Key Takeaways

- TrueAUD is a stablecoin launched in 2019 by TrustToken, pegged to the value of the Australian dollar.

- It is fully collateralized and TrustToken publishes proof of reserves to verify its value.

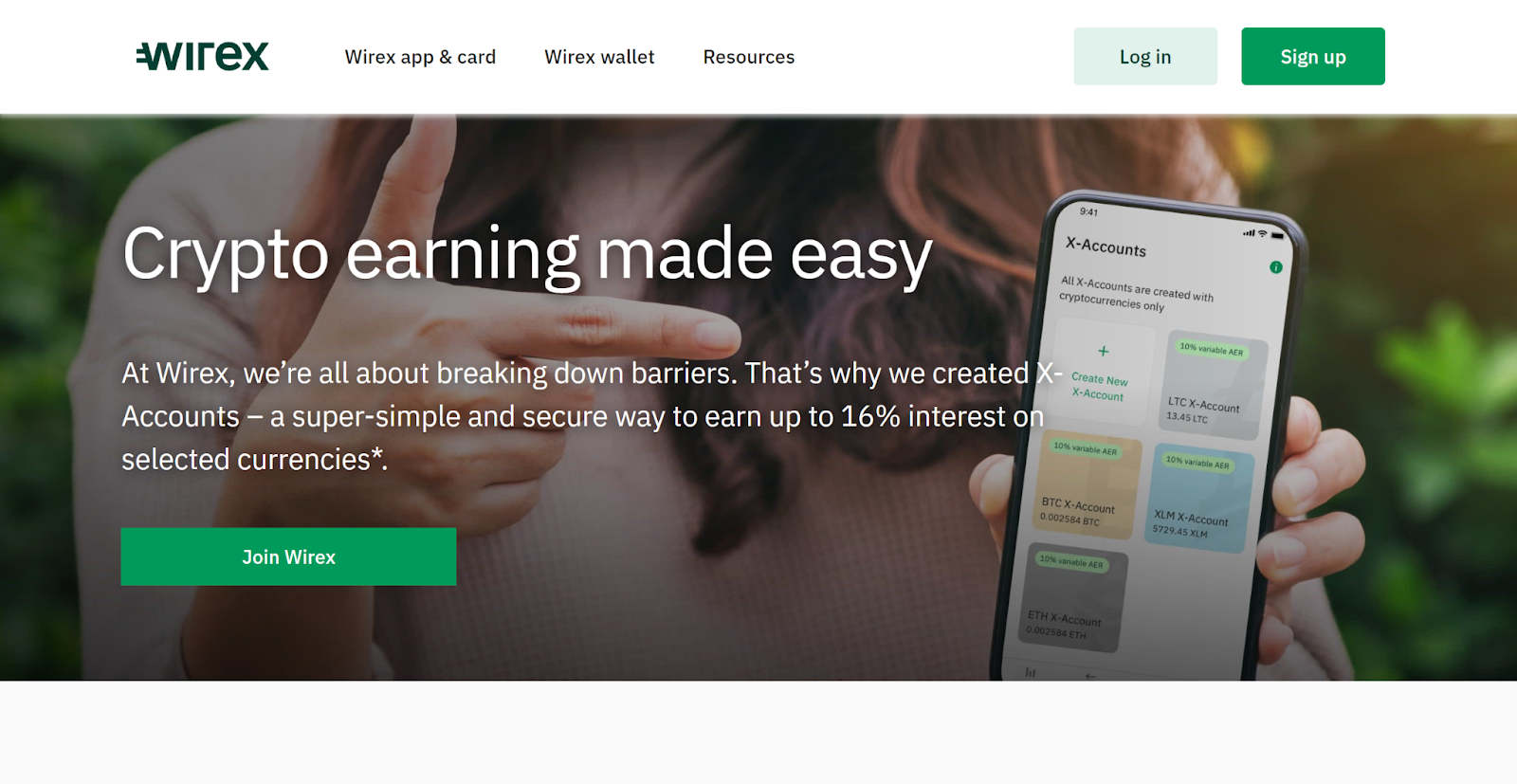

- TrueAUD can be earned through staking on platforms like Wirex, where users can earn up to 16% interest on their investment.

- Staking has risks, such as locking assets for a certain period and platform fees, but can provide a sustainable income with a safe investment in TrueAUD.

You might have heard of people earning huge profits from cryptocurrencies, but we all know trading or holding cryptocurrencies come with risk due to high volatility. If you want to minimize the risk, consider investing in stablecoins like TrueAUD that can benefit you through staking or by other means.

What is TrueAUD?

TrueAUD is a stablecoin launched in 2019 by US-based cryptocurrency platform TrustToken. A unique thing about TrueAUD is that the asset is pegged to the value of the Australian dollar instead of the US dollar. In contrast, other stablecoins like USDT or USDC are pegged to the value of USD. Because it is pegged to the value of AUD, TrueAUD is an excellent investment for Australians who want to earn interest on their own currency, or for others who want to invest in the AUD without signing up to a forex broker.

TrueAUD is based on the Ethereum network and administered solely by TrustToken. TrustToken claims that TrueAUD is fully collateralized, meaning the entire ecosystem is backed by real Australian dollars. To prove their claim, TrustToken publishes their proof of reserves with an up-to-date tracker and Blockchain that is available for anyone to verify and evaluate.

What are stablecoins?

Just like the name suggests, stablecoins are coins that come with a stable price. The prices of stablecoins are not volatile like the prices of other cryptocurrencies, including Bitcoin or Ethereum, which can have a drastic value change within a day. Stablecoins are usually pegged with a backing currency or an asset to keep their price stable. It can be a commodity or a fiat currency like USD, AUD, or GBP. There are algorithmic stablecoins too, but they are stabilized by a computer program, algorithm, or code that runs on a provided parameter and controls the price without requiring a reserve.

Staking - The best way to earn TrueAUD

How can one benefit from TrueAUD which comes with a stable price and no price fluctuations? By staking, to earn interest on your coins. All you have to do is buy TrueAUD coins, stake them on a trusted platform, and earn interest on a periodic basis while you relax and sleep. No need to worry about price fluctuations, as TrueAUD is a stablecoin.

How does it work?

When you stake TrueAUD on any platform, it works on the proof of stake consensus mechanism. This mechanism verifies and secures every transaction that takes place on a blockchain without requiring the involvement of a governing or central party. When you stake your TrueAUD tokens, you are helping the whole ecosystem to run smoothly by being a validator on the network. The more you decide to contribute with your tokens, the more you are awarded at the end of the duration.

What’s the best place for TrueAUD staking?

There are not many places where you can stake TrueAUD. In the past, you could earn TAUD on Crypto.com and Celsius, however Crypto.com has stopped this feature, and Celsius is no longer in operation. Our top recommendation for earning TAUD is now Wirex. You can earn up to 16% interest on your TAUD, which is much higher than any interest rates you will earn in a bank on AUD. You can also read our full Wirex review here.

Are there any risks to crypto staking?

There certainly are some risks to crypto staking that one should keep in mind before staking their assets. First of all, many staking programs require investors to lock their assets for a certain period. You won't have access to your assets for a month, three months, or even a whole year.

So, if you need some urgent cash or want to trade your TAUD, you will not be able to get your hands on your crypto as it will be locked for a certain period. You also have to keep in mind any fees that may be charged by the platform that you are staking on.

Conclusion

You can definitely earn passive income on TrueAUD. You just have to find a good platform to stake your assets, ideally one that offers a decent interest to create a sustainable income with your investment. As TrueAUD is pegged and backed by the Australian Dollar, and the creators offer proof of reserves along with an open-blockchain where you can verify everything, you can rest assured your investment is safe.