Ethereum, renowned as a leading decentralized blockchain, holds the distinction of having its native cryptocurrency, ETH, as the second-largest by market capitalization, trailing only behind Bitcoin. A significant development in its journey is the upgrade to Ethereum 2.0, a transition that introduces the capability for users to stake their ETH and earn rewards in return.

For those interested in staking Ethereum, it's essential to utilize either an on-chain wallet or a dedicated staking platform. After hours of extensive research into the various options available, I've identified the best platforms for staking Ethereum. These platforms have been selected based on their ability to offer the highest rewards, ensuring that you can maximize your returns from staking ETH.

Top Places to Stake ETH in 2024

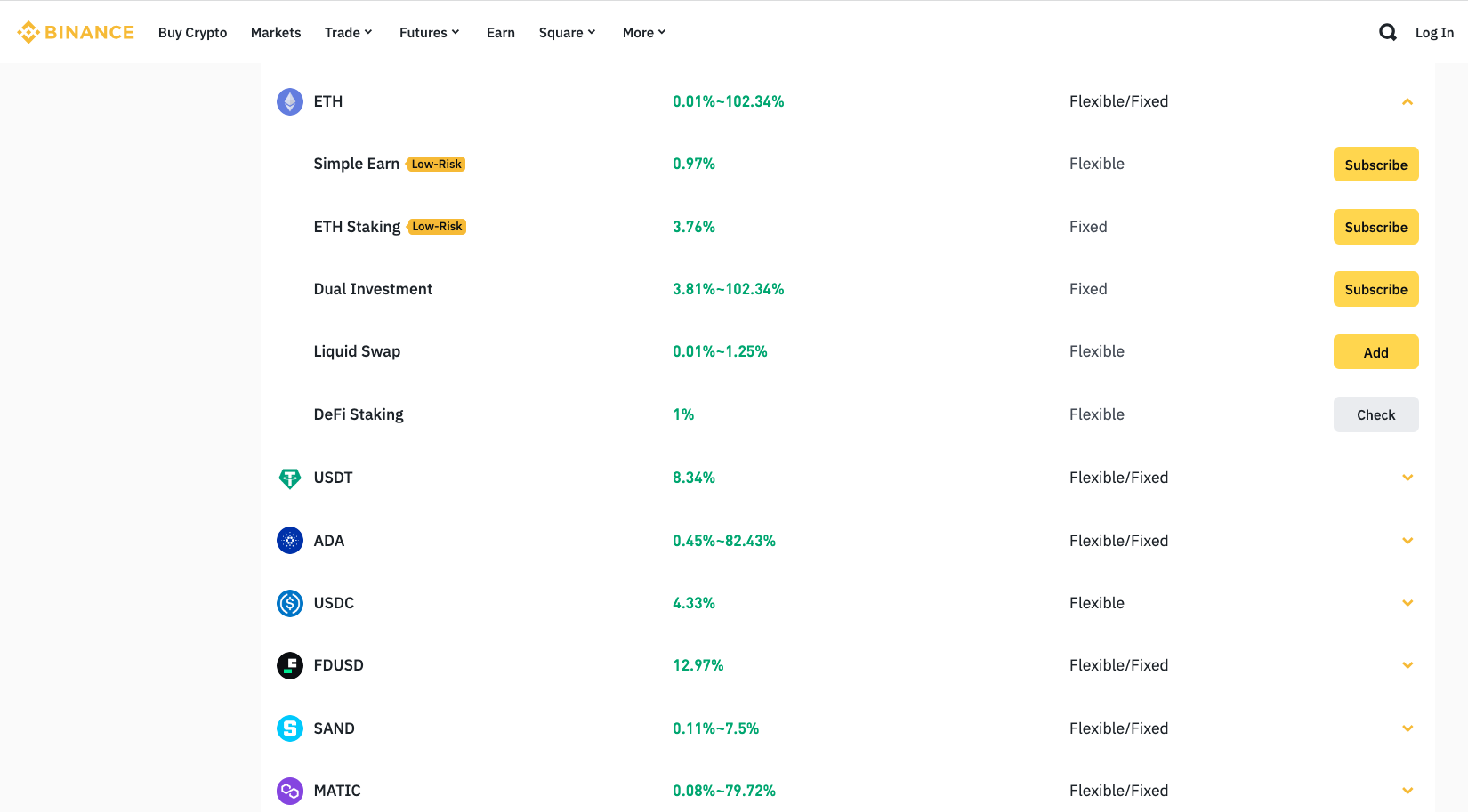

1. Binance

Binance is my TOP choice for staking Ethereum as it has the highest rates available for fixed staking. At the time of writing, the rewards are 3.76% APR for fixed rates. If you prefer to keep your ETH flexible, the rates are lower, at 0.72% APR, but you can also claim an additional 0.25% APR if you have less than 0.2 ETH staked.

Binance is a great choice because it is one of the best crypto exchanges, and you can directly buy ETH with low trading fees of just 0.1%. It is very convenient to stake it on Binance after your purchase.

If you plan on doing more than staking ETH, for example if you are into day trading, leverage trading or earning interest on other coins, Binance also caters for that, so you can rely on it for all your crypto needs. The only issue is that Binance is not available for US users, so if you are a resident of the States, have a look at my #4 option, Coinbase.

- Largest cryptocurrency exchange in the world

- Buy ETH easily with low trading fees of 0.1%

- Receive high ETH rewards with fixed staking

- Not supported in the US

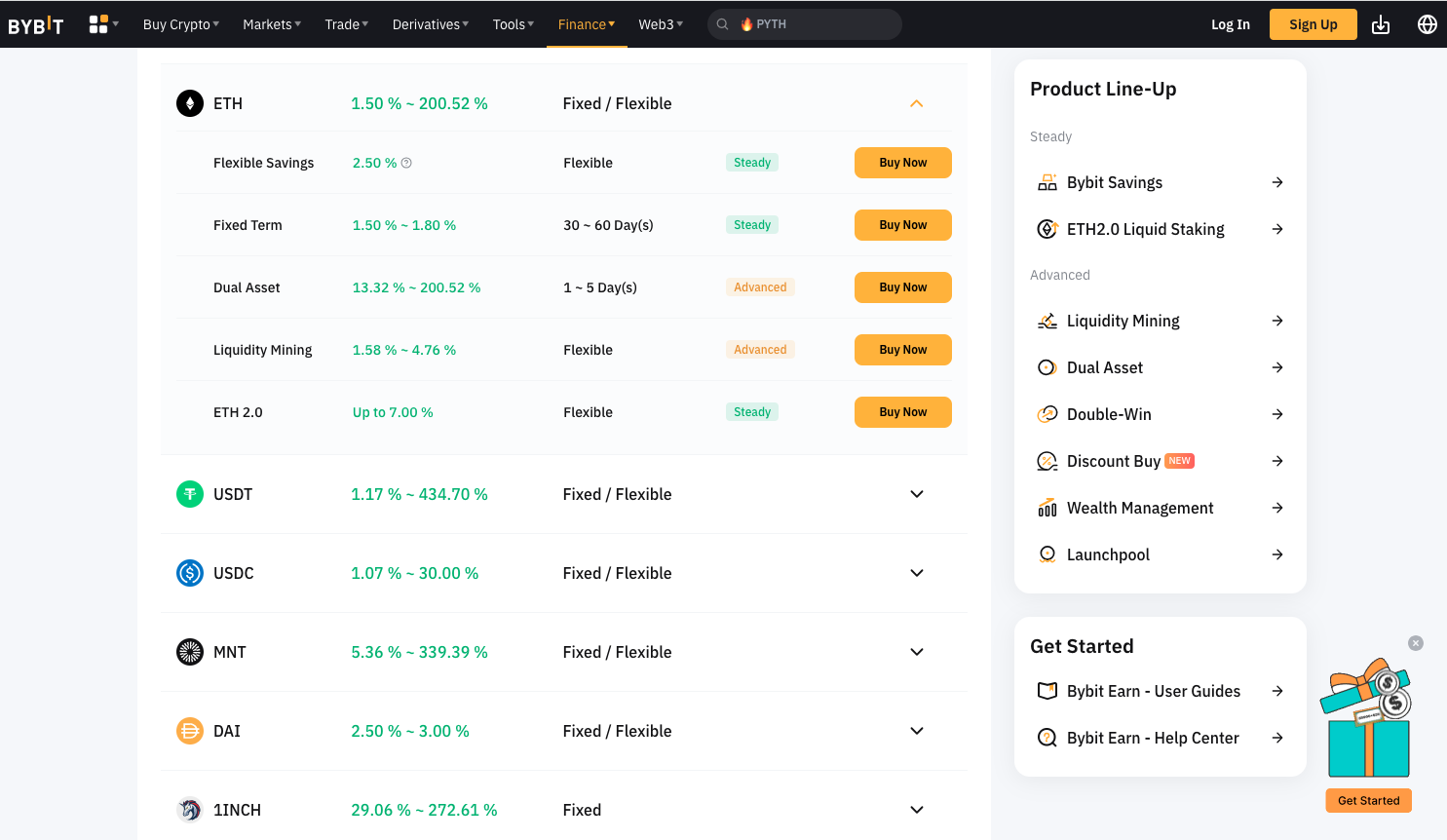

2. Bybit

Bybit is an excellent choice for staking ETH, particularly for those who prioritize anonymity, as it allows users to sign up without ID. While the staking rewards on Bybit may not be as high as on some other platforms like Binance, it remains a viable option for those who might not have access to Binance or prefer a different platform.

The staking rewards on Bybit vary depending on the duration of the stake. If you stake your ETH for 60 days, you can earn an Annual Percentage Yield (APY) of 1.80%, and for a 30-day period, the APY is 1.50%. Interestingly, Bybit offers a flexible staking option with a higher APY of 6.00%, but this rate is limited to the first 0.05 ETH staked. Beyond this amount, the APY drops to 1.50%. For those like myself who view ETH as a long-term investment and are not concerned about maintaining flexibility, the 60-day staking option to earn a higher rate can be more appealing.

It’s important to note that reward rates on Bybit are subject to change, so it's advisable to regularly check Bybit's Earn page on their website for the most up-to-date interest rates and staking options.

- Buy and stake ETH easily from the one platform

- You can remain anonymous on Bybit, with no KYC required

- Earn higher rewards on ETH when you stake it for 60 days

- The interest rates are low if you choose flexible staking and you have >0.05 ETH

3. eToro

eToro USA LCC does not offer CFDs, only real Crypto assets available

eToro stands out as one of the best crypto brokers in the USA, offering a substantial range of over 75 cryptocurrencies, along with the opportunity to earn interest on some of these assets. While eToro provides the option to stake Ethereum, it's important to note that ETH staking is currently not available for users based in the United States. For US-based investors interested in staking Ethereum, Coinbase, which is the fourth option on this list, can be a viable alternative.

The specifics of rewards for staking on eToro are somewhat vague. Their website indicates that users can "earn up to 4.3% rewards per year on the ETH that they stake". However, the details regarding how to achieve this high yield or the minimum staking requirements are not explicitly stated. Given that the information on staking options and rewards can change rapidly, those interested in staking ETH on eToro should visit their official site for the most current details.

Despite this lack of clarity on staking details, eToro remains a top choice due to its well-established reputation and the trust it has garnered from millions of users globally. Additionally, eToro offers access to a range of other asset classes, including forex and stocks, making it an attractive platform for investors looking to diversify their portfolio beyond cryptocurrencies.

- Very simple and easy to use

- Trusted and well-known platform

- Potential high rewards of 4.3% APY on ETH

- Staking ETH not available in the USA

- Vague information about how much interest you can earn on ETH

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

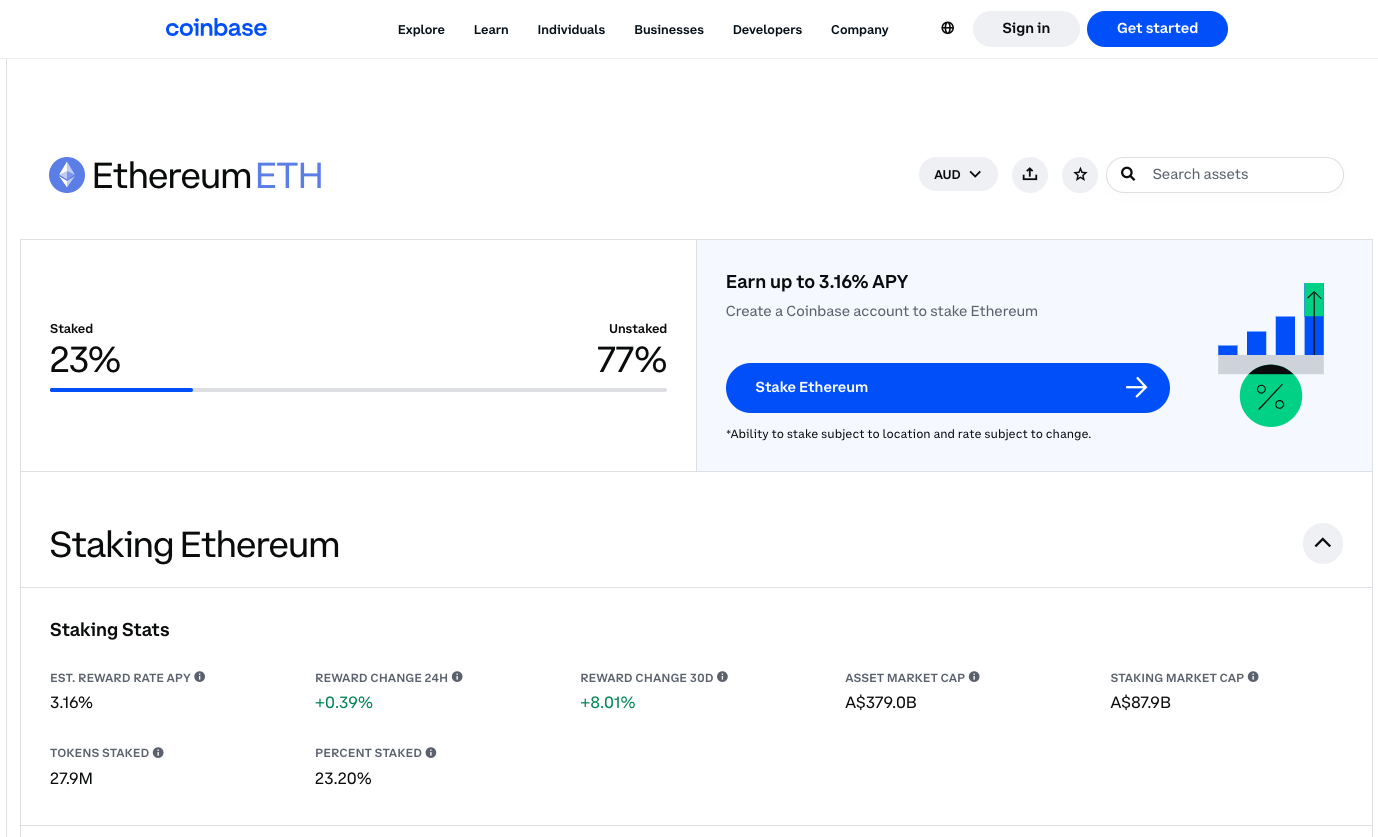

4. Coinbase

Coinbase is my #1 recommendation for US citizens looking to stake Ethereum (ETH). Unlike many other platforms mentioned in this article, Coinbase uniquely offers ETH staking to residents of the United States. It stands out for its user-friendly interface, making it a popular choice among beginners and those new to the world of crypto, as evidenced by positive feedback from users who find it easy to navigate.

Depositing money into Coinbase and purchasing ETH is straightforward, with the option to buy Ethereum directly using a credit card. Although the fees for buying crypto on Coinbase are higher compared to some other exchanges, many users find the convenience and user-friendliness of the platform to be worth the extra cost.

When it comes to staking, owning ETH on Coinbase allows you to earn up to 3.16% APY. In addition to Ethereum, Coinbase also supports staking for other cryptocurrencies, providing diverse interest-earning opportunities. For instance, users can earn 9.95% APY on DOT, 5.01% APY on SOL, 4.62% APY on XTZ, and 2.04% APY on ADA. This variety of staking options makes Coinbase a versatile platform for those looking to earn interest on their crypto holdings.

- Beginner-friendly exchange

- Available in the USA

- Fairly high rewards of 3.16% APY

- Fees to purchase ETH are higher than other exchanges

5. Kraken

Kraken is one of the best crypto exchanges in the US, due to its ease of use and low trading fees. Of course, the Earn feature on Kraken is another attractive drawcard to many users. There are more than 15 coins available to stake on Kraken, and ETH is one of them.

The staking is flexible on Kraken, and the rewards are high, at between 4 and 7% APY. The website states that they charge an admin fee, which is 15% of your rewards. This sounds high, but this is already taken into account when they state that the annualized rewards are 4-7%. This means that your actual returns are higher, but after Kraken takes their admin fee, you are left with between 4 and 7% APY.

Besides ETH, you can stake other popular cryptocurrencies such as DOT, ATOM, XTZ, ADA and SOL. Visit Kraken's website to view the full list of coins for staking and the most current reward rates.

- High interest rates for staking ETH

- An excellent choice for beginners since it is easy to use, and has low fees

- As of February 2023, staking no longer supported in the US

6. OKX

OKX is one of the world's largest crypto trading platforms, and is well-known for low fees, range of markets, and advanced trading tools. It is also an excellent option for staking ETH, with a current reward rate of 4.14% APY. This interest rate will vary between 5 and 20% depending on how much ETH is locked, so check the current rate from the OKX website before signing up.

The minimum amount of ETH to get started staking is 0.1 ETH, which is something you need to be aware of, if you only own a small amount. If you wish to purchase more ETH, you can easily do so on OKX.

- Low trading fees if you need to buy ETH

- Easy one-click staking from the OKX website

- High rewards for staking ETH (between 5-20% APY)

- Minimum 0.1 ETH required to start staking

7. Bitfinex

Bitfinex is another top cryptocurrency exchange that accepts staking on Ethereum. They offer up to 3.5% APY on ETH, and there are various other coins you can also earn interest on, such as ADA, DOT, ATOM, SOL, and XTZ. It is easy to stake on Bitfinex, as you can easily purchase ETH directly from the platform, or deposit it from an external exchange or wallet.

There is no minimum amount of ETH that you must stake, no staking fees, and the reward rate of up to 3.5% APY is quite decent. Be sure to check out Bitfinex's site to see the most recent reward rates.

- No staking fees

- No minimum deposit amount for staking ETH

- Earn up to 3.5% APY when you stake ETH

- Not available in the US and Canada

What is Ethereum 2.0?

The transition from Ethereum's original Proof-of-Work (PoW) model to the new Proof-of-Stake (PoS) model in Ethereum 2.0 represents a significant shift in how the blockchain operates. In the PoS system, instead of relying on the computational power of miners to validate transactions and create new blocks, as was the case in PoW, the blockchain requires users to stake their ETH to participate in these processes.

The PoW model, while foundational to many early blockchains, was criticized for its inefficiency, primarily due to the competitive nature of nodes vying to solve complex mathematical problems to mine blocks. This competition resulted in substantial energy consumption, raising environmental concerns.

Ethereum 2.0's PoS system addresses these inefficiencies by eliminating the need for such intense computational work and, consequently, significantly reducing the blockchain's energy consumption. In PoS, validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to "stake" or lock up as collateral, making the process more energy-efficient and sustainable. This shift to PoS is a crucial step towards a more environmentally friendly and scalable blockchain network.

What is staking Ethereum?

Staking ETH involves the process of locking up your Ethereum holdings, contributing to the security and governance of the Ethereum blockchain. This action plays a critical role in the blockchain's functionality, particularly under the Proof-of-Stake (PoS) model. By staking your ETH, you support the network's ability to validate transactions and create new blocks.

The mechanism behind staking ETH is centered around participating in the network's consensus process. As a staker, you essentially commit your ETH to the network, which then uses these staked assets to select validators responsible for verifying transactions and adding new blocks to the blockchain. This process is vital for maintaining the integrity and smooth operation of the Ethereum network.

In exchange for staking your ETH and contributing to the network's health and security, you are rewarded with additional ETH. These rewards represent the yield from staking and are an incentive for users to lock their funds and support the network. The yield can vary based on several factors, including the total amount of ETH staked on the network and the overall network activity. This system not only ensures the security of the Ethereum blockchain but also provides an opportunity for ETH holders to earn passive income through staking rewards.

What are the best ETH staking rates?

The rates you can receive for staking ETH is continually changing, as it depends on the exchange you choose, and how much ETH is currently being staked. You will see the highest rewards when there is not much ETH staked, because the higher yield will encourage more people to contribute their ETH. However, when there are a lot of people staking ETH, the rates will decrease.

Currently, the best ETH staking rates are 4-7% APY which is found on Kraken. However, as of February 2023, Kraken ceased staking in the USA, so if you are a US citizen, you will need to find a suitable exchange, such as Coinbase, where the current rewards are 3.16%.

Do I need to stake 32 ETH?

If you have done some research on staking ETH, you may have seen that you need at least 32 ETH to begin staking. This is true only if you want to be a full validator. Most casual crypto investors do not own at least 32 ETH, but the good news is you can still stake Ethereum using a crypto exchange such as the ones in the list above. Some of them may have a minimum requirement of 0.1 ETH, or others may have no restrictions at all.

How to Stake Ethereum?

There are two ways to stake Ethereum: run your own Ethereum node or use a crypto exchange. To run an Ethereum node, you will need at least 32 ETH, which is more than most crypto enthusiasts own. It is a complex system where you need to set up hardware and software, and I won't go into detail about how to do this in this article.

Instead, I will focus on the simple way to stake Ethereum, using a crypto exchange. All you have to do is sign up to a suitable crypto exchange in the list above, and purchase or deposit ETH from an external wallet. Then navigate to the Earn or Staking section, and search for Ethereum. Choose the amount you wish to stake, and click to confirm, and you can start staking ETH straight away.

Conclusion

These are the best places to stake Ethereum, and at each of the exchanges above you can easily purchase ETH directly, if you don't already own some. Binance is our top choice to stake ETH, but it is not available for US users. Be sure to consult our full list of options above to find the most suitable exchange for staking ETH.