Frauds, identity thefts, hacks, breaches, incompetent management, and false claims are not new to the crypto industry. Since the very start, the crypto industry has faced many hurdles shackling the trust of the crypto community. Be it the Mt. Gox hack back in 2011, the sudden Luna crash, or Binance hack back in 2019, all of these incidents damaged the industry and questioned our belief in crypto. Now, it is FTX's turn - the 4th largest cryptocurrency exchange with millions of users and investors from all over the world. Within a week of the events, the company filed for bankruptcy, ceased withdrawals, and shut down their services.

The initial trouble for FTX started with their own native token, FTT, which became prey to the liquidity crisis, crumbling the entire exchange. Most of the FTT tokens were held by Alameda, a trading firm, with some reports even suggest that they were holding $14.6 billion worth of FTT tokens. With the huge sell-off from the big whale, FTT started losing its value, creating tension in the industry, which resulted in a stream of events where people started withdrawing their money.

The question is, where should we trade now? If you still believe in crypto and think the industry will grow, there are some good alternatives to FTX. Of course, it is essential to evaluate the reliability and security of the next crypto exchange you choose, and we have done the research for you.

Safest Alternatives to FTX

We have come up with the top 5 alternatives to FTX. These exchanges have been in the industry for a long time, serving millions of users. From our research, there have been no suspicious projects or activities related to any of these platforms. Have a read of our mini reviews and choose which platform best suits you.

#1. Bybit - Best alternative to FTX

Bybit is the #1 best alternative to FTX due to their security, reliability, and low fees. We did some digging to see the origins of the platform, and how trustworthy it is. Bybit was founded back in 2018 by Ben Zhou, the former General Manager of XM, an award-winning forex and CFD broker. Ben seems like a reliable CEO, as we could not find anything linking him to suspicious or illegitimate activities.

Bybit has over 10 million users, and is the third most visited crypto exchange in the world, but we still needed to see whether it could be fully trusted. After all, FTX was the 4th largest crypto exchange, and it was a huge shock when they collapsed. The thing that sets Bybit apart from FTX is that they have a proof of reserves system. Users can verify the holdings of the company, and authenticate that assets are held 1:1, giving complete transparency.

Now that you know Bybit can be trusted, what does it offer? There is so much to discuss, that you can read it all in our comprehensive review here. We will briefly cover some of the main points here. Firstly, Bybit offers more than 280+ coins, that you are able to trade using spot, margin, or derivatives trading. This gives you plenty of options depending on the specific type of trader you are.

Secondly, the low fees are an attractive feature of the exchange. Spot trading is only 0.1% for both makers and takers. Derivatives trading is even lower, at just 0.01% for makers and 0.06% for takers. When you are trading large volumes, it is so important to get the best deal you can with fees, as it adds up to large dollar amounts.

If you are new to trading, or simply don't have time to continually monitor the charts, Bybit caters for your needs too. There is a Copy Trading feature which allows you to follow a successful trader on the platform. Whatever trades he or she makes will be instantly executed on your own account with your funds. That way, you can profit from the knowledge and expertise of the best traders on Bybit. Another option is to use the free trading bots - these are set up by you to automatically make trades based on certain parameters, and ensure you never miss out on a trading opportunity.

Bybit's features, combined with a user-friendly interface and excellent customer support, make it the best choice for anyone looking for an alternative to FTX. If you sign up with our unique link, you will receive $10 BTC for FREE when you deposit $100.

The only drawback is that Bybit is not available for US users. If you reside in the US, we suggest you look at our #2 alternative, MEXC Global.

- Excellent range of 280+ coins

- Trade spot or margin trade with 100x leverage

- Transparent proof of reserves so you can verify assets are backed 1:1

- Copy Trading and Automatic Bots are available

- Professional trading layout with responsive customer support

- Not available for US users

- Fiat withdrawals are not supported

#2. MEXC Global - Best alternative to FTX in USA

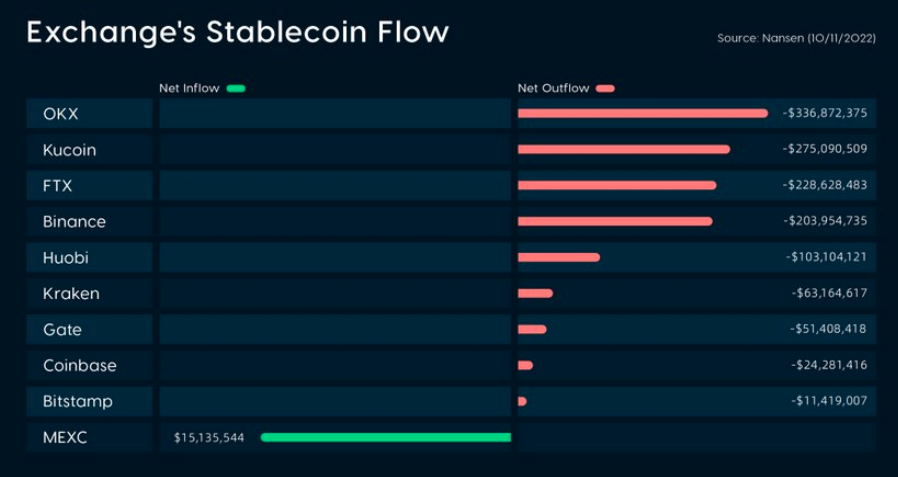

The next exchange on our list of FTX alternatives is MEXC Global, and it is our #1 choice for those who live in the US. The amount of trust in this platform is proven by the huge number of users flocking to MEXC immediately after the FTX collapse. We found this chart of stablecoin flow in the two days after the incident; you can see that massive exchanges like OKX, KuCoin, Binance and Huobi all had large net withdrawals from their sites, whereas MEXC saw net $15 million being deposited.

Moreover, according to a statement from MEXC Global, the trading system witnessed a new record 24-hour volume of over $20 billion spot trading, and $67 billion for derivatives, second only to Binance.

We did some investigating to see why so many crypto traders trust MEXC. We found that the company is built on the tenet of 'Customer First', and has always had a strict user reserve system, with all funds able to be redeemed 100% at any time. MEXC does not misappropriate users' funds for risky investments such as loans or DeFi mining. We are satisfied that MEXC is a trustworthy and legitimate crypto exchange and that's why we recommend it as our #2 alternative to FTX.

Taking a look at the services of MEXC, the platform provides their users an easy gateway to purchase cryptocurrencies with fiat assets. You can then trade on the spot or futures markets, with an enormous range of 1,520 coins, and more than 2,110 trading pairs. Fees are extremely low on MEXC, and in fact is FREE for market makers for spot and futures trading. If you are a market taker, the fees are 0.1% for spot trading, and 0.01% for futures.

MEXC has also introduced many earning options like staking, savings accounts, DeFi, and auctions that allow users to create a passive income stream. This is an excellent way to grow your cryptocurrency holdings while you HODL for the long-term.

If you ever find yourself requiring assistance, MEXC has a dedicated customer support team as well as communities on different social media platforms. You can even educate yourself with all the available guides and articles to help you become a better trader. If you are new to trading, or want to brush up on some skills, have a look at our FREE crypto trading course that we developed alongside MEXC. It includes step-by-step lessons with screenshots from our MEXC account so you can follow along easily. You will be trading like a pro in no time!

If you want to sign up to MEXC, use our link here, where you will receive $30 USDT for FREE, plus 10% discount on all your trading fees. To learn more about the exchange and its features, see our full review on MEXC here.

- Over 1,520 cryptocurrencies are available to trade

- Extremely trusted and secure exchange

- Instantly buy crypto with fiat

- Earn by staking, savings, and other methods

- High liquidity means your trades are filled quickly

- Fiat withdrawals are not supported

#3. KuCoin - Best for Trading Bots

KuCoin is #3 on our list of best alternatives to FTX. It is an immensely popular cryptocurrency exchange with more than 20 million users, serving one in four crypto users around the world. However, as we have seen from FTX, even massive crypto exchanges can have underlying issues. So then how do we know we can trust KuCoin?

We did a deep dive into KuCoin and we were able to find that they have transparent proof of reserves. This is public proof that KuCoin holds their customers' assets 1:1 on the platform. You can easily sign in and verify your own asset data. This way, you can see that it is always there and ready to be withdrawn when you need it. We tried this out with our own funds on KuCoin and can confirm that they are available. You can rest assured that your funds are safe when you trade on KuCoin.

KuCoin is an excellent alternative to FTX because it offers much of what FTX used to have, with many additional features as well. Firstly, KuCoin offers a huge range of 700+ coins, which is an improvement on FTX's list of 275 cryptocurrencies. When you are on KuCoin, you will able to find almost any cryptocurrency that you can think of, so you never have to worry about switching to another exchange. You can also trade spot, margin, or futures, giving plenty of choice to traders of all skill levels.

Fees at KuCoin are very low, with futures trading only 0.02% for makers and 0.06% for takers. Spot traders have fees of 0.1% for maker and taker, and if you pay your fees using KCS (KuCoin's native coin), you reduce this by 20%. If you are a frequent trader, you can take advantage of heavily reduced fees, based on your trading volume over the last 30 days.

One of the best features of KuCoin is their free trading bots. It is really simple to set up a bot that can trade based on your set parameters, ensuring that you never miss out on making profits from quick price swings. We experimented with a grid trading bot over a 1 month period, and made some decent gains without once having to sign into KuCoin to check on it. The more you can automate your trades, the more you have time for researching other investment opportunities. An additional benefit to bot trading is that you remove the emotion during trading. When you trade based on your emotion, you act irrationally and often lose money based on poor decisions.

KuCoin is an excellent alternative to FTX, and you can visit the site here, or read our full review and learn more about what it offers.

- Extremely secure, with 1:1 proof of reserves

- Low trading fees

- Trade over 700 cryptocurrencies

- Margin trade or spot trade

- Free automatic trading bots included in the platform

- No live chat customer support

#4. Margex - Best for margin trading

Margex is another excellent choice of crypto trading platform, and is popular among margin traders. To find out how secure the exchange is, we did some research. We found that 100% of all assets are held in a multisignature offline cold storage, which is higher than many other exchanges, who hold 95% or 97% offline. Moreover, Margex uses real-time monitoring and alerts for all asset movements, and they incorporate access segregation system, which prevents malicious employees committing fraud from the inside. Margex has also developed an intelligent system for monitoring suspicious trading, to prevent price manipulation, which we have not found on any other site.

Margex focuses solely on margin trading, so if you are inexperienced with trading, we do not recommend this exchange. Margin trading is very risky, and should only be conducted by experienced and professional traders. If you do choose to use Margex, you will enjoy the low trading fees of only 0.019% for makers and 0.06% for takers. If you plan on holding some of your coins for the long term, you can stake on Margex and earn up to 12% APY, which is very profitable for a low-risk activity.

One disadvantage of Margex is that it has a very limited range of 39 cryptocurrencies. While this is an issue for traders who like a wide array of markets to choose from, there is a positive aspect. It means that only the most popular and trusted cryptocurrencies are available, and you can't be tricked into making a poor trade with a scam coin.

- Multi-layered security

- 100% of all assets are held securely offline

- Earn up to 12% APY with staking

- Margin trade with low fees of 0.019/0.06%

- Margex has a system to monitor trades and prevent price manipulation

- Not available in the US

- Very limited cryptocurrencies are available

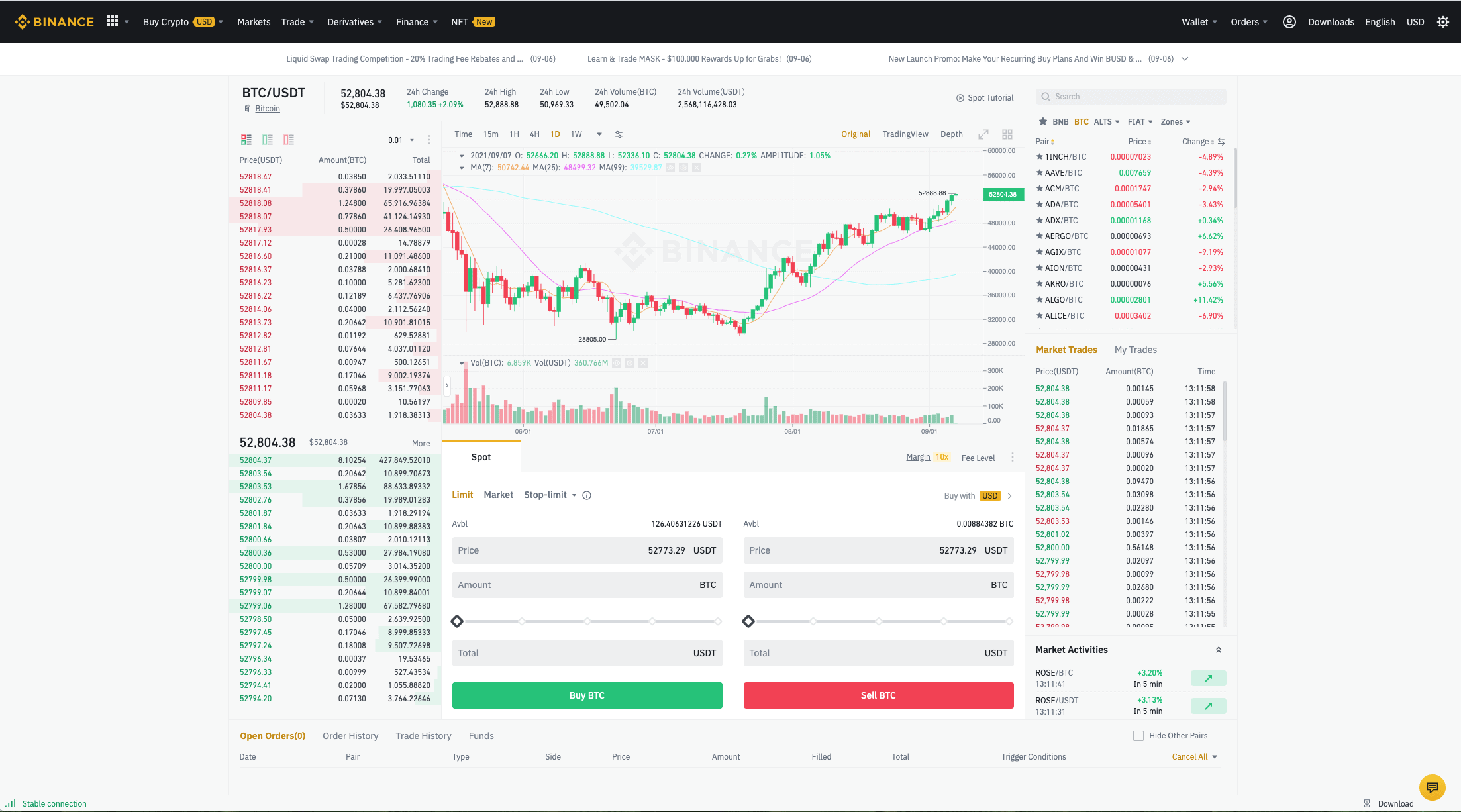

#5. Binance - Best for trading volume

Binance rounds out our list of the best alternatives to FTX. Binance is the largest crypto exchange in the world, with the highest daily trading volume, and 120 million users. Let's find out how safe their platform is before we look at the features.

We did some research into the company's transparency, and we found that they have proof of reserves, meaning they have evidence that all users' funds are covered 1:1, with some additional reserves. This is completely separate to Binance's corporate holdings, so there is no worry about your personal funds being spent by the exchange. They also use a cryptographic tool called a Merkle Tree that allows users to verify their own funds. We tested this out, and the process was quite straightforward. All you need to do is log in to Binance, click 'Wallet', then 'Verification'. You can then choose the date to check, and find confirmation of verification type, your Record ID, the assets that were covered, and your asset balance at time of verification.

Binance is hugely popular around the world because of the huge range of features it offers. You can instantly buy/sell crypto, spot trade, margin trade, earn interest, buy NFTs, and much more. There are over 600+ cryptocurrencies available, and trading fees are only 0.1%, which can be reduced by 25% if you pay using their coin, BNB. Frequent traders can reduce fees further based on trading volume over the last 30 days.

To learn more about Binance, you can read our review here, or visit the official site to explore what they have to offer.

- Over 600+ cryptocurrencies listed

- Different trading markets, including spot and derivatives

- Buy cryptocurrencies instantly with 40+ fiat currencies

- Earn by staking, farming, liquidity pools, and other methods

- Largest crypto exchange in the world

- Not available in the USA

- Strict identity verification process

Frequently Asked Questions

Will FTX users get their money back?

It is possible for the FTX users to get their money back, or at least a good chunk out of it, if not complete. But the whole process can take days or even months due to the legal actions and procedures.

What are the best alternatives to FTX?

There are a few good alternatives to FTX, including Binance, Margex, and ByBit, that you can go with and have a safe trading experience.

Will FTX start offering their services again?

It is very unlikely for FTX to start offering their services again after they file for bankruptcy.

How to not fall prey to unreliable cryptocurrency exchanges?

If you do not want to fall prey to unreliable cryptocurrency exchanges, you will have to do some background research, and check the overall standing of the exchange, how big of a community they have, and the projects they are working on before signing up for one.

Is it safe to trade with Binance?

Binance is one of the safest cryptocurrency exchanges having over a hundred million users from all over the world and the best safety and security precautions.

Conclusion

If you were one of the unfortunate users of FTX who fell victim to their bankruptcy, it can feel hard to move on. But if you believe in cryptocurrency, you would know that the crypto industry itself is not at fault here. Instead, it is the failing of a private company due to poor management decisions.

Instead of losing hope, we should look at the positives - in the aftermath of the FTX saga, crypto exchanges are publishing proof of reserves and increasing transparency about how they manage, store, and use funds. We can now have increased trust in legitimate cryptocurrency exchanges, that are doing the right thing. If you choose any of the alternatives on this list, you can rest assured that you will be trading on a safe and trustworthy platform.

Frequently Asked Questions

It might be possible for FTX users to get their money back, but the whole process could take months due to legal actions and procedures.

There are a few good alternatives to FTX, including Bybit, MEXC, and KuCoin, which we discuss in this article.

It is very unlikely for FTX to start offering their services again after they file for bankruptcy.

If you do not want to fall prey to unreliable cryptocurrency exchanges, you need to do some background research. Check their proof of reserves, and security protocol before signing up to a crypto trading platform.