What is Nexo?

Nexo is an institutional-grade cryptocurrency exchange that is considered as one of the most complete platforms; it not only allows users to make crypto sales and purchases, but they have a wide variety of other features too, such as interest earning options. The main highlight of the platform is their crypto card, which is a credit card that pays cashback in cryptocurrency each time you use it.

With Nexo Card, you can spend without selling your cryptocurrencies. The best thing is that the features and pros of the Nexo Card do not end here! As Nexo claims, they have a “card like no other”, you can expect quite a lot of benefits from your Nexo Card.

My Overall Thoughts on Nexo Card

Nexo Card is a physical crypto card that can be considered a credit card for your daily needs. The platform delivers the card to users who order it through the website, and they can start using it after activating the card through their account. Make sure to maintain the minimum balance in your account in order to be eligible for the Nexo Card.

The best thing about Nexo Card is that it can be used worldwide without any limitations. You can use it on the internet to shop online, or spend your day out and pay with your Nexo Card wherever you go.

Key Features and Advantages of Nexo Card

The crypto community needed a solution for payments, withdrawals, and easy spending. The Nexo Card delivered this solution and took over the European crypto market by making the lives of crypto users easier and more efficient.

The following are the key features and advantages of the Nexo Card:

Negatives and Disadvantages of Nexo Card

The Nexo Card has two disadvantages:

A Brief Look Into the Benefits of Nexo Card

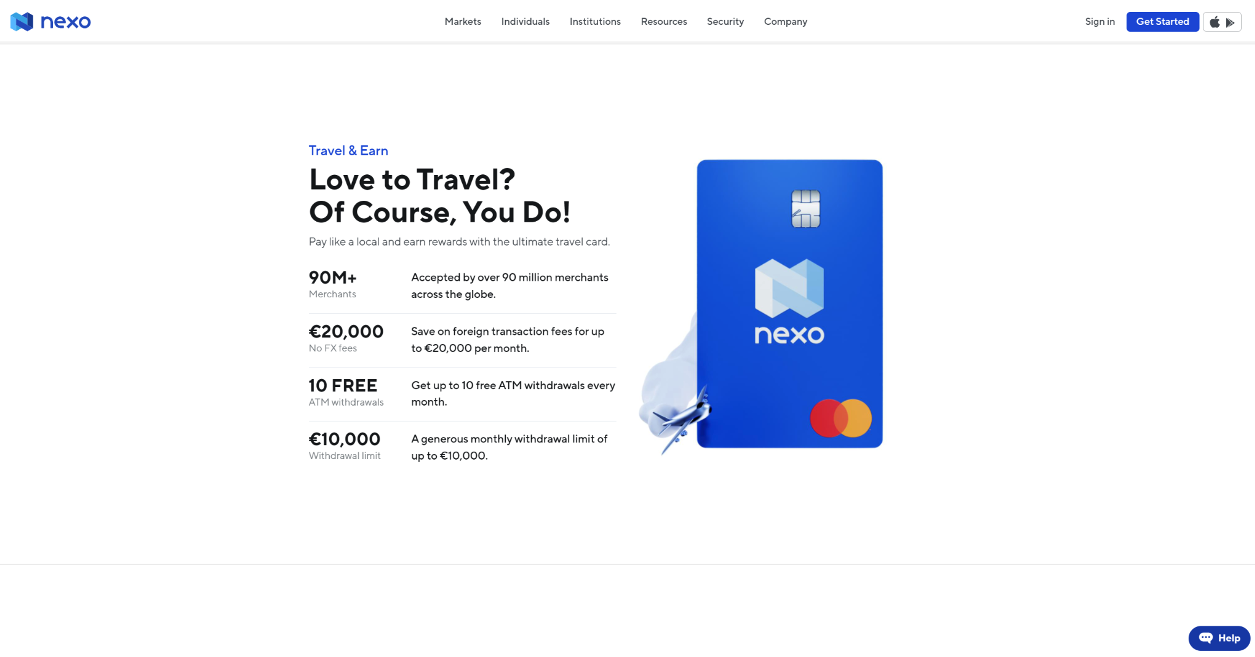

Works worldwide as a Mastercard: One of the best things about the Nexo Card is that it is a MasterCard – you can use it anywhere you want. The platform claims that you can use Nexo Card with millions of merchants worldwide and travel the world with the help of cryptocurrencies.

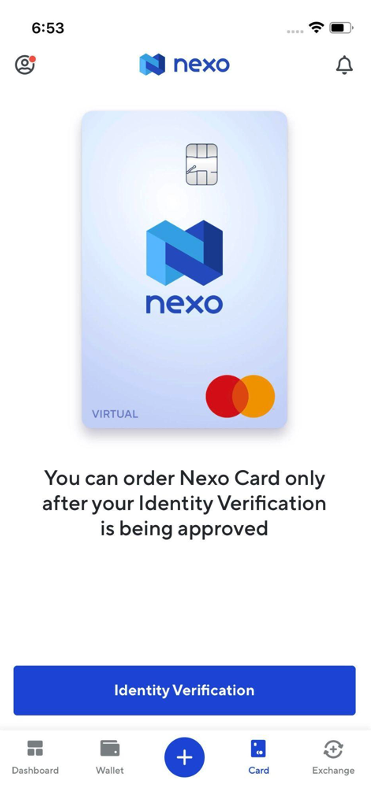

Available physically and virtually: You can also opt for the Nexo virtual cards that can be created within a second. Virtual cards have definitely made things easier due to their easy access and one-time use. In case you are skeptical about a website and want to remain on the safe side, you can use a virtual card provided by Nexo that is low on funds and then make a transaction. You will be able to securely process your transaction and shop wherever you want on the internet.

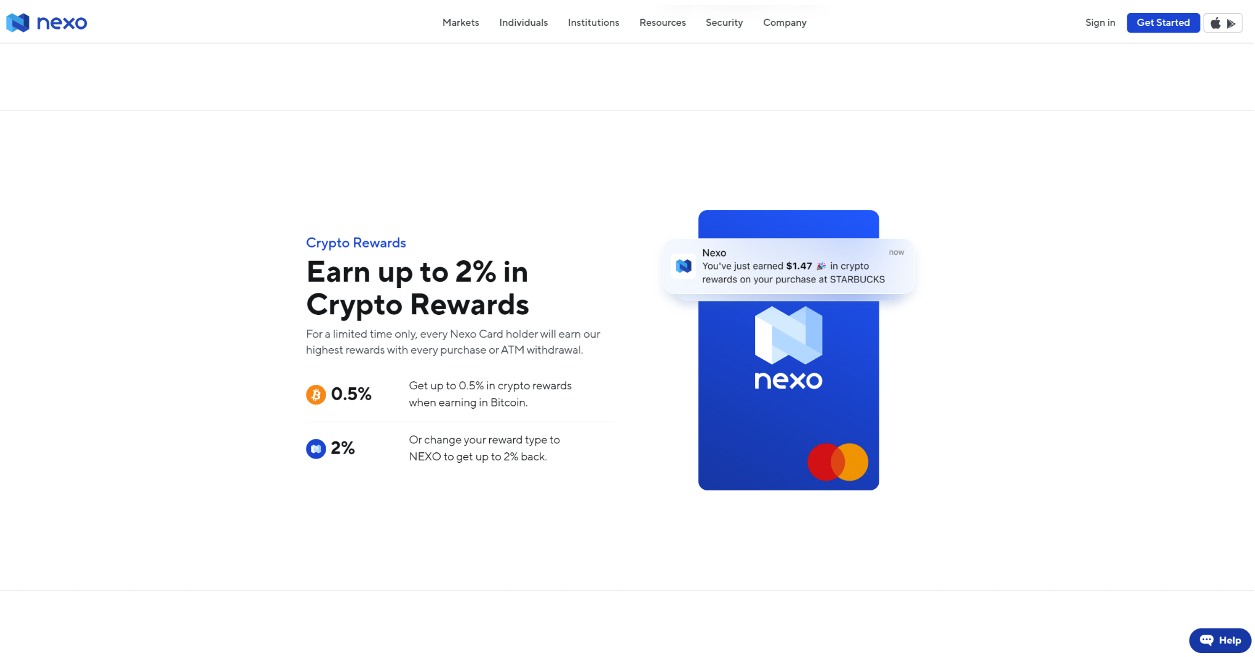

Earn up to 2% in crypto rewards: With every purchase you make with your Nexo Card, you get a 2% reward in NEXO coin or 0.5% in Bitcoin. It can be an amazing way to earn while spending money, and you can also save a lot. But do remember that this feature is temporary, and it might not be available in the future. So get as many rewards as possible now.

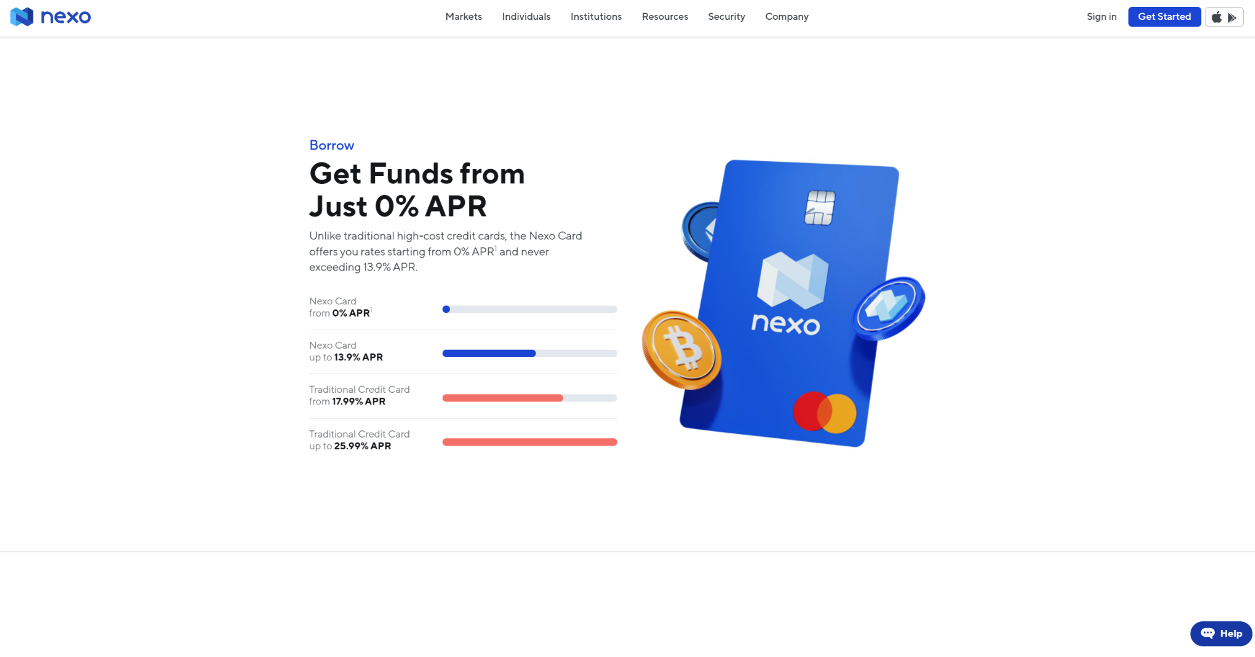

Borrowing rates starting at 0% APR: As Nexo Card works on the credit mechanism, the interest rate automatically becomes a factor. The good news is the starting APR of the card is literally 0%, and it never ever exceeds 13.9%. With traditional credit cards, users can pay interest as high as 15% to 25%. But with Nexo Card, you can have a cheap and budget-friendly credit card experience based on your cryptocurrencies.

No taxable liability: Taxable events mainly occur when you sell or purchase your cryptocurrencies. With Nexo Card, no sale or purchase of cryptocurrency is made as the platform lends you fiat currencies against your crypto collateral. In short, you save your money from being taxed, and you can easily spend a huge amount without paying a percentage to the government. But of course, lending comes with an interest rate that Nexo charges from its users, but you can still save a lot of money by paying zero taxes.

Up to ten free ATM withdrawals per month: While banking cards or other crypto cards charge several dollars for each withdrawal, Nexo Card offers up to 10 free withdrawals per month depending on your loyalty tier.

There are four loyalty tiers. Platinum users receive 10 free withdrawals, gold users get 5, silver users get 3, and basic users get one free withdrawal per month. If you use up all of your free withdrawals in a month, you have to pay a fixed fee of €1.99, which is quite reasonable considering the market prices and fees.

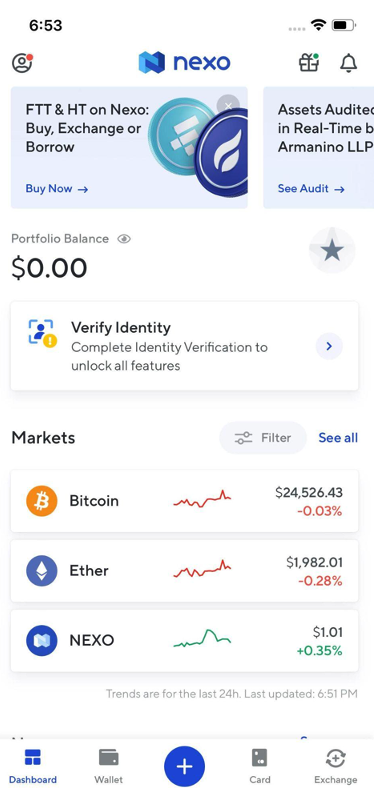

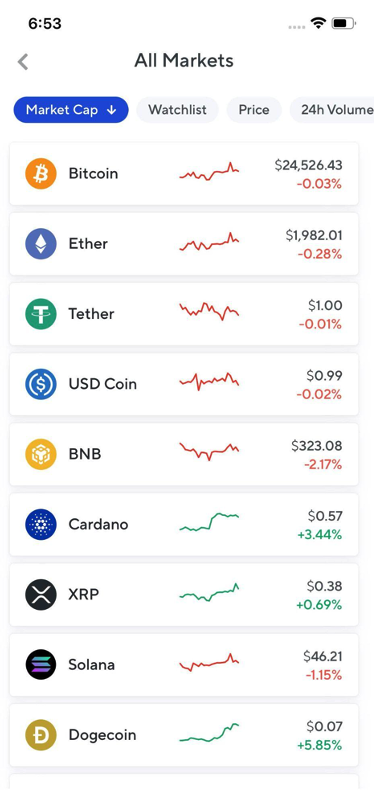

Mobile app available for easy management: It doesn’t matter whether you want to freeze your physical Nexo Card, use or create a virtual card, or any other function, the Nexo mobile app is available to help you manage your card. The Nexo mobile app is accessible on Android and iOS devices and users can access their funds and card management portal from anywhere.

The app is fast and efficient, and lets you access all the card features, as well as crypto trading, without any lag. Just make sure you have a suitable internet connection, and you will be good to go.

Excellet security and customer support: Nexo has not compromised on security, and made sure they comply with all the laws and regulations. They have also tightened their security system to minimize the risk of a hack or a breach.

Nexo has an integrated email support system and live chat system. I recommend you go with live chat if you want a solution quickly. Opt for email support if the problem is complex and you find it easier to explain in an email.

Things I Don't Like About Nexo Card

There are certain things about Nexo Cards that are definitely not ideal for some users. I have listed two of them below:

Only available for European users: Nexo Card is currently only available for European users. Nexo might have plans to expand in the future, but as of now, the platform seems to be focused on the European market only.

Works on a credit basis only: Nexo Card is a credit card that provides you access to money that you do not own. The platform charges an interest rate that you have to pay whenever you pay the platform with your cryptocurrencies. Of course, you also have to provide collateral in order to create a spending limit on your Nexo Card.

So, if you were looking for a debit card where you can instantly use your cryptocurrencies for payments, Nexo Card might not be the best choice for you. You might want to look at our article on the best crypto debit cards.

Nexo Card Fees

Nexo Card Order Fee

There is no fee for ordering a Nexo Card. You can simply head to the dashboard of your Nexo account and order your card from there without any cost.

Nexo Card Transaction Fees

The transaction fee on Nexo cards is absolutely free as long as you spend below the credit limit mentioned below, which depends on your loyalty level:

- Platinum: €20,000

- Gold: €10,000

- Silver: €5,000

- Basic: €3,000

If your spending on the Nexo card exceeds the limit, you have to pay a fixed fee of 0.5% for each foreign transaction.

Nexo Card ATM Withdrawal Fee

Nexo card users can get up to 10 free ATM withdrawals per month depending on your loyalty tier.

Platinum users receive 10 free withdrawals, gold users get 5, silver users get 3, and basic users get 1 free withdrawal per month. When you have used up all your free withdrawals, you will be charged a fixed fee of €1.99 for each ATM withdrawal.

Pros and Cons of Nexo Card

- The card can be used as a Mastercard worldwide

- Low interest rates, starting at 0% APR

- 2% cashback paid in NEXO tokens on each purchase

- Physical or virtual card available to suit your preference

- Up to 10 free ATM withdrawals per month

- Currently only available to European residents

- Only works on a credit basis

The Verdict

Nexo definitely deserves the credit for what they have delivered and designed, and it is unquestionably the next step towards a better crypto world. All they need to do is consistently focus on industry needs. Bringing new features and expanding their services would help the world a lot in accessing their cards, and it will surely help people utilize their cryptocurrencies in a better way.

So, if you are living in Europe and have not tried the Nexo Card yet, you might want to sign up for it right now. The cashback, rewards, and free withdrawals and transactions make it worthwhile to order the card, and begin using it anywhere in the world. For a limited time, you will also receive $10 FREE BTC for every $1,000 you spend before 31st December!

Frequently Asked Questions

Unfortunately, the Nexo Card is not available worldwide as of now. The platform has officially stated that only users residing within the European Economic Area (EEA) can order the card and use its services.

Absolutely! It is free to order the Nexo Card, and the platform won’t charge you anything even when you activate it.

Nexo Card is a credit card that works on the crypto collateral provided by the user. The platform charges an interest rate from users that vary accordingly.

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To view our privacy policy read this page.