When you sell or exchange a cryptocurrency, whether you make or lose money, tracking your gains and losses for tax purposes is critical.

This crypto taxation became compulsory when the IRS began classifying virtual currencies as property in 2014. Since then, anyone dealing with cryptocurrencies must consider the tax ramifications. This is especially applicable to frequent crypto traders and Bitcoin miners.

But, tax calculations can become extremely complex when you add several wallets or exchange accounts, gas costs, mining income, and NFT transactions. This is where ZenLedger steps in.

This crypto tax software offers assistance for tracking your crypto gains. And with its paid plan, you get more and better features. But this doesn't mean the software doesn't have any downsides. For one, ZenLedger plans can be pricey. Moreover, depending on how frequently you trade, some features might be more valuable than others.

So, is ZenLedger the ideal crypto tax software for you? To help you navigate, read my review where I explain everything ZenLedger offers based on my experience with the software.

What is ZenLedger?

As I previously mentioned, the numerous types of crypto investments make it necessary to calculate each of your investments when paying your crypto tax. Of course, doing it manually can result in hours of complex and confusing tax calculations.

However, if you utilize a reliable crypto tax software like ZenLedger, the same task will take much less time and effort. And the best thing is, you can confirm that your crypto tax calculations are accurate.

The question now is, 'What precisely does ZenLedger do?' Based on my experience with the software, this cryptocurrency tax and tracking software assists in tracking cryptocurrency balances and earnings (or losses) across an individual's exchange and wallet accounts. What's the best part? You can do it with a single, unified view.

With this, you can prepare most of your tax paperwork required for Bitcoin reporting using ZenLedger. But, if you prefer leaving the paperwork to a professional, their premium service supports crypto tax form preparation by a tax professional. So, there's nothing left for you to worry about!

Key Features and Benefits

Now that we've covered the basics of what ZenLedger does let's dig deeper into how it does it, i.e., its various tax-calculating features.

Tax Reports & Capital Gains Calculations

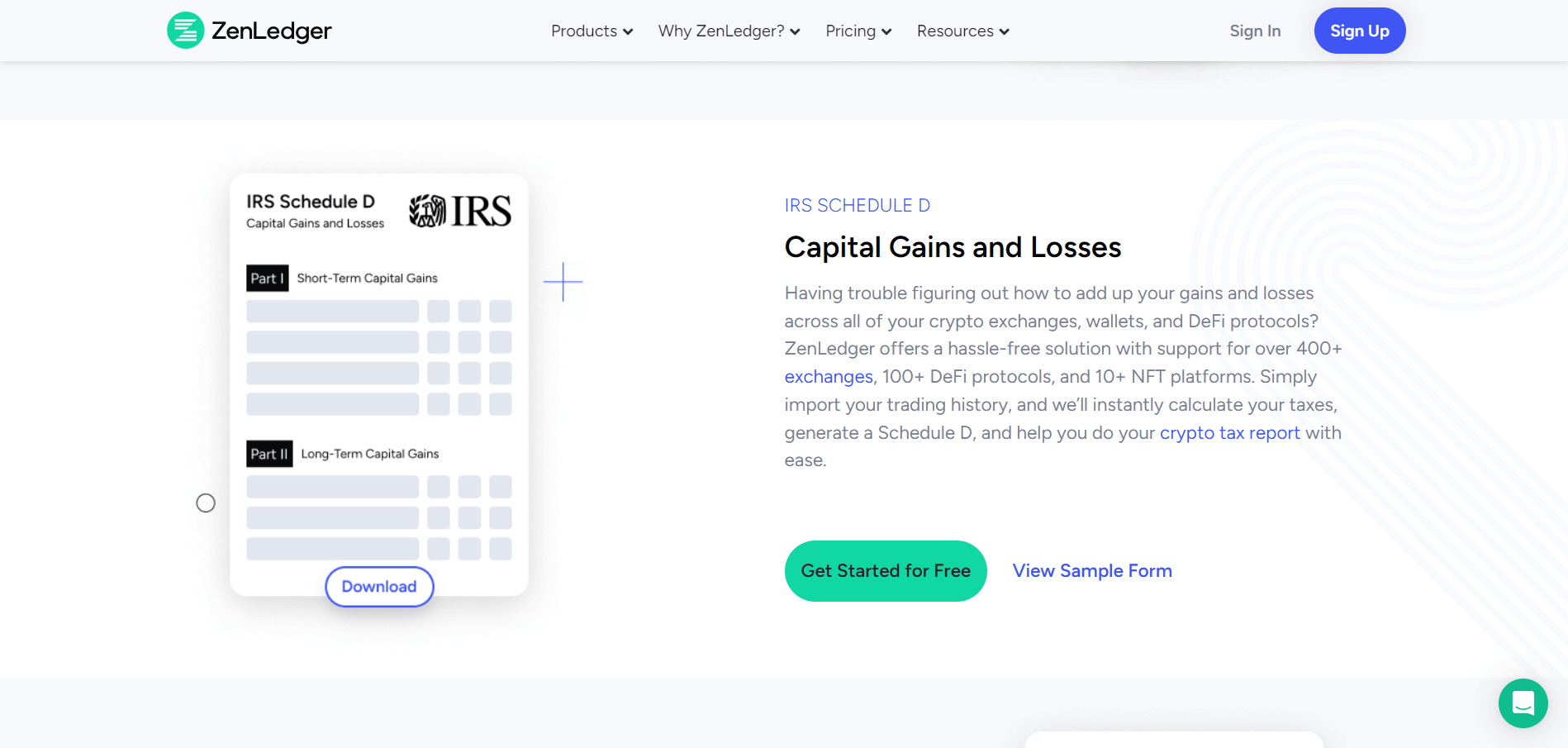

One of the major reasons I suggest using ZenLedger is the different tax reports it offers. This excludes the need to understand and organize a report based on your filing tax requirements. The best part is that you can download these reports in PDF format, allowing you to save and print them to efficiently manage your tax records. Now, let's explore the different tax reports you can access with ZenLedger:

Calculating Capital Gains

Besides understanding the different types of tax reports and why they are needed, another important aspect of crypto tax filing with ZenLedger is calculating capital gains. You can determine these gains by calculating the difference between a coin's purchase price (cost basis) and its sale price.

Don't worry; it's not a complex process. In fact, with ZenLedger, I could easily calculate my capital gains. All I had to do was follow these steps:

The same approach is also used to calculate capital losses on crypto investments. You must determine if you sold your assets for less than what you paid. In this situation, it's a capital loss. Likewise, if you sell your assets for a higher value than the price you paid, it will be considered a capital gain.

Once you determine whether your crypto trade was a capital gain or loss, you can file your crypto tax report accurately.

Integration with Exchanges & Wallets

Currently, ZenLedger supports over 400+ exchanges, 100+ DeFi & NFT protocols, 50+ blockchains, 7,000 different tokens, 13 mobile wallets, and 10 desktop wallets. These wide integrations allow "grand unified accounting" of your cryptocurrencies for your records and tax purposes.

This is especially beneficial for active traders like myself who prefer trading on various exchanges, blockchains, and tokens all while working with advanced accounting features.

Following are some prominent exchanges, blockchains and wallets that I was able to integrate with ZenLedger:

Exchanges | Supported Blockchains | Crypto Wallets |

|---|---|---|

Binance | ||

Algorand | Coinbase Wallet | |

Cardano | Bitpay | |

Bitcoin | ||

Ethereum | ||

Dogecoin | ||

Polkadot | ||

Litecoin | Mycelium | |

TRON | and more | |

Uniswap | Polygon | |

SushiSwap | And more | |

And many more. |

If Zenledger doesn't support the specific exchange or wallet you use, you can still use the software by simply uploading your data or requesting support.

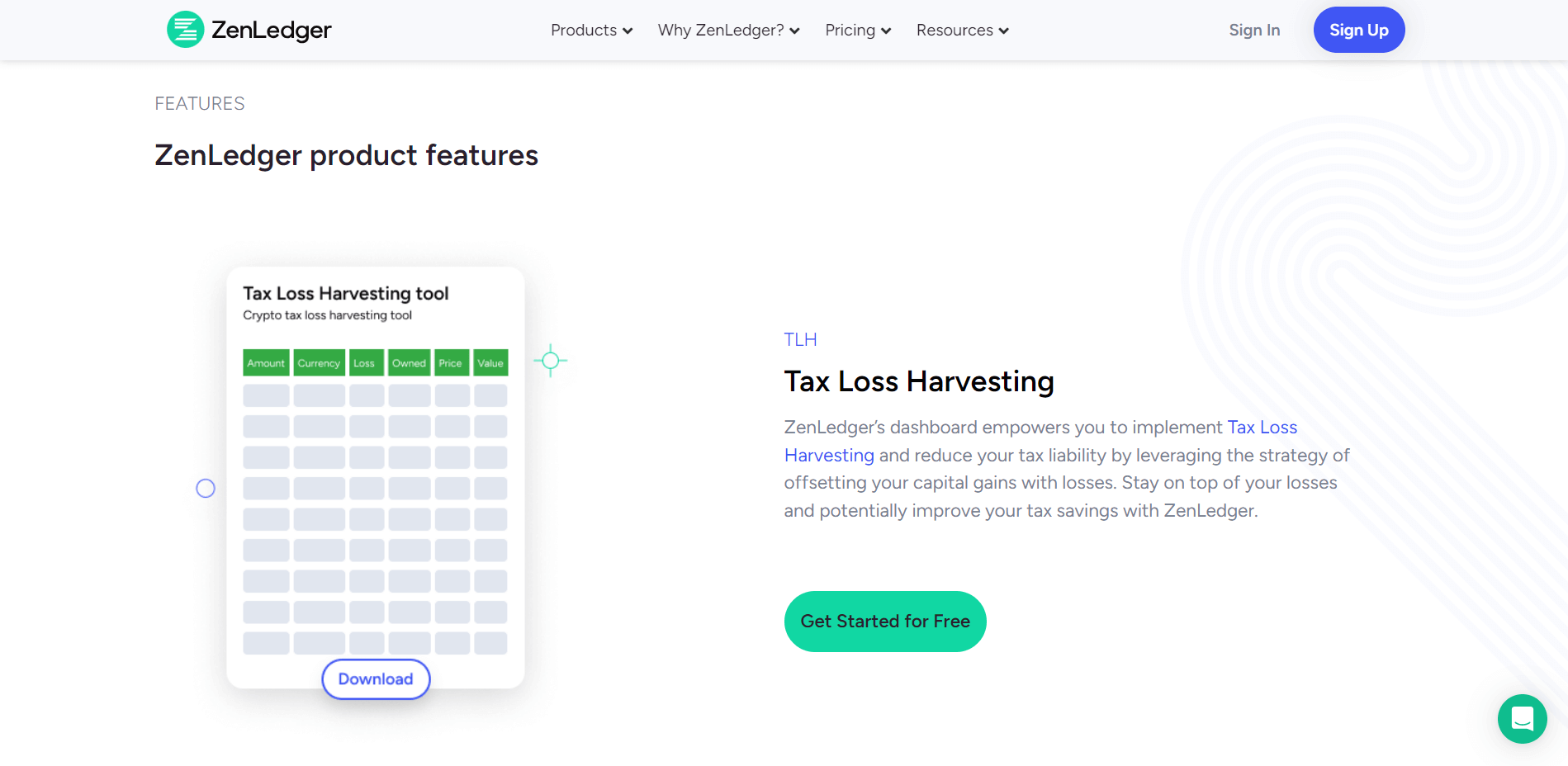

Tax Loss Harvesting

Another significant feature of ZenLedger is the tax loss harvesting feature. With this feature, you can intentionally sell assets at a loss to offset capital gains. This way, you can reduce the amount of tax you pay. This feature aims to replace the assets you sell at a loss with comparable assets so that your portfolio composition remains constant.

For example, consider investing $10,000 in Bitcoin when the asset value soared to $65,000 per Bitcoin. Unfortunately, the price of Bitcoin fell, and the current value of Bitcoin is $4,000 less than what you paid. This means you are at a loss of $4,000. In this situation, you might want to sell your Bitcoin at the lower price of $6,000.

While you can't prevent the loss, you can use it to lower your yearly crypto tax amount. How exactly? You can use that $4,000 loss to reduce the profit you pay taxes on from other investments or income sources. This process is known as offsetting since it allows you to use the losses to offset or balance the gains from a different asset. In summary, even though selling your Bitcoin at a loss isn't great for your financial situation, it can be a silver lining when paying your crypto taxes.

Since the deadline for realizing crypto losses by the IRS is December 31st, the tax-loss harvesting feature can be typically accessible through a year-end plan. Eventually, when you use this feature by the end of the year, you can see your unrealized gains and losses. This also allows you to analyze how many coins you need to sell to maximize your loss.

But do remember that this particular feature is only beneficial for larger portfolios. It is mainly helpful when you have a huge margin between profit and losses that needs to be balanced to lower the amount of applicable taxes when it's time to pay for them. Having said that, tax-loss harvesting can help save up to $3,000 in yearly taxable income for larger portfolios.

Audit Trail

During my experience with ZenLedger, I especially found its Audit Trail Report helpful for tracking my trading activity throughout an entire tax year. Not to mention how it had all the details on each transaction I made throughout the year.

Notably, this report mentions the overall quantity/cost per trade and other important information about each trade. And the best part about accessing this report through ZenLedger is that it comes in the form of a CSV file, which is easily readable by anyone!

User-Friendly Interface

If all of this isn't enough, this standout crypto tax software also features a simple and user-friendly interface. This means you can simplify and automate your crypto tax filing with a single click. Some of the options you will come across on its easy-to-use interface include:

Zenledger Support: This widget lets you contact the ZenLedger support team directly.

How Does ZenLedger Compare to its Competitors?

In the wide list of crypto tax software available today, some offer a variety of features while others focus more on certain areas, like following US or international tax legislation.

Considering the endless options available today, ZenLedger is one of the most popular among crypto investors and traders. Why do I say that? Because of its comprehensive features and ease of use, something I haven't found on most other tax calculating software.

However, if I compare ZenLedger to another popular crypto tax platform like TaxBit, the former will appear as a more costly crypto tax software. This can be one huge drawback, especially for crypto traders who don't want to invest much in calculating software.

Now, if you're confused about whether ZenLedger is the ideal software for you or not, let's compare it with some other popular crypto tax software:

Features | ZenLedger | CoinLedger | TaxBit |

|---|---|---|---|

Software Pricing | $0 - $999/yearly | $0 - $199+/yearly | $50 – $500/yearly |

Exchange/ Wallet Integrations | 400+ | 280+ | 150+ |

Tax Software Integrations | TurboTax | TurboTax, TaxAct | TurboTax, TaxAct |

Free Plan Available | Yes | No | Yes |

Ideal For | Advanced accounting features | Frequent traders | Unlimited transactions |

Pricing and Packages

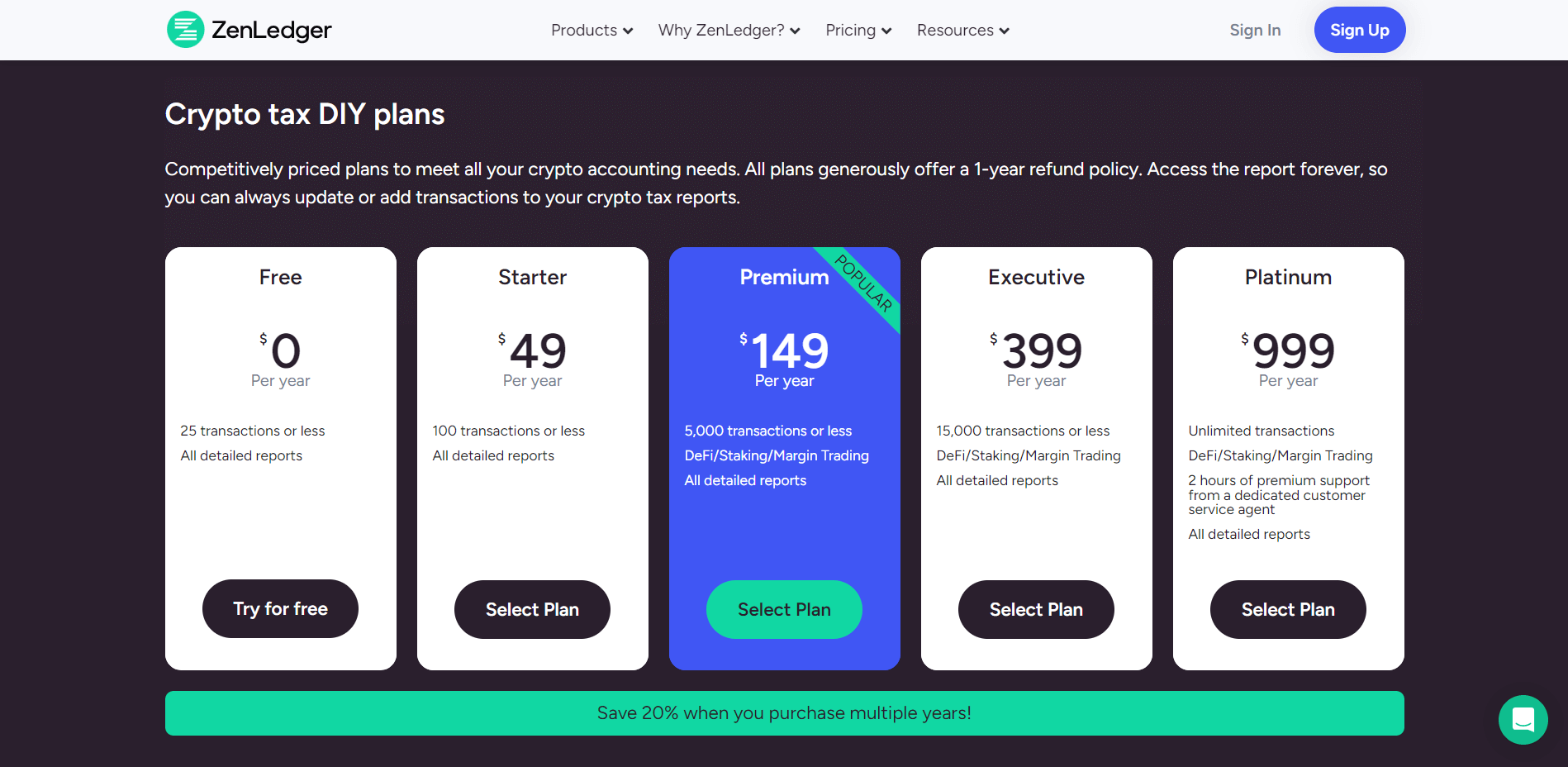

Regarding ZenLedger's pricing and packages, I found it to be quite expensive. Especially considering the free plan offers a very small transaction limit and basic features. This makes the free plan ideal for smaller traders who may invest only around $25 per trade.

Speaking of which, if you are a trader that makes higher transactions per crypto trade, you will have to move to their paid plans. And the higher your transactions, the more expensive plan you will have to choose. But then again, ZenLedger does make crypto tax calculations effortless, especially for larger portfolios. This makes their more expensive packages worth the purchase.

Nevertheless, ZenLedger features five distinct plans with four paid plans. You can refer to the table below to better understand what each plan offers:

Membership Level | Free | Starter | Premium | Executive | Platinum |

|---|---|---|---|---|---|

Yearly Cost | $0 | $49 | $149 | $399 | $999 |

Transaction Limit | 25 | 100 | 5,000 | 15,000 | Unlimited |

DeFi/NFT Support | No | No | Yes | Yes | Yes |

Besides these pricing and packages, ZenLedger also offers frequent discounts and promotions. These discounts are mainly accessible to old or existing customers who are re-purchasing any of their paid plans.

Customer Support and Resources

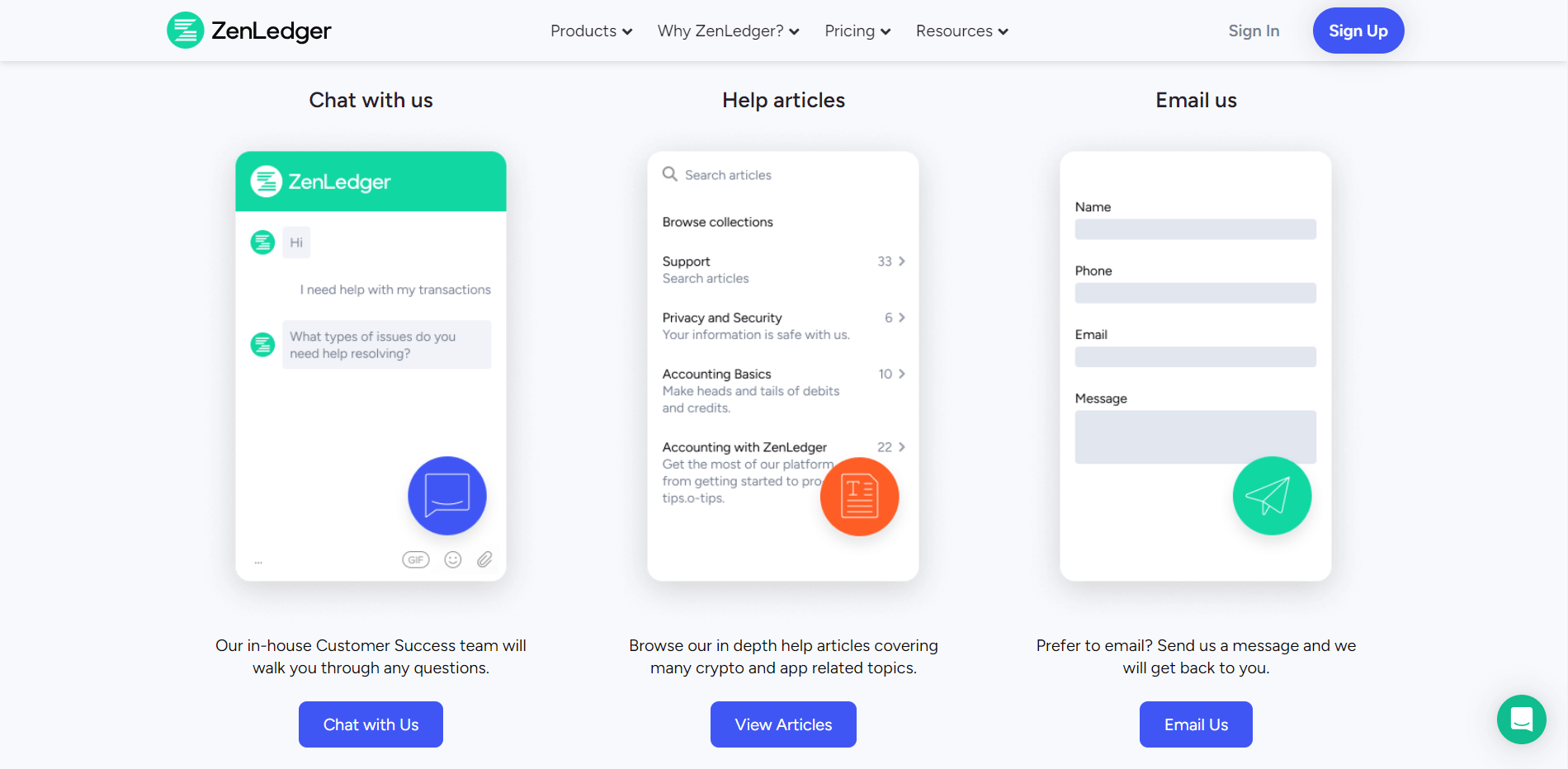

I found ZenLedger's team easily accessible in times of need through various means. Whether for instant support or more detailed professional help related to tax calculations or using the software. Notably, here are the different ways you can connect with their team:

Website Support

ZenLedger users can access customer support through various means, including:

Social Media Support

Besides the support options on their website, ZenLedger also has a social media presence on various platforms, including:

Online Reviews

As a popular crypto tax software, ZenLedger has received various reviews on online consumer review sites. This includes 60 reviews and an overall 3.5-star rating on Trustpilot. Among these 60 reviews, 52% of them are 5-star reviews. Besides this, the company received a C rating with three reviews (incl. one complaint in the past 12 months) on BBB (Better Business Bureau).

Pros and Cons of ZenLedger

- Accurate and up-to-date tax calculation and reports

- Can connect to several exchanges and wallets

- Easy-to-use platform

- Reports on tax-loss harvesting are available for free

- Outstanding customer support service

- Professional tax filing assistance and consultations are also provided for a fee

- The free plan is extremely limited

- Plans that support tax calculations of more than 100 transactions can be costly

- Some accounts are unable to connect through the API

- Only offers US-based tax forms for download

Final Thoughts

ZenLedger is a great crypto tax software that helps you save time and improve accuracy when filing cryptocurrency taxes. So, if you're a novice investor or don't trade frequently, software with free plans like ZenLedger is most likely sufficient for your tax calculating needs.

At the same time, I also suggest this software for investors with large portfolios and a diverse range of cryptocurrencies and DeFi activities, mainly due to its wide compatibility with endless crypto exchange tokens, blockchains, and more. But, this is only preferable for such investors if they don't mind purchasing the more expensive ZenLedger packages.

Either way, it is better to seek the advice of a tax professional before deciding which software is ideal based on your specific requirements and preferences.