KuCoin is one of the largest and most popular crypto trading platforms in the world, with over 30 million users. It supports a massive range of 700 coins, and a variety of trading markets. Coinbase is the largest US-based crypto exchange, and has a focus on making crypto purchases easy for beginners. In this article, I directly compare these two across several criteria to help you decide which is better for your needs.

If you are new to the crypto industry, then a basic, user-friendly exchange like Coinbase is the preferred option. It has more deposit methods, a simple interface, and the ability to easily withdraw fiat currencies. For experienced crypto traders, KuCoin is the clear winner, with extremely low trading fees (0.1% for spot, 0.02/0.06% for futures), over 700+ cryptocurrencies, plenty of trading markets, and advanced features.

Cell |  |  |

Fiat Currencies | USD, EUR, GBP, RUB, CNY, AUD & 40+ more | AUD, USD, EUR, GBP, CAD, MXN, HRK, CZK & 10+ more |

Number of Coins | 700+ | 160+ |

Trading Fees | 0.1% for spot, 0.02/0.06% for futures | |

Payment Methods | Cell | Cell |

Bank Transfer (SEPA) | ||

Bank Transfer (ACH) | ||

Fedwire | ||

PayPal | ||

Credit Card | ||

Debit Card | ||

Apple Pay | ||

SWIFT | ||

Skrill | ||

SOFORT/iDEAL | ||

Cryptocurrency | ||

Features | Cell | Cell |

User-friendly | ||

Mobile app | ||

Live Chat | ||

Security | Cell | Cell |

2FA | ||

Biometric security | ||

ISO 27001 certified | ||

Offline cold storage | ||

Website |

Cell |  |  |

Fiat Currencies | USD, EUR, GBP, RUB, CNY, AUD & 40+ more | AUD, USD, EUR, GBP, CAD, MXN, HRK, CZK & 10+ more |

Number of Coins | 700+ | 160+ |

Trading Fees | 0.1% for spot, 0.02/0.06% for futures | |

Payment Methods | Cell | Cell |

Bank Transfer (SEPA) | ||

Bank Transfer (ACH) | ||

Fedwire | ||

PayPal | ||

Credit Card | ||

Debit Card | ||

Apple Pay | ||

SWIFT | ||

Skrill | ||

SOFORT/iDEAL | ||

Cryptocurrency | ||

Features | Cell | Cell |

User-friendly | ||

Mobile app | ||

Live Chat | ||

Security | Cell | Cell |

2FA | ||

Biometric security | ||

ISO 27001 certified | ||

Offline cold storage | ||

Website |

- Large crypto exchange with over 30 million users worldwide

- Extremely low fees: 0.1% for spot, 0.02/0.06% for futures

- Mobile app available for iOS and Android

- Over 700+ cryptocurrencies available

- Additional features such as crypto lending, trading bots, margin trading, futures trading

- High fees when buying crypto with fiat (3%-5%)

- Cannot withdraw fiat currencies without using another crypto exchange

- Poor customer service - no live chat support

- Coinbase privately insures their own platform so your funds are safe in the event there is a hack

- Simple and user-friendly interface

- Only takes a few minutes to register and start trading

- Over 160+ cryptocurrencies available

- Extremely secure and trusted platform

- Complicated fee structure that is higher than competitors

- Customer service lacks live chat support - email assistance only

KuCoin vs Coinbase Fees

Deposit Fees

KuCoin does not support fiat deposits, but you can buy crypto directly via the fiat gateway. Payment options include debit/credit cards, Google Pay, Apple Pay, and various local methods for payment, and the fee varies from 3% - 5%, depending on your payment method. Click here to find out more information.

To buy crypto on Coinbase, you can either pay for it directly at the time of purchase, or deposit fiat currency into your account first. If you want to deposit first, there are two methods for US residents:

- ACH Transfer: no fee

- Wire Transfer: $10 fee

Trading Fees

KuCoin has extremely low spot trading fees of only 0.1%, and users receive a 20% discount if they pay fees with KCS coin (Kucoin's token). This reduces the trade fee to only 0.08% per trade. If you are a large-volume trader, or you own a significant amount of KCS, you can reduce your fees further, on a tiered structure. Click here to see detailed information regarding trading fee discounts. If you trade futures on KuCoin, the fees are only 0.02% for makers and 0.06% for takers.

To buy crypto directly using fiat currency on KuCoin, the fee ranges from 3% to 5% based on payment method and payment channel. Although the trading fees are very low, if you don't have crypto to trade, you need to pay a high fee to buy those initial coins.

Coinbase has a more complex trading fee structure, consisting of two components. There is a 0.50% spread fee, and a 'Coinbase fee' on top, which is the larger of the 'flat fee' or the 'variable fee', shown below.

Flat fee

Transaction value | Fee |

|---|---|

$10 or less | $0.99 |

$10 to $25 | $1.49 |

$25 to $50 | $1.99 |

$50 to $200 | $2.99 |

Variable fee

Payment Method/Payout Method | Effective Rate of Conversion Fee |

|---|---|

US Bank Account | 1.49% |

Coinbase USD Wallet | 1.49% |

Debit Card or PayPal | 3.99% |

Instant Card Withdrawal | up to 1.5% (minimum $0.55) |

Withdrawal Fees

KuCoin charges a flat fee to withdraw cryptocurrency which varies depending on the coin you are withdrawing. You can see a full list of KuCoin's cryptocurrencies and corresponding withdrawal fees here. Also keep in mind the daily withdrawal limits on KuCoin, which are based on your verification level.

Unfortunately, fiat withdrawals aren't supported on KuCoin, and is the main downside of this trading platform. However, there is a very simple way to withdraw your money from KuCoin. See my complete guide to learn how to use another crypto exchange to withdraw your money.

Coinbase's withdrawal fees vary based on location and payment method. The most popular fiat withdrawal methods are listed here, with their respective fees.

Bank Transfers (SEPA): €0.15

US Wire Transfer: $25

If you a resident of Singapore, note that Coinbase doesn't support fiat withdrawals there. You can read why in this help article from Coinbase.

Winner - Depends on your needs

This will depend on what your goals are. If you are a long-term investor who wants to buy and sell crypto, Coinbase is the better option. If you are a frequent trader, then KuCoin is more cost-effective, with 0.1% trading fees.

KuCoin vs Coinbase Deposit Methods

KuCoin and Coinbase are designed to cater to a global user base, offering a broad selection of deposit options. Both platforms support several common methods, including bank transfer (SEPA), PayPal, credit and debit cards, Apple Pay, and direct cryptocurrency deposits.

KuCoin stands out by accepting Skrill, a payment option that Coinbase does not offer.

On the other hand, Coinbase provides additional payment methods which are not available on KuCoin. These include bank transfer (ACH), Fedwire, SWIFT, and SOFORT/iDEAL, expanding its accessibility to a wider range of users with varying banking preferences.

Winner - Coinbase

Both of these crypto exchanges have a wide array of deposit methods, but Coinbase wins as it offers several more that are not available on KuCoin.

KuCoin vs Coinbase Features

KuCoin and Coinbase are both well-established cryptocurrency exchanges with plenty of features. In this comparison article, I will only focus on a few features that make each exchange stand out instead of going into detail about each available service. To find out more information, take a look at my reviews for KuCoin (here) and Coinbase (here).

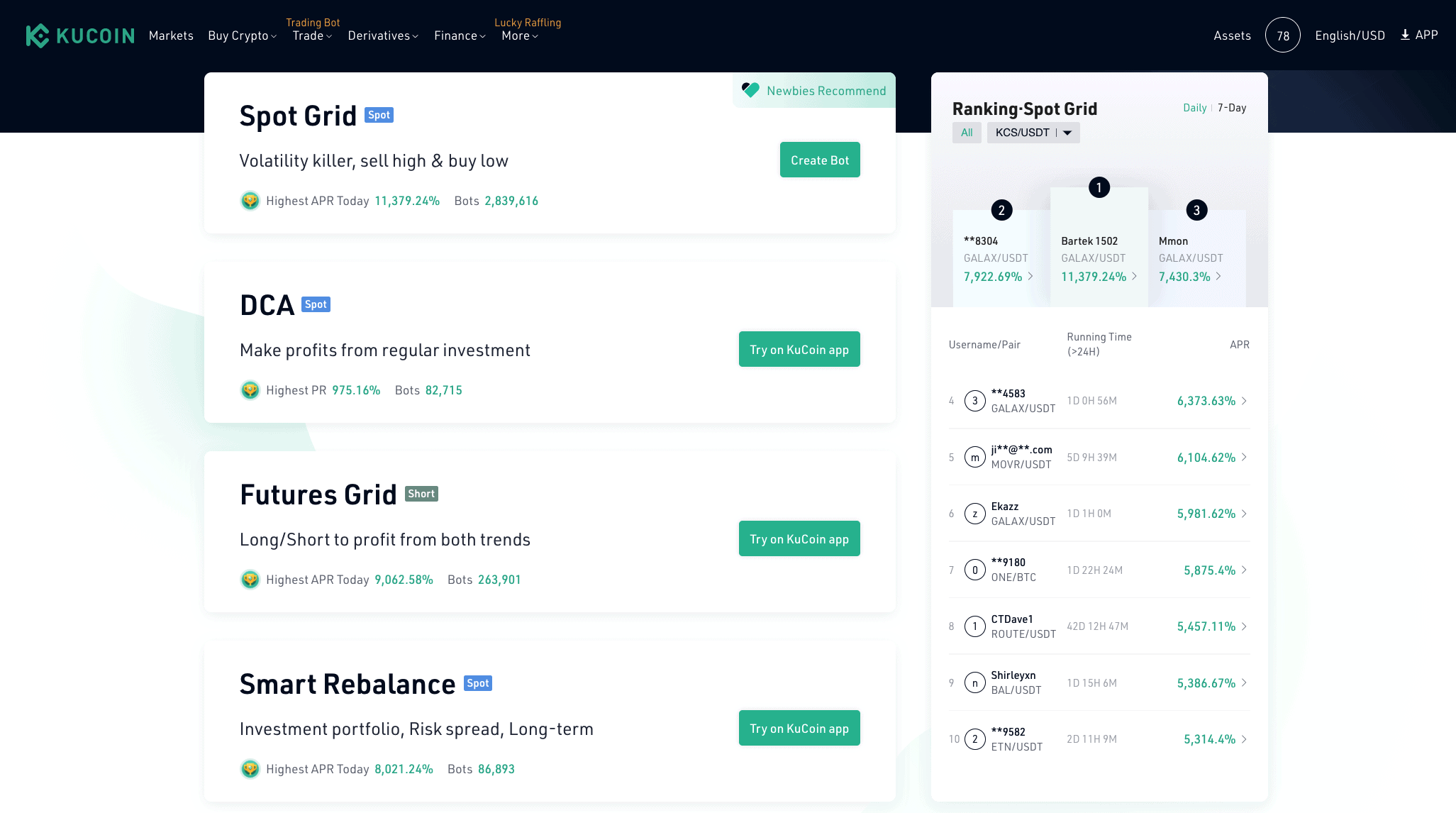

KuCoin has trading bots on their platform that are free to use, and they can help you maximize your profits. You can set the rules for your bot to automatically trade for you, and you can even copy the parameters of the most successful bots. The bots run on a cloud, so your phone or computer doesn't need to be running for the bot to operate. This is an excellent way of trading because it removes any emotion from the process, and you can trade at any time so you don't miss out on potential opportunities.

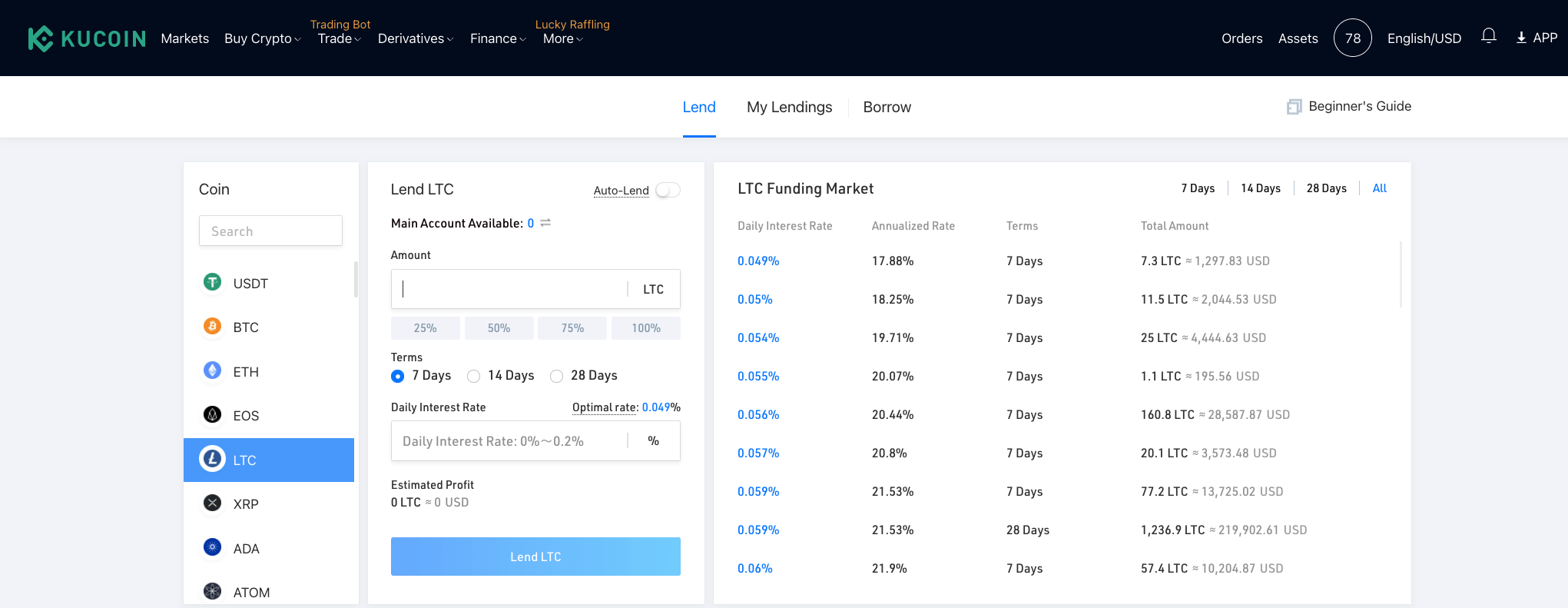

KuCoin gives you ways to earn extra crypto while you leave it in your KuCoin account. The first way is to buy and hold KCS coin (KuCoin's own token). If you hold at least 6 KCS, you automatically earn daily interest on it, with an estimated APR of 22%. Another way to earn interest on your crypto is to lend it to other users.

There are over 160 available coins to lend, and you can select your term of 7, 14 or 28 days. You get to choose how much daily interest you want to charge on your loan. If you set a higher interest rate, you will benefit from higher returns, but it is also less likely someone will borrow from you if there are more attractive interest rates available.

Conversely, if you need to borrow some crypto, you are able to do that on KuCoin. All you need to do is select the coin, the amount, and the daily interest rate that you want.

Coinbase also has a unique way of earning crypto on their platform called Coinbase Earn. You will receive free crypto in return for watching short videos about cryptocurrency! These videos are only about 3 minutes each, and you earn crypto after watching each one. For example, I watched three videos about Compound coin, and earned $9 of COMP crypto.

Coinbase has its own Wallet app that is available to download on your mobile device. There are over 10 million downloads on Google Play store, with a 4.7-star rating from 183K reviews, at the time of writing. Users of the Coinbase Wallet can store crypto safely and access a wide range of decentralised innovation. You can participate in airdrops and ICOs, collect NFTs, browse decentralised apps (DApps), and send crypto to anyone, no matter where they are.

Winner - KuCoin

KuCoin wins when it comes to features. It has trading bots, crypto lending, margin trading, futures and a P2P marketplace with zero fees. Coinbase isn't bad in terms of features, it's just that KuCoin has more to offer.

KuCoin vs Coinbase Security

KuCoin adopts many security measures to keep their users' funds safe, such as micro-withdrawal wallets, industry-level multilayer encryption and dynamic multi-factor authentication. They also have dedicated internal risk control departments that oversee all transactions daily.

KuCoin was subject to a hack in 2020, where $150 million was stolen. The way the exchange responded was excellent - they worked quickly to recover a large portion of the stolen funds, and their insurance covered the remaining amount. None of KuCoin's users suffered losses from this cybersecurity breach.

Coinbase has extensive levels of security such as 2FA (2-factor authentication), biometric logins (fingerprint and face ID), and data encryption, with USB drives and paper backups distributed geographically in safes and vaults around the world. Coinbase employees have to pass a criminal background check, and have encrypted hard drives.

Coinbase stores 98% of its digital assets offline in cold storage, and has crime insurance cover to protect digital assets against losses from theft. For more information about how users are covered, click here. Coinbase operates in the USA, which has much stricter regulation standards than most countries. For example, KuCoin strategically domiciled its business in Singapore, which has relaxed regulations and tax laws. From a compliance standpoint, Coinbase operates at a higher standard.

Winner - Coinbase

KuCoin and Coinbase are both very secure crypto exchanges, with insurance cover for any cybersecurity breaches. Coinbase wins here as it has not experienced any hacks and because it is subject to the USA's strict regulations and compliance standards.

Verdict - Depends on your needs

KuCoin is one of the most popular exchanges around the world, with over 30 million users, while Coinbase is one of the best crypto exchanges in the US, so which one is better? It all comes down to what you are looking for from your crypto exchange.

Coinbase has more deposit options, lower fees for direct purchases of crypto and higher level of compliance and regulation, while KuCoin has low trading fees of only 0.1%, trading bots, and a wealth of additional features including ways to earn interest on your crypto.

If you are an experienced day trader, KuCoin is an excellent choice, with low trading fees of 0.1%. The only downside is that it is expensive to purchase crypto on KuCoin to begin trading - in this case I would suggest buying on another exchange, for example Coinbase or Coinmama and sending it to KuCoin. You can see my article here on how to transfer from Coinbase to KuCoin. If you want to sell your crypto on KuCoin, you will have to send it back to one of the other exchanges to convert it to fiat.

For beginners to crypto, or investors that plan to buy and HODL their crypto, I would suggest using Coinbase over KuCoin. It is easier to use, will cost you less in buy/sell fees, and you can withdraw your fiat if you decide to sell it.

Overall Winner - Depends on your needs

For beginners who want to buy/sell crypto, Coinbase is the winner. If you are a serious crypto trader, KuCoin has much lower fees, many advanced markets, and 700+ coins.

Still Researching?

To read more detailed information about these two exchanges, follow the links to my KuCoin review and Coinbase review. If you are a US resident, you might be interested in my breakdown of the best US crypto exchanges. Below is a quick comparison table to see a summary of the key information.

Comparison Table of the Best Crypto Exchanges in the USA

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Related reading: KuCoin review, Coinbase review, KuCoin vs Binance, Best US crypto exchanges

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this breakdown.