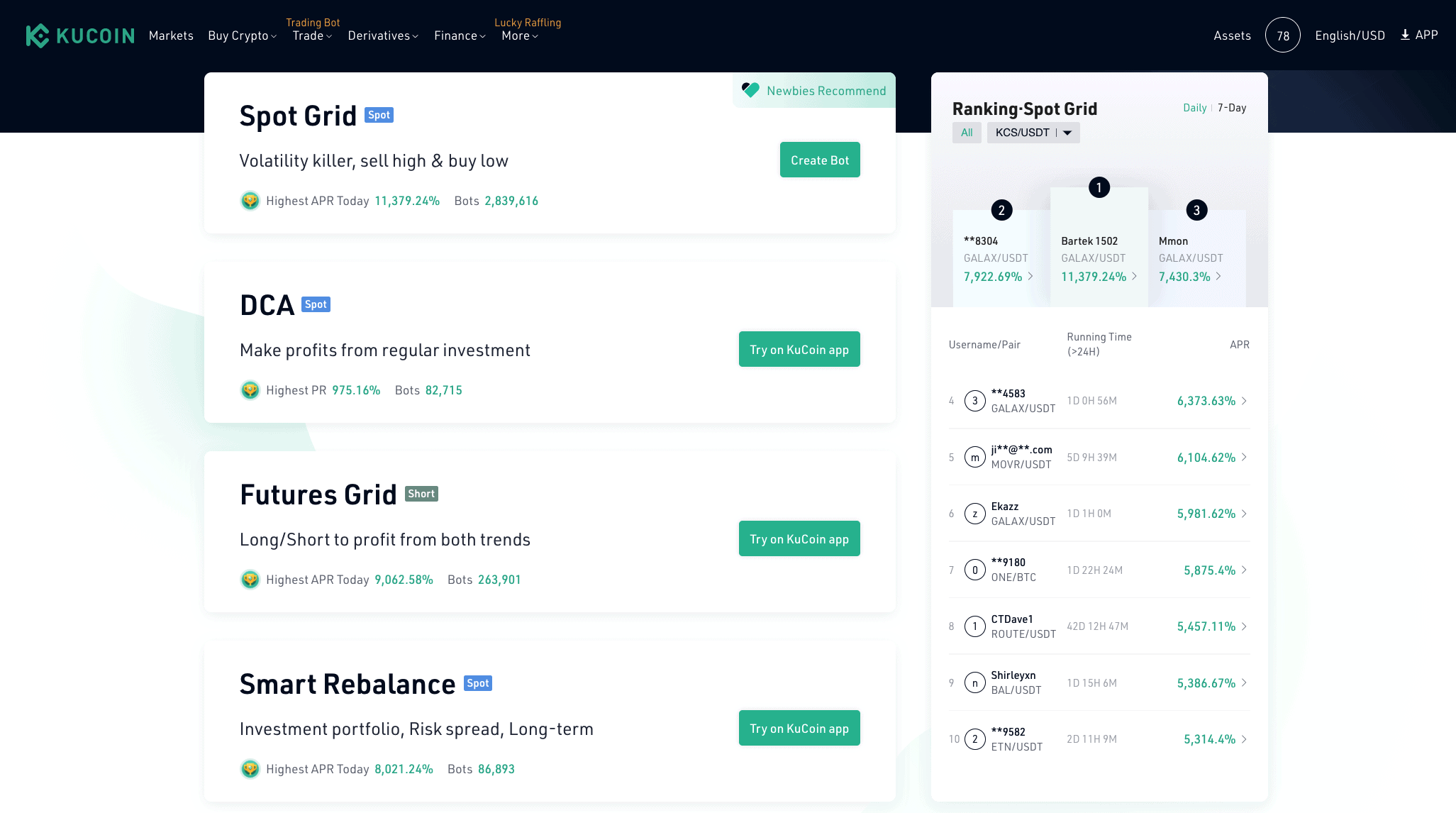

KuCoin has a really cool feature with their free trading bots available to increase your investing potential. You can choose the parameters for your bot to automatically trade for you, even when you are busy or asleep. The bots run on a cloud, so you don't need to have your phone or computer operating for the bot to do its job. You can even see who the best-performing bots are, and KuCoin allows you to mimic the performance of those bots by copying their settings.

KuCoin also has options to earn interest on your crypto while it's held on the exchange. The easiest way is to simply buy and hold KuCoin's token (KCS). If you have at least 6 KCS, you will automatically earn interest daily, at an estimated APR of 22%.

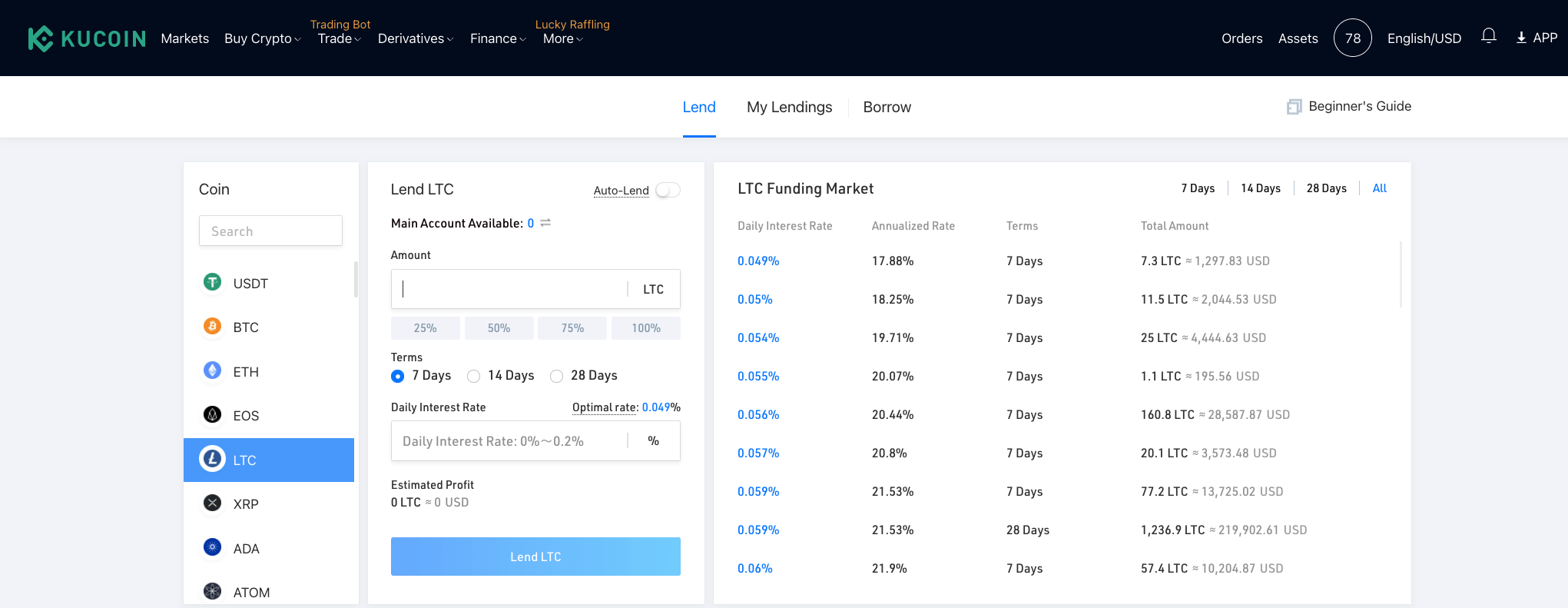

You can also lend your crypto to other traders and earn daily interest. KuCoin offers over 160 possible coins that you can lend, with a loan term of 7, 14 or 28 days (your choice). You can select the amount of daily interest you want to charge. The higher the rate, the more you will earn, but the less likely someone will accept your loan conditions if there are comparatively lower rates available. If you are looking to borrow some crypto, you can also do that easily on KuCoin.

Winner - KuCoin

KuCoin and Binance are both crammed with features. They both have a P2P marketplace, margin trading, futures market, and a simple 'buy now' interface. KuCoin pulls ahead with its useful trading bots and the ability to lend crypto and earn interest while you invest.

Binance vs KuCoin Security

Binance stores the majority of their digital assets offline in cold storage, and provide useful information to their customers on ways to increase security, for example enabling 2FA (two-factor authentication), whitelisting devices, managing withdrawal addresses, anti-phishing codes and even U2F (universal 2nd factor authentication), which requires physical access to hardware to access your account. However, even the most secure crypto exchange can have vulnerablities that are exploited, and in 2019 Binance suffered from a hack, where they lost over $40 million worth of Bitcoin.

It is the way Binance responded to this situation that is important. They covered the entire amount of the loss, so no users were affected by the cybersecurity breach, and then four months later, they received the coveted ISO 27001 certification, which is awarded after passing a thorough audit of its information security management.

KuCoin adopts multiple layers of security measures to ensure their customers' funds are protected, such as micro-withdrawal wallets, industry-level multilayer encryption and dynamic multi-factor authentication. They even have dedicated internal risk control departments to oversee all transactions on a daily basis. In 2020, KuCoin was also the target of a hack, where $150 million was stolen. KuCoin responded promptly, recovering a large portions of the stolen funds, and the remainder was covered under their insurance policy. KuCoin's users did not suffer any losses in this cybersecurity breach.

Winner - Binance

Binance and KuCoin are both very safe crypto exchanges, with many layers of security. Although they have both been hacked, they covered the losses so their users did not suffer. Binance is a close winner when it comes to security because it has the additional ISO 27001 certification which is hard to find in the cryptocurrency industry.

Verdict - Binance

Binance and KuCoin are both giants in the cryptocurrency industry. They both have hundreds of cryptocurrencies, huge trading volume and liquidity, and tons of features. I thought it would be a really close comparison between the two, but in fact Binance stands out as the clear favourite.

The deciding factor was that Binance charges a small fee (or even zero fee in some cases) to deposit fiat currency, and then you can buy crypto with your fiat for only 0.1% fee. On KuCoin, you can't access the markets using fiat currency, so to take advantage of the 0.1% trading fee, you need to purchase crypto using fiat with a high 3% - 5% fee. Moreover, you cannot withdraw fiat currency from you KuCoin account.

Overall Winner - Binance

The biggest thing that makes Binance the winner is that you can buy crypto using fiat on the market, which is much cheaper than KuCoin's 3% - 5% fee. Also, you can withdraw fiat from your Binance account, which isn't possible from KuCoin.

Still Researching?

If you want to learn more about Binance and KuCoin before making up your mind, check out my Binance review and KuCoin review. If you live in the USA, Binance is not available, but they have a sister exchange called Binance.US which has much of the same features, low 0.1% fees but fewer coins (50+ different cryptocurrencies). You can also take a look at my review of the best US crypto exchanges. I have included a quick comparison table below, which summarizes some important information.

Comparison Table of the Best Crypto Exchanges in the USA

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Related reading: Binance review, KuCoin review, KuCoin vs Coinbase, Best US crypto exchanges

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this breakdown.