Investing in lesser-known altcoins can be a good way of earning profit and diversifying your portfolio. The only issue with this approach is that there are more than 22,900 crypto assets on the market at the time of writing. Going through all of them manually in search of the right investment opportunities is completely impractical for both novice and expert traders.

Fortunately, crypto screeners can help you get past this hurdle with ease. They are tools that allow you to scan cryptocurrencies based on filters like trading volume, liquidity, and more. You can use them to quickly navigate the crypto landscape and find your next investment.

Join us as we take a closer look at what makes a crypto screener good and build a list of our favorite screening platforms.

Criteria for evaluating crypto screeners

Here are some of the most important factors we consider when evaluating crypto screeners:

Variety in filters and sorting options

The variety in filters and sorting options is a massive consideration for us as it has a direct impact on the screener’s usability. For instance, a crypto screener with sorting options like price change within a certain time period is more useful than the ones that don’t.

Data accuracy

A crypto screener with inaccurate prices and other relevant market data is not worth your time or money. Even small discrepancies in this data can lead to massive trading losses.

User interface

The crypto screener should be easy to navigate with a user-friendly UI. But, these UI improvements should not have a negative effect on the usability and information density of the screener.

Technical analysis tools

Basic line graphs for price movement are an essential part of analyzing a crypto asset, but it is not enough on its own. Traders will need more advanced technical indicators if they want to use a crypto screener for creating and modifying trading strategies.

Mobile interface

Even the most active traders will have a hard time sitting at their desks at all times. This makes a usable mobile app or web interface necessary to give traders the ability to monitor and find crypto assets anytime they want.

Pricing

We don’t mind paying a subscription fee for a useful crypto screening service. But this fee should be fair and reflect the platform’s features and benefits.

Top crypto screeners

With these criteria and our personal experience with these platforms in mind, here are the six best crypto screeners on the market:

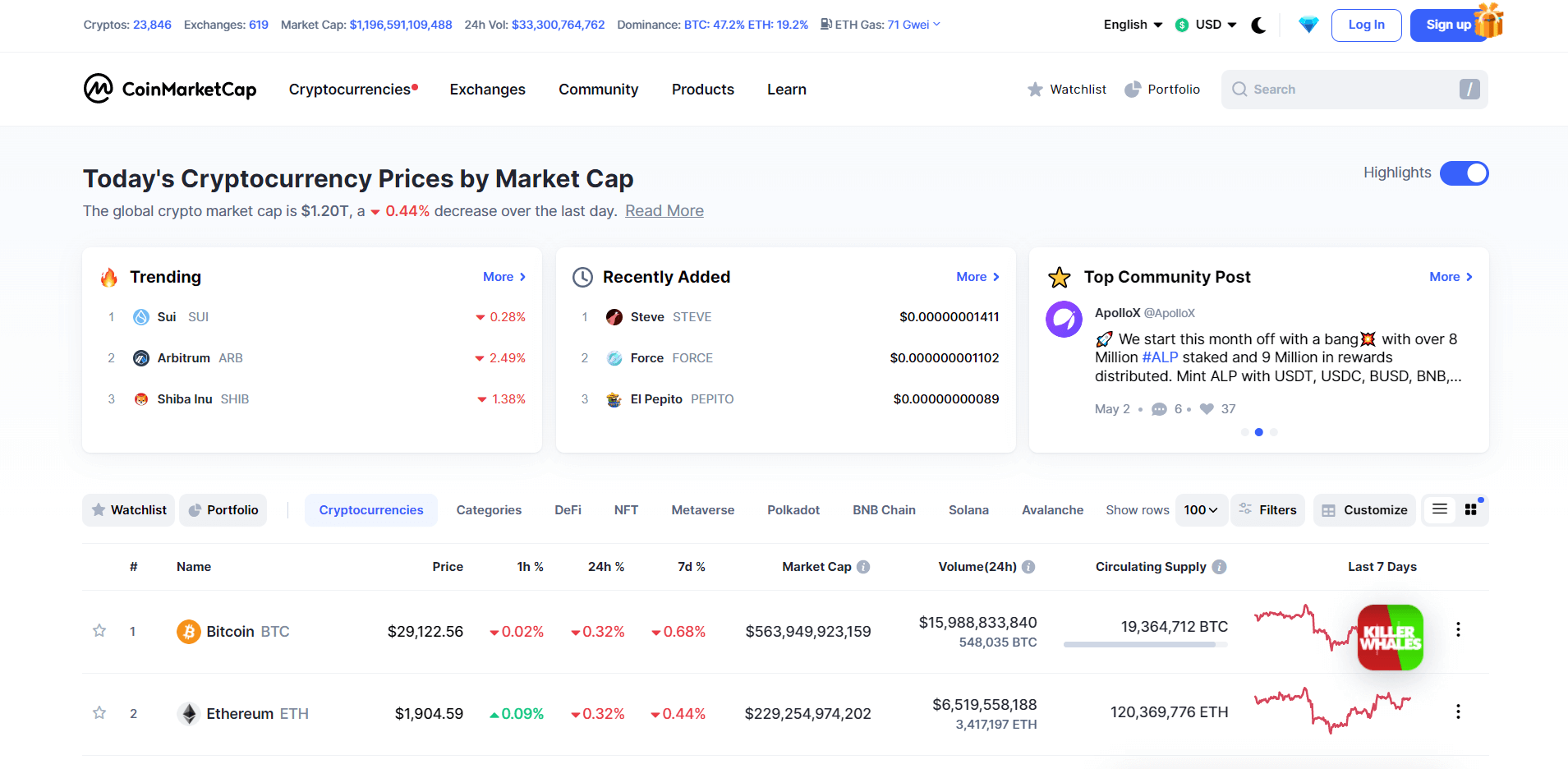

CoinMarketCap

CoinMarketCap (CMC) is one of the most popular crypto screeners on this list and one of our personal favorites. It is a complete crypto-tracking platform with 12+ filters that allows you to analyze an asset's historic price, current market cap, and more. It even has a section about the latest news about that particular asset so you can get a full picture of its market potential.

This crypto screener also features detailed categories for exchanges and other crypto products like NFTs as well.

However, the most notable feature of CoinMarketCap for us is its impressive coverage.

You can use this platform to find the relevant data on more than 20,000 crypto assets which include everything from BTC and ETH to the newest altcoins. This makes CMC a valuable tool for any trader who wants to invest in a wide variety of coins.

If you want to access all of this information on your phone, CoinMarketCap has an app available on both iOS and Android. From our use, this app does a great job of showing relevant information while also staying mobile-friendly without much clutter on your screen.

Pricing

CoinMarketCap is completely free to use.

Pros and cons

- Has an easy-to-navigate UI

- Does not require a paid subscription

- Supports over 20,000 crypto assets

- Offers plenty of educational resources for beginners

- Doesn’t have the most advanced charting tools and indicators

TradingView

It wouldn’t be wrong for us to say that TradingView is one of the most technically advanced crypto screeners on our list. It offers more than 50 different filters to help you locate your next crypto investment from its 700+ supported assets.

Where TradingView truly shines is its technical analysis tools variety. In total, this crypto screener features more than 100 pre-build indicators and 90+ drawing tools. From there, you can overlay up to 20 different technical indicators on each crypto chart to get a better understanding of its current valuation and future potential.

Pricing

TradingView has three pricing tiers. These are:

You can also get discounts on all of these tiers by choosing to pay yearly instead of monthly.

Pros and cons

- Available on Windows, MacOS, Linux, iOS, and Android

- Large number of technical analysis tools

- A decent free version to test the service before purchase

- Ideal for expert traders

- Might take some time to learn its layout for novice traders

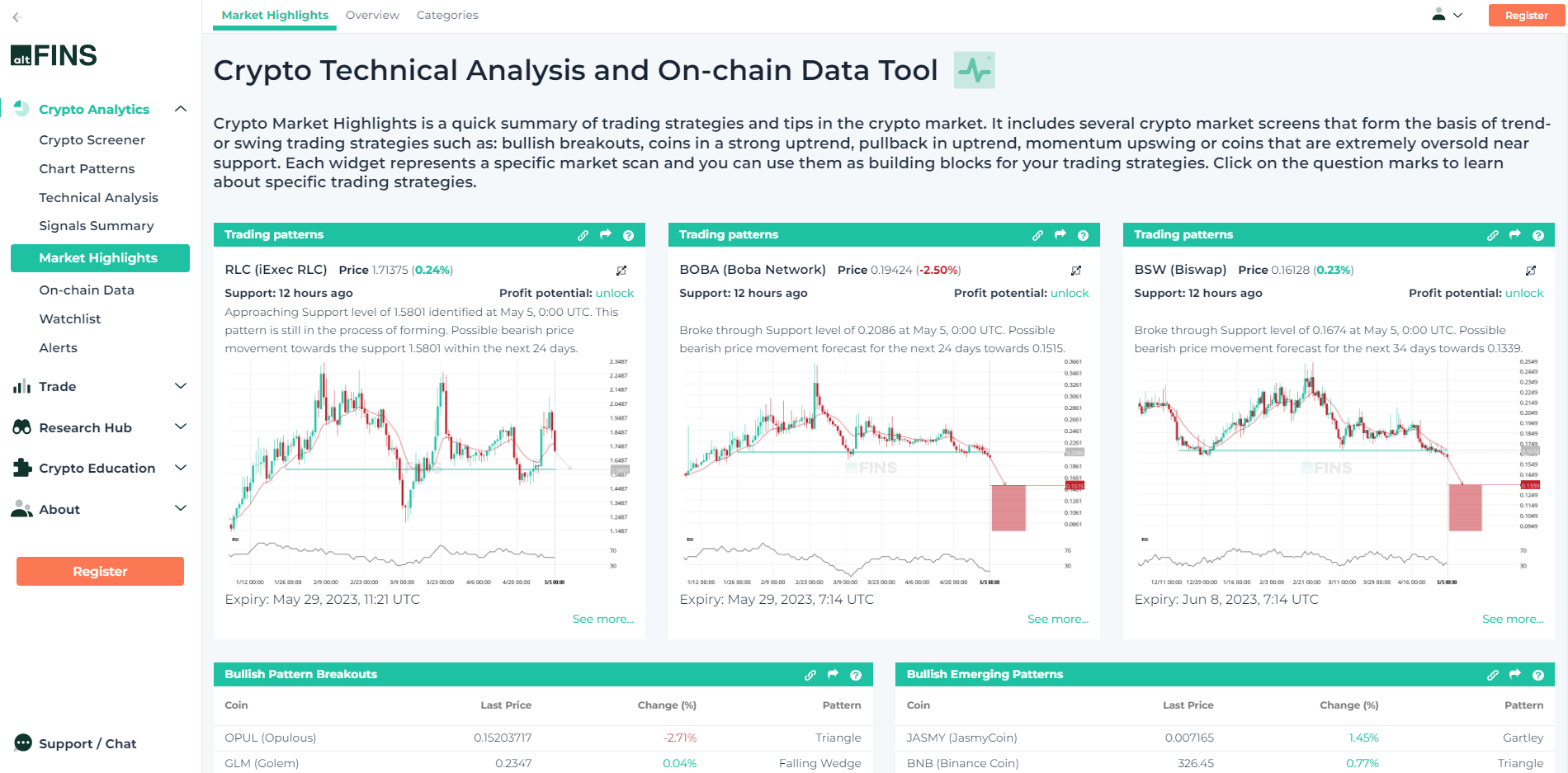

altFINS

altFINS combines the positives of both CoinMarketCap and TradingView into one platform. For instance, it allows you to screen more than 2,700 crypto assets, from the market toppers to obscure new coins. You can also sort these assets with a massive number of filters such as oscillators, trends, moving averages, and many more.

On the other hand, each of these asset charts is also equipped with several technical indicators for deeper analysis.

These features combined with the easy-to-understand UI of altFINS make it a stepping stone for newer traders. This crypto screener can be the platform that helps them expand their portfolio and upgrade their trading strategies with ease.

Pricing

altFINS has four pricing tiers for its service, including:

Similar to TradingView, you can also get large discounts by choosing to pay on a yearly basis.

Pros and cons

- Features notable filters and charting tools

- Has an easy-to-understand and beginner-friendly UI

- Provides data on an impressive 2,700+ crypto assets

- Its mobile app is a bit difficult to use

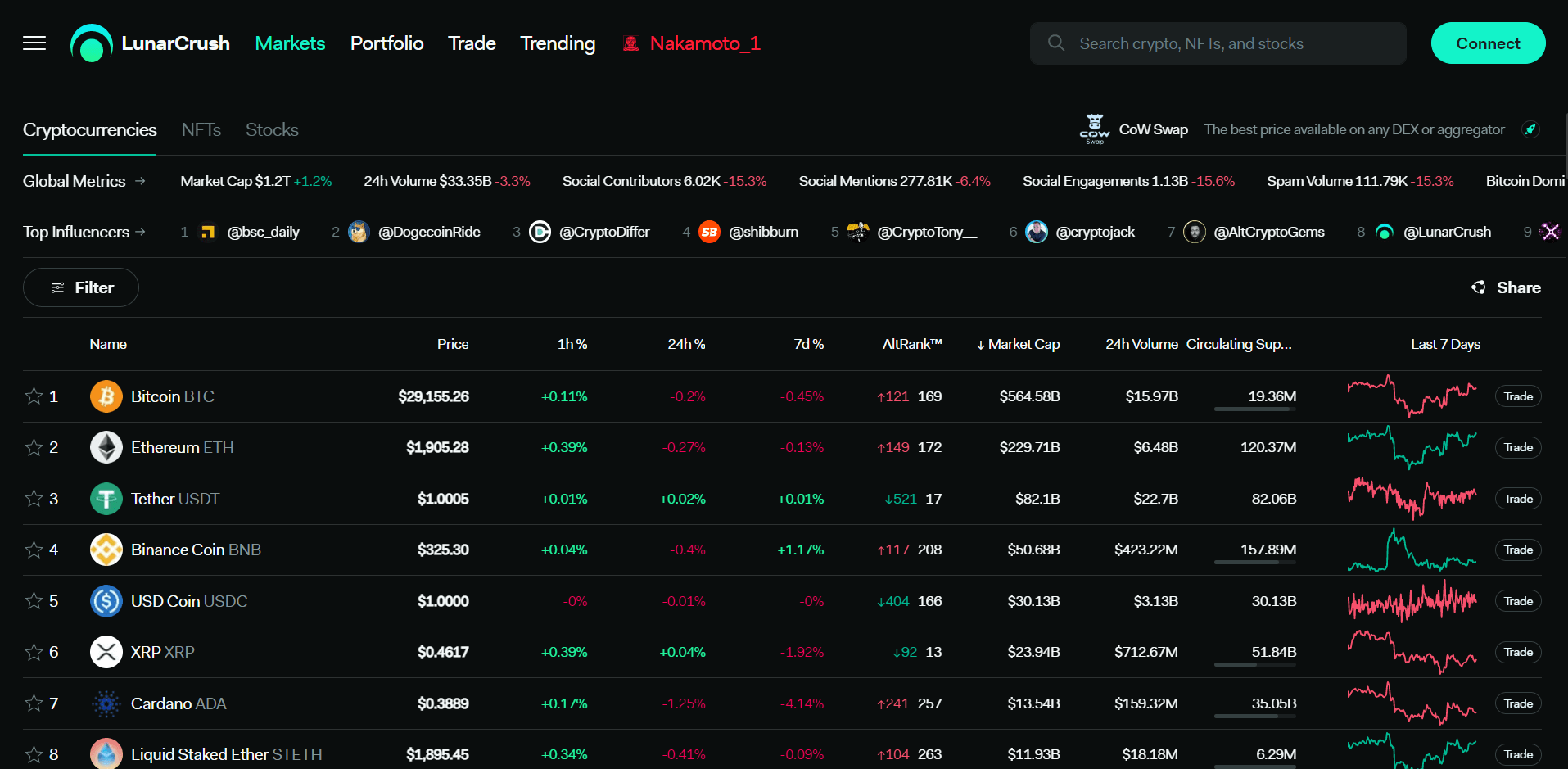

LunarCrush

LunarCrush looks like a normal crypto screener at first glance with 3,900+ supported assets. But, take a peek under the surface and you’ll find an AI-powered platform that makes finding the right crypto investments a whole lot easier.

In terms of raw numbers, LunarCrush has only eight filters. But this number does not matter in practice because LunarCrush’s smart algorithm provides automatic insight into the top-performing coins and NFTs on the market.

This makes it a solid consideration for newer traders who want to stay ahead of the curve, but lack the experience to utilize complex technical indicators. Expert traders can also use this crypto screener to validate and update their existing strategies or come up with new approaches.

Not only that, but LunarCrush also comes with a built-in portfolio tracker that allows you to manage all of your crypto assets from one platform.

Pricing

General use of LunarCrush is free. But, some features are locked behind the amount of LUNR cryptocurrency you hold.

Pros and cons

- Suitable for beginners and experts

- Helps you analyze social media sentiment about an asset

- Has an intuitive layout and interface

- Has a limited number of manual filters

Messari

We included Messari on this list because of its excellent collection of useful filters. Each of the 100+ available filters on this crypto screener has a use of its own. For example, you can use the “Volatility” filter to find coins with stable prices for long-term investments. Similarly, the “DeFi Assets” filter can help you locate coins associated with leading deFi projects on the market.

Messari also offers a detailed analysis of over 2,825 different assets at the time of writing with metrics such as 1H Range, Cycle Low, ATH, and more.

One of the interesting aspects of Messari, however, is its UI. It is unlike any other crypto screener we’ve seen which does mean it has a slight learning curve. However, once you have a general idea of its layout, using this screener for crypto analysis becomes super efficient and saves a lot of time.

Pricing

Messari offers a free version that doesn't even require you to sign up, but it has a very limited number of filters and indicators.

To use all of the features, you will have to upgrade to the Pro version for $29.99 per month. Before that, you can also try out Messari Pro using the free 7-day trial period.

Pros and cons

- Good value for your money

- Has one of the best selections of filters

- Its unique UI is optimal for fast and efficient market analysis

- Doesn’t have data on many gaming and meme coins

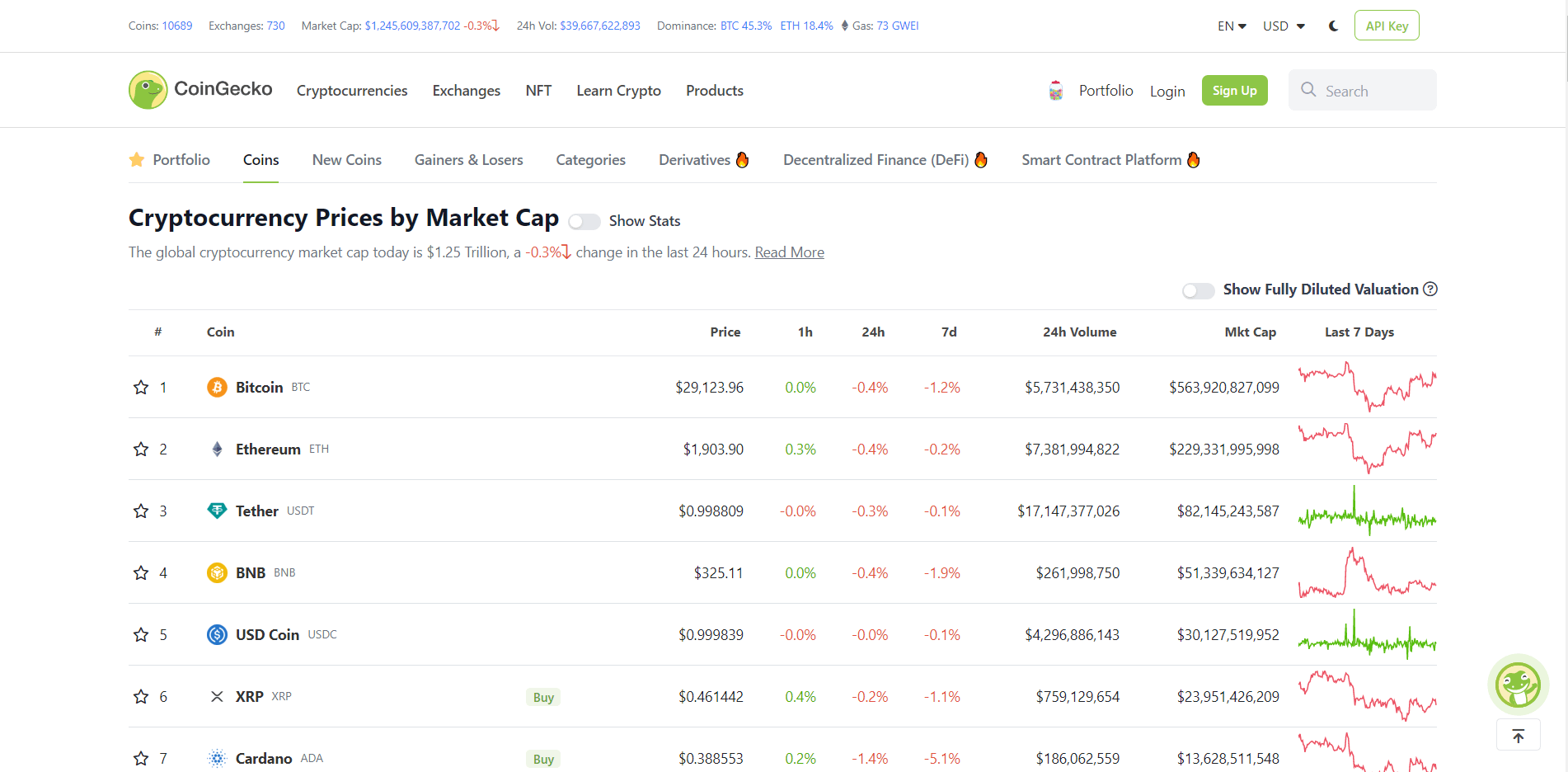

CoinGecko

CoinGecko is the biggest competitor to CoinMarketCap on our list. This is because it supports screening for over 13,000 different crypto assets and 651 exchanges at the time of writing. This puts it among one of the largest crypto data aggregators in the world.

This broad-reaching data collection of CoinGecko makes it a suitable choice for traders that like to explore the crypto market as a whole. With unique filters — like fully diluted valuation — you can find assets that would normally fly under your radar with most other crypto screeners.

However, CoinGecko is mainly suitable for beginners. This is because it has only 10+ filters which remove any confusing factors for new traders and helps them understand the basics of the crypto market. That said, experts can still use it as an efficient way of analyzing recent market movements.

Pricing

Similar to CoinMarketCap, CoinGecko is completely free to use.

Pros and cons

- Does not require a paid subscription

- Limited number of filters make it more beginner-friendly

- Has data on a large number of assets and exchanges

- Its UI is very easy to navigate

- Charting tools are a bit limited

How to choose the best crypto screener for your needs

Choosing the right crypto screener can dictate the future of your trading strategies and investment plans. Here are a few important points to think about before spending time and money on a screening platform:

Understand your investment strategy

First of all, understand your trading and investment strategy. Are you actively looking for the next big breakthrough in the crypto world? Or are you investing in well-established crypto assets to accumulate savings?

Answers to these and other similar questions can help you find a crypto screener that has the necessary features you need. For example, let’s say you are looking for the next big breakthrough. In this situation, you’ll want to use a screener that provides data on the newest crypto assets as soon as they launch.

Ease of Use

Think about your skills, knowledge, and experience. A crypto screener meant for expert traders will be very complex and confusing for a beginner. Similarly, a beginner-focused screener won’t provide enough useful filters and sorting options to match the trading strategies of a pro.

Check for compatibility

If you already have a diverse portfolio, make sure that the crypto screener of your choice supports the assets in your wallet. While these platforms are meant for finding new investment opportunities, having to use some other service to monitor your current holdings would be quite the hassle.

Conclusion

Among the many crypto screeners on the market, CoinMarketCap, TradingView, altFINS, LunarCrush, Messari, and CoinGecko stood out to us above the rest. Each of these offers unique benefits to its users and is suitable for a different type of trader.

So, make sure to do your research. Understand your own crypto trading style and think about the features you want. This will help you locate the perfect crypto screener for your use — helping you take your crypto investment to the next level.