Cryptocurrencies are revolutionising the finance industry, as they give you full authority over your funds. However, it is currently inconvenient to use cryptocurrencies for day-to-day purchases due to slow adoption in Australia. The introduction of the CoinSpot Mastercard addresses this problem by enabling you to use your cryptocurrencies as cash wherever and however you like.

Overview: What is CoinSpot Mastercard?

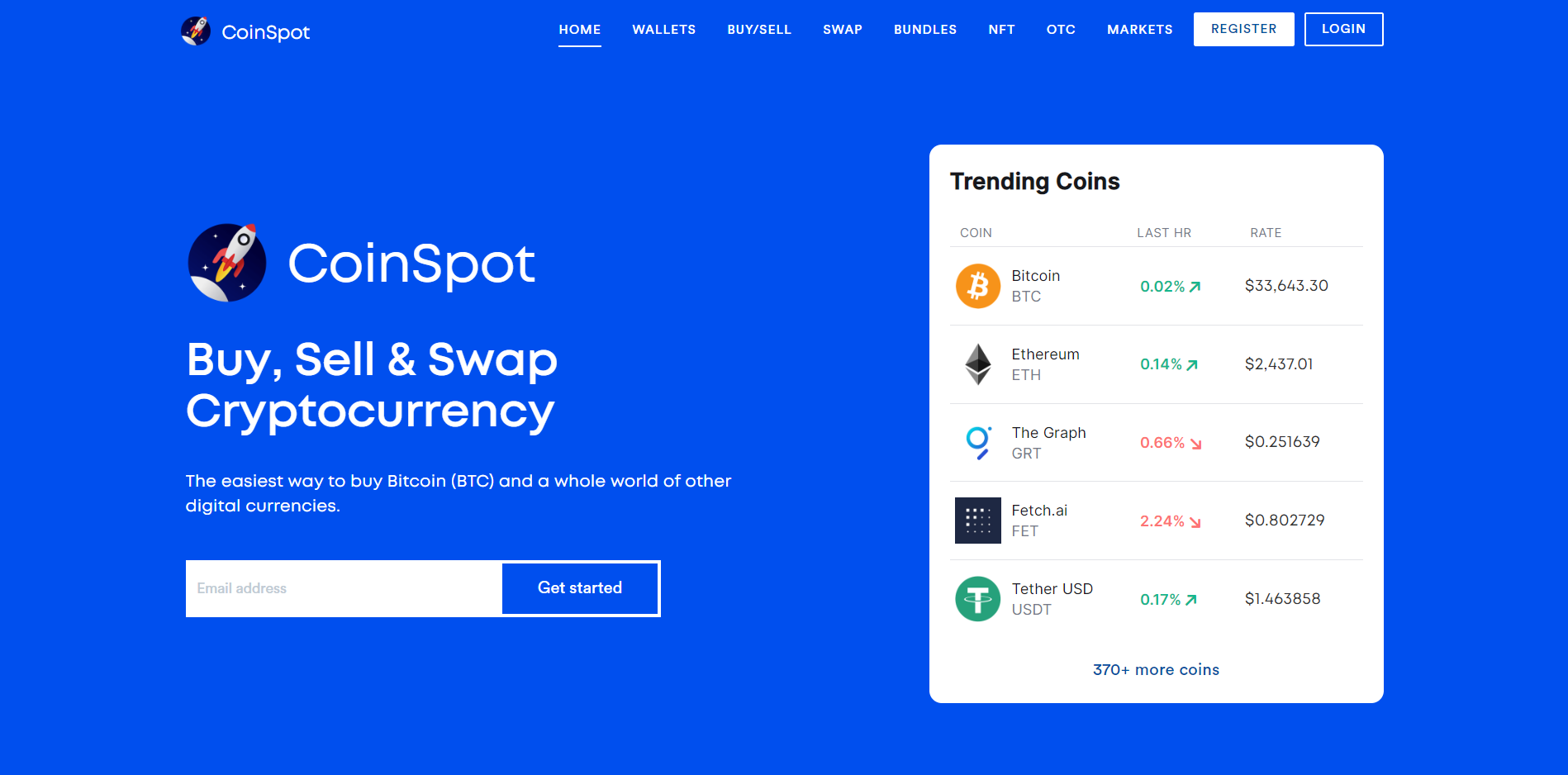

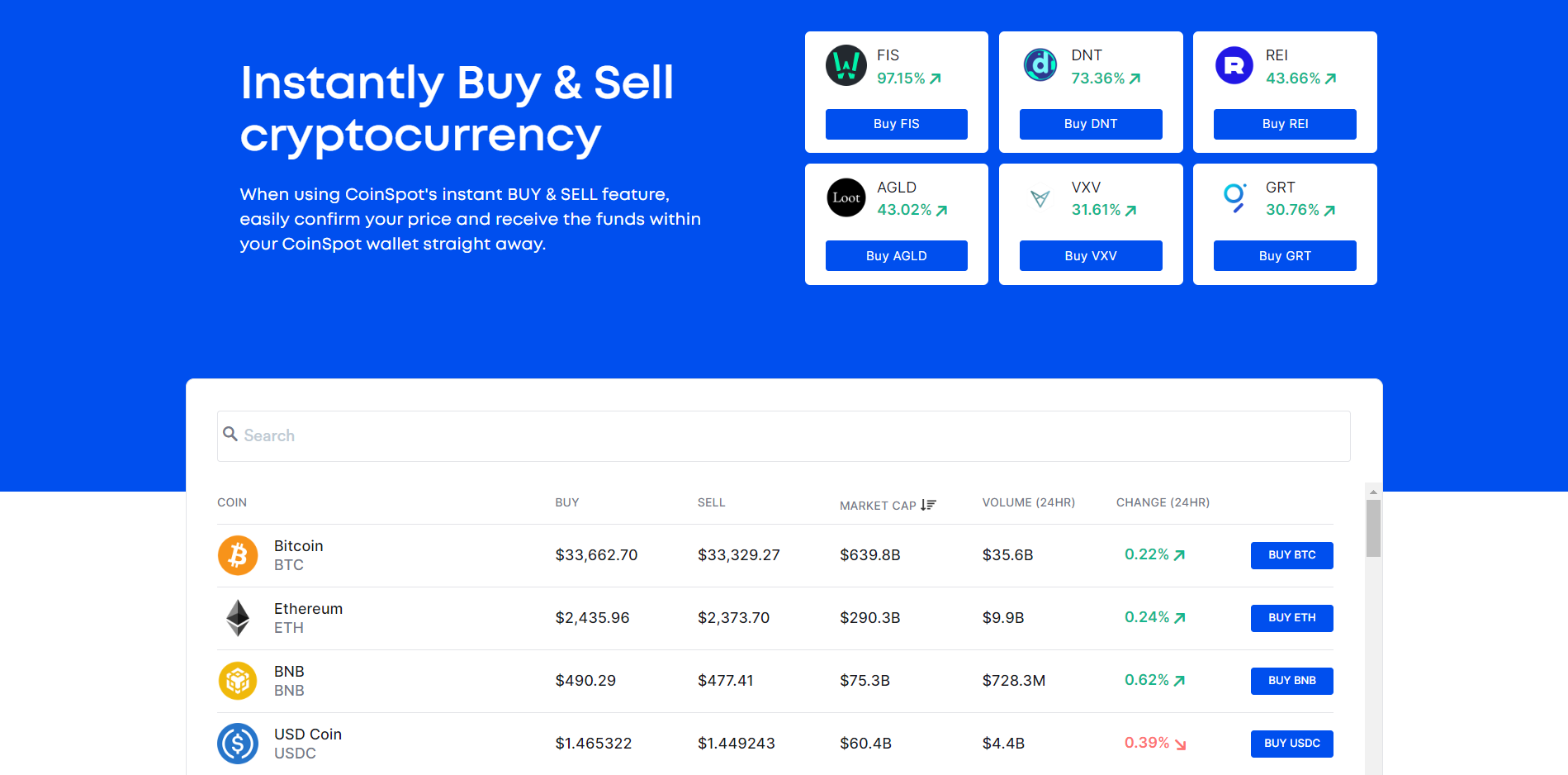

CoinSpot is an Australian cryptocurrency exchange that allows users to easily spend cryptocurrencies in their daily lives with their debit Mastercard. You can use CoinSpot Mastercard for online and in-store purchases just like your regular credit or debit card. With instant AUD conversion at the best rates, you can spend your cryptocurrencies easily without worrying about high international conversion fees. Any of the 430 cryptocurrencies available on CoinSpot can be spent on your debit Mastercard.

We were impressed when we tested out the card. We spent BTC, USDT, and ETH at over two dozen different stores, both online and in-person, with no issues at all. The fees are very reasonable, and it feels great that we can integrate crypto into our daily lives. Those who made a lot of money in past bull runs will love spending their crypto profits without having to convert it back to fiat first.

Pros

Cons

CoinSpot Mastercard Features

Use in-store or online with millions of merchants:

CoinSpot Mastercard comes with Mastercard perks. You can use your card in-store or make online purchases with millions of merchants from all over the world.

Access 430+ cryptocurrencies:

CoinSpot Mastercard supports 430+ cryptocurrencies.

Best exchange rates:

With instant exchanges at the best AUD rates, you can spend your cryptocurrencies without worrying about expensive fees.

Easy management:

With CoinSpot mobile app, you can keep track of and manage your card any time, wherever you are.

Connect with Apple or Google Pay:

CoinSpot Mastercard can be connected to Apple and Google Pay so that you can pay with your mobile device without carrying a card.

What makes CoinSpot Mastercard unique?

There are a few aspects that make CoinSpot Mastercard unique from other crypto cards. For starters, CoinSpot Mastercard is a debit and not a credit card. You spend whatever you have in your CoinSpot account rather than relying on credit offered by the platform. This way, you do not have to pay any interest, and you are only spending what you already own.

CoinSpot Mastercard can also be connected to your Apple or Google Pay account so that you can use your mobile to pay anywhere in the world without carrying a physical card. With easy activation and no annual fee, CoinSpot Mastercard is one of the very few crypto cards that offer such an affordable experience to their users. You can manage your CoinSpot Mastercard with the CoinSpot mobile applications and manage different crypto accounts through it.

How safe is CoinSpot Mastercard?

CoinSpot crypto card comes with all the Mastercard security features, which include identity theft protection, monitoring, alerts, and the best possible customer support. You need to keep your private credentials safe and secure in order to avoid any type of uncertain scenario. Keep your PIN and all the card details private and never use them on untrusted sources or websites.

CoinSpot also enables users to secure their accounts in several ways. You can choose a strong password, enable 2FA, and use face ID recognition so that no unauthorised party will be able to access your account through your mobile device.

What’s the protocol for getting a CoinSpot Mastercard?

It is really simple and easy to get your CoinSpot Mastercard. You need to be an Australian resident, as CoinSpot is an Australian crypto exchange. You need to sign up to CoinSpot, and verify your account with your real details. You will need to submit required documents so that CoinSpot can check your identity and adhere to KYC protocols.

After fully verifying your account, you can top up your CoinSpot account with AUD and then buy any cryptocurrency you want. You can also make direct crypto deposits through external wallets and get started instantly. After purchasing or depositing cryptocurrencies, you can navigate to the accounts section of your CoinSpot account and opt for the Mastercard option. That is where you can manage everything, link your card with Google or Apple Pay, and decide which crypto accounts you want to have.

How do I know if I’m eligible?

You are automatically eligible for CoinSpot Mastercard if you live in Australia, have a fully verified CoinSpot account, and have enough funds.

What cryptocurrencies can I use on the CoinSpot Mastercard?

CoinSpot Mastercard can be used with any of the 430+ cryptocurrencies available on the exchange, which is one of its best aspects. You can create up to 5 crypto accounts at a time for your CoinSpot Mastercard. You can prioritise any crypto account for usage, and if there is no balance in your first priority account, the amount will be charged from the second account in the list.

You can top up your CoinSpot Mastercard with popular cryptocurrencies like Bitcoin, Ethereum, USDT, Shib, Doge, XRP, and many more. With instant exchange rates, you will also be able to pay with your cryptocurrencies like real cash.

CoinSpot Mastercard Fees

There are no ongoing fees, card ordering fees, or card activation fees imposed by CoinSpot. There is only a flat 1% conversion fee when you shop with your CoinSpot Mastercard. However, you need to keep in mind that there is a daily limit of $4,999 AUD. If you exceed this, your card could be restricted.

Conclusion

Overall, the CoinSpot Mastercard is one of the best choices for spending your cryptocurrency like cash at an affordable rate. With easy management on the app, connectivity with Apple and Google Pay, and support of 430+ cryptocurrencies, you will have a hassle-free experience with your CoinSpot Mastercard. The best thing is it is easy and free to receive one. All you have to do is enable the security features for your CoinSpot account to ensure the safety of your funds and the card.