Key Takeaways

- The two popular ways of earning interest on Ethereum are staking and lending.

- Staking is a popular way of earning interest and also supports the security of crypto, while lending allows investors to lend their digital assets to various borrowers.

- While staking and lending are both good options, they both come with downsides that need to be considered.

- Bybit is one of the best platforms to earn interest on Ethereum.

Ethereum is, by far, one of the best performing digital assets ever. This cryptocurrency rose from a price of only $0.31 back in 2014 to over $3,500 in 2022. A lot of investors are confident that the price of Ethereum (ETH) will continue to rise in years to come.

An excellent way to build the amount of ETH you own, without spending more money, is to earn interest on it. In this article, we will cover how and where to earn interest on Ethereum.

Two Ways to Earn Interest on Ethereum

To understand how you earn interest on Ethereum, you can think of it like depositing cash into a savings account. The depositor earns interest on the money while it is held in the bank, and is rewarded after a certain amount of time has passed.

Staking

Staking is one of the most popular ways of earning interest on crypto holdings. It also supports the security of crypto, as users who stake are validating cryptocurrency transactions.

Security

One of the factors that makes staking a safe investment option is that your money never leaves your digital wallet. On some platforms, you need to lock your funds for a certain period of time, but the ETH is not removed from your wallet. However, you must remember that during any lock-up period you won’t be able to withdraw, sell, or trade your funds.

How much interest can I earn by staking ETH?

The reward rate for staking ETH depends on a few factors, such as how much you stake, and how much staking competition there is across the blockchain.. At the time of writing, the annual percentage yield (APY) rewards for Ethereum are around 5%.

What to know before staking ETH

As mentioned above, staking often requires you to lock up your funds for a period of time. Keep in mind that crypto prices tend to be volatile and can drop pretty quickly. If Ethereum suffers a big price drop, it may outweigh the interest you earn on your coins.

Lending

Crypto lending allows investors to lend their digital assets to various borrowers. In return, you receive interest payments, often called “crypto dividends”.

Security

Although crypto lending is not a risk-free investment strategy, the potential return often justifies the risks. The best thing you can do to minimize the risk of crypto lending is to only invest with an established provider.

How much interest can I earn by lending ETH?

When it comes to the rewards you can earn from lending, each platform will offer their own interest rates. From our research, we found that lending rates for Ethereum usually range from 2% to 8%.

What to know before lending ETH

If you decide to lock up your crypto in return for a higher lending rate, you won’t be able to cash it out if the market swings dramatically. Unlike staking, crypto lending requires you to deposit your funds to a certain exchange, and does not remain in your own wallet. This means you have to find a trustworthy crypto exchange that you can trust with your Ethereum.

Taxation And Regulations

Crypto staking is a yield-earning product and it counts as regular taxable income, just like mining. In other words, you owe tax on the crypto rewards you receive. Still, the exact tax rate can depend on a lot of factors such as the country you live in and jurisdiction. Although most countries count crypto gains as Income Tax or Capital Gains Tax, there are some countries where you do not get taxed on crypto.

Likewise, earning interest from lending crypto may be subject to capital gains tax or income tax, depending on your country's local regulations.

Staking vs Lending Ethereum? Which is safer?

When it comes to Ethereum staking vs lending, a lot of people are wondering which option is safer. With enough knowledge and experience, both options make a pretty good choice. Still, they both come with downsides that everyone, especially beginners, need to consider.

The main downside to staking is that in a lot of cases, it includes a lock-up period. While it may not seem like a deal at first, it is definitely something to be considered. Since you won’t be able to access your assets for a certain duration, you may lose money if the price drops dramatically, and you are unable to sell it or convert it back to fiat currency.

Even though crypto lending offers higher rates than staking, it also tends to be a bit more risky. With lending you will have to pay attention to a few things, including margin calls, illiquidity, and unregulated crypto lending platforms.

Best Places To Earn Interest On Ethereum

Earning interest on ETH is one of the best ways to make your crypto work for you if you are HODLing for the long term. Choosing trustworthy platforms that you can rely on is the most important consideration. We have done our research on the best platforms to earn interest on ETH, and come up with this list. They are all easy to use, with no complicated terms or requirements.

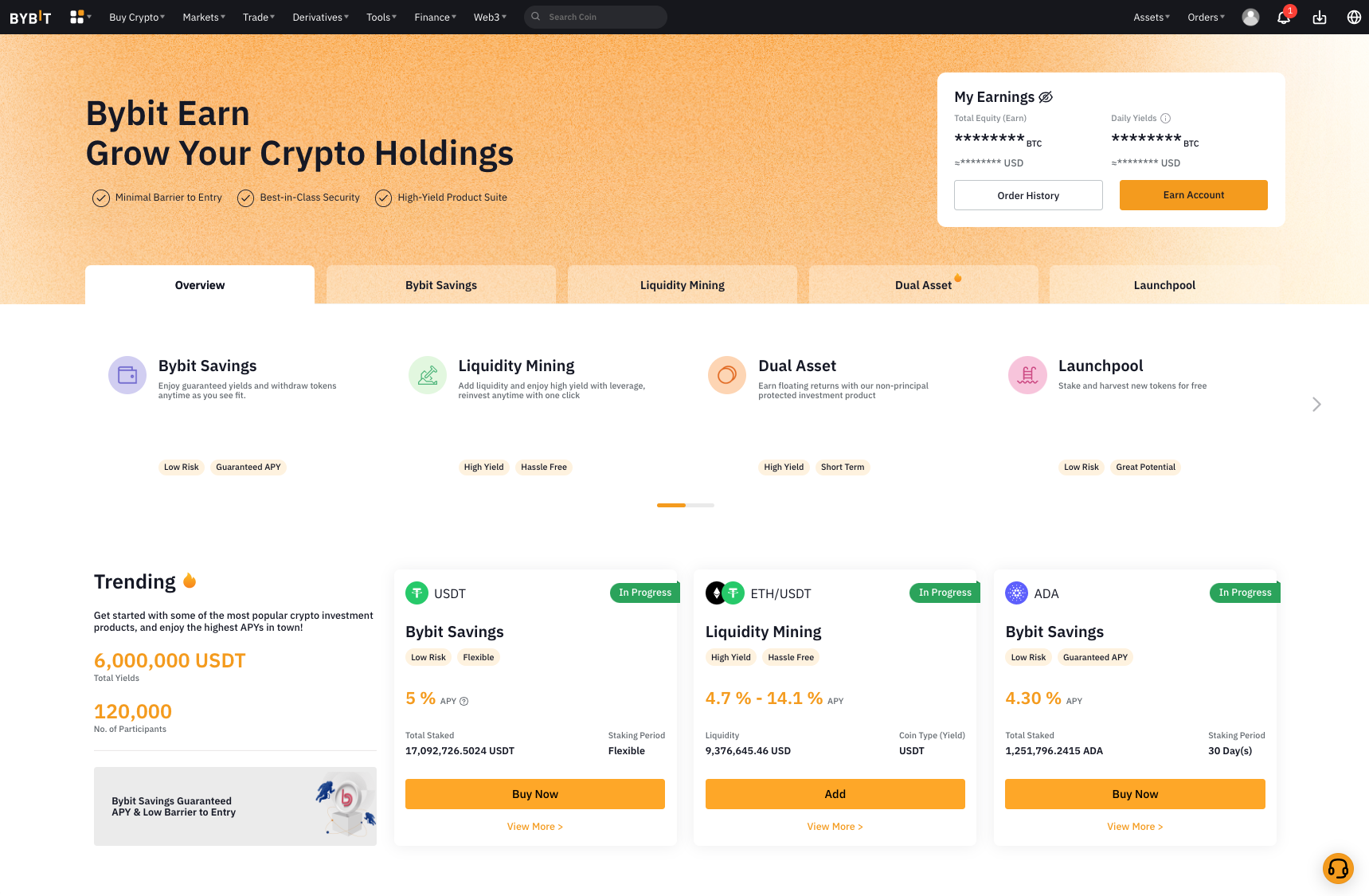

#1. Bybit

Bybit was launched back in 2018 in Singapore as an advanced derivatives and margin trading exchange. It has grown quite a lot since then and currently boasts more than 10 million users worldwide. Besides being focused on trading, Bybit has introduced an 'Earn' section, where you can earn interest on Ethereum.

If you use the Bybit Savings account to stake Ethereum, you can earn 1.80% APY if you lock for 60 days, or 1.00% APY when you lock for 30 days. If you prefer flexible staking, the rate is 1.20% for your first 0.2 ETH, then 0.08% for 0.2 to 1 ETH, and 0.05% for > 1 ETH.

Bybit also offers Liquidity Mining for Ethereum, where you can receive rewards of between 4.7% - 14.1% APY.

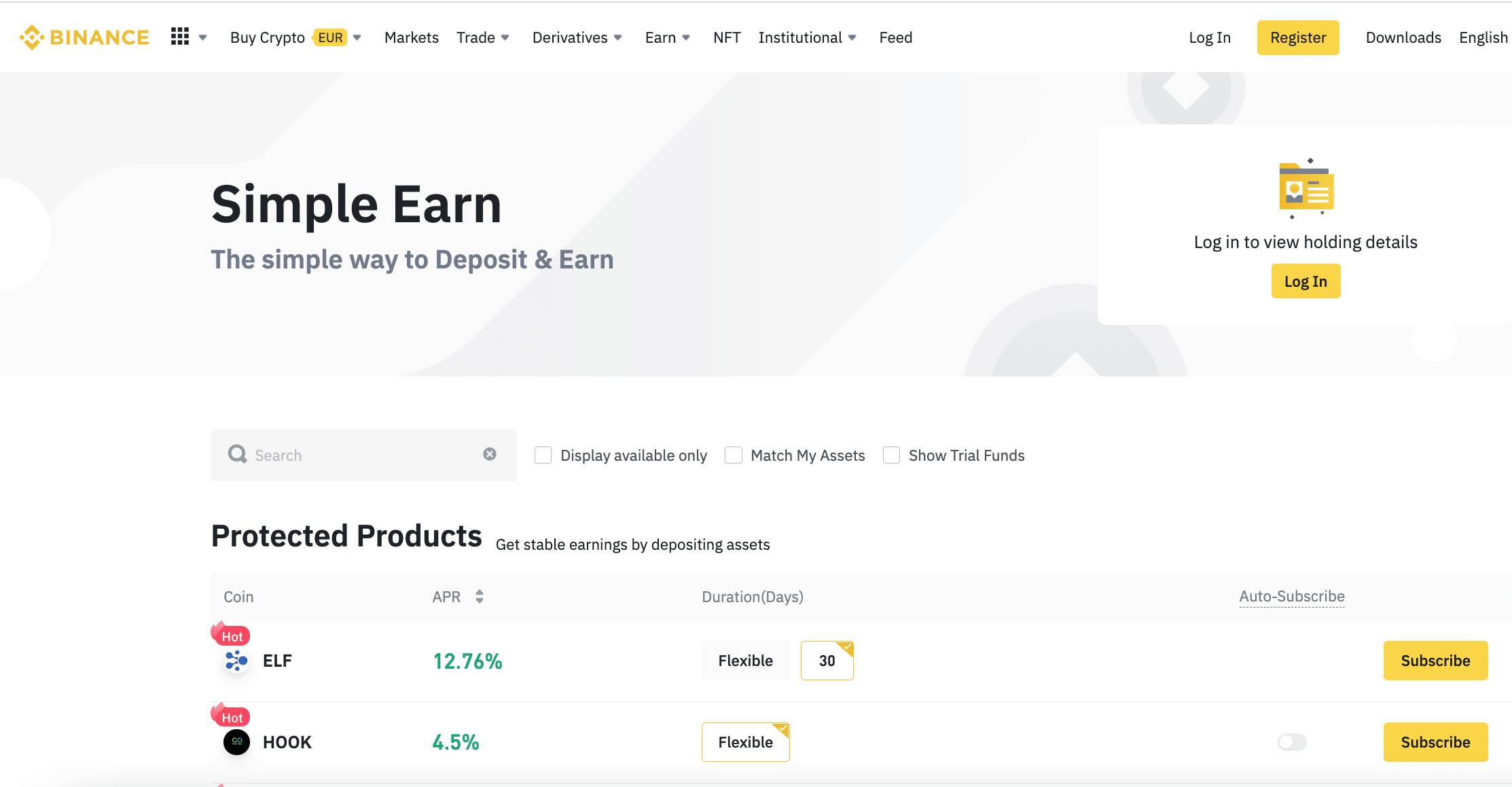

#2. Binance

When it comes to the number of reputation and number of users, Binance is one of the best cryptocurrency exchanges you can find. The range of services it offers is quite extensive and includes dApps, NFT Marketplace, and Binance Earn. Binance Earn is a service that allows their users to earn interest on ETH and many other listed assets.

Binance has the largest trading volume in the world, and more than 600+ cryptocurrencies. You can easily purchase Ethereum (or many other cryptocurrencies) to stake, and earn generous interest rates. There is an option to stake Ethereum 2.0 and earn up to 11.2% APR. Alternatively, you can earn 1.2% on ETH with flexible earn, and withdraw it at any time.

#3. Crypto.com

Crypto.com is one of the best crypto exchanges for earning interest on various cryptocurrencies, including ETH. This mobile app was founded back in 2016 and has established a great reputation. Cronos (CRO), the native token of Crypto.com, has increased in value and is one of the top 20 coins by market cap.

Crypto.com offers a varying interest rate on ETH, based on several factors: length of time you lock your ETH, how much CRO you have staked, and the amount of ETH you stake. For example, if you lock in your ETH for 3 months, and don't have any CRO staked, you can receive 3% APY on your first $3,000 of ETH. If you stake more ETH, you will receive reduced rates on the additional amounts.

If you are a big believer in CRO, and you have more than $40,000 CRO staked, you can receive a maximum of 6% APY when you lock for 3 months.

Our Final Verdict

We have shown you various options for earning interest on ETH, and our top suggestions. Be sure to check the current interest rates on any platform you choose, as they vary from time to time. You can also check our 'Crypto Earn' section in the menu to learn about other cryptocurrencies you can stake.

Frequently Asked Questions

How do I earn interest on my crypto?

If you don’t have much experience when it comes to crypto, you should aim for the safest options first. We highly recommend you to check the platforms mentioned above as they offer a high degree of safety and still allow you to earn great interest rates on your assets.

How do you get passive income with Ethereum?

If you are looking for the best way to earn passive income on your ETH, there are a couple of things to do. The main methods of earning passive income you should try out first are crypto staking and crypto lending. Both come with some ups and downs and thus, you should choose the ideal one for you based on your plans, the level of expertise, etc.

How do you earn interest on ETH Coinbase?

Coinbase is a platform that allows users to stake Cosmos, Tezos, or Ethereum and earn up to 5% interest rate. Still, the rate can vary depending on a few factors. All you need to do to start staking Ethereum is:

Go to Coinbase and click on the “Assets” tab

Select Ethereum

Enter the amount

Press “Stake Now”

Frequently Asked Questions

If you don’t have much experience when it comes to crypto, you should aim for the safest options first. We highly recommend you to check the platforms mentioned above as they offer a high degree of safety and still allow you to earn great interest rates on your assets.

If you are looking for the best way to earn passive income on your ETH, look at our suggestions in this article. We recommend Bybit as it has high earnings and is a secure and reputable exchange.

Coinbase is a platform that allows users to stake coins such as Ethereum, Cosmos, and Tezos and earn up to 5% interest rate. All you need to do to start staking Ethereum is:

- Go to Coinbase and click on the “Assets” tab

- Select Ethereum

- Enter the amount

- Press “Stake Now”