What is Aave?

Aave is a decentralized cryptocurrency exchange where users can lend and borrow crypto. Investors can earn a handsome amount by contributing assets to liquidity pools from which others borrow. On the flip side, borrowers get a hassle-free experience borrowing assets in a perpetual or an undercollateralized fashion. With a market cap of over $15 billion, Aave is one of the biggest decentralized cryptocurrency exchanges. It operates within 13 different markets and seven networks.

Users can also stake AAVE tokens to gain rewards and have the chance to govern the exchange. Aave claims to be an entirely community-driven crypto exchange that provides investing and borrowing opportunities in a safe environment. It even goes so far as to claim that users’ funds are always protected, since the exchange has been audited by some of the best security firms in the world. The treasury system focuses on ecosystem growth that benefits everyone through transaction fees, liquidation and staking. Aave also offers a great range of Ethereum-based crypto assets. To get started, simply connect your wallet and pick the relevant section of the website to invest, stake or borrow.

My Overall Thoughts on Aave

Aave can be an excellent choice for professional and beginner crypto enthusiasts looking for a crypto exchange that provides plentiful opportunities, offers security and allows users to learn and grow at the same time. With Aave, users can earn money through liquidity pools and even govern the exchange when they stake their Aave tokens. If you need to borrow assets, simply provide collateral and you will be good to go.

Aave also supports various crypto wallets, which means most users waste no time accessing their funds. The customer support and the Discord community increase interaction between users, which is essential for any decentralized exchange. But the features that I think stand out are listed below:

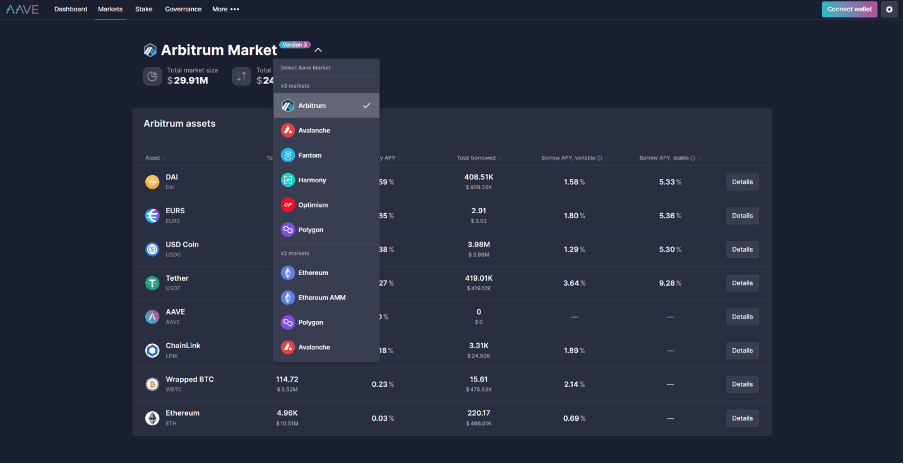

1) The platform supports various liquidity pools within different markets: Aave offers excellent choices when it comes to liquidity pools. You can go with different crypto networks such as Ethereum, Polygon or Avalanche and select any pool to start investing your money. This gives users the chance to diversify their investments, lower risk and earn more.

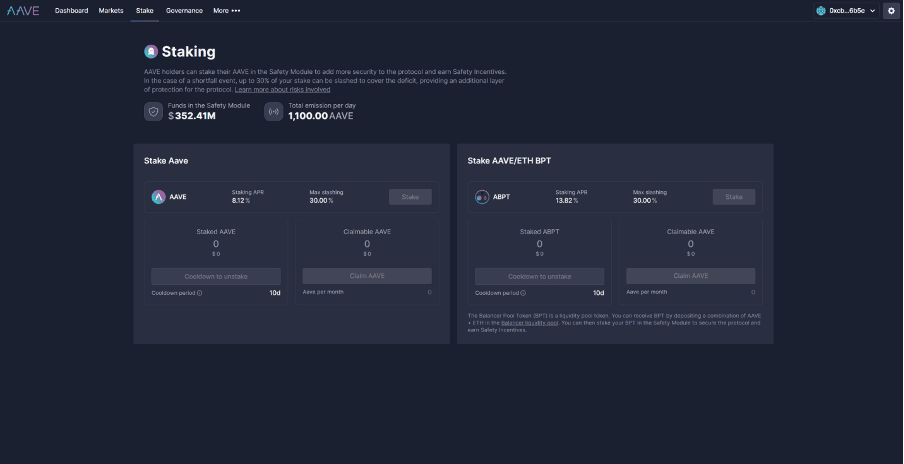

2) Users can earn and stake AAVE tokens: When a user adds liquidity or provides collateral to the platform, Aave rewards them with AAVE tokens. Those tokens can be staked on the platform in exchange for governance tokens, which give users the right to propose and vote on changes for the betterment of the exchange.

3) You can earn high returns: Investors on Aave can earn up to 50% APY on a few assets, which is massive compared to competitors’ rates. However, there is more risk when going for assets with high returns. With Aave, you can also earn passive income on stablecoins that come with lower returns but a steady flow and low risk.

Aave also has a bit to work on to make the platform easier to use. They have introduced flash loans, but they are difficult for common users to understand and use. It would also be helpful if the platform provided dedicated mobile apps.

Key Features and Advantages of Aave

Aave did not just pop out of nowhere with its offerings. It has been in business for a long time now, and there is a reason it has a locked liquidity of over $15 billion—it is a community-driven exchange that allows common users to help govern and to earn money. Investors can earn a handsome amount by adding liquidity to liquidity pools or staking their assets on the platform. Users can also borrow assets after agreeing to pay off the interest at the end of the lending period. It is a trusted exchange, because its documents are open source. In addition to the platform’s transparency, audits further ensure that the exchange is safe. But the services and benefits of Aave do not end here. Take a look below to discover the complete key features of Aave:

Negatives and Disadvantages of Aave

All great things come with some cons, and Aave is no exception. Users must compromise, though for some it will seem negligible. Keep reading to see how they might affect you and keep it in mind before proceeding with the exchange.

What Services Does Aave Offer?

Aave might be one of the best exchanges to offer a community-built protocol where you can invest, stake and borrow assets without a third party interfering. Aave has proven quite successful through its wide range of liquidity pools and governance tokens, along with great security. The platform even offers a bug bounty if you find an issue within the system.

Besides that, Aave has a Discord community, good customer support and complete documentation. Read on to learn about these and the other services Aave offers and how they can benefit the crypto community.

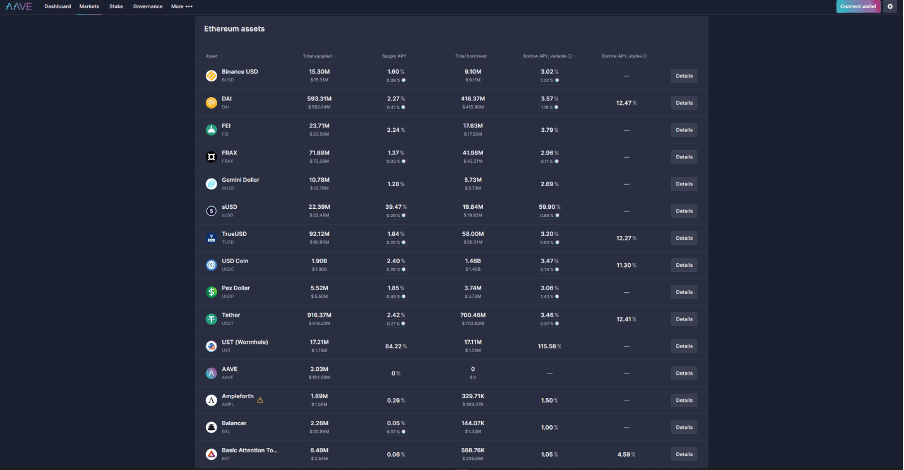

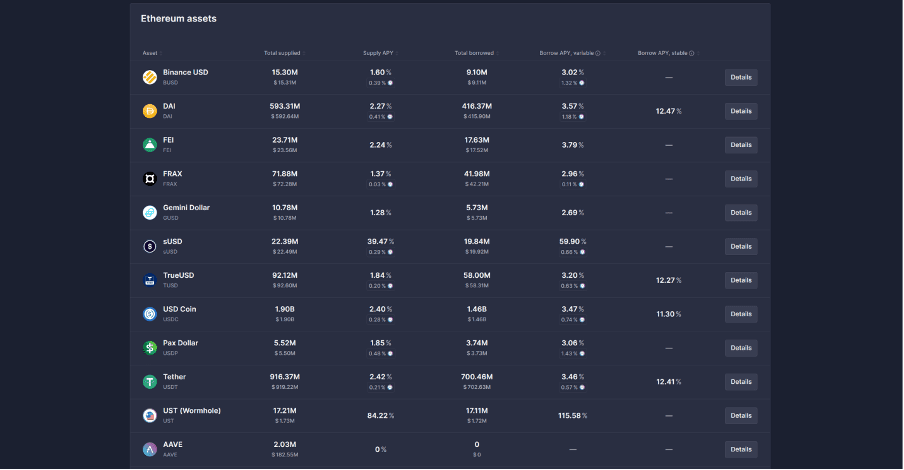

30+ cryptocurrencies: Aave has a great variety of cryptocurrencies for users to invest money in. Users can look out for their best match and then invest or borrow that particular asset right on the platform. Having a wide variety of crypto assets allows investors to diversify their portfolios. This enhances the chance of profiting more and lowers the risk.

The assets at Aave include DAI, USDC, ETH, USDT, Aave, LINK, WBTC and many other popular cryptocurrencies.

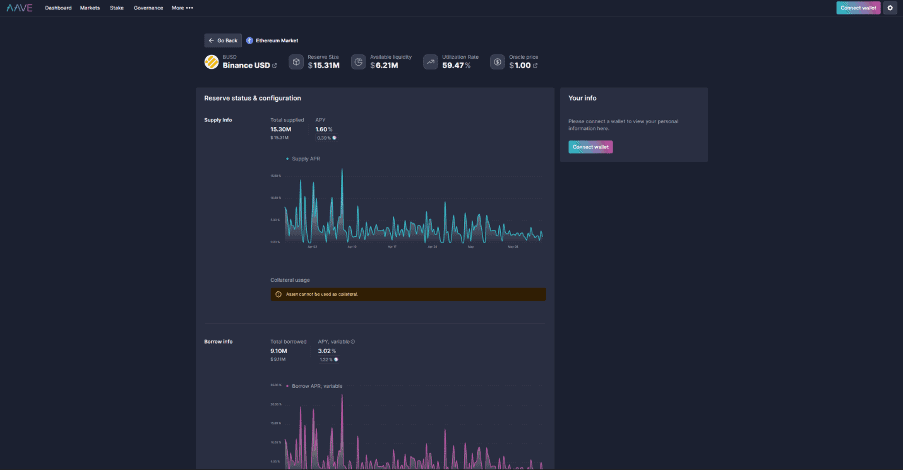

Wide range of liquidity pools: Aave offers a great number of liquidity pools across different crypto markets on networks such as Polygon and Ethereum. This feature allows investors to spread their assets across the platform and choose the pools that offer the best interest rates and that they can add plenty of liquidity to. Users will not be restricted when adding liquidity to the pools, as they have multiple pools to choose from.

Several crypto markets: There are several crypto markets available on the exchange, each with several liquidity pools. Aave has divided the markets into two different categories—V2 markets and V3 markets. This gives users the opportunity to choose any market they desire rather than being forced to swap their asset for a different one just to fulfill the demands on the exchange. In addition to reducing hassle, this allows users to find the markets that are most profitable for them.

Earn governance tokens: Whenever users add liquidity to a pool, they are awarded Aave tokens. You can then stake these tokens on the exchange to earn governance tokens. Governance tokens allow users to discuss, propose and vote on changes to the platform. This helps keep the exchange up to date on what the majority of its users want. When you are in charge, you do not have to follow guidelines or terms created by a third party, and the users of the exchange are always the ones to decide what happens on the platform.

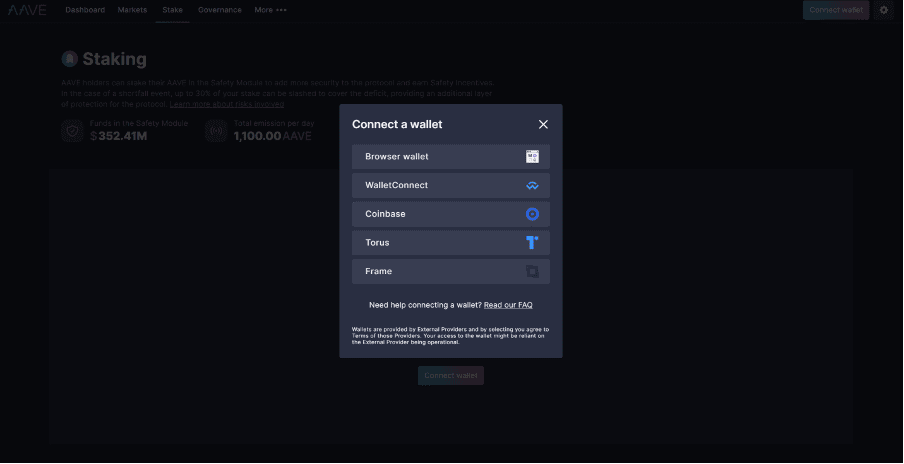

Connect a variety of wallets: Aave supports a variety of crypto wallets. To connect a wallet to the exchange, users just have to enter the passcode and proceed. Easy wallet connections allow users to access their funds and perform transactions on the exchange without the hassle of creating a new wallet just to access Aave’s features. Almost any popular crypto wallet can be connected to the exchange, including MetaMask, WalletConnect, Coinbase, Torus and a few others.

Impressive returns and earning opportunities: There are great earning opportunities on Aave, as the exchange offers excellent returns on the liquidity you add to the pools. Investors can earn up to 50% APY depending on the market and asset they have chosen. With Aave, investors can earn much more, generating a passive income stream just by adding liquidity to the pools. But it is important to find a reliable asset to invest in. Great returns allow users to grow their overall portfolio and enjoy profits more quickly than they could with competitors on the internet.

Borrow with ease: In addition to lending and investing opportunities, Aave provides the opportunity to borrow assets on the platform. To do so, users must offer collateral and lock some assets. But it is the most efficient way to borrow, as it does not require long forms or procedures. How much you can borrow depends on the collateral you provide. The more you provide, the more you can borrow.

Simple platform with no signup hassle: Aave is a decentralized exchange and does not require users to sign up or provide any personal info to get started. This not only saves time but allows users to protect their identities. The platform is also easy to use, thanks to its simplified layout and to-the-point features. Even beginners can use Aave.

Aave community: Aave has a Discord community that was created solely to help users discuss and learn together. Communities like this offer opportunities to solve problems, create solutions and propose and make changes to the platform through voting. All users of the platform can join the community.

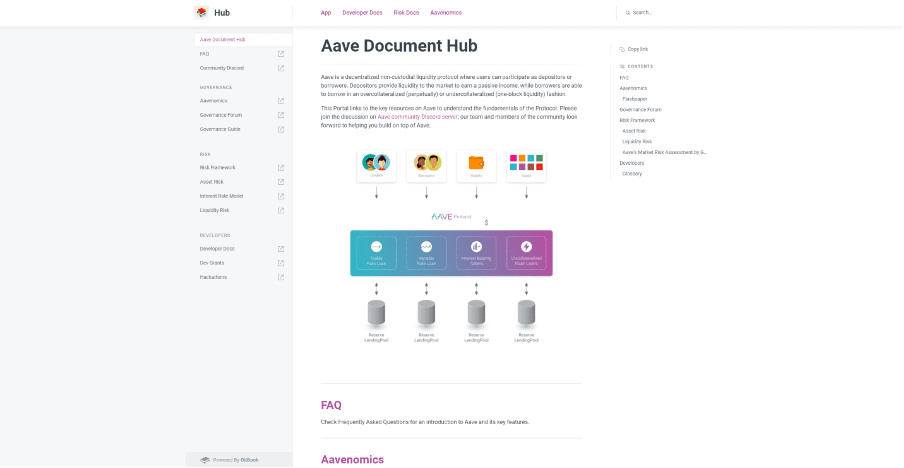

Complete documents with tokenomics: The platform does not keep any secrets regarding its inner workings and system, and it has always been transparent with its users. Aave offers complete documentation for developers along with tokenomics to help users understand how the ecosystem works. Being transparent builds trust with platform users, as they are always updated. When the platform gains trust, users can invest without worrying about scams.

Audited through multiple security channels: Aave claims to be one of the most secure and trusted decentralized exchanges, due to its security implementations. To prove that, the platform has been audited by several security firms. Extensive security ensures that the platform will not be hacked or breached, compromising user funds.

Aave also offers a bug bounty of up to $250,000 to any user who can point out a flaw in the exchange that could be a threat to the system.

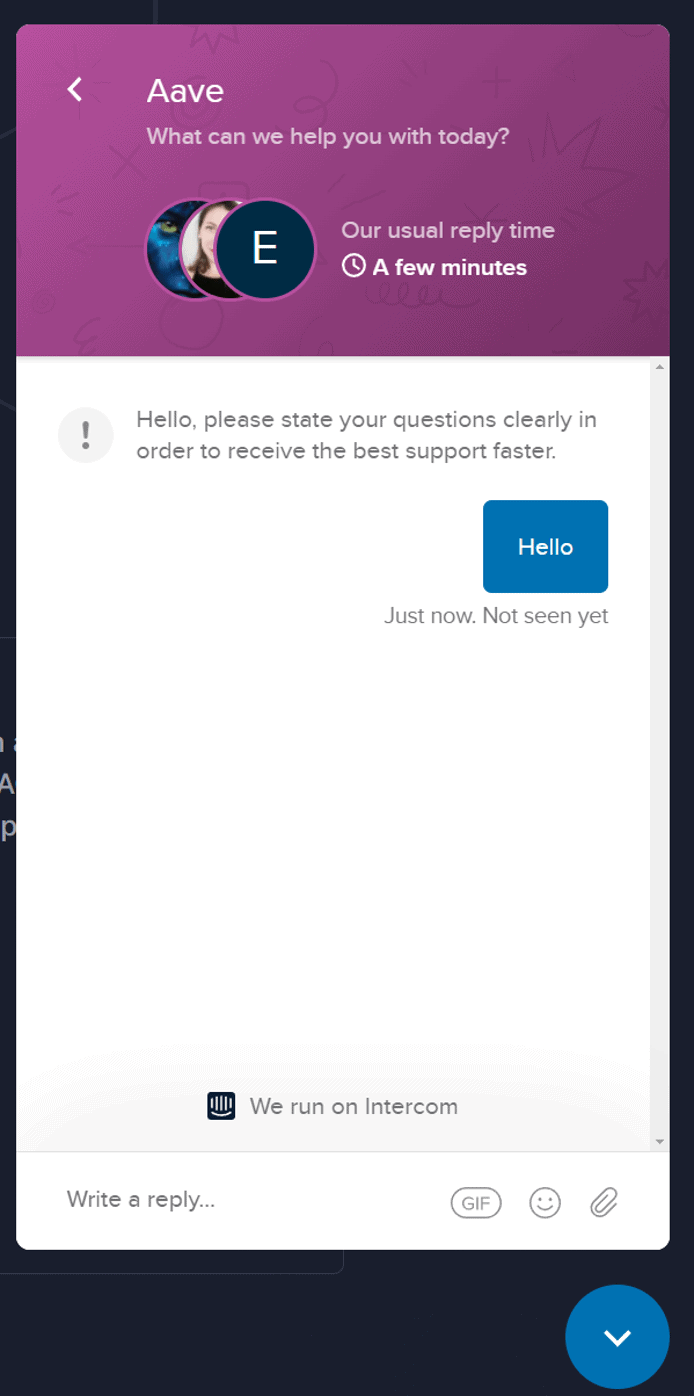

Great customer support: Aave offers live chat customer support to help users get in touch with the exchange’s team. Users can ask questions regarding the platform, their problems, deposit issues or any other concerns they might have. The support team is usually available all the time, but you might have to wait for a few minutes for an agent to connect with you.

Things I Don't Like About Aave

All the great things about Aave come with a few negatives to consider before investing with the exchange. See below to find out what those are.

Flash loans are not beginner-friendly: Along with simple loans you can acquire by providing collateral, Aave offers collateral-free flash loans. However, only developers who have extensive technical knowledge should opt for flash loans. They require a contract that can be confusing for the usual trader or investor. Additionally, with flash loans, the entire liquidity should be returned in one block transaction.

Lack of mobile apps: Aave does not have a mobile app that would allow users to easily access the platform through their mobile devices. Users must open the exchange on their browser, which could slow the whole process down and make it harder to connect wallets.

A great mobile app would solve this problem. It would improve the speed of connecting wallets, adding liquidity, staking and borrowing.

Aave Fees

Aave Transaction Fees

Any interaction at Aave—depositing, withdrawing or staking—requires users to pay a transaction fee, which differs widely depending on market conditions.

Pros and Cons of Aave

- Various liquidity pools within different markets

- High interest rate and great returns

- Borrow tokens with ease

- Distribution of Aave tokens

- Stake Aave to govern the platform

- No mobile app

- Flash loans are not beginner-friendly

The Verdict

If you are longing for an opportunity to invest crypto assets that are lying in your crypto wallet doing nothing, Aave can help. Aave has become a trusted name in the crypto industry due to its working structure and the enormous liquidity it holds. the exchange is also community-driven and governed by common crypto investors.

Whether you are a beginner or an advanced user, Aave features and options can serve you remarkably well. The security, safety, community support, exchange layout, easy connections and almost every other aspect is spot-on, making for a great user experience. Just keep in mind that the flash loan feature is not suitable for everyone, as it requires extra knowledge, and that the exchange does not have a mobile app. Otherwise, it is a perfect place with all-in-one features for lenders, borrowers and developers.

Frequently Asked Questions

Aave is a safe and trusted decentralized investment and borrowing platform.

Your borrowing capacity depends on the collateral you provide to the exchange. The more the collateral, the more you can borrow.

Aave is one of the most secure decentralized exchanges. It has been audited by several security firms, and it offers a bug bounty.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.