Key Takeaways

- Credit cards are similar to regular credit cards, while debit cards work like regular debit cards.

- Crypto.com, Nexo, and Binance are some of the top crypto card providers. Crypto.com offers a debit card that rewards users with cashback and other benefits in cryptocurrency.

- Nexo provides a credit card that allows users to borrow against their crypto assets without having to sell them.

- Binance provides a Visa debit card that can be used to spend cryptocurrency, and it is available in many European countries.

What is a crypto debit/credit card?

Cryptocurrency has gained mainstream momentum since 2020 and now there are cryptocurrency debit and credit cards available for users. What exactly are they and how do they work? There are different types of crypto cards that you can get, so you need to be aware of the differences before signing up to one. Let's take a look at the difference between crypto credit cards and crypto debit cards.

Crypto Credit cards

These work in a similar way to a regular credit card: you pay for goods upfront on a line of credit, and then you pay off your card later, using fiat currency. The difference is that you receive rewards in cryptocurrency, as opposed to credit card points. These are a great option for those that regularly use a credit card, as you can earn crypto while you spend fiat currency, so you are slowly investing in crypto over time.

Crypto Debit cards

These work similar to a regular debit card, you need to have funds loaded on your card before you can spend it. Some crypto debit cards allow you to spend your fiat currency, and receive rewards in cryptocurrency (similar to the crypto credit cards), while other cards let you spend your cryptocurrency.

In this article we have looked at various cryptocurrency debit and credit cards and came up with a list of our top recommendations. Have a read and see if you can find one that is suitable for your needs.

Best Crypto Debit/Credit Cards

| Crypto Card | Features | Score | Sign Up |

|---|---|---|---|

Best crypto debit card  | ☑️ Free to use, load with fiat currency, and receive up to 5% cashback in CRO coin ☑️ Cashback is received immediately after purchase is made with your card ☑️ Available in the USA, Europe, UK, Singapore, Australia, Canada and Brazil | 9.8 | Apply for Card |

Earn crypto when you spend  | ☑️ Borrow against your crypto line of credit, without having to sell crypto and pay capital gains tax ☑️ Receive 0.5% cashback paid in BTC or 2% paid in NEXO ☑️ Up to 10 free ATM withdrawals per month | 9.6 | Apply for Card |

Spend crypto (non-USA)  | ☑️ Free debit card, that allows you to spend your crypto in store, in restaurants and online where Visa is accepted ☑️ Earn up to 8% cashback in BNB, paid daily ☑️ Available in Europe, but not in the USA | 9.2 | Apply for Card |

#1. Crypto.com - Best Crypto Debit Card

Crypto.com is an excellent cryptocurrency app (see review here) that is building a big name for itself, quite literally. In November 2021, they paid $700 million for the rights to change the Staples Center to Crypto.com Arena for the next 20 years. They have their own crypto debit card, which has plenty of benefits besides the usual cashback rewards. The way it works is you need to purchase their coin (CRO) and stake it (locked for 6 months) to be eligible for the Crypto.com card and start receiving benefits. But note that you load your card up with fiat currency, and pay for goods like a regular debit card. You are not paying with CRO or any other cryptocurrency.

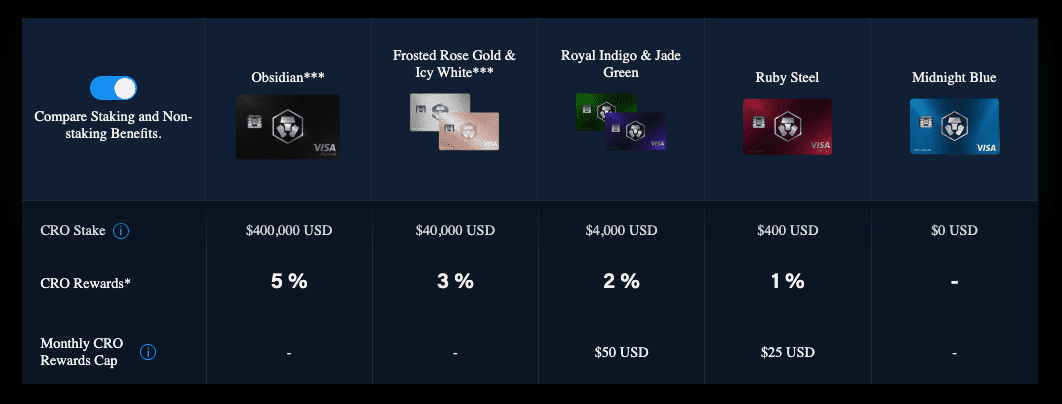

The amount of CRO you stake will determine what kind of benefits you receive. If you stake $400 of CRO, you receive the Ruby Steel card, where you receive 1% cashback on all your purchases. The cashback received is paid in CRO, but you can easily sell it for fiat or trade it for any other cryptocurrency (over 250+ coins) when you like.

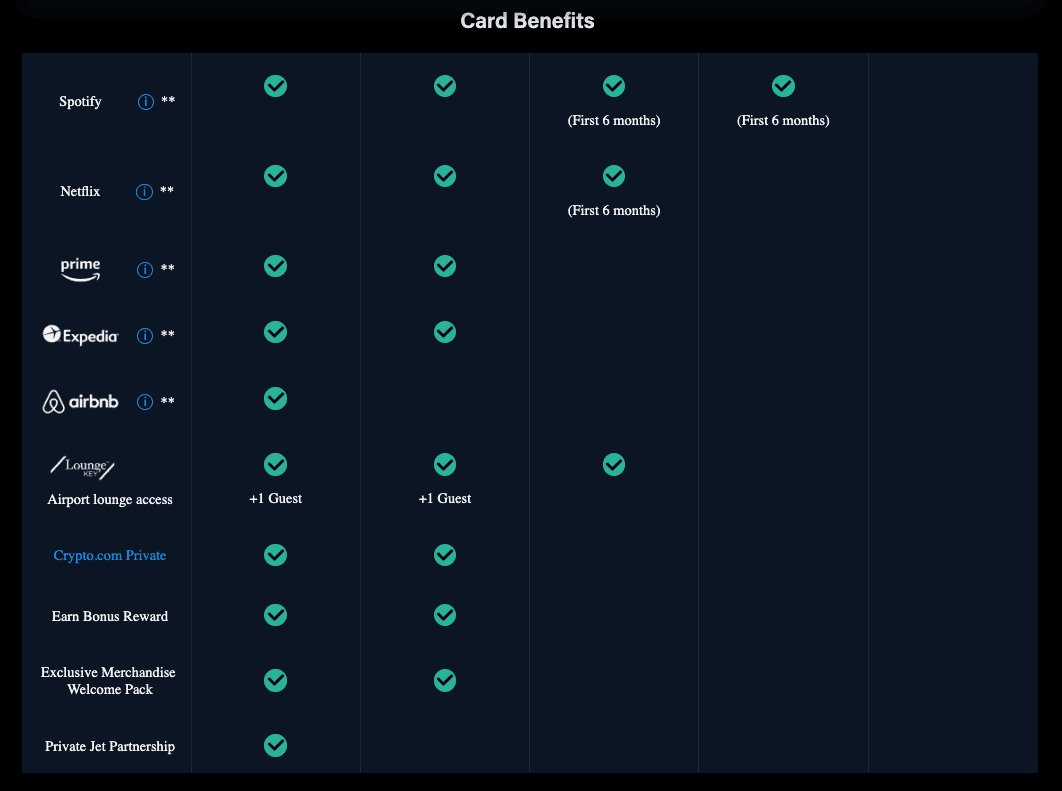

When you stake $4,000 USD or more, you receive 2% CRO cashback, plus 100% rebate on your Spotify and Netflix bills for 6 months. You also start earning interest on the staked CRO, at 10% per year. You even receive complimentary airport lounge access with this card. If you stake at the higher levels, you can receive 5% cashback in CRO, rebates on Airbnb and even Private Jet Partnership as shown in the table below.

The Crypto.com card is free to set up and there are no monthly fees. Once you stake your CRO for 6 months, you will be eligible for the digital version of the card (you do not need to wait 6 months before you can receive the card). This digital version can be used for online purchases and direct debits, and your physical card will be sent out shortly afterwards. The physical card can be used in-store at any place that accepts Visa, as well as online.

To top-up your card, you need to deposit fiat currency into your Crypto.com app, then load it on your card through a few clicks. Once you have done that, it is ready to spend and you can start earning CRO on every purchase you make. The great thing about Crypto.com card is that it is NOT restricted to the USA, like many other cards are. The Crypto.com Visa card is currently available in the USA, Europe, UK, Singapore, Canada, Australia and Brazil.

- Free to set up and use

- Receive up to 5% cashback in CRO

- Cashback is processed immediately after purchase

- Receive rebates on Spotify, Netflix, Airbnb and Expedia

- Airport lounge access for higher tier cards

- Available in many countries, not just the US

- Live Chat support available if you need assistance

- You need to stake CRO for 6 months to receive higher benefits

- Rewards can only be paid in CRO, but you can easily swap for another cryptocurrency after you receive it

#2. Nexo - Earn Crypto while you spend

Nexo has a crypto credit card (see review here), where you can borrow against your crypto credit line without having to sell your crypto assets and incur capital gains tax. In other words, it is like a loan that you take out against your crypto assets in the form of a revolving credit line, and the interest rate ranges from 0% up to 13.9% APR.

With Nexo card, you also earn up to 2% rewards when you make purchases. You can choose to get paid in BTC or Nexo tokens (NEXO), and you can easily switch between the two using your phone app, even right before you make a purchase. If you choose to receive cashback rewards in BTC, you will receive 0.5% of your transaction, whereas if you use NEXO, you receive 2% back. There are no annual fees or any set-up costs involved with getting the card, and you can use it easily on your phone, connecting with Google Pay and Apple Pay.

- Borrow against your crypto line of credit

- Receive 2% cashback rewards in NEXO or 0.5% cashback in NEXO

- Free to set up and no monthly fees

- Works seamlessly with Google Pay and Apple Pay

- Can only receive rewards in BTC or NEXO

- May not be available in your country - website does not specify which regions it is supported

#3. Binance - Best for Non-USA Spending Crypto

Binance is the world's largest cryptocurrency exchange by trading volume, and they offer over 600+ different cryptocurrencies (read full review). With Binance's Visa debit card, users can spend their cryptocurrency online and in-person as if it was cash.

Binance has the best crypto debit card for non-USA residents, as it is unfortunately not yet available in the US. It is available in much of Europe, including Germany, France, Italy, France, Portugal, Spain, and the Netherlands. For a full list of eligible countries, click here. It is free to open an account with Binance, and the Visa card is also free of charge, with no admin fees, processing fees, or monthly charges.

With Binance Visa card, you can choose which cryptocurrency to pay with, and even set up a payment priority order. For example, if your order is USDT, BTC, ETH and then BNB, when you make a payment with the card, it will use your USDT to pay. If you have no more USDT remaining, it will then take funds from your BTC wallet. If there is no BTC, it will pay using ETH, and finally BNB. This is a convenient way to set up your payments, so you are not left trying to change the payment cryptocurrency when you have run out of funds.

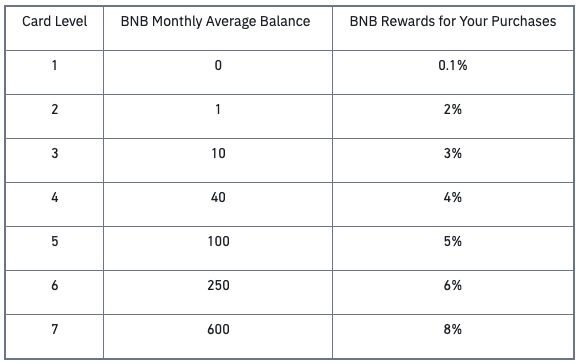

Besides the benefit of being able to spend your cryptocurrency in stores, restaurants, and online purchases that accept Visa, you also receive cashback to your account, paid out daily in Binance coin (BNB). The amount you receive depends on how much BNB you already own and hold in your Binance account, averaged over the last 30 days. As you can see in the table below, to receive 2% cashback you need at least 1 BNB coin, which at the time of writing is about $530 USD. As you own more BNB you can earn up to 8% cashback at the highest card level.

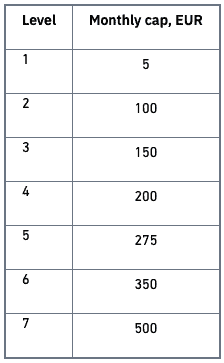

There is a limit on how much cashback you can earn per month, as per the table below. The limits are reasonable for most users, as you would need to spend over 5,000 EUR per month to reach the earning cap.

- Spend your crypto at stores, restaurants and online where Visa is accepted

- Earn up to 8% cashback in BNB coin paid daily

- Free to use, no admin, processing or monthly fees

- Available in Europe

- Rewards are only paid in BNB

- Not available in the USA

Should I get a crypto credit/debit card?

This is a personal choice that depends on your individual needs, spending habits, and financial situation. You should consult a financial advisor before applying for a crypto credit or debit card.

If you are already using a debit card to pay for your goods on a regular basis, then it is worth considering using a crypto debit card, where you receive free cryptocurrency on purchases that you already make. In the long run, these small crypto rewards add up, and if the price of the coins increase, you could have a substantial investment.

If you are someone that uses a credit card to collect loyalty points, and you are now interested in cryptocurrency, a crypto credit card may be a good option, as you receive cryptocurrency rewards on your usual purchases. This could turn into a significant amount if you are using your credit card regularly.

For those that invested in cryptocurrency early, congratulations! You might be sitting on a cryptocurrency fortune, and want to spend it like cash, without converting it back to fiat first. A crypto debit card like the Nexo Mastercard or the Binance Visa are both great options that you can use to spend your cryptocurrency.

Are there fees with crypto credit/debit cards?

This depends on the individual card. Some will charge a monthly or annual fee, others may charge a percentage fee for loading your card with funds, and still others may charge a transaction fee. All the crypto credit/debit cards we have listed on this article are free to set-up, have no monthly fees, and no transaction fees. We have done our research and only picked the ones that give you the best value for money. There is no point choosing a crypto debit card like Coinbase, offering up to 4% cashback, but you need to pay 2.49% fee on each transaction.

Is Crypto.com card credit or debit?

The Crypto.com card is a prepaid debit card, which means you need to load your card with fiat currency before you can use it. You cannot pay using cryptocurrency, and you cannot make purchases with the card like a credit card, and pay the bill later. It is an excellent way to make daily purchases because it is completely free to use and you receive up to 5% cashback in CRO coin on all payments.

Are there tax implications with crypto credit/debit cards?

You will need to check the tax laws relevant to your country, as they differ around the world. Some jurisdictions will view the cashback as a rebate and not income, which means it is not taxable. If you are spending cryptocurrency, this may count as 'disposing' of an asset, so you might need to pay capital gains tax if your crypto increased in value from when you bought it till the time you spent it. Please consult a tax accountant before making any decisions regarding crypto credit or debit cards.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our privacy policy click here.