What is Curve Finance?

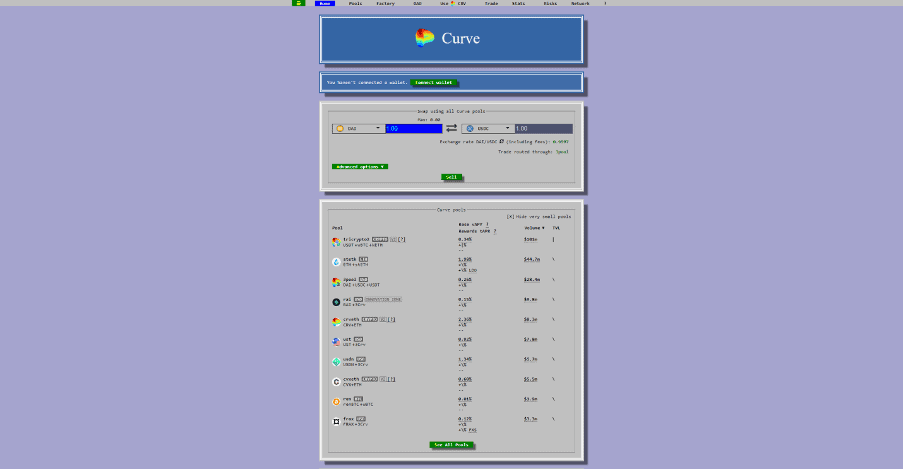

Curve Finance is an advanced decentralized cryptocurrency exchange with low slippage and high liquidity that allows traders to swap their assets. The exchange is headquartered in Switzerland, and it has been around for a few years. Users might find Curve Finance a little unique due to its overall layout and design. But if you are a retro fan and love to explore old themes, it will not be a problem for you. Curve Finance mainly focuses on stablecoins, which has attracted users from all over the world seeking low-risk opportunities.

The platform also offers some earning and investing opportunities. Users simply connect their crypto wallets to the exchange to access their funds and apply them to any of the investment activities available at the exchange. It would be best to have at least basic knowledge about liquidity pools before using the platform. Otherwise, the concepts on the exchange may be confusing.

My Overall Thoughts on Curve Finance

With all the investment and trading opportunities Curve Finance brings, it is definitely a great place for anyone who wants to make money with their assets. The security, the environment, the rewards and the chance to govern the exchange make it an even better choice for anyone who does not want to compromise on their experience.

If you asked me what the best traits of Curve Finance are, I would say:

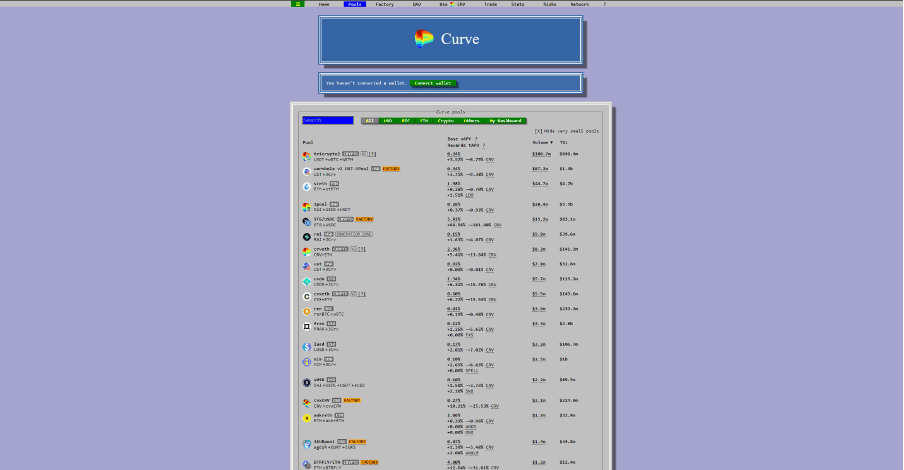

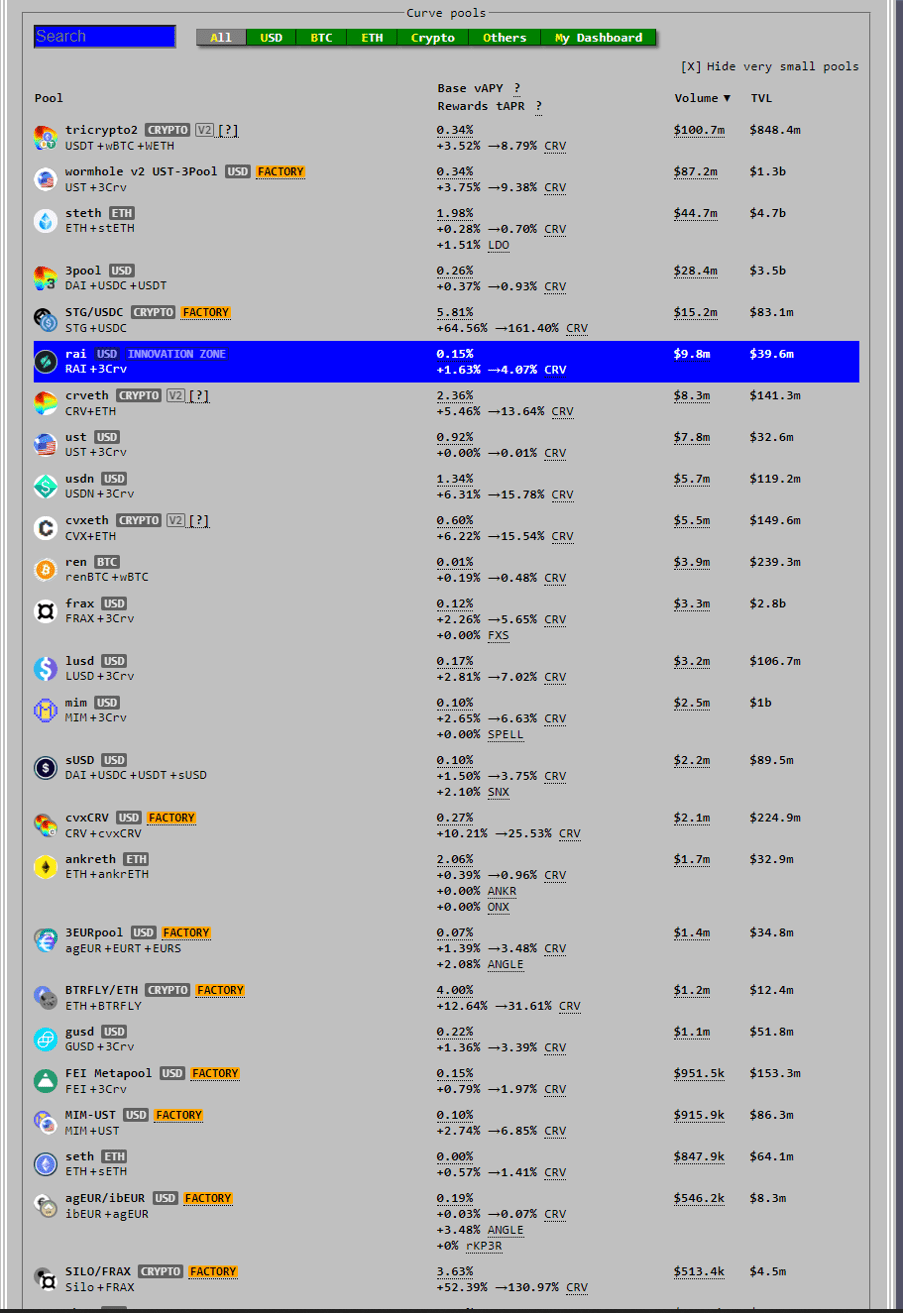

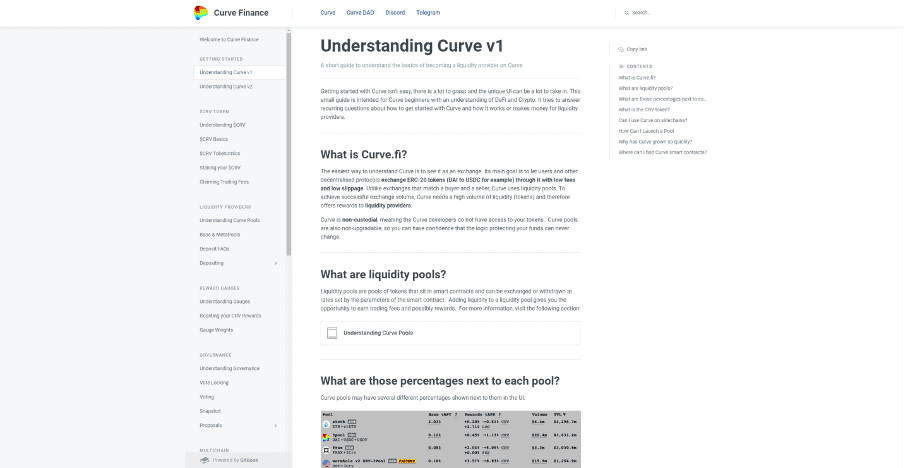

1) There are several liquidity pools: More liquidity pools simply means more opportunities for traders to provide liquidity and earn money and rewards. There are about 100 liquidity pools on Curve Finance, and each of them comes with specific rewards. Take a look at their APY and decide if your investment would be worth it in the long term.

2) You can earn CRV rewards: CRV is the platform’s native token. The CRV rewards are quite attractive at Curve Finance due to the benefits they carry. You can either swap the tokens and earn money through them or you can gain governance through them to help rule the exchange through voting.

3) The platform offers great learning resources: Curve Finance has a section where users can learn all about the exchange and its services. If you are having trouble understanding liquidity pools, DAO (Decentralized Autonomous Organization), AMM (Automated Market Makers) or other aspects, you can visit the resources section to sort out your issues.

Key Features and Advantages of Curve Finance

Before you dive into the details, keep in mind that Curve Finance was not developed for all types of traders and investors. The exchange targets traders looking to swap only stable assets with high liquidity and no risk. Users will often require a little prior knowledge in order to successfully process transactions.

But for those who know what they are doing, Curve Finance is one of the best places to generate passive income and earn safely with minimal risk. Check out the key features of Curve Finance below to learn how.

Negatives and Disadvantages of Curve Finance

No doubt Curve Finance is one of the biggest decentralized cryptocurrency exchanges. But along with all the advantages, there are a few disadvantages. Find out what they are below:

What Services Does Curve Finance Offer?

Curve Finance offers limited services. But the thing that makes Curve Finance a premium exchange is that it is the best in what it offers. Whether it be keeping slippage low, keeping liquidity high or offering tons of liquidity pools, you will not be disappointed.

To obtain a deeper understanding of Curve Finance and its services, explore the aspects below.

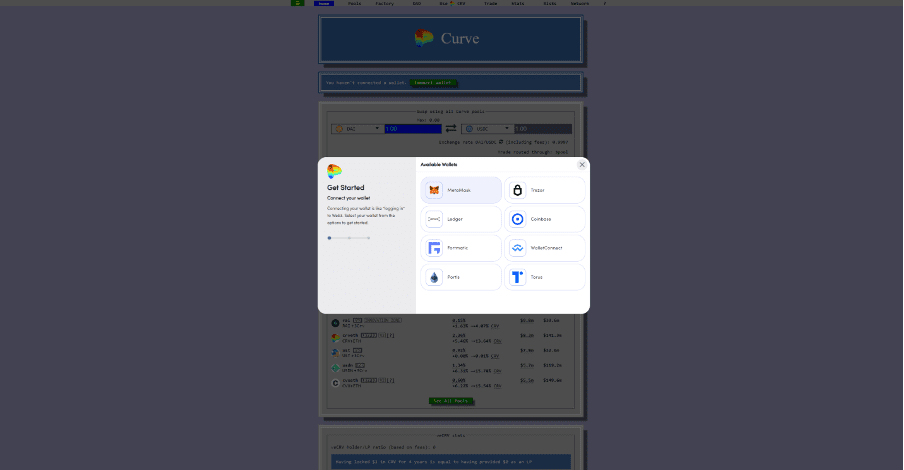

Easy wallet connection: Curve Finance connects relatively easily and quickly to a number of popular cryptocurrency wallets, such as MetaMask, Ledger, Trezor and Coinbase. This allows traders to start trading or investing right away, saving the time it would take to create a whole new wallet just to use the exchange.

Tons of liquidity pools: Curve Finance has tons of liquidity pools that users can explore and invest money into. This allows them to diversify their investments and ultimately reduce overall risk. When you spread your investment across multiple pools, you limit your exposure to impermanent loss and can avoid losing a great deal of money.

Fast and efficient AMM protocol: The AMM (automated market maker) is an underlying protocol that decentralized cryptocurrency exchanges use to support autonomous trading mechanisms.

The protocol is what allows the exchanges to function without a centralized authority or third-party interventions. This way, everyone can become a market maker on Curve Finance, providing liquidity to the pools, earning interest and trading right away.

Premium APY rewards: Users can earn up to 25% APY by combining all the rewards in a single liquidity pool. But, of course, the APY might vary depending on the pool, its assets and market conditions.

High returns like these are impressive compared to earnings from crypto interest accounts. For example, if you look at the popular crypto interest service Hodlnaut, it offers only about 9% APY on low-risk assets, which is considerably lower than the APY Curve Finance offers.

CRV token rewards: If you provide liquidity to the pools on Curve Finance, you receive free CRV tokens, the exchange’s native tokens. CRV tokens can be swapped with any other asset, which you can withdraw into a crypto wallet, or they can be locked on the exchange to earn veCRV, native tokens that allow users to gain voting rights of the platform. With this perk, users not only earn interest from liquidity pools but also benefit from the platform’s free tokens.

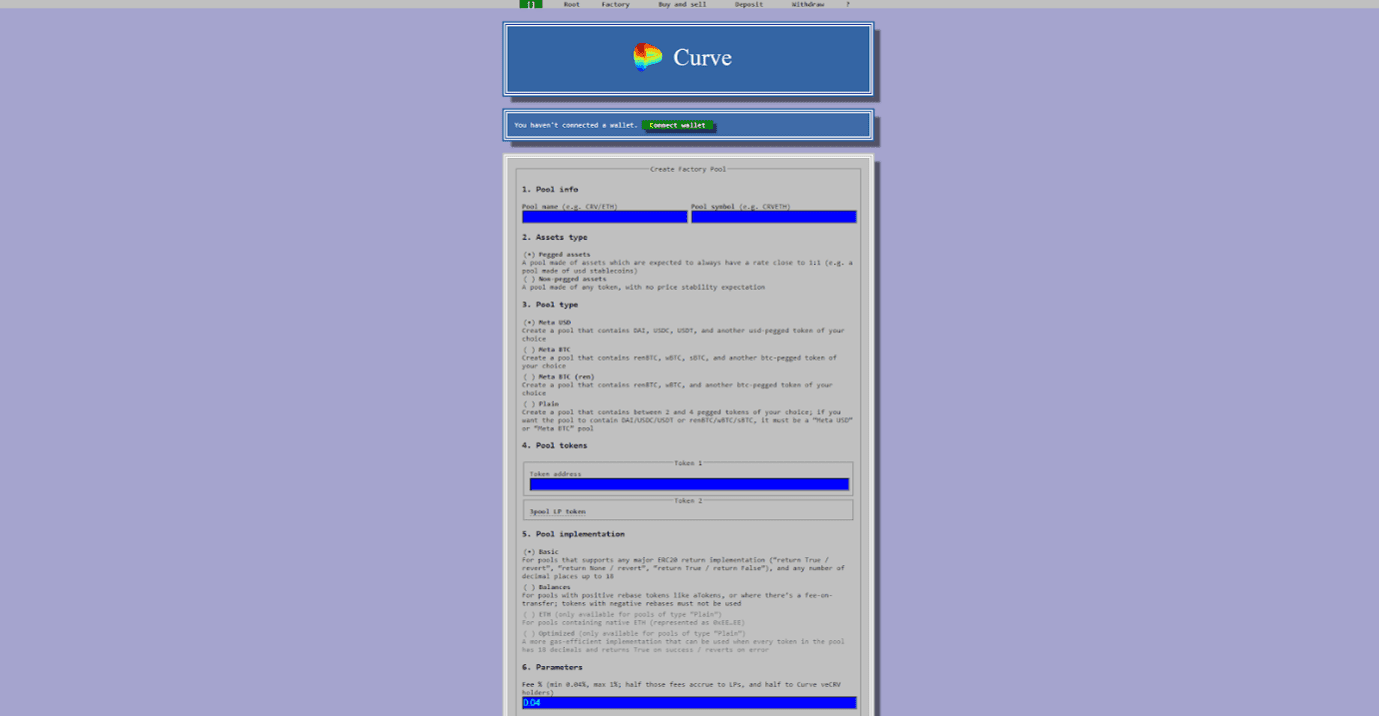

Create your own pools: Curve Finance allows users to create their own customizable liquidity pools in the easiest and most efficient way. Users can decide which tokens will go into the pool, allocate portions and then earn from the pool as long as it can be sustained by other traders as well. Curve Finance allows everyone to create liquidity pools without any requirements or limitations.

Governance through Curve DAO: In a DAO (decentralized autonomous organization), decisions are made by community members who stick to a particular set of rules. In Curve Finance’s case, the DAO was created in such a way that the exchange is controlled by a network of computers with particular codes, which makes it impossible for any single third party to tweak the exchange unnecessarily.

This reduces the risk of manipulation of the market or of a pool by any trader or owner, which in turn builds trust among investors. The DAO code is open source, so anyone can see and evaluate it.

When an exchange does not offer such assurances, integrity and proof, traders and investors become reluctant to invest assets. But this is not the case with Curve Finance.

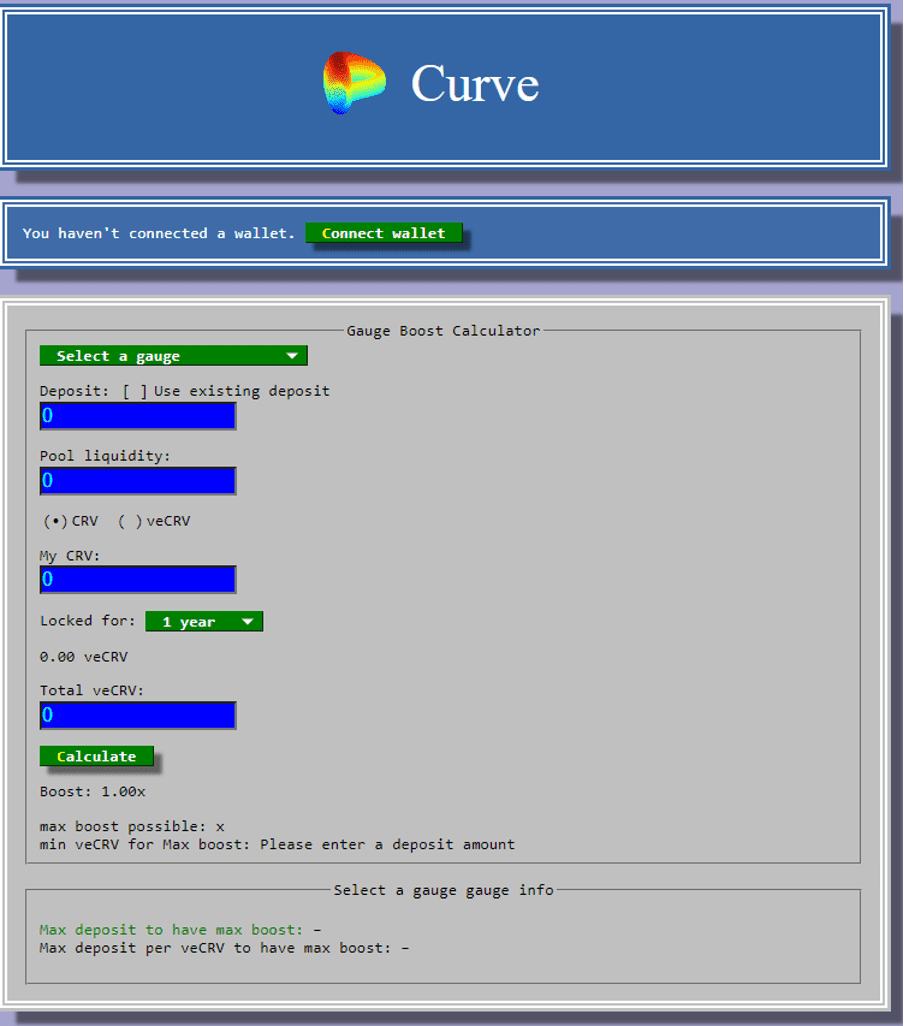

Gauge Boost Calculator: Curve Finance offers a Gauge Boost Calculator to help you estimate your average earnings for a specific period. Users select what compound they would like to go with, the deposit amount, the liquidity amount and for how long they would like to lock the deposit for to create an estimate. This lets users know before they invest their funds how much they can expect to earn on the exchange.

No signup required: Users can get started on Curve Finance without the hassle of signup. All you have to do is connect your crypto wallet to the exchange. This saves a lot of time and lets you use the exchange without providing personal information. This feature is not unique to Curve Finance. Unlike usual crypto exchanges, where users have to sign up and verify their identities, decentralized exchanges do not require these things from users.

News and resources: Curve Finance has a dedicated section with relevant news, guides, articles and tutorials. This resources section can help users understand how everything works, including AMM, DAO, decentralization, liquidity pools, interest rates and many other things. When you learn about the exchange thoroughly, it’s easier to understand how features work and how you can make the most out of them.

Things I Don't Like About Curve Finance

If you love the idea of earning through Curve Finance, make sure to also be aware of the negative side of the platform. Read on to learn what I don’t really love about the exchange.

Not very beginner-friendly: As I mentioned earlier, Curve Finance has a very retro look. This can be a problem for many users who are not familiar with old websites. The retro look makes the website harder to navigate, especially because the lack of fonts and sections can make tools and features hard to find. So I consider Curve Finance not to be a very beginner-friendly platform, and you might have to spend an hour or two on the exchange to understand what and where everything is.

High gas fee: The main network that Curve Finance works on is Ethereum. The gas fee for the Ethereum network can seriously bankrupt you on a day with heavy traffic. As users have to pay a gas fee for each of their transactions, it can be quite expensive to invest or trade Ethereum-based tokens. For other networks like Polygon, the fee is relatively cheaper and affordable even on high-traffic days.

Curve Finance Fees

Curve Finance Transaction Fees

The transaction fee at Curve Finance depends on the network you have chosen and market conditions. It can be as low as a few cents or as high as a couple hundred dollars for a simple transaction. Make sure to check the fee before approving any transaction. The transaction fee applies to all deposits, swaps and withdrawals on the exchange.

Curve Finance Liquidity Pools Fee

The liquidity pool fee is decided by Curve DAO members, so it can vary if the members vote to change it. But right now, Curve Finance has a fee of 0.04% on all pools, half of which is given to all the liquidity providers and the other half of which goes to the DAO members.

Pros and Cons of Curve Finance

- A great variety of liquidity pools are available

- Premium APY rewards

- Create your own pools on the exchange

- Free CRV for liquidity providers

- Inclusion of DAO and AMM for a hassle-free experience

- Not very beginner-friendly

- High gas fee for transactions

The Verdict

If you want a different way of investing with better rewards, then Curve Finance is an excellent exchange. You might find the exchange a little old-fashioned, but once you get a hold on all its features, you will have access to some of the best tools and opportunities. You can even calculate how much you can earn on the exchange with your initial investments.

If you pick the right liquidity pool and deposit the right amount of funds, you can get hefty yearly returns. You can also receive CRV rewards, depending on your investment. In other words, Curve Finance can pay off very nicely if you evaluate things and make the right decisions.

Frequently Asked Questions

Curve Finance is a legit decentralized exchange developed to make trading of stablecoins easier. Users can also invest their money in liquidity pools and earn high returns and rewards.

Curve Finance can offer you great returns if you choose the right liquidity pool and invest the right amount. But, of course, the risk is always there.

Beginner-friendliness is one of the very few things that Curve Finance is not good at. Due to its retro look, users might find it a little difficult to explore the exchange and all its options.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.